Cortadera Copper-Gold Discovery Continues Impressive Run of Drill Results

Cortadera Copper-Gold Discovery

Continues Impressive Run of Drill Results

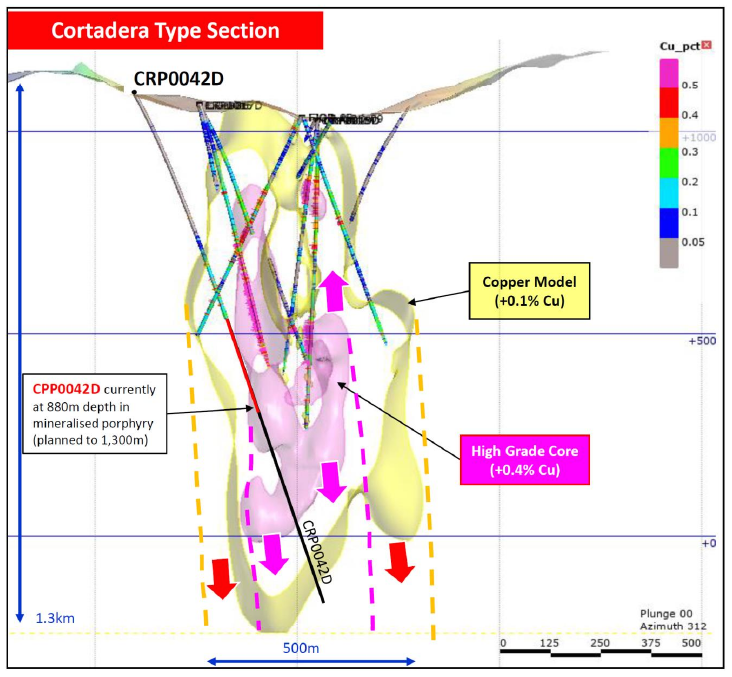

First Diamond Hole Below Cuerpo 2 Records

Broad 500m zone of Mineralised Porphyry

Highlights

- New drill results at Hot Chili’s Cortadera porphyry discovery in Chile, point toward a significant upgrade to the recently released 451Mt maiden copper-gold Mineral Resource

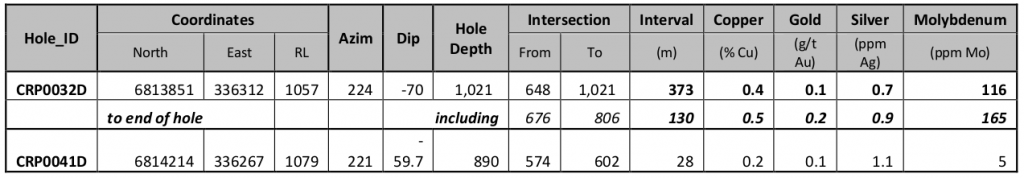

Significant Drill Result for CRP0032D

373m grading 0.4% copper & 0.1g/t gold

from 648m down-hole depth to end-of hole

including

130m grading 0.5% copper & 0.2g/t gold

(plus additional silver and molybdenum credits)

- The end-of-hole intersection in CRP0032D extends the maiden Cortadera resource and confirms that the NW margin of the main porphyry (Cuerpo 3) remains open, with up to 400m of potential strike extension remaining to be tested

- Diamond drill rig currently testing the SE extension of Cuerpo 3; CRP0052D is currently in mineralisation at a depth of approximately 360m down-hole, with a planned hole depth of 1,200m

- First Hot Chili diamond hole completed below Cuerpo 2 (CRP0053D) has recorded a broad 500m zone of mineralised porphyry – assays pending and a second hole planned

- Two first-pass Reverse Circulation (RC) holes complete and a third is underway across the 2km long Cortadera North target – results pending, seven RC holes remaining

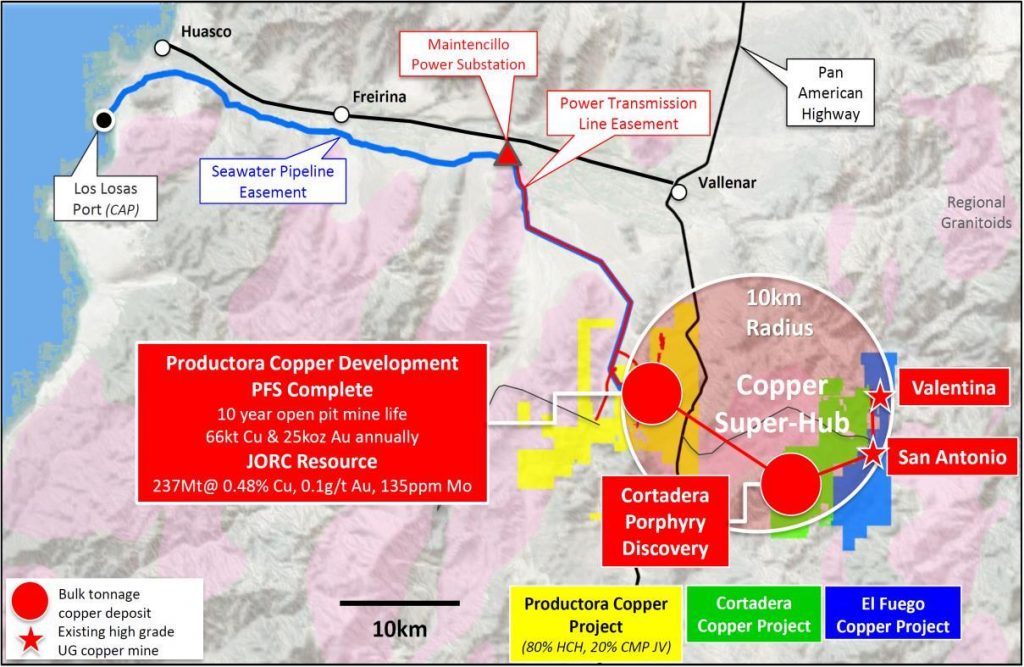

- Mine plan and final permitting approvals for Productora underground mine received, ramp-up of lease mining activities progressing well towards first commercial cash flow

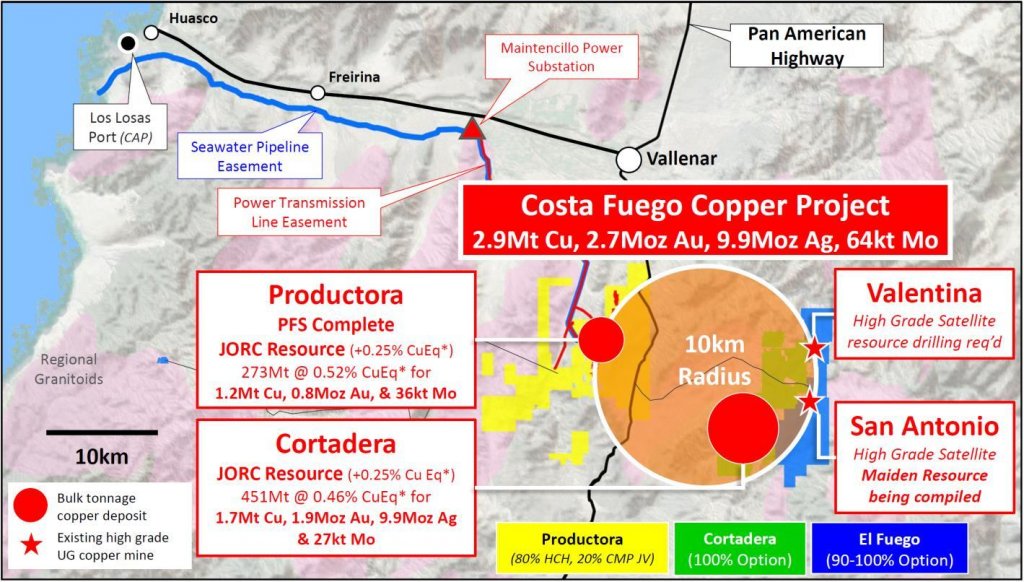

Hot Chili Limited (ASX code HCH) (“Hot Chili” or “Company”) is pleased to announce the first steps towards a major upgrade of its maiden 451Mt Cortadera Mineral Resource (resource), released just one month ago.

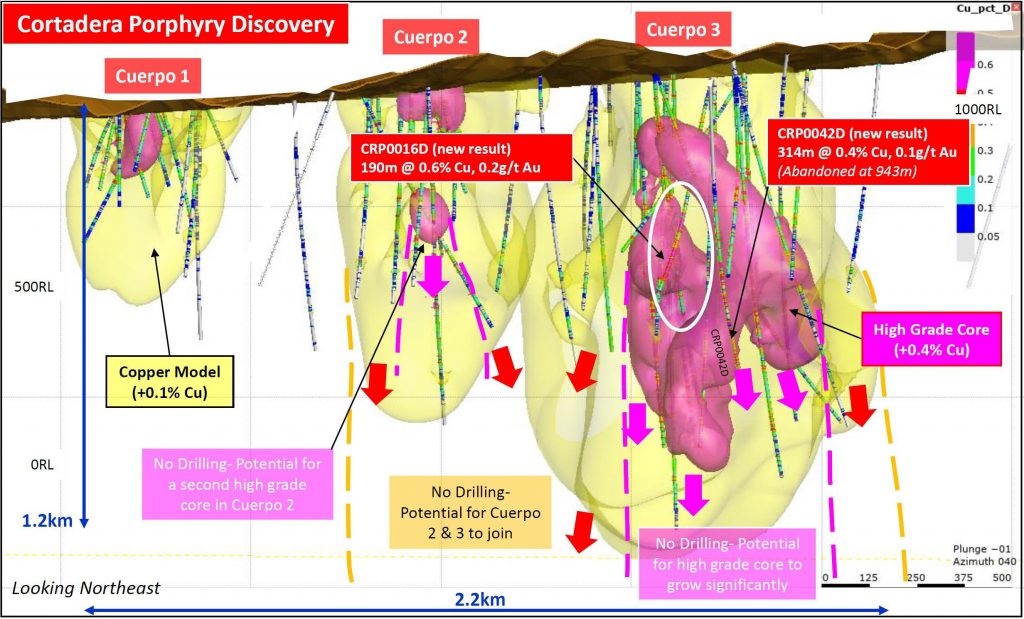

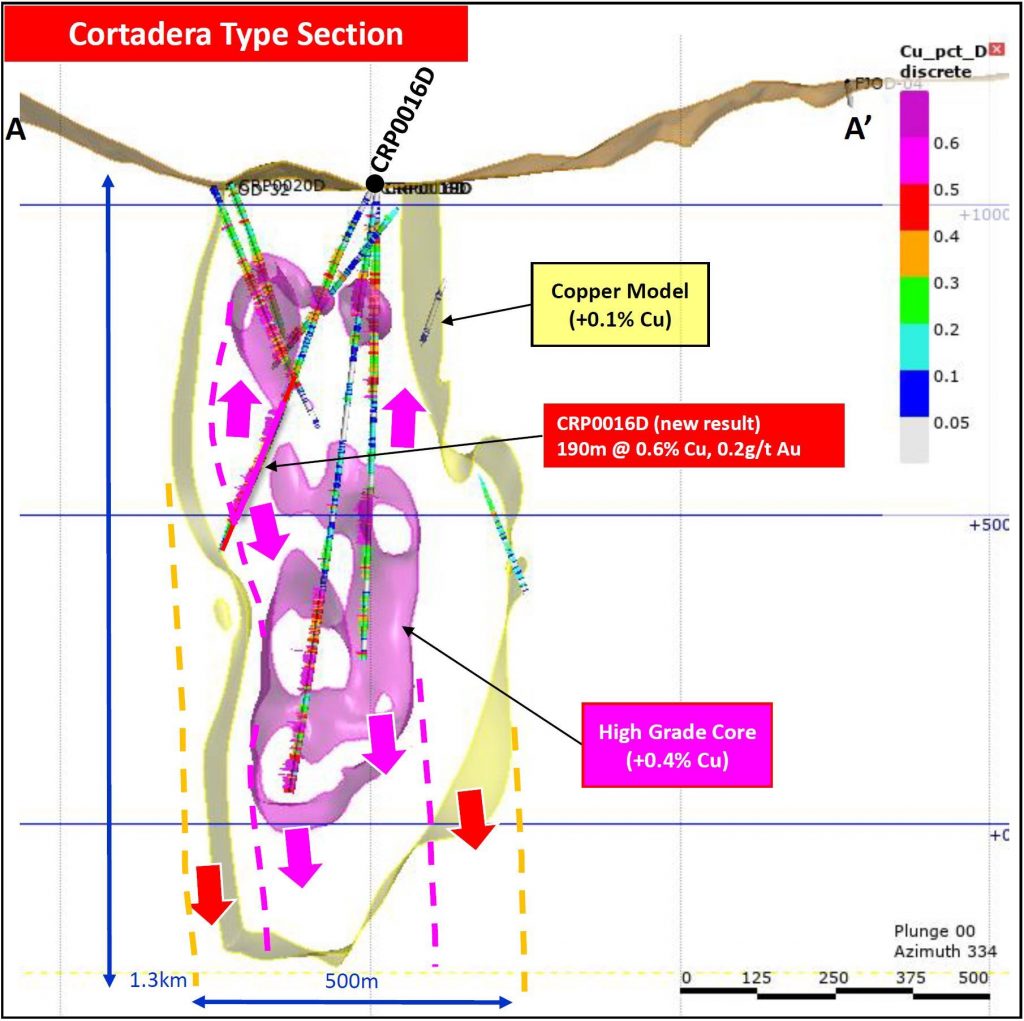

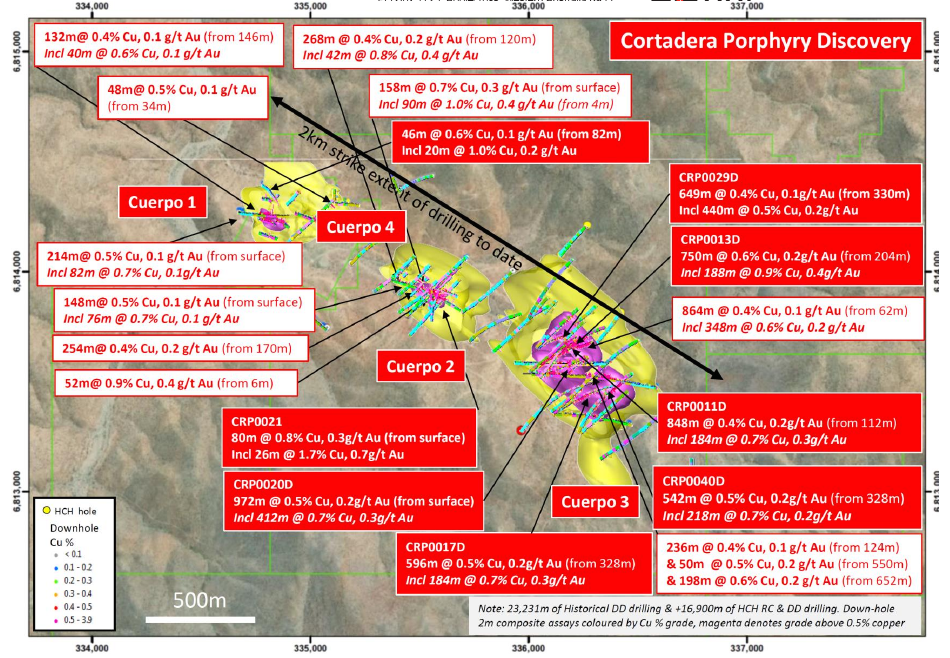

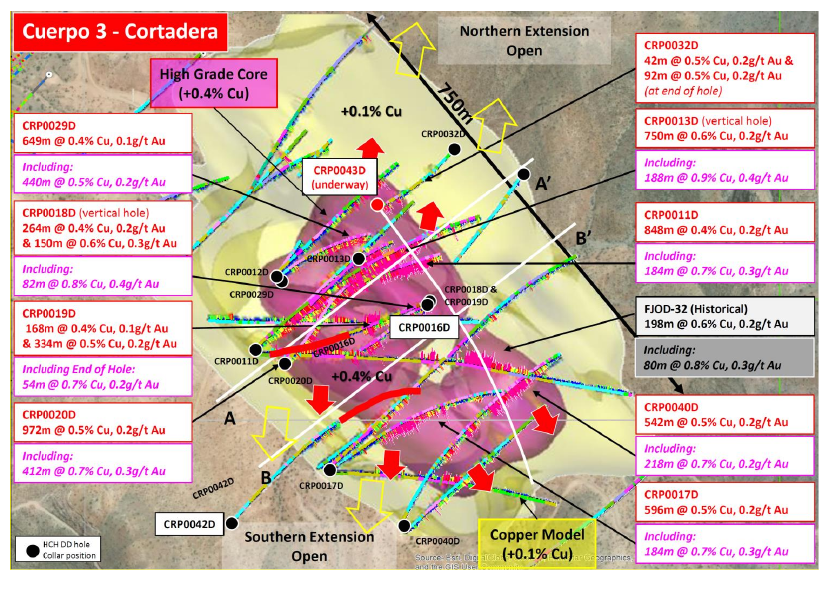

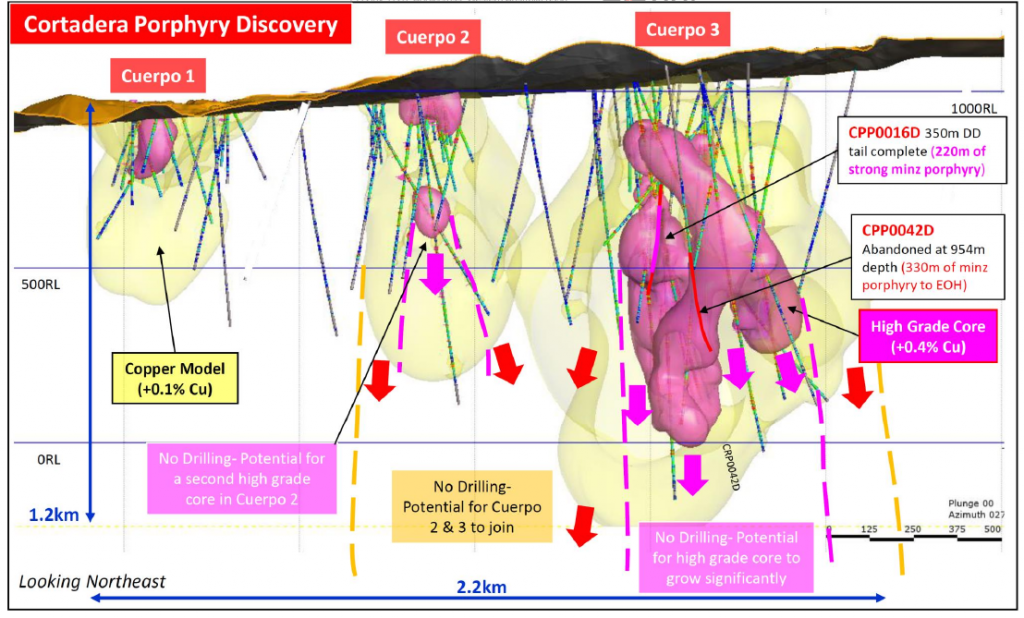

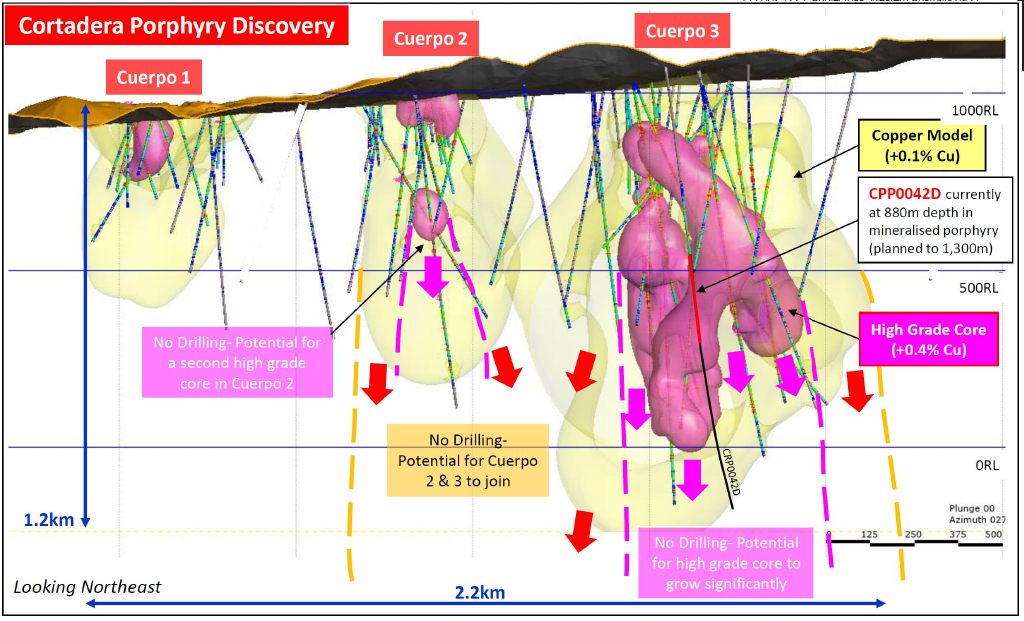

Expansion drilling of the Cortadera resource is seeing continued success, with wide intersections being recorded from extensional drilling of the main porphyry (Cuerpo 3) and the second largest porphyry (Cuerpo 2). These results continue to underpin the Company’s view that Cortadera is rapidly growing toward a potential Tier 1 copper discovery in its own right.

