Hot Chili (HCH) – The Assay TV interview 2022

Hot Chili (HCH) – ASX Investor Interview at RIU Resurgence Conference 2021

RIU Explorers Conference Presentation 2024 – Costa Fuego

RIU Explorers Presentation 2023 – Costa FueGO

Hot Chili is a standout major developer

Hot Chili Commences Trading On US-Based OTCQX Market

Coline Sandell-Hay | The Assay | April 7, 2022

Hot Chili Limited’s (ASX:HCH) (TSXV:HCH) (OTCQX:HHLKF) application to join the US-based OTCQX market has been accepted and the company’s shares will commence trading in the US on the OTCQX Best Market under the ticker OTCQX: HHLKF on April 7, 2022.

The OTCQX Best Market is the highest tier of OTC Markets Group’s market platforms, on which 12,000 US and international securities trade.

The OTCQX Market is designed for established, investor-focused U.S. and international companies. To qualify, companies must meet high financial standards, follow best practice corporate governance, and demonstrate compliance with applicable securities laws.

Managing Director, Christian Easterday, said Hot Chili Ltd has upgraded to OTCQX from the OTCQB Venture Market where it has been trading since 6 May 2021. By upgrading to the OTCQX the company is positioned to enhance its visibility and broaden its access to the extensive market of US retail, high net worth and institutional investors.

The primary advantages to North American investors of the company’s inclusion on the OTCQX platform include:

• It allows trading of HCH securities in the local time zone; appealing to investors and brokers who prefer securities that trade and settle during US trading hours.

• Trades and settlements are conducted in US Dollars with no exchange rate risk or additional FX fees.

The company’s shares will continue to trade on the Australian Securities Exchange and the TSX Venture Exchange under the symbol HCH, with its shares now also tradeable on the OTCQX market (www.otcmarkets.com).

“We are delighted to be moving up to OTCQX, as we deliver the next level of growth. An upgrade to OTCQX is a logical next step for Hot Chili,” Mr Easterday said.

“This designation is OTC Market’s top tier and a step towards greater liquidity and support to our active North American investor outreach.”

Short 6.5Mt of copper by 2030? Hot Chili’s spicy 112,000tpa project could ease that when it comes online by 2028

Funny man tries a spicy and hot dish from the national cuisine. He’s all red and is trying to cool his mouth with his hand

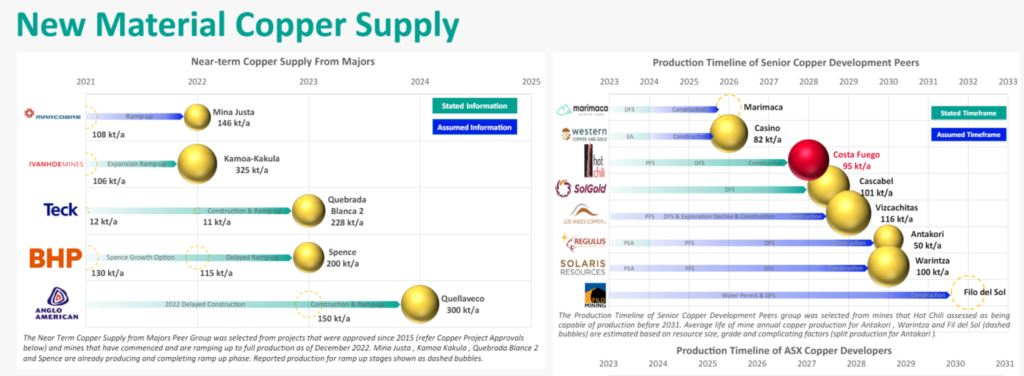

Copper is fast emerging as the go-to commodity for exposure to the energy transition, but a new wave of mines is needed to bridge the 6.5Mt supply gap experts are forecasting by 2030.

Bank of America warns the shortfall could arrive as early as 2025 following the completion of the current wave of project buildouts, the latest being Ivanhoe Mines’ massive Kamoa-Kakula project in the Democratic Republic of the Congo.

Even economic headwinds such as China’s slower than expected recovery and continued concerns that the US might enter into a recession will not alleviate the need for more copper production.

