Cortadera Delivers Outstanding 813m Drill Result

ASX Announcement

Thursday 18th March 2021

Hot Chili Delivers its Seventh World-Class Drill Result from Cortadera

Highlights

- New drill result confirms the Company’s Cortadera copper-gold porphyry discovery in Chile is on-track to deliver a significant resource upgrade later this year

Significant Drill Result for CRP0061D

813m grading 0.4% copper & 0.1g/t gold

from 54m depth to end of hole

Including an Intercept Extending the High Grade Core of:

318m grading 0.6% copper & 0.2g/t gold

from 440m depth

(plus additional silver and molybdenum credits)

- The new result demonstrates the high grade core within the main porphyry (Cuerpo 3) at Cortadera is growing rapidly and predictably

- Results are expected shortly from CRP0046D which intersected two wide zones of well mineralised porphyry within a broad zone of mineralisation at Cuerpo 3 (as outlined in ASX announcement “Cortadera Rising RIU presentation”, 16th Feb 2021)

- An update on diamond drilling at Cortadera (two drill rigs operating 24 hrs a day) and Reverse Circulation drilling at Cortadera North (single rig on day shift) to be provided shortly

- Assay results from a large soil geochemical programme completed across the newly consolidated Santiago Z project are also expected shortly

Hot Chili Limited (ASX code HCH) (“Hot Chili” or “Company”) is pleased to announce yet another exceptionally wide drill intersection from its Cortadera copper-gold porphyry discovery in Chile.

The new drill result ranks as one of the widest intersections recorded by Hot Chili at Cortadera and most importantly – confirms that the high grade core discovered in the main porphyry (Cuerpo 3) is expanding rapidly.

Cortadera has delivered a remarkable run of world-class copper-gold drill intersections since the Company announced a deal to acquire the private discovery in early 2019.

Cortadera Returns Another Outstanding Drill Result

Hot Chili has delivered its seventh world-class drill result from the Cortadera copper-gold porphyry discovery as the Company advances toward a major resource upgrade this year.

Results received from CRP0061D recorded 813m grading 0.4% copper and 0.1g/t gold from a depth of 54m down-hole depth to end of hole. The hole was planned to 1,500m depth but unfortunately had to be abandoned in mineralised porphyry at 863m depth owing to mechanical issues.

Importantly, CRP0061D successfully achieved its target of testing a predicted extension of the high grade core across the southern flank of Cuerpo 3. From 440m depth, CRP0061D recorded a very wide intersection of 318m grading 0.6% copper, 0.2g/t gold, 89ppm molybdenum and 1g/t silver.

The high grade zone recorded in CRP0061D provides confidence in Hot Chili’s approach to rapidly and predictably growing high grade, bulk tonnage, resources at Cortadera.

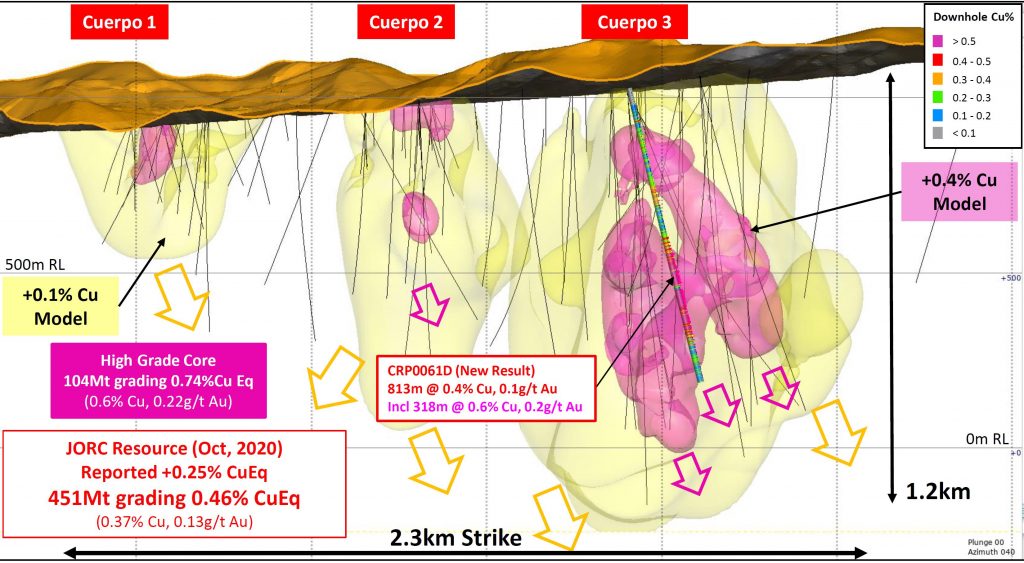

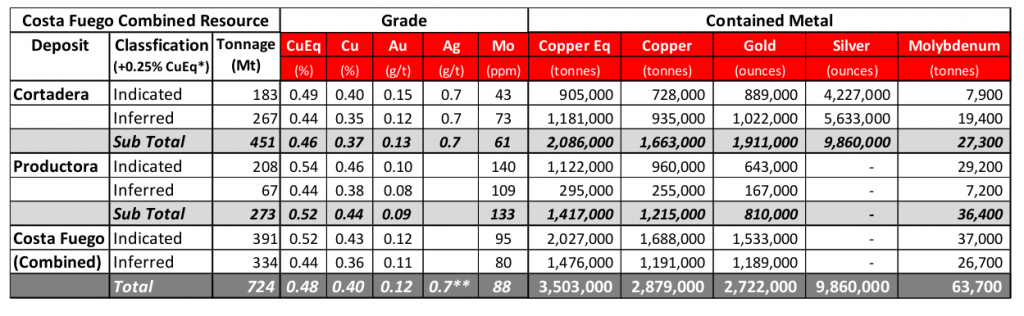

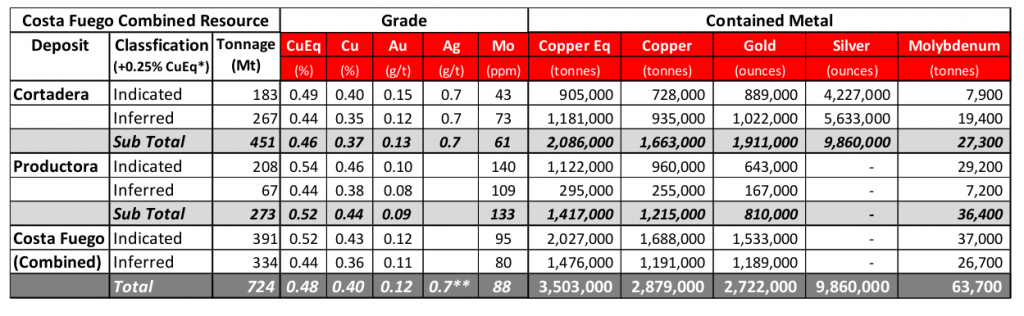

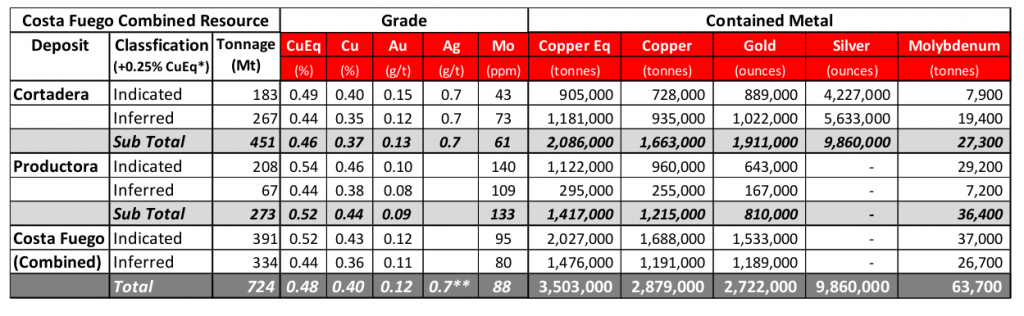

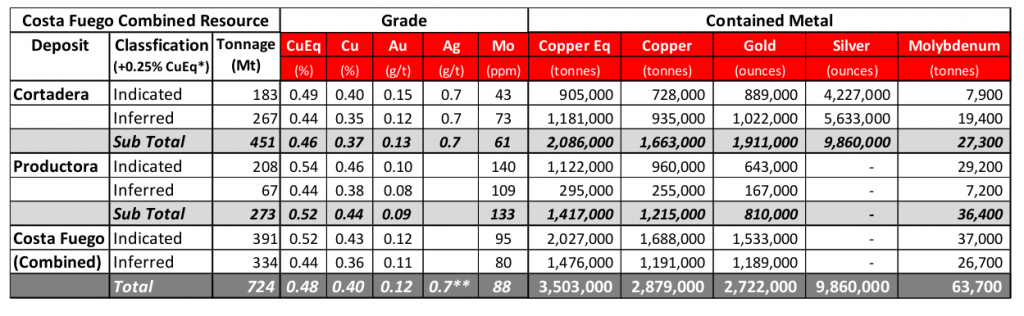

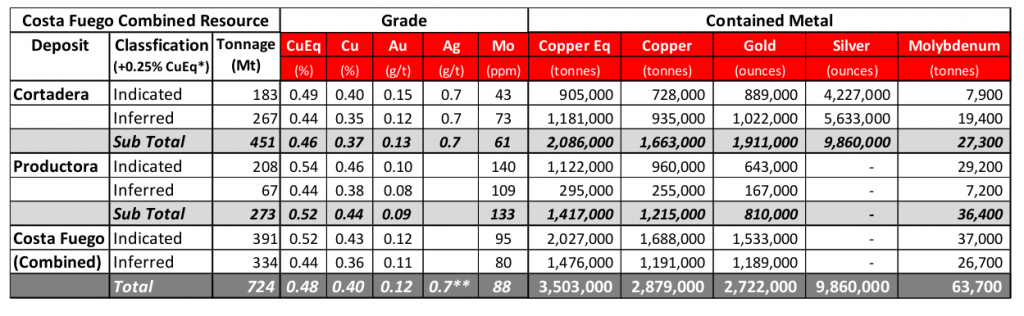

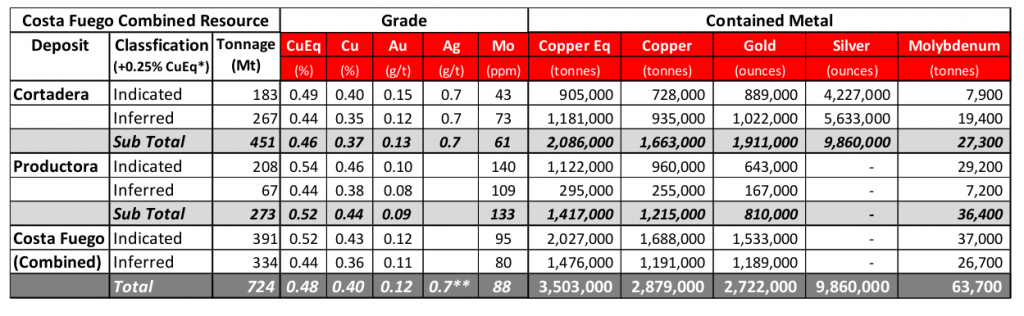

The high grade core at Cuerpo 3 currently stands at 104Mt grading 0.74% Cu Eq (0.6% Cu and 0.22g/t Au) and is a key growth focus for the Company’s 40,000m drill programme which aims to significantly upgrade Cortadera’s maiden resource estimate of 451Mt grading 0.46% Cu Eq this year (refer to ASX announcement “Costa Fuego Becomes Leading Global Copper Project, date 12th October 2020).

Hot Chili’s recent drill holes at Cuerpo 3 (the largest of the four porphyries discovered to date) include some of the worlds’ stand-out copper-gold porphyry drill results. The new drill result from CRP0061D rates as one of the best drill results recorded at Cortadera:

Cortadera’s Most Significant Drill Intersections to Date

- 972m grading 0.5% copper and 0.2g/t gold from surface (CRP0020D)

- (including 412m grading 0.7% copper and 0.3g/t gold),

- 750m grading 0.6% copper and 0.2g/t gold from 204m down-hole depth (CRP0013D)

- (including 188m grading 0.9% copper and 0.4g/t gold),

- 848m grading 0.4% copper and 0.2g/t gold from 112m down-hole depth (CRP0011D)

- (including 184m grading 0.7% copper and 0.3g/t gold),

- 864m grading 0.4% copper and 0.1g/t gold from 62m down-hole depth (FJOD-23 – Minera Fuego)

- (including 348m grading 0.6% copper and 0.2g/t gold),

- 813m grading 0.4% copper and 0.1g/t gold from 54m down-hole depth (CRP0061D)

- (including 318m grading 0.6% copper and 0.2g/t gold),

- 649m grading 0.4% copper and 0.1g/t gold from 328m down-hole depth (CRP0029D)

- (including 440m grading 0.5% copper and 0.2g/t gold), and

- 596m grading 0.5% copper and 0.2g/t gold from 328m down-hole depth (CRP0017D)

- (including 184m grading 0.7% copper and 0.3g/t gold)

- 542m grading 0.5% copper and 0.2g/t gold from 422m down-hole depth (CRP0040D)

- (including 218m grading 0.7% copper and 0.2g/t gold)

Cortadera continues to be one of the few large global copper discoveries to regularly achieve copper-sector leading drill results from its continued exploration and resource growth drilling activities.

The Company looks forward to a rich period of news flow related to its multiple activity streams spanning exploration, resource growth and lease mining activities at its Costa Fuego copper development in Chile.

This announcement is authorised by the Board of Directors for release to ASX.

For more information please contact:

Christian Easterday Tel: +61 8 9315 9009

Managing Director Email: christian@hotchili.net.au

or visit Hot Chili’s website at www.hotchili.net.au

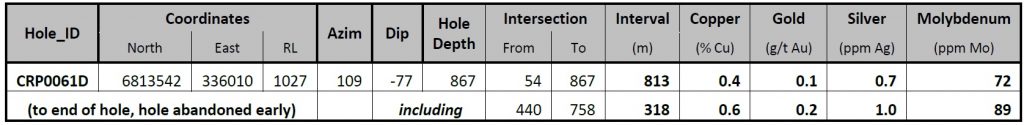

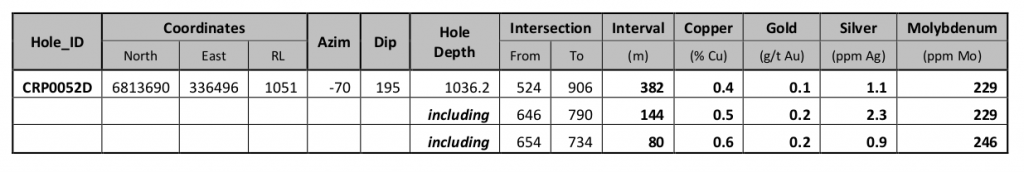

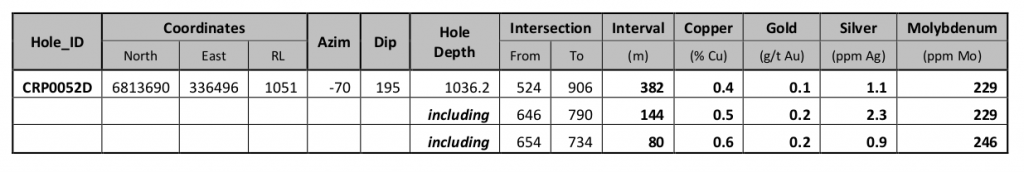

Table 1 New Significant DD Drill Results at Cortadera

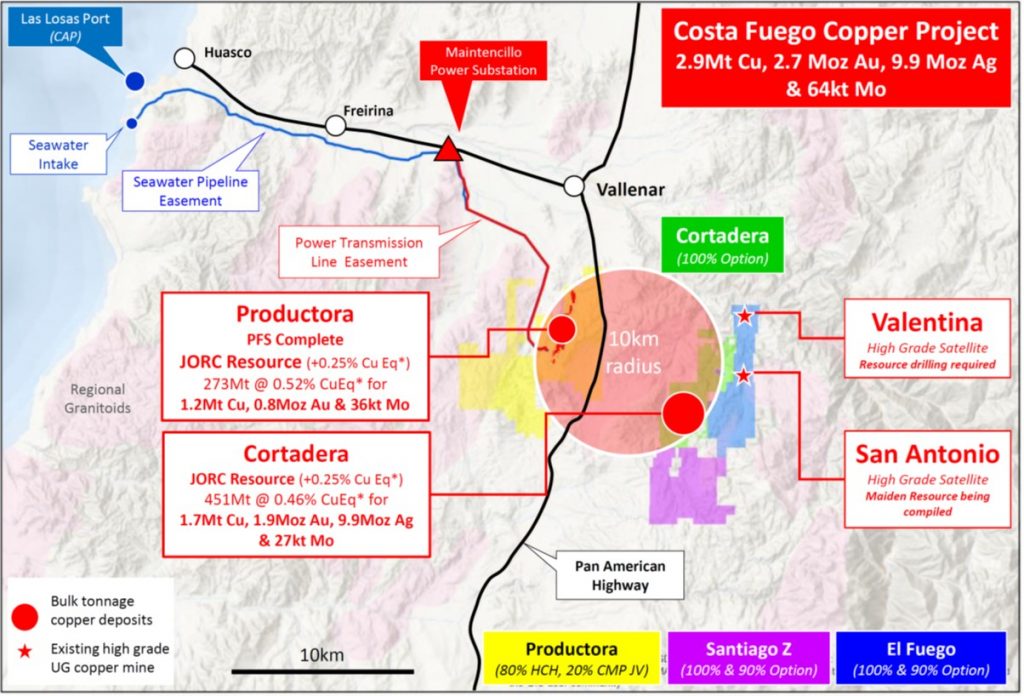

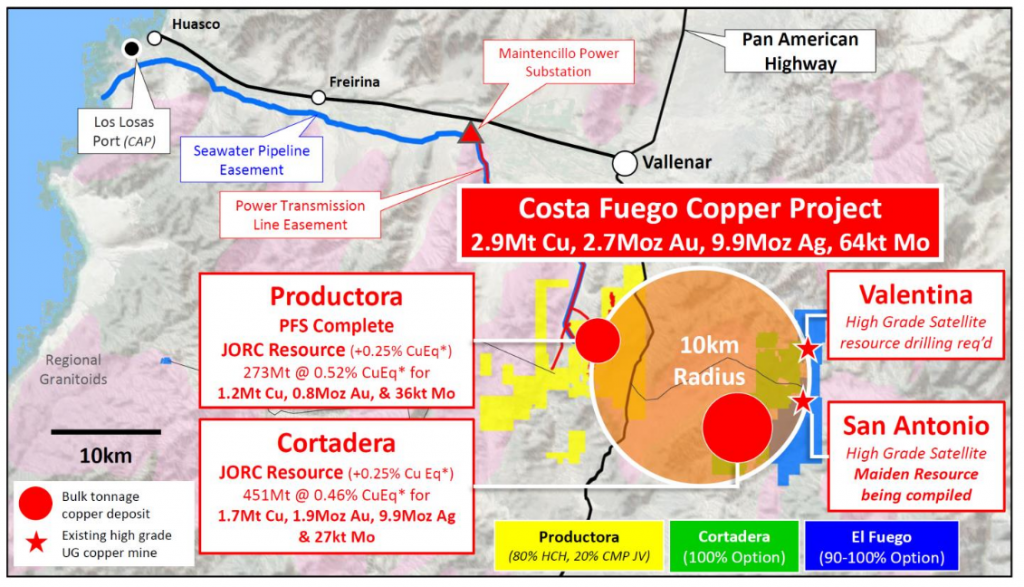

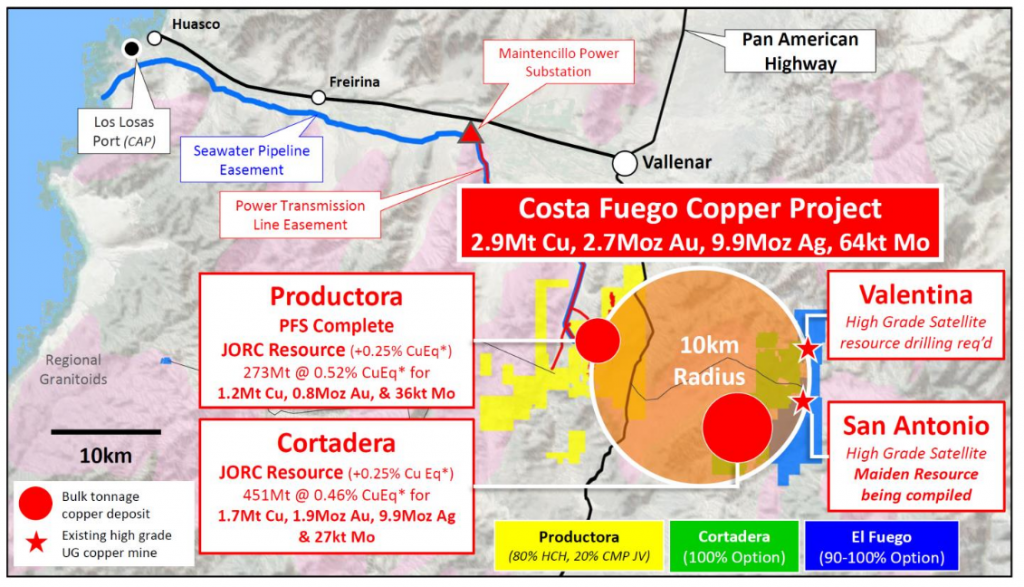

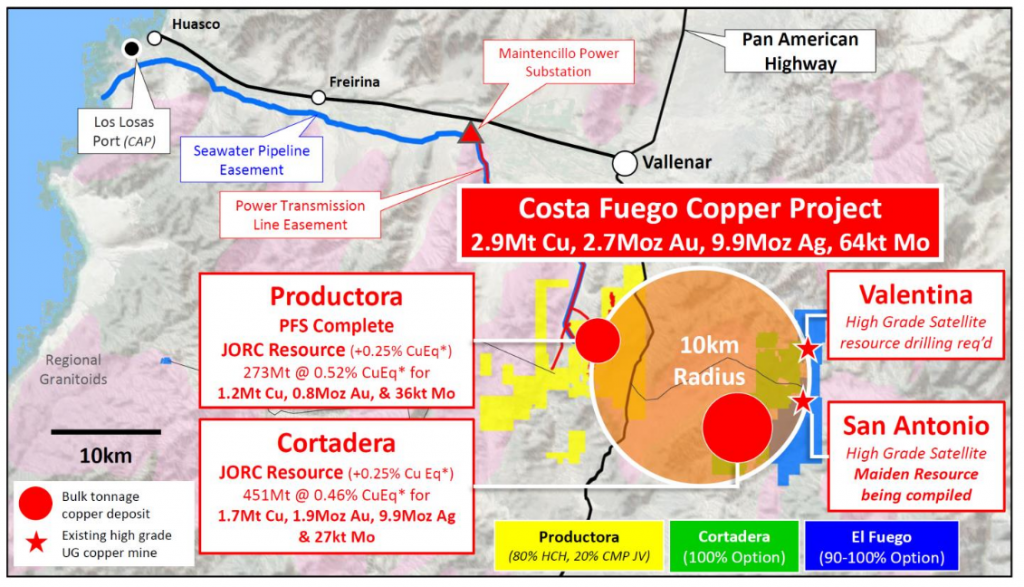

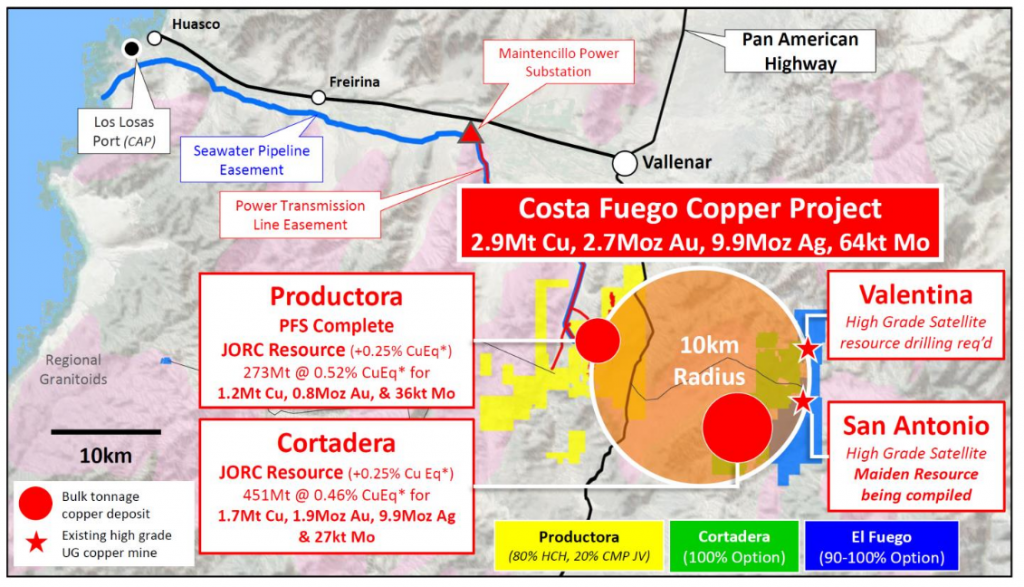

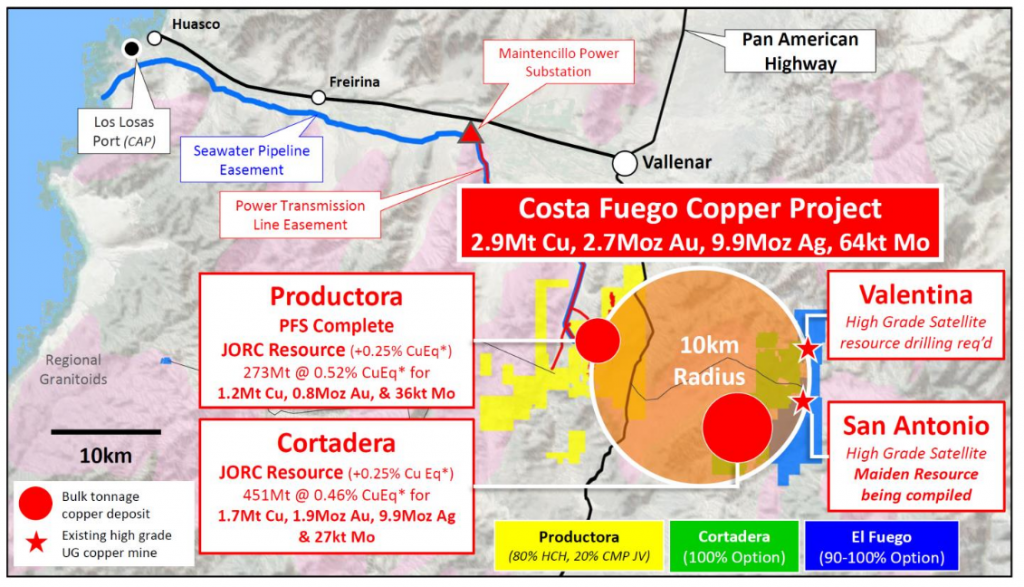

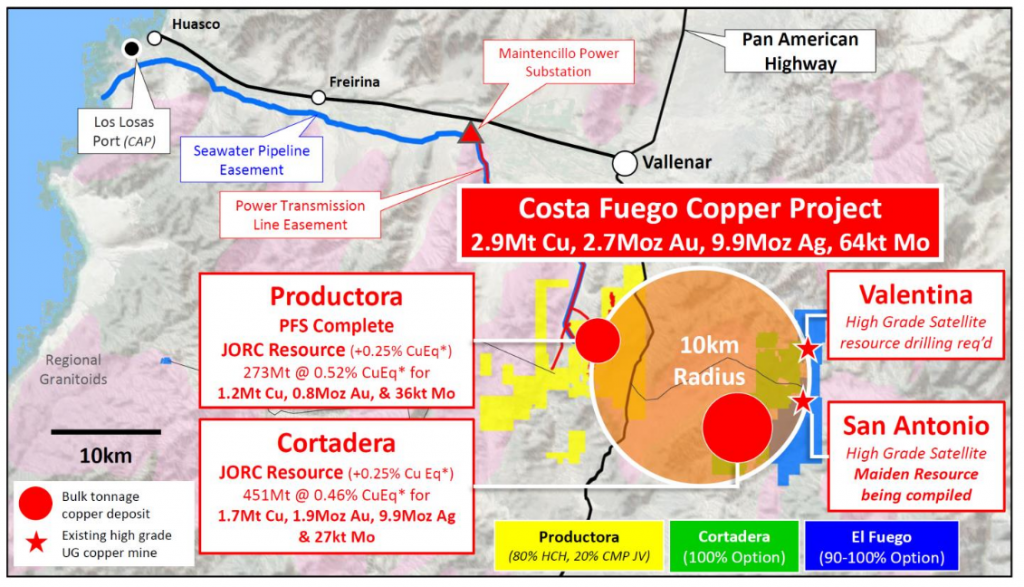

Figure 1 Location of Productora and the Cortadera discovery in relation to the coastal range infrastructure of Hot Chili’s combined Costa Fuego copper project, located 600km north of Santiago in Chile

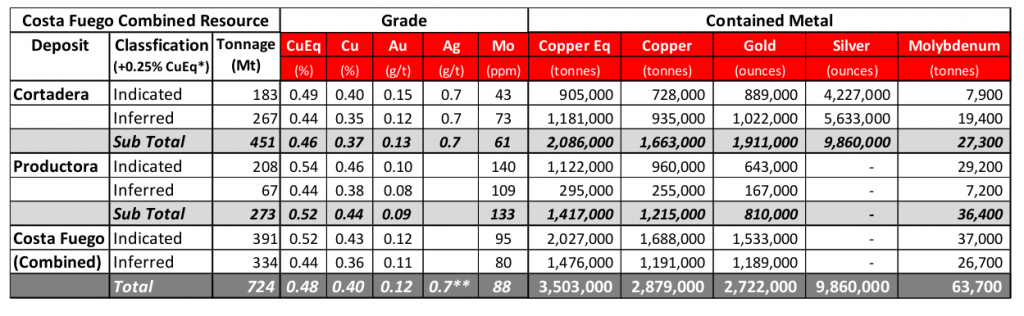

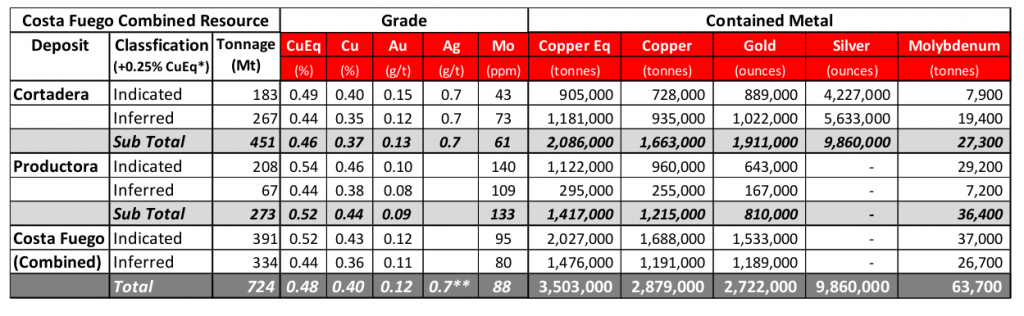

Refer to ASX Announcement “Costa Fuego Becomes a Leading Global Copper Project” (12th October 2020) for JORC Table 1 information related to the Cortadera JORC compliant Mineral Resource estimate by Wood and the Productora re-stated JORC compliant Mineral Resource estimate by AMC Consultants

* Copper Equivalent (CuEq) reported for the resource were calculated using the following formula: CuEq% = ((Cu% × Cu price 1% per tonne × Cu_recovery)+(Mo ppm × Mo price per g/t × Mo_recovery)+(Au ppm × Au price per g/t × Au_recovery)+ (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price 1% per tonne). The Metal Prices applied in the calculation were: Cu=3.00 USD/lb, Au=1,550 USD/oz, Mo=12 USD/lb, and Ag=18 USD/oz. For Cortadera (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=56%, Mo=82%, and Ag=37%. For Productora (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=43% and Mo=42%. For Costa Fuego (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=51%, Mo=67% and Ag=23%.