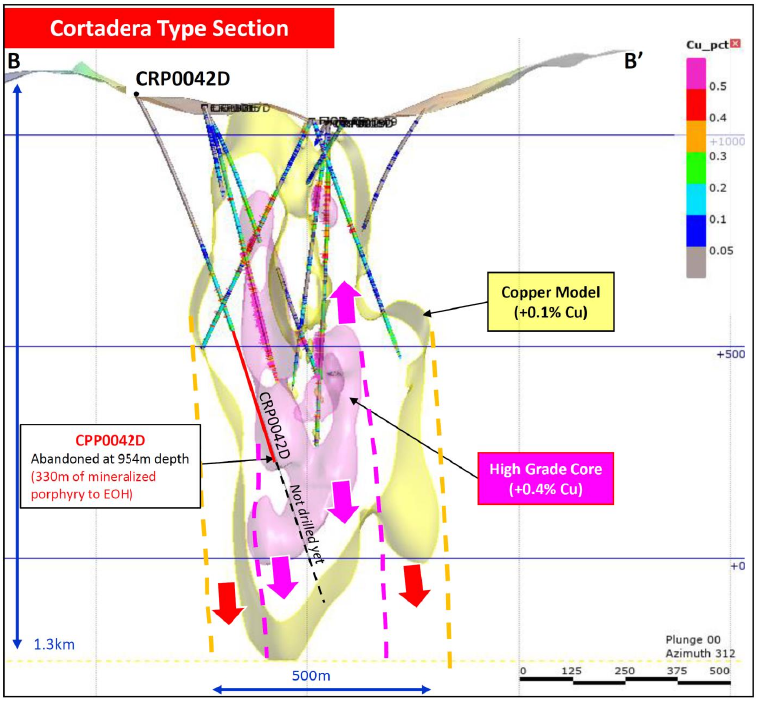

New Results Expand the Size of the Main Porphyry (Cuerpo 3) at Cortadera

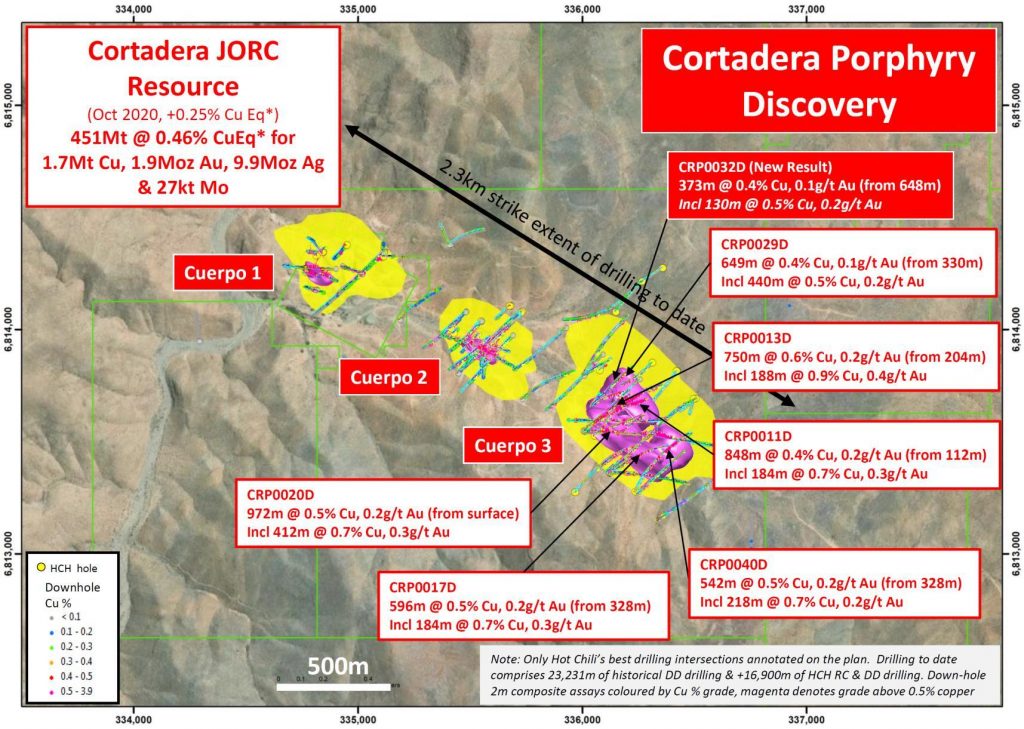

New results from ongoing expansion drilling at its Cortadera copper-gold discovery in Chile have recorded a significant drill intersection from a 282m extension of diamond hole CRP0032D, located along the NW

extent of the Cortadera resource. The hole had previously ended in mineralisation, leaving the NW margin of Cuerpo 3 open.

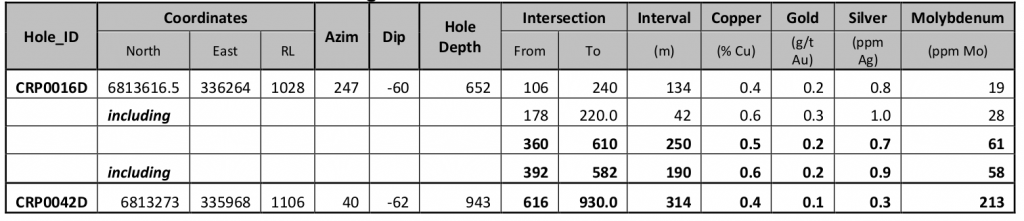

CRP0032D recorded a significant end-of-hole drill result of 373m grading 0.4% copper and 0.1g/t gold from 648m down-hole, including 130m grading 0.5% copper and 0.2g/t gold.

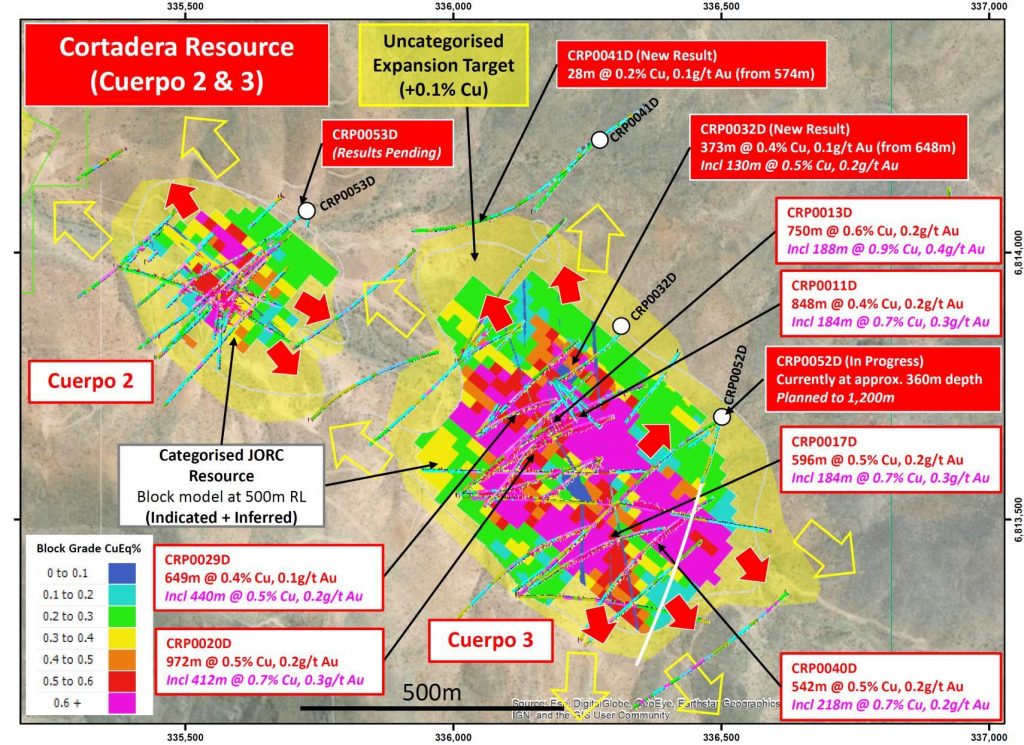

Importantly, this new result further extends the strike and depth extent of Cuerpo 3, indicating a substantial tonnage addition to the recently announced maiden Cortadera resource.

The Company has also completed an 890m diamond drill hole (CRP0041D) located 400m NW of diamond hole CRP0032D. Proximal halo alteration in association with low grade copper mineralisation was intersected in an along-strike target position predicted by the Company’s four-dimensional geological model. Information from CRP0041D will greatly assist in designing the next extensional hole along the NW margin of Cuerpo 3 and confirms a 400m zone of extensional potential remains to be tested.

The Company is currently completing a 1,200m diamond drill hole (CRP0052D) across the SE extension of Cuerpo 3, which also remains open. CRP0052D is at a down-hole depth of approximately 360m and has just entered mineralisation.

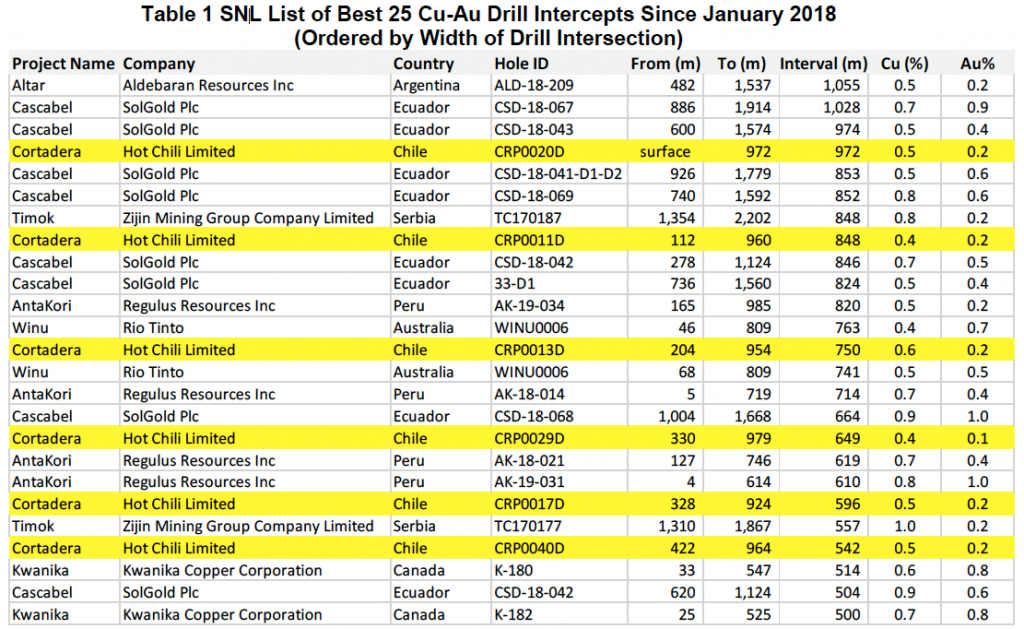

The last hole completed by Hot Chili across the SE margin of Cuerpo 3 recorded an outstanding drill intersection in diamond hole CRP0040D, comprising 542m grading 0.5% copper and 0.2g/t gold from 328m, including 218m grading 0.7% copper and 0.2g/t gold.

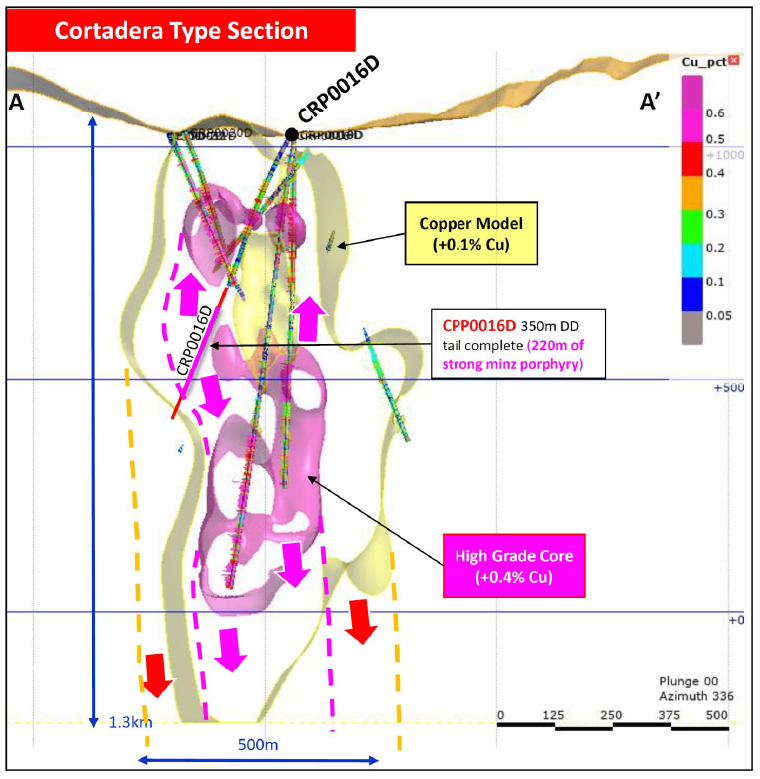

First Hot Chili Diamond Hole Below Cuerpo 2 Returns a Broad Zone of Mineralisation

Hot Chili has completed its first diamond drill hole (CRP0053D) below Cortadera’s Cuerpo 2 porphyry which tested further depth extensions and the potential for Cuerpo 2 to host a high grade core, similar to that seen

at Cuerpo 3.

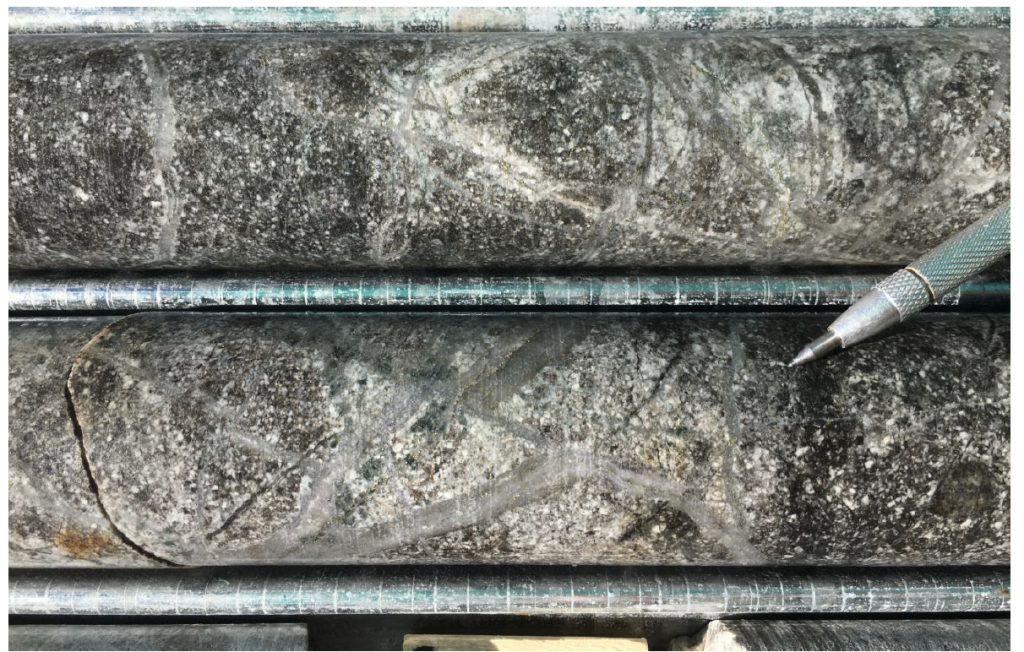

CRP0053D was terminated at a depth of 843.9m after recording a broad 500m zone of mineralised porphyry between 284m and 785m down-hole depth.

Mineralisation between 284m and 785m down-hole depth comprises a visual estimate of 0.3% – 2.5% chalcopyrite contained as fine dissemination and in association with 1% to 8% B-vein abundance. Visual estimates of sulphide minerals are not an accurate representation of expected assay value and are provided for indicative purposes only.

Once all assay results have been received for CRP0053D, the Company will incorporate this data into its integrated four-dimensional geological model in order to optimise the design of a second diamond hole below Cuerpo 2.

Assay results for CRP0053D are pending and have been assigned priority turnaround.

Cortadera North First-Pass Drilling Progressing Well

The Company is also advancing well with it first-pass RC drill programme across the exciting 2km long Cortadera North target zone. To date, two deep RC drill holes have been completed and a third RC drill hole is underway. RC drilling is operating in parallel with pre-collar drilling at Cortadera and at this stage is being undertaken on a two week-on, two week-off basis.

The first two deep RC holes (CRP0054 and CRP0055) are located along a 700m long traverse across a large surface molybdenum soil geochemical anomaly at Cortadera North. Both drill holes have recorded encouraging proximal alteration and low-level pyrite mineralisation towards the end-of hole. Minor copper- oxide mineralisation (copper oxide clays between 17m and 37m depth) has also been recorded in the third RC drill hole (CRP0056), which is underway and at a depth of approximately 90m.

The Company plans to complete the remaining eight holes (including CRP0056) and await receipt of all results prior to moving to a follow-up drill programme in the New Year, which may involve further RC drilling and targeted diamond tails from certain first-pass RC drill holes.

Results for the two completed Cortadera North holes are pending.

Next Steps and Forward News Flow

Drilling – The Company looks forward to releasing further drill results from its phase three drill program at Cortadera once assay results are received. This will include diamond drill results for CRP0053D (Cuerpo 2), CRP0052D (Cuerpo 3 – currently drilling) and updates on first-pass drilling being undertaken at Cortadera North over the coming weeks.

Hot Chili is working closely with its drilling contractor to plan for the commencement of accelerated drilling operations in a safe manner given ongoing COVID restrictions and challenges in the Vallenar region. The Company expects to provide an update once this is implemented.

Resource Growth – The Company is on-track to complete a maiden resource estimate for its San Antonio high grade satellite deposit located 4km from Cortadera. Hot Chili is also planning an extensional drilling

programme along the San Antonio to Valentina corridor during 2021. High grade resource additions and a resource upgrade at Cortadera aim to grow Costa Fuego into a Tier-1 copper resource base in 2021.

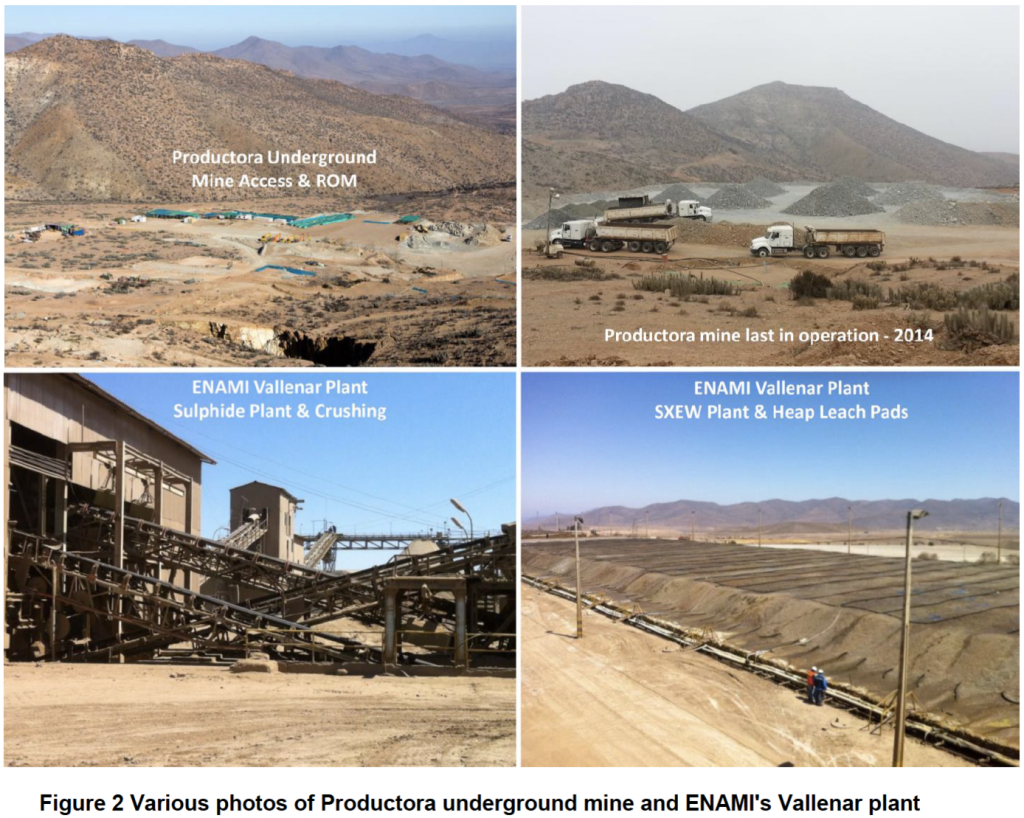

First Commercial Cash Flow – Lease mining and processing activities at the Productora copper-gold deposit are expected to ramp-up following receipt of mine plan and final permitting approvals for the

Productora underground mine. This approval will greatly assist lease mining operations and the commencement of first commercial cash flow to Hot Chili through its agreement with Chilean government agency ENAMI.

The Directors look forward to providing an update on production as well as discussions to potentially expand the lease mining and processing agreement with ENAMI within the coming month.

This announcement is authorised by the Board of Directors for release to ASX.

For more information please contact:

Christian Easterday Tel: +61 893159009

Managing Director Email: christian@hotchili.net.au

or visit Hot Chili’s website at www.hotchili.net.au

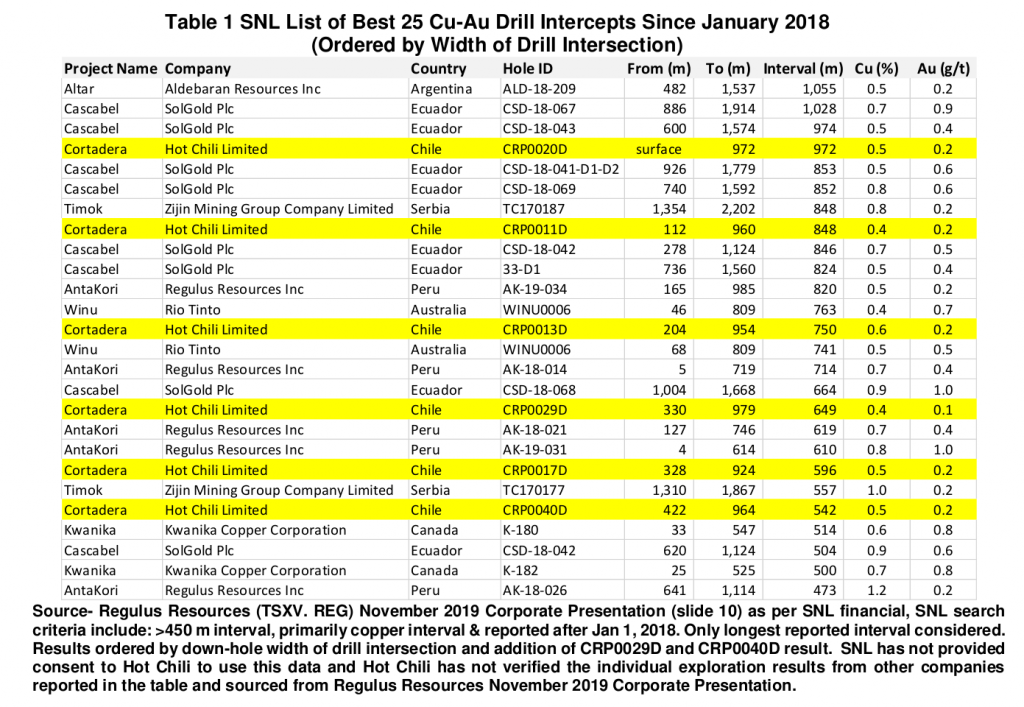

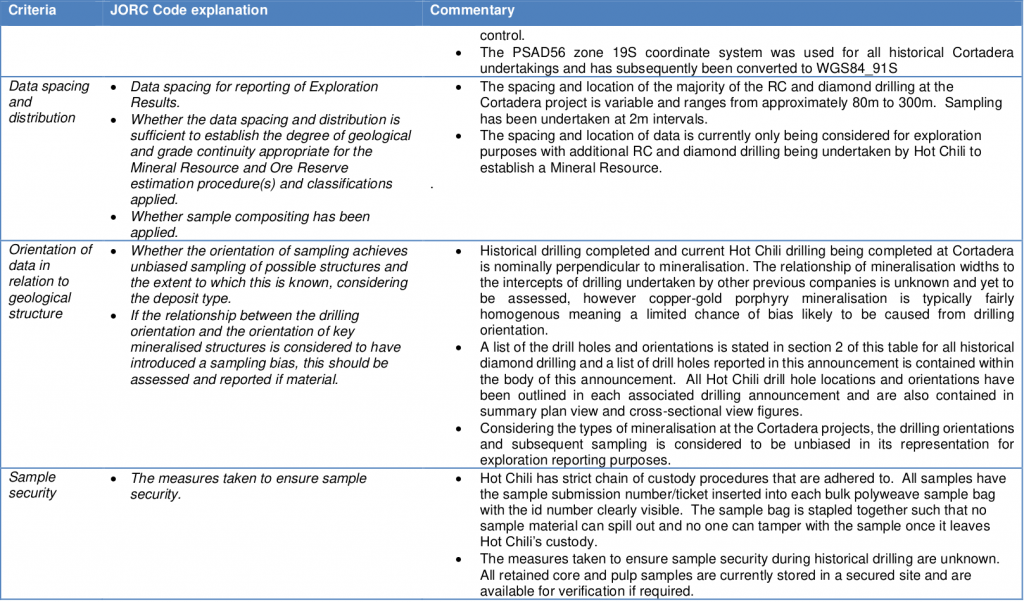

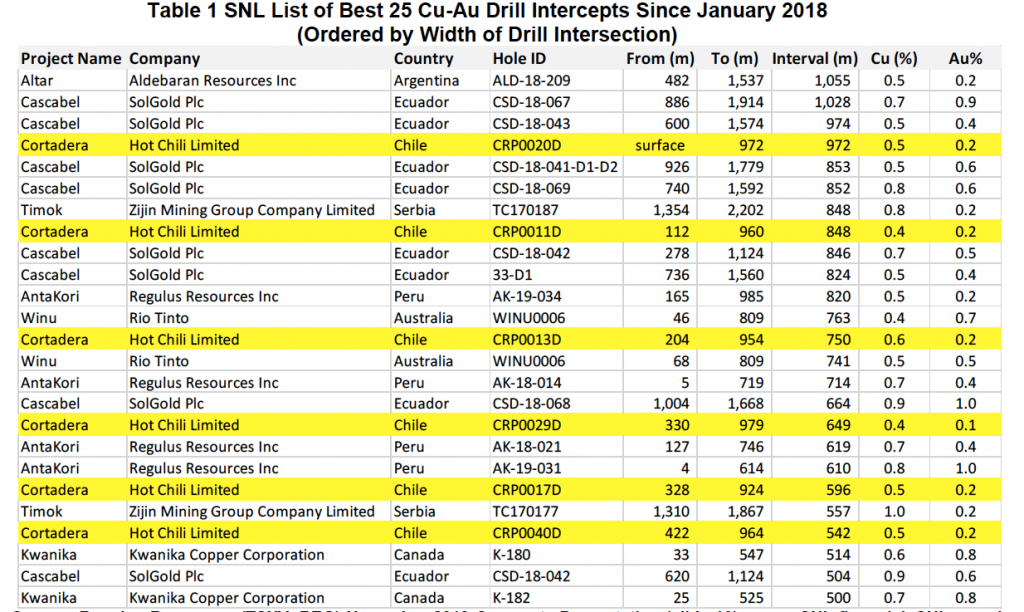

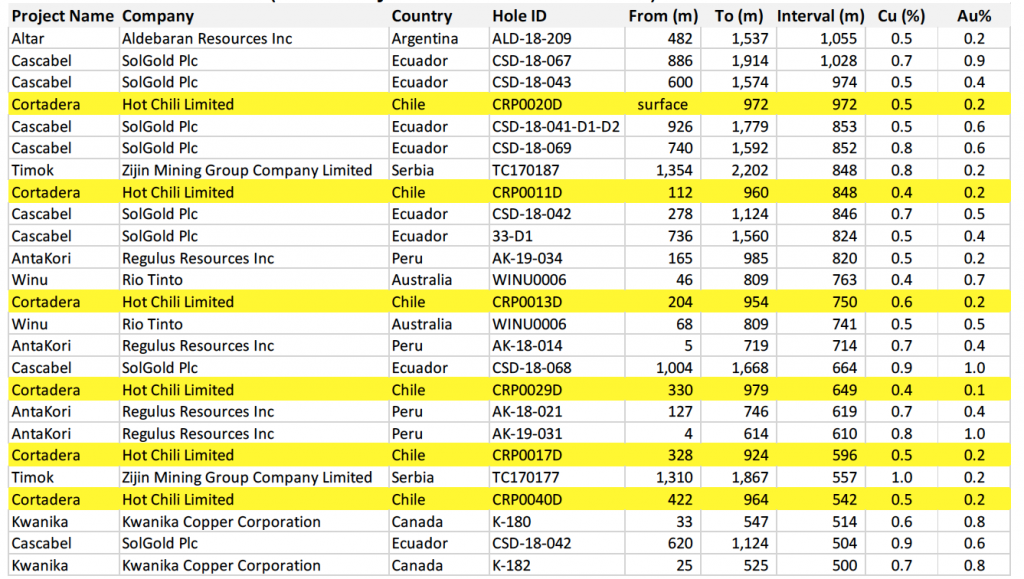

Table 1 New Significant DD Drill Results at Cortadera

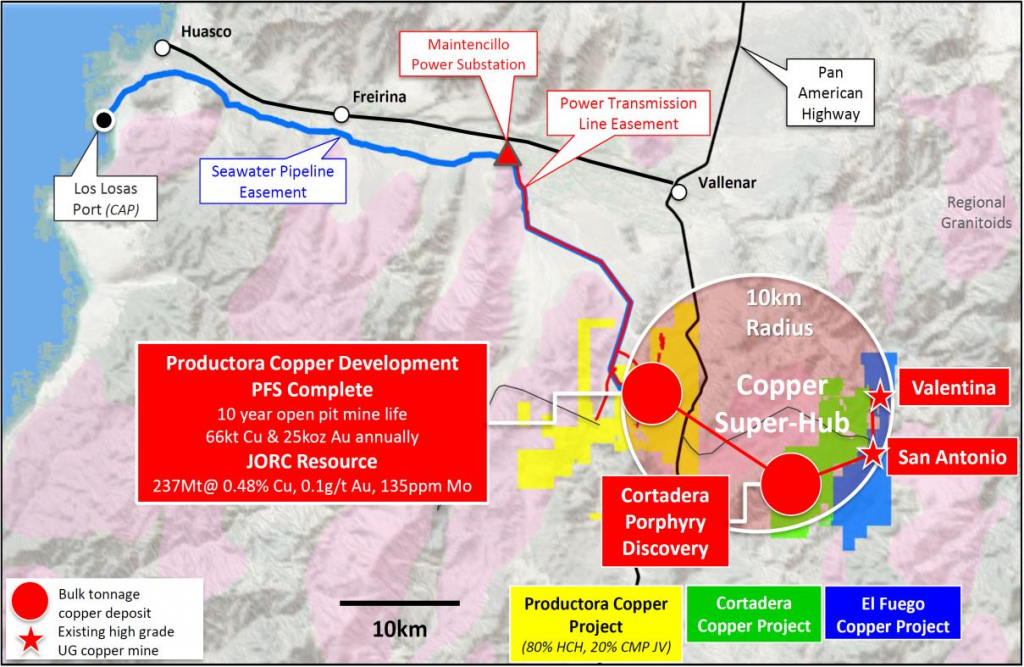

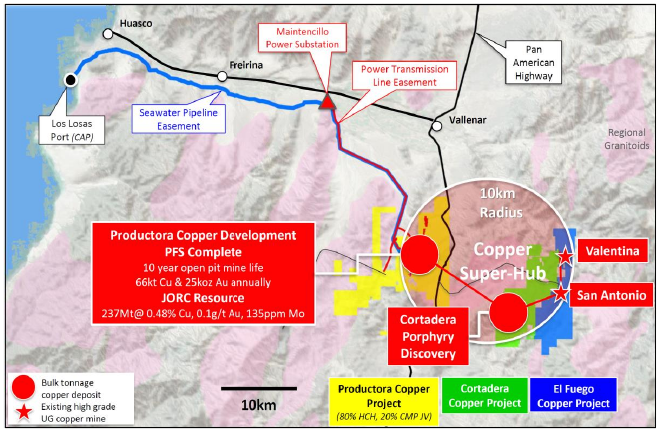

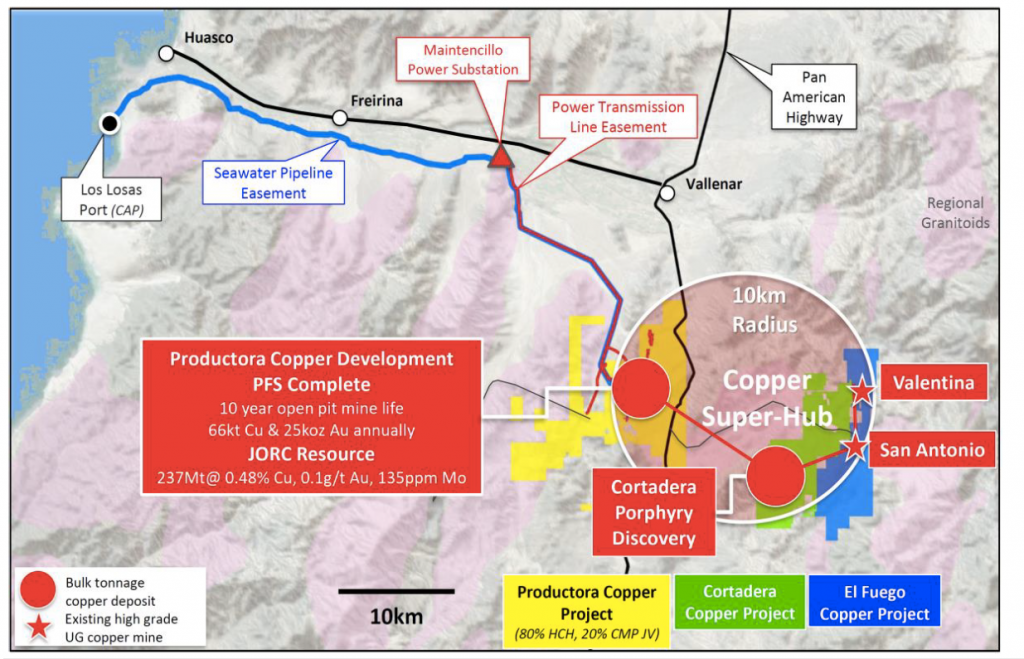

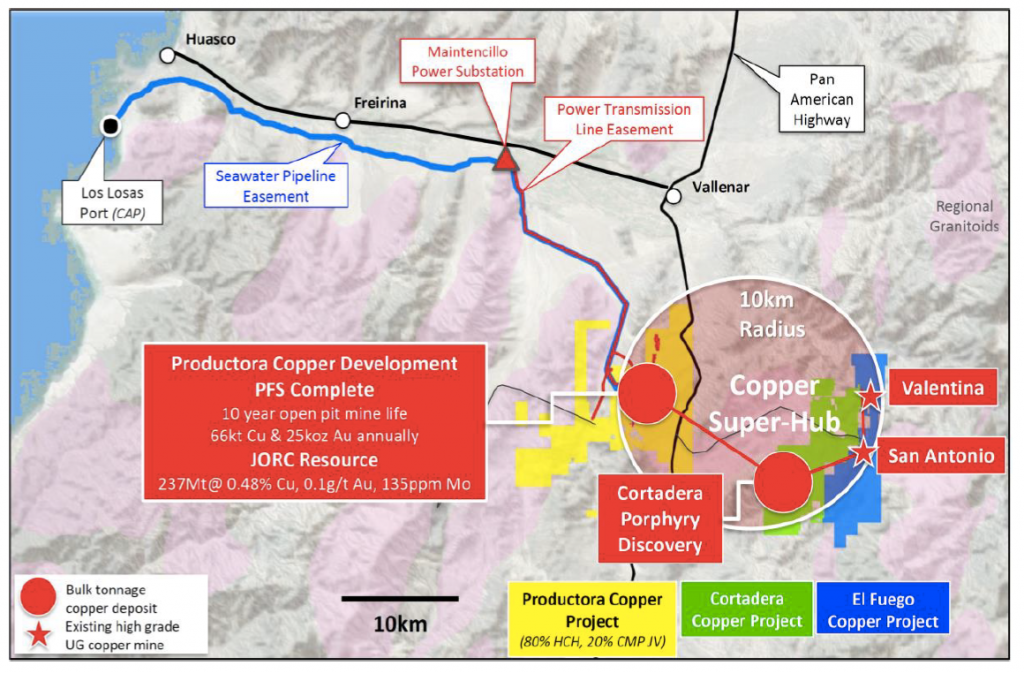

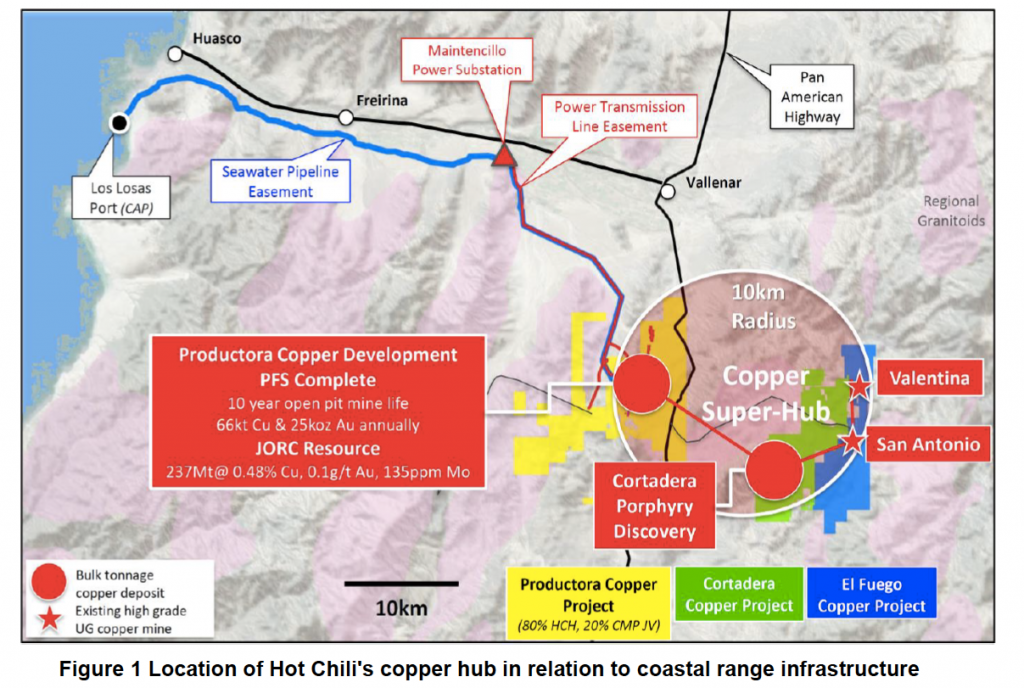

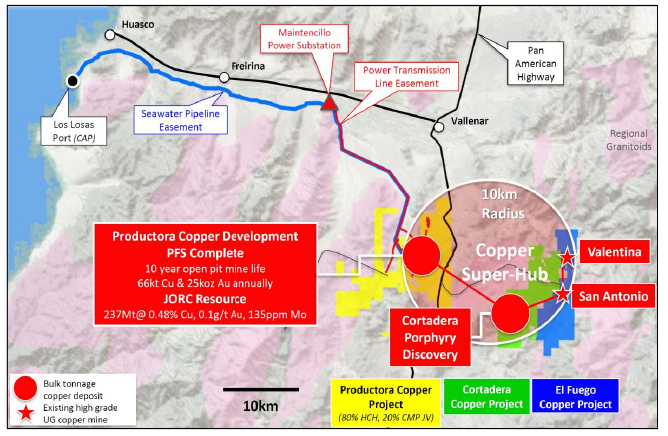

Figure 1 Location of Productora and the Cortadera discovery in relation to the coastal range infrastructure of Hot Chili’s combined Costa Fuego copper project, located 600km north of Santiago in Chile.

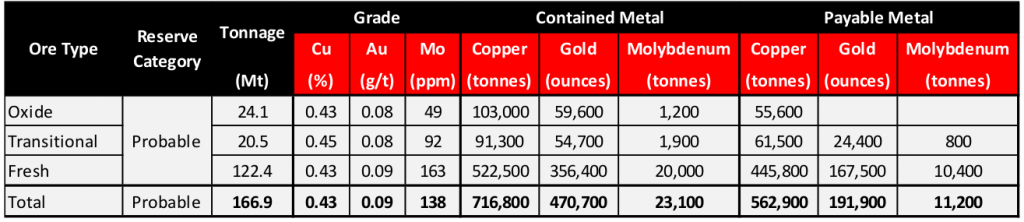

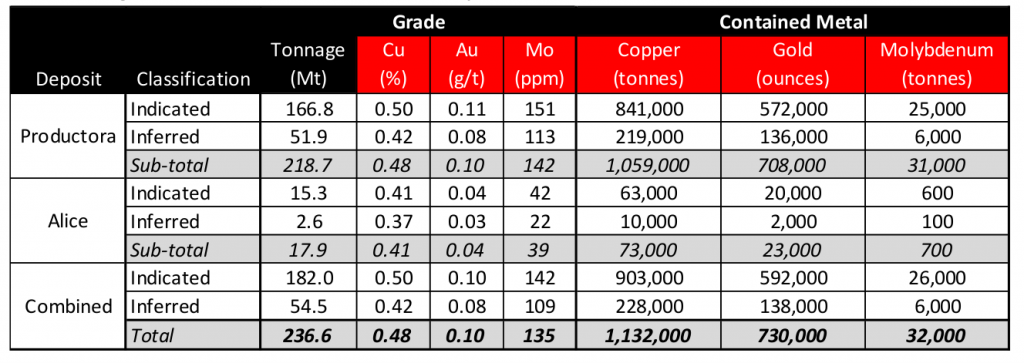

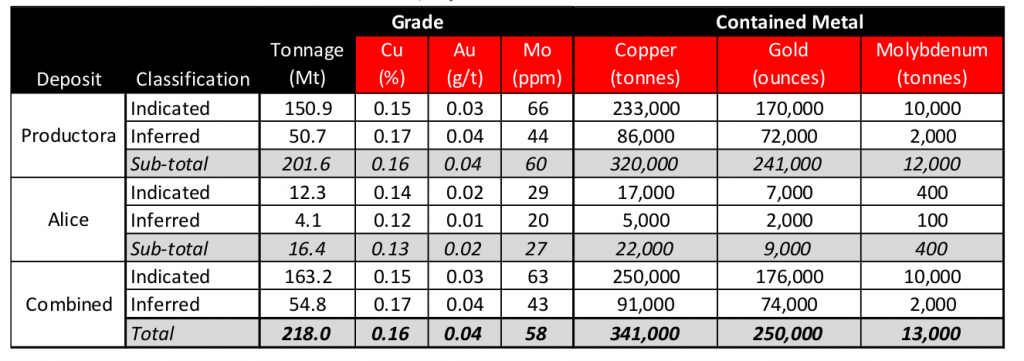

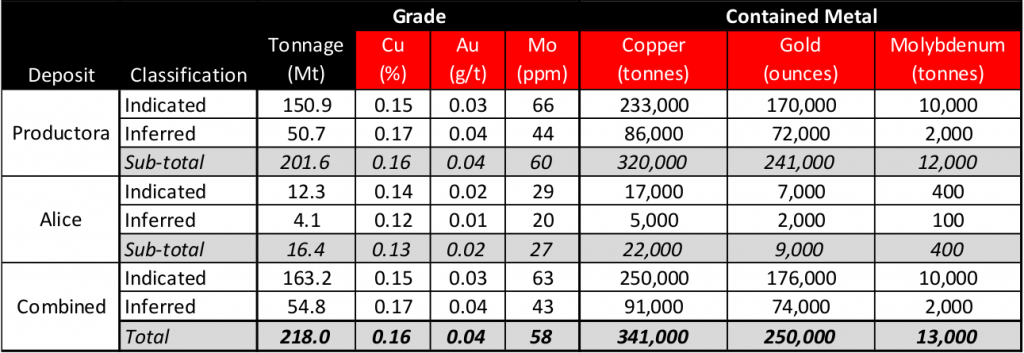

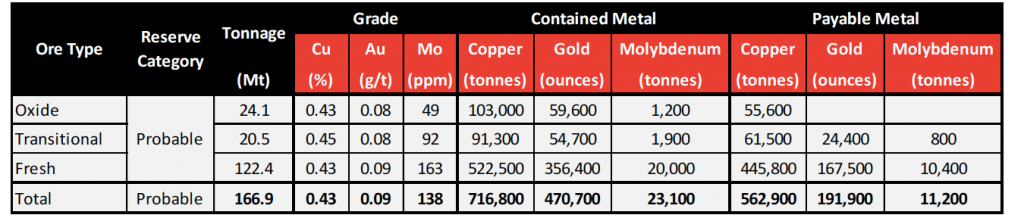

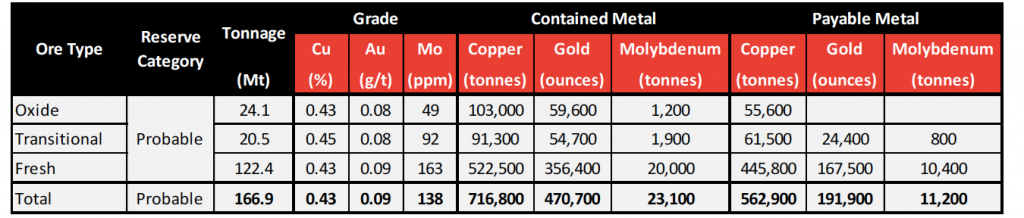

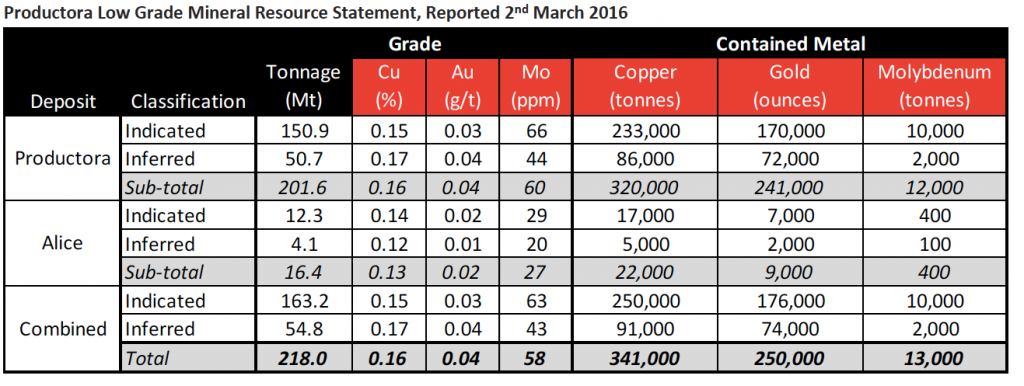

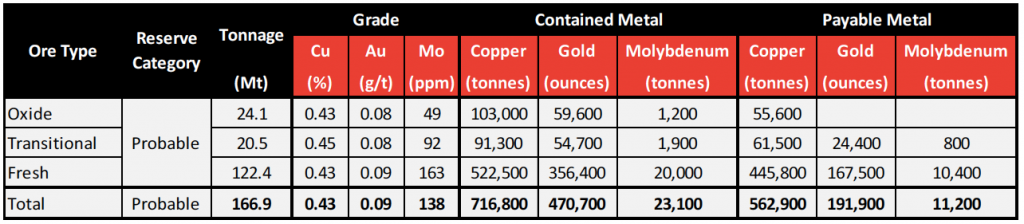

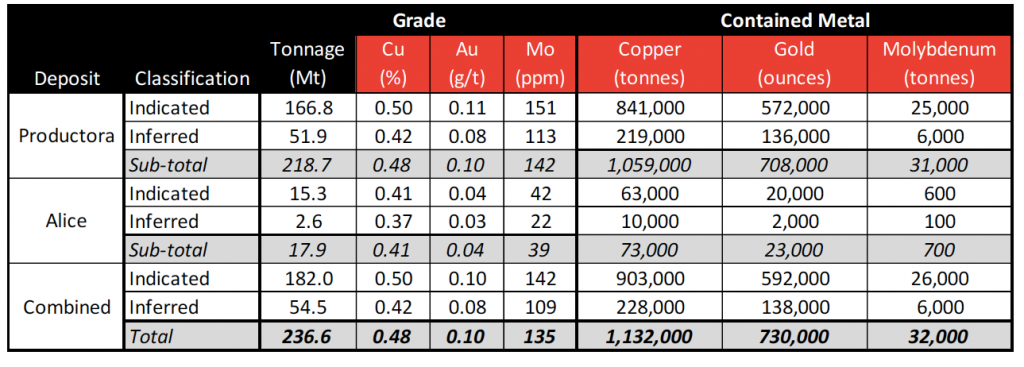

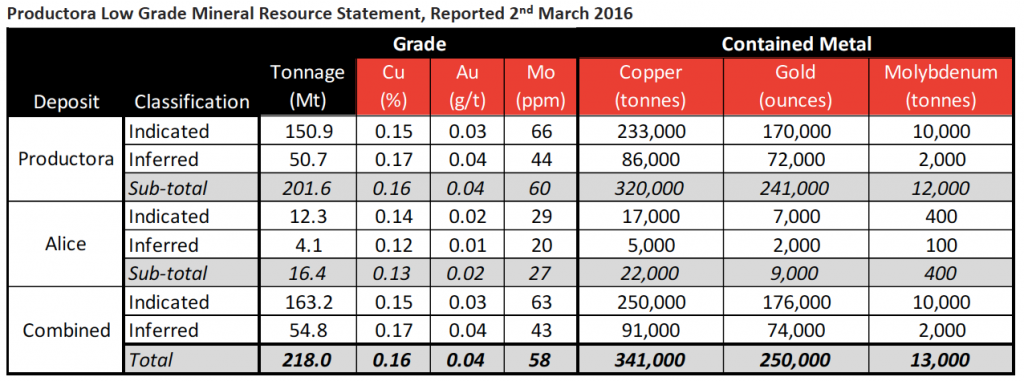

Refer to ASX Announcement “Costa Fuego Becomes a Leading Global Copper Project” (12th October 2020) for JORC Table 1 information related to the Cortadera JORC compliant Mineral Resource estimate by Wood and the Productora re-stated JORC compliant Mineral Resource estimate by AMC Consultants

Copper Equivalent (CuEq) reported for the resource were calculated using the following formula: CuEq% = ((Cu% × Cu price 1% per tonne × Cu_recovery)+(Mo ppm × Mo price per g/t × Mo_recovery)+(Au ppm × Au price per g/t × Au_recovery)+ (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price 1% per tonne). The Metal Prices applied in the calculation were: Cu=3.00 USD/lb, Au=1,550 USD/oz, Mo=12 USD/lb, and Ag=18 USD/oz. For Cortadera (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=56%, Mo=82%, and Ag=37%. For Productora (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=43% and Mo=42%. For Costa Fuego (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=51%, Mo=67% and Ag=23%.

