Hot Chili Lays Out Key Strategic Priorities for Costa Fuego, Chile’s Next Low Cost Copper Project

July 2, 2024 | Capital 10X

Hot Chili (ASX: HCH) (TSXV: HCH) (OTCQX: HHLKF) held an investor webinar recently and laid out current investment priorities and what comes next for Costa Fuego, the company’s low cost, high return Chilean copper project.

Importantly, the company shared a copper price forecast using the Lassonde curve and gave their view on where we are in the current copper commodity cycle.

Below is a summary of all the important information shared on the webinar.

A Successful Recent Private Placement

Hot Chili’s A$25 million private placement was well subscribed and saw strong interest from investor’s across Australia, Europe and North America. The company also had to cap the number of current investors who could buy more shares even after upsizing the buyback option to A$7 million from A$5 million. Management reported that out of 24 participants in the capital raise, 17 were institutional, 13 were from North America and 6 were new to the company.

Glencore was also a participant in the capital raise and owns 7.5% of Hot Chili. Glencore’s desire to maintain its current ownership stake is an important positive mark for the potential of Hot Chili’s Costa Fuego project in Chile, one of the largest copper projects not owned by a major.

Costa Fuego One of the Lowest Cost Projects in Chile

Initiative Ongoing to Bring in More North American Investors

Hot Chili made forays into the North American market over the past two years and now has 8% of the registrar on the TSX coming from North American capital.

Hot Chili is moving towards financing on their large-scale copper asset and the company is expanding relations with investment banks and broker groups in North America with the long term goal of growing a stable group of shareholders.

Costa Fuego is High Return With Strong Leverage to Copper Prices

Hot Chili’s recent PEA for Costa Fuego showed that for every 10 cent move in the copper price above $3.85 /lb., the project value increases by $100 million.

$1.5Bn NPV and 26% IRR at Current Copper Prices ($4.35/lb)

This leverage puts them in line with six other large-scale copper producers on the TSX/ASX, outside of the majors that are +100,000 tons per annum projects.

At current copper prices of $4.35/lb Costa Fuego is worth US$1.5 billion to Hot Chili vs the company’s current market cap of only US$94 million.

Management believes that more capital will move from producers to developers with exposure to the copper price at copper prices above $4.00/lb.

Relative Performance

Looking at the performance of Hot Chili on the ASX over the past 18 months (red) the stock has done well on a relative basis, in line with most of the copper equities up 10% – 20% with the copper price. Xanadu Mines is the outperformer of the group.

Results were similar on the TSX; producers’ stock prices are up 20 to 30% over the past 3 months, with the expectation that the continuing bull market will also lift developers and explorers in time.

Chart shows the performance of several ASX copper equities (December 2022 to June 06, 2024)

Strategy: A Story of the Commodity Cycle

Understanding where we are in the commodity cycle is key for investors to understand how explorers, developers and producers are positioned in the market.

Hot Chili’s Non-Executive Chairman, Dr. Nicole Adshead-Bell gave some insights while highlighting 2 charts; one from Scotiabank quarterly’s commodity cycle chart and another from Investec’s Mining Clock.

The goal for investors is always to get in at the lows and ride the rebound.

