RIU Explorers Conference Presentation 2024 – Costa Fuego

RIU Explorers Presentation 2023 – Costa FueGO

Hot Chili is a standout major developer

Hot Chili serves up Chilean copper PFS

Updated Costa Fuego study outlines 20 years of copper-gold production

27 March 2025

After a decade in the Chilean copper space, Hot Chili is closer than ever to delivering a developable Costa Fuego project it now believes can deliver some 3.3 billion pounds of the red metal over two decades.

Two years after delivering a preliminary economic assessment, today’s prefeasibility study has outlined a more expensive, but larger and more robust development option that could generate US$3.9 billion in free cash over 20 years.

The PFS outlines a project that could produce around 116,000 tonnes per annum of copper equivalent over the mine life at all-in sustaining costs of $1.85/lb after credits for the gold, silver, and molybdenum.

The first 14 years should support the production of 95,000tpa copper and 48,000 ounces per annum gold from reserves now re-stated as 502Mt grading 0.37% copper, 0.10 grams per tonne gold, 0.49gpt silver, and 97 parts per million molybdenum.

YOU MIGHT ALSO LIKE

- Traders eye $12k copper at Swiss conference

- Belararox bounces on thick copper shows

- Holy moly! Copper’s ‘ugly stepsister’ getting some love

Total resources are 798 Mt grading 0.45% CuEq, making it one of the largest undeveloped copper projects globally.

Early mining is concentrated at the Productora and Alice open pits before the focus shifts to the Cortadera underground.

Processing comes from a circa 21Mtpa sulphide concentrator and leaching facilities.

Initial capex is now $1.27 billion, almost $220 million more than originally outlined, while an expansion will cost almost double the prior estimate at $1.3 billion.

Assuming a copper price of $4.30/lb, post-tax net present value is put at $1.2 billion with an internal rate of return of 19%.

Payback should be around 4.5 years.

At the prevailing near-record spot price of $5.30/lb, NPV jumps to $2.2 billion with an IRR of 30%.

Credits: Hot Chili

Hot Chili says its work has reduced development risks, and it estimates it will offer some of the lowest capital intensities of any project along Chile’s coastal belt at $14,079/t CuEq.

The company expects to have a better leverage to the copper price than its peers, such as Capstone Copper’s Mantoverde mine or Santo Domingo development, BHP’s new Filo del Sol investment, or Solgold’s Cascabel.

Further, its location on the coastal belt offers easier access to water and power than its peers at higher elevations.

Hot Chili also claims to have a head start in permitting on its rivals. Its stage one environmental impact assessment is due to be submitted soon.

Growth targets

Work on a second EIA that supports the integration of the La Verde porphyry, which was excluded from the PFS, could enhance project economics in the planned definitive feasibility study.

Managing director Christian Easterday said Hot Chili was now “within an elite grouping of copper developments globally” that could offer a meaningful source of near-term copper into a market set to struggle to meet demand.

The company will advance its DFS and drill out La Verde over the next year.

It aims to deliver its first red metal by the end of the decade.

Glencore looming in background

The question remains: how will it pay for it? Hot Chili has around A$19 million in cash to fund its DFS and studies for a complementary Huasco water supply and desalination business.

With Glencore still on the register as a 7.5% shareholder, it is an obvious development partner. As long as the Swiss-based trader maintains that equity level, it can purchase up to 60% of concentrate for the first eight years of its life.

A PFS for the Huasco Water project is also imminent.

Hot Chili shares were up 2% in early trade to 72c, capitalising the company at $108 million.

The stock has traded between 60c and $1.31 over the past year, having peaked at $2.60 in 2020.

Hot Chili unveils blockbuster PFS in booming copper-gold market

Andrew ToddSponsored

Thu, 27 March 2025 2:47PM

Hot Chili has dropped a bombshell prefeasibility study for its Costa Fuego copper-gold project in Chile, cementing its place among the world’s top copper developments with a 20-year mine life, top-tier production scale and economics that scream upside in today’s red-hot metals market.

At a conservative copper price of US$4.30 (A$6.79) per pound and gold at US$2280 per ounce, Costa Fuego has a post-tax net present value (NPV) of US$1.2 billion (A$1.9b) assuming an 8 per cent discount rate. The figure quickly blows out to a massive US$2.2b (A$3.5b) at current spot prices, allowing for a much quicker return on investment in the process.

The company’s latest milestone reveals Costa Fuego is poised to pump out an average of 116,000 tonnes per annum of copper-equivalent metal, which includes 95,000t of copper and 48,000 ounces of gold in its first 14 years.

Across its full 20-year life span the project is set to deliver a staggering 1.5 million tonnes of copper and 780,000 ounces of gold before any by-products are factored in. Hot Chili says the haul will put it firmly in the top quartile of global producing copper projects.