So it is a good thing that ASX copper developers like Xanadu Mines (ASX:XAM), Rex Minerals (ASX:RXM), Caravel Minerals (ASX:CVV) and Hot Chili (ASX:HCH) are working hard at bringing their near-term monster copper projects into production.

Bright future for copper production at Costa Fuego

Of these, Hot Chili might well have the biggest impact with the much-anticipated Preliminary Economic Assessment (PEA) for its Costa Fuego development packing a hefty punch as befitting such a large copper-gold resource.

Commonly referred to as a scoping study, the PEA looks at the economic factors to determine the potential viability of a mine – in this case Costa Fuego, which Hot Chili believes can be further optimised in the company’s planned PFS, due for completion in the second half of 2024.

From the estimated copper equivalent production rate of 112,000t per annum – consisting of 95,000t of copper and 49,000oz of gold over a 14-year period of a 16-year mine life – to the estimated revenue and free cash flow of US$13.52bn and US$3.28bn down to the post-tax net present value (a measure of profitability) of US$1.1bn, there’s nothing small about Costa Fuego.

That’s the equivalent of bringing another Oz Minerals (ASX:OZL) into production for the Australian market and should come as no surprise given the massive Measured and Indicated resource (high confidence stuff that you can base mine plans off) of 725Mt grading 0.47% copper equivalent.

Armed with an Inferred resource of 202Mt grading 0.36% copper equivalent, there’s still plenty of room to grow Costa Fuego’s mineable resources with Hot Chili targeting a potential increase in study scale towards 150,000tpa copper project for a +20 years mines life.

he largest development-scale project on ASX

In an interview with Stockhead, Hot Chili (ASX:HCH) managing director Christian Easterday says the company has taken a conservative approach, using a standard NPV 8% discount rate, a calculated 20% contingency on all items of capital and long-term US$3.30/lb copper price for optimisations.

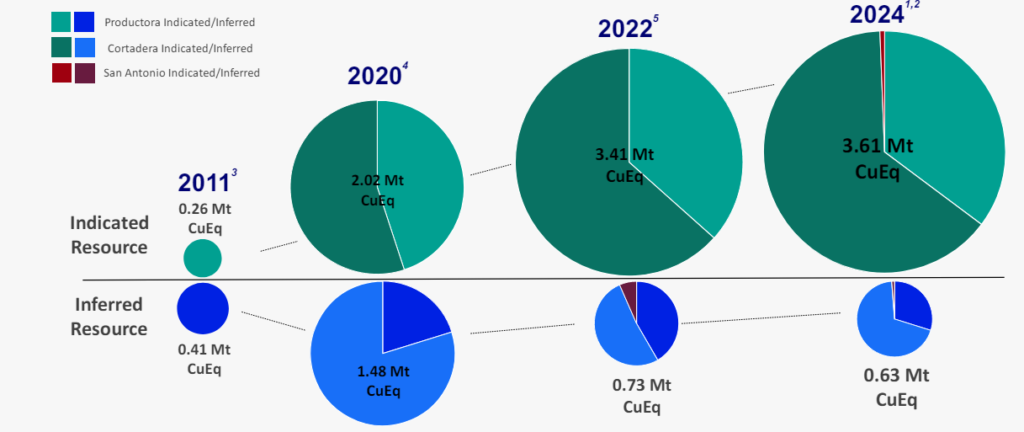

“We’ve been working towards a combined project for our advanced resources at Costa Fuego for 10 years and have quadrupled our resource base in that time,” he explained.

“Most importantly, the metal production on the project will make it the largest development project by scale on the ASX.

