Hot Chili bites into US$1bn Costa Fuego copper-gold project with another 10,000m of drilling under way

By STOCKHEAD

Pic: via Getty Images.

- A 10,000m drilling campaign across 10 holes has kicked off at Costa Fuego

- Assays are back from four RC holes at the Marsellesa pit showing grades of up to 1% copper and six holes from Cordillera showing up to 0.4% copper

- Final stages of an upgrade to the mineral resource are being finalised

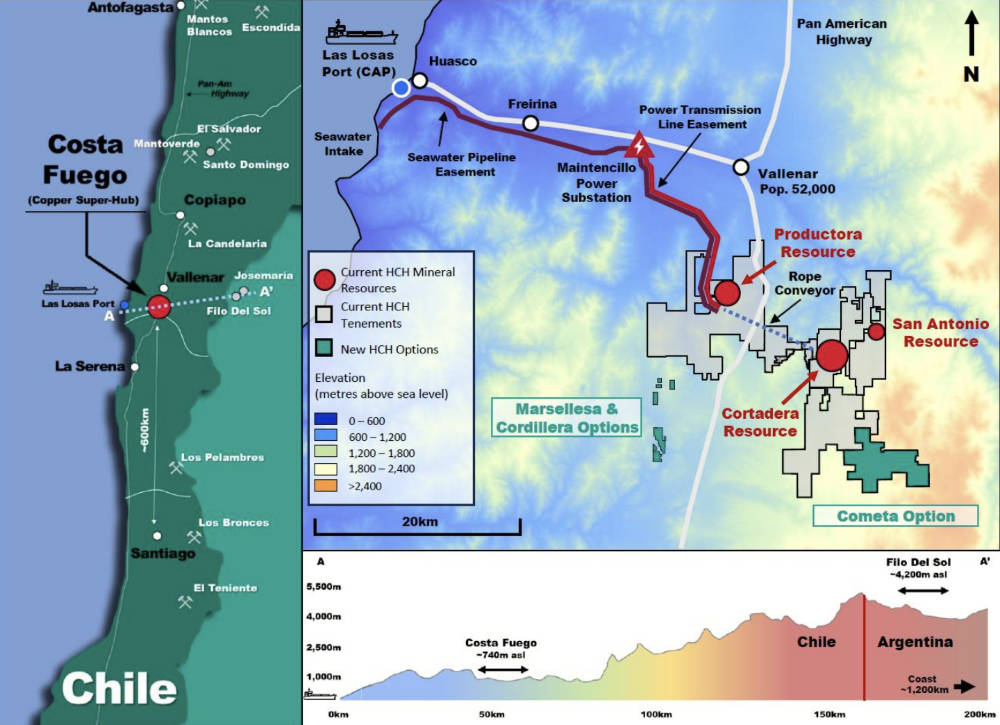

Special Report: The next phase of Hot Chili’s 30,000m resource growing expedition at its Costa Fuego copper-gold project in Chile has kicked off at seven large-scale targets adjacent to the Cortadera and Productora deposits.

Hot Chili’s return to drilling comes off the back of a landholding expansion of the project and a recent scoping study which estimated the >US$1 billion project can produce ~112,000tpa of copper equivalent (95,000t CU and 49,000oz Au) for an initial 14-year mine life.

Chile is renowned for its high-value copper deposits and is the largest producer of the red metal in the world, with heavy hitters such as BHP, Rio Tinto and JECO running the operations of world-class deposits.

Phased drilling

47 RC drill holes for 11,500m have been completed since Hot Chili (ASX:HCH) kicked off the extensive drill program in late July last year, and this round comprises 10 diamond holes to test four large-scale targets near Cortadera and three large-scale targets near Productora for a total of 10,000m.

Assays have come back from the late-2023 targets of Marsellesa, Cordillera and Correteo – all within 15km of Costa Fuego’s planned central processing hub showing grades of up to 1% copper across 500m of prospective strike length.

Four RC holes for 1,244m were completed and include:

- 25m @ 0.4% copper from surface, including 10m grading 0.8% copper from 7m depth

- 8m @ 0.8% copper from 1m depth downhole, including 4m grading 1.0% copper from 4m depth

HCH says the higher grade copper intersections are associated with both copper oxide and sulphide mineralisation and further work is being planned to assess mineralisation continuity.

