Hotcopper Corporate Spotlight: Interview with Christian Easterday

The Pick Magazine: New World Metals Q&A

RIU Explorers Conference

Coffee with Samso – Hot Chili Tier-1 Copper-Gold Porphyry Deposits

Coffee with Samso – A Giant Copper – Gold Porphyry Story, Chili

Stock Head Interview

Hot Chili unveils spicy world class copper resource for Cortadera

Hot Chili (ASX:HCH) is rubbing shoulders with giants after defining a maiden resource of 451Mt at 0.46 per cent copper equivalent (CuEq) for its Cortadera deposit in Chile

Stockhead – Special Report October 12, 2020

This resource compares favourably with the only other significant copper discovery announced globally since 2016, Rio Tinto’s (ASX:RIO) Winu discovery in Western Australia that has a resource of 503Mt grading 0.45 per cent CuEq.

With the addition of Cortadera, the company now has a globally significant resource of 724Mt at 0.48 per cent CuEq, or a contained resource of 2.9 million tonnes of copper, 2.7 million ounces of gold, 9.9 million ounces of silver and 64,000t of molybdenum at its Costa Fuego project.

“The Cortadera resource estimate is a strong achievement given the company only executed a deal to acquire the privately owned discovery in February 2019,” managing director Christian Easterday said.

“Generating a 451Mt maiden resource for Cortadera a mere 14km away from our established Productora deposit (273Mt resource) demonstrates the sheer scale of Hot Chili’s Coast Fuego copper hub.”

He added that Cortadera has a high grade core of 104Mt grading 0.74 per cent CuEq that has the potential to grow rapidly with further drilling.

Further growth could come from the company’s ongoing exploration, which includes an expanded program at the Cortadera North prospect.

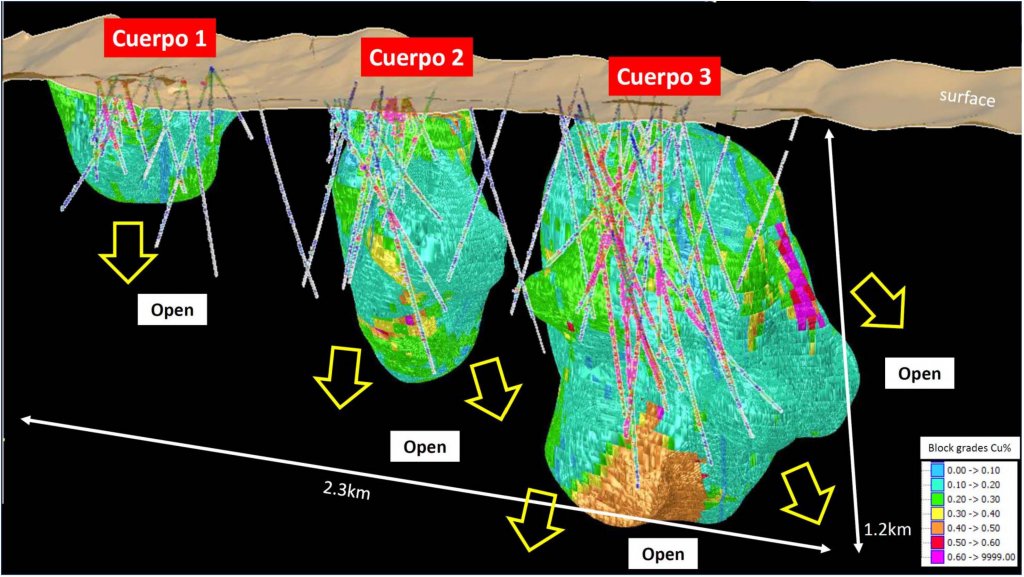

Oblique Long Section (looking NNE) displaying the Maiden Cortadera Mineral Resource extents in relation to drilling

Copper and gold resources set to grow

The resource at Cortadera extends from surface and is considered to be amendable for large-scale open pit mining while the high-grade core represents a large underground development opportunity. This high-grade core was defined by six world-class intersections with the most recent being a 190m zone grading 0.6 per cent copper and 0.2 grams per tonne gold. There is also potential for further growth as the high-grade core remains open in several key areas.

Copper Plans

Hot Chili is currently carrying out an internal scoping study to assess a combined development for Costa Fuego involving both open pit and underground operations.

This will leverage central processing and exiting infrastructure access that it has already secured. Cortadera test work has demonstrated consistent and compatible ore metallurgy to other deposits within Costa Fuego such as Productora and San Antonio with all ore sources expected to be processed using sea water and conventional sulphide flotation.

The company expects to pursue a similar development approach to Teck and Newmont’s Nueva Union copper project in Chile, where the Relincho and El Morro copper-gold deposits are being combined into one development via haulage using a 40km conveyor belt.