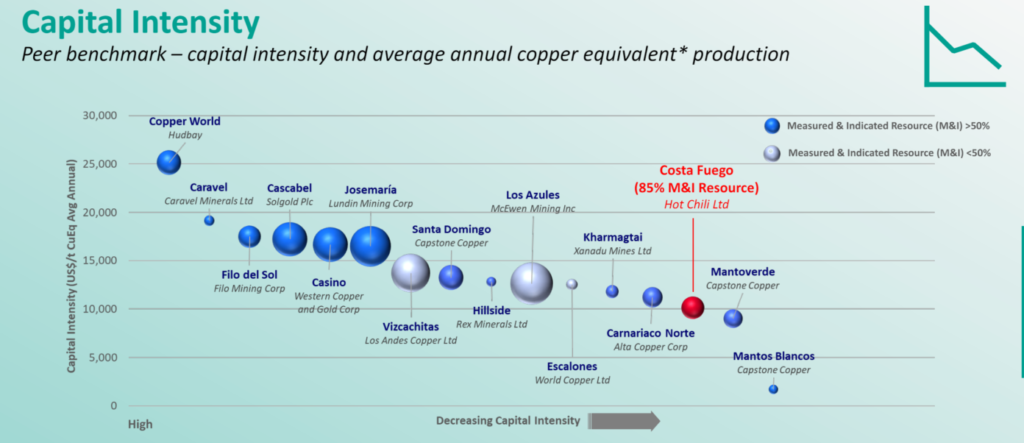

“The capital to build Costa Fuego has come in at US$1bn and for the 112,000 tonnes of copper production coming out of this thing annually, what that means is that we have the lowest capital intensity project of large-scale undeveloped projects in the world – that’s a very, very important point one that really differentiates us from our counterparts.”

Pathway to production

Hot Chili has a clear pathway to production with plans to kick off a 30,000m drilling program targeting resource expansion and exploration targets ahead of an upcoming Costa Fuego resource upgrade by late 2023.

“We’ll be looking to see if we can pull that mine life out to plus 20 years which will be determined by our next steps on resource growth,” Easterday explained.

“This next resource upgrade will include about two years’ worth of drilling and will likely take us comfortably over 1 billion tonnes.

“Next year, we plan to deliver the pre-feasibility study – which is already 80% complete – by the mid-year mark and most importantly, before the end of 2024 we will deliver our environmental impact assessment for our final approval for mining and aiming for a definitive feasibility following that in the first half of 2026.”

Ample treasury of $26m to fund resource expansion drilling

Alongside the PEA, Hot Chili has executed a binding US$15m investment agreement with Osisko Gold Royalties for a 1.0% net smelter return (NSR) royalty on copper and a 3% NSR royalty on gold across the Costa Fuego copper-gold project, 600km north of Santiago.

While the cash injection is undoubtedly useful for…. it also clearly highlights the value that Osisko attributes to the Costa Fuego project given that Hot Chili has a market capitalisation of just $119m.

The funds provide the company with ample treasury of around $26m to undertake the upcoming 30,000m drilling program fully funded.

“Importantly, Osisko’s involvement alongside Glencore’s strategic shareholding in Hot Chili demonstrates Costa Fuego’s global relevance and the project’s potential to deliver near-term, meaningful, new copper supply,” Easterday said.

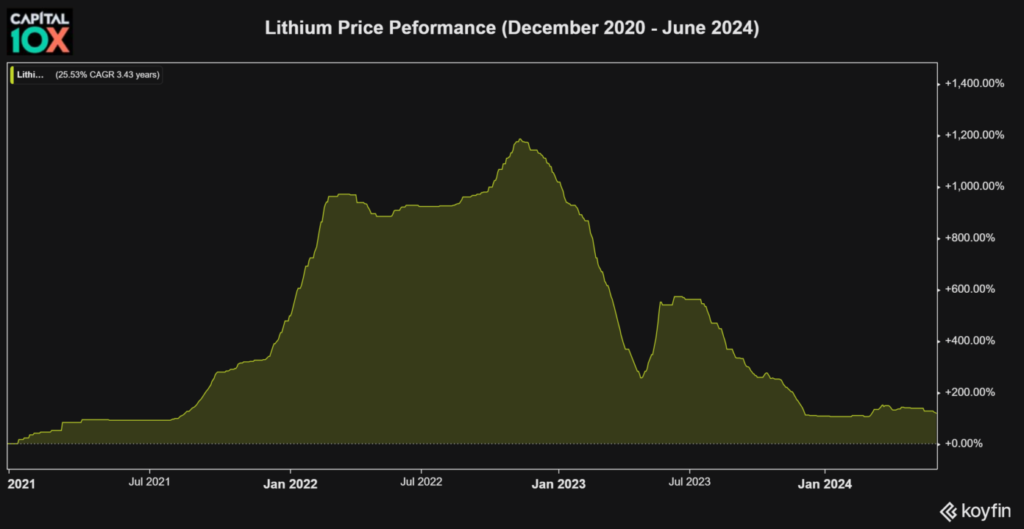

Third commodity in the 21st Century to make a step-change in price

From Hot Chili’s point of view, copper is primed as the third commodity of the 21st Century to make a step-change in price, with all the ingredients for a 10-fold increase.