** Reported on a 100% Basis – combining Cortadera and Productora Mineral Resources using a +0.25% CuEq reporting cut-off grade

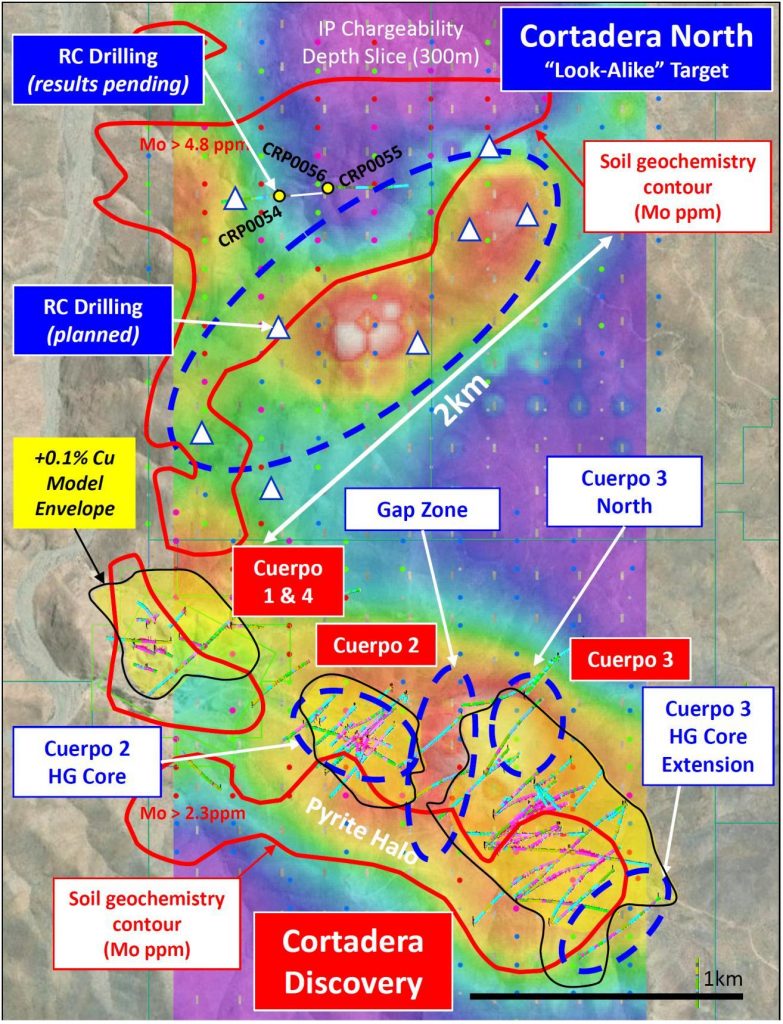

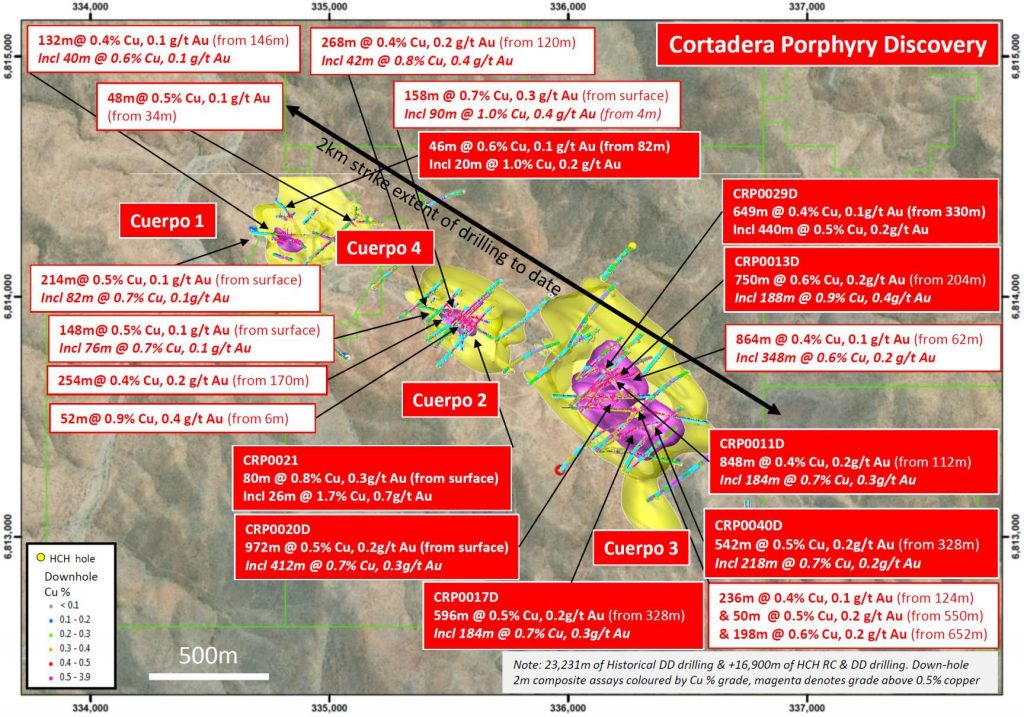

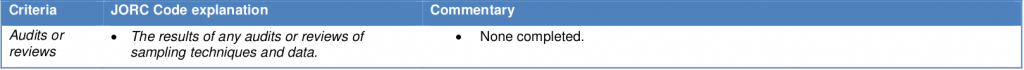

Figure 2 Plan view across the Cortadera discovery area displaying

significant historical copper-gold DD intersections across Cuerpo 1, 2, 3 and 4 tonalitic porphyry intrusive centres (represented by modelled copper envelopes, yellow- +0.1% Cu and majenta +0.4% Cu). Note the selected HCH drilling intersections (White) and the new results reported from CRP0032D (Red).

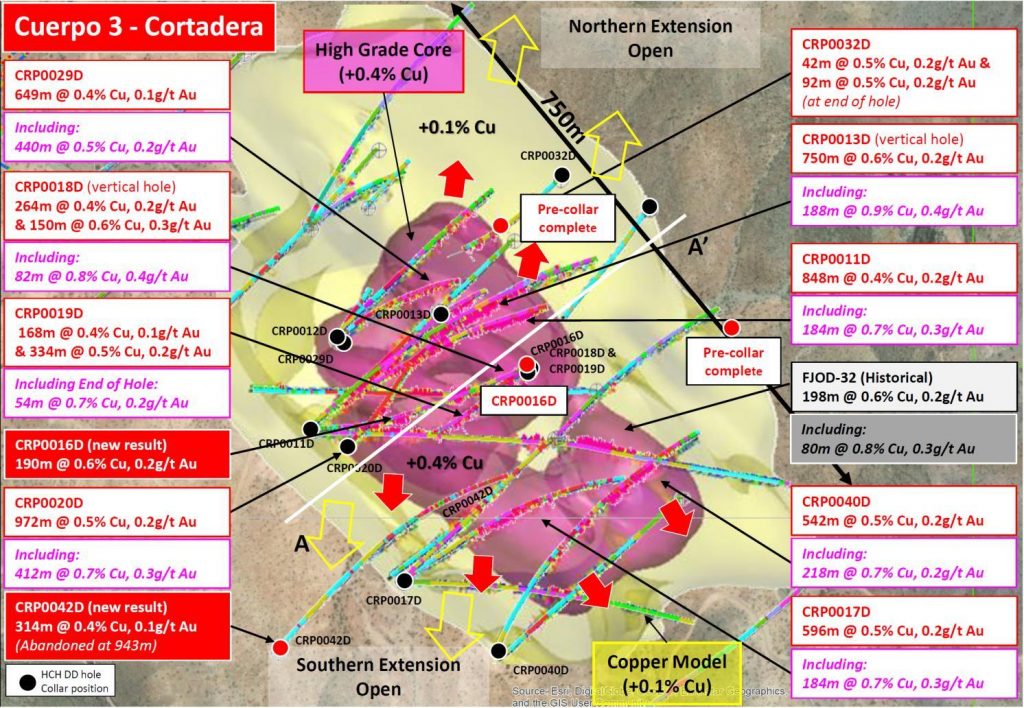

Figure 3 Plan view across the Cortadera discovery area displaying significant historical copper-gold DD intersections across Cuerpo 2 and 3. The plan view displays the 500m level block model flitch of the JORC Mineral Resource in relation to the Uncategorised expansion target area (represented by modelled copper envelope, yellow- +0.1% Cu). Note the selected HCH drilling intersections (White) and the new results reported from CRP0032D, CRP0041D as well as the location of CRP0052D and CRP0053D (Red).

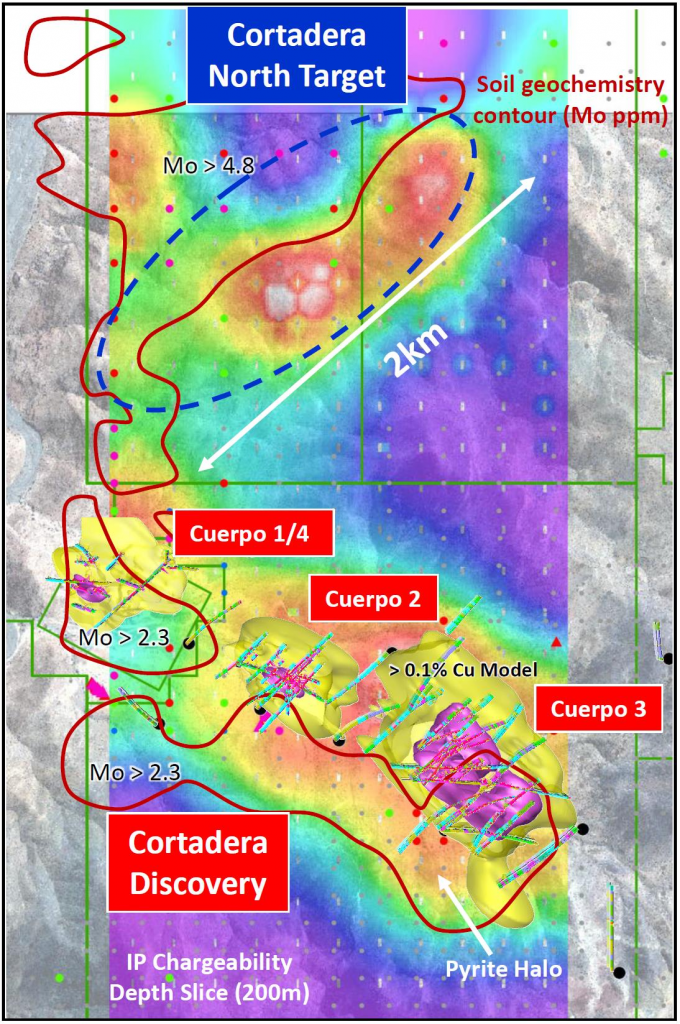

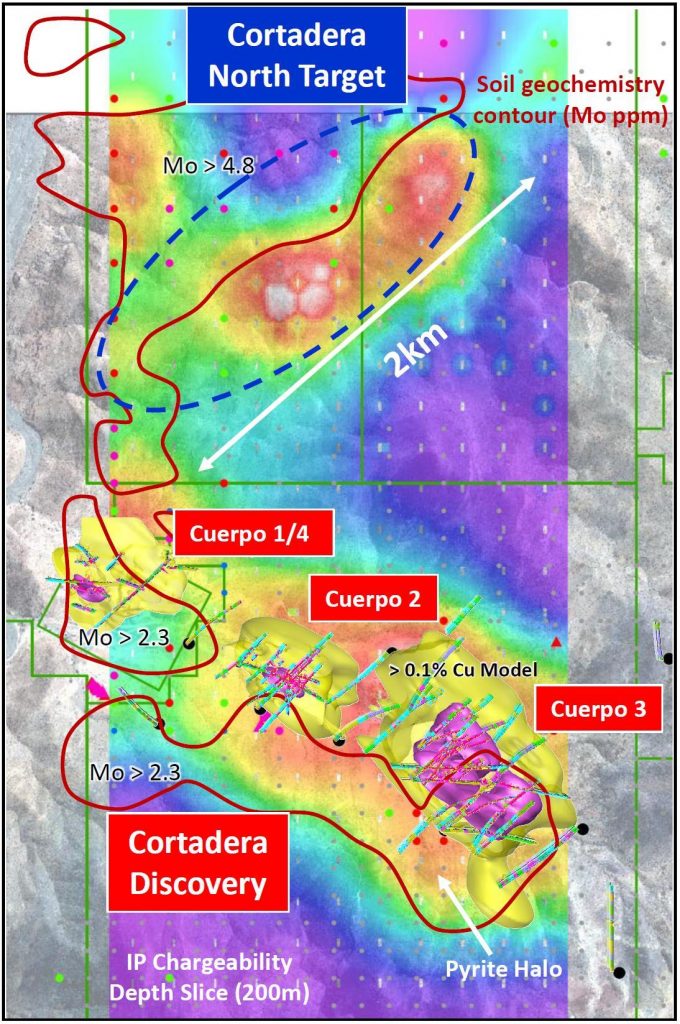

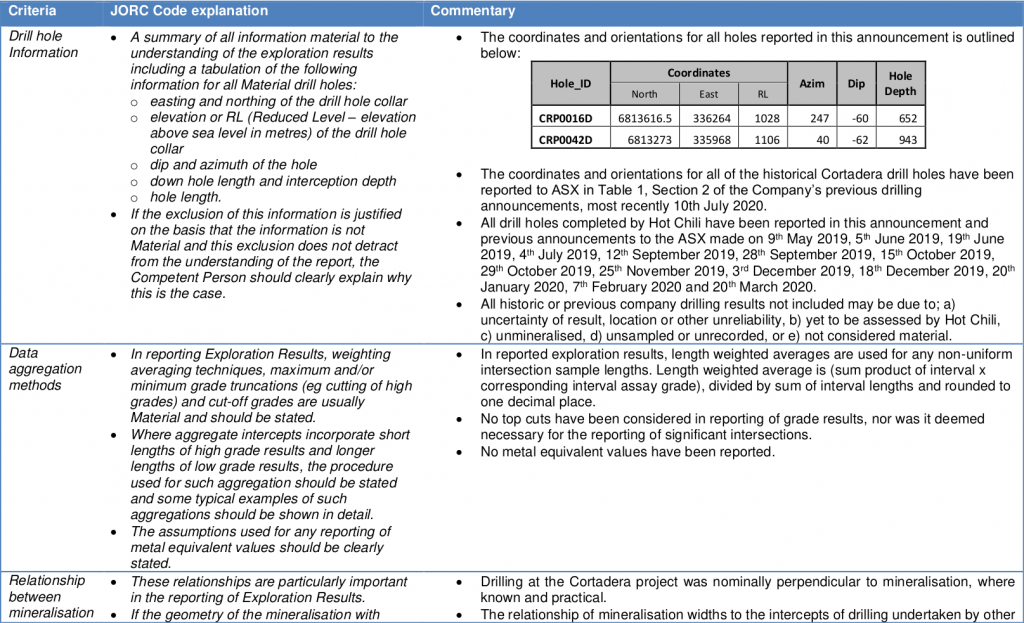

Figure 4 Plan view displaying the location of the Cortadera discovery zone in relation to the Cortadera North target. The plan displays the location of Cuerpo 1, 2, 3 and 4 tonalitic porphyry intrusive centres (represented by modelled copper envelopes, yellow- +0.1% Cu) in relation to surface molybdenum anomalism and IP chargeability response at 200m depth slice. Cortadera North, located 2km north of Cortadera displays “look alike” characteristics to the Cortadera discovery. Note locations of first pass RC drill holes.

Qualifying Statements

Competent Person’s Statement- Exploration Results

Exploration information in this Announcement is based upon work compiled by Mr Christian Easterday, the Managing Director and a full-time employee of Hot Chili Limited whom is a Member of the Australasian Institute of Geoscientists (AIG). Mr Easterday has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a ‘Competent Person’ as defined in the 2012 Edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’ (JORC Code). Mr Easterday consents to the inclusion in the report of the matters based on their information in the form and context in which it appears.

Reporting of Copper Equivalent

Copper Equivalent (CuEq) reported for the resource were calculated using the following formula: CuEq% = ((Cu% × Cu price 1% per tonne × Cu_recovery)+(Mo ppm × Mo price per g/t × Mo_recovery)+(Au ppm × Au price per g/t × Au_recovery)+ (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price 1 % per tonne). The Metal Prices applied in the calculation were: Cu=3.00 USD/lb, Au=1,550 USD/oz, Mo=12 USD/lb, and Ag=18 USD/oz. For Cortadera (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=56%, Mo=82%, and Ag=37%. For Productora (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=43% and Mo=42%. For Costa Fuego (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%,Au=51%, Mo=67% and Ag=23%.

Forward Looking Statements

This Announcement is provided on the basis that neither the Company nor its representatives make any warranty (express or implied) as to the accuracy, reliability, relevance or completeness of the material contained in the Announcement and nothing contained in the Announcement is, or may be relied upon as a promise, representation or warranty, whether as to the past or the future. The Company hereby excludes all warranties that can be excluded by law. The Announcement contains material which is predictive in nature and may be affected by inaccurate assumptions or by known and unknown risks and uncertainties and may differ materially from results ultimately achieved.

The Announcement contains “forward-looking statements”. All statements other than those of historical facts included in the Announcement are forward-looking statements including estimates of Mineral Resources. However, forward-looking statements are subject to risks, uncertainties and other factors, which could cause actual results to differ materially from future results expressed, projected or implied by such forward-looking statements. Such risks include, but are not limited to, copper, gold and

other metals price volatility, currency fluctuations, increased production costs and variances in ore grade recovery rates from those assumed in mining plans, as well as political and operational risks and governmental regulation and judicial outcomes. The Company does not undertake any obligation to release publicly any revisions to any “forward-looking statement” to reflect events or circumstances after the date of the Announcement, or to reflect the occurrence of unanticipated events, except as may be required under applicable securities laws. All persons should consider seeking appropriate professional advice in reviewing the Announcement and all other information with respect to the Company and evaluating the business, financial performance and operations of the Company. Neither the provision of the Announcement nor any information contained in the Announcement or subsequently communicated to any person in connection with the Announcement is, or should be taken as, constituting the giving of investment advice to any person

