July 2, 2024 | Capital 10X

Hot Chili (ASX: HCH) (TSXV: HCH) (OTCQX: HHLKF) held an investor webinar recently and laid out current investment priorities and what comes next for Costa Fuego, the company’s low cost, high return Chilean copper project.

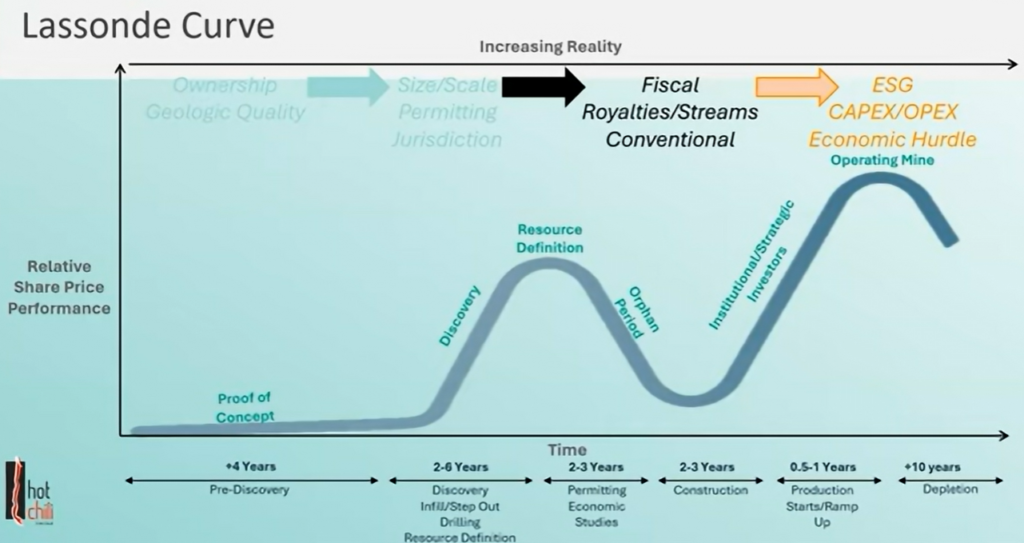

Importantly, the company shared a copper price forecast using the Lassonde curve and gave their view on where we are in the current copper commodity cycle.

Below is a summary of all the important information shared on the webinar.

A Successful Recent Private Placement

Hot Chili’s A$25 million private placement was well subscribed and saw strong interest from investor’s across Australia, Europe and North America. The company also had to cap the number of current investors who could buy more shares even after upsizing the buyback option to A$7 million from A$5 million. Management reported that out of 24 participants in the capital raise, 17 were institutional, 13 were from North America and 6 were new to the company.

Glencore was also a participant in the capital raise and owns 7.5% of Hot Chili. Glencore’s desire to maintain its current ownership stake is an important positive mark for the potential of Hot Chili’s Costa Fuego project in Chile, one of the largest copper projects not owned by a major.

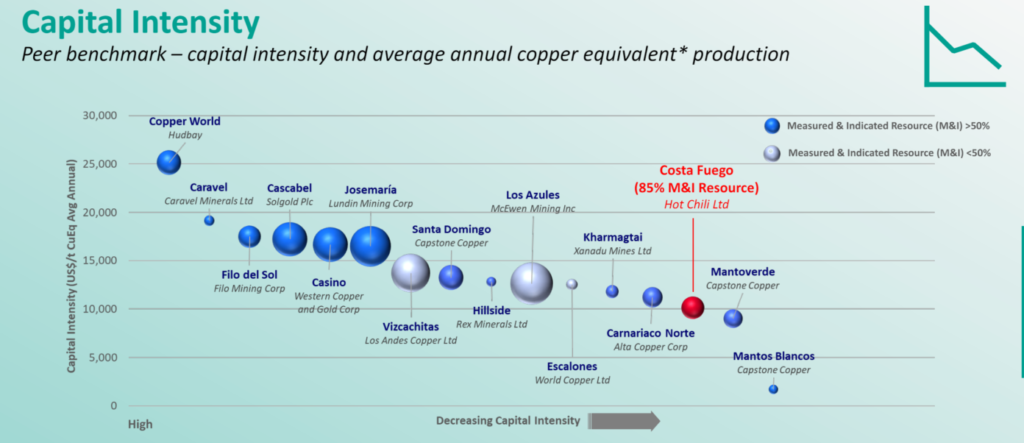

Costa Fuego One of the Lowest Cost Projects in Chile

Initiative Ongoing to Bring in More North American Investors

Hot Chili made forays into the North American market over the past two years and now has 8% of the registrar on the TSX coming from North American capital.

Hot Chili is moving towards financing on their large-scale copper asset and the company is expanding relations with investment banks and broker groups in North America with the long term goal of growing a stable group of shareholders.

Costa Fuego is High Return With Strong Leverage to Copper Prices

Hot Chili’s recent PEA for Costa Fuego showed that for every 10 cent move in the copper price above $3.85 /lb., the project value increases by $100 million.