“The first commodity to do so was iron ore (the largest metal market in the world) in the early 2000s, moving from $20/tonne to $200/tonne and eventually balancing at around $90 to $120/tonne,” he said.

“The second commodity to do so has been lithium in the past five years.

“Copper is the second largest metal market in the world and has all the hallmarks of a commodity which has very little ability to respond with new supply to a demand shift that will require the market to add at least 50% more annual production in the next 10 years.

“I imagine in the next five to 10 years we will see copper prices driving north of US$8/lb – interestingly this is only double the current price.”

Hot Chili leverages existing port, steps into five-year MoU deal for Costa Fuego copper-gold project

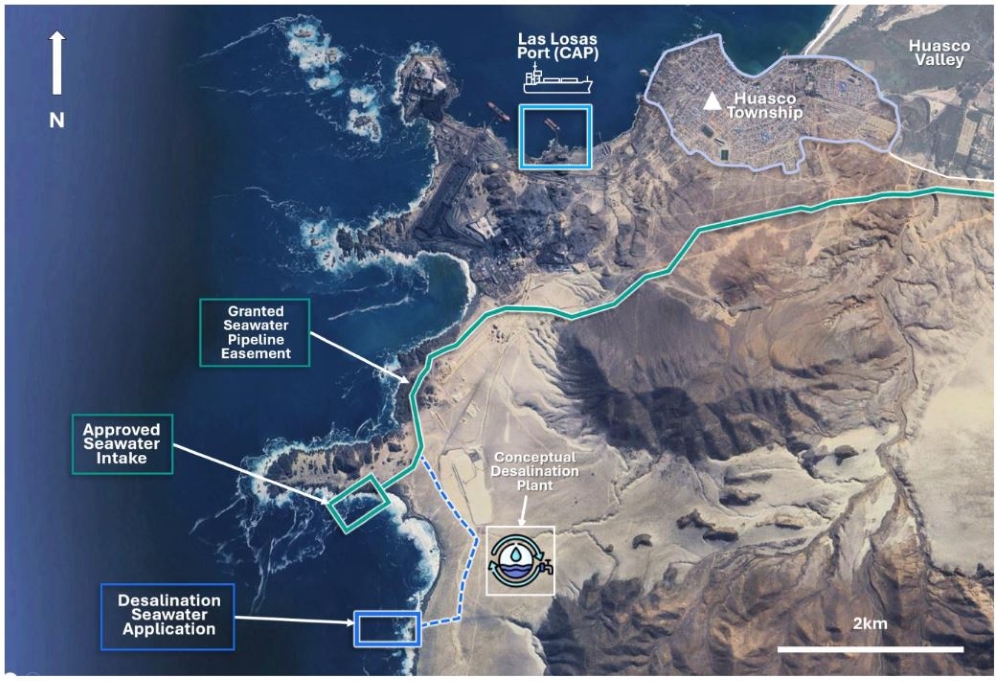

- Hot Chili has entered into an MoU with the existing Las Losas port facility in Chile

- The two parties will work together to undertake a port feasibility study for a bulk tonnage copper concentrate facility to be developed

- Hot Chili plans to fund 20% of the US$4.6m study for two years

Special Report: Hot Chili has executed a five-year MoU deal with Puerto Las Losas SA (PLL) to evaluate bulk tonnage loading alternatives for copper concentrate from the Costa Fuego project in Chile.

The MoU with PLL provides Hot Chili (ASX:HCH) the right (for up to five years) to negotiate a binding port services agreement for Costa Fuego, which would include a ‘take or pay volume’ clause based on at least 80% of the project’s future annual concentrate production.