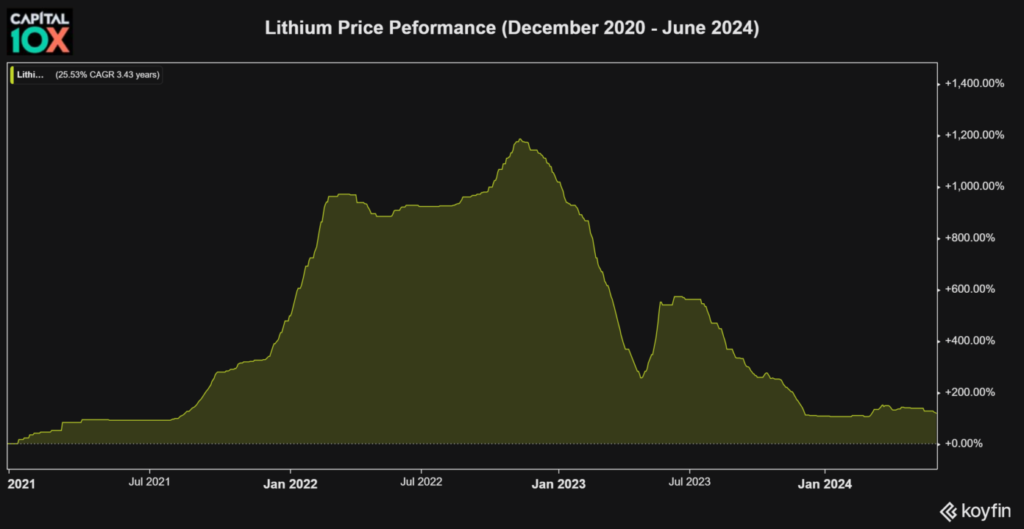

A good example to look at is the past 2-year price action of lithium.

We saw the start of a lithium bull run in December 2020 which ultimately took the price up 12x, with almost all equities with exposure to lithium rising spectacularly as well.

Rising prices saw huge inflows of investment in discoveries and production. Due to rising production from the wave of investment, lithium prices have fallen lately, down significantly from the highs though still well above where they were in late 2020.

Lithium Price Performance (Dec 2020-Jun 2024)

Adshead-Bell believes that even after strong copper price performance so far in 2024, we are still at lows in the copper price looking at the cycle overall. She believes supply will continue to decline over the next 18 months supporting higher prices.

Provocatively, Hot Chili management strong believes the copper price needed to incentivize enough supply is between $6.00-$8.00/lb, 30%-70% above peak levels reached in the last cycle.

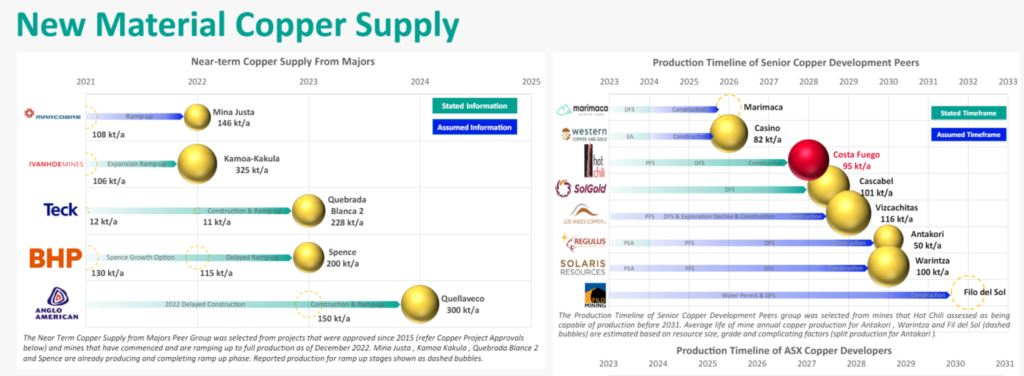

Hot Chili’s goal is to manage their business to take advantage of where we are in the cycle. They are aggressively advancing the Costa Fuego project so that production can coincide with rising prices. Costa Fuego will be one of the first medium term projects to start up after a few projects from the majors begin producing in 2024 and 2025.

Hot Chili Production Timeline vs Industry Peers

Themes: Investor & Company Behavior

Hot Chili talked through different parts of the commodities cycle and the behavior of companies and investors depending on where in the cycle we are.

During a bear market, there are bankruptcies, asset sales and dilutive financings in the juniors sector, where capital is spent just to keep going, no investments are made that may move the equity price beyond the commodity price.

Generalist investors tend to buy high and sell low.

As prices stabilize (or in the case of copper, stay resilient) mining companies pinch pennies,; geologists are fired as companies attempt to avoid going under.

This is when savvy investors begin to buy. They understand the cycle and know that prices are at lows demonstrated by companies implement efficiencies on the balance sheet.

Industry Behavior Through the Commodity Cycle

As prices finally begin to rise there is low-risk M&A, producers buy other producers.

In the past year BHP acquired Oz Minerals, and is currently negotiating to buy Anglo American, primarily for its copper assets.

As mid and small caps strengthen their balance sheets, their attractiveness to the majors increases. As the cycle continues and the underlying commodity price improves, capital becomes available for development, not just for mine expansion. We are here today.

Financings for mid and small cap companies are the green shoots of a bull market in the view of Adshead-Bell.

