Hot Chili On Fire At Cortadera

The Assay | Colin Sandell-Hay | 29 January 2021

High Grade Core Continues To Expand Copper Discovery

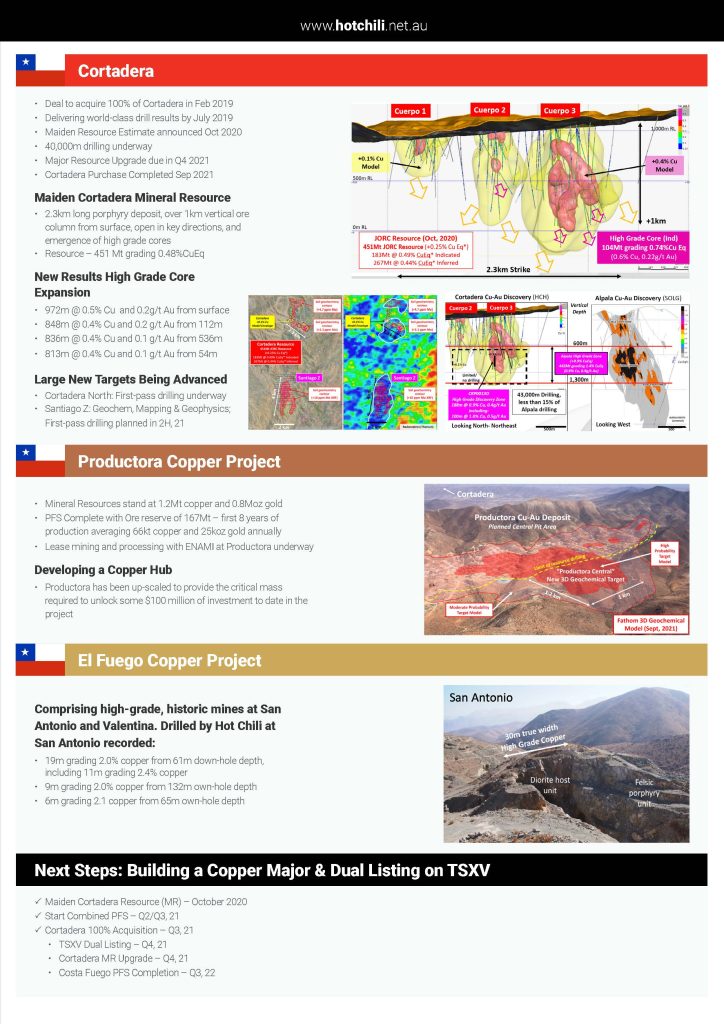

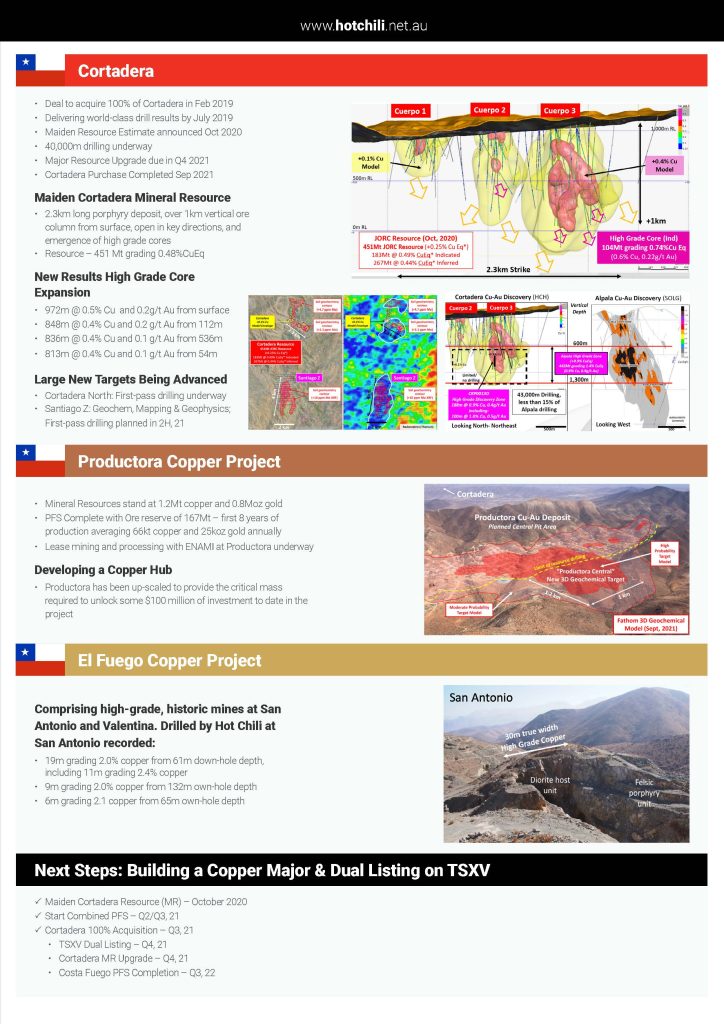

Hot Chili Limited (ASX:HCH) has commenced a 40,000m drilling programme at the Cortadera copper-gold porphyry discovery, part of the company’s Costa Fuego coastal range copper development in Chile.