Under the terms of the agreement, HCH and PLL will undertake a port feasibility study, comprising pre-feasibility engineering (FEL2), feasibility engineering (FEL3) and environmental studies.

HCH will fund 20% of the port feasibility study, which is estimated to have a total cost of ~US$4.6m and will take roughly two years to complete.

Upon completion of the port feasibility study – and provided that a shipping solution for loading copper concentrates is agreed at existing or potential infrastructure in PLL – HCH will have a right of first refusal (ROFR) to ship copper concentrates through PLL’s facilities in Huasco Bay for a three-year period.

PLL may terminate the ROFR by reimbursing HCH’s port feasibility study costs.

Unlocking a significant copper infrastructure corridor

“Leveraging an existing port, 50km away, into a bulk concentrate export facility has the potential to unlock significant capital and operating savings for Costa Fuego and other potential mine developers in the Huasco region of Chile,” HCH managing director Christian Easterday says.

“Hot Chili plans to jointly develop a significant copper infrastructure corridor, enabling our own production and unlocking multiple projects within the region, which would benefit significantly from desalinated water supply and proximal bulk copper concentrate port facilities.”

Port feasibility study to begin shortly

Within the coming months, PPL will be responsible for selecting a suitably qualified, top-tier, independent engineering company to carry out a port feasibility study.

This study will evaluate bulk handling and loading alternatives for copper concentrates using the existing Las Losas port facilities, potentially with or without modifying the existing infrastructure for the port in operation.

Representatives from both PPL and HCH will form a technical committee to progress the studies and within the first month, aim to define key project deliverables, as well as a timetable for management of the completion of the feasibility study workstreams.

Hot Chili reveals new plan for Chilean water concessions

Bulls n Bears

Hot Chili has applied for a second maritime concession in Chile as it looks to develop a new company that will have an overflowing stream of water infrastructure assets.

Management says the new company will be aimed at servicing the growing demand for the valued commodity from the community, other mining companies and local farmers within the fast-growing region.

The company today confirmed it had submitted its latest maritime concession application to support the potential for a whopping long-term, regional multi-user seawater and desalination water supply network for the Huasco valley area of the Southern Atacama region of Chile that sits about 600km north of the Santiago capital. The second application includes brine discharge for potential seawater desalination operations as part of a push to deliver both raw seawater and desalinated water from its proposed network.

Hot Chili is now preparing to transfer all of its water assets into the new standalone company that it will still control. It says positive discussions with several potential desalinated water customers in the Huasco Valley region have already taken place, in addition to engaging with potentially suitable infrastructure partners.

It has also held talks with Chilean Government regulators to determine the best approach for its proposed plans and is reviewing the potential for direct government support to assist with driving the project forward. Management believes such a positive development within the region could trigger substantial local mining investment and deliver impressive growth to the company’s market value.

Water scarcity is THE critical issue for new mine developments in the Atacama on both the Chilean and Argentinean side of the Andes. Hot Chili is the only Company holding most of the necessary permits required to provide desalinated water to the Huasco Valley – a prolific region for potential new global copper supply needed to support global electrification and decarbonation. Securing these assets has involved over a decade of commitment.

Hot Chili executive vice-president José Ignacio Silva

The company’s recently-completed concept study for a staged water network development indicated the viability of the project at an initial 300 litres per second scale, with an eventual ramp-up to 3700 litres per second.

The study assessed a potential 100 per cent renewable energy-driven desalination water project with the potential to supply those needing a reliable water supply, such as agricultural, community and new mining companies within the Huasco Valley region near to where the company’s Costa Fuego copper project sits. The region contains six major undeveloped copper projects and two new, large-scale copper discoveries, with all projects requiring desalinated water supply.

Hot Chili says it holds the only granted maritime water concession and most of the necessary permits to be able to provide much-needed critical water to the region. It says the Chilean Government is actively encouraging investment in multi-user water networks in the region, with water scarcity being one of the biggest obstacles facing new global copper supply.

The compelling Costa Fuego project’s total resource sits at 3.62 million tonnes of copper-equivalent, with resources in the indicated category of 798 million tonnes grading 0.45 per cent copper-equivalent for 2.9 million tonnes of copper, 2.6 million ounces of gold, 12.9 million ounces of silver and 68,000 tonnes of molybdenum.