** Reported on a 100% Basis – combining Cortadera and Productora Mineral Resources using a +0.25% CuEq reporting cut-off grade

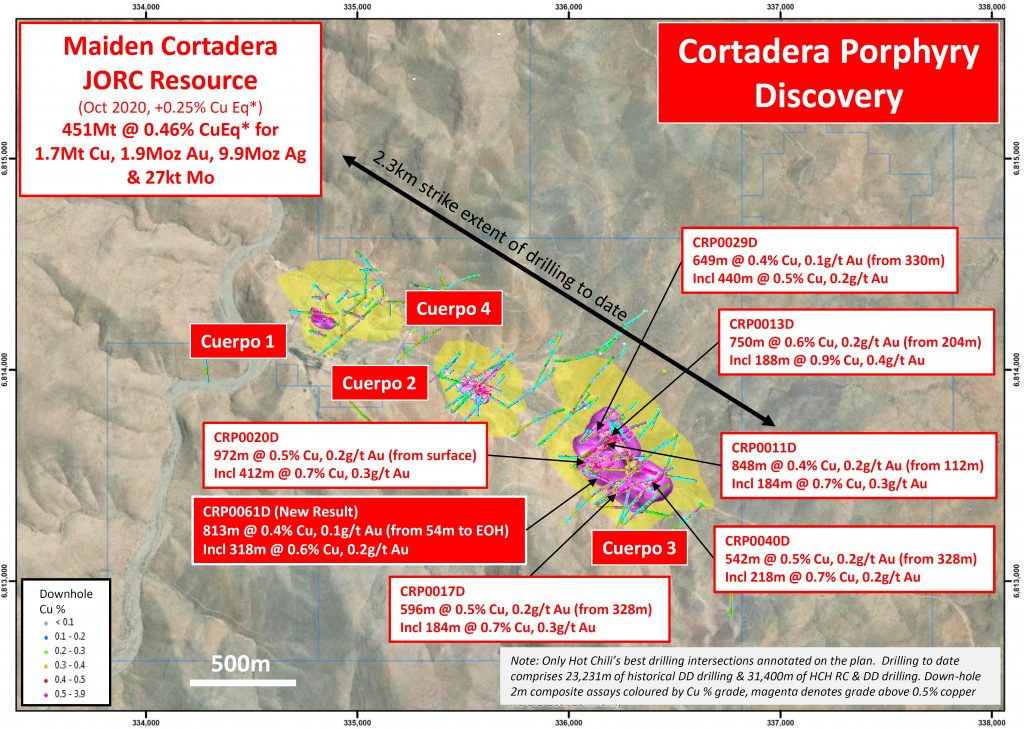

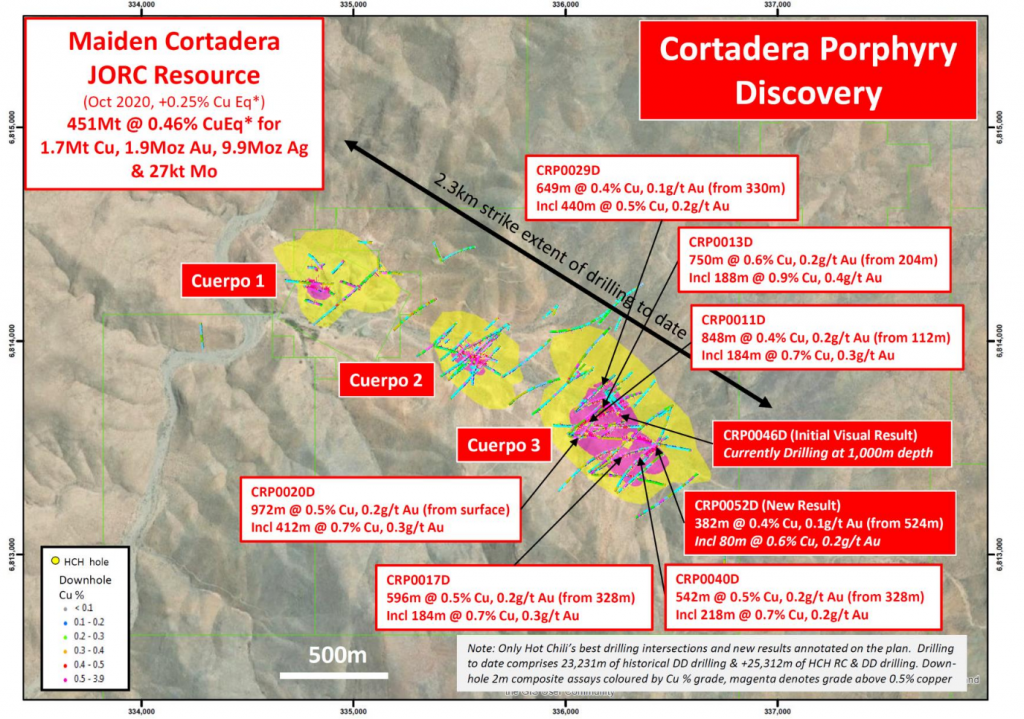

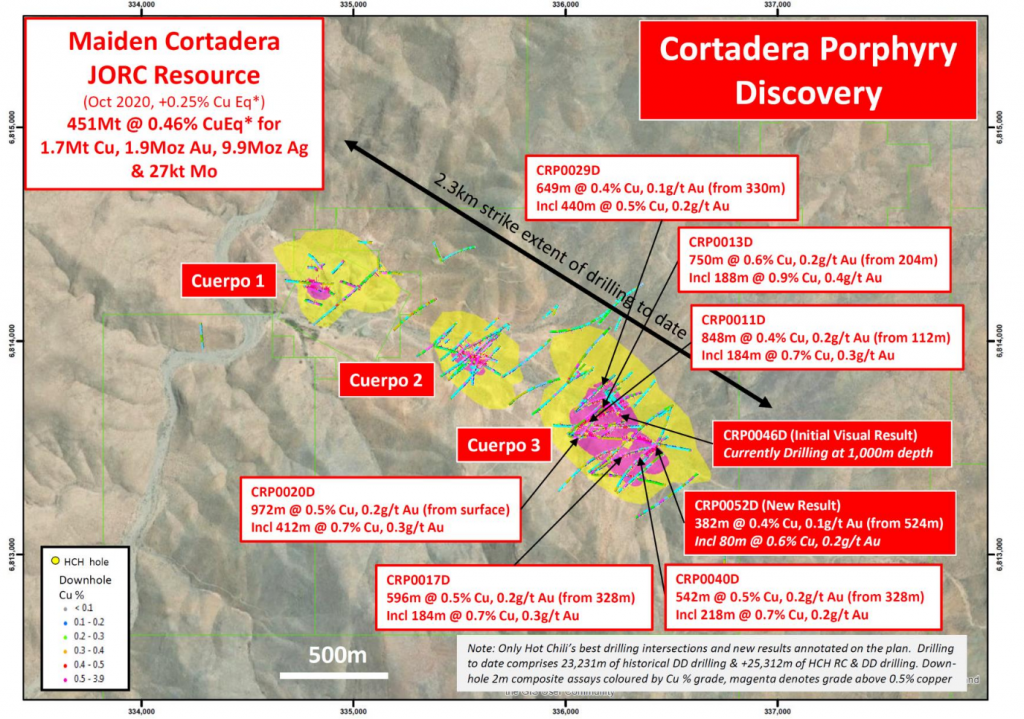

Figure 2 Plan view across the Cortadera discovery area displaying significant historical copper-gold DD intersections across Cuerpo 1, 2, 3 and 4 tonalitic porphyry intrusive centres (represented by modelled copper envelopes, yellow- +0.1% Cu and magenta +0.4% Cu). Note the selected HCH drilling intersections (White) and the new result reported from CRP0061D (Red).

Figure 2 Plan view across the Cortadera discovery area displaying significant historical copper-gold DD intersections across Cuerpo 1, 2, 3 and 4 tonalitic porphyry intrusive centres (represented by modelled copper envelopes, yellow- +0.1% Cu and magenta +0.4% Cu). Note the selected HCH drilling intersections (White) and the new result reported from CRP0061D (Red).