The company’s fully funded 2021 work programme aims to continue building Costa Fuego toward a tier one copper project (+5Mt copper) from its current contained metal resource base of 2.9Mt copper and 2.7Moz gold.

Drilling has been significantly accelerated from last year with two drill rigs currently in operation and a third rig expected to commence shortly in February.

New results from drilling designed to expand the main high-grade core at Cortadera have returned another set of strong intersections.

A primary focus for the company in 2021 is to expand the high grade core (defined as >0.6% CuEq), currently sitting at 104Mt at 0.74% CuEq, within Cortadera’s 451Mt Mineral Resource.

Diamond drill hole CRP0052D returned a higher-grade intersection of 80m grading 0.6% copper and 0.2g/t gold within a broader zone of 382m grading 0.4% copper and 0.1g/t gold from 524m down-hole depth along the south-eastern extent of the high-grade core to the main porphyry (Cuerpo 3).

In addition, the company has recorded an exceptionally wide 750m interval of porphyry mineralisation from a down-hole depth of 250m in diamond drill hole CRP0046D. The hole is currently at 1,000m in porphyry mineralisation and is planned to extend to 1,200m at this stage.

Importantly, within the wide 750m visual interval of mineralisation, two zones of strongly mineralised porphyry have been recorded:

- 100m wide zone between 250m and 350m depth down-hole, and

- 170m wide zone between 550m and 720m depth down-hole

Both zones of strongly mineralised porphyry comprise visual estimates of 1.0% – 2.5% chalcopyrite contained as fine dissemination and in association with 2% to 15% B-vein abundance. Visual estimates of sulphide minerals are not an accurate representation of expected assay value and are provided for indicative purposes only.

Importantly, the results provide confidence for further growth in predictive extensional areas where the high-grade core is absent from Cortadera’s maiden resource owing to low or no drilling density.

The company commenced a major drilling campaign at Cortadera recently, initially utilising two drill rigs with a third drill rig set to arrive in February.

Each drill rig will focus on key growth areas within the Cortadera discovery window as well as other large satellite growth opportunities.

Full news click on the link below:

The Assay – Hot Chili On Fire At Cortadera

Hot Chili moves to secure Chilean port access

The West Australia | Matt Birney | Friday, 21 January 2022

ASX-listed copper developer Hot Chili has entered into negotiations for a port access and services deal at the Chilean port of Huasco. The company said it has begun the process of securing the final critical item of infrastructure for the development of its massive Costa Fuego copper project, one of the world’s largest copper discoveries.

It has inked a letter of intent with local port services firm Puerto Las Losas SA, or “PLL” to finance a study to investigate using the existing PLL dock facilities to ship copper concentrates and other products from the Costa Fuego mine that is located some 50 kilometres away.

PLL has three months to present Hot Chili with a binding port services offer that may include required upgrades. Both parties are looking to start operations during the last quarter of 2025.

Securing port services will be a major step forward for Costa Fuego. Leveraging off existing port infrastructure will materially reduce Costa Fuego’s environmental footprint during construction and operations.

As no new port or areas will be required for construction or subject to environmental permitting, we expect a positive impact to our construction capital requirements and overall permitting/construction timelines.

Hot Chili Ltd Country Manager and Chief Legal Counsel, Jose Ignacio Silva.

“Costa Fuego continues to benefit from its low altitude location and proximity to existing transport, power and port infrastructure, resulting in low capital intensity.”

“Our Letter of Intent with PLL demonstrates our continued commitment to advancing Costa Fuego within an ESG framework that reduces the overall environmental impact and uses Chilean goods, services and businesses where possible.” Hot Chili Ltd Managing Director, Christian Easterday.

The Costa Fuego project is one of the two largest copper discoveries made in the world since 2016 and takes in a massive 724 million tonne resource base grading 0.48 per cent copper equivalent, largely from two main deposits, Cortadera and Productura that sit just 14 kilometres apart.