The total resource classified as inferred is 203 million tonnes at 0.31 per cent copper-equivalent for 500,000 tonnes of copper, 400,000 ounces of gold, 2.4 million ounces of silver and 12,000 tonnes of molybdenum.

The Costa Fuego project comprises the Cortadera, Productora, Alice and San Antonio deposits and management says they are all in close proximity and sit at low altitude – about 800m to 1000m.

Hot Chili’s push to build an in-demand water supply network could see it deliver tremendous value to the region and it may well find itself swimming in proposals from potential users.

Hot Chili heats up with new Chilean copper-gold patch

Bulls n Bears

Hot Chili has nailed down the right to acquire a lucrative 140-square-kilometre patch of the historical Domekyo copper-gold mining centre, a mere 30km from its flagship Costa Fuego copper hub in Chile.

And it is a timely acquisition for the ASX-listed explorer as the price for the red metal hit US$10,000 (AU$15,244) a tonne last week for the first time since 2022. Supply disruptions following the forced closure of one of the world’s biggest copper mines in Panama late last year and ongoing drought conditions in Zambia that have impacted copper production, married up with increasing demand from green industries, have spurred the significant copper rally.

Under the terms of the acquisition agreement, Hot Chili – via its Chilean subsidiary La Frontera – will stump up US$4 million (AU$6.1 million) in staged payments over four years to earn a 100 per cent interest in the 12 exploration and 14 exploitation concessions at Domeyko. Additionally, the vendor will be granted a 1 per cent net smelter royalty (NSR) for the concession package and Frontera will have the first right of refusal to buy it back.

The Domeyko mining centre lays claim to several significant historical copper-gold mines where previous operators exploited the shallow oxide mineralisation, but never ventured deeper to test the potential copper sulphide source. Interestingly, management says the area is prospective for both porphyry and structurally-hosted styles of copper-gold mineralisation.

Hot Chili has been on a land grab of late, picking up the nearby historical Marsellesa and Cordillera copper mines and the Cometa project, all within an easy 30km trucking distance to its developing Costa Fuego project.

However, Domeyko – which boosts its land-holding by a hefty 25 per cent –is its biggest acquisition since 2019 when it stitched up its Cortadera concessions that sit adjacent to its Productora and San Antonio copper assets and collectively make up Hot Chili’s Costa Fuego copper hub.

The three deposits at Costa Fuego have a combined mineral resource estimate of 798 million tonnes of measured and indicated resources grading 0.45 per cent copper-equivalent for 2.9 million tonnes of copper, 2.6 million ounces of gold, 12.9 million ounces of silver and 68,000 tonnes of molybdenum

Hot Chili released a preliminary economic assessment (PEA) in June last year showing the project will spit out a massive $309 million a year on average in free cash across a 16-year mine life. With the impressive set of numbers outlined, the project is emerging as one of the world’s biggest and lowest-cost copper plays, with an estimated post-tax net present value (NPV) of US$1.1 billion (AU$1.66 billion).

Management says it is on track to deliver a prefeasibility study (PFS) on the project in the second half of this year.

Costa Fuego sits in the low coastal range of the Atacama Region, 600km north of the Chilean capital of Santiago in a country famed for its copper resources. With a compelling portfolio of new projects in the pipeline, all within easy trucking distance to Costa Fuego, Hot Chili looks set to strike at a time when the copper price is just starting to heat up.

Hot Chili Lays Out Key Strategic Priorities for Costa Fuego, Chile’s Next Low Cost Copper Project

July 2, 2024 | Capital 10X

Hot Chili (ASX: HCH) (TSXV: HCH) (OTCQX: HHLKF) held an investor webinar recently and laid out current investment priorities and what comes next for Costa Fuego, the company’s low cost, high return Chilean copper project.

Importantly, the company shared a copper price forecast using the Lassonde curve and gave their view on where we are in the current copper commodity cycle.

Below is a summary of all the important information shared on the webinar.

A Successful Recent Private Placement

Hot Chili’s A$25 million private placement was well subscribed and saw strong interest from investor’s across Australia, Europe and North America. The company also had to cap the number of current investors who could buy more shares even after upsizing the buyback option to A$7 million from A$5 million. Management reported that out of 24 participants in the capital raise, 17 were institutional, 13 were from North America and 6 were new to the company.