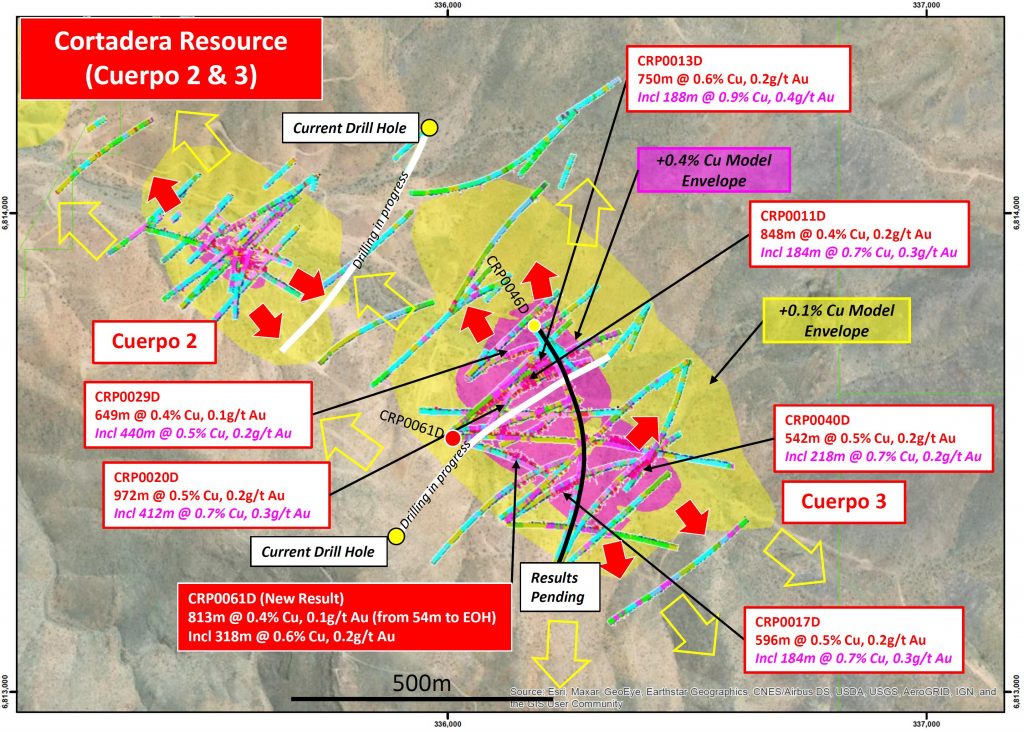

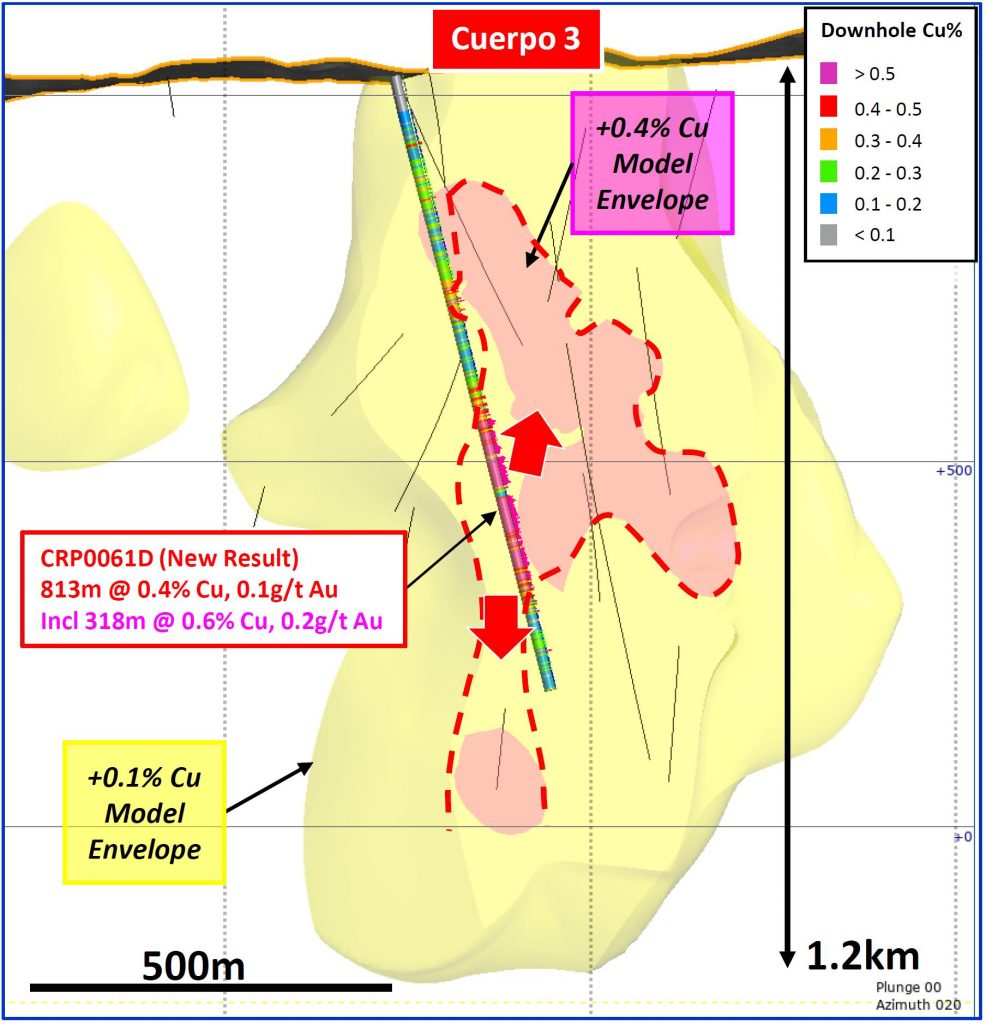

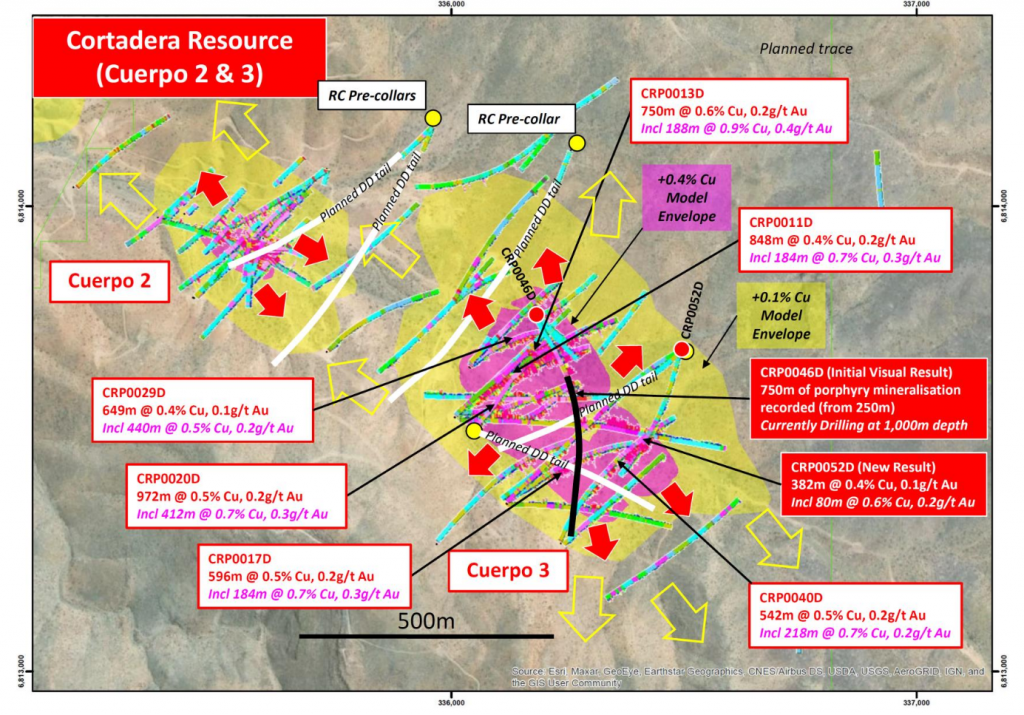

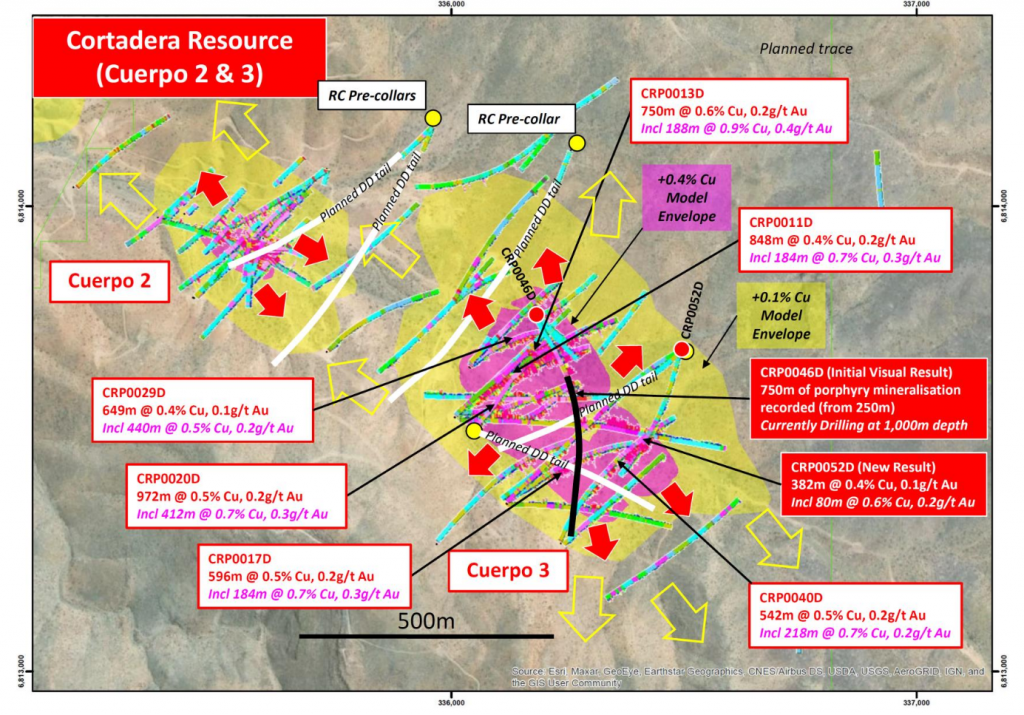

Figure 3 Plan view across the Cortadera discovery area displaying significant historical copper-gold DD intersections across Cuerpo 2 and 3. The plan view displays the Mineral Resource extents (represented by modelled copper envelope, yellow- +0.1% Cu). Note the selected HCH drilling intersections (White) and the new results reported from CRP0061D (Red collars) as well as the location of current deep diamond holes (white traces).

Figure 4 Long Section displaying the location of CRP0061D in relation to the Cortadera copper-gold discovery window

Figure 5 Long Section across Cuerpo 3 with a 100m slicing window (+/-50m viewing) through the bulk copper envelope (+0.1%Cu model) and high grade copper envelope (+0.4% Cu model). Note the location of CRP0061D high grade intersection in relation to the high grade model and the implications for significant extension of the October 2020 high grade core copper model

Qualifying Statements

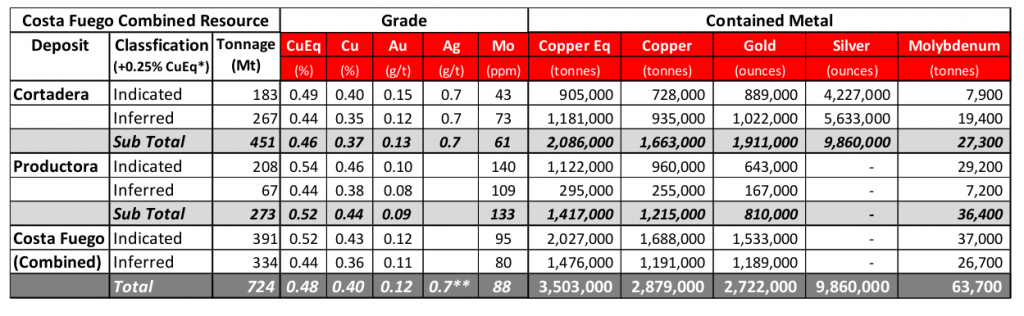

Independent JORC Code Costa Fuego Combined Mineral Resource (Reported 12th October 2020)

Competent Person’s Statement- Exploration Results

Reported at or above 0.25% CuEq*. Figures in the above table are rounded, reported to appropriate significant figures, and reported in accordance with the JORC Code – Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves. Metal rounded to nearest thousand, or if less, to the nearest hundred. * * Copper Equivalent (CuEq) reported for the resource were calculated using the following formula:: CuEq% = ((Cu% × Cu price 1% per tonne × Cu_recovery)+(Mo ppm × Mo price per g/t × Mo_recovery)+(Au ppm × Au price per g/t × Au_recovery)+ (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price 1% per tonne). The Metal Prices applied in the calculation were: Cu=3.00 USD/lb, Au=1,550 USD/oz, Mo=12 USD/lb, and Ag=18 USD/oz. For Cortadera (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=56%, Mo=82%, and Ag=37%. For Productora (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=43% and Mo=42%. For Costa Fuego (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=51%, Mo=67% and Ag=23%.

** Note: Silver (Ag) is only present within the Cortadera Mineral Resource estimate

Exploration information in this Announcement is based upon work compiled by Mr Christian Easterday, the Managing Director and a full-time employee of Hot Chili Limited whom is a Member of the Australasian Institute of Geoscientists (AIG). Mr Easterday has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a ‘Competent Person’ as defined in the 2012 Edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’ (JORC Code). Mr Easterday consents to the inclusion in the report of the matters based on their information in the form and context in which it appears.

Competent Person’s Statement- Productora Mineral Resources

The information in this Announcement that relates to the Productora Project Mineral Resources, is based on information compiled by Mr N Ingvar Kirchner. Mr Kirchner is employed by AMC Consultants (AMC). AMC has been engaged on a fee for service basis to provide independent technical advice and final audit for the Productora Project Mineral Resource estimates. Mr Kirchner is a Fellow of the Australasian Institute of Mining and Metallurgy (AusIMM) and is a Member of the Australian Institute of Geoscientists (AIG). Mr Kirchner has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’ (the JORC Code 2012). Mr Kirchner consents to the inclusion in this report of the matters based on the source information in the form and context in which it appears.

Competent Person’s Statement- Cortadera and Costa Fuego Mineral Resources

The information in this report that relates to Mineral Resources for the Cortadera and combined Costa Fuego Project is based on information compiled by Elizabeth Haren, a Competent Person who is a Member and Chartered Professional of the Australasian Institute of Mining and Metallurgy and a Member of the Australian Institute of Geoscientists. Elizabeth Haren is employed as an associate Principal Geologist of Wood, who was engaged by Hot Chili Limited. Elizabeth Haren has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a

Competent Person as defined in the 2012 Edition of the “Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves”. Elizabeth Haren consents to the inclusion in the report of the matters based on her information in the form and context in which it appears.

Reporting of Copper Equivalent

Copper Equivalent (CuEq) reported for the resource were calculated using the following formula: CuEq% = ((Cu% × Cu price 1% per tonne × Cu_recovery)+( Mo ppm × Mo price per g/t × Mo_recovery)+(Au ppm × Au price per g/t × Au_recovery)+ (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price 1 % per tonne). The Metal Prices applied in the calculation were: Cu=3.00 USD/lb, Au=1,550 USD/oz, Mo=12 USD/lb, and Ag=18 USD/oz. For Cortadera (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=56%, Mo=82%, and Ag=37%. For Productora (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=43% and Mo=42%. For Costa Fuego (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=51%, Mo=67% and Ag=23%.

Forward Looking Statements

This Announcement is provided on the basis that neither the Company nor its representatives make any warranty (express or implied) as to the accuracy, reliability, relevance or completeness of the material contained in the Announcement and nothing contained in the Announcement is, or may be relied upon as a promise, representation or warranty, whether as to the past or the future. The Company hereby excludes all warranties that can be excluded by law. The Announcement contains material which is predictive in nature and may be affected by inaccurate assumptions or by known and unknown risks and uncertainties and may differ materially from results ultimately achieved.

The Announcement contains “forward-looking statements”. All statements other than those of historical facts included in the Announcement are forward-looking statements including estimates of Mineral Resources. However, forward-looking statements are subject to risks, uncertainties and other factors, which could cause actual results to differ materially from future results expressed, projected or implied by such forward-looking statements. Such risks include, but are not limited to, copper, gold and other metals price volatility, currency fluctuations, increased production costs and variances in ore grade recovery rates from those assumed in mining plans, as well as political and operational risks and governmental regulation and judicial outcomes. The Company does not undertake any obligation to release publicly any revisions to any “forward-looking statement” to reflect events or circumstances after the date of the Announcement, or to reflect the occurrence of unanticipated events, except as may be required under applicable securities laws. All persons should consider seeking appropriate professional advice in reviewing the Announcement and all other information with respect to the Company and evaluating the business, financial performance and operations of the Company. Neither the provision of the Announcement nor any information contained in the Announcement or subsequently communicated to any person in connection with the Announcement is, or should be taken as, constituting the giving of investment advice to any person

To download the announcement please click on the below link.

Cortadera Delivers Outstanding 813m Drill Result

High Grade Copper-Gold Core Continues to Expand at Cortadera

ASX Announcement Wednesday 27th January 2021

High Grade Copper-Gold Core Continues to Expand at Cortadera

40,000m Drill Programme Underway

Highlights

- Fully funded 2021 drill programme commenced at the Cortadera copper-gold discovery in Chile

- Two drill rigs) in operation with a third drill rig planned to start in February

- Significant new drill results confirm continuity and extensions to the high grade core of the main porphyry at Cortadera (Cuerpo 3) – a key focus for a targeted major resource upgrade this year

Significant Drill Result for CRP0052D

382m grading 0.4% copper & 0.1g/t gold

from 524m down-hole depth

including

80m grading 0.6% copper & 0.2g/t gold

(plus additional silver and molybdenum credits)

Wide Visual Result from Current Diamond Hole CRP0046D

750m of Porphyry Mineralisation Recorded

from 250m to 1,000m down-hole depth, hole planned to 1,200m

Results Pending

• Two wide zones of strongly mineralised porphyry recorded in current diamond drill hole CRP0046D, from 250m to 350m (100m zone) and 550m and 720m (170m zone) downhole depth

• CRP0046D is currently at 1,000m depth in porphyry mineralisation and is planned to extend to 1,200m

• Reverse circulation drilling is advancing across several growth targets at Cuerpo 1 and Cuerpo 4

• Clearing at Cortadera North is on-track and drilling is expected to commence in February

Hot Chili Limited (ASX code HCH) (“Hot Chili” or “Company”) is pleased to announce the commencement of a 40,000m drilling programme at the Cortadera copper-gold porphyry discovery, part of the Company’s Costa Fuego coastal range copper development in Chile.

The Company’s fully funded 2021 work programme aims to continue building Costa Fuego toward a tier one copper project (+5Mt copper) from its current contained metal resource base of 2.9Mt copper and 2.7Moz gold.

Drilling has been significantly accelerated from last year with two drill rigs currently in operation and a third rig expected to commence shortly in February.

New results from drilling designed to expand the main high grade core at Cortadera have returned another set of strong intersections.

New Results Continue to Expand the Main High Grade Core at Cortadera

A primary focus for the Company in 2021 is to expand the high grade core (defined as >0.6% CuEq*), currently sitting at 104Mt at 0.74% CuEq (as reported to ASX on 12th October 2020), within Cortadera’s 451Mt Mineral

Resource.

Diamond drill hole CRP0052D returned a higher grade intersection of 80m grading 0.6% copper and 0.2g/t gold within a broader zone of 382m grading 0.4% copper and 0.1g/t gold from 524m down-hole depth along the south-eastern extent of the high grade core to the main porphyry (Cuerpo 3).

In addition, the Company has recorded an exceptionally wide 750m interval of porphyry mineralisation from a down-hole depth of 250m in diamond drill hole CRP0046D. The hole is currently at 1,000m in porphyry mineralisation and is planned to extend to 1,200m at this stage.

Importantly, within the wide 750m visual interval of mineralisation, two zones of strongly mineralised porphyry have been recorded:

- 100m wide zone between 250m and 350m depth down-hole, and

- 170m wide zone between 550m and 720m depth down-hole

Both zones of strongly mineralised porphyry comprise visual estimates of 1.0% – 2.5% chalcopyrite contained as fine dissemination and in association with 2% to 15% B-vein abundance. Visual estimates of sulphide minerals are not an accurate representation of expected assay value and are provided for indicative purposes only.

Importantly, the results provide confidence for further growth in predictive extensional areas where the high grade core is absent from Cortadera’s maiden resource owing to low or no drilling density.

Acceleration of Drilling Operations at Cortadera

The Company commenced a major drilling campaign at Cortadera on 11 th January 2021 initially utilising two drill rigs with a third drill rig set to arrive in February.

Each drill rig will focus on key growth areas within the Cortadera discovery window as well as other large satellite growth opportunities:

Diamond drill rig 1 (in operation)

• Focus on Cuerpo 3 resource addition: bulk expansion and high grade growth

• Currently drilling CRP0046D, a further 8 holes planned

Diamond drill rig 2 (planned to start in February)

• Focus on large growth potential within the Cortadera discovery window outside of Cuerpo 3

• Three deep pre-collar holes complete and ready to test Cuerpo 2 and gap zone, a further five holes planned

Reverse Circulation drill rig 1 (in operation)

• Focus on Cuerpo 1 and Cuerpo 4 open pit targets, pre-collar drilling and new large growth opportunities (Cortadera North etc)

• Currently drilling at Cortadera and planned to move to Cortadera North in February

The Directors look forward to an exciting year of news flow and the opportunity to continue growing Cortadera as one of the most significant global copper discoveries of recent time.

This announcement is authorised by the Board of Directors for release to ASX.

For more information please contact:

Christian Easterday Tel: +61 8 9315 9009

Managing Director Email: christian@hotchili.net.au

or visit Hot Chili’s website at www.hotchili.net.au

Table 1 New Significant DD Drill Results at Cortadera

Figure 1 Location of Productora and the Cortadera discovery in relation to the coastal range infrastructure of Hot Chili’s combined Costa Fuego copper project, located 600km north of Santiago in Chile.

Refer to ASX Announcement “Costa Fuego Becomes a Leading Global Copper Project” (12th October 2020) for JORC Table 1 information related to the Cortadera JORC compliant Mineral Resource estimate by Wood and the Productora re-stated JORC compliant Mineral Resource estimate by AMC Consultants

* Copper Equivalent (CuEq) reported for the resource were calculated using the following formula: CuEq% = ((Cu% × Cu price 1% per tonne × Cu_recovery)+(Mo ppm × Mo price per g/t × Mo_recovery)+(Au ppm × Au price per g/t × Au_recovery)+ (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price 1% per tonne). The Metal Prices applied in the calculation were: Cu=3.00 USD/lb, Au=1,550 USD/oz, Mo=12 USD/lb, and Ag=18 USD/oz. For Cortadera (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=56%, Mo=82%, and Ag=37%. For Productora (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=43% and Mo=42%. For Costa Fuego (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=51%, Mo=67% and Ag=23%.