Hot Chili has so far drilled out a 451 million tonne resource at Cortadera grading 0.46 per cent copper equivalent in the indicated and inferred categories. The deposit contains more than 1.6 million tonnes of copper, about 1.9 million ounces of gold, nearly 10 million ounces of silver and some 27,000 tonnes of molybdenum.

Productora boasts a 273 million tonne resource at a 0.52 per cent copper equivalent.

The company says the next stage in the development of the two deposits will focus on upgrading the Cortadera resource to a higher confidence resource category and advancing a preliminary feasibility study on the broader, multi-deposit Costa Fuego project.

It will also seek to test other high-priority exploration targets identified at the tenure.

Hot Chili took 100 per cent ownership of Cortadera last year and recently became a dual-listed company after its shares commenced trading on the Canadian TSXV post a C$30 million capital raise.

With money in the bank and massive mineralisation in the ground, Hot Chili appears well on its way to getting the development of this major project off the ground. Should it be able to secure port access to export facilities it will have secured yet another key piece of the puzzle – and arguably perhaps the most vital piece.

Full news click on the link below:

The West Australia – Hot Chili News Article

Hot Chili targets Costa Fuego resource and PFS in 2022

Mining Journal | Paul Harris | Copper News 13 January 2022

Hot Chili Limited

Hot Chili plans to issue a resource update during the March quarter combining the Cortadera and Productora resources, in what it now calls the Costa Fuego copper-gold project in central Chile, as it aims to publish a pre-feasibility study in the September quarter.

The resource update will include 46,000m of drilling completed in 2021, which will primarily upgrade the inferred resources at Cortadera to indicated. Cortedera has a measured and indicated resource of 183 million tonnes grading 0.49% copper equivalent, of which about 40% is indicated and the rest inferred. Productora has a resource of 208Mt grading 0.54% copper equivalent.

Recent drilling results from Cortadera deposit continue to expand Cortadera with highlights of 156m grading 0.4% copper and 0.1 gram per tonne gold from surface including 32m grading 0.5% copper and 0.2g/t gold, or 0.6% copper equivalent.

Hot Chili debuted on the TSXV at the start of this month having raised C$30 million in its IPO a move the company believes will help it realise the value of being a large copper developer.

“We found ourselves as the as the biggest fish in a small pond in Australia, which is not really known for its large-scale copper developers. When we took on Cortadera in 2019 we tripled our resource base and found ourselves the only senior copper developer that wasn’t listed in North America. In the last cycle, there wasn’t the rerate in the Australian market that occurred in North America. Craig Williams at Equinox Mining took a A$400 million company to North America at US$4 a pound copper, financed the mine, built it and nine months later was taken over for C$7.3 billion [in 2011 by Barrick Gold]. We’re trading at three or four times out of the money compared to the values paid in North America for senior copper developers,” MD Christian Easterday told Mining Journal.

The IPO saw global diversified miner Glencore become a 9.99% shareholder, attracted by the company’s potential for low arsenic copper concentrate production. Hot Chili expects to sign an offtake agreement with the major later this quarter which may see Glencore take a 60% offtake on the first eight years of production. A supply of clean concentrate will potentially provide Glencore with material to blend with higher arsenic concentrates which it may be able to acquire for discounted prices.

“The Glencore investment gives us a solid endorsement and provides a good rubber stamp on what we’re doing and the asset we have,” said Easterday.

Glencore is also pushing Hot Chili to explore for the broader potential in the district in order to have a better idea of what the ultimate mining potential may be, and the company has commenced a 20,000m exploration drilling programme to test several copper-gold targets within its combined Costa Fuego landholding.

“We’re aiming for a multi decade project that’s going to put out 100,000 tonnes per year of copper and 70,000-80,000 ounces of gold. If we can add another asset of the scale into it, it’s not inconceivable that this year we’ll answer the question of whether is this a 150,000tpy copper project over 20 to 30 years? That’s what Glencoe wants us to answer quite quickly, before we move into feasibility so we have given our exploration team 22,000m to drill 12 large-scale targets in a short period of time,” said Easterday.

With a PFS due later this year, Easterday believes Hot Chili has one of the most advanced development stage projects in the world. With Costa Fuego being in the coastal range at low elevation, he says it has infrastructure advantages which will translate into a lower development cost compared to competing projects, including easement corridors to build a water pipeline from the coast and transmission lines, a full tailings storage facility and a water license.

“We are the only non-major in Chile that holds a maritime concession to extract seawater, which will provide all the water requirements for the entire combined development. We can process with salt water because of the metallurgy, which means we skip a $500 million item as we don’t have to build a desalination plant. And we don’t have to build a $500 million pipeline to bring water up into the Andes. We are potentially looking at a $1.3 billion project rather than a $3 billion one,” said Easterday.