The Marsellesa mine area is laterally extensive, measuring 400x200m, with historical open pit and underground mine workings exposing multiple zones of shallow-dipping, strata-bound (manto-style), copper mineralisation.

Six holes for 1,450m at Cordillera, 1km to the west of Marsellesa, showed up to 0.4% copper below and surrounding the historical small surface mine workings, including:

- 93m @ 0.3% copper from surface, including 14m grading 0.4% copper from surface

- 53m @ 0.3% copper from 19m depth, including 10m grading 0.4% copper from 44m depth

Eight RC holes for 2,324m were completed at the greenfield Corroteo exploration target, however, no significant intersections were recorded.

HCH is in the final stages of the resource upgrade for Costa Fuego, which is expected to be released this quarter.

Hot Chili’s new option deal reduces payments from US$11m at the Costa Fuego copper hub for 2024

By STOCKHEAD

The new El Fuego Option will also increase the company’s ownership from 90% to 100% at the San Antonio, Valentina and Santiago Z privately-owned landholdings. Pic via Getty Images

- Three options due for exercise in 2024 have now been terminated and replaced with one new option agreement

- Hot Chili’s new deal, named the ‘El Fuego Option’ covers the San Antonio, Valentina and Santiago Z privately-owned landholdings

- Updates on growth drilling, resource upgrades and water conceptual studies are expected in the near term

Special Report: Hot Chili has materially improved the terms of the El Fuego option agreement to acquire landholdings as part of the company’s Costa Fuego copper-gold project in Chile.

Hot Chili’s (ASX:HCH) 725Mt Costa Fuego project is rapidly emerging as one of the few projects in the world capable of delivering meaningful new copper supply that isn’t controlled by a major.

A recent PEA – the equivalent of a scoping study – estimated the US$1.05bn project would be capable of producing 112,000t of copper equivalent (95,000t of copper and 49,000oz of gold) per annum over 14-years of a 16-year mine life.

Over this time, it would deliver revenue and free cash flow of US$13.52bn and US$3.28bn, respectively.

HCH is now looking to increase its resource base to support an increase in Costa Fuego’s copper production profile to 150,000tpa ahead of its pre-feasibility study, which is expected to be delivered in the first half of 2024.

A new deal

HCH has now renegotiated terms over the El Fuego option which covers the San Antonio, Valentina, and Santiago Z privately owned landholdings along the eastern extent of the Costa Fuego project.

The new deal – originally due to exercise next year – will now be exercised in September 2026 with a revitalised agreement which comes with better terms for HCH.

Improvements to the deal include:

- A material reduction to HCH’s option payments due in 2024 from US$11m to US$1m;

- An increase to HCH’s ownership from 90% to 100%, subject to the exercise of the option;

- Extends the option expiry from 2024 to 2026 in exchange for payments of US$4.3m over the next three years

Strength of local partnerships in Chile

HCH managing director Christian Easterday says the option re-negotiation is further confirmation of the strength of the company’s local partnerships in Chile.

“Alignment of local partners has been a key element of our consolidation strategy for Costa Fuego,” he says.

“The El Fuego Option allows the company to focus its balance sheet on exploration and growth of our mineral resource as opposed to property payments.

“Our near-term focus on increasing value per share and leverage to future copper price for our shareholders centres around enhancing Costa Fuego’s mineral resource and potential economics in advance of a planned pre-feasibility study.”

Easterday says the company is “actively” evaluating the region for consolidation opportunities and expects to see further success on this front as it looks to up-scale Costa Fuego’s potential study scale towards a 150kt per annum copper development from its current 95kt per annum copper metal production scale.

Updates on growth drilling, resource upgrades and water conceptual studies are also expected shortly.

Acquisition delivers pipeline of opportunities

HCH announced the move to acquire two nearby copper mine areas that have never been drill tested before – despite previously reaching production – around 10km from the planned central processing hub at Costa Fuego.

The latest option agreements to acquire the Marsellesa and Cordillera copper mine areas are part of the company’s strategy to increase resources.

The new project options near Costa Fuego. Pic via Hot Chili

Both mine areas have been privately held and historically exploited for shallow copper oxide and copper sulphide material but have never previously been drill tested.

Marsellesa measures 400x200m with mine workings exposing multiple zones of shallow-dipping, strata-bound (manto-style) copper mineralisation.

The smaller Cordillera mine workings expose new, outcropping porphyry copper mineralisation with well-developed stockwork and sheeted A and B style porphyry veining.