A Bull Market: More Opportunity, More Risk

The next phase of the cycle is development in more higher risk activities (e.g. exploration, development) as companies drill holes and make new discoveries.

At this point investors demand growth, and there are new IPOs, as companies strive to prove their exposure to the commodity.

At the top of the bull market, high risk M&A rules the day, as large caps start acquiring companies down the supply chain – including developers and higher risk explorers.

Generalist investors get involved, as they begin to do their research and invest. In order to maximize shareholder returns, companies should time the cycle.

We are definitely not in this stage according to Hot Chili.

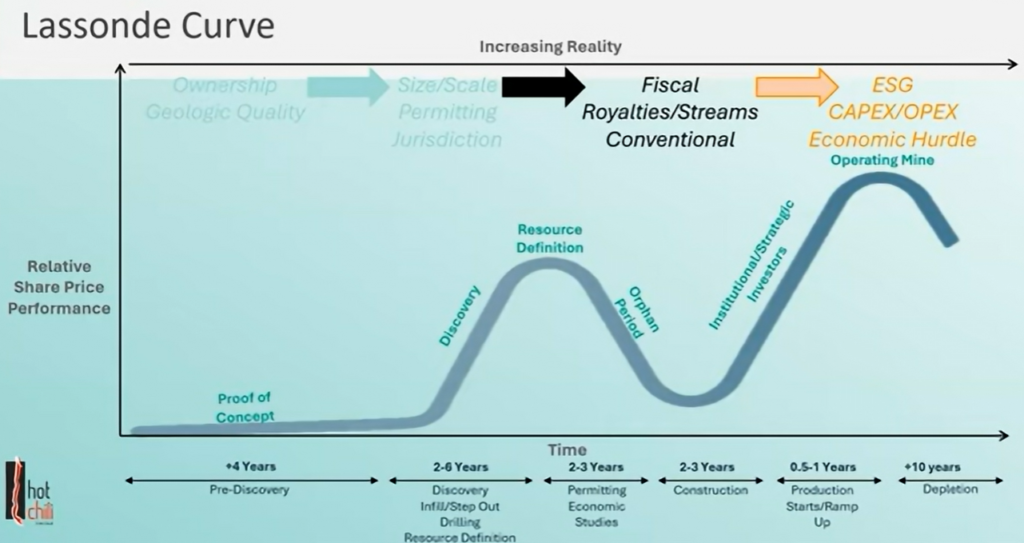

The Lassonde Curve: A Visual of Optimal Investment Timing

So where does the Lassonde Curve fit into the cycle?

Adshead-Bell believes that the best time for alpha generation is in the discovery phase, when investor sentiment is at its highest, which is reflected in the share price.

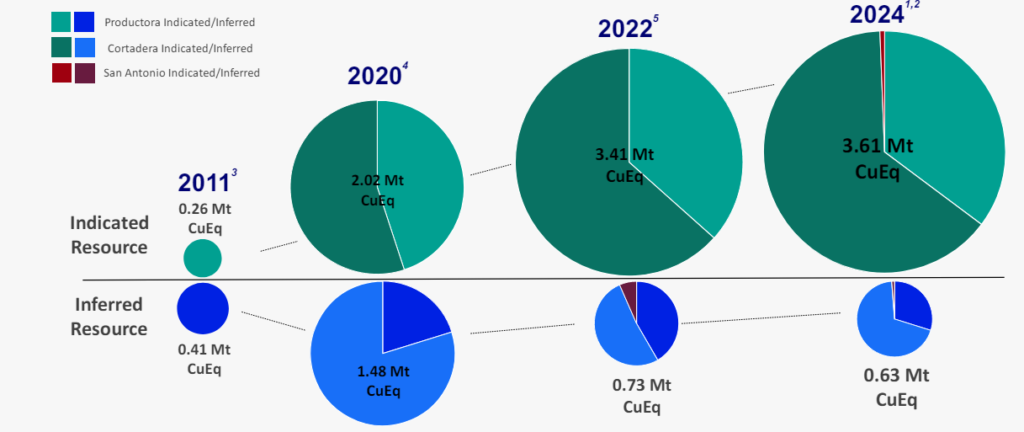

Hot Chili is focusing on additional discovery drilling and increasing the total copper resource to drive value before making a construction decision in 2025.