The company plans to use a rope conveyor to move ore to the plant at an estimated cost of 1.5c per tonne compared with 16c/t with trucks, for a $110 million capex compared with $630 million. With a potential mine start in 2026, Easterday also expects mining fleet suppliers to have launched commercial electrified solutions rather than the traditional diesel-powered haul fleet. “The largest transport benefit we’re going to have is not running trucks between Cortadera and the plant site at Productora, 14km away at lower altitude. Rope conveyors are extremely efficient for a quarter of the cost of the conventional conveyor, or less than a tenth the cost of trucking, and with no carbon footprint,” he said.

Hot Chili is working on getting power supply bids, with the project located to two of the biggest solar power developments in the country.

The EIA is about 85% on Cortadera and will now tie-in Productura into Costa Fuego, which are expected to be complete by year end for submission in early 2023. “We’re looking to be at the development decision at the end of 2024,” he said.

Shares in Hot Chili are trading at A$1.77, valuing the company at $193 million.

To read the full news click on the link below:

Mining Journal – Copper – Copper – News – 13 January 2022

Investor Guide: Gold & Copper FY2025 featuring Barry FitzGerald

Hot Chili Limited

ASX: HCH | TSXV: HCH | OTCQX: HHLKF

To read the full magazine click on the link below:

Investor Guide: Gold & Copper FY2025 – Hot Chili Limited – page27

The Assay – Tech Metals Edition 2022

“This month, we have a special edition aligned with our first ever Global Online: Tech Metals mining investment event. We hear from market investors and expert analysts on investment in the energy transition, OEMs and mining, and supply chain security for critical minerals. There’s also focus on where demand is pushing lithium prices, and we examine Latin America’s potential lithium “OPEC” between key producing countries. What’s more, you can explore company profiles for 20 tech-metals-focused mining companies, either drilling, developing, or producing the materials critical to decarbonization. “

The Assay – Tech Metals Edition 2022

Hot Chili Limited

Big Vision in Big Copper

The Assay, Tech Metals Edition 2022, November 2022

Hot Chili is developing the large-scale Costa Fuego Project – a copper hub comprising two major copper deposits: Productora and Cortadera. Costa Fuego’s Total Indicated Resource is 725Mt grading 0.47% CuEq for 2.8Mt Cu, 2.6Moz Au, 10.5Moz Ag & 67kt Mo, and the Inferred Resource is 202Mt grading 0.36% CuEq for 0.6Mt Cu, 0.4Moz Au, 2.0Moz Ag and 13kt Mo. The deposits are 14km apart and within 50km of port, making it one of the lowest altitude major developments in the Americas.

Hot Chili is now trading on the TSXV, which is our natural home. The comparison of resource size and market cap amongst peers demonstrates the inherent value and the company is excited to debut this exciting investment opportunity to North American investors –TSXV: HCH.

Investment Highlights

- Tier 1 Mining Jurisdiction – Chile: home to 7 of the 20 largest copper mines in the world

- Only low-altitude sizeable copper developer position for production in the next 5 years

- Backed by Glencore

- Lack of new Cu supply + rising demand = higher Cu price

- Critical Infrastructure & Access – Easement for water/power & surface rights secured, 55km from port, Pan American Hwy, major power substation

- Water Licence – Maritime concession approved in Dec 2020

- Environmental – Foundation of low-emission Chilean grid power, next to major solar projects, sea water processing

- Social – Chilean-focused goods and services, direct taxes and royalties, community support programmes, employee engagement

- Governance – Transparency, accountability and integrity, broad view of diversity, ESG reporting

Full Company Profile

To read the full magazine click on the link below:

The Assay – Tech Metals Edition 2022 – Hot Chili Limited – page54-55

The Assay – Tech Metals Edition 2021

In the latest edition of The Assay, it reviews how mining explorers, developers, and producers are fuelling the energy transition and helping to ensure its success. Inside, you can read about increasing global demand for minerals, price volatility, the likelihood of a “supercycle”, as well as deep-dive into the tech metals driving the development of EVs and battery technologies. You will also find profiles for 20 tech-metals-focused mining companies, all of which are chasing the critical materials we need to create a greener future for all.

Hot Chili Limited

Cortadera Rising: Big Vision in Big Copper

The Assay , Tech Metals Edition 2021 Oct 2021

Hot Chili is a copper company listed on the Australian Stock Exchange (ASX: HCH). Our focus is copper exploration and development in Chile’s Atacama Region, and we aim to be one of the largest copper companies operating in the area.