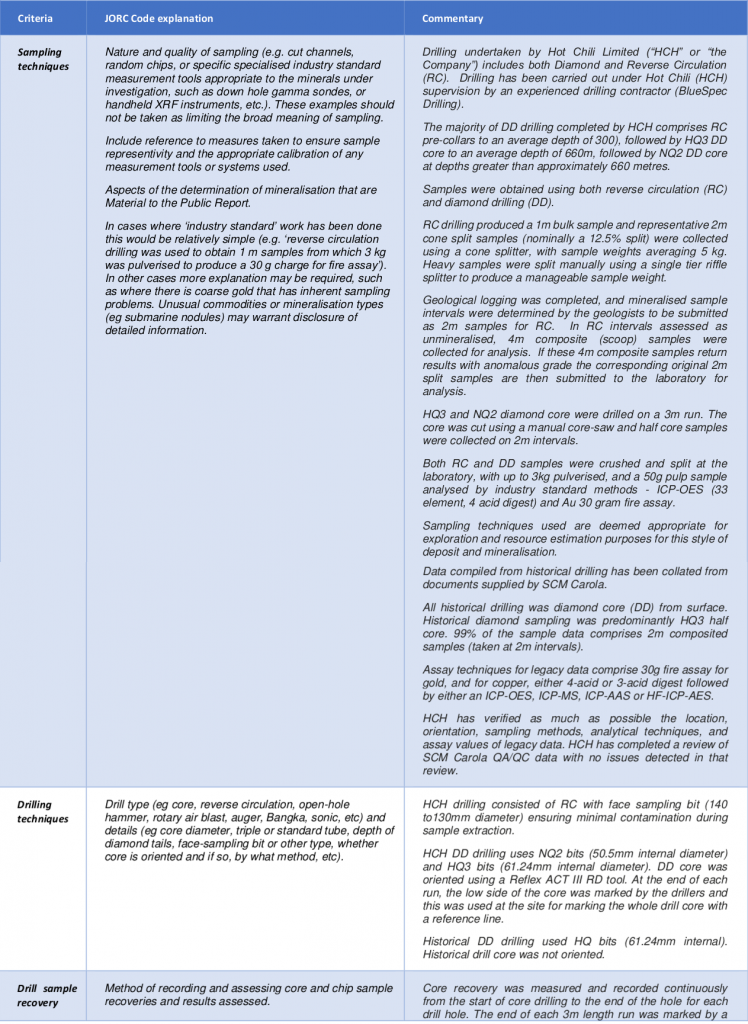

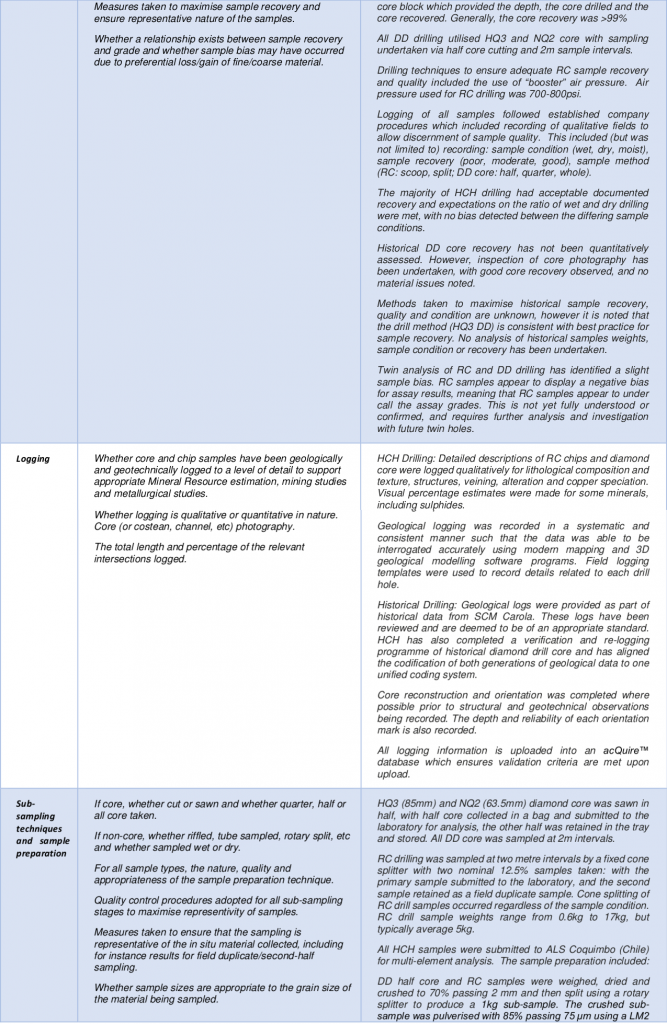

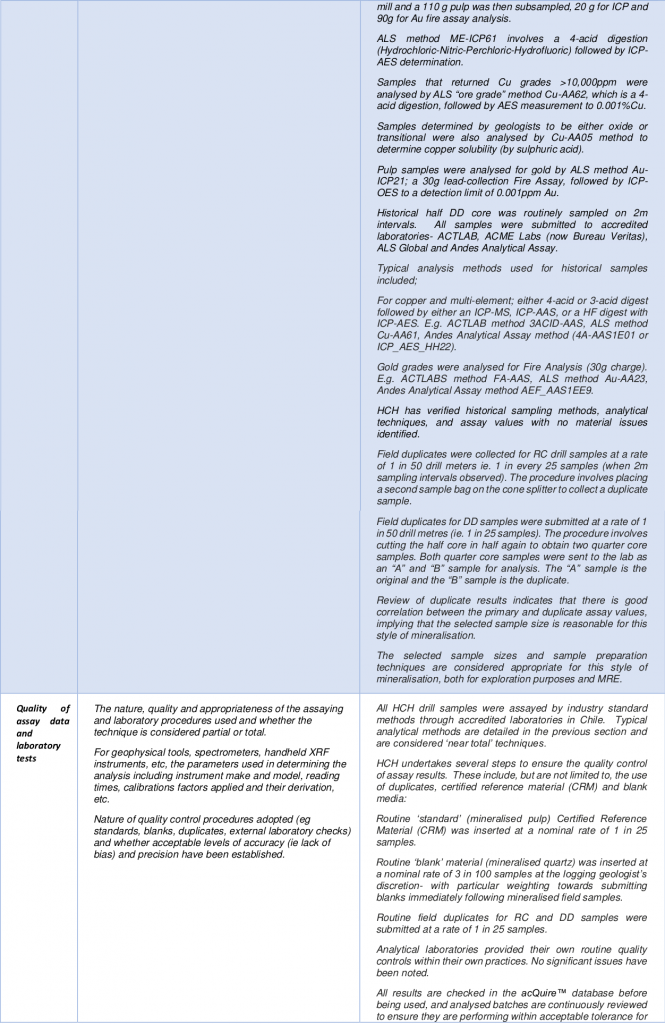

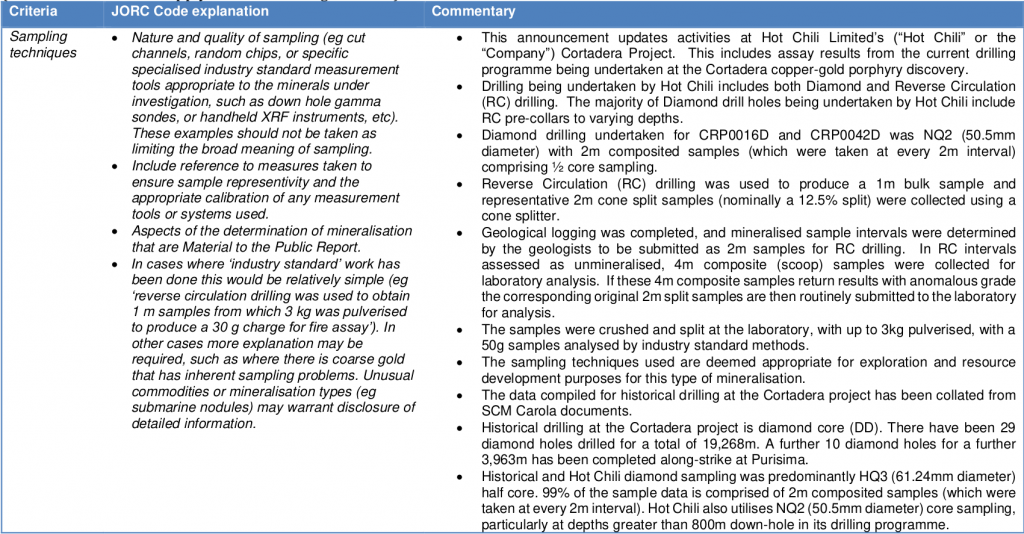

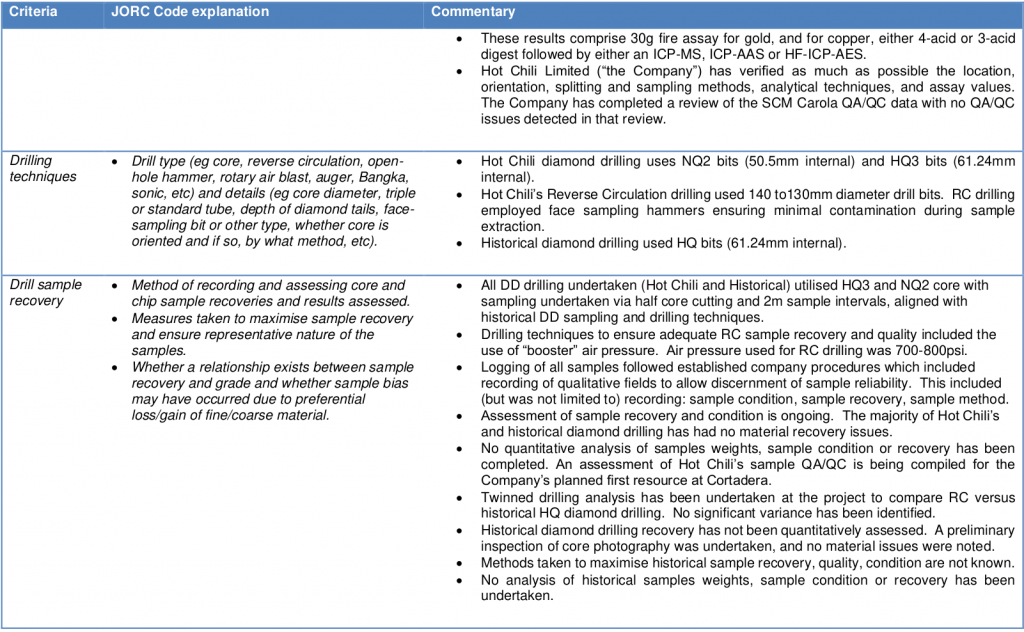

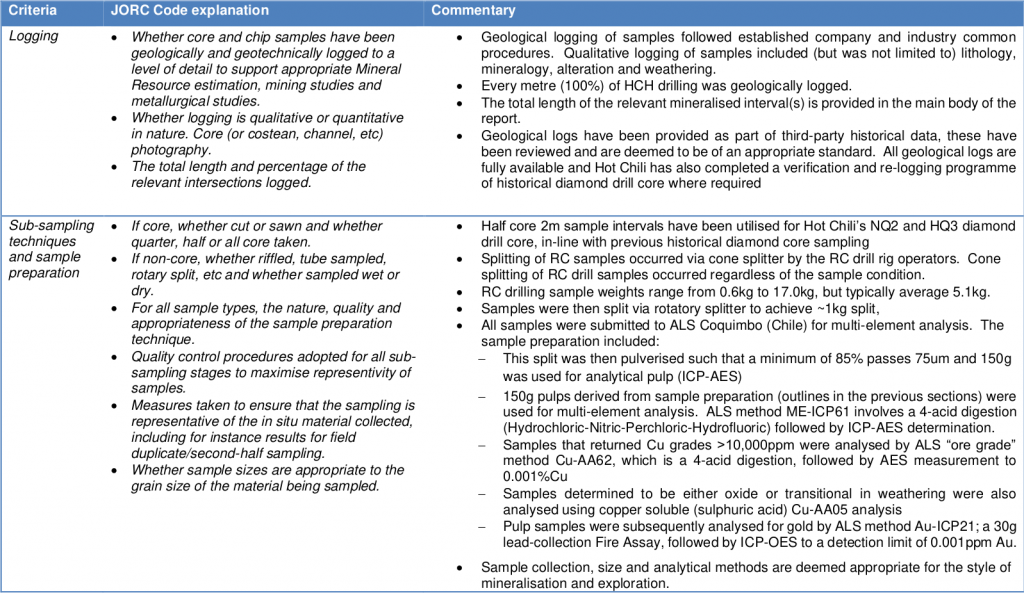

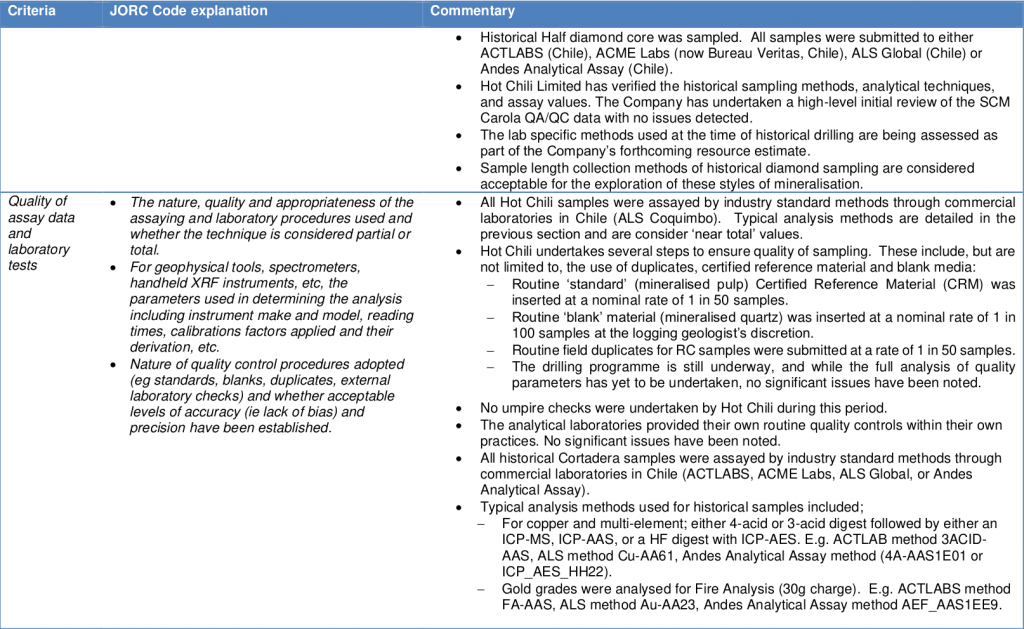

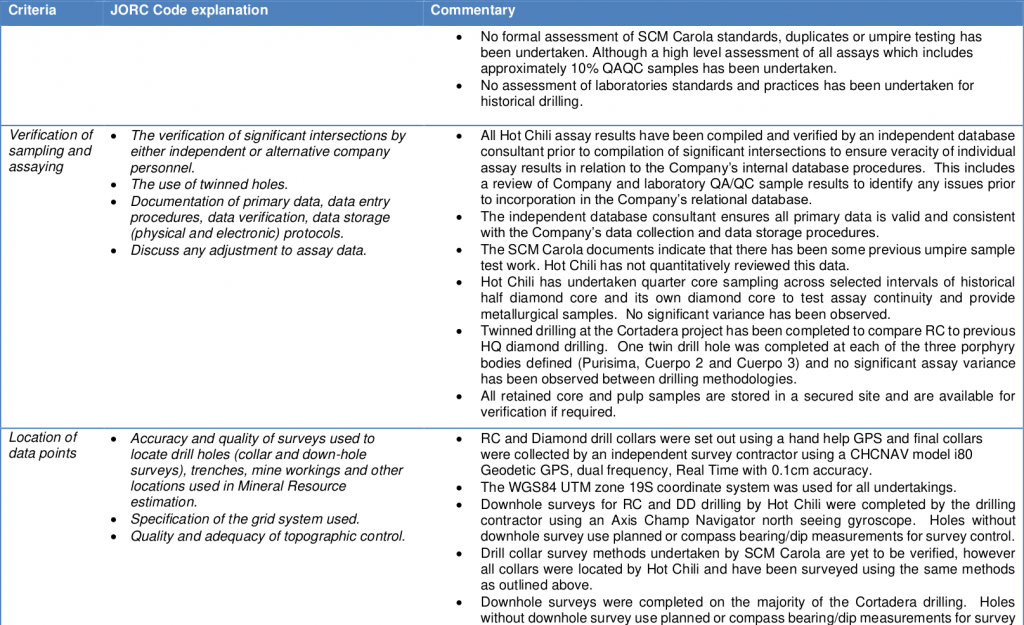

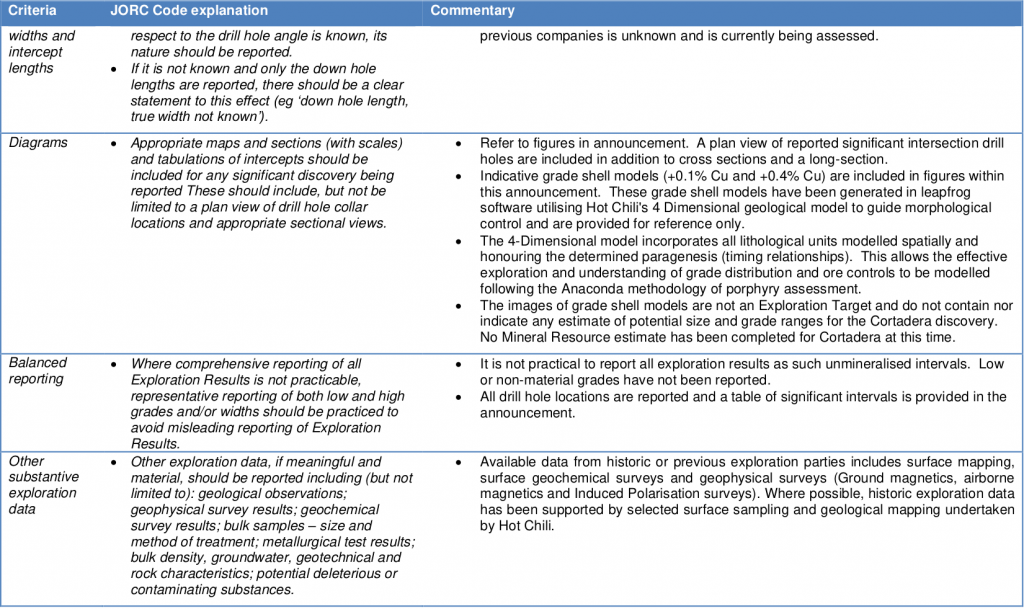

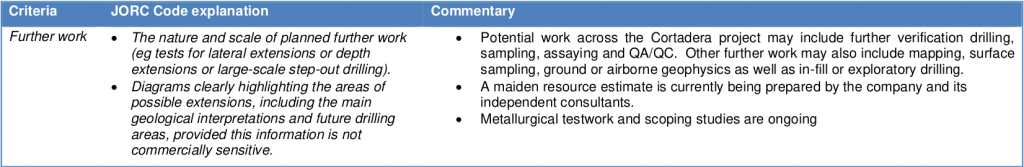

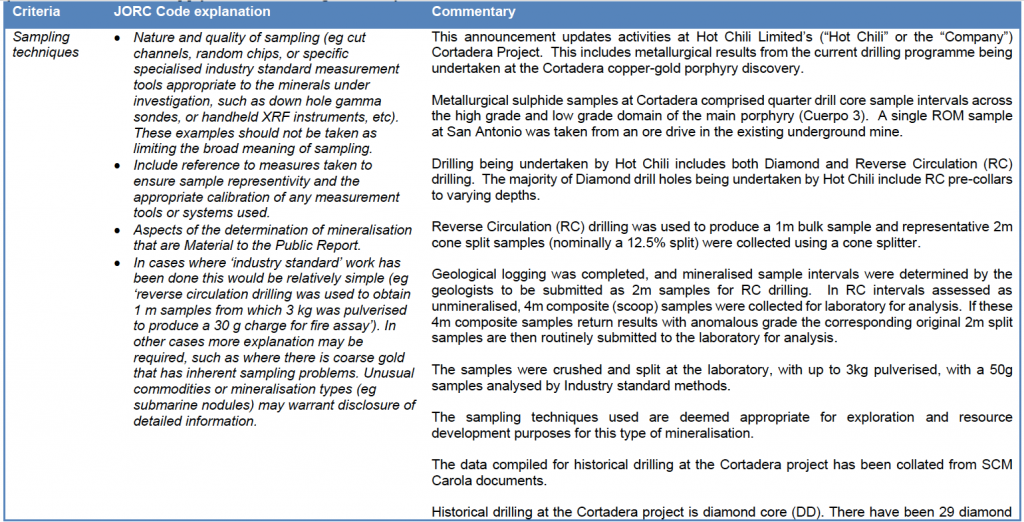

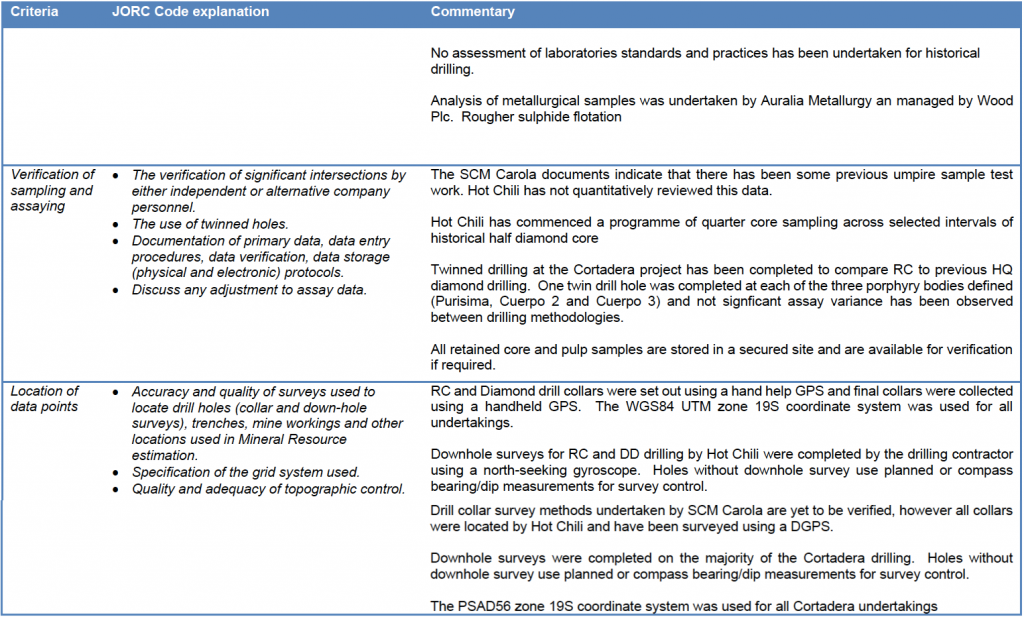

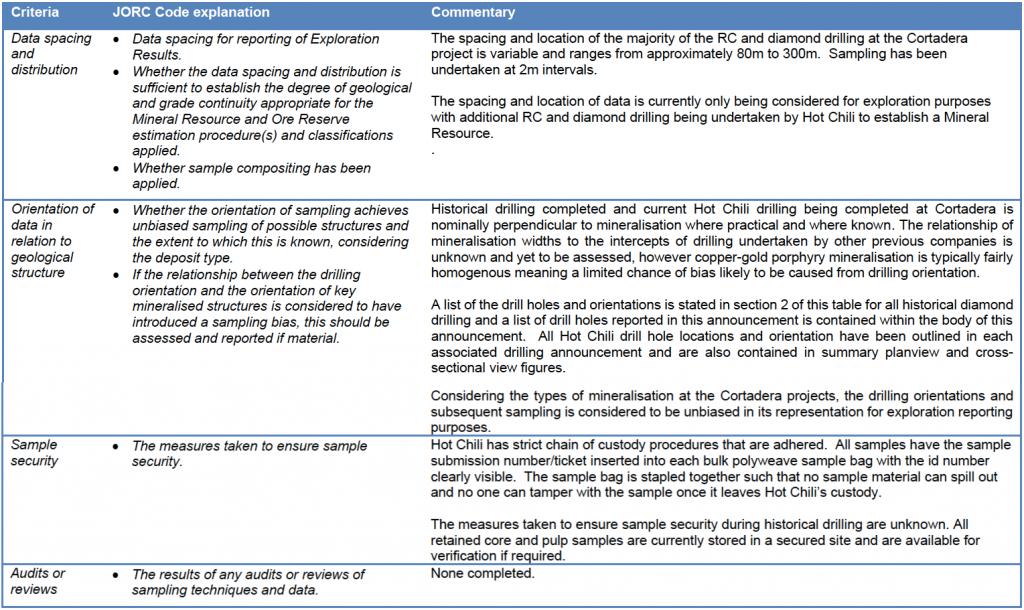

Appendix 1. JORC Code Table 1 for Cortadera

Section 1 Sampling Techniques and Data

Section 2 Reporting of Exploration Results

Hot Chili NOM

27 October 2020

Dear Shareholder

ANNUAL GENERAL MEETING OF SHAREHOLDERS

The Board of Directors of Hot Chili Limited (the Company) advises that its 2020 annual general meeting (AGM) will be held at First Floor, 768 Canning Highway, Applecross, Western Australia on Monday 30 November 2020 at 11.00am (WST).

Notice of Meeting

In accordance with section 5(1)(f) of the Corporations (Coronarivus Economic Response) Determination (No.3) 2020 made by the Commonwealth Treasurer on 21 September 2020, the Company will not be dispatching physical copies of the notice of AGM (Notice). The Notice is made available to shareholders electronically and can be viewed and downloaded online from the Company’s website at the following link: https://es.hotchili.net.au/. A personalized proxy form will be attached to

this letter.

Voting

All resolutions at the AGM will be decided on a poll.

The poll will be conducted based on votes submitted by proxy and those cast at the AGM by shareholders who attend in-person.