The project is set for a five-year payback period on capital expenditure clocking in an internal rate of return of 19 per cent on an upfront US$1.27b (A$2b) to get the mine running.

Hot Chili reports a total life-of-mine free cash flow of some US$3.86b after tax, with revenue pegged at a whopping US$17.3b.

The eye-popping numbers still have plenty of room for improvement, thanks to a surging gold and copper price. Copper is flying thanks to United States President Donald Trump’s tariff war. The gold price is too, as it continues to push new all-time highs above US$3000 per ounce. At current prices, Hot Chili’s forecast NPV rockets up to US$2.2b (A$3.5b) and the internal rate of return jumps to 30 per cent.

In fact, every US$0.10 per pound bump in the copper price adds another US$100 million to the NPV, making Costa Fuego a highly leveraged play in a market screaming for more copper amid electrification and renewable energy booms.

The company will now kick off its definitive feasibility study (DFS) and submission for stage one environmental approvals to keep the project on-track for first production before the end of the decade.

With cash of approximately A$19 million as at the end of last year and both of our key assets (Costa Fuego and Huasco Water) at PFS level study, we are well positioned to pursue potential strategic partnership and sponsorship funding discussions.Hot Chili managing director Christian Easterday

Costa Fuego is widely regarded as one of the better undeveloped copper resources globally. It has a mammoth combined resource of 798mt grading 0.45 per cent copper equivalent for 2.9mt of copper, 2.6m ounces of gold, 12.9m ounces of silver and 68,000t of molybdenum.

The company has tabled a maiden ore reserve of 502 million tonnes grading 0.37 per cent copper, 0.10 grams per tonne (g/t) gold from blending an open pit and underground mining strategy across its Cortadera, Productora, Alice and San Antonio deposits.

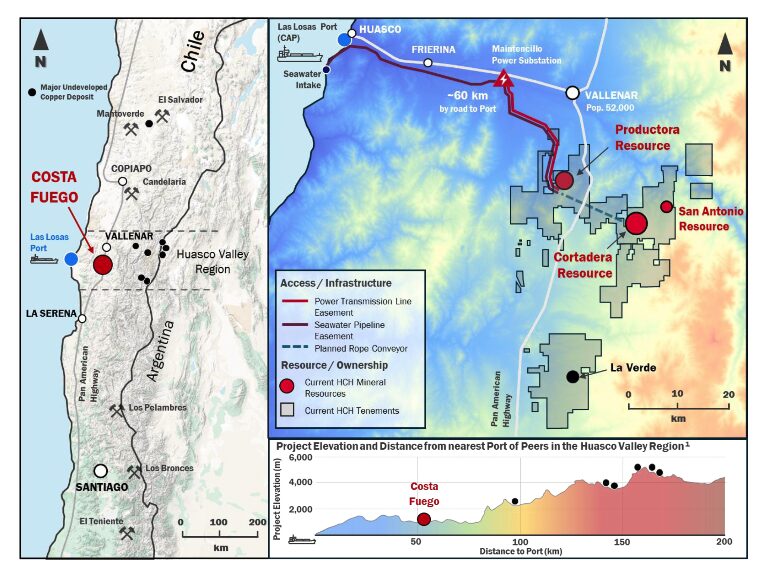

Nestled at a low 740 metres above sea level on Chile’s coastal range, Costa Fuego leverages a strategic edge few jurisdictions can match. It is just 60 kilometres from the Las Losas port and a stone’s throw from Vallenar’s skilled workforce.

The projected mining costs are calculated to be below the benchmark of undeveloped competitors, with the project’s C1 cash cost sits at a lean US$1.38 per pound of copper, including by-product credits, with an all-in sustaining cost of US$1.85 per pound – placing it among the lowest-cost producers globally.

Hot Chili has outlined a hybrid mining approach for its considerable undertaking. Open pits will cornerstone the low-cost operation, accompanied by a massive block cave mining operation down to 1000m at its flagship Cortadera deposit. The operation will kick off in year three and add 146mt of higher-grade feed.

The company’s processing will be undertaken by a massive 20.7mt-21.7mt per annum sulphide concentrator, a 4mtpa oxide heap leach and a 3.6mtpa low-grade sulphide leach that will churn out concentrate and cathode copper.

Hot Chili isn’t quite done yet with exploration at its Chile operation, saying its recent La Verde copper-gold porphyry discovery, 35km south of Costa Fuego, is shaping up as a game-changing second porphyry project.