Laura Tyler at World Mining Congress 2023

Think and Act Differently: transforming our oldest industry with our newest technology

We hear the term ‘transformation’ a lot lately – because it is a time of great change in the world. The pace of change, driven and enabled by technology, is increasing. And so it’s appropriate that we’re here talking about transformations in mining. But what is it that we’re transforming to? What are we seeking to become?

The world is starting to wake up to the role of the resources sector to support the global trends that are changing the world.

These trends will feed demand for metals and minerals for decades to come.

But new deposits are harder to come by.

What remains is deeper, harder to find, more difficult to access, or in more challenging locations.

And we have to produce those commodities in those locations with less – less energy, less water, less waste, less disruption – a fraction of the impacts traditionally caused by intensive mining activity.

I would ask us all to stand in the future for a moment – what do we see?

I see people removed from the line of fire, reducing both the risk of both safety and health impacts as we automate the work we do.

I see value chains with automated decision processes that lead to reduced power and water use and improve our productivity, contributing to responsible mining, and enhancing our ability to increase return on capital every day.

I see the democratisation of data with citizen developers throughout the value chain making processes run more efficiently, and digital twins enabling accurate prediction of problems to allow better maintenance and operational upgrades.

Under this vision, the processes we will be working on will be fundamentally different – we will have solved for in situ recovery, we will have eliminated energy hungry mill and float to use new and different ways to liberate the minerals we seek.

In doing so, we will have the ability to produce the commodities we need with a fraction of the waste, and whatever waste we do produce, can be repurposed into useful products.

Our power will have zero greenhouse gas emissions – and I believe nuclear energy will be a part of the baseload mix in the global elimination of carbon emissions rich energy.

As more of our systems and decisions are automated, we will become the orchestrators of improvement and innovation – the skills we need for the future must embrace highly digital operational and project management as the way we deliver value and efficiency.

We will fundamentally change what we consider to be an attractive resource.

The sub 0.5% copper resources of tomorrow will be just as attractive as the 2% copper resources of yesterday, delivering the critical minerals the world needs to decarbonise at low cost.

This means the mine waste of the past, will become some of the new resources of the future.

As we stand in the future I see an exciting, safe and automated sector, valued by society for the types of work it provides.

How do we set ourselves up to do this? At BHP we want to Think and Act Differently. But we also need to do it with urgency.

So how do we build a solution? What are we doing in BHP?

The solution

It’s been said before that data is the new gold – but we have to know how to use it.

Every mining operator generates reams of data. But it is how this information is captured, distilled, analysed, stored and used that makes the difference. You get out what you put in – quality outputs from quality inputs – or the alternative, garbage in, garbage out.

The opportunity – the prize – is clearly massive.

But there is no change without innovation.

Building the ecosystem

Firstly, we need to expand the ecosystem of ideas that we are exposed to – we are not in every pool of expertise, but we must be more open to conversations and ideas than ever before.

We know that not every good idea is our own idea.

I’m sure all the companies, universities, research groups represented here today have some very smart people working for them. We certainly do at BHP. But we know that the world of ideas is broader than our own company or our own industry.

And so we’re looking outwards to build an ecosystem of ideas, with a partnership mindset. So what have we done…

We are changing the way we work…

BHP Innovation has adopted an open innovation model, we are transparent about the ambitious opportunities and challenges we are working on and invite collaborators from universities, industry peers, adjacent industries and start-ups to join us.

We work with expert scanning and scouting partners, as well as ecosystem collaborators, like Deloitte’s new GreenSpace Tech ecosystem or MIT’s Industrial Liaison Program including their Startup Exchange.

We want to accelerate the technology development roadmaps of our partners and share in their success, not lock up their IP or restrict their growth potential.

We intend to Think and Act Differently in all our interactions.

We are also willing to invest.

BHP Ventures, our own Venture Capital arm, has been in action now for about 3 years. It is focused on emerging technologies that can help grow and improve our existing operations, our resource base, and our value chain.

It has screened more than 1,200 opportunities and built a high-quality global portfolio of over 20 holdings and continues to go from strength to strength.

We are thinking and acting differently about exploration.

Our exploration accelerator, BHP Xplor, merges concepts from venture capital and early-stage accelerators. We announced BHP Xplor in August 2022 and had many applications from all around the world, focused on the discovery of copper, nickel and other critical minerals. We’ve worked with seven companies, to provide funding and support to accelerate their growth. Wave 2 is coming soon…and I hope that all those from our first cohort can speak to this as a positive experience.