To vote by proxy, please use one of the following methods:

By hand: Automic, Level 5, 126 Philip Street, Sydney NSW 2000

By post: Automic, GPO Box 5193, Sydney NSW 2001

By email: meetings@automicgroup.com.au

By fax: +61 2 8583 3040

Your proxy instructions must be received not later than 48 hours before the commencement of the AGM, being 11.00am (WST) on Saturday 28 November 2020. Proxy Forms received later than this time will be invalid. Shareholders who wish to participate and vote at the AGM are strongly

encouraged to complete and submit their proxies as early as possible.

The Chairperson intends to vote all open proxies in favour of all resolutions, where permitted.

Questions

Shareholders will be able to ask questions at the AGM.

Shareholders are also encouraged to submit questions in advance of the AGM to the Company. Questions must be submitted by email to admin@hotchili.net.au or in writing to the Company’s office by 5.00pm (WST) on Monday 23 November 2020.

Approved for release by the Board of Directors

Lloyd Flint

Company Secretary

ACN 130 955 725

Notice of Annual General Meeting,

Explanatory Statement and Proxy Form

Annual General Meeting to be held at

First Floor

768 Canning Highway

Applecross Western Australia

On Monday 30 November 2020 at 11.00am (WST)

| IMPORTANT NOTE The Notice of Annual General Meeting, Explanatory Statement and Proxy Form should be read in their entirety. If you are in doubt as to how you should vote, you should seek advice from your accountant, solicitor or other professional adviser prior to voting. |

Important Information

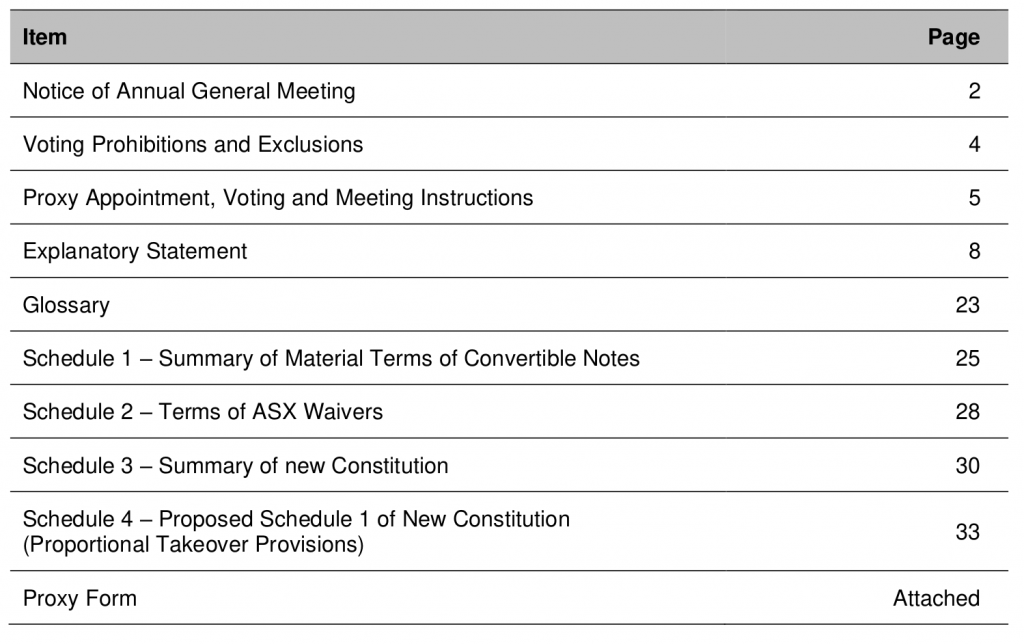

Contents

Important Dates

An indicative timetable of key proposed dates is set out below. These dates are indicative only and are

subject to change.

Defined Terms

Capitalised terms used in this Notice of Annual General Meeting will, unless the context otherwise requires, have the same meaning given to them in the Glossary set out in the Explanatory Statement.

Notice of Annual General Meeting

Notice is hereby given that the Annual General Meeting of Hot Chili Limited (ACN 130 955 725) (HotChili or Company) will be held at First Floor, 768 Canning Highway, Applecross, Perth, Western Australia at 11.00am (WST) on Monday 30 November 2020.

The Explanatory Statement, which accompanies and forms part of this Notice, describes the various matters to be considered.

Terms used in this Notice will, unless the context otherwise requires, have the same meaning given to them in the Glossary as set out in the Explanatory Statement.

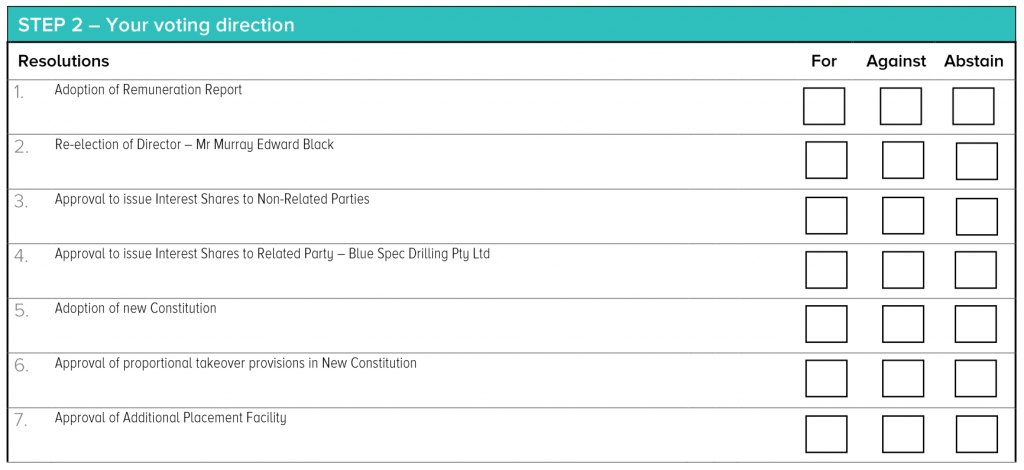

AGENDA

To consider, and if thought fit to pass, the resolutions set out below as an advisory resolution (in respect of Resolution 1), ordinary resolutions (in respect of Resolutions 2 to 4) and as special resolutions (in

respect of Resolutions 5 to 7).

Financial Statements and Reports

To receive and consider the annual financial report, Directors’ report and Auditor’s report of the Company for the financial year ended 30 June 2020, as contained in the Company’s Annual Report.

Resolution 1: Adoption of Remuneration Report

To consider and, if thought fit to pass, with or without amendment, the following resolution as a non-binding advisory resolution:

“That the Remuneration Report contained in the Directors’ Report for the year ended 30 June 2020 be adopted by the Company.”

Notes: In accordance with the Corporations Act, the vote on this Resolution is advisory only and does not bind the Directors or the Company.

The Directors will consider the outcome of the vote and comments made by Shareholders on the Remuneration Report at the Meeting when reviewing the Company’s remuneration policies.

Resolution 2: Re-election of Director – Mr Murray Edward Black

To consider, and if thought fit, to pass the following resolution as an ordinary resolution:

“That for the purposes of Listing Rule 14.4, clause 11.3 of the Company’s Constitution, and for all other purposes, Mr Murray Edward Black, a Director of the Company who retires in accordance with clause 11.3 of the Constitution and, being eligible, offers himself for re-election,

be re-elected as a Director of the Company.”

Resolution 3: Approval to issue Interest Shares to Non-Related Parties

To consider and, if thought fit, to pass, the following resolution as an ordinary resolution:

“That for the purposes of Listing Rule 7.1 and for all other purposes, Shareholders approve the issue of up to 30,537,423 Interest Shares to holders of Convertible Notes (or their nominees), as payment of interest pursuant to the terms of those Convertible Notes, in the manner and on

the terms and conditions set out in the Explanatory Statement.”

Resolution 4: Approval to issue Interest Shares to Related Party – Blue SpecDrilling Pty Ltd

To consider and, if thought fit, to pass, the following resolution as an ordinary resolution:

“That for the purposes of Listing Rule 10.11 and for all other purposes, Shareholders approve the issue of up to 1,543,841 Interest Shares to Blue Spec Drilling Pty Ltd, a company controlled by Mr Murray Black, the Chairperson of the Company, (or its nominee) as payment of interest

pursuant to the terms of Convertible Notes held by Blue Spec Drilling Pty Ltd, in the manner and on the terms and conditions set out in the Explanatory Statement.”

Note: Resolution 5 is a special resolution. To be passed, it must be approved by at least 75% of the votes cast by Shareholders entitled to vote on the Resolution

Resolution 6: Approval of proportional takeover provisions in New Constitution

To consider and, if thought fit, to pass with or without amendment, the following resolution as a special resolution:

“ That, subject to the approval of Resolution 5, with effect from the close of the Meeting, Schedule 1 of the proposed New Constitution, which sets out proposed proportional takeover provisions, be approved and adopted in the New Constitution in the form set out in Schedule 4 to the Explanatory Statement.”

Note: Resolution 6 is a special resolution. To be passed, it must be approved by at least 75% of the votes cast by Shareholders entitled to vote on the Resolution.

Resolution 7: Approval of Additional Placement Facility

To consider and, if thought fit, to pass, with or without amendment, the following resolution as a special resolution:

“That the Company have the additional capacity to issue equity securities provided for in Listing

Rule 7.1A.”

Note: Resolution 7 is a special resolution. To be passed, it must be approved by at least 75% of the votes cast by Shareholders entitled to vote on the Resolution.

By order of the Board

Lloyd Flint

Company Secretary

27 October 2020

Voting Prohibitions and Exclusions

Corporations Act voting prohibitions

Pursuant to sections 250BD and 250R(4) of the Corporations Act, the following are subject to restrictions on voting as set out in the table:

| Resolution | Description | Exclusion |

| Resolution 1 | Adoption of the Remuneration Report | A vote on the resolution must not be cast (in any capacity) by or on behalf of either of the following persons: (i) members of Key Management Personnel details of whose remuneration are included in the Remuneration Report; or (ii)a Closely Related Party of such a member. |

In relation to Resolution 1, members of Key Management Personnel and their closely Related Parties (other than the Chairperson) may not vote as proxy if the appointment does not specify how the proxy is to vote. The Chairperson may vote as proxy in accordance with an express authorisation for the Chairperson to exercise the proxy on the Proxy Form.

ASX voting exclusion statements

For the purposes of Listing Rule 14.11, the following voting exclusion statements apply to the Resolutions.

The Company will disregard any votes cast in favour of the following Resolutions by or on behalf of the following persons or an Associate of those persons.

However, this does not apply to a vote cast in favour of the following Resolutions by:

- the person as proxy or attorney for a person who is entitled to vote on the Resolution, in accordance with directions given to the proxy or attorney to vote on the Resolution in that way; or

- the Chairperson as proxy or attorney for a person who is entitled to vote on the Resolution, in accordance with a direction given to the Chairperson to vote on the Resolution as the Chairperson decides; or

- a holder acting solely in a nominee, trustee, custodial, or other fiduciary capacity on behalf of a beneficiary provided the following conditions are met:

- the beneficiary provides written confirmation to the holder that the beneficiary is not excluded from voting, and is not an Associate of a person excluded from voting, on the

Resolution; and - the holder votes on the Resolution in accordance with directions given by the beneficiary to the holder to vote in that way.

- the beneficiary provides written confirmation to the holder that the beneficiary is not excluded from voting, and is not an Associate of a person excluded from voting, on the

| Resolution | Excluded Parties |

|---|---|

| Resolution3 | Any person who is expected to participate in, or who will obtain a material benefit as a result of, the proposed issue (except a benefit solely by reason of being a holder of Shares in the Company). |

| Resolution4 | Blue Spec Drilling Pty Ltd and any nominee of Blue Spec Drilling Pty Ltd, and any other person who will obtain a material benefit as a result of the issue of the securities (except a benefit solely by reason of being a holder of Shares in the Company). |

Proxy Appointment, Voting, and Meeting Instructions

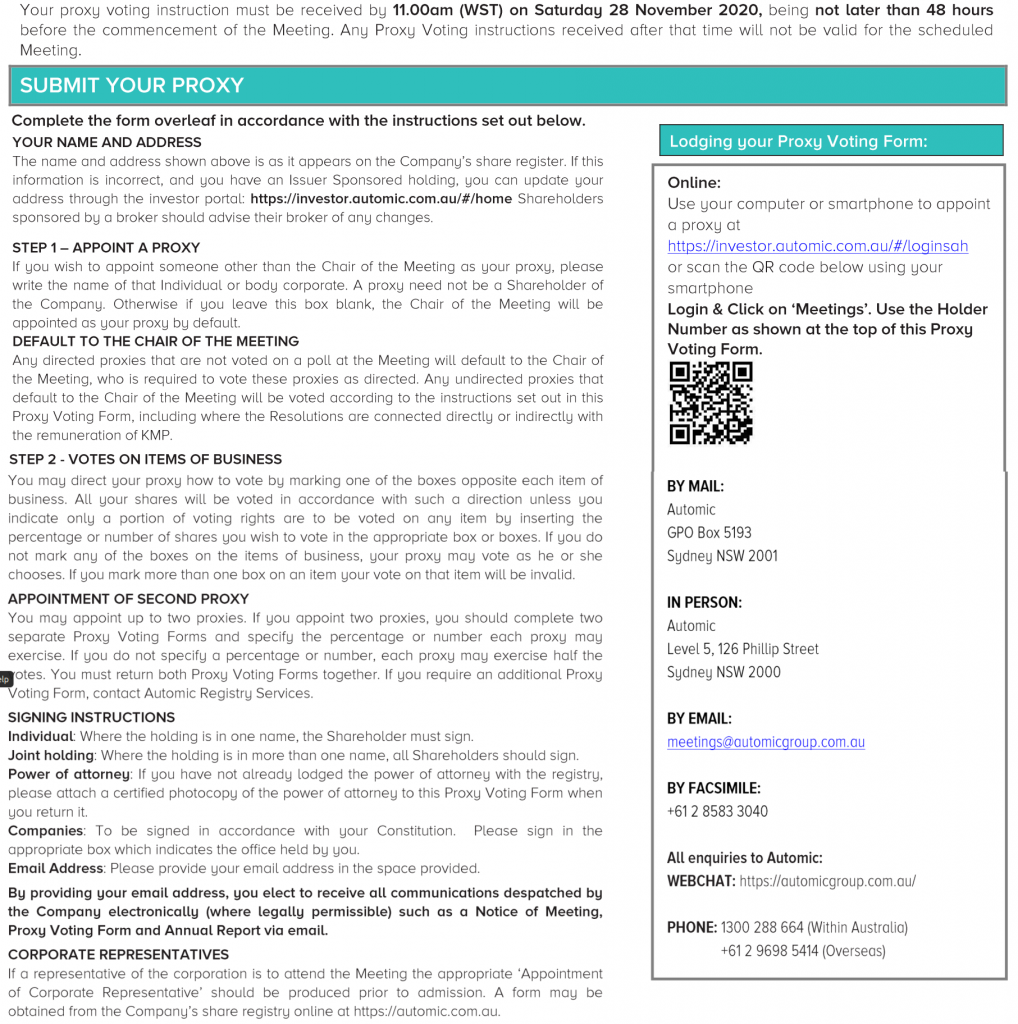

Proxy Form

The Proxy Form (and any power of attorney or other authority, if any, under which it is signed) must be received as below by 11am (WST) on Saturday 28 November 2020, being not later than 48 hours before the commencement of the Meeting. A Proxy Form received after that time will not be valid.

By post: Automic GPO Box 5193

Sydney NSW 2001

By hand: Automic Level 5, 126 Phillip Street

Sydney NSW 2000

By email: meetings@automicgroup.com.au

By fax: (02) 8583 3040 (within Australia)

+61 2 8583 3040 (outside Australia)

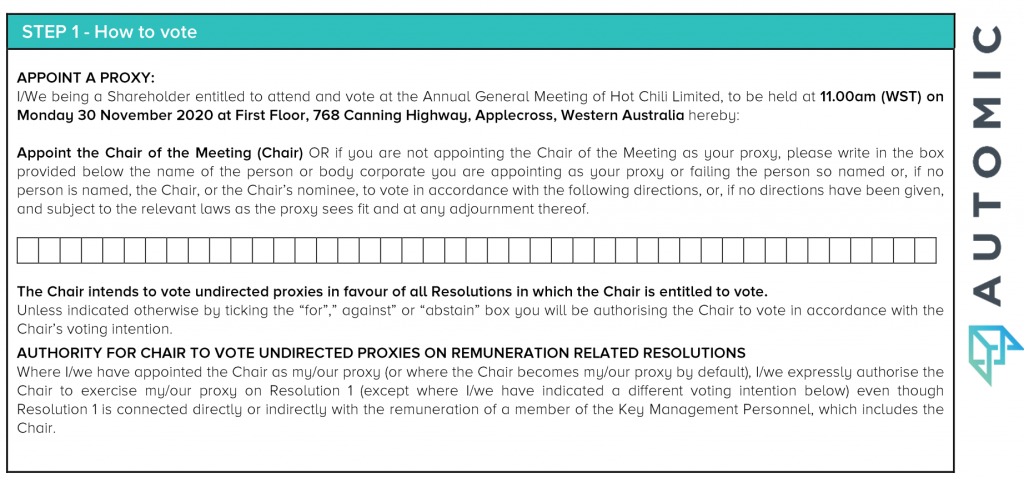

Appointment of a proxy

A Shareholder entitled to attend and vote at the Meeting is entitled to appoint a proxy. The proxy may, but need not be, a Shareholder.

The Company encourages Shareholders to appoint the Chairperson as your proxy. To do so, mark the appropriate box on the Proxy Form. If the person you wish to appoint as your proxy is someone other

than the Chairperson, please write the name of that person in the space provided on the Proxy Form. If you leave this section blank, or your named proxy does not attend the Meeting, the Chairperson will be your proxy.

You are entitled to appoint up to two persons as proxies to attend the Meeting and vote on a poll. If you wish to appoint a second proxy, you may photocopy the Proxy Form or an additional Proxy Form may be obtained by telephoning the Company on +61 8 9315 9009.

Please note, as the Company discourages physical attendance at the Meeting by Shareholders and/or proxies, it is recommended Shareholders complete the attached proxy form and send to the Company via the communication methods outlined above.

To appoint a second proxy you must, on each Proxy Form, state (in the appropriate box) the percentage of your voting rights which are the subject of the relevant proxy. If both Proxy Forms do not specify that percentage, each proxy may exercise half your votes. Fractions of votes will be disregarded.

Corporate Shareholders

Corporate Shareholders should comply with the execution requirements set out on the proxy form or otherwise with the provisions of section 127 of the Corporations Act. Section 127 of the Corporations Act provides that a company may execute a document without using its common seal if the document is signed by:

- two directors of the company;

- a director and a company secretary of the company; or

- for a proprietary company that has a sole director who is also the sole company secretary, that

director.

Corporate representatives

A corporation may elect to appoint an individual to act as its representative in accordance with section 250D of the Corporations Act, in which case the Company will require a certificate of appointment of thecorporate representative executed in accordance with the Corporations Act. The certificate of appointment must be lodged with the Company and/or the Company’s share registry before the Meeting or at the registration desk on the day of the Meeting.

Votes on Resolutions

You may direct your proxy how to vote by placing a mark in the ‘FOR’, ‘AGAINST’ or ‘ABSTAIN’ box opposite the Resolution. All your votes will be cast in accordance with such a direction unless you indicate only a portion of voting rights are to be voted on the Resolution by inserting the percentage or number of Shares you wish to vote in the appropriate boxes. If you do not mark any of the boxes next to a Resolution, your proxy may vote as he or she chooses. If you mark more than one box on the

Resolution, your vote will be invalid.

Chairperson voting undirected proxies

If the Chairperson is your proxy, the Chairperson will cast your votes in accordance with your directions on the Proxy Form. If you do not mark any of the boxes on the Resolutions, then you expressly authorise the Chairperson to vote your undirected proxies at his/her discretion.

As at the date of this Notice of Meeting, the Chairperson intends to vote undirected proxies FOR each of the Resolutions. In exceptional cases the Chairperson’s intentions may subsequently change and in this event, the Company will make an announcement to the market.

Voting entitlement (snapshot date)

For the purposes of determining voting and attendance entitlements at the Meeting, Shares will be taken to be held by the persons who are registered as holding the Shares at 11am (WST) on Saturday 28 November 2020. Accordingly, transactions registered after that time will be disregarded in determining entitlements to attend and vote at the Meeting.

Questions from Shareholders

Shareholders are also encouraged to submit questions in advance of the AGM to the Company. Questions must be submitted in writing by 5pm (WST) on Saturday 28 November 2020 by one of the following methods:

By hand: First Floor, 768 Canning Highway, Applecross, WA, 6153

By post: Company Secretary, Hot Chili Limited, PO Box 1725 Applecross, WA, 6953

By email: admin@hotchili.net.au

By fax: (08) 9315 5004 (within Australia) or +61 8 9315 5004 (outside Australia)

The board of Directors will endeavour to prepare answers to these questions, where necessary they will be moderated and curated to cover common ground.

Copies of written questions will be made available on the Company’s website prior to the Meeting.

The Chairperson will allow a reasonable opportunity for Shareholders to ask questions or make comments on the management and performance of the Company.

RSM Partners Australia, as the Auditor responsible for preparing the Auditor’s Report for the year ended 30 June 2020 (or its representative), will attend the Meeting. The Chairperson will allow a reasonable opportunity for the Shareholders as a whole to ask the Auditor questions at the Meeting about:

(a) the conduct of the audit;

(b) the preparation and content of the Auditor’s Report;

(c) the accounting policies adopted by the Company in relation to the preparation of the Financial

Statements; and

(d)the independence of the Auditor in relation to the conduct of the audit.

To assist the Auditor of the Company in responding to any questions you may have, please submit any questions you may have to the Auditor at an address below by no later than 5.00pm (WST) on 28

November 2020.

By mail: Level 32, Exchange Tower, 2 The Esplanade

Perth WA 6000

By fax: +61 8 9261 9111

As required under section 250PA of the Corporations Act, at the Meeting, the Company will make available those questions directed to the Auditor received in writing at least five Business Days prior to the Meeting, being questions which the Auditor considers relevant to the content of the Auditor’s report or the conduct of the audit of the Annual Financial Report for the year ended 30 June 2020. The Chairperson will allow a reasonable opportunity for the Auditor to respond to the questions set out on

this list.

Annual Report

The Company advises that a copy of its Annual Report for the year ended 30 June 2020, is available to download at the website address, https://es.hotchili.net.au/investors/.

When you access the Company’s Annual Report online, you can view it and print a copy.

Please note that if you have elected to continue to receive a hard copy of the Company’s Annual Reports, the Annual Report will accompany this Notice of Meeting or alternatively it will be mailed to you no later than 21 days before the Meeting.

However, if you did not elect to continue to receive a hard copy of the Company’s Annual Reports and now (or sometime in the future) wish to receive a hard copy of the Company’s Annual Reports, please contact the Company Secretary at admin@hotchili.net.au. We will be pleased to mail you a copy.

Explanatory Statement

This Explanatory Statement has been prepared for the information of Shareholders in relation to the business to be conducted at the Annual General Meeting.

The purpose of this Explanatory Statement is to provide Shareholders with all information known to the Company which is material to a decision on how to vote on the Resolutions in the accompanying Notice of Annual General Meeting.

This Explanatory Statement should be read in conjunction with the Notice of Annual General Meeting. Capitalised terms in this Explanatory Statement are defined in the Glossary.