Hot Chili has three key copper projects – Cortadera, Productora, and El Fuego – all located in close proximity to one another. In developing these projects, our copper exploration and development company seeks to create a new mining hub on the coastal range of the Chile called Costa Fuego. We believe this kind of project portfolio is unique among senior copper developers.

Current Projects

The Cortadera acquThe centerpiece of our copper company’s ambitious discovery program is our Cortadera copper-gold project. In addition to Cortadera, our Productora copper-gold project entered production in 2020 through a partnership agreement with Chilean government-owned ENAMI, and our El Fuego project encompasses two historic high-grade copper mines.

Investment Highlights

- Tier 1 Mining Jurisdiction – Chile

- Low Altitude – 800m to 1,000m altitude (Coastal Range)

- Clean Concentrate – No arsenic

- Critical Infrastructure & Access – Easement for water/power & surface rights secured, 50km from port, Pan American Hwy, major power substation

- Water Licence – Maritime concession approved in Dec 2020

- Environmental – Next to major solar projects, sea water processing

- Social – Active community support programmes (orphanages) and local employer

- Government – Chilean Government agency (ENAMI) partnership in lease mining and processing at Productora, VAT refund approval

Full Company Profile

To read the full magazine click on the link below:

The Assay – Tech Metals Edition 2021 – Hot Chili Limited – page55

Hot Chili rises to the top

Mining Journal- Resource Stocks Article

Chile-focused copper junior aggressively drilling to expand one of world’s best new copper finds

24th March 2021

Size is not everything in the mining business, but scale is something North American copper investors certainly appreciate. Back in 2011 Barrick Gold paid C$7.3 billion for Equinox Resources and its copper-gold mines in Zambia and Saudi Arabia after the Australian company listed in Toronto. Five years later TSX-listed Ivanhoe Mines added the fabulous Kakula copper discovery to its 2008 find at Kamoa in the DRC and now has a market value around C$9.4 billion.

Promising Toronto-listed Ecuador copper explorer Solaris Resources is in the early stages of a new, big drilling campaign at Warintza but has already seen its market value climb past C$700 million.

And Newmont Mining has just agreed to pay more than C$450 million for GT Gold (TSXV: GTT) and its circa-3Mlb indicated copper-equivalent resource at Tatogga (average 0.47% Cu-eq resource grade) in British Columbia.

With other recent healthy copperco funding and the red metal itself selling for more than US$4/pound, deal momentum in the space is clearly escalating. All of which means there is likely only one direction ASX-listed Hot Chili can go from here.

That’s north.

Sitting on one of two major global copper discoveries of the past five years or so, Hot Chili is fully funded to complete an aggressive drilling program this year aimed at extending the maiden JORC 451 million tonnes grading 0.46% copperequivalent (1.7Mt of copper and 1.9Moz of gold) reported for Cortadera in northern Chile last October. That’s up with Rio Tinto’s maiden 503Mt at 0.45% Cu-eq for Winu in Western Australia in a list compiled by S&P Global Market Intelligence, which highlights the dearth of major new copper finds around the world over the past decade.

Hot Chili also has the Productora project within its Costa Fuego hub, 50km from the Chilean coast and port at Los Losas, which has a JORC resource of 273Mt grading 0.52% Cu-eq. All up, the company is sitting on circa 2.9 million tonnes of copper, 2.7Moz of gold, 9.9Moz of silver and 64,000t of molybdenum, in what is – compared with similar projects elsewhere – the formative stage of the exploration cycle for Cortadera and wider Costa Fuego area.

Unlike Rio and Winu, and less advanced developers in the Americas, Hot Chili has battled to get proper market recognition in Australia of the progress made in Chile, where it has been working for more than a decade but only two years ago added Cortadera to its portfolio. Since landing the deal to acquire Cortadera, it has featured regularly in compilations of the best drill intercepts from multi-metal programs around the globe, with some stunning, 500-950m-wide mineralised diamond core results that have underlined the Cortadera porphyry copper-gold deposit sequence’s scale and growing metal endowment from near-surface.

Already, Cortadera’s scale makes Hot Chili the standout copper-resource holder on the ASX and, according to the company’s managing director Christian Easterday, “one of the few low-altitude, no-arsenic, tier 1-location, infrastructureready major copper resources” worldwide – certainly one in the hands of a A$135 million-market-cap junior.

“And this is an emerging project,” says Easterday. “Not one that has been in the global pipeline for some time that is stalled. The important thing to look at with the global copper development pipeline is the cost, technical and other factors slowing the progress of some major projects. In that context, it’s important to look at some of the key attributes of Costa Fuego.