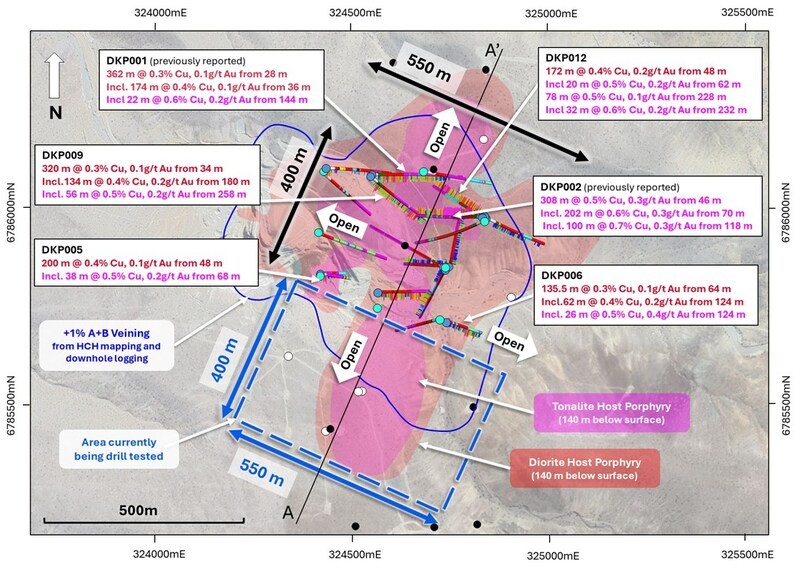

La Verde’s wide, shallow intercepts, including 320m at 0.3 per cent copper and 0.1g/t gold, hint at a massive system still open in all directions. Step-out drilling is underway, and the company believes it can one day fold La Verde into Costa Fuego’s production hub, potentially juicing front-end mine life and economics ahead of a DFS.

With copper prices soaring and gold continuously at all-time highs, Costa Fuego’s timing is impeccable. The company’s $19m cash pile positions it well to rapidly expand La Verde while simultaneously courting strategic partners for production, as it charges toward the all-important DFS milestone.

Hot Chili chases US$447M free cash flow from Chilean water business

In partnership with BULLS N’ BEARS

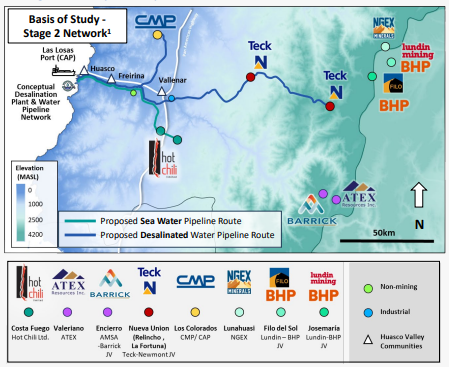

Hot Chili says it can solve Chile’s water problem for large industrial projects in the Huasco Valley region and bank US$447m over 20 years in free cash by getting into the water supply business using its giant Costa Fuego copper play as a foundation off-taker.

The company recently tabled a pre-feasibility study on its 80 per cent owned Huasco Water project in Chile that makes use of its hard won permit to supply sea water to Chile’s Huasco Valley region. According to management, the Huasco joint venture holds the only active maritime license in the Huasco region – a feat that it says took 10 years of regulatory burden to achieve.

The JV is aiming to develop a long-term, regional multi-user seawater and desalination water supply network for the Huasco valley area of the Southern Atacama region of Chile, which sits about 600km north of the Santiago capital.

Hot Chili says the project will initially cost US$151m in start up capital which it says can be paid back in 4.5 years from the operation.

Total expected revenues have been modelled over 20 years and come in at US$880M and the project shows a pre-tax net present value using an 8 per cent discount rate of US$179m and a 22 per cent internal rate of return.

‘The company views the potential to outsourcing of its seawater supply infrastructure as a key value enabler…’Hot Chili managing director Christian Easterday

Stage 1 for the business will target the potential supply of seawater at 500 litres per second (L/s) to Hot Chili’s Costa Feugo copper-gold project which will be the foundation off-taker for the project via a 62km over-land pipeline.

A memorandum of understanding (MOU) has been executed with its own Costa Feugo project that will see the supply of seawater for the duration of the 20-year project life.

In addition to its sought after concessions to extract sea water, Huasco Water has permits for coastal land access, stage 1 pipeline easements and has secured connection to the electricity grid. The company plans to supply seawater by the end of the decade.

Stage 2 will see a desalination plant, estimated to cost US$1.4 billion, supply water at a rate of 1300L/s to a range of potential businesses within the Huasco Valley region.

The numbers really begin to ramp up during the second stage, with post-tax-free cash flows jumping to an estimated $4 billion from revenue of US$9.35B modelled over 22 years.

The post-tax NPV for stage 2 comes in at $977M with a 4 year payback.