- Financial Statements and Reports

Shareholders are to receive and consider the Financial Statements, Directors’ Report and the Auditor’s Report of the Company for the financial year ended 30 June 2020.

Shareholders will be given the opportunity to ask questions of the Board and the Auditors in relation to the Annual Report for the financial year ended 30 June 2020 at the Meeting.

2. Resolution 1: Adoption of Remuneration Report

The Remuneration Report is set out in the Directors’ Report in the Company’s 2020 Annual Report.

The Corporations Act requires the Company to put a resolution to Shareholders that the Remuneration Report be adopted. In accordance with section 250R (3) of the Corporations Act, the vote on this Resolution is advisory only and does not bind the Directors or the Company.

In accordance with Division 9 of Part 2G.2 of the Corporations Act, if 25% or more of votes that are cast are voted against the adoption of the Remuneration Report at two consecutive annual general meetings, Shareholders will be required to vote at the second of those annual general meetings on a resolution (a “spill resolution”) that another meeting be held within 90 days at which all of the Company’s directors (other than the Managing Director) must go up for re-election.

At the Company’s previous Annual General Meeting the votes against the Remuneration Report was less than 25% of the votes cast on the Resolution. As such, Shareholders do not need to consider a spill resolution at the Meeting.

A voting exclusion applies to Resolution 1 in the terms set out in the Notice of Meeting. Key Management Personnel and their Closely Related Parties may not vote on this Resolution and may not cast a vote as proxy, unless the proxy appointment gives a direction on how to vote or the proxy is given to the Chairperson and expressly authorises the Chairperson to exercise the proxy. The Chairperson will use any such proxies to vote in favour of Resolution 1.

The Company encourages all Shareholders to cast their votes on Resolution

3. Resolution 2: Re-election of Director – Mr Murray Edward Black

3.1 Background

Resolution 2 seeks Shareholder approval for the re-election of Mr Murray Edward Black as a Director of the Company.

In accordance with the Listing Rules and clause 11.3 of the Constitution, at every Annual General Meeting, one third of the Directors for the time being must retire from office and are eligible for re-election. The Directors to retire are:

(a) those who have been in office for 3 years since their appointment or last re-appointment;

(b) those who have been longest in office since their appointment or last re-appointment; or

(c) if the Directors have been in office for an equal length of time, by agreement.

Mr Black retires by rotation and, being eligible, offers himself for re-election as a Director.

If Resolution 2 is not passed, Mr Murray Edward Black will no longer be a Director of the Company.

Biography – Mr Murray Edward Black

Mr Black has over 44 years’ experience in the mineral exploration and mining industry and has served as an executive director and Chairperson for several listed Australian exploration and mining companies. He part-owns and manages a substantial private Australian drilling business, has interests in several commercial developments and has significant experience in capital financing. Mr Black is currently a non-executive director of Great Boulder Resources Ltd (appointed 6 April 2016).

Directors’ recommendation

The Directors (other than Mr Black) recommend that Shareholders vote in favour of Resolution 2 to re-elect Mr Black as a Director.

Resolution 3: Approval to issue Interest Shares to Non-Related Parties

Background

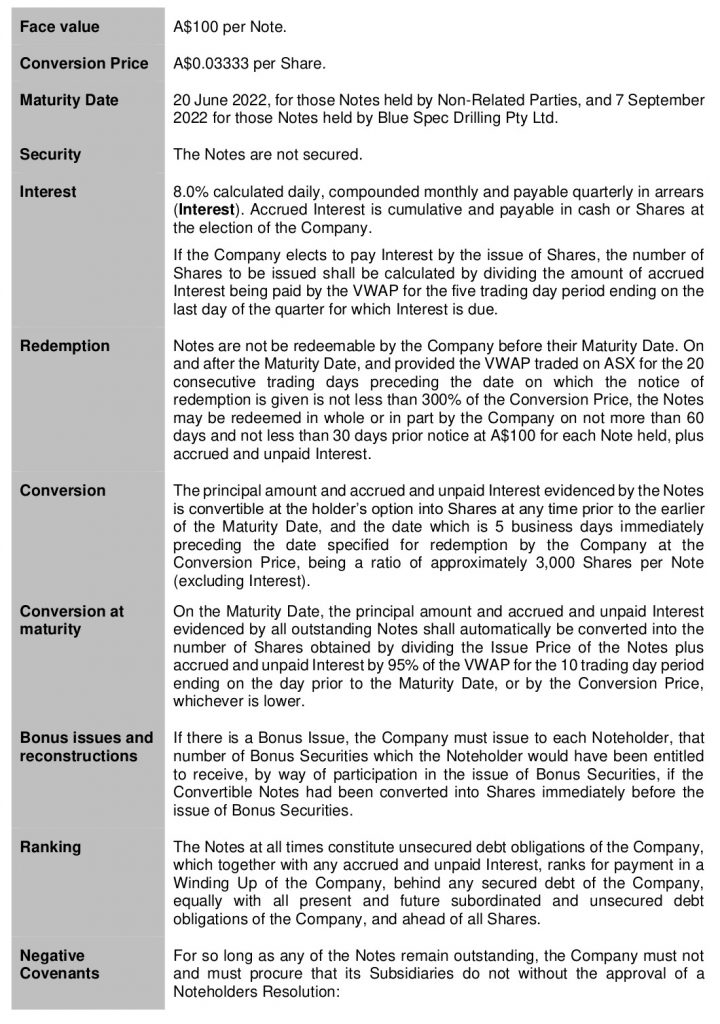

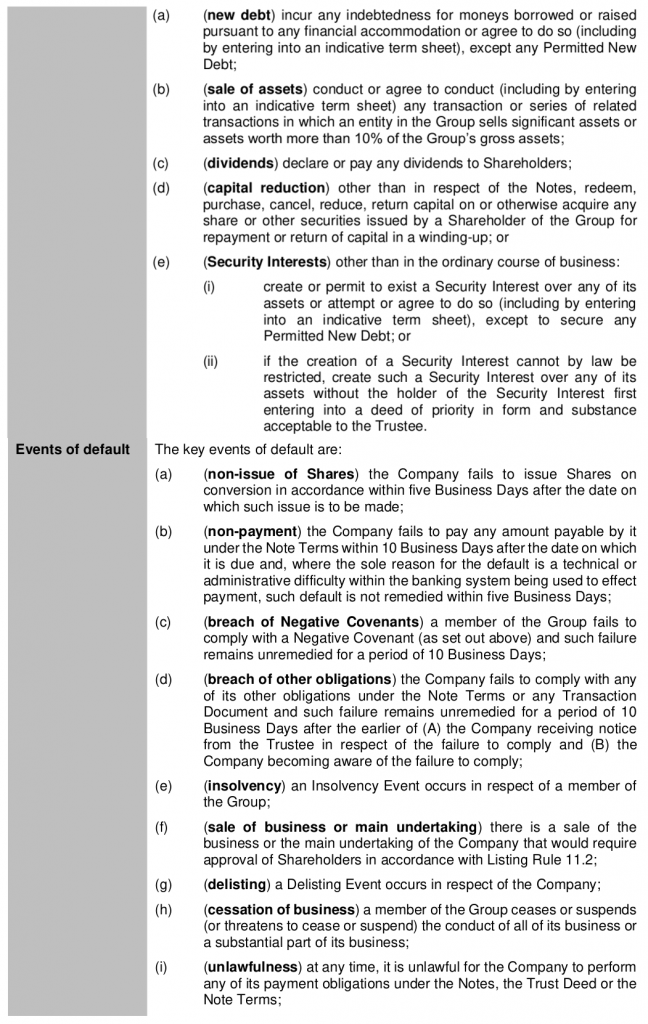

Resolution 3 seeks Shareholder approval to enable the Company to issue fully-paid ordinary shares (Shares) in satisfaction of interest (Interest) that will become due and payable by the Company pursuant to the terms and conditions of the convertible notes with a face value of $100 each that it

issued to investors under its capital raising announced to ASX on 21 June 2017 (Convertible Notes).

The Convertible Notes were issued with shareholder approval at the Company’s general meetings held on 6 June 2017 and 31 August 2017.

Pursuant to the terms of the Convertible Notes, Interest of 8% per annum, calculated daily,compounding monthly, is payable to holders of Convertible Notes (Noteholders) on a quarterly basis (each an Interest Period) in either cash or Shares, at the election of the Company.

Pursuant to the terms of the Convertible Notes, if the Company elects to pay Interest in Shares (Interest Shares), the Interest Shares are to be issued at a deemed issue price equal to the volume-weighted average price (VWAP) of the Company’s Shares calculated over the five trading days prior to their issue date, being the last date of the relevant Interest Period (31 December, 31 March, 30 June, or 30 September in each calendar year).

A s at the date of this Notice, there are a total of 79,221 Notes on issue, of which 75,837 Notes are held by Non-Related Parties.

Resolution 3 seeks Shareholder approval for the issue of up to 30,537,423 Interest Shares in satisfaction of interest in the amount of up to $610,748.50 that will become due and payable by the Company with respect to Convertible Notes held by Non-Related Parties over the 12 months from the

date of the Meeting, being with respect to the quarters ending on 31 December 2020, 31 March 2021,30 June 2021, and 30 September 2021 (each a Relevant Quarter).

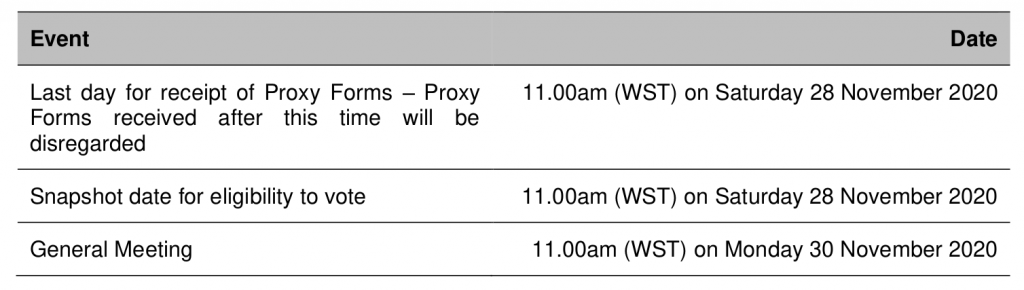

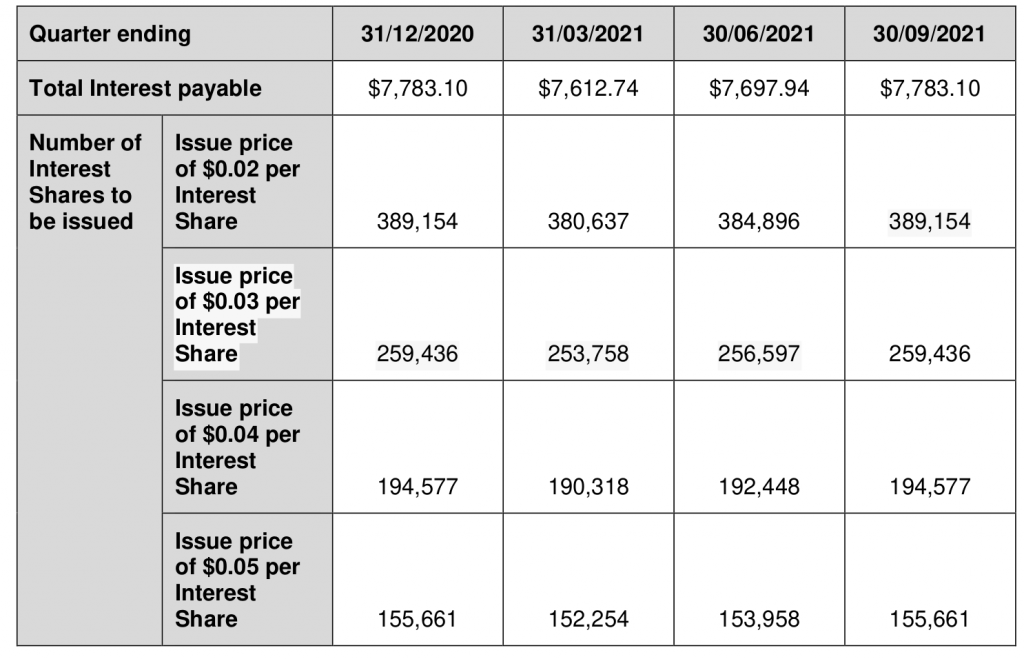

The table below sets out the potential amount of interest that will be payable to Non-Related Parties by the Company with respect to each Relevant Quarter, and the number of Interest Shares that may

be issued pursuant to Resolution 3 for each Relevant Quarter. The table shows examples assuming the Interest Shares will be issued at an issue price of $0.02, $0.03, $0.04 or $0.05 each.

If the maximum number of Interest Shares are issued for each Relevant Quarter, which will only occur if the VWAP of Shares over the five trading days prior to the end of each Relevant Quarter is $0.02 or less, then the number of Interest Shares to be issued to unrelated Noteholders with the approval of Shareholders, will be 30,537,423 Shares, which represents approximately 1.27% of the Company’s current issued Share capital, and the Company’s shareholders will be diluted accordingly.

To the extent that Interest Shares in addition to those approved pursuant to Resolution 3 are required to be issued to satisfy interest payable pursuant to the Notes for a given quarter, then the Company intends to issue those Interest Shares using its issuing capacity under Listing Rule 7.1 and, if

applicable, Listing Rule 7.1A.

Applicable Listing Rules

Broadly speaking, and subject to a number of exceptions, Listing Rule 7.1 limits the amount of equity securities that a listed company can issue without the approval of its shareholders over any 12-month period to 15% of the fully-paid ordinary shares it had on issue at the start of that period.

The issue of the Interest Shares does not fall within any of these exceptions and exceeds the 15% limit in Listing Rule 7.1. The issue therefore requires approval of the Company’s Shareholders under Listing Rule 7.1.

To that end, Resolution 3 seeks the required Shareholder approval for the issues under and for the purposes of Listing Rule 7.1.

If Resolution 3 is passed, the Company will be able to proceed with the issue of the Interest Shares. In addition, the Interest Shares will be excluded from the calculation of the number of equity securities that the Company can issue without Shareholder approval under Listing Rule 7.1.

Listing Rule information requirements

In accordance with the disclosure requirements of Listing Rule 7.3, the following information is provided in relation to Resolution 3:

(a) Names of the persons to whom the Company will issue securities

The recipients of the Interest Shares will be the Noteholders of the Company, or their nominees, none of whom are Related Parties of the Company, and none of whom are members of the Company’s key management personnel, substantial holders in the Company,

advisers to the Company, or an associate of any of the above, who will be issued more than 1% of the Company’s current issued capital.

(b) Number and class of the securities to be issued

A maximum of 30,537,423 fully-paid ordinary are proposed to be issued to the Noteholders under Resolution 3.

(c) The date of issue

Listing Rule 7.3.4 requires that any securities issued pursuant to Shareholder approval undern Listing Rule 7.1 be issued within 3 months of the meeting at which approval was obtained.

ASX has granted the Company a waiver from Listing Rule 7.3.4 to the effect that, if Resolution3 is approved, the Company may issue up to 30,537,423 Interest Shares to the unrelated Noteholders no later than 30 November 2021.

The Company anticipates issuing the Interest Shares over four separate dates, each corresponding with the end of each quarter, being 31 December 2020, 31 March 2021, 30 June 2021, and 30 September 2021.

The full terms of the waiver of Listing Rule 7.3.4 that was granted by ASX are set out at Schedule 2 to this Explanatory Statement.

A summary of the material terms of the Convertible Notes, as is required by the terms of the waiver, are set out at Schedule 1 to this Explanatory Statement.

Price or consideration the Company will receive for the issue

The Interest Shares will be issued at a deemed issue price equal to the VWAP of Shares over the 5 trading days prior to their issue date, being the last date of the relevant quarter (being 31 December 2020, 31 March 2021, 30 June 2021, and 30 September 2021).

The purpose of the issue and intended use of funds

The Interest Shares are to be issued in satisfaction of interest payable by the Company to Noteholders pursuant to the terms of their Convertible Notes. Accordingly, no funds will be raised by the issue of the Interest Shares.

If the securities are being issued under an agreement, a summary of any other material terms of the agreement.

A summary of the material terms of the Convertible Notes are set out at Schedule 1 to this Explanatory Statement.

Directors’ recommendation

The Directors unanimously recommend that Shareholders vote in favour of Resolution 3, as the payment of Interest due on Convertible Notes in Shares rather than cash will preserve the Company’s cash reserves and allow the Company to spend a greater portion of its available cash on its operations

rather than on the payment of Interest due in respect of the Convertible Notes.

Resolution 4: Approval to issue Interest Shares to Blue Spec Drilling Pty Ltd

Background

The terms of the Company’s Convertible Notes are summarised at section 4.1 above.

Resolution 4 seeks approval by Shareholders for the issue of up to 1,543,841 Interest Shares in satisfaction of interest in the amount of $30,876.88 that will become due and payable by the Company with respect to 3,384 Convertible Notes held by Blue Spec Drilling Pty Ltd (Blue Spec) over the 12

months from the date of the Meeting, being with respect to the quarters ending on 31 December 2020, 31 March 2021, 30 June 2021, and 30 September 2021 (each a Relevant Quarter).

Blue Spec is a company controlled by Mr Murray Black, the Non-Executive Chairperson of the Company, and is therefore a Related Party of the Company.

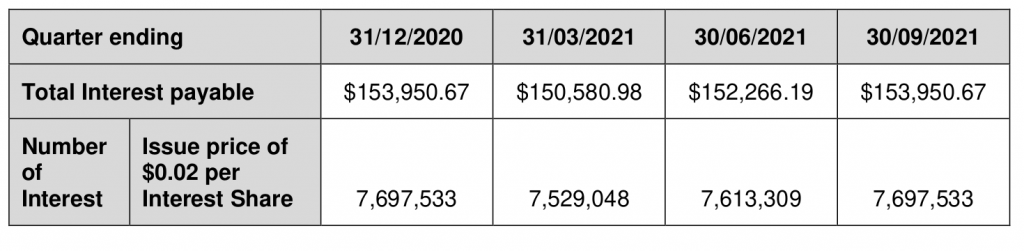

The table below sets out the potential amount of interest that will be payable to Blue Spec by the Company with respect to each Relevant Quarter, and the number of Interest Shares that may be issued pursuant to Resolution 4 for each Relevant Quarter. The table shows examples assuming the Interest Shares will be issued at an issue price of $0.02, $0.03, $0.04 or $0.05 each.

If the maximum number of Interest Shares are issued for each Relevant Quarter, which will only occur if the VWAP of Shares over the five trading days prior to the end of each Relevant Quarter is $0.02 or less, then the number of Interest Shares to be issued to Blue Spec, with the approval of Shareholders will be 1,543,841 Shares, which represents approximately 0.06% of the Company’s current issued Share capital, and the Company’s shareholders will be diluted accordingly.

To the extent that Interest Shares in addition to those approved pursuant to Resolution 4 are required to be issued to satisfy interest payable pursuant to the Convertible Notes held by Blue Spec for a given Relevant Quarter, then the Company intends to satisfy that shortfall by way of a cash payment to Blue Spec.

Applicable Listing Rules

Listing Rule 10.11 provides that unless one of the exceptions in Listing Rule 10.12 applies, a listed company must not issue or agree to issue equity securities to:

10.11.1 – a related party; a related party includes a director and a person who will become a director;

10.11.2 – a person who is, or was at any time in the 6 months before the issue or agreement, a substantial (30%+) holder in the Company;

10.11.3 – a person who is, or was at any time in the 6 months before the issue or agreement, a substantial (10%+) holder in the Company and who has nominated a director to the board of the Company pursuant to a relevant agreement which gives them a right or expectation to do so;

10.11.4 – an associate of a person referred to in Listing Rules 10.11.1 to 10.11.3; or

10.11.5 – a person whose relationship with the company or a person referred to in Listing Rule 10.11.1 to 10.11.4 is such that, ASX’s opinion, the issue or agreement should be approved by its shareholders,

unless it obtains approval of its shareholders.

The issue of the Interest Shares to a Related Party falls within Listing Rule 10.11.1 and does not fall within any of the exceptions in Listing Rule 10.12. It therefore requires approval of Shareholders under Listing Rule 10.11.

Resolution 7 seeks the required Shareholder approvals to issue the Interest Shares to Blue Spec under and for the purposes of Listing Rule 10.11.

If Resolution 7 is passed, the Company will be able to proceed with the issue of Interest Shares to Blue Spec.

If Resolution 7 is not passed, the Company will not be able to proceed with the issue of the Interest Shares and would instead need to pay Interest to Blue Spec in cash.

Chapter 2E of the Corporations Act

Section 208(1) of the Corporations Act (set out in Chapter 2E) requires that, where a public company proposes to give a financial benefit to a Related Party, the public company must:

• obtain the approval of the company’s members in accordance with section 208 of the Corporations Act in the manner set out in sections 217 to 227 of the Corporations Act; and

• give the benefit within 15 months following such approval,

unless the giving of the financial benefit falls within an exception set out in sections 210 to 216 of the Corporations Act.

Section 210 of the Corporations Act provides that shareholder approval is not required to give a financial benefit in circumstances where the benefit is given on terms that would be reasonable in the circumstances if the public company and the related party were dealing at arm’s length.

The issue of Interest Shares to Blue Spec constitutes the giving of a financial benefit to a Related Party of the Company for the purposes of section 208 of the Corporations Act.

The Board (other than Mr Murray Black) has formed the view that Shareholder approval under section 208 of the Corporations Act is not required for the proposed issue of the Interest Shares to Blue Spec,

as those Interest Shares will be issued at the same price on the same terms and conditions as any Interest Shares issued to each other Noteholder, being terms and conditions agreed on commercial terms with arm’s length parties who are not Related Parties of the Company.

Accordingly, the Board (other than Mr Murray Black) considers that the issue of the Interest Shares to Blue Spec is reasonable in the circumstances as if the Company and that Related Party was dealing on arm’s length terms, and has determined not to seek Shareholder approval under section 208 of the Corporations Act for the issue of the Interest Shares to Blue Spec.

Listing Rule information requirements

Listing Rule 10.13 requires that information be provided to Shareholders for the purposes of obtaining Shareholder approval pursuant to Listing Rule 10.11 as follows:

The names of the person

The Interest Shares will be issued to Blue Spec Drilling Pty Ltd, a company controlled by Mr Murray Black, the Non-Executive Chairperson of the Company, or its nominee.

Which category in rules 10.11.1 – 10.11.5 the person falls within and why

Blue Spec falls within Listing Rule 10.11.1, as an entity controlled by Mr Murray Black, who is a Related Party of the Company by virtue of being a Director.

The number and class of securities to be issued to the persons

A maximum of 1,543,841 Shares are proposed to be issued to Blue Spec.

The Interest Shares will be fully-paid ordinary Shares which will rank equally in all respects with Shares then on issue.

The date on which the company will issue the securities

Listing Rule 10.13.5 requires that a notice of meeting seeking approval for an issue of securities under Listing Rule 10.11 state that the securities will be issued within 1 month of the meeting at which approval was obtained.

ASX has granted the Company a waiver from Listing Rule 10.13.5 to the effect that, if Resolution 4 is approved, the Company may issue up to an aggregate of 1,543,841 Interest Shares to Blue Spec (or its nominee) no later than 30 November 2021.

The Company anticipates issuing the Interest Shares on four separate dates, each corresponding with the end of each quarter, being 31 December 2020, 31 March 2021, 30 June 2021, and 30 September 2021.