Costa Fuego Resource Continues to Grow Driving Value for Shareholders

Hot Chili has 16 years of experience in Chile as a company in the market, and is currently fostering relationships with institutional and strategic investors.

The company believes that the best way to generate market excitement at the next stage of the curve, is material resource growth and success.

The path to exposure to alpha generation for developers is mainly through value in the drill bit; smart exploration with historic mining activity and/or oxide mineralization as evidence of a larger system.

Also managing the company efficiency allows to strike well asset acquisition opportunities take place. So the company is focused and ready to benefit as the copper price continues to rise quarter over quarter.

To learn more about Hot Chili, including upcoming catalysts and who the economics of Costa Fuego are so strong, we recommend browsing the company’s investor presentations found HERE

Hot Chili Limited is a market awareness client of Capital 10X. For more information, including potential conflicts of interest please see our Content Disclaimer.

ASX Resources Quarterly Wrap: Hot Chili primed for spicy PFS release

July 30, 2024 | Jessica Cummins

It’s the quarterly season again as the ASX market announcements page becomes increasingly flooded with update lodgements.

To save you the trouble of trudging through it all, we’ve wrapped up the highlights from some of the (resources) reports that caught our eye.

Hot Chili (ASX:HCH)

Hot Chili continued to focus on several development studies workstreams during the quarter ahead of the planned delivery of a pre-feasibility study for the Costa Fuego copper hub in late 2024.

In March, the company entered an MOU with the existing Las Losas port facility in Chile to negotiate a binding port services agreement and in May $31.9m was raised by way of a $24.9m private placement and $7m share purchase plan to fund development and exploration activities over the next 18 months.

Development study drilling during the quarter focussed on metallurgical and hydrogeological drill programs at Productora as well as the planned Tailings Storage Facility (TSF) for Costa Fuego while several independent experts were engaged to review and provide assurance reports for all critical areas of the PFS.

On the exploration front, HCH kicked-off several programs at newly acquired concessions covering the Domeyko Cluster, which span an area of 141km2 and represents a 25% increase in the company’s total landholding at Costa Fuego.

Soil geochemistry, geophysics and surface mapping were among the activities with an extensive ground magnetics survey currently underway.

The survey data collection is expected to be finalised early Q3 and will aid in targeting across this most recent addition to HCH’s tenement package. Post quarter, HCH also announced the launch of a water supply business Huasco Water, with Costa Fuego as a foundation offtake partner.

But its assessments to date have shown there will be external demand sources, with access to critical water rights in the dry Atacama region a do or die proposition for many projects.

HCH finished the quarter with $33.8m in the bank, funding the company says will facilitate “completion of the Costa Fuego Pre-Feasibility Study, completion of the Water Supply Business Case Study, completion of the Costa Fuego Environmental Impact Assessment, commencement of a bankable feasibility study and further exploration activities over the next 18 months.”

Sunshine Metals (ASX:SHN)

SHN delivered thick gold and copper results from step-out drilling in the under-drilled Liontown Gap Zone at the 1,700km2 Ravenswood Consolidated project near Charters Towers in QLD.

Stand-out hits include 16.2m at 4.54 g/t gold, 1.11% copper from 319m including 5m at 2.96 g/t gold from 310m and 6.2m at 9g/t gold as well as 2.52% copper from 329m.

SHN believes the Gap Zone presents an opportunity for resource extension, with the first of seven diamond holes (~2,500m) kicking off in mid-July.

A resource update is scheduled for December.

Sunshine finished the quarter well stocked to chase extensions and new discoveries at Ravenswood, with $3.4m in the bank after spending $982,000 on exploration and evaluation in the June term.

Antipa Minerals (ASX:AZY)

Completing Phase 1 RC and diamond drilling at the Minyari Dome gold-copper project in WA was AZY’s main goal for the quarter.

Results identified new zones of near-surface gold mineralisation along the northern edge of the GEO-01 discovery, at the GP01 target, and at the Minyari Southeastern Extension target.

Mineralisation at multiple GEO-01 lodes and the Minyari Southeastern Extension target remains open in most directions, adding to the existing maiden mineral resource opportunities.

Antipa already controls 1.8Moz at Minyari Dome, one of the largest resources in a region known for the legendary but ageing Telfer gold mine where consolidation is a live possibility, while it also boasts JVs with majors Rio, Newmont and IGO.