However, while Nuevo Union is located between 2,000m and 4,000m elevation with similar average copper grades and co-credit metals to Costa Fuego, the Cortadera and Productora copper-gold deposits are just 14km apart and are at lower altitudes of between 800m to 1,000m elevation along the Pan American Highway and within 50km of port facilities.

Future Activity

Over the coming months, Hot Chili expects to announce a maiden resource estimate for the San Antonio satellite deposit and complete first pass drilling across three large growth targets at Cortadera.

It also plans to continue expansion drilling of the Cortadera resource targeting an updated resource estimate in 2021.

MiningNews.net- Surging copper could test record highs- Goldman Sachs

Mining News Article

2nd December 2020

Kirsty Batten

Copper has soared in recent weeks amid falling stockpiles, strong demand, and hopes of a faster economic recovery from the COVID-19 pandemic.

According to the International Copper Study Group, global copper mine production for the first eight months of the year fell by 0.8%, refined production increased by 1.2% and apparent refined usage increased by 1%.

Based on the data, the ICSG estimates an apparent deficit of 293,000 tonnes for the eight months to August 31.

Copper rose towards an eight-year high overnight after gaining a further 1.6% to $7688/t.

It is now up 66.2% from its March low.

Goldman Sachs said the bull market was fully underway.

“This current price strength is not an irrational aberration, rather we view it as the first leg of a structural bull market in copper,” the bank said overnight.

Goldman Sachs believes 2021 will bring the tightest copper market in a decade, with a deficit of 327,000t, followed by a 153,000t deficit in 2022 and 35,000t surplus in 2023.

“This period will be framed by a robust cyclical and policy driven demand environment set against already low inventories, a fast-approaching peak of base case mine supply and a falling dollar,” analysts said.

“We believe a significantly higher copper price is needed to help balance this structurally tight fundamental backdrop.”

The bank lifted its 12-month copper price target from $7500/t to $9500/t.

It is expecting copper to average $8625/t next year and $9175/t in 2022.

“We believe it is highly probable that by 1H2022, copper will test the existing record highs set in 2011 ($10,170/t),” Goldman Sachs said.

“Higher prices should ultimately help defer peak supply and ease market tightness, but this first requires a sustained rally through 2021/22.”

US bank Jefferies hasn’t ruled out an even higher price, saying last month wouldn’t be unreasonable to assume the copper price would rise to at least $5 per pound ($11,020/t).

“The copper market is heading into a multi-year period of deficits,” it said last week.

Jefferies says the market is yet to factor in demand from the forecast ‘green wave’, which it expects to result in demand from renewable energy to rise from 991,000t this year to 6.4Mt by 2030 under its bull case.

800m copper drill hit for Hot Chili

The West Australian

18th March 2021

Matt Birney

ASX-listed Chilean focused copper hopeful, Hot Chili has unearthed yet another spectacularly long copper mineralised drill hit at its giant Cortadera copper-gold porphyry discovery in Chile. Latest results from the Perth-based company’s 40,000-metre follow-up diamond and RC drilling campaign at Cortadera were headlined by an eye-catching 813m intercept grading an average 0.4 per cent copper and 0.1 grams per tonne gold from just 54m depth.

Importantly, the 813m drill intersection was punctuated by a 318m-wide high-grade core going 0.6 per cent copper and 0.2 g/t gold from 440m.

The Cortadera prospect forms part of Hot Chili’s Costa Fuego copper-gold project approximately 600 kilometres north of Chile’s capital, Santiago.

Costa Fuego takes in multiple prospects that are a mixture between crazy big low-grade deposits and smaller higher-grade ones.

According to Hot Chili, the new diamond drill hit ranks as one of the broadest intersections recorded yet at Cortadera and most importantly, it continues to beef up the high-grade core within Cortadera’s main porphyry Cuerpo 3 deposit as it progresses towards a mineral resource upgrade this year.

Hot Chili says the latest spectacular diamond drill assay result was effectively the seventh “world-class” drill intercept from Cortadera’s Cuerpo 3 deposit in just two years since the company entered into an agreement to acquire the project.

Other stand-out intersections over the two-year period have included a whopping 972m at 0.5 per cent copper and 0.2 g/t gold from surface, including 412m at 0.7 per cent copper and 0.3 g/t gold and 750m at 0.6 per cent copper and 0.2 g/t gold from 204m down-hole including 188m at 0.9 per cent copper and 0.4 g/t gold.

Two other notable prior drill hits are 848m at 0.4 per cent copper and 0.2 g/t gold from 112m down-hole depth including 184m at 0.7 per cent copper and 0.3 g/t gold and 864m at 0.4 per cent copper and 0.1 g/t gold from only 62m down-hole including 348m at 0.6 per cent copper and 0.2 g/t gold.