The company’s staged approach enables scaling up for long term supply to mining, community and agricultural firms in the Huasco Valley region, with the potential to stretch beyond initial project estimates.

Hot Chili managing director Christian Easterday said: “The outcomes of the water supply preliminary feasibility study provide an opportunity for Hot Chili to fully consider the strategic value of its 80 per cent owned subsidiary company Huasco Water, which controls all our critical water assets. The company views the potential to outsourcing of its seawater supply infrastructure as a key value enabler and has anchored Huasco Water by executing a memorandum of understanding to negotiate a foundational seawater offtake agreement for Costa Fuego.”

Huasco Water has identified possible demand of at least up to 4000L/s across six undeveloped mining projects, all requiring access to a desalinated water supply.

Desalination water supply is projected to occur shortly after the seawater supply, due to begin at the end of the decade, is piped to Costa Feugo.

The permitting process to upgrade its maritime concessions to enable desalinated water to be provided is advancing.

The Huasco Valley region contains one of the largest groupings of major undeveloped copper projects in the world, all of which are in need of a reliable water supply. If an improving copper price warrants a move towards production for Hot Chili’s Costa Fuego, Huasco Water will be dragged along with it.

Management says just three potential clients in the region who may tap into their water business are Teck Resources, Atex Resources and Agrosuper.

Agrosuper is a food production company and also produces animal feed. An MOU for desalinated water has been executed with the group.

The HW Aguas para El Huasco SpA (Huasco Water) is a joint venture between Hot Chili (80 per cent interest) and Compañia Minera Del Pacifico – CMP (20 per cent interest).

Huasco Water is the only company with permitted access to supply seawater in the Huasco Valley region following a ten-year regulatory approval process.

The permitting process for desalination water has advanced over the past year with regulatory applications made to enable the supply from the existing maritime concession. A second maritime concession application by Huasco Water has been lodged. The second application includes brine discharge for the potential seawater desalination operations.

Hot Chili’s first mover advantage in the water sector in Chile cannot be overstated. The demand in the area appears to be real and the barriers to entry for others that have not suffered the ten year ordeal to get permitted just might give Huasco and Hot Chili a potentially decades long free run at supplying water to both its own project and the other mega projects that are littered around the area with no current water options.

With copper prices recently on the move, Hot Chili stands to derive a double benefit. Not only will the economics at its Costa Feugo project improve, but the company stands to reap the rewards from other copper groups in the region who may develop a thirst for some Huasco water.

Milestone registrations to expedite Hot Chili copper-gold project

Doug Bright BULLS N’ BEARS

Hot Chili has secured the milestone government registrations necessary to help fast-track its Costa Fuego copper-gold and Huasco Water projects in Chile.

The registrations, before Chile’s Office for Sustainable Project Management, confirm the two projects meet the government’s key criteria for consideration for a list of strategic investment projects that could be prioritised through a streamlined administrative approvals process.

Part of the office’s objectives is to optimise and accelerate approvals for projects that promote sustainability.

Hot Chili’s maiden combined probable open pit and underground ore reserves for its Costa Fuego project stands at 502 million tonnes at 0.37 per cent copper, 0.10 grams per tonne (g/t) gold, 0.49g/t silver and 97 parts per million molybdenum across multiple processing streams. The streams include the sulphide concentrator, oxide leach and low-grade sulphide leach processes.

The total combined metal in the reserves is a heady 1.86Mt copper, 1.58M ounces of gold, 7.95M ounces silver and 49,000t molybdenum.

Significant additional opportunity exists to extend the overall resource numbers with the company’s recent discovery of copper-gold porphyry mineralisation at its non-contiguous but nearby La Verde project.

La Verde is the latest addition to Hot Chili’s Costa Fuego production hub. It is only 50 kilometres south by road from the company’s central processing facility at Productora, within the company’s Costa Fuego group of projects.

The Costa Fuego complex is on Chile’s coastal range and comprises the company’s principal reserves zones at Productora, Alice, San Antonio and Cortadera, which all lie within a radius of about 10km.

The centre of the company’s contiguous tenure and its current resources is about 63km southeast of the port city of Huasco, in the Huasco province of the nation’s highly prospective Atacama region.

Huasco plays an important role in Hot Chili’s plans, as it is the proposed location for the seawater intake for the company’s Huasco Water project.

Huasco Water is an joint venture between Hot Chili and Chilean mining company Compañia Minera Del Pacifico. With its first-mover advantage, Huasco Water is the only company permitted to supply seawater in the Huasco Valley region, following a 10-year regulatory approval process.

The combined projects possess a valuable, unique and strategic mix for Hot Chili over the next decade and have what the company describes as a “top quartile copper production capacity with lowest quartile capital intensity”.