Glencore was also a participant in the capital raise and owns 7.5% of Hot Chili. Glencore’s desire to maintain its current ownership stake is an important positive mark for the potential of Hot Chili’s Costa Fuego project in Chile, one of the largest copper projects not owned by a major.

Costa Fuego One of the Lowest Cost Projects in Chile

Initiative Ongoing to Bring in More North American Investors

Hot Chili made forays into the North American market over the past two years and now has 8% of the registrar on the TSX coming from North American capital.

Hot Chili is moving towards financing on their large-scale copper asset and the company is expanding relations with investment banks and broker groups in North America with the long term goal of growing a stable group of shareholders.

Costa Fuego is High Return With Strong Leverage to Copper Prices

Hot Chili’s recent PEA for Costa Fuego showed that for every 10 cent move in the copper price above $3.85 /lb., the project value increases by $100 million.

$1.5Bn NPV and 26% IRR at Current Copper Prices ($4.35/lb)

This leverage puts them in line with six other large-scale copper producers on the TSX/ASX, outside of the majors that are +100,000 tons per annum projects.

At current copper prices of $4.35/lb Costa Fuego is worth US$1.5 billion to Hot Chili vs the company’s current market cap of only US$94 million.

Management believes that more capital will move from producers to developers with exposure to the copper price at copper prices above $4.00/lb.

Relative Performance

Looking at the performance of Hot Chili on the ASX over the past 18 months (red) the stock has done well on a relative basis, in line with most of the copper equities up 10% – 20% with the copper price. Xanadu Mines is the outperformer of the group.

Results were similar on the TSX; producers’ stock prices are up 20 to 30% over the past 3 months, with the expectation that the continuing bull market will also lift developers and explorers in time.

Chart shows the performance of several ASX copper equities (December 2022 to June 06, 2024)

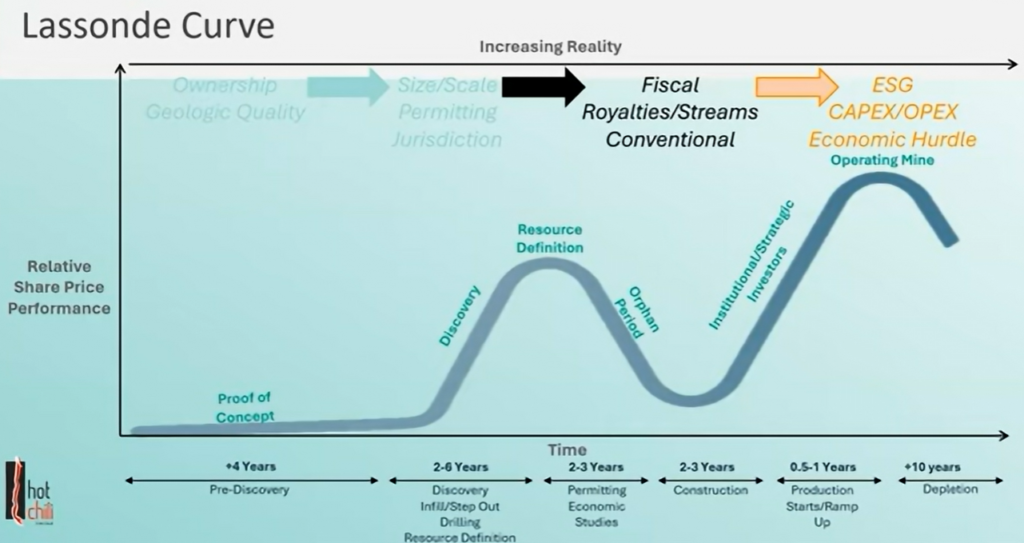

Strategy: A Story of the Commodity Cycle

Understanding where we are in the commodity cycle is key for investors to understand how explorers, developers and producers are positioned in the market.

Hot Chili’s Non-Executive Chairman, Dr. Nicole Adshead-Bell gave some insights while highlighting 2 charts; one from Scotiabank quarterly’s commodity cycle chart and another from Investec’s Mining Clock.