** Reported on a 100% Basis – combining Cortadera and Productora Mineral Resources using a +0.25% CuEq reporting cut-off grade

Figure 2 Plan view across the Cortadera discovery area displaying significant historical copper-gold DD intersections across Cuerpo 1, 2, 3 and 4 tonalitic porphyry intrusive centres (represented by modelled copper envelopes, yellow- +0.1% Cu and majenta +0.4% Cu). Note the selected HCH drilling intersections (White) and the new results reported from CRP0046D and CRP0052D (Red).

Figure 3 Plan view across the Cortadera discovery area displaying significant historical copper-gold DD intersections across Cuerpo 2 and 3. The plan view displays the Mineral Resource extents (represented by modelled copper envelope, yellow- +0.1% Cu). Note the selected HCH drilling intersections (White) and the new results reported from CRP0052D and CRP0046D (Red collars) as well as the location of planned deep diamond tails (white traces)

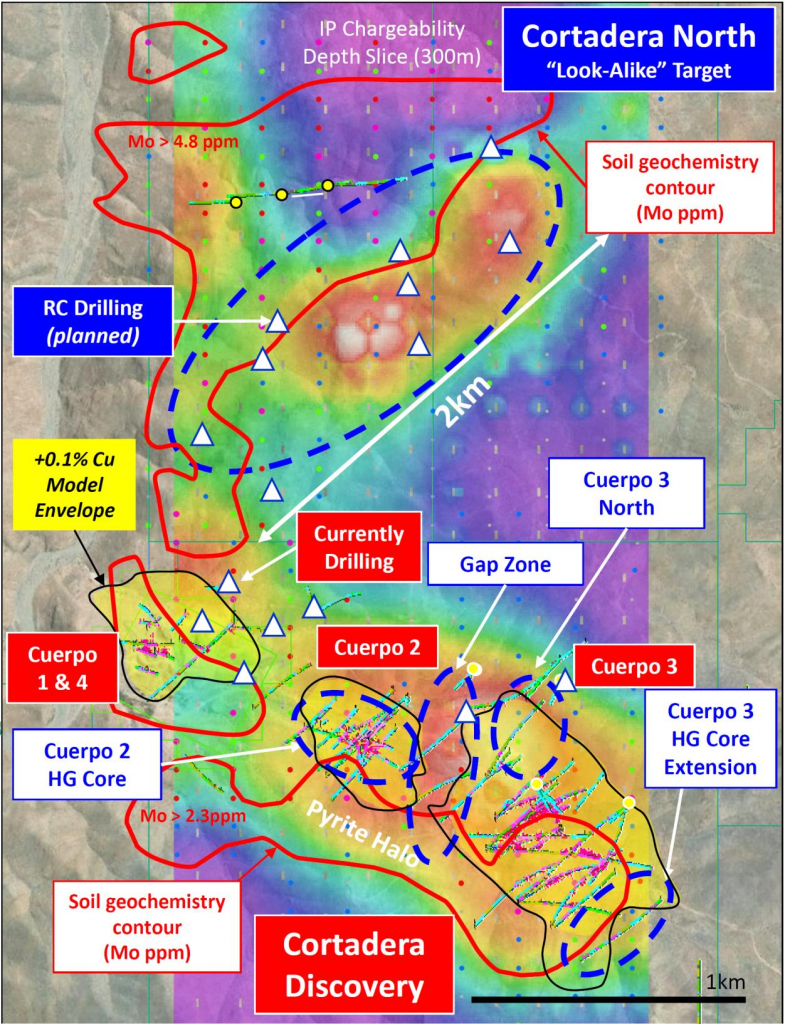

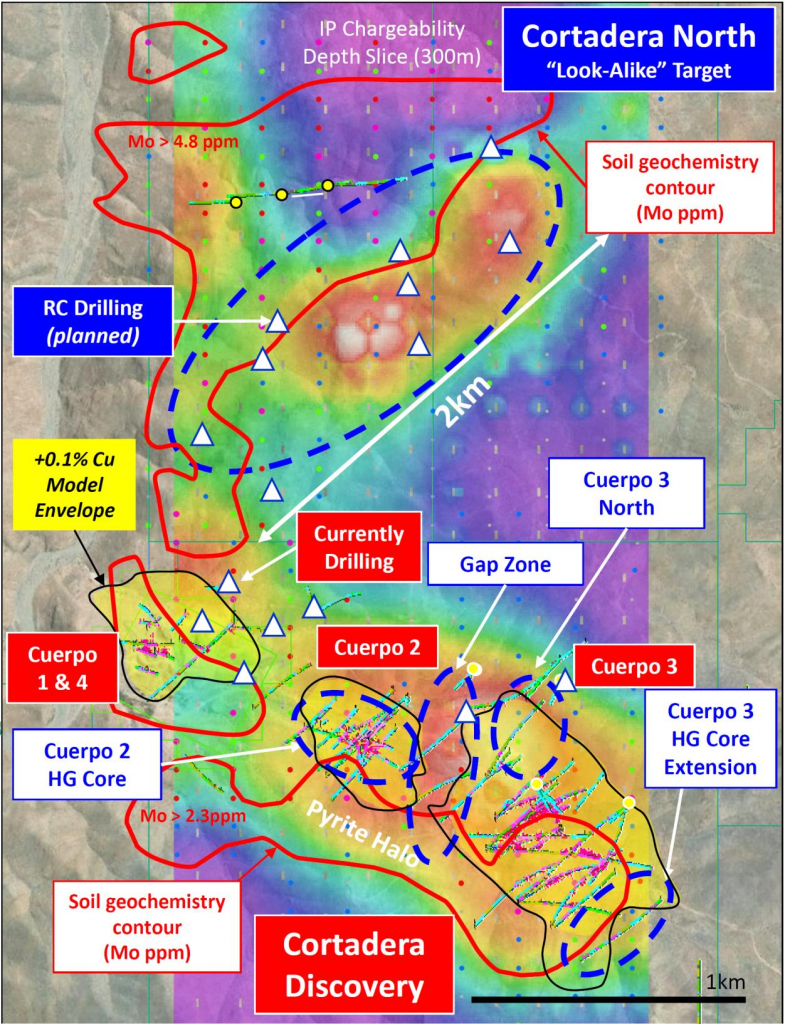

Figure 4. Plan view displaying the location of the Cortadera discovery zone in relationnto the Cortadera North target. The plan displays the location of Cuerpo 1, 2, 3 and 4 tonalitic porphyry intrusive centres (represented by modelled copper envelopes, yellow- +0.1% Cu) in relation to surface molybdenum anomalism and IP chargeability response at 200m depth slice. Cortadera North, located 2km north of Cortadera displays “look alike” characteristics to the Cortadera discovery. Note locations of planned first pass RC drill holes at Cortadera North in a addition to Cuerpo 1 and Cuerpo 4. An RC drill rig is currently in operation north of Cuerpo 1.

Qualifying Statements

Independent JORC Code Costa Fuego Combined Mineral Resource (Reported 12th October 2020)

Reported at or above 0.25% CuEq*. Figures in the above table are rounded, reported to appropriate significant figures, and reported in accordance with the JORC Code – Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves. Metal rounded to nearest thousand, or if less, to the nearest hundred. * * Copper Equivalent (CuEq) reported for the resource were calculated using the following formula:: CuEq% = ((Cu% × Cu price 1% per tonne × Cu_recovery)+(Mo ppm × Mo price per g/t × Mo_recovery)+(Au ppm × Au price per g/t × Au_recovery)+ (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price 1% per tonne). The Metal Prices applied in the calculation were: Cu=3.00 USD/lb, Au=1,550 USD/oz, Mo=12 USD/lb, and Ag=18 USD/oz. For Cortadera (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=56%, Mo=82%, and Ag=37%. For Productora (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=43% and Mo=42%. For Costa Fuego (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=51%, Mo=67% and Ag=23%.

** Note: Silver (Ag) is only present within the Cortadera Mineral Resource estimate

Competent Person’s Statement- Exploration Results

Exploration information in this Announcement is based upon work compiled by Mr Christian Easterday, the Managing Director and a full-time employee of Hot Chili Limited whom is a Member of the Australasian Institute of Geoscientists (AIG). Mr Easterday has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a ‘Competent Person’ as defined in the 2012 Edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’ (JORC Code). Mr Easterday consents to the inclusion in the report of the matters based on their information in the form and context in which it appears.

Competent Person’s Statement- Productora Mineral Resources

The information in this Announcement that relates to the Productora Project Mineral Resources, is based on information compiled by Mr N Ingvar Kirchner. Mr Kirchner is employed by AMC Consultants (AMC). AMC has been engaged on a fee for service basis to provide independent technical advice and final audit for the Productora Project Mineral Resource estimates. Mr Kirchner is a Fellow of the Australasian Institute of Mining and Metallurgy (AusIMM) and is a Member of the Australian Institute of Geoscientists (AIG). Mr Kirchner has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’ (the JORC Code 2012). Mr Kirchner consents to the inclusion in this report of the matters based on the source information in the form and context in which it appears.

Competent Person’s Statement- Cortadera and Costa Fuego Mineral Resources

The information in this report that relates to Mineral Resources for the Cortadera and combined Costa Fuego Project is based on information compiled by Elizabeth Haren, a Competent Person who is a Member and Chartered Professional of the Australasian Institute of Mining and Metallurgy and a Member of the Australian Institute of Geoscientists. Elizabeth Haren is employed as an associate Principal Geologist of Wood, who was engaged by Hot Chili Limited. Elizabeth Haren has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a

Competent Person as defined in the 2012 Edition of the “Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves”. Elizabeth Haren consents to the inclusion in the report of the matters based on her information in the form and context in which it appears.

Reporting of Copper Equivalent

Copper Equivalent (CuEq) reported for the resource were calculated using the following formula: CuEq% = ((Cu% × Cu price 1% per tonne × Cu_recovery)+( Mo ppm × Mo price per g/t × Mo_recovery)+(Au ppm × Au price per g/t × Au_recovery)+ (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price 1 % per tonne). The Metal Prices applied in the calculation were: Cu=3.00 USD/lb, Au=1,550 USD/oz, Mo=12 USD/lb, and Ag=18 USD/oz. For Cortadera (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=56%, Mo=82%, and Ag=37%. For Productora (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=43% and Mo=42%. For Costa Fuego (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=51%, Mo=67% and Ag=23%.

Forward Looking Statements

This Announcement is provided on the basis that neither the Company nor its representatives make any warranty (express or implied) as to the accuracy, reliability, relevance or completeness of the material contained in the Announcement and nothing contained in the Announcement is, or may be relied upon as a promise, representation or warranty, whether as to the past or the future. The Company hereby excludes all warranties that can be excluded by law. The Announcement contains material which is predictive in nature and may be affected by inaccurate assumptions or by known and unknown risks and uncertainties and may differ materially from results ultimately achieved.

The Announcement contains “forward-looking statements”. All statements other than those of historical facts included in the Announcement are forward-looking statements including estimates of Mineral Resources. However, forward-looking statements are subject to risks, uncertainties and other factors, which could cause actual results to differ materially from future results expressed, projected or implied by such forward-looking statements. Such risks include, but are not limited to, copper, gold and other metals price volatility, currency fluctuations, increased production costs and variances in ore grade recovery rates from those assumed in mining plans, as well as political and operational risks and governmental regulation and judicial outcomes. The Company does not undertake any obligation to release publicly any revisions to any “forward-looking statement” to reflect events or circumstances after the date of the Announcement, or to reflect the occurrence of unanticipated events, except as may be required under applicable securities laws. All persons should consider seeking appropriate professional advice in reviewing the Announcement and all other information with respect to the Company and evaluating the business, financial performance and operations of the Company. Neither the provision of the Announcement nor any information contained in the Announcement or subsequently communicated to any person in connection with the Announcement is, or should be taken as, constituting the giving of investment advice to any person