Operationally we also seek to be different, we have evolved our relationships with many of our vendors – we seek to partner to solve some of our biggest opportunities… this maybe quite tactical such as the partnership between Minerals America Technology, Escondida Operations and Microsoft to improve Escondida Concentrator recoveries…

A program that uses artificial intelligence and machine learning, to combine real-time plant data from the concentrators and AI-based recommendations from Microsoft’s Azure platform to feed our operations team information so they can adjust variables that affect ore processing and grade recovery.

This is the building of an eco-system, the setting of a foundation of partnerships and ways of working that is different – so what is that making possible.

What it’s delivering

Using these ecosystems, we must use data to drive solutions to make systems run better.

Partnering on tech and innovation is making our sites safer and more sustainable as we think and act differently to deliver real results.

One of the best ways we can reduce safety risks is through removing people from the frontline.

Where we have implemented truck automation at Jimblebar and Newman in Western Australia, there has been a 90% reduction in near miss events involving vehicles with a fatality potential.

We have extended automation to our fleets in Western Australia and here in Queensland and we are in implementation at Spence and Escondida in Chile.

Decision automation using real time data feeds from on the board fleet management systems provides a more efficient and productive result, shift in and shift out, delivering more safe tonnes per truck per year.

The advance of autonomous haulage by OEMs like Komatsu, Caterpillar – delivered in partnership with companies such as BHP are the first stage for decarbonisation…

The next stage is zero emission trucks…and at BHP we are investing in electric – even as we watch the hydrogen journey like hawks. We have a great partnership with Caterpillar and have a prototype truck running about in Arizona. We have advanced plans that consider trolley assists, recharging station distribution and dynamic charging as a part of the mine design of the future. Anna Wiley has presented BHPs vision of the electrified future here this week.

We can only create future value by through strong partnerships with our OEMs.

The other side of the equation is the need for sensible, innovative solutions to be shared for the collective benefit of the sector.

Our Operation and Technology teams at our Newman operation recently won their category at the Safety Excellence Awards run by the Western Australian government, for a remotely operated thermal lance for removing debris jams in crushers. It connects to a boom, meaning no more handheld thermal lances, removing people from potential harm from uncontrolled energy release.

BHP is licensing the design on a royalty-free basis so it can be used across the industry, worldwide – so please do get in touch with us if you want more information.

Tech and innovation supports better exploration.

Over the last couple of years BHP has re-organised our exploration team to seek out new deposits located across four global regions. We recognise that the old ways in which we approached exploration will not serve us as well in a new deeper, under-cover type of world.

We have leveraged the systems thinking of the petroleum industry and seek to understand the dynamic system required to emplace a new ore deposit – we aim to look at the earth in a different way.

I have to acknowledge the many BHP Petroleum colleagues who worked with the mineral geologists to develop and mature a minerals systems model using the extensive BHP datasets.

They have built a new way of thinking of the accumulations and concentrations of metals in given regions to inform our exploration search spaces. Those interested in more deeply understanding this can refer to the paper presented yesterday in this conference by Dr Cam McCuaig.

We also partner with those who bring new eyes, a different way of thinking and challenge to our process – the AI/ML partnerships such as those with DeepIQ/SRK, and Kobold are such examples.

And as we home in on our new targets we recognise the importance of new ways of using and collecting data. BHP Innovation, the Resource Centre of Excellence and Olympic Dam geologists and geometallurgists, have applied the first sparse 3D Hardrock Seismic Survey across the Olympic Dam deposit with very interesting results.

This work is an adaption of modern-day hard-rock seismic methodologies (again borrowed from the petroleum industry) and successfully applied across an ore deposit. This will accelerate resource characterisation and the targeting of drillholes – ultimately reducing cost and time to production.

If you are interested, check out a series of three papers presented at this year’s Australasian Exploration Geoscience Conference, led by Kathy Ehrig, Heather Schijns, and Jared Townsend, that explore these concepts more deeply.

And so what is old, or known in one industry, is being refashioned, accelerated and innovated to deliver new and exciting results today.

Collaborating on tech and innovation changes production and reduces waste.

At BHP, we have organised to have Digital Factories at all our operated assets, seeking to resolve problems through application of digital solutions using agile methodologies and strong asset sponsorship.