Including expenditure by those farm-in partners, AZY spent $3.27m on exploration in the June quarter, and held a total $8m in cash as of June 30. It also saw Lion Selection Group come in as a key institutional backer via a $2m investment, while Newmont topped up its 8.6% stake in the firm.

AZY additionally holds a $1m drill for equity deal with Topdrill, meaning it can stretch its cash balance further in pursuit of additional gold and copper resources.

Everest Metals Corporation (ASX:EMC)

EMC made significant headway on its portfolio of projects during the quarter beginning with the commencement of bulk sampling at the Revere gold project, which sets the company on the pathway for a maiden resource.

A process plant is due to be mobilised this quarter to the site, where 8000t of stockpiled high-grade near surface material has been prepared, with some samples grading up to 33g/t. Gold grades up to almost 100g/t in parts have also been identified in drilling at the site.

Over at Mt Edon, Phase 1 resource drilling continued to find multiple pegmatites including results up to 0.54% rubidium oxide and up to 1% lithium oxide.The extraction process in collaboration with Edith Cowan University (ECU) recovered ~75% rubidium, demonstration the project is developing into a standalone rubidium deposit. A maiden resource is due in August, with phase 2 drilling pegged for the December quarter.

EMC divested its uranium projects to Cobold Metals and looks forward to working with the team towards completing the IPO over the coming quarters.

It held $3.1m in cash at the end of June, with another $500,000 tranche from a recent $2.2m placement landing in July.

Hot Chili Pioneers Low-Cost Copper Development in Chile’s Costa Fuego Copper-Gold Project

October 8, 2024 | Crux Investor

- Hot Chili is developing the Costa Fuego copper project in Chile, aiming to be one of the top five large-scale copper developers outside of major mining companies.

- The project has an estimated annual production of 95,000 tons of copper and 50,000 ounces of gold, with a 16-year mine life based on current estimates.

- Hot Chili has a strategic partnership with Glencore for 60% of offtake for the first 8 years, leaving 40% uncommitted for potential future deals.

- The company is developing a water supply business, Huasco Water, which could potentially be monetized to help fund the main copper project.

- Hot Chili is targeting completion of prefeasibility studies for both the copper project and water business by late 2023/early 2024, with the goal of securing project financing by late 2026/early 2027.

In an era where the global demand for copper is steadily rising, driven by the green energy transition and infrastructure development, Hot Chili Limited stands out as a compelling investment opportunity in the copper mining sector. As one of the preeminent large-scale copper developers outside of major mining companies, Hot Chili is advancing its flagship Costa Fuego project on the Chilean coastline. With a combination of strategic advantages, including a favorable location, significant resource base, and innovative approaches to infrastructure development, Hot Chili is positioning itself to become a major player in the copper market.

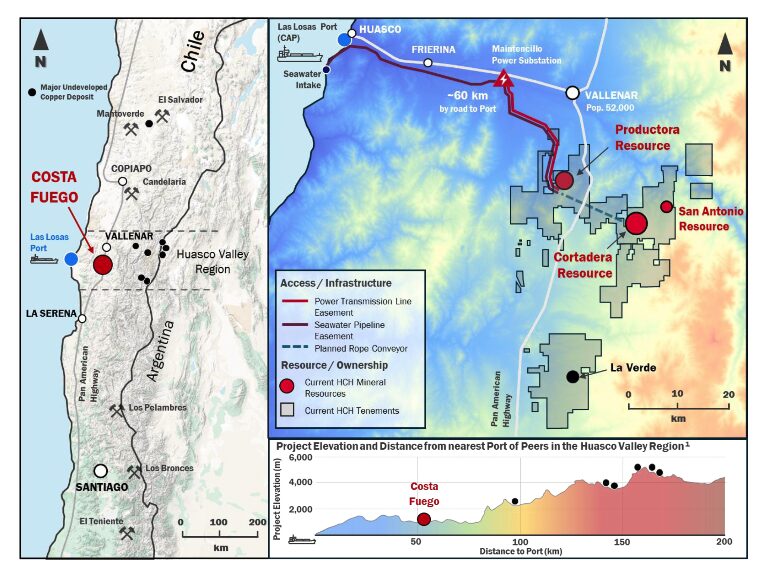

Project Overview: Costa Fuego

Hot Chili’s Costa Fuego copper project is located on the Chilean coastline. The project benefits from several natural advantages that set it apart from many of its peers in the copper development space.