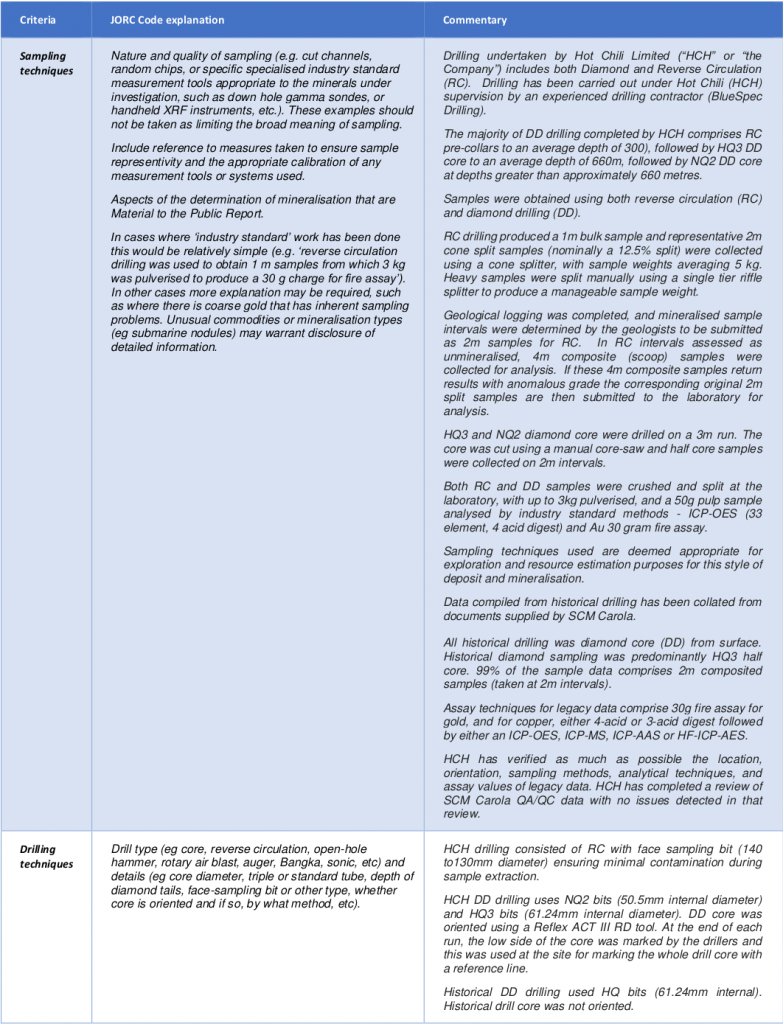

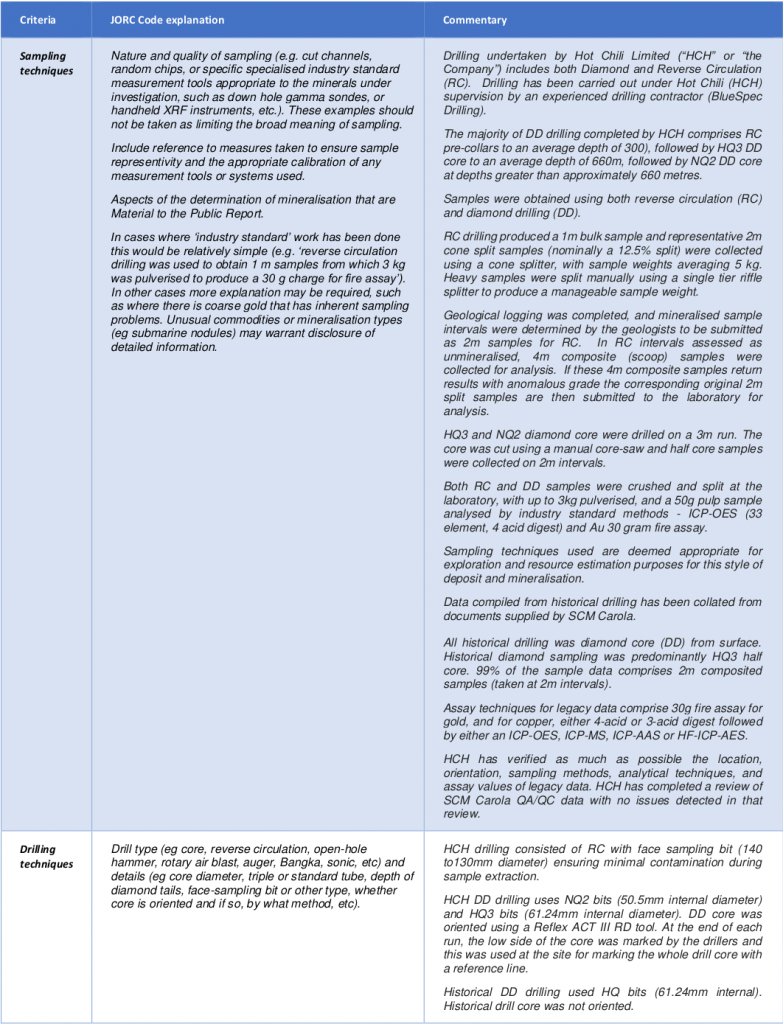

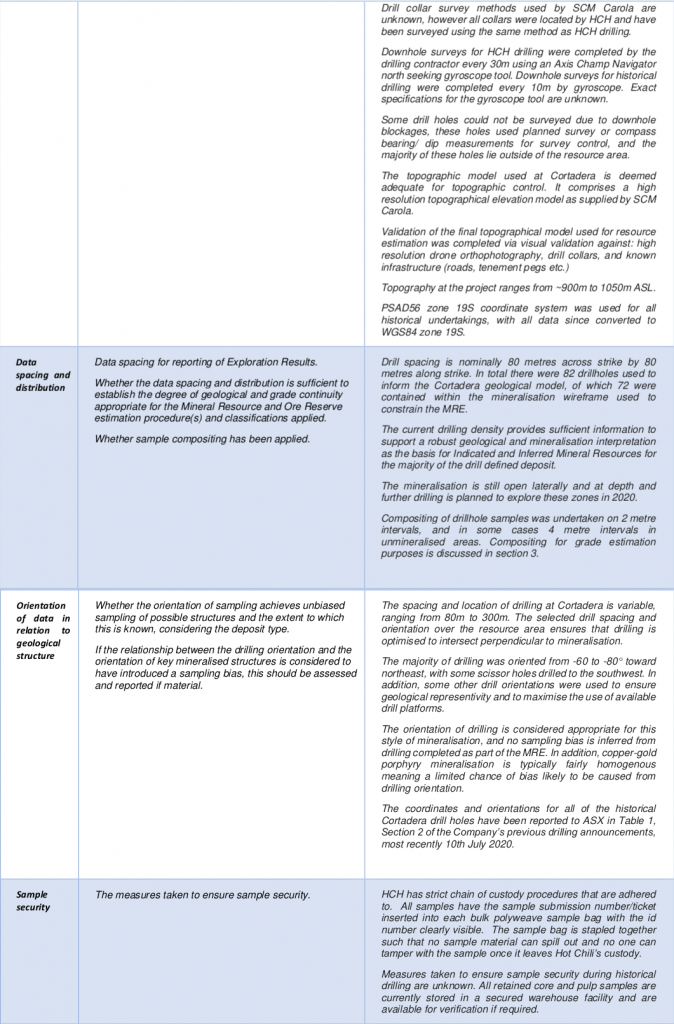

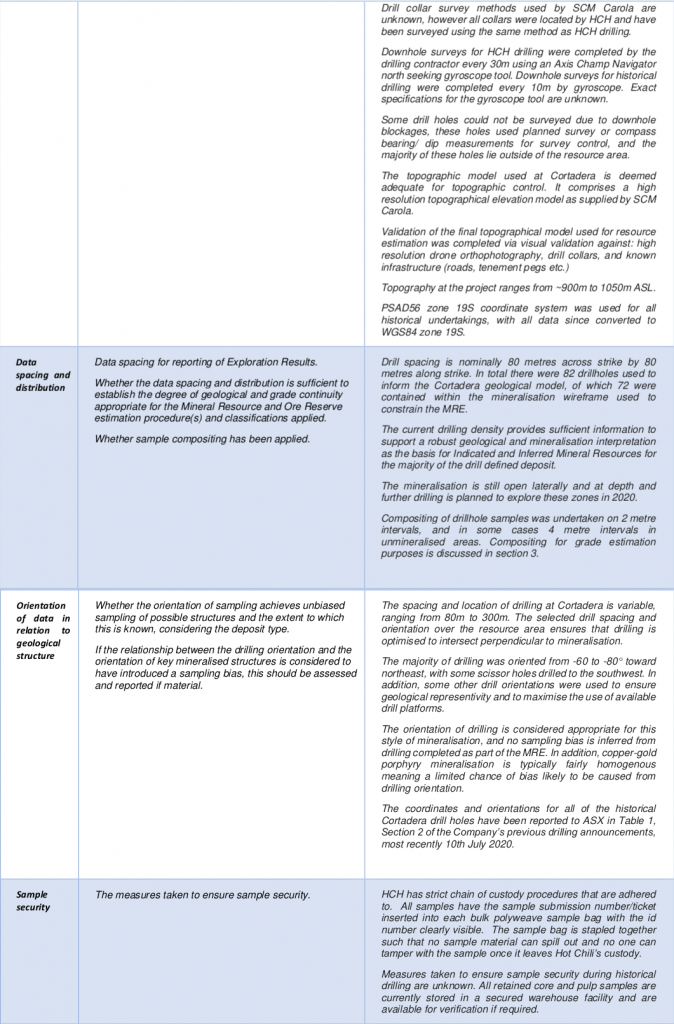

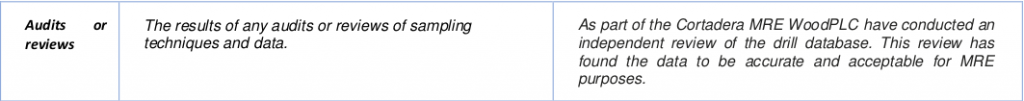

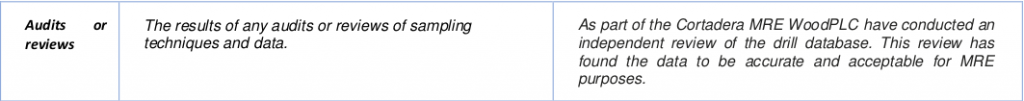

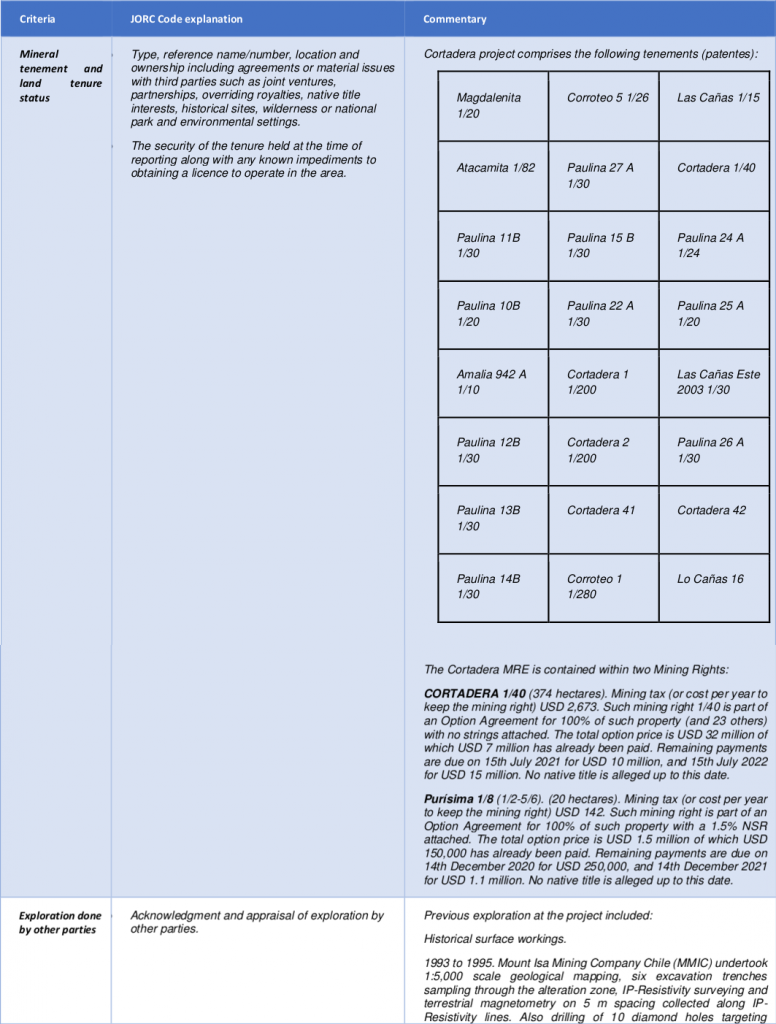

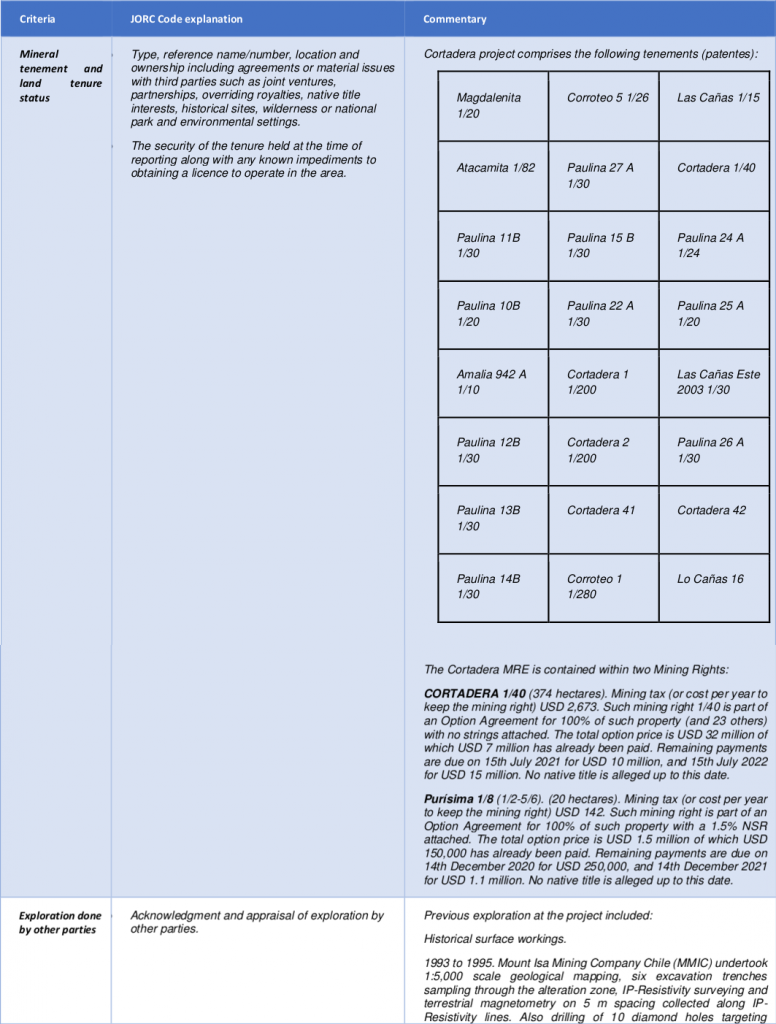

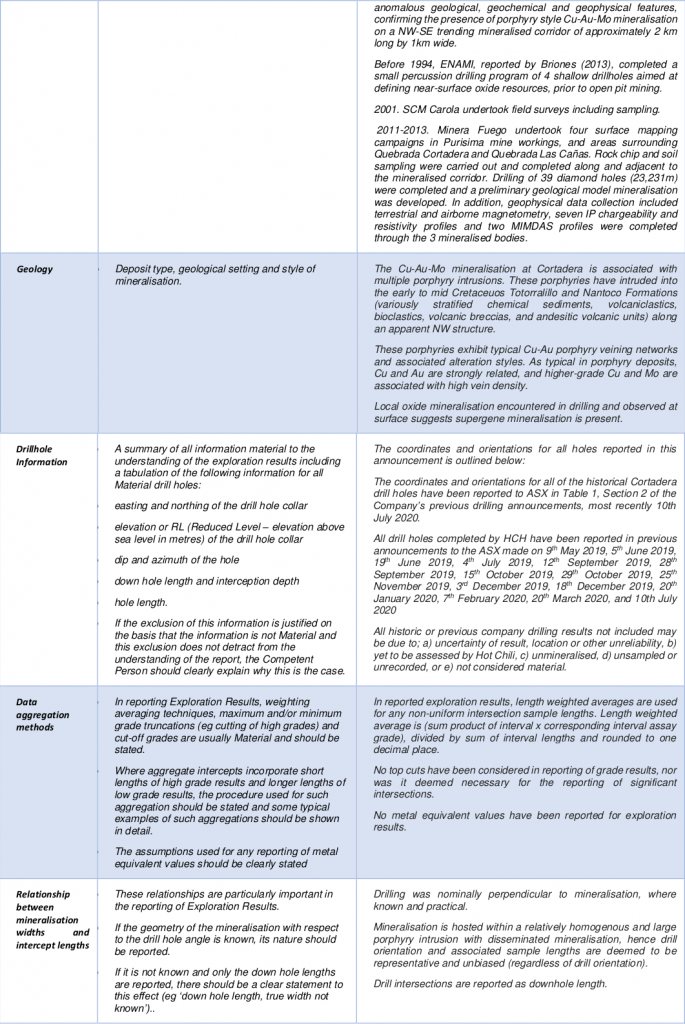

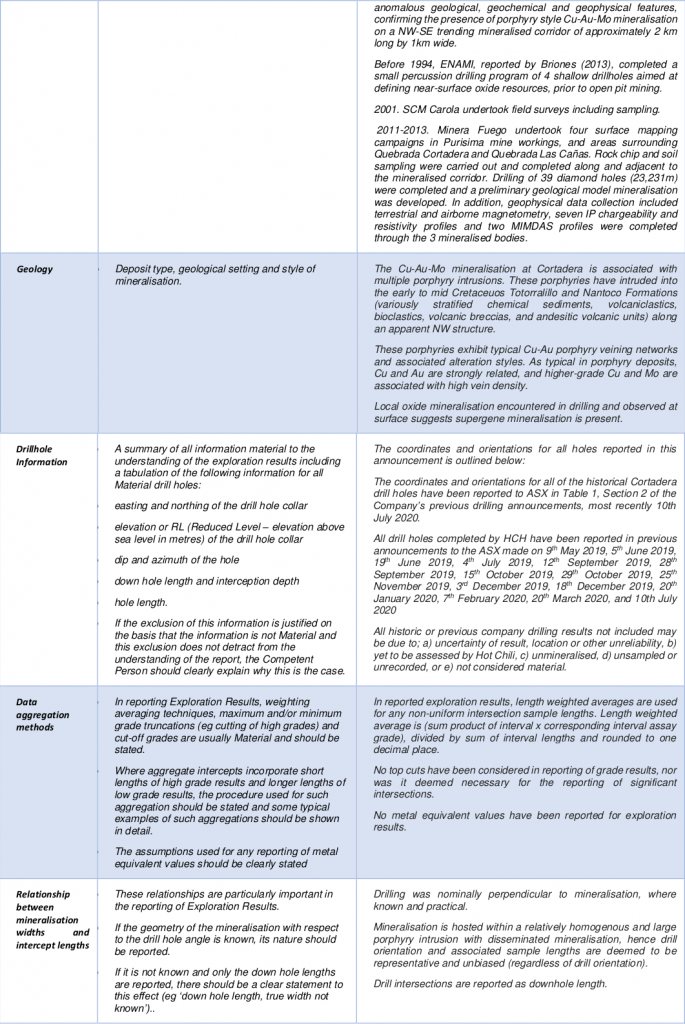

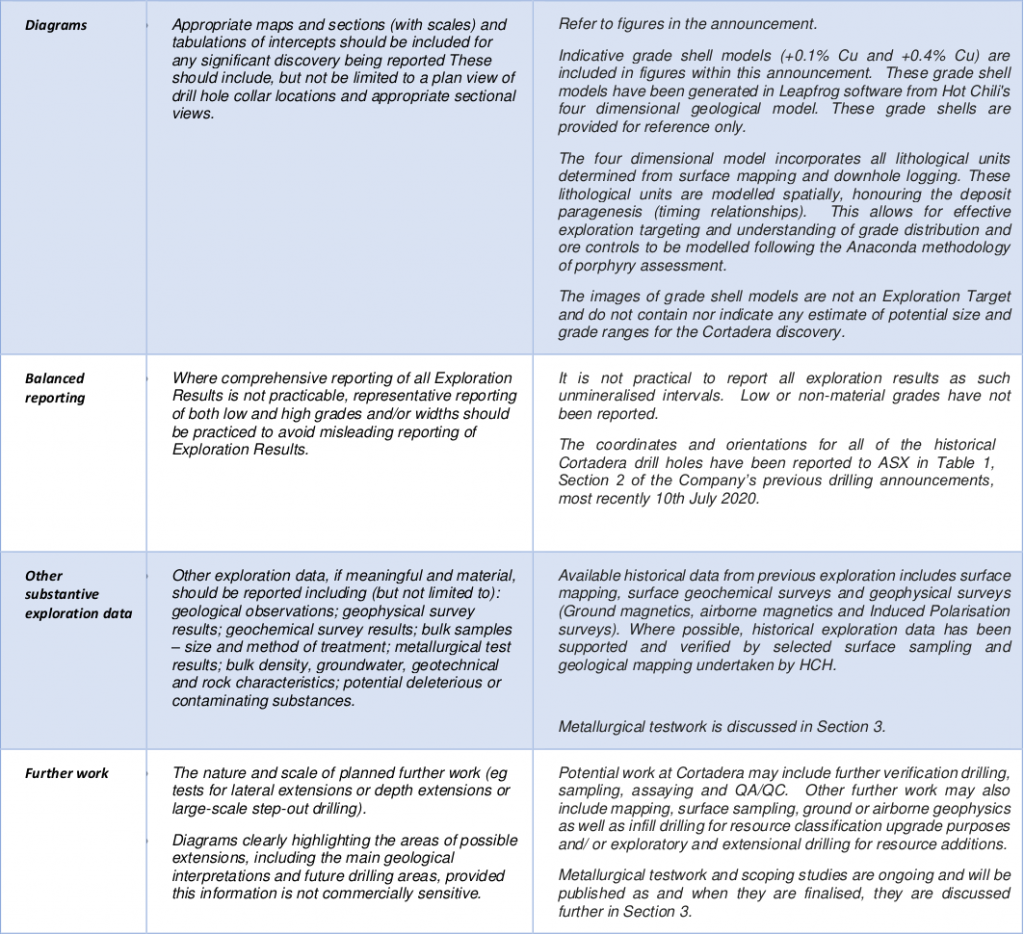

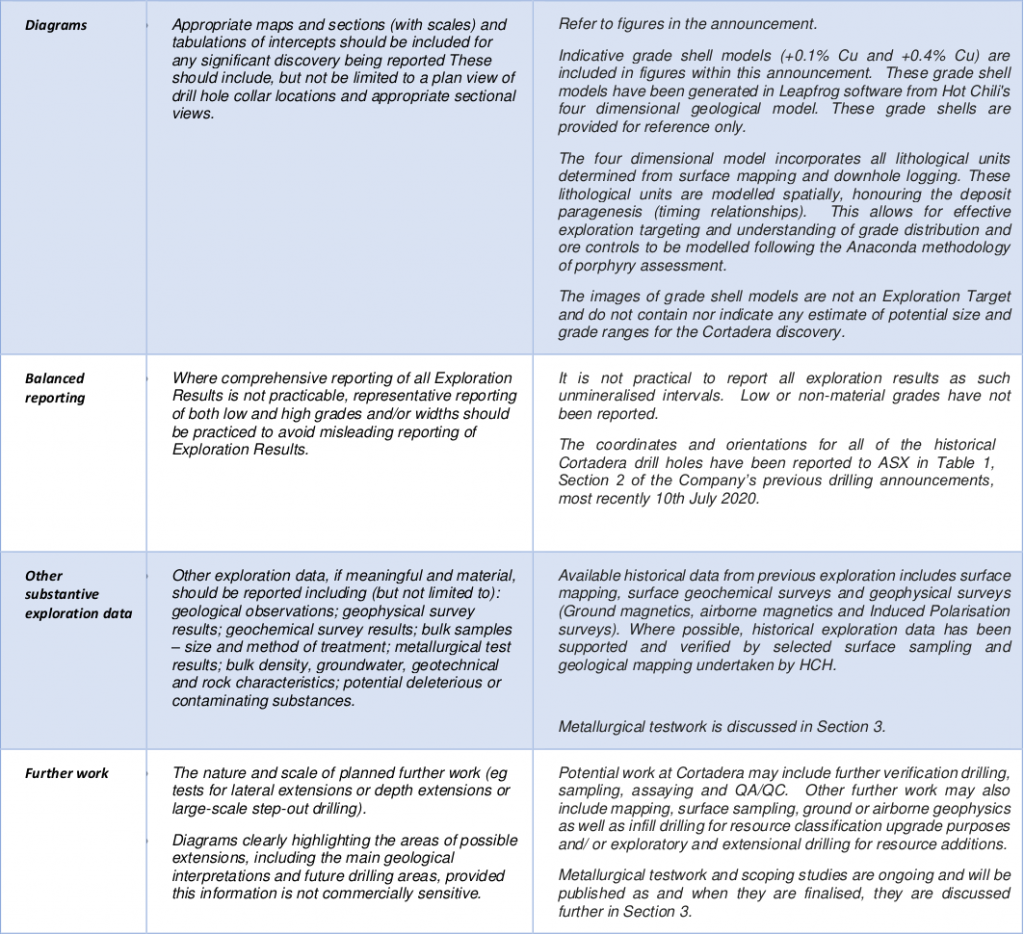

Appendix 1. JORC Code Table 1 for Cortadera

Section 1 Sampling Techniques and Data

Section 2 Reporting of Exploration Results

Second Payment Satisfied for Cortadera Acquisition

ASX Announcement Monday 8th February 2021

Cortadera Acquisition Nears Completion

Hot Chili Limited (ASX code HCH) (“Hot Chili” or “Company”) is pleased to announce that the Company has moved to the final stage of its 100% acquisition of the world-class Cortadera copper-gold discovery in Chile.

An instalment of US$10 million has been satisfied to acquire Cortadera from private Chilean mining group SCM Carola. This brings total payments by Hot Chili to US$17 million since the deal to acquire Cortadera was announced in February 2019.

The Company now has only one remaining payment of US$15 million due in mid-July 2022.

Early payment of the US$10 million instalment to SCM Carola, which was due in mid-July this year, provides Hot Chili with over 18 months to focus on the growth of Cortadera’s maiden resource before the final acquisition payment is due.

The Company has accelerated its activities with the commencement of a fully funded 40,000m drill programme and scoping studies designed to incorporate Cortadera as the centre piece of Hot Chili’s combined large-scale Cost Fuego copper development.

Hot Chili’s Managing Director, Christian Easterday, said that SCM Carola were pleased with the early payment and remained a key partner in the success of Cortadera.

“In less than two years we have transformed Cortadera from a small privately-held discovery in Chile to a leading global copper resource.

“Coming off the back of our first resource of 1.7Mt copper metal and 1.9Moz gold, announced in October 2020, Cortadera now represents one of the lowest cost recent acquisitions in the copper sector.

“This equates to less than US 1 cent per pound of copper added in resource against the total purchase price of US$32 million and is set to further reduce with additional resource growth this year.

“I look forward to a very exciting year ahead for our shareholders as we take Cortadera to the next level.”

Further updates on multiple work streams across Costa Fuego are expected shortly.

This announcement is authorised by the Board of Directors for release to ASX.

For more information please contact:

Christian Easterday Tel: +61 8 9315 9009

Managing Director Email: christian@hotchili.net.au

or visit Hot Chili’s website at www.hotchili.net.au

VAT Refund Approval from Chilean Tax Authority

ASX Announcement Tuesday 9th February 2021

VAT Refund Approval from Chilean Tax Authority

Funds Set to Boost Hot Chili’s Cash Position by up to A$4 Million

Hot Chili (ASX: HCH) is pleased to announce that it has been granted a VAT refund exporting benefit (VAT Refund Payment) from the Chilean Ministry of Economy, Development, and Tourism) for all expenditure associated with its 100% subsidiary Frontera SpA.

Frontera SpA controls the Cortadera copper-gold discovery, the centrepiece of Hot Chili’s Costa Fuego combined copper development, located along the Chilean coastal range 600km north of Santiago.

The VAT Refund Payment significantly strengthens the Company’s cash position in 2021 with an estimated refund of up to A$4 million expected to be paid to Hot Chili.

An initial VAT Refund Payment of A$1.8 to A$2 million (for previously accumulated VAT) is expected to be received in the coming months and further VAT Refund Payments will be received against all forthcoming

expenditure which attracts the 19% tax rate (drilling and assay costs etc).

The VAT Refund Payment relates to the future exporting capacity of Hot Chili’s Cortadera copper-gold project where Hot Chili is now able to claim VAT refund payments for ongoing expenditure up to US$258 million over

the course of its development activities.

Under the terms of the Vat Refund Payment, the Company has until the 1st January 2025 to commercialise production from Cortadera and meet certain export targets. Hot Chili also has the right to extend this term. In

the event that the term is not extended and Hot Chili does not meet certain export targets, Hot Chili will be required to re-pay the VAT Refund Payments to the Chilean Treasury subject to certain terms and conditions.

However, if Hot Chili achieves the export targets from Cortadera within that timeframe or its renewal, if required, any VAT Refund Payments will not be required to be re-paid.

Hot Chili had previously been granted a VAT Refund Payment for its Productora copper project in July 2014, which is active and also remains in-place until 1st January 2025.

This second VAT Refund Payment recognises the Company’s combined development approach for Costa Fuego and reinforces Chile’s proactive stance towards providing a stable and attractive destination for foreign

investment.

Further updates on multiple work streams across Costa Fuego are expected shortly.

This announcement is authorised by the Board of Directors for release to ASX.

For more information please contact:

Christian Easterday Tel: +61 8 9315 9009

Managing Director Email: christian@hotchili.net.au

or visit Hot Chili’s website at www.hotchili.net.au

Refer to ASX Announcement “Costa Fuego Becomes a Leading Global Copper Project” (12th October 2020) for JORC Table 1 information related to the Cortadera JORC compliant Mineral Resource estimate by Wood and the Productora re-stated JORC compliant Mineral Resource estimate by AMC ConsultantsCopper Equivalent (CuEq) reported for the resource were calculated using the following formula: CuEq% = ((Cu% × Cu price