$1.5Bn NPV and 26% IRR at Current Copper Prices ($4.35/lb)

This leverage puts them in line with six other large-scale copper producers on the TSX/ASX, outside of the majors that are +100,000 tons per annum projects.

At current copper prices of $4.35/lb Costa Fuego is worth US$1.5 billion to Hot Chili vs the company’s current market cap of only US$94 million.

Management believes that more capital will move from producers to developers with exposure to the copper price at copper prices above $4.00/lb.

Relative Performance

Looking at the performance of Hot Chili on the ASX over the past 18 months (red) the stock has done well on a relative basis, in line with most of the copper equities up 10% – 20% with the copper price. Xanadu Mines is the outperformer of the group.

Results were similar on the TSX; producers’ stock prices are up 20 to 30% over the past 3 months, with the expectation that the continuing bull market will also lift developers and explorers in time.

Chart shows the performance of several ASX copper equities (December 2022 to June 06, 2024)

Strategy: A Story of the Commodity Cycle

Understanding where we are in the commodity cycle is key for investors to understand how explorers, developers and producers are positioned in the market.

Hot Chili’s Non-Executive Chairman, Dr. Nicole Adshead-Bell gave some insights while highlighting 2 charts; one from Scotiabank quarterly’s commodity cycle chart and another from Investec’s Mining Clock.

The goal for investors is always to get in at the lows and ride the rebound.

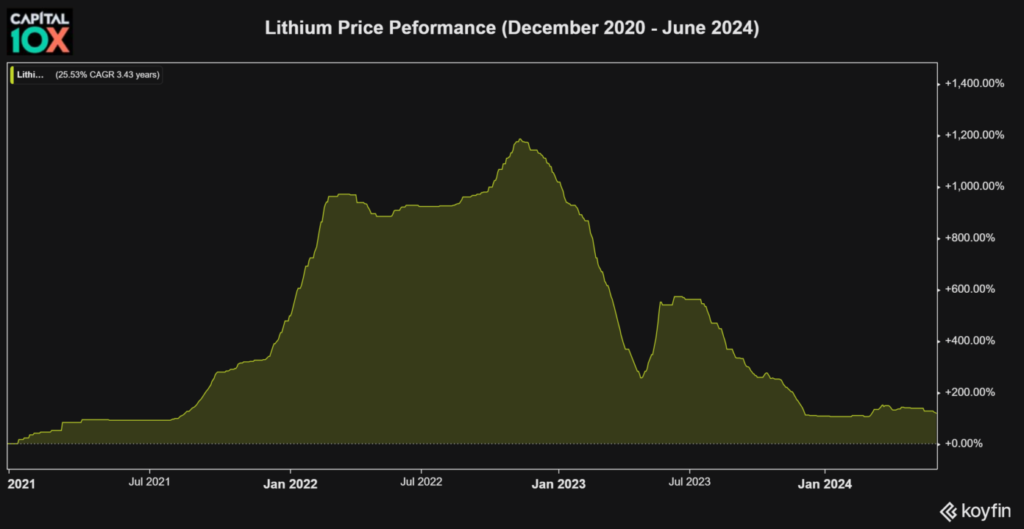

A good example to look at is the past 2-year price action of lithium.

We saw the start of a lithium bull run in December 2020 which ultimately took the price up 12x, with almost all equities with exposure to lithium rising spectacularly as well.

Rising prices saw huge inflows of investment in discoveries and production. Due to rising production from the wave of investment, lithium prices have fallen lately, down significantly from the highs though still well above where they were in late 2020.

Lithium Price Performance (Dec 2020-Jun 2024)

Adshead-Bell believes that even after strong copper price performance so far in 2024, we are still at lows in the copper price looking at the cycle overall. She believes supply will continue to decline over the next 18 months supporting higher prices.

Provocatively, Hot Chili management strong believes the copper price needed to incentivize enough supply is between $6.00-$8.00/lb, 30%-70% above peak levels reached in the last cycle.

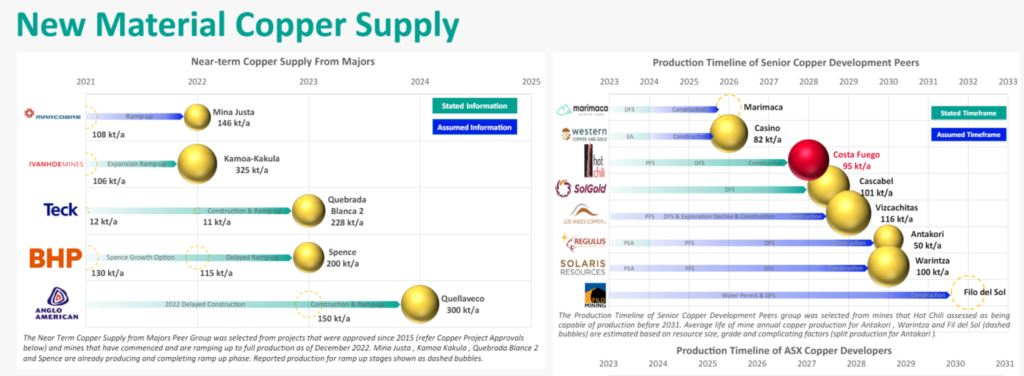

Hot Chili’s goal is to manage their business to take advantage of where we are in the cycle. They are aggressively advancing the Costa Fuego project so that production can coincide with rising prices. Costa Fuego will be one of the first medium term projects to start up after a few projects from the majors begin producing in 2024 and 2025.

