StockHead | August 2023

- Company moves to acquire Cometa project near flagship 725Mt Costa Fuego asset

- New project provides opportunity to discover more resources, upgrade production to 150,000tpa CuEq

- 30km expansion drilling campaign is continuing

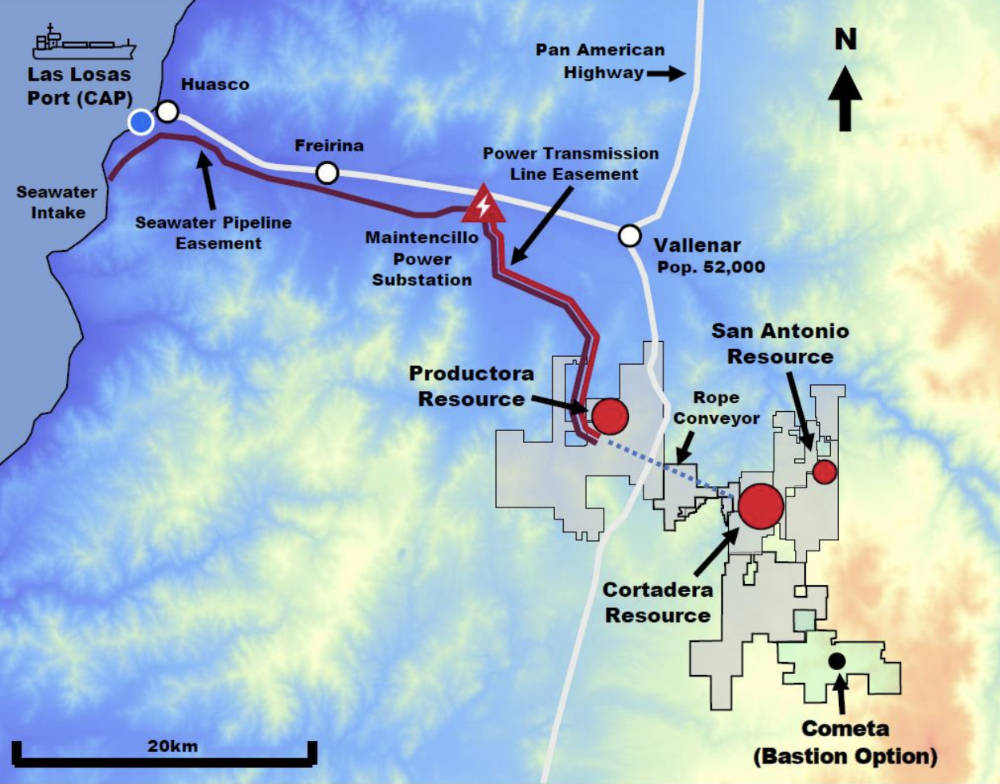

Hot Chili is progressing its strategy of upscaling its already significant 2.8Mt copper, 2.6Moz gold Costa Fuego flagship project in Chile with a move to acquire the nearby Cometa asset.

Hot Chili says Costa Fuego is already “one of the world’s lowest capital intensity major copper developments” and one of only a handful of projects outside of the control of major miners capable of delivering meaningful new copper supply this decade.

Its indicated resource of 725Mt grading 0.47% copper equivalent powers a punchy Preliminary Economic Assessment (PEA) – essentially a Scoping Study – which showcases attractive returns.

The PEA envisages a US$1.05bn project capable of producing 112,000t of copper equivalent (95,000t of copper and 49,000oz of gold) per annum over 14-years of a 16-year mine life.

Ove this time it would deliver revenue and free cash flow of US$13.52bn and US$3.28bn, respectively.

Post-tax net present value and internal rate of return – both measures of a project’s profitability – are estimated at US$1.1bn and 24% respectively.

Exploration, acquisitions to support production boost to 150,000tpa

Hot Chili (ASX:HCH) is now focused on upscaling Costa Fuego’s resource base to support an increase in the copper production profile to 150,000tpa ahead of its Pre-Feasibility Study, which is expected to be delivered in the first half of 2024.

Its planned acquisition of Bastion Minerals’ (ASX:BMO) Cometa project, 15km from Costa Fuego’s planned operating centre, is aimed at furthering this strategy via the discovery of further mineral deposits which could add supplemental feed or extend mine life.

Acquisition terms

Under the letter of intent, the company has secured a 60-day exclusivity period to carry out due diligence with the intention to enter into a definitive option agreement for the acquisition of Cometa.

Hot Chili will pay Bastion US$100,000 in cash on the grant of the option and will pay a further US$200,000 within 12 months of its grant to keep the option in good standing.

Should the company exercise the option within 18 months of it being granted, it will have to pay Bastion US$2.4m in cash or an equal mix of cash and HCH shares.

This increases to US$3m if the decision is made after the initial 18 months and before the option expires 30 months from its grant.

An emerging copper monster

Hot Chili’s acquisition of the Cortadera project in early 2019 delivered multiple, very thick copper-gold porphyry hits that drastically changed the scale of what became the Costa Fuego project.

Not only does Cortadera account for the majority of resources at Costa Fuego – at 451Mt at 0.46% copper equivalent – but drilling also outside of the resource envelope continues to deliver more thick, copper-gold porphyry hits that strongly indicate there’s plenty of growth to come.

Expansion drilling continuing

The company is continuing a 30,000m expansion drilling campaign at Cortadera with nine reverse circulation holes totalling 2,010m completed so far.

Four of these drillholes have been completed across the western extension of the Cortadera porphyry resource, including one pre-collar in preparation for a deep diamond hole beneath Cuerpo 4.

Once the RC pre-collars are drilling, the RC rig is expected to begin a hydrogeological program at Cortadera from mid-September.

Hot Chili also plans to have one diamond drilling rig starting double shift drilling in September with preparations underway to bring a second rig online as it ramps up drilling across multiple exploration targets.