1% per tonne × Cu_recovery)+(Mo ppm × Mo price per g/t × Mo_recovery)+(Au ppm × Au price per g/t × Au_recovery)+ (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price 1% per tonne). The Metal Prices applied in the calculation were: Cu=3.00 USD/lb, Au=1,550 USD/oz, Mo=12 USD/lb, and Ag=18 USD/oz. For Cortadera (Inferred + Indicated), the average Metallurgical

Recoveries were: Cu=83%, Au=56%, Mo=82%, and Ag=37%. For Productora (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=43% and Mo=42%. For Costa Fuego (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=51%, Mo=67% and Ag=23%.

** Reported on a 100% Basis - combining Cortadera and Productora Mineral Resources using a +0.25% CuEq reporting cut-off grade

Qualifying Statements

Independent JORC Code Costa Fuego Combined Mineral Resource (Reported 12th October 2020)

Reported at or above 0.25% CuEq*. Figures in the above table are rounded, reported to appropriate significant figures, and reported in accordance with the JORC Code - Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves. Metal rounded to nearest thousand, or if less, to the nearest hundred. * * Copper Equivalent (CuEq) reported for the resource were calculated using the following formula:: CuEq% = ((Cu% × Cu price 1% per tonne × Cu_recovery)+(Mo ppm × Mo price per g/t × Mo_recovery)+(Au ppm × Au price per g/t × Au_recovery)+ (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price 1 % per tonne). The Metal Prices applied in the calculation were: Cu=3.00 USD/lb, Au=1,550 USD/oz, Mo=12 USD/lb, and Ag=18 USD/oz. For Cortadera (Inferred + Indicated), the

average Metallurgical Recoveries were: Cu=83%, Au=56%, Mo=82%, and Ag=37%. For Productora (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=43% and Mo=42%. For Costa Fuego (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=51%, Mo=67% and Ag=23%.

** Note: Silver (Ag) is only present within the Cortadera Mineral Resource estimate

Competent Person’s Statement- Exploration Results

Exploration information in this Announcement is based upon work compiled by Mr Christian Easterday, the Managing Director and a fulltime employee of Hot Chili Limited whom is a Member of the Australasian Institute of Geoscientists (AIG). Mr Easterday has sufficient

experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is

undertaking to qualify as a ‘Competent Person’ as defined in the 2012 Edition of the ‘Australasian Code for Reporting of Exploration

Results, Mineral Resources and Ore Reserves’ (JORC Code). Mr Easterday consents to the inclusion in the report of the matters based on

their information in the form and context in which it appears.

Competent Person’s Statement- Productora Mineral Resources

The information in this Announcement that relates to the Productora Project Mineral Resources, is based on information compiled by

Mr N Ingvar Kirchner. Mr Kirchner is employed by AMC Consultants (AMC). AMC has been engaged on a fee for service basis to provide

independent technical advice and final audit for the Productora Project Mineral Resource estimates. Mr Kirchner is a Fellow of the

Australasian Institute of Mining and Metallurgy (AusIMM) and is a Member of the Australian Institute of Geoscientists (AIG). Mr Kirchner

has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being

undertaken to qualify as a Competent Person as defined in the 2012 Edition of the ‘Australasian Code for Reporting of Exploration Results,

Mineral Resources and Ore Reserves’ (the JORC Code 2012). Mr Kirchner consents to the inclusion in this report of the matters based on

the source information in the form and context in which it appears.

ears.

Competent Person’s Statement- Cortadera and Costa Fuego Mineral Resources

The information in this report that relates to Mineral Resources for the Cortadera and combined Costa Fuego Project is based on

information compiled by Elizabeth Haren, a Competent Person who is a Member and Chartered Professional of the Australasian Institute

of Mining and Metallurgy and a Member of the Australian Institute of Geoscientists. Elizabeth Haren is employed as an associate Principal

Geologist of Wood, who was engaged by Hot Chili Limited. Elizabeth Haren has sufficient experience that is relevant to the style of

mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined

in the 2012 Edition of the “Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves”. Elizabeth Haren

consents to the inclusion in the report of the matters based on her information in the form and context in which it appears.

Reporting of Copper Equivalent

Copper Equivalent (CuEq) reported for the resource were calculated using the following formula: CuEq% = ((Cu% × Cu price 1% per tonne × Cu_recovery)+(Mo ppm × Mo price per g/t × Mo_recovery)+(Au ppm × Au price per g/t × Au_recovery)+ (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price 1 % per tonne). The Metal Prices applied in the calculation were: Cu=3.00 USD/lb, Au=1,550 USD/oz, Mo=12 USD/lb, and Ag=18 USD/oz. For Cortadera (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=56%, Mo=82%, and Ag=37%. For Productora (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=43% and Mo=42%. For Costa Fuego (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=51%, Mo=67% and Ag=23%.

Forward Looking Statements

This Announcement is provided on the basis that neither the Company nor its representatives make any warranty (express or implied) as to the accuracy, reliability, relevance or completeness of the material contained in the Announcement and nothing contained in the Announcement is, or may be relied upon as a promise, representation or warranty, whether as to the past or the future. The Company hereby excludes all warranties that can be excluded by law. The Announcement contains material which is predictive in nature and may be affected by inaccurate assumptions or by known and unknown risks and uncertainties and may differ materially from results ultimately achieved.