“It’s at 800-1,000m elevation, near the coast, on the Pan American Highway and near established infrastructure in northern Chile; it’s not a 3,000-4,000m altitude project. It hasn’t got 300ppm arsenic sitting in the metallurgy. We can produce a clean copper-gold concentrate.”

Compared with the nearest emerging deposit of similar scale, Winu, Costa Fuego continues to look good.

“We’re certainly sitting in a very good pedigree,” Easterday says. “I believe both discoveries have got a long way to go.

“At this stage the comparison is very similar on a grade basis, as bulk tonnage copper discoveries, but when you look at the detail clearly Cortadera is coming out head and shoulders above Winu. We don’t have 90m of desert to remove to get to the deposit … [which has] a very dramatic impact on pre-strip capital requirements; all of our deposits go through to surface and have very low strip ratios.

“We’re not sitting 350km from Port Hedland. Our infrastructure advantage that we have in relation to Winu is really night and day in comparison. And in addition we believe the combined approach of joining Cortadera and [currently producing] Productora together, and other assets within the Costa Fuego grouping, offers us a significant amount of flexibility in how we stage development of this large project so that we can maximise value and minimise all of the risks associated with that.”

Hot Chili’s planned 40,000m of drilling this year, including a number of deep holes to infill and extend the 104Mt grading 0.74%Cu-eq “high-grade core” at Cortadera, will double the amount of drilling done so far.

“Our aim this year is to elevate it to a top 5-6 project in the world,” Easterday says. We have quite a lot of treasury coming in this year [through Chile government tax refunds and in the money options, adding to last year’s $25 million equity injection] to support a $20 million, very aggressive drilling program on this. We’re aiming to lift Cortadera into legitimate tier-1 territory and become a titan of the copper sector … [to support a] blueprint for 100,000tpa copper project and 100,000ozpa gold producer. In plain speak that’s a project that will kick out US$800 million per annum of revenues and we’re looking to position this as a 20-year project. These are very rare. We’re already by far the largest ASX [listed] copper resource, and we’re sitting in a league where this part of the copper space is dominated by the North Americans.”

‘Tier-1 territory’ means circa 5Mt of copper, or more.

“So we require another 2Mt of contained copper metal,” says Easterday. “We’re going to be shooting for that very aggressively, and what’s really exciting for us this year is we have not started testing that depth component of Cortadera. This thing is open-ended in a lot of its lateral extents but more importantly, when you have an over-1km vertical ore column that has a high-grade core the size that is evident in Cuerpo 3, we can grow this quite rapidly.

“We have not tested that magical zone at around 1,000m that made [SolGold’s] Alpala and the Cascabel project what it is today. That’s really where those fingers of that porphyry turned into a hand and… we’ve got all the indications that a similar thing may be possible at Cortadera. We will be putting a lot of money into six or seven or eight very deep holes underneath Cuerpo 2 and Cuerpo 3, and seeing if this discovery turns into something a lot, lot larger in a very short period of time.”

Adding to the continuous stream of drill results set to flow from Cortadera this year, Hot Chili will keep investors informed about work at the exciting Santiago Z ground recently picked up after mapping and soil geochemical work completed in December and January highlighted a 4km-long copper porphyry feature that’s 5km from its “world class” Cortadera copper-gold discovery and features a molybdenum soil anomaly “more than twice the size and four times the tenor of Cortadera’s soil molybdenum footprint”.

Detailed mapping and geophysics is planned for the first half of 2021 in advance of first-pass drilling. Hot Chili picked up Santiago Z as part of its option agreement with a private Chilean landowner on the San Antonio high-grade copper mine 5km from Cortadera. With copper prices soaring, it’s no surprise a North American dual listing for Hot Chili is on the radar for the second half of 2021.

https://www.mining-journal.com/resourcestocks/resourcestocks/1406834/hot-chili-rises-to-the-top

Productora cash flow

Hot Chili expects Productora cash to start flowing within months.

Stockhead – Special Report June 2, 2020

Hot Chili is just months away from cash flow after executing a formal agreement for the lease mining and processing of ore from its satellite Productora copper-gold project.

With the execution of the formal agreement, Chilean government agency Empresa Nacional de Mineria (ENAMI) will start mining within three months from the grant of the necessary exploitation licences, with first revenue expected in the fourth quarter of 2020.

Hot Chili (ASX:HCH) says that at current spot prices for copper and gold, the lease mining of Productora could deliver revenues of between $1.2m and $1.5m per annum.