In October last year, the company released a maiden indicated and inferred mineral resource estimate for Cortadera of 451 million tonnes of ore at a copper equivalent grade averaging 0.46 per cent for 1.66 million tonnes of contained copper, 1.91 million ounces of contained gold and 9.86 million ounces of silver.

Cortadera’s porphyry deposits, which extend for a strike length of 2.3km to a depth of 1km, comprise Cuerpo 1, Cuerpo 2, Cuerpo 3 and Cuerpo 4.

Within the overall Cortadera resource estimate, the Cuerpo 3 deposit’s high-grade core currently stands at 104 million tonnes at a copper equivalent grade averaging 0.74 per cent.

To put that into some perspective, one of the most famous porphyry copper-gold discoveries in the world is Newcrest Mining’s Cadia Ridgeway mine, which sits 25km south of Orange in New South Wales. The immense mine boasts a footprint that extends over 5km of strike where it hosts an astounding resource of 3.1 billion tonnes – at just 0.25 per cent copper and 0.36 g/t gold, grades that at first pass might be dismissed as too low.

The milling operation at Cadia processes around 33 million tonnes of ore per annum and pushes out an impressive 843,000 ounces of gold and 96,000 tonnes of copper, positioning the mine as one of Australia’s premier gold producers.

Interesting, Newcrest also delivers one of the lowest-cost per ounce gold operations in Australia, producing gold at a ridiculously low all-in sustaining cash cost of $160 an ounce due to the production of copper from the same orebody that pays the bills and gives gold pretty much a free ride straight into the company’s coffers.

The low-cost production from Cadia underlines the inherent value of the ore system and showcases the handsome profit to be made from these low-grade, metal-rich porphyry deposits.

Hot Chili says Cuerpo 3 was a key growth target for the company’s current 40,000m drill program as it looked to test interpreted extensions of the high-grade core across the southern flank of Cuerpo 3.

The new (drill) result demonstrates the high-grade core within the main porphyry (Cuerpo 3) at Cortadera is growing rapidly and predictably.

Management hopes to significantly upgrade the Cortadera resource estimate later this year.

The $150 million market-capped company currently has two diamond drill rigs operating 24 hours a day at Cortadera and an RC rig going at the Cortadera North prospect on day shift.

Assay results are expected shortly for a diamond hole that Hot Chili says intersected two wide zones of well mineralised porphyry within a broad zone of mineralisation at Cuerpo 3.

https://thewest.com.au/business/public-companies/800m-copper-drill-hit-for-hot-chili-c-2381661

Hot Chili fast-tracks Costa Fuego copper feasibility

Hot Chili fast-tracks Costa Fuego copper feasibility

The West Australian

27th May 2021

Matt Birney

ASX-listed Hot Chili seems to be sailing into a perfect storm as it looks to ramp up copper production at its Costa Fuego project in northern Chile while the bellwether red metal trades at close to US$10,000 per tonne on the benchmark London Metals Exchange.

The company is already pushing out copper from high-grade lodes at its Productora mine and is now casting an eye over the nearby Cortadera porphyries as it looks to launch into a larger scale operation.

Hot Chili says it is on schedule to kick into feasibility mode on Cortadera in the weeks ahead as drilling continues to return thick intercepts of copper and gold. Latest results include a whopping 836 metres at 0.4 per cent copper and 0.2 grams per tonne gold.

In light of the strengthening copper price, Hot Chili is eager to charge up operations at Costa Fuego due to the rich endowment of the mineralised system. The global resource for Costa Fuego, including Productora and Cortadera deposits, contains a modelled king’s ransom in metal – 2.9 million tonnes of copper and 2.7 million ounces of gold.

However, the totals are likely to balloon out in the months ahead as the company continues to pepper the Cortadera porphyries with deep drilling and exploration commences at the Cortadera North and Santiago Z discoveries that appear to be repetitions.

Hot Chili has already dusted off its 2016 Productora pre-feasibility study, or “PFS”. The original PFS proposed a large, bulk open pit mining operation, as opposed to the small-scale underground venture currently providing feed to the nearby ENAMI copper plant and a still-healthy cash flow to Hot Chili.

Interestingly, the Productora deposit boasts a bulk-tonnage open pit reserve of 167 million tonnes grading 0.43 per cent copper and 0.09 g/t gold, with only the high-grade portions of the potential ore system being exploited by the current mining operations. This is unlikely to have a material impact on the updated mining study.

The revised financial model for Productora is showing vastly improved economic outputs due to the burgeoning copper price, boasting a 500 per cent increase in the net present value, which now sits at an impressive US$1.1 billion whilst the internal rate of return has leapt 150 per cent to a respectable 38 per cent.

With the Productora modelling already showing handsome returns, Hot Chili is racing to complete the current 40,000m resource drilling program at Cortadera to allow the calculation of a new JORC resource that can then be inserted into a revised project pre-feasibility study.