Hot Chili undertook March pre-feasibility studies for the water and the Costa Fuego gold-copper projects. A positive study outcome provides Hot Chili with an opportunity to consider the strategic value of its 80%-owned subsidiary company Huasco Water, which controls all its critical water assets.

The company sees significant value potential in outsourcing its vital seawater supply infrastructure and has secured Huasco Water’s position by executing a memorandum of understanding for a ground-breaking seawater offtake agreement for a proposed large-scale, multi-customer water business.

Its stage one water supply pre-feasibility study examined the delivery of 500 litres per second (L/s) of seawater, followed by a stage two 1300L/s of desalinated seawater supply.

A conceptual stage three study looked at future expansion to supply up to 2300L/s of desalinated water.

The staged approach considers the initial establishment of seawater supply infrastructure, including pumps and pipelines, towards the end of the decade, to be followed by an initial desalinated water supply and then subsequent phases of expansion.

It would enable long-term water supply to be scaled to regional demand growth to support mining, communities and agriculture in the Huasco Valley, with the potential to extend well beyond the project’s initial horizons.

The concept is further supported by significant interest in Huasco Water displayed by other Chilean and international water infrastructure investment groups, along with nearby mine developers, agricultural and community groups and government bodies.

Hot Chili says while long permitting timelines continue, its desalination permitting is progressing and no regulatory changes have been made to Chile’s maritime permitting process since Huasco Water was granted its concession.

Additionally, the company’s environmental impact assessment (EIA) is advancing, with its stage one seawater supply baseline studies completed for inclusion in its Costa Fuego EIA.

The latest registration is a significant milestone that confirms Hot Chili’s projects meet the Chilean government’s objective criteria to acquire priority status.

With the paperwork in hand for both Costa Fuego and Huasco Water, the company is now able to centralise and monitor all of its active permitting processes through a single platform and supervisory entity.

The current permitting needs include the company’s second maritime concession application for Huasco Water and its upcoming EIA submission for Costa Fuego and Huasco Water.

Hot Chili doubles copper-gold discovery footprint in Chile

STOCKHEAD

- HCH doubles footprint of La Verde copper-gold discovery

- Prospect sits within Costa Fuego project in Chile’s Atacama region

- Company planning deeper drilling to expand discovery further

Special Report: Hot Chili has doubled its porphyry discovery footprint at its Chilean project, with a third round of strong assay results at the La Verde copper-gold discovery at its Costa Fuego project.

La Verde is around 30km south of the Costa Fuego planned central processing hub at low elevation in the coastal range of the Atacama region.

The phase one reverse circulation (RC) drilling has now doubled the initial discovery footprint, confirming copper-gold mineralisation extends over 1km in length and up to 750m in width, from near surface.

Notable results include:

- 389m grading 0.4% copper and 0.1g/t gold from 4 m depth to end-of-hole (DKP030), including 46m at 0.6% copper and 0.2g/t gold from 238m, including 34m at 0.6% copper and 0.2g/t gold from 322m;

- 120m grading 0.4% copper and 0.1 /t gold from 6m depth (DKP028), including 48m at 0.5% copper and 0.1g/t gold from 26m and, 114m at 0.3% copper, 0.1g/t gold from 318m depth to end-of-hole, including 34m at 0.4% copper, 0.2g/t gold from 380m to end-of-hole;

- 114m grading 0.4% copper from 86m depth (DKP024), including 52m at 0.5% copper and 0.1 g/t gold from 96m;

- 286m grading 0.3% copper and 0.1g/t gold from 4m depth (DKP027), including 154m at 0.4% copper, 0.1g/t gold from 44m; and

- 228m grading 0.3% copper and 0.2g/t gold from 42m depth (DKP013), including 104m at 0.4% copper and 0.3g/t gold from 42m.

Hot Chili (ASX:HCH) has also confirmed higher-grade centres across the extent of the shallow oxide and sulphide discovery, indicating:

Importantly, multiple distinct higher-grade centres have been confirmed from near surface. Assessment of each of these higher-grade centres indicates:

- A North-East (NE) higher-grade centre, 180m strike by 280m width by 320m in vertical extent

- South-east (SE) higher-grade centre, 320m strike by 340m width by 400m in vertical extent

- South-west (SW) higher-grade centre, 90m strike by 120m width by 260m in vertical extent

Deeper diamond drilling planned

Since over half of the drill holes ending in significant mineralisation at the limit of RC drilling depth capability, HCH is on the hunt for a potentially larger porphyry cluster at La Verde.

The extent of the mineralisation beneath the open pit remains untested.

The company is now planning deeper diamond drilling for phase two to extend these higher-grade centres at depth.