Hot Chili Production Timeline vs Industry Peers

Themes: Investor & Company Behavior

Hot Chili talked through different parts of the commodities cycle and the behavior of companies and investors depending on where in the cycle we are.

During a bear market, there are bankruptcies, asset sales and dilutive financings in the juniors sector, where capital is spent just to keep going, no investments are made that may move the equity price beyond the commodity price.

Generalist investors tend to buy high and sell low.

As prices stabilize (or in the case of copper, stay resilient) mining companies pinch pennies,; geologists are fired as companies attempt to avoid going under.

This is when savvy investors begin to buy. They understand the cycle and know that prices are at lows demonstrated by companies implement efficiencies on the balance sheet.

Industry Behavior Through the Commodity Cycle

As prices finally begin to rise there is low-risk M&A, producers buy other producers.

In the past year BHP acquired Oz Minerals, and is currently negotiating to buy Anglo American, primarily for its copper assets.

As mid and small caps strengthen their balance sheets, their attractiveness to the majors increases. As the cycle continues and the underlying commodity price improves, capital becomes available for development, not just for mine expansion. We are here today.

Financings for mid and small cap companies are the green shoots of a bull market in the view of Adshead-Bell.

A Bull Market: More Opportunity, More Risk

The next phase of the cycle is development in more higher risk activities (e.g. exploration, development) as companies drill holes and make new discoveries.

At this point investors demand growth, and there are new IPOs, as companies strive to prove their exposure to the commodity.

At the top of the bull market, high risk M&A rules the day, as large caps start acquiring companies down the supply chain – including developers and higher risk explorers.

Generalist investors get involved, as they begin to do their research and invest. In order to maximize shareholder returns, companies should time the cycle.

We are definitely not in this stage according to Hot Chili.

The Lassonde Curve: A Visual of Optimal Investment Timing

So where does the Lassonde Curve fit into the cycle?

Adshead-Bell believes that the best time for alpha generation is in the discovery phase, when investor sentiment is at its highest, which is reflected in the share price.

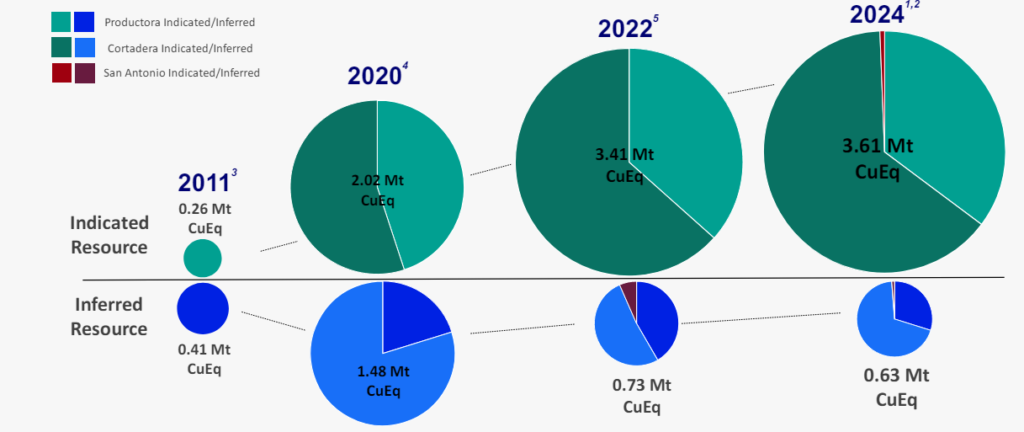

Hot Chili is focusing on additional discovery drilling and increasing the total copper resource to drive value before making a construction decision in 2025.

Costa Fuego Resource Continues to Grow Driving Value for Shareholders

Hot Chili has 16 years of experience in Chile as a company in the market, and is currently fostering relationships with institutional and strategic investors.

The company believes that the best way to generate market excitement at the next stage of the curve, is material resource growth and success.

The path to exposure to alpha generation for developers is mainly through value in the drill bit; smart exploration with historic mining activity and/or oxide mineralization as evidence of a larger system.

Also managing the company efficiency allows to strike well asset acquisition opportunities take place. So the company is focused and ready to benefit as the copper price continues to rise quarter over quarter.

To learn more about Hot Chili, including upcoming catalysts and who the economics of Costa Fuego are so strong, we recommend browsing the company’s investor presentations found HERE

Hot Chili Limited is a market awareness client of Capital 10X. For more information, including potential conflicts of interest please see our Content Disclaimer.