Let me give you an example. We all know product variability is a challenge across the industry. When we over or underestimate the quality of ore shipped to customers, it impacts the value we create.

So our digital factories got to work and came up with the Product Variability program, which we’ve been using at West Australian Iron Ore.

The technology used a Grade Adjustment Model that uses data sources to capture movements of ore across the supply chain in real time to map the grade coming from the mine.

We then use an application called StacksOn to maintain a 3D model of material in the stockyard, so we know what to load when.

The program addresses a fundamental issue in an innovative way. It is materially adding value to our operations, and we’re rolling it out across other commodities.

We have a Value Engineering team who work with operations to build dynamic models to answer questions about value chain performance and anticipated improvement options – able to define where capital spend, operational or improvement effort should be applied to maximise value, the team is in high demand across our business.

From modelling capital spend at NiWest, to defining the improvement activities to maximise throughput in the Escondida Concentrators, to predicting maintenance in train loadout stations in the WAIO, we are using data to define, measure and solve for the production impacts of tomorrow through dynamic modelling and digital twins.

At all stages of production, whether in exploration, in trucking, or extraction, we seek ways to innovate or disrupt… but we can only do this by thinking and acting differently.

How to support it

The evolution of the new mine site – safer, smarter, more automated and less manual – means the capabilities we need to run these operations are changing

We’re moving to a world where we are less hands on.

We increasingly need more people with digital skills right through our sector from the innovators to the front lines of production and maintenance. We need to bring workers with us on that journey. We simply don’t have enough of them.

The good news is that today’s generations of primary and secondary students are picking up digital skills as they learn coding etc at school; the base language of digital analysis is being engrained early.

The concept of a ‘citizen developer’ is built on this growing familiarity and comfort with code – and it’s important that the industry recognises the opportunity in these new generations of future resource sector workers.

At BHP, we enable people to register as a citizen developer to work on BHP problems. They are formally onboarded, supported with access to resources like security groups and environment access, and provided with education and training. There are more than 300 registered citizen developers at BHP, working individually and in collaborative communities.

The outcomes are exciting – for example, an app that improves on a complex escalation process for safety and environment events within our integrated remote operating centre has been a game changer for that team. The app was built by a processing specialist with no coding experience – he just saw a process that could be improved and set about doing it.

The industry needs more citizen developers. We need to train them now, and we need to make sure they see the mining industry as stable, attractive – dare I say exciting and future facing.

Conclusion

In conclusion, to deliver what the world needs, means identifying, developing and implementing digital and technical innovations – some of it novel and maybe a little scary(!)… and investing now in the people we need to find, build and work the mines of the future.

We all need to be thinking about setting ourselves up to do this now; Build our ecosystems, be open to new partnerships and ways of working, and be organised to move faster – driving ourselves forward with data, with people close to the opportunity finding the solution and then sharing the outcome for us all to use.

The data this industry can capture is increasing apace with the speed and quality of our capability to analyse it the only limiter. The opportunities to improve will be driven by our use of this data as much as by any other factor.

These mines of the future are vital to help to deliver the world of the future and a surer pathway to net zero. A transformation of mining, to deliver a global transformation by mining.

Hot Chili to upscale Costa Fuego

The Mining Journal | Paul Harris | 27 July 2023

Australian copper developer Hot Chili is looking to increase the scale of its Costa Fuego project in Chile as it advances towards a prefeasibility study (PFS), MD Christian Easterday told Mining Journal at the Rule Symposium in Boca Raton, Florida, US.

With the PFS 80% complete and due early in 2024, the company is looking to add to the mine life and production scale, with a 30,000m drilling programme to commence soon.

“Hopefully, we can take advantage of an upscale opportunity to scale this project up from around 100,000tpa of copper production for a 16-year life with 50,000oz of gold production towards a 22 or 23-year mine life and upscaling this towards 150,000tpa.

“This would make it not only one of the largest projects in the development pipeline outside of a major but would allow the cash costs to be reduced and sit within the first quartile for the industry,” Easterday said.

Easterday said the project has a lower-than-average capital intensity of $10,000/t of annual copper production capacity, compared with a $17,000-18,000/t average.

“The last cycle for copper was unfortunately littered with a number of projects which saw significant overruns on capital. It is about being able to build these with the correct economics that produces quick paybacks and, ultimately strong returns. [The project in Chile’s Coastal Belt] is about half the cost it would be if it were in the high Andes alongside our global peers,” said Easterday.