This could potentially add to the open-pit mine life for the Costa Fuego hub, with further development study updates expected in the near-term.

Watch: Hot Chili adds mine-making credentials for Costa Fuego copper-gold

Regulatory application for phase-two drilling access is progressing, with drilling to commence once approved.

In the meantime, development study activities to optimise the recent Costa Fuego Pre-Feasibility Study (PFS) are underway, building on the recently released PFS, which highlighted impressive post-tax numbers for the asset including an NPV of US$1.2b and IRR of 19%.

All-in sustaining costs totalled US$1.85/lb from the production of 1.5Mt of copper and 780,000oz of gold over a 20-year mine life.

The Copper Play the Market Is Missing

Streetwise

Disconnects between price and value in the resource sector occur regularly but are usually accompanied by issues. Issues such as a low metal price, local social pressures, political interference, or an environmental problem.

In situations like these, the disconnect between price and value makes sense. There is something that has to be overcome to get price recognition from the market. Investors looking to take positions in these sorts of situations must be cautious of their approach and understand how these risks will be overcome. In essence, this is what a contrarian investor is all about: taking a calculated risk on a solution to issues such as these.

That said, there are times when there is a disconnect and no major reason for it. These aren’t as common, but I have learned that when I personally come across them, I need to pursue them as strongly as I can. These are the true asymmetrical bets that can really propel a portfolio’s return forward.

Over the last two years, I have personally benefited by identifying a few of these situations, taking a big position, and waiting.

In my experience, the biggest factor to overcome in situations is time.

As they say, patience is a virtue. In situations like this, it becomes glaringly obvious.

Today, I have for you an opportunity that I think has no obvious reason for the major disconnect between price and value. The company is focused on developing two copper-gold porphyry projects in Chile. One is at the feasibility study stage, while the other is a brand new discovery story.

The company is

Hot Chili Ltd. (HCH:ASX; HCH:TSXV; HHLKF:OTCQX).

Let me explain to you why I think this is arguably the most undervalued junior mining company in the sector right now.

Costa Fuego

Costa Fuego is Hot Chili’s flagship project, which just recently had a PFS completed.

Costa Fuego will be both an open pit and an underground mining operation in the future.

On average, it will produce 116kt CuEq (copper equivalent) for 14 of the 20 years of its mine life, making it one of the largest undeveloped copper operations owned by a junior.

In terms of economics, Costa Fuego has great leverage to the copper price, with an NPV above US$2B and an IRR of 27% at US$5.30/lb copper.

- Post-tax NPV8% of US$1.2 B and IRR of 19% (at US$4.30/lb copper)

- Post-tax NPV8% of US$2.2 B and IRR of 27% (at US$5.30/lb copper)

As I mentioned, Costa Fuego will start as an open pit mining operation and then transition to an underground block caving operation later in the mine life.

Upfront CAPEX is, therefore, estimated to be US$1.27B with an expansionary capital around US$1.35B — big mines cost big money.

If I were to pick a reason for Hot Chili’s low valuation, this might be it. That said, if you look at all of the large, advanced (at least PFS level) projects out there and owned by a junior, billions in CAPEX is the commonality.

Not only this, but I view Hot Chili’s recent discovery of copper-gold mineralization at their La Verde project as reason to believe that the impact of the CAPEX will be lessened.

Discovery hole: DKP002 308m of 0.5% copper + 0.3g/t gold, including 202m of 0.6% copper + 0.3g/t gold, and including 100m of 0.7% copper + 0.3g/t gold.

As I see it, La Verde has the potential to add significant amounts of ore early on into a future combined mining operation. This additional open pit tonnage from La Verde could be trucked to nearby Costa Fuego and push out the expansionary capital needed to build the underground — this is very meaningful.

In a discounted cash flow model, cash flows in the future are discounted.

Meaning, the earlier in a mine life you can produce higher cash flow, the better the net present value (NPV).

Hot Chili still has much to prove at La Verde, but I think they are well on their way to doing it.

In closing, additional tonnage from La Verde doesn’t negate the size of the CAPEX; what it does is push it further out in the mine life, which will increase the overall NPV of the project.

Huasco Water

One of the biggest factors affecting copper project development in both Chile and Argentina right now is access to water. On the Chilean side, it’s both an altitude and a permit issue.

Firstly, the Chilean government is no longer allowing water extraction via underground sources. They are exclusively forcing development projects to apply for a maritime concession or do a deal with a company that already has one. A maritime concession allows for the extraction and treatment of seawater.

The reality of the situation is that there have only been two maritime concessions granted in the last 13 years. One of those was granted to Hot Chili, which has since placed that permit into Huasco Water — of which they own 80%.

Hot Chili is now very much in the driver’s seat for water supply of a region which is on the cusp of a major development cycle.