Under the agreement with ENAMI, Hot Chili and its partner CMP (20 per cent) will be paid $US2 ($2.95) per tonne of ore processed and a 10 per cent royalty on the sale value of extracted minerals.

Hot Chili is currently working with ENAMI to outline higher-grade areas with +1.2 per cent copper that can be assessed from the two existing underground mines.

The company noted that the lease mining rate of 120,000 tonnes per annum will not materially deplete the project’s existing 167 million tonne open pit reserve.

Location of Hot Chili’s copper hub in relation to coastal range infrastructure.

Flagship project returns to the limelight

Exciting as the lease mining of Productora and the prospect of some early cash flow might be, Hot Chili is especially keen to resume activity at its potentially massive Cortadera project.

The company recently completed a revised four-dimensional geological model of the project that incorporates all drilling completed to date to assist in the estimation of a maiden resource, which remains on track to be announced in the coming months.

Notably, the model has highlighted that the discovery remains open and has the potential to grow significantly beyond the limits of the initial resource as well as the growing extent of the high-grade core within the Cuerpo 3 and Cuerpo 2 porphyries and their potential to join up at depth.

Long Section of the Cortadera discovery demonstrating the growing extent of the high grade core within Cuerpo 3 and Cuerpo 2, and the potential for both to join at depth.

This higher-grade core now stretches over 500m in strike and 200m in width. It also extends from 200m vertical depth and remains open beyond a depth of 1,000m with average grades of between 0.7 per cent to 0.9 per cent copper and between 0.2 grams per tonne (g/t) to 0.5g/t gold.

Hot Chili noted that the grades and near 1km vertical high-grade core are features that are also found in some of the world’s best large-scale porphyry mines such as El Teniente, Grasberg and Cadia-Ridgeway.

Hot Chili has started preparation for the eventual resumption of drilling at Cortadera with a focus on the extension of several deep pre-collar and unfinished diamond holes

Additionally, the mining and development of high-grade satellite ore sources like Productora will help internal studies into a larger combined development centred around the company’s standalone Cortadera copper discovery.

Now watch: RockTalk: How COVID-19 might have made copper look more attractive sooner

Positive test work ups the ante for Hot Chili in Chile

Hot Chili has tabled some positive test work from its three copper deposits in in Chile, delivering a common processing route and potentially a high-value product.

The West Australian July 31, 2020

Metallurgical test work on sulphide samples from the Cortadera, Productora and San Antonio copper deposits confirm that the selected processing flowsheet should see over 89 per cent of the contained copper mineralisation recovered.

Flotation and concentrate trials conducted by expert consultants Wood PLC returned copper recoveries of 89-95 per cent into a clean concentrate from the Cortadera and San Antonio’s. The concentrates boast low contaminants and corresponding high levels of valuable co-products including gold, silver and molybdenum.

Drilling at Cortadera

The test work confirms the ores from these deposits can be readily treated using a conventional milling and concentration circuit. Copper and other metal recoveries increase as the grind size becomes finer with similar comminution characteristics seen to those generated during the PFS for the Productora ores.

Trials on both high and low-grade ores from Cortadera and San Antonio show excellent recoveries of both copper and precious metals, producing a 22-28 per cent copper concentrate that exhibits no significant levels of ‘deleterious’ elements – a desirable and high-grade product for sale into the global market place.

The company said the test work proves that a high-value concentrate can be easily produced from the various Costa Fuego ores which compares well with emerging products being produced by other players in the market including those from SolGold’s Cascabel and Rio’s Winu concentrate trials.

Hot Chili’s Costa Fuego copper project is located in the coastal region of Chile, around 600km north of the capital of Santiago and 50km inland from the port of Los Lasas. The project suite now takes in the Cortadera, Productora and San Antonio copper deposits.The region hosting the Costa Fuego project boasts outstanding infrastructure including the nearby port, power, the Vallenar mineral processing facility and a seawater pipeline to supply much needed process water to the mill. The Vallenar mill is owned by the Chilean Government’s ENAMI group and is ideally positioned for the company, sitting a mere 15km north of Hot Chili’s Productora mine.

The success of Hot Chili’s exploration program and explosive growth in the resource inventory prompted the company to move into production during the June quarter. The company put in place an agreement with ENAMI to process the near-surface, high-grade copper ores at Productora through the Vallenar mill – delivering A$1.4-1.8 million per annum into Hot Chili’s coffers.

Whilst ENAMI’s mill at Vallenar provides a near-term cash flow for Hot Chili, it also provides a proven processing route for the company which can used as a blueprint for its developing production hub.