Last man standing

Hot Chili is listed on the ASX and uniquely positioned as the last copper developer standing following M&A transactions. Barrick Gold acquired Equinox Minerals for C$7.3 billion in 2011 at a 30% premium, Oz Minerals was acquired by BHP for US$6.4 billion in March and Newcrest is being taken over by Newmont.

“We are the largest resource on the ASX in copper outside of BHP, and now we are the largest project in the entire market for Australia by producer, developer or explorer class that is holding a project capable of 100,000tpa of copper production. We find ourselves in the very weird situation that one of the world’s leading venture capital markets for mining does not have a mid-tier copper space and Hot Chili being the only player in that space,” said Easterday.

Easterday is keen to emulate the success of some of those takeovers. With a market capitalisation of about US$130 million, he sees the development of Costa Fuego as the path the company needs to tread to derisk the project and potentially elicit a bid fully.

“From here to a financing decision in 2026 and potential production, to be one of the first of the 100,000 tonners to come to market this decade is not a long period of time to wait after building this company for 15 years. There is tremendous upside if by the end of the decade copper is around $8/lb, and that’s a pretty exciting equation on our share price,” said Easterday.

A US$15 million investment from Osisko Gold Royalties in early July appears to have added more than funding to the company, as its share price increased more than 50% to about C$1.30.

“The Osisko transaction has allowed us to put the asset value to work rather than the market capitalisation of Hot Chili. The addition of NPV (net present value) we add with these funds is extraordinary. It leverages the value equation but removes any overhang of a fundraising anytime in the future.”

“The significant endorsement from Osisko, one of the leading North American streaming-royalty groups, has an amplification effect, particularly following our dual listing into the North American market through the TSXV and the OTCQX,” said Easterday.

Rename rejected

The North American listings saw the company work on a rebrand and a new name, Costa Copper, but while the new brand image is being used, the name change was rejected at the company’s May shareholder meeting.

“We were getting negative feedback on the name, and we thought that was something the shareholders should vote on. I didn’t have an opinion either way as I believe that a company makes the name; the name doesn’t make the company,” said Easterday.

Hot Chili closes US$15m investment by Osisko Gold Royalties for Chilean copper-gold project

StockHead | 26 July 2023

The company is now fully funded for its 30,000m drilling program in the coming weeks. Pic via Getty Images.

Hot Chili has closed its transaction with Osisko Gold Royalties, receiving proceeds of US$15 million in exchange for the sale of a 1% Net Smelter Return (NSR) royalty on copper and a 3% NSR royalty on gold across its Costa Fuego copper-gold project in Chile.

Not only is the transaction a significant endorsement of the project from one of North America’s leading royalty-streaming groups, it’s also a nice boost to the company’s cash position to around A$26m – which means the upcoming 30,000m drill program is fully funded.

The deal also clearly highlights the value Osisko attributes to the project.

Hot Chili (ASX:HCH) MD Christian Easterday says that Osisko’s involvement, alongside Glencore’s strategic shareholding, demonstrates “Costa Fuego is globally relevant, being one of only a handful of projects with potential to deliver near-term, meaningful, new copper supply into a looming global copper supply shortage.”

“We are very pleased to have closed the Investment with Osisko Gold Royalties enabling the Company to advance the project without the dilution of a share issuance,” he said.

Near-term drilling and PFS in H2

The Costa Fuego project has a massive measured and indicated resource of 725Mt grading 0.47% copper equivalent.

And the recent scoping study flagged an estimated copper equivalent production rate of 112,000t per annum – consisting of 95,000t of copper and 49,000oz of gold over a 14-year period of a 16-year mine life – to the estimated revenue and free cash flow of US$13.52bn and US$3.28bn down to the post-tax net present value (a measure of profitability) of US$1.1bn.

For context, that’s the equivalent of bringing another Oz Minerals (ASX:OZL) into production.

The project also has an inferred resource of 202Mt grading 0.36% copper equivalent, meaning there’s still plenty of room to grow with Hot Chili targeting a potential increase in study scale towards 150,000tpa copper for a +20-year mine life.

Now the Osisko deal is wrapped up, Hot Chili is well-funded to kick off its 30,000m drilling program in the coming weeks which is targeting a resource expansion, and exploration targets ahead of an upcoming resource upgrade by late 2023.

Hot Chili is also aiming to deliver the Pre-Feasibility Study (PFS) – which is currently around 80% complete – in H2 2024.