Now, I don’t believe that this situation allows Hot Chili to unreasonably leverage their position; that isn’t what the Chilean government would promote or accept.

What it means, though, is that HCH has a major source of value that the market isn’t giving them credit for.

So the question begs: What are the water rights worth?

It’s a great question, one that I can’t fully answer.

What I will draw your attention to is Antofastga’s deal with Transelec and Almar Water Solutions for $600M. That situation is a little different because it includes some existing infrastructure, but essentially gives us a rough idea of what these types of assets are worth.

Further, Hot Chili completed an economic study on the Huasco Water business, which proves its potential — 2 Stage / 1300L/s Desalinated Water Supply: Post-tax NPV(8%) of US$977M and IRR of 19%.

Not only do I think that this supply is meaningful for Chilean development projects, but it is an obvious source of water for the Argentinian side, too.

I think one of the biggest misnomers right now is the water situation for a few of the largest copper development projects in the world — BHP & Lundin’s Jose Maria and Filo projects.

Personally, I don’t think they have an alternative to doing an off-take agreement with Hot Chili’s Huasco Water. . .

Concluding Remarks

Nothing is for sure in life, especially in the junior mining sector. However, once in a while there are asymmetric bets that you can make that are mostly a function of time, rather than the solving of some other specific issue.

In my view, the opportunity in Hot Chili is one of those high-potential asymmetric bets whose value recognition is just a matter of time.

Currently, Hot Chili’s MCAP is around $70M, which I think is extremely cheap.

Its flagship project, Costa Fuego, has a PFS completed on it with an after-tax value well over US$1B at today’s copper price. Not only is the project undervalued to the current state of development, but I think it has a clear path towards optimization with the combination of the discovery at La Verde.

The real X-Factor lies with Huasco Water, which holds the water rights to a region of Chile and Argentina which is on the cusp of major development.

Mine construction and operation don’t happen without water, and, therefore, this is a catalyst that is very much a when question, not if.

With over AU$10M in cash, continued drilling at La Verde and the potential for water offtake agreements to be signed with Huasco, I believe it is only a matter of time before Hot Chili’s value is recognized by the market.

Hot Chili strengthens team to push Chile projects into development

Andrew Todd BULLS N’ BEARS

Hot Chili has secured the services of two seasoned mining executives to bolster leadership as the company progresses its Costa Fuego copper-gold project and Huasco Water venture in Chile’s Atacama region.

Ex-Gold Fields Australia executive Stuart Mathews joins as non-executive chairman, while Chilean copper expert Alberto Cerda assumes the role of project director. Cerda brings a particular set of skills… namely in mine development and operations to support the company’s upcoming definitive feasibility studies for both projects.

The appointments align with Hot Chili’s strategic focus on advancing its low-altitude, copper and water projects amid a looming copper market, which has international majors clamouring for quality.

Hot Chili says Mathews’ and Cerda’s proven expertise in delivering large-scale mining operations – particularly in Chile in Cerda’s case – positions the company to navigate the complexities of project development, resource optimisation and strategic partnerships in the world’s top copper producing country.

Costa Fuego is a large copper-gold porphyry set to churn out 116,000 tonnes per annum of copper-equivalent metal, which includes 95,000t of copper and 48,000 ounces of gold in its first 14 years. Importantly for Hot Chili’s metals mix, chairman Mathews comes from a gold mining background as the recent executive vice president for Gold Fields in Australasia, where he oversaw operations producing more than 1 million ounces of gold annually.

Cerda takes care of the copper background as a Chilean mining engineer with more than 40 years of experience in major copper projects in Chile for companies such as Newmont, Barrick and BHP Billiton.

Hot Chili’s projects are strategically positioned to benefit from rising copper demand and regional infrastructure needs. Costa Fuego’s robust economics and Huasco Water’s exclusive water supply permit make it strategically significant to the region.

With environmental permitting and exploration ongoing, the company is well-placed to deliver and further extend its overall resource numbers, thanks to a recent discovery of copper-gold porphyry mineralisation at its non-contiguous but nearby La Verde project.

Located 60 kilometres from Las Losas port on Chile’s coastal range, Costa Fuego is Hot Chili’s flagship project. A recent prefeasibility study outlined a 20-year mine life with a maiden ore reserve of 502Mt grading 0.37 per cent copper, 0.10 grams per tonne (g/t) gold, 0.49g/t silver, and 97 parts per million (ppm) molybdenum, with a contained 1.86Mt copper, 1.58M ounces gold, 7.95M ounces silver and 49,000t molybdenum.

The project is expected to generate a post-tax net present value (NPV) of US$1.2 billion at a US$4.30 a pound copper price and US$2280 per ounce gold price. At current market prices, the NPV increases to US$2.2B, with a 19 per cent internal rate of return and a five-year payback on US$1.27B capital expenditure.