The goal for investors is always to get in at the lows and ride the rebound.

A good example to look at is the past 2-year price action of lithium.

We saw the start of a lithium bull run in December 2020 which ultimately took the price up 12x, with almost all equities with exposure to lithium rising spectacularly as well.

Rising prices saw huge inflows of investment in discoveries and production. Due to rising production from the wave of investment, lithium prices have fallen lately, down significantly from the highs though still well above where they were in late 2020.

Lithium Price Performance (Dec 2020-Jun 2024)

Adshead-Bell believes that even after strong copper price performance so far in 2024, we are still at lows in the copper price looking at the cycle overall. She believes supply will continue to decline over the next 18 months supporting higher prices.

Provocatively, Hot Chili management strong believes the copper price needed to incentivize enough supply is between $6.00-$8.00/lb, 30%-70% above peak levels reached in the last cycle.

Hot Chili’s goal is to manage their business to take advantage of where we are in the cycle. They are aggressively advancing the Costa Fuego project so that production can coincide with rising prices. Costa Fuego will be one of the first medium term projects to start up after a few projects from the majors begin producing in 2024 and 2025.

Hot Chili Production Timeline vs Industry Peers

Themes: Investor & Company Behavior

Hot Chili talked through different parts of the commodities cycle and the behavior of companies and investors depending on where in the cycle we are.

During a bear market, there are bankruptcies, asset sales and dilutive financings in the juniors sector, where capital is spent just to keep going, no investments are made that may move the equity price beyond the commodity price.

Generalist investors tend to buy high and sell low.

As prices stabilize (or in the case of copper, stay resilient) mining companies pinch pennies,; geologists are fired as companies attempt to avoid going under.

This is when savvy investors begin to buy. They understand the cycle and know that prices are at lows demonstrated by companies implement efficiencies on the balance sheet.

Industry Behavior Through the Commodity Cycle

As prices finally begin to rise there is low-risk M&A, producers buy other producers.

In the past year BHP acquired Oz Minerals, and is currently negotiating to buy Anglo American, primarily for its copper assets.

As mid and small caps strengthen their balance sheets, their attractiveness to the majors increases. As the cycle continues and the underlying commodity price improves, capital becomes available for development, not just for mine expansion. We are here today.

Financings for mid and small cap companies are the green shoots of a bull market in the view of Adshead-Bell.

A Bull Market: More Opportunity, More Risk

The next phase of the cycle is development in more higher risk activities (e.g. exploration, development) as companies drill holes and make new discoveries.

At this point investors demand growth, and there are new IPOs, as companies strive to prove their exposure to the commodity.

At the top of the bull market, high risk M&A rules the day, as large caps start acquiring companies down the supply chain – including developers and higher risk explorers.

Generalist investors get involved, as they begin to do their research and invest. In order to maximize shareholder returns, companies should time the cycle.

We are definitely not in this stage according to Hot Chili.

The Lassonde Curve: A Visual of Optimal Investment Timing

So where does the Lassonde Curve fit into the cycle?

Adshead-Bell believes that the best time for alpha generation is in the discovery phase, when investor sentiment is at its highest, which is reflected in the share price.

Hot Chili is focusing on additional discovery drilling and increasing the total copper resource to drive value before making a construction decision in 2025.

Costa Fuego Resource Continues to Grow Driving Value for Shareholders

Hot Chili has 16 years of experience in Chile as a company in the market, and is currently fostering relationships with institutional and strategic investors.

The company believes that the best way to generate market excitement at the next stage of the curve, is material resource growth and success.

The path to exposure to alpha generation for developers is mainly through value in the drill bit; smart exploration with historic mining activity and/or oxide mineralization as evidence of a larger system.

Also managing the company efficiency allows to strike well asset acquisition opportunities take place. So the company is focused and ready to benefit as the copper price continues to rise quarter over quarter.

To learn more about Hot Chili, including upcoming catalysts and who the economics of Costa Fuego are so strong, we recommend browsing the company’s investor presentations found HERE

Hot Chili Limited is a market awareness client of Capital 10X. For more information, including potential conflicts of interest please see our Content Disclaimer.