Hot Chili closes $22 million deal to boost copper play

The West Australian | 26 July 2023

Hot Chili’s Costa Fuego copper project has got a timely cash boost. Credit: Claudia Aliste/File.

A cashed-up Hot Chili will ramp up a new exploration campaign at its Costa Fuego project in Chile after banking $22 million in a strategic deal with leading United States royalty streaming group, Osisko Gold Royalties.

Management says money from the deal – from which Osisko will get a 1 per cent net smelter return royalty on copper and a 3 per cent royalty on gold – will be used to fund the next steps in its project’s development, including a 30,000m drilling program.

It will also help fund the completion of the project’s resource upgrade and the delivery of its much-anticipated prefeasibility study (PFS). The company has pencilled in late this year for its resource upgrade and the second half of 2024 for unveiling its PFS.

We are very pleased to have closed the Investment with Osisko Gold Royalties enabling the Company to advance the project without the dilution of a share issuance. Costa Fuego is globally relevant, being one of only a handful of projects with potential to deliver near term, meaningful, new copper supply into a looming global copper supply shortage.

Hot Chili managing director Christian Easterday

Management sees Osisko’s involvement as a heavy-hitting endorsement for the operation. It argues that the group’s presence, alongside mining giant Glencore’s strategic lead shareholding in the company, demonstrates Costa Fuego’s global relevance and the project’s potential to deliver a near-term, meaningful, new copper supply.

The company recently revealed a preliminary economic assessment (PEA) showing the project will spit out a whopping $309 million a year on average in free cash across a 16-year mine life.

With the impressive set of numbers outlined, the project is emerging as one of the world’s biggest and lowest-cost copper plays, with an estimated post-tax net present value (NPV) of US$1.1 billion (AU$1.66 billion).

Despite the eye-watering US$1.05 billion (AU$1.57 billion) Hot Chili says it will cost to build its project, it says its payback period will be just three and a half years. Average annual operating costs clocked in at US$1.33 (AU$2) per pound of copper in the study, positioning the company at the low end of the cost curve among its industry peers.

Keys to the lower-cost estimates include the fact that at its relatively low altitude, it does not face the extraordinary costs of having to pump water up into the mountains, in addition to the fact it has proven better recoveries using salt water and does not need an expensive desalination plant. It is believed those factors alone save the company about US$1 billion (AU$1.51 billion).

The economic evaluation pegged a long-term average selling price at US$3.85 (AU$5.76) per pound of copper and US$1750 (AU$2620) per ounce of gold. But the company says that for every extra 10 cents added to that copper selling estimate – and at a time when global predictions of a significant price hike are growing by the day – it will add another US$100 million (AU$150.1 million) to its post-tax NPV.

An pre-tax internal rate of return of 24 per cent and a pre-tax NPV of US$1.54 billion (A$2.30 billion) were also predicted in the study.

Costa Fuego holds 725 million tonnes of measured and indicated resources grading 0.47 per cent copper equivalent for 2.8 million tonnes of copper and 2.6 million ounces of gold with molybdenum credits.

A PEA study is similar in nature to an Australian JORC scoping study. Hot Chili believes its cursory assessment at its Costa Fuego project suggests it could churn out about 112,000 tonnes of copper equivalent each year for the first 14 years of an initial 16-year mine life.

American investment bank Morgan Stanley has already predicted copper to have a strong quarter, largely on its central role in anything to do with electrification and decarbonisation. Key to its success in the next few months could be a meeting of the Chinese politburo next week, where a much-anticipated package of economic stimulus could be announced, especially if it boosts spending on electric vehicles and electronics.

A shortage in copper has been widely predicted as demand heats up. According to global consultancy firm McKinsey, the want for the red metal is expected to increase to 36.6 million tonnes by 2031, compared to the current demand of about 25 million tonnes.

However, the copper supply is forecast to be around 30.1 million tonnes, leaving a gap of 6.5 million tonnes by the start of next decade.

So with a hungry market baying for more copper, Hot Chili will be keen to get some to the table in double quick time and its latest cash boost should make that pursuit a little easier.

Investor Guide: Gold & Copper FY2025 featuring Barry FitzGerald

Hot Chili Limited

ASX: HCH | TSXV: HCH | OTCQX: HHLKF

To read the full magazine click on the link below:

Investor Guide: Gold & Copper FY2025 – Hot Chili Limited – page27