Hot Chili’s 80 per cent-owned Huasco Water project, in partnership with Compañia Minera del Pacifico, addresses critical water scarcity in the Huasco Valley.

Secured after a decade-long regulatory process, Huasco Water holds the region’s only maritime licence for seawater supply, providing the project with a significant competitive advantage. Its recent pre-feasibility study detailed a two-stage development plan to supply water to local major copper producers, to earn an estimated revenue of US$9.35B and a US$977M NPV over 22 years of supply.

The company has completed its baseline environmental studies and a second maritime concession application is under review, positioning Huasco Water, like Costa Fuego copper, to commence supply by the end of the decade.

With copper prices soaring and gold continuing at all-time highs, the appointments come at pivotal time in the company’s development. Hot Chili says it remains on a tidy $7.5M cash pile to rapidly expand its resources, while simultaneously courting strategic partners for production at its huge copper and water undertakings.

The Assay | May 20, 2022

Hot Chili Limited (ASX: HCH) (TSXV: HCH) has obtained another outstanding drill result at the Cortadera porphyry deposit, part of the company’s Costa Fuego, coastal range, copper-gold hub in Chile.

Managing Director Christian Easterday said that Cortadera has a track record of outperforming expectation.

“The PFS in-fill drill programme across Cortadera has collected important geotechnical and hydrogeological information and has also continued to define and expand high grade resources,” Mr Easterday said.

“Upgrading our resources with wide drill intersections grading 0.8% to 1.0% copper equivalent is a great outcome, which demonstrates the quality and growth potential of Costa Fuego as one of the only low-altitude, material, copper developments in the world capable of near-term development.”

Latest Significant Drill Results from Cortadera

Latest results from development study drilling at Cortadera have returned further significant intersections.

Diamond drill hole CORMET005 returned 658m grading 0.6% CuEq (0.4% Cu, 0.2g/t Au, 122ppm Mo) from 232m depth, including 134m grading 0.8% CuEq (0.6% Cu, 0.2g/t Au, 181ppm Mo) from 470m depth, and including 130m grading 0.9% CuEq (0.6% Cu, 0.2g/t Au, 253ppm Mo) from 662m depth.

CORMET005 was drilled across the northern flank to the high-grade core within the main porphyry (Cuerpo 3) at Cortadera.

Mr Easterday said that pleasingly, the wide significant intersection again confirmed further extension to the high grade core and included an impressive 30m grading 1.4% CuEq (1.1% Cu, 0.5g/t Au, 165ppm Mo) from 690m depth outside of the current high grade (+0.6% CuEq) resource model.

The latest result follows the previous two outstanding drill results in April 2022 from Cuerpo 3, which also confirmed further growth of the high grade core, notably:

• 552m at 0.6% CuEq from 276m depth, including 248m at 0.8% CuEq (CORMET003), and

• 876m grading 0.5% CuEq from 246m depth, including 206m grading 0.9% CuEq (CORMET006)

In addition, diamond drill hole CORMET002 has returned 370m grading 0.4% CuEq (0.3% Cu, 0.1g/t Au) from surface, including 20m grading 0.8% CuEq (0.6% Cu, 0.4g/t Au) from 24m depth, and including 22m grading 1.0% CuEq (0.8% Cu, 0.5g/t Au) from 136m depth at Cuerpo 2.

These high-grade intersections were also outside the current high grade resource at Cuerpo 2.

A final development study diamond drill hole (CORMET004) is being completed at Cortadera and results are also pending for four metallurgical diamond drill holes completed at Productora.

High-Grade Satellite Resource Drilling Underway

Resource growth drilling has commenced targeting the San Antonio and Valentina high grade copper deposits, located 5 kms northeast of Cortadera.

High-grade, copper-gold mineralisation at both deposits remains open at depth and along strike. Drilling is already underway at Valentina where ten drill holes are planned. A further thirteen drill holes are planned at San Antonio.

San Antonio’s maiden Inferred resource, reported in March, extends from surface and already stands at 4.2Mt @ 1.2% CuEq (1.1% Cu, 2.1g/t Ag) for 48kt Cu and 287kt Ag. Both high grade satellite deposits are intended to form part of Costa Fuego’s next resource upgrade and combined PFS open pit mine schedule later this year.

Santiago Z Target Prepared for First-Ever Drilling Platform and access clearing across the Santiago Z exploration target is expected to be complete in the coming week and first-pass drilling is expected to commence following conclusion of drilling at Valentina and San Antonio.

Hot Chili’s soil results and mapping have confirmed a potentially large copper porphyry footprint measuring.