Given the potentially massive size of Hot Chili’s resource inventory at Costa Fuego, which already stands at close to half a billion tonnes of ore, plans for a central mill and processing facility at Cortadera look to be firmly on the cards.

Hot Chili’s ongoing success is the culmination of a well-planned and successful development program in Chile. The company continues to spit out more than half a kilometre-long drill intercepts at Cortadera and with production underway at Productora, it has now made the step from explorer to the venerated ranks of copper producer.

With metallurgical testing confirming a common processing route for Hot Chili’s three projects and a highly anticipated maiden resource due to be tabled at Cortadera any day now, Hot Chili may well have an entirely different complexion this time next year.

Is your ASX listed company doing something interesting? Contact: matt.birney@wanews.com.au

Hot Chili raises $5m

Hot Chili raises $5m to progress porphyry copper-gold strategy.

Author: Matt Birney

Published by: Business News Tuesday, 19 May, 2020

Despite the current Coronavirus inspired market challenges, ASX-listed Hot Chili has encountered no difficulty in completing a $5m placement to sophisticated and institutional investors to progress its burgeoning Cortadera copper-gold discovery in Chile. Existing shareholders have also been extended an invitation to participate in the placement, with an additional $3.9m expected to be raised from a non-renounceable rights issue.

Funds were raised at a share price of 1.5 cents with a 1 for 2 unlisted option exercisable at 2.5 cents also offered. Eligible shareholders are entitled to the same terms as the rights issue with the options expiring on or before May 20th 2022.

Whilst the rights issue is not underwritten, the placement which was led by Veritas Securities, was over-bid and the book was closed off in just one day, suggesting strong support from both high net worth investors and institutions.

The Christian Easterday – led Chilean porphyry copper developer said the funds raised will be deployed to re-commence drilling at Cortadera, targeting a maiden resource estimate at both the Cortadera and nearby San Antonio copper-gold projects.

Some of the cash will be used to pay a US$2m extension fee to extend the remaining payment schedule necessary for Hot Chili to acquire its 100 per cent interest in Cortadera from private mining group SCM Carola.

The extension is good news for Hot Chili who otherwise would have needed to do a much bigger capital raise to satisfy its acquisition payment schedule.

Cortadera lies 14km south east of Hot Chili’s developing Productora copper-gold project that was once considered to be its flag ship project before the acquisition of Cortadera. Hot Chili has now elevated Cortadera into a stand-alone project in its own right.

Management is already able to claim bragging rights at Cortadera after its successful drilling campaigns delivered six record breaking drill intercepts that landed on SNL Financials’ top 25 list of the best copper-gold hits. The size and quality of Hot Chili’s Cortadera copper-gold intercepts rank fourth on SNL’s top 25 list. The recent and extraordinary 972m intercept grading 0.5% copper and 0.2g/t gold from surface at the Cupero 3 deposit took line honours.

To give Cortadera some context, the massive Cascabel copper-gold project in Ecuador has a mineral resource of 8.4 million tonnes of copper grading 0.41% and 19.4 million ounces of gold grading 0.29g/t.

Funding will also cover the completion of the metallurgical test work and preliminary economic model that will no doubt end up in a preliminary feasibility study at Cortadera in the near term.

Hot Chili Managing Director, Christian Easterday said the funding will facilitate a re-positioning of the company’s copper and gold resource base as it targets its drilling to achieve further extensions of the Cortadera discovery. Cortadera appears to expand with every drill hole and remains open to the north, south and at depth.

One of the best historic intersections in the Cuerpo 3 porphyry returned 750m grading a solid 0.6% copper and 0.2g/t gold from 204m with an exceptional 188m going 0.9% copper and 0.4g/t gold.

Other outstanding intersections included 596m grading 0.5% copper and 0.2g/t gold from 328m down-hole, including 184m grading 0.7% copper and 0.3g/t gold and 864m grading 0.4% copper and 0.1g/t gold from a shallow 62m down-hole, including 348m grading 0.6% copper and 0.2g/t gold.

Hot Chili Managing Director, Christian Easterday said: “With each hole, the Cortadera discovery has expanded – delivering six world class, copper-gold drill results already and still remaining open.”

“We look forward to continuing our push to rapidly grow Cortadera while also working towards establishing a new and expanded, combined development plan for our coastal copper-gold assets in Chile.”

“I am very pleased with the strong funding support we have received, in addition to providing all shareholders the ability to participate in this exciting phase of growth for our Company.”

Easterday is now planning another swag of holes at Cortadera to try to duplicate these stellar results and confirm Cortadera as a stand-alone deposit.

Download Business News article (pdf) here: Hot Chili raises $5m to progress porphyry copper-gold strategy