The full terms of the waiver of Listing Rule 10.13.5 that was granted by ASX are set out at Schedule 2 to this Explanatory Statement.

A summary of the material terms of the Convertible Notes, as is required by the terms of the waiver, are set out at Schedule 1 to this Explanatory Statement.

The price or consideration the entity will receive for the issue

The Interest Shares will be issued at a deemed issue price equal to the VWAP of Shares over the 5 trading days prior to their issue date, being the last date of the relevant quarter (being 31 December 2020, 31 March 2021, 30 June 2021, and 30 September 2021).

The purpose of the issue and use of funds

The Interest Shares are to be issued in satisfaction of interest payable by the Company to Blue Spec pursuant to the terms of its Convertible Notes. Accordingly, no funds will be raised by the issue of the Interest Shares.

If the issue is intended to remunerate or incentivise a director, details of the director’s remuneration

A summary of the material terms of the Convertible Notes are set out at Schedule 1 to this Explanatory Statement.

Directors’ recommendation

The Directors (other than Mr Black) recommend that Shareholders vote in favour of Resolution 4, as the payment of interest due on Convertible Notes in Shares rather than cash will preserve the Company’s cash reserves and allow the Company to spend a greater portion of its cash reserves on

its operations rather than on the payment of interest due in respect of the Convertible Notes.

Mr Black (the controller of Blue Spec) has a material personal interest in the outcome of Resolution 4 and declines to make any recommendation as to how Shareholders should vote on that Resolution.

Resolution 5: Adoption of a new Constitution

Background

The Company’s current Constitution was adopted prior to the Company’s listing on ASX in 2010. Since that time, there have been a number of changes to provisions of both the Corporations Act and the

Listing Rules that affect matters set out in the Constitution. Given the number of changes that would need to be made throughout the current Constitution, the Directors consider that it is more appropriate

to adopt the New Constitution.

The New Constitution reflects a standard listed public company constitution and has updated definitions used to reflect current terminology in the Corporations Act, Listing Rules, and ASX

Settlement Operating Rules. A summary of the material terms of the New Constitution is set out in Schedule 3.

It is not practicable to list all of the differences between the current Constitution and the New Constitution in this Notice. However, of particular note is that the New Constitution:

reflects changes to the Listing Rules regarding restricted securities, namely a two-tiered escrow regime whereby ASX will:

(i) still require formal restriction agreements to be executed by certain more significant holders and their controllers, such as related parties, promoters, substantial holders, service providers and their Associates; and

(ii) permit entities to rely on provisions in their constitutions to impose escrow restrictions on less significant holders of restricted securities and to give a pro forma notice to those holders advising them of those restrictions;

will permit dividends to be paid in the discretion of the Directors and pursuant to the “assets test” set out in section 254T of the Corporations Act rather than solely out of profits as is the case pursuant to the current Constitution, and will not require final dividends to be both recommended by the Directors and approved by Shareholders in general meeting; and

will, subject to the passage of Resolution 6, contain proportional takeover provisions as discussed in section 7 below.

Shareholders are invited to contact the Company if they have any queries or concerns. For this purpose, a copy of the New Constitution is available for review by Shareholders at the office of the

Company and on the Company’s website, https://es.hotchili.net.au/. A copy of the New Constitution will also be tabled and available for inspection at the Meeting and a copy will be sent to those Shareholders that request a copy prior to the Meeting free of charge.

Adoption of the New Constitution will provide consistency between the Company’s Constitution, the Corporations Act, and Listing Rules.

Legal requirements

Section 136 (2) of the Corporations Act provide that a company may modify its constitution by a special resolution of its shareholders.

A special resolution is defined in section 9 of the Corporations Act as a resolution passed by at least 75% of the votes cast by shareholders entitled to vote on the resolution.

Summary of material terms of New Constitution

A summary of the material terms of the New Constitution is set out in Schedule 3.

Directors’ recommendation

The Directors unanimously recommend that Shareholders vote in favour of Resolution 5.

Resolution 6: Approval of proportional takeover provisions in New Constitution

As a part of the proposal to adopt the New Constitution pursuant to Resolution 6, it is intended to insert into the New Constitution the proposed Schedule 1 (as set out in Schedule 4 to this Explanatory Statement), which contains proportional takeover provisions.

In accordance with the requirements of section 648G(5) of the Corporations Act, the Company provides the information set out below.

What is a proportional takeover bid?

A proportional takeover bid is a takeover offer sent to all Shareholders in a particular class but only in respect of a proportion of each Shareholder’s Shares. If a Shareholder accepts an offer under a proportional takeover bid, the Shareholder disposes of the specified proportion of their Shares and

retains the balance.

Effect of the provisions to be adopted

The provisions require the Directors to refuse to register any transfer of Shares made in acceptance of a proportional takeover offer until Shareholder approval has been obtained at a meeting of Shareholders held in accordance with the Constitution.

The meeting must be held at least 14 days before the day the offer under the proportional takeover bid closes.

A resolution for approval of a proportional takeover bid will be taken to have been passed if a majority of Shares voted at the meeting, excluding any Shares held by the bidder and its associates, vote in favour of the resolution. The Directors will breach the Corporations Act if they fail to ensure that an approving resolution is voted upon. However, if no resolution is voted on before the end of the 14 th day before the close of the offer, the resolution will be deemed to have been passed.

Where the resolution approving the offer is passed, transfers of Shares resulting from acceptance of the offer will be registered provided they otherwise comply with the Corporations Act and other provisions of the Constitution.

If the resolution is not passed then in accordance with the Corporations Act, the offer will be deemed to be withdrawn and transfers that would have resulted from acceptance of the bid will not be registered.

The proportional takeover bid provisions do not apply to full takeover bids and only apply for three years after the date of adoption of the provisions. The provisions may be renewed but only by special resolution.

Reasons for adopting the provisions

Without Schedule 5, a proportional takeover bid for the Company may enable effective control of the Company to be acquired without Shareholders having the opportunity to dispose of all of their Shares

to the bidder. If the provisions are not adopted, Shareholders could be at risk of passing control to a bidder without payment of an adequate control premium for all of their Shares whilst leaving themselves as part of a minority interest in the Company.

Schedule 5 protects Shareholders by providing that if a proportional takeover bid is made, Shareholders must vote on whether it should proceed.

The benefit of Schedule 5 is that it enables Shareholders to decide whether the proportional offer is acceptable in principle and appropriately priced.

Potential advantages and disadvantages for Directors and Shareholders

The potential advantages of including proportional takeover provisions in the Constitution are that such provisions may:

(a) enhance the bargaining power of Directors in connection with any potential sale of the Company;

(b) improve corporate management by eliminating the possible threat of a hostile takeover through longer term planning;

(c) make it easier for Directors to discharge their fiduciary and statutory duties to the Company and its Shareholders to advise and guide in the event of a proportional bid occurring; and

(d) strengthen the position of Shareholders of the Company in the event of a takeover, assuming the takeover will result in a sharing of wealth between the bidder and Shareholders, as the more cohesive Shareholders are in determining their response the stronger they are. A requirement for approval can force Shareholders to act in a more cohesive manner. Where

Shareholders know that a bid will only be successful if a specified majority of Shareholders accept the offer, they have less to fear by not tendering to any offer which they think is too low.

The potential disadvantages of including proportional takeover provisions in the Constitution include the following matters:

(a) a vote on approval of a specific bid suffers from a bias in favour of the incumbent Board;

(b) the provisions are inconsistent with the principle that a share in a public company should be transferable without the consent of other shareholders; and

(c) a Shareholder may lack a sufficient financial interest in the Company to have an incentive to determine whether a proposal is appropriate.

No knowledge of present acquisition proposals

As at the date on which this Explanatory Statement is prepared, no Director is aware of a proposal by any person to acquire, or to increase the extent of, a substantial interest in the Company.

Directors’ recommendation

The Directors unanimously recommend that Shareholders vote in favour of Resolution 6.

Resolution 7: Approval of Additional Placement Facility

Background

Resolution 7 seeks Shareholder approval for an additional issuing capacity under ASX Listing Rule 7.1A (Additional Placement Facility).

If approved, Resolution 7 would enable the Company to issue additional Equity Securities (calculated below) over a 12-month period without obtaining Shareholder approval.

Broadly speaking, and subject to a number of exceptions, Listing Rule 7.1 limits the amount of equity securities that a listed company can issue without approval of its shareholders over any 12-month period to 15% of the fully-paid ordinary securities it had on issue at the start of that period.

Under Listing Rule 7.1A, however, an eligible entity can seek approval from its members, by way of a special resolution passed at its annual general meeting, to increase this 15% limit by an extra 10% to15%.

An “eligible entity” means an entity which is not included in the S&P/ASX 300 index and which has a market capitalisation of $300 million or less. The Company is an eligible entity for these purposes.

Resolution 7 seeks Shareholder approval by way of special resolution for the Company to have the additional 10% capacity provided for in Listing Rule 7.1A to issue equity securities without Shareholder approval.

If Resolution 7 is passed, the Company will be able to issue equity securities up to the combined 25% limit in Listing Rules 7.1 and 7.1A without any further Shareholder approval.

If Resolution 7 is not passed, the Company will not be able to access the additional 10% capacity to issue equity securities without Shareholder approval provided for in Listing Rule 7.1A and will remain

subject to the 15% limit on issuing equity securities without Shareholder approval set out in Listing Rule 7.1.

Information on Additional Placement Facility

(a) Quoted securities

Any Equity Securities issued under the Additional Placement Facility must be in the same class as an existing class of Equity Securities of the Company that are quoted on ASX. As at the date of this Notice, the Company has one class of Equity Securities quoted on ASX, being its fully-paid ordinary Shares.

(b) Formula for Additional Placement Facility

If this Resolution 5 is passed, the Company may issue or agree to issue, during the 12-month period after this Meeting, the number of Equity Securities calculated in accordance with the following formula.

Additional Placement Capacity = (A x D) – E

where:

A = the number of fully-paid ordinary securities on issue at the commencement of the relevant period:

- plus the number of fully-paid ordinary securities issued in the relevant period under an exception in ASX Listing Rule 7.2 other than exception 9, 16, or 17;

- plus the number of fully-paid ordinary securities issued in the relevant period on the conversion of convertible securities within rule 7.2 exception 9 where:

the convertible securities were issued or agreed to be issued before the commencement of the relevant period; or

the issue of, or agreement to issue, the convertible securities was approved, or taken under the Listing Rules to have been approved under Listing Rule 7.1 or 7.4;

- plus the number of fully-paid ordinary securities issued in the relevant period under an agreement to issue securities within rule 7.2 exception 16 where:

the agreement was entered into before the commencement of the relevant period; or

the agreement or issue was approved, or taken under the Listing Rules to have been approved under Listing Rule 7.1 or 7.4;

- plus the number of fully-paid ordinary securities issued in the relevant period with approval under Listing Rule 7.1 or ASX Listing Rule 7.4;

- plus the number of partly-paid ordinary securities that became fully-paid in the relevant period;

- less the number of fully-paid ordinary securities cancelled in the relevant period;

D = 10%; and

E = the number of Equity Securities issued or agreed to be issued under Listing Rule 7.1A.2 in the relevant period where the issue or agreement has not been subsequently approved by Shareholders under Listing Rule 7.4.

ASX Listing Rule requirements

In accordance with Listing Rule 7.3A, the following information is provided in relation to the proposed approval of the Additional Placement Facility:

(a) Period for which the approval will be valid

The Additional Placement Facility would commence on the date of the Meeting and expire on the first to occur of the following:

- the date that is 12 months after this Meeting (i.e. 30 November 2021);

- the time and date of the Company’s next annual general meeting; or

- the time and date of the approval by Shareholders of a transaction under Listing Rule 11.1.2 (a significant change to the nature or scale of activities) or Listing Rule 11.2 (disposal of main undertaking).

(b) Minimum price at which equity securities may be issued

Any Equity Securities issued under the Additional Placement Facility must be in an existing quoted class of the Company’s securities and issued for cash consideration per security which is not be less than 75% of the VWAP for securities in that class, calculated over the 15 trading days on which trades in that class were recorded immediately before:

- the date on which the price at which the securities are to be issued is agreed; or

- if the securities are not issued within 10 trading days of the above date, the date on which the securities are issued.

(c) Purposes for which the funds raised by an issue of equity securities may be used

The Company may seek to issue Equity Securities under the Additional Placement Facility for cash consideration to fund business growth (including in relation to development of the Company’s business), to acquire new assets or make investments, to develop the Company’s existing assets and operations, and for general working capital.

Risk of economic and voting dilution

If Resolution 5 is passed and the Company issues securities under the Additional Placement Facility, there will be is a risk to existing Shareholders of economic and voting dilution, including the risk that:

(a) the market price for Equity Securities in the same class may be significantly lower on the issue date of the new Equity Securities than on the date of this Meeting; and

(b) the new Equity Securities may be issued at a price that is at a discount to the market price for Equity Securities in the same class on the issue date.

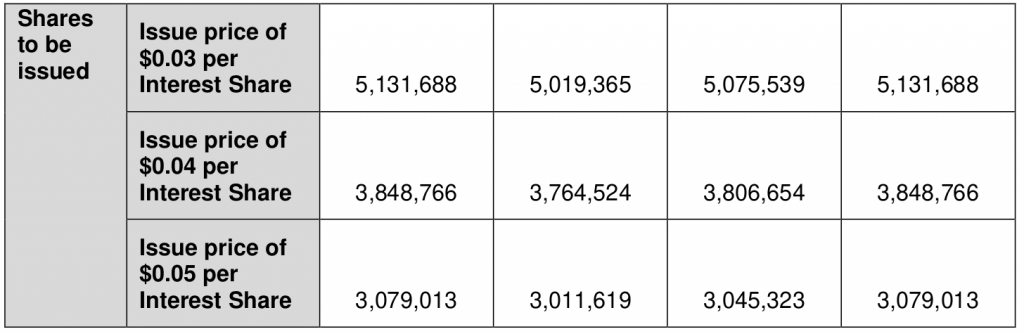

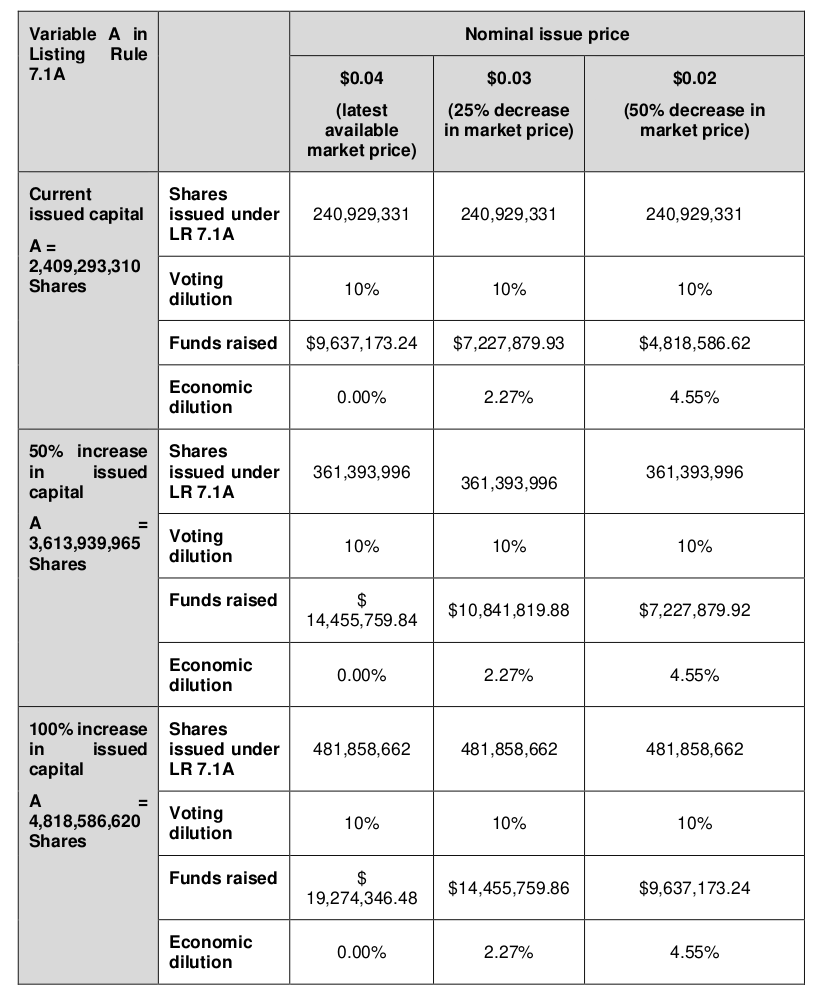

The table below identifies the potential dilution to existing Shareholders following the issue of Equity Securities under the Additional Placement Facility (based on the formula set out above) using different variables for the number of issued Shares and the market price of Shares.

The numbers are calculated on the basis of the latest available market price of Shares before the date of this Notice and the current number of Shares on issue.

Notes: The above table has been prepared on the following bases/assumptions:

- The latest available market price of Shares as at the date of the Notice was $0.04.

- The Company issues the maximum number of Equity Securities available under the Additional Placement Facility.

- Existing Shareholders’ holdings do not change from the date of this Meeting to the date of the issue under the Additional Placement Facility.

- The Company issues Shares only and does not issue other types of Equity Securities (such as Options) under the Additional Placement Facility.

- The impact of additional issues of securities under ASX Listing Rule 7.1 or following the exercise of options is not included in the calculations.

- Economic dilution for the table above is calculated using the following formula:

ED = (MP – (NMC / TS)) / MP

where:

MC = market capitalisation prior to issue of Equity Securities, being the MP multiplied by the number of Shares on issue;

MP = the market price of Shares traded on ASX, expressed as in dollars;

NMC = notional market capitalisation, being the market capitalisation plus the NSV;

NSV = new security value, being the number of new Equity Securities multiplied by the issue price of those Equity Securities; and

TS = total Shares on issue following new Equity Security issue.

(e) Allocation policy

The Company’s allocation policy for the issue of Equity Securities under the Additional Placement Facility will depend on the prevailing market conditions at the time of the proposed issue. The allottees will be determined on a case-by-case basis having regard to the factors

such as:

(i) the methods of raising funds that are available to the Company, including but not limited to, rights issues or other issues in which existing Security holders can participate;

(ii) the effect of the issue of the new securities on the control of the Company;

(iii) the financial situation and solvency of the Company; and

(iv) advice from corporate and other advisors.

As at the date of this Notice, the Company has not identified any proposed allottees of Equity Securities using the Additional Placement Facility. However, the eventual allottees may include existing substantial Shareholders, other Shareholders and/or new investors.

None of the allottees will be a related party or an associate of a related party of the Company, except as permitted under ASX Listing Rule 7.2. Existing Shareholders may or may not be entitled to subscribe for Equity Securities under the Additional Placement Facility and it is

possible that their shareholding will be diluted.

The Company will comply with the disclosure obligations under ASX Listing Rules 7.1A.4 and 3.10.5A upon issue of any Equity Securities under the Additional Placement Facility.

(f) Previous issues under Listing Rule 7.1A in previous 12 months

The Company made one issue pursuant to Listing Rule 7.1A during the 12 months prior to the Meeting, on 25 May 2020, which had the following characteristics:

(i) Total number of securities issued under Listing Rule 7.1A and percentage of securities on issue at the commencement of the 12-month period: 72,553,367 fully-paid ordinary shares were issued, which represents approximately 4.08% of the 1,778,875,752 equity securities that were on issue at the start of the 12 months prior to the Meeting.

(ii) The names of the persons to whom the entity issued or agreed to issue the securities or the basis on which those persons were identified or selected: The Shares were issued via a placement to sophisticated and professional investor clients of Veritas Securities, none of whom were related parties of the Company. In allocating the placement Shares, there was no objective to allocate pro-rata to existing shareholders of the Company, as the principal objectives of the placement were to

raise additional capital without the requirement to issue a prospectus to the investors and to increase the institutional shareholder base of the Company.

(iii) The number and class of equity securities issued or agreed to be issued:

72,553,367 fully-paid ordinary shares were issued under the placement.

(iv) The price at which the Equity Securities were issued or agreed to be issued and the discount if any) that the issue price represented to the closing market price on the date of the issue or agreement: The Shares were issued for cash consideration of $0.015 per Share, which was the same as (i.e., a 0% discount to) the closing market price of the Company’s Shares on the date of issue, being 25 May 2020.

(v) The total cash consideration received or to be received by the entity, the amount of cash that has been spent, what it was spent on, and what is the intended use for the remaining amount of that cash: The Company received cash consideration of approximately $1,088,300.50 under the placement. As at the date of this Notice, these funds have been wholly deployed by the Company, being spent on drilling at the Cortadera Cu-Au Project in Chile, the delineation of the maiden Cu-Au resource estimate at Cortadera, and for working capital.

(g) Voting exclusion statement

At the time of dispatching this Notice, the Company is not proposing to make any issue of Equity Securities under Listing Rule 7.1A. Accordingly, no voting exclusion statement is required to be included with this Notice, and no parties will be excluded from voting on Resolution 5.

Directors’ recommendation

The Directors unanimously recommend that Shareholders vote in favour of Resolution 5 as it will give the Company the flexibility to raise and fund necessary working capital whilst preserving the Company’s cash reserves.

Glossary

In this Explanatory Statement, the following terms have the following meaning unless the context otherwise requires:

Additional Placement Capacity

Has the meaning given to that term in section 8.1 of this Explanatory Statement.

A$ or $

Australian dollars.

Annual General Meeting or Meeting

The annual general meeting of Shareholders, or any resumption thereof,

convened by this Notice.

Annual Report

The annual report of the Company for the financial year ended 30 June 2020, including the annual financial report, the Directors’ report and the Auditor’s report.

Associate

Has the meaning given to that term in the Listing Rules.

ASX

ASX Limited (ACN 008 624 691) or the financial market known as the Australian Securities Exchange, as the context requires.

Auditor

The auditor of the Company, being RSM Partners Australia at the date of this

Notice.

Blue Spec

Blue Spec Drilling Pty Ltd (ACN 601 943 364).

Chairperson The chairperson of the Annual General Meeting.

Closely Related Party

Has same meaning given to that term in section 9 of the Corporations Act, being, in relation to a member of Key Management Personnel:

(a) a spouse or child of the member;

(b) a child of the member’s spouse;

(c) a dependent of the member or the member’s spouse;

(d) anyone else who is one of the member’s family and may be expected to

influence the member, or be influenced by the member, in the member’s

dealing with the entity;

(e) a company the member controls; or

(f) a person prescribed by the Corporations Regulations 2001 (Cth)

(currently none are prescribed).

Company or Hot Chili Hot Chili Limited (ACN 130 955 725).

Company Secretary The company secretary of the Company at the time of the Meeting.

Constitution The Constitution of the Company.

Convertible Note A convertible note issued by the Company with a face value of $100, and otherwise on the terms and conditions set out in the Trust Deed between the Company and Equity Trustees Limited dated 25 May 2018 as varied by deed of variation dated 19 June 2018, as announced to ASX on 21 June 2017.

Corporations Act Corporations Act 2001 (Cth).

Director A director of the Company.

Equity Security Has the meaning given to that term in the Listing Rules.

Explanatory Statement This explanatory statement which accompanies and forms part of the Notice.

Glossary This glossary of terms.

Interest Shares Shares issued as payment of interest pursuant to the terms of the Convertiblem Notes.

Key Management Personnel Has the meaning given in section 9 of the Corporations Act.

Listing Rules The listing rules of ASX, as amended from time to time.

New Constitution The Company’s proposed new constitution, being the subject of Resolution 5.