The Announcement contains “forward-looking statements”. All statements other than those of historical facts included in the Announcement are forward-looking statements including estimates of Mineral Resources. However, forward-looking statements are subject to risks, uncertainties and other factors, which could cause actual results to differ materially from future results expressed, projected or implied by such forward-looking statements. Such risks include, but are not limited to, copper, gold and other metals price volatility, currency fluctuations, increased production costs and variances in ore grade recovery rates from those assumed in mining

plans, as well as political and operational risks and governmental regulation and judicial outcomes. The Company does not undertake

any obligation to release publicly any revisions to any “forward-looking statement” to reflect events or circumstances after the date of the Announcement, or to reflect the occurrence of unanticipated events, except as may be required under applicable securities laws. All persons should consider seeking appropriate professional advice in reviewing the Announcement and all other information with respect to the Company and evaluating the business, financial performance and operations of the Company. Neither the provision of the Announcement nor any information contained in the Announcement or subsequently communicated to any person in connection with the Announcement is, or should be taken as, constituting the giving of investment advice to any person.

Second High Grade Core Confirmed at Cortadera

ASX Announcement

17th December 2020

Second High Grade Copper-Gold Core Confirmed at Cortadera

Highlights

- Widest significant drill intersection recorded to date at the second largest porphyry (Cuerpo 2) of the Cortadera copper-gold discovery in Chile

Significant Drill Result for CRP0053D

248m grading 0.4% copper & 0.1g/t gold

from 446m down-hole depth

including

32m grading 0.6% copper & 0.3g/t gold

(plus additional silver and molybdenum credits)

- The wide intersection in CRP0053D broadens the extent of the maiden Cortadera resource below Cuerpo 2 and confirms increasing grade and porphyry B-vein abundance with depth

- Three diamond hole pre-collars are complete and ready for deep testing below Cuerpo 2 as well as the gap zone between the two largest porphyries (Cuerpo 2 and Cuerpo 3)

- Drill results are pending for expansion hole CRP0052D (completed to 1,040m down-hole depth) across the SE extension of the main porphyry – Cuerpo 3

- Diamond drill hole CRP0046D, testing the up-dip extension of the high grade core at Cuerpo 3, is currently at 300m down-hole depth in mineralisation (planned to 1,000m)

- Access and platform clearing advancing well across the large Cortadera North “look alike” target, results pending for first four RC drill holes

Hot Chili Limited (ASX code HCH) (“Hot Chili” or “Company”) is pleased to announce that its first diamond drilling below the second largest porphyry (Cuerpo 2) of the Cortadera copper-gold porphyry discovery in Chile has confirmed both increasing grade and width with depth.

The new result in CRP0053D is the widest significant intersection recorded in drilling to date at Cuerpo 2, which had only previously been drill tested over a relatively shallow depth.

Cortadera’s 451Mt maiden Mineral Resource includes a higher-grade component (+0.6% CuEq*) of 104Mt at 0.74% CuEq (as reported to ASX on 12th October 2020), which is currently being expanded. The identification of a significant second high grade core has the potential to dramatically increase Cortadera’s high grade resource inventory.

The Company’s Phase-3 drill programme at Cortadera has made significant advances over the past month in key growth areas of the discovery.

Increasing Grade with Depth Confirmed at Cortadera’s Cuerpo 2 Porphyry

New results returned from Hot Chili’s first diamond drill hole (CRP0053D) below Cortadera’s Cuerpo 2 porphyry have returned a significant intersection of 248m grading 0.4% copper and 0.1g/t gold from 446m depth down-hole, within a broader result of 613.9m grading 0.3% copper and 0.1g/t gold from 220m depth down-hole.

Importantly, CRP0053D recorded two high grade zones of 32m grading 0.6% copper and 0.3g/t gold and 24m grading 0.6% copper and 0.2g/t gold in association with increasing porphyry B-vein intensity.

Only two previous historical drill holes had tested Cuerpo 2 at depth, with both recording high grade copper-gold results in association with increasing porphyry B-vein intensity. Higher grade intervals within these historical holes included 42m grading 0.8% copper and 0.4g/t gold (FD0008, from 206m) and 64m grading 0.6% copper and 0.1g/t gold (FD0020, from 360m depth).

Increasing grade at depth in association with increasing porphyry B-vein abundance was key to the discovery of the high grade core within the main porphyry by Hot Chili in August 2019.

The Company has now completed three pre-collar Reverse Circulation (RC) holes in preparation for deep diamond drill testing below Cuerpo 2 and the gap zone between Cuerpo 2 and Cuerpo 3.

Drilling of these holes is prioritised for Phase-4 drilling early in the New Year.

Cortadera Main Porphyry Continues to Expand

Diamond drill hole CRP0052D, testing the south-east extension of Cuerpo 3, is now complete at 1,040m down-hole depth. As announced to ASX on 1st December 2020, CRP0052D recorded a broad 500m intersection of porphyry mineralisation.

Between 500m and 1,000m down-hole depth, CRP0052D recorded a visual estimate of 0.5% – 3.0% chalcopyrite contained as fine dissemination and in association with 1% to 10% B-vein abundance. Visual estimates of sulphide minerals are not an accurate representation of expected assay value and are provided for indicative purposes only.

The Company has also completed two new RC pre-collars at Cuerpo 3 and is currently drilling diamond hole CRP0046D. CRP0046D is in mineralisation at a depth of approximately 300m down-hole with a planned total depth of 1,000m.

These holes (including CRP0046D) are all designed to expand the high grade core at Cuerpo 3.

Final assay results from CRP0052D are expected to be received soon.

Cortadera North

Clearing is well underway to provide access to the remaining planned drill holes planned across the large Cortadera North “look-alike” target, located 2km north of Cortadera.

Four RC holes are already complete across the large surface molybdenum anomaly with results expected to be received soon.

Once additional platforms are prepared, the Company plans to complete a further six RC holes which will target the large Induced Polarisation (IP) chargeability anomaly and areas of outcropping copper-bearing B-veins.

Drilling at Cortadera North is expected to re-commence in late January or early February of next year.

This announcement is authorised by the Board of Directors for release to ASX.

For more information please contact:

Christian Easterday

Managing Director

Tel: +61 8 9315 9009

Email: christian@hotchili.net.au

or visit Hot Chili’s website at www.hotchili.net.au

Water Rights Secured for Costa Fuego Copper-Gold Super Hub

ASX Announcement

7th December 2020

Water Rights Secured for Costa Fuego Copper-Gold Super Hub

Highlights

- Crucial water extraction rights granted for the Company’s Costa Fuego coastal copper development in Chile

- Water extraction rights represent a critical infrastructure requirement for Costa Fuego, securing sufficient water supply to support a large-scale conventional copper-gold operation

- Water extraction rights for sea water processing (no de-salination plant) adds to Costa Fuego’s growing credentials as one of the leading new “green” copper developments (existing infrastructure footprint, adjacent to largest solar projects in Chile and clean arsenic-free concentrate)

Hot Chili Limited, through its Chilean subsidiary company Sociedad Minera El Aguila SpA, is pleased to announce that it has been granted a Maritime Concession for extraction of sea water just 60 kilometres from the Company’s Costa Fuego coastal copper-gold development in Chile.

Costa Fuego has a combined Mineral Resource of 2.9Mt copper, 2.7Moz gold, 9.9Moz silver and 64kt molybdenum (released to ASX 12th October 2020) and is located at low altitude (800m to 1,000m), along the Pan American highway and adjacent to port facilities, 600km north of Santiago.

Following a rigorous seven-year application process, Hot Chili is now one of the few copper developers in Chile controlling a Maritime Concession for water. This adds significantly to critical infrastructure access requirements already secured including surface rights and water and electricity easements.

The water rights represent a major step forward in establishing an infrastructure-ready major coastal copper development which can leverage from a central processing and combined infrastructure approach.

Pre-feasibility studies completed in 2016 (contemplating Productora only) modelled the extraction of seawater via a 62km buried water pipeline from the coast to Productora (as announced to ASX 2nd March 2016). All metallurgical testwork results to date from Costa Fuego have achieved strong metal recoveries using sea water processing.

The seawater pipeline design is now planned to be increased and extended to Cortadera, as the new operating centre for the combined Costa Fuego development.

The maritime concession alone is considered a significant asset, and further enhances the Company’s social license to operate ensuring no ground water will be used and no de-salination plant is required.

The Directors of Hot Chili are pleased with advances being made with Chilean regulatory applications and growing local community support for Costa Fuego.

This announcement is authorised by the Board of Directors for release to ASX.

For more information please contact:

Christian Easterday

Managing Director

Tel: +61 8 9315 9009

Email: christian@hotchili.net.au

or visit Hot Chili’s website at www.hotchili.net.au

Lease Mining & Processing Agreement Expanded

ASX Announcement

11th December 2020

Annual Ore Production Cap with ENAMI Increased by 50%

Highlights

- Hot Chili has expanded its agreement with Chilean government agency ENAMI for the mining and processing of ore from the Company’s Productora copper-gold project

- Concession for maximum annual production lifted by 50% to 180,000 tonnes per annum

- Ore supply from Productora planned to account for all remaining capacity at ENAMI’s nearby Vallenar oxide and sulphide processing facility

- New decline access being developed in the Productora underground mine

Hot Chili Limited, through its Chilean subsidiary company Sociedad Minera El Aguila SpA (SMEA), is pleased to announce a significant expansion to its lease mining and processing agreement with Chilean government agency ENAMI.

The Company has granted ENAMI a further concession for an additional 60,000 tonnes of oxide ore supply per annum to their Vallenar processing facility, located 15km north of Productora.

The concession for lease mining and processing now allows a maximum180,000 tonnes per annum of oxide and sulphide ore supply from Productora. The Increased production rate accounts for all remaining processing capacity at ENAMI’s oxide and sulphide processing facility.

The Productora joint venture company SMEA (80% Hot Chili) will be paid US$2 per tonne for ore purchased by ENAMI and a 10% royalty on the sale value of extracted minerals subject to ENAMI toll treatment conditions (as announced to ASX on 26th March).

Since the ENAMI agreement was first announced in late March this year, the royalty component has provided significant upside exposure to the copper price which has increased from US$2.15/lb to and eight year high of US$3.57/lb today.

Ramp-up of lease mining is underway following recent mine plan and permitting approval at Productora (as announced to ASX on 11th November 2020). The lease mining team is currently extending the existing decline to access new ore development below the Productora underground mine.

Once access to new development is In-place, the lease mining team expects to increase its production rate which has been limited to small-scale remnant ore extraction to date.

The Directors of Hot Chili are pleased with this next positive step forward in its local partnership with Chilean government agency ENAMI.

This announcement is authorised by the Board of Directors for release to ASX.

For more information please contact:

Christian Easterday

Managing Director

Tel: +61 8 9315 9009

Email: christian@hotchili.net.au

or visit Hot Chili’s website at www.hotchili.net.au

$25.6M Funding Accelerates Cortadera Acquisition & Drilling

ASX Announcement

1st December 2020

$25.6M Institutional Placement to Secure Cortadera Copper-Gold Discovery and Accelerate Drilling

Highlights

- Successful A$25.6M private placement led and supported by several of Australia’s top resource funds

- New funds satisfy next acquisition payment of US$10M for the Cortadera copper-gold discovery in Chile, ensuring 100% control is maintained

- An aggressive 40,000m Phase-4 drill programme at Cortadera is now fully funded for 2021 and set to be significantly accelerated to five shifts of drilling per day using three drill rigs

- Expansion drilling at Cortadera has recorded a second 500m wide intersection of porphyry mineralisation – results pending

- Resource upgrades over the next 12 months expected to add significantly to the Company’s combined Costa Fuego development, currently standing at 2.9Mt copper, 2.7Moz gold, 9.9Moz silver and 64kt molybdenum (as announced to ASX on 12th October 2020)

Hot Chili Limited (ASX Code: HCH) (“Hot Chili” or the “Company”) is pleased to announce that it has successfully arranged a $25.6 million institutional-led private placement to sophisticated and professional investors through the issue of shares at 4.2 cent per share (the “Placement”). Veritas Securities acted as lead manager to the Placement.

Funds from the Placement will primarily be used for payment of the second instalment of US$10 million for the 100% acquisition of the Cortadera copper-gold discovery and commencement of a 40,000m Phase-4 drill campaign. Phase-4 drilling is scheduled to commence early in the New Year utilising two Diamond (DD) drill rigs and one Reverse Circulation (RC) drill rig based on five shifts of drilling per day.

The Placement clears the way for Hot Chili to maintain its control over the world-class Cortadera copper-gold discovery and fund an aggressive growth strategy at a time of resurgent copper and gold price conditions.

Ongoing expansion drilling has recorded further exceptional widths of porphyry mineralisation, continuing Cortadera’s strong run of results.

Hot Chili’s Managing Director Christian Easterday said “the institutional backing of the Placement was pleasing and a strong endorsement of Hot Chili’s growth strategy and continuing success at Cortadera.”

“This funding provides certainty over our ability to deliver multiple catalysts in the year ahead.”

“With copper price at seven-year highs, we are poised to accelerate our plans for Cortadera and position the Costa Fuego coastal copper project as one of the world’s leading new copper developments.”

Upcoming News Flow

The Company plans to provide several drilling and operational updates over the coming weeks following strong advancement across multiple work streams, including:

- Expansion DD drill results pending from Cuerpo 2 at Cortadera (CRP0053D). Preliminary details of a broad 500m intersection of porphyry mineralisation recorded in CRP0053D were reported to ASX on 11th November.

- The current DD drill hole from Cuerpo 3 at Cortadera (CRP0052D) is drilling to a planned down-hole depth of 1,200m, testing the south-east extension of the main porphyry. CRP0052D has also recorded a broad 500m intersection of porphyry mineralisation and still remains in mineralisation at its current depth of approximately 1,000m.

- Between 500m and 1,000m down-hole depth, CRP0052D recorded a visual estimate of 0.5% – 3.0% chalcopyrite contained as fine dissemination and in association with 1% to 10% B-vein abundance. Visual estimates of sulphide minerals are not an accurate representation of expected assay value and are provided for indicative purposes only.

- First pass RC drill results across the Cortadera North target. The first four holes across the large surface molybdenum anomaly at Cortadera North have been completed with results pending. Clearing is now underway to provide access to the remaining six planned drill holes which will target the large Induced Polarisation (IP) chargeability anomaly and areas of outcropping copper-bearing B-veins.

- Lease mining and processing of high grade ore at Productora. Ramp-up of production is continuing and the Company expects to provide an update shortly on ongoing discussions related to expansion of production with Chilean government agency ENAMI.

Details of the Placement

The Company has arranged a Placement of 609,800,000 new shares in two tranches to raise $25,611,600 with sophisticated and professional investors as defined by section 708 (8), (10) and (11) of the Corporations Act 2001.

The issue of 597,895,238 shares under Tranche 1 of the Placement will not be subject to shareholder approval and will be made within the Company’s 25% placement capacity under Australian Securities Exchange (ASX) listing rules 7.1 and 7.1A.

A total of 353,963,243 new shares will be issued within the Company’s 15% placement capacity under listing rule 7.1 and a total of 243,931,995 new shares will be issued within the Company’s additional 10% placement capacity under listing rule 7.1A.

Following the issue of the Placement shares, the Company’s remaining placement capacity under listing rule 7.1 and 7.1A will be 11,934,749 ordinary securities.

The issue of 11,904,762 shares to Blue Spec Sondajes Chile SpA, a Company associated with Hot Chili’s chairman Murray Black, under Tranche 2 of the Placement will be subject to shareholder approval.

Each new share will be issued at a price of 4.2 cents.

The Company will convene a general meeting seeking shareholder approval of the issue of Tranche 2 Placement shares, anticipated to be late-January 2021.

The issue price of 4.2 cents per new share represents a 14% discount to the Company’s last closing price and an 18% discount to the 15-day VWAP of Hot Chili shares prior to the trading halt announced on Monday 16th November 2020.

Shares issued under the Placement will be fully paid ordinary shares in the Company and will rank equally with shares currently on issue.

Settlement and issue of the Placement shares is expected to occur on or around Friday 4th December 2020.

This announcement is authorised by the Board of Directors for release to ASX.

For more information please contact:

Christian Easterday

Managing Director

Tel: +61 8 9315 9009

Email: christian@hotchili.net.au

or visit Hot Chili’s website at www.hotchili.net.au