Costa Fuego is projected to produce approximately 95,000 tons of copper and 50,000 ounces of gold annually. This substantial output places Hot Chili among the top five large-scale copper developers globally, outside of major mining companies. The current mine life is estimated at 16 years, based on a resource base of one billion tons, with potential for extension as further studies are completed.

Christian Easterday, CEO and Managing Director of Hot Chili, emphasizes the project’s significance:

“There are only five projects that are scaled at 100,000 tons per annum of fine copper production globally outside of the control of majors. For the independent projects, there are not many of those that are near term.”

Cost Advantages

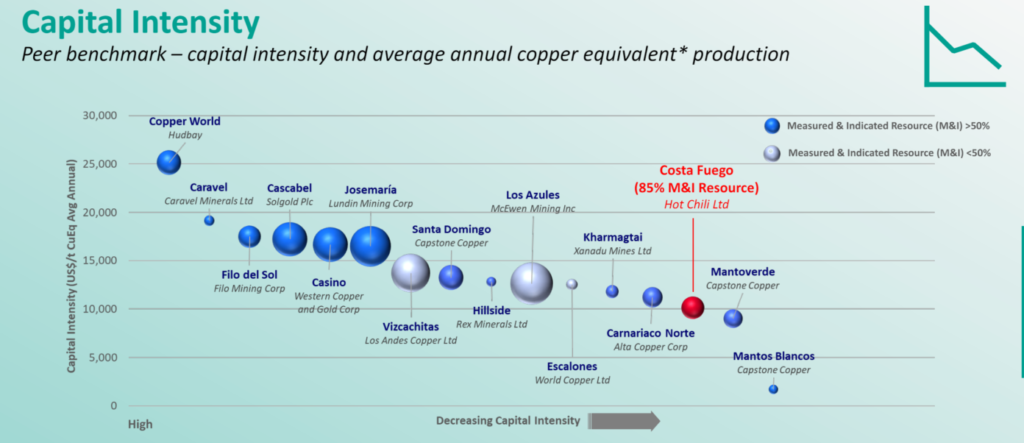

One of the most compelling aspects of Costa Fuego is its relatively low capital intensity. Easterday notes:

“It’s a billion dollars to build. If we were in the high Andes and we required fresh water or desalinated water to process with, which we don’t, then we would be talking about a $2 billion project to put out that kind of metal production.”

This cost advantage is primarily due to the project’s coastal location, which eliminates the need for expensive water infrastructure and reduces overall development costs. The lower elevation also simplifies operations and reduces associated risks compared to high-altitude projects in the Andes.

Development Timeline & Permitting Progress

Hot Chili is making steady progress towards project development. The company is preparing to submit its environmental impact assessment in mid-2024, which will be the last major permit required before obtaining the mining permit for Costa Fuego. This puts Hot Chili ahead of many of its peers in terms of permitting progress. Easterday outlines the timeline:

“Conceivably, with our best timelines at the moment, early production no earlier than late 2028 is what we foresee in the schedule.”

This timeline includes a two-year construction phase and a six-month ramp-up period to reach nameplate capacity.

Glencore Partnership

Hot Chili has secured a strategic partnership with Glencore, one of the world’s largest commodity traders. This partnership includes an offtake agreement for 60% of Costa Fuego’s production for the first eight years. This arrangement provides Hot Chili with a guaranteed market for a significant portion of its future production while leaving room for additional partnerships or spot market sales.

Importantly, Hot Chili has retained 40% of its offtake uncommitted, providing flexibility and potential upside. Easterday explains the strategy:

“We very prudently kept 40% of our offtake uncommitted outside of the Glencore arrangement, and that’s getting a significant amount of interest.”

This uncommitted portion could be particularly valuable given the tight copper concentrate market and growing interest from Asian investors in securing supply from new copper projects.

Interview with Managing Director & CEO, Christian Easterday

Huasco Water: A Strategic Asset

In addition to its core copper project, Hot Chili has developed a potentially valuable water supply business, Huasco Water. This subsidiary holds rights to supply both saltwater and desalinated water to the region, including to Hot Chili’s own project and potentially to other mining and industrial operations in the area.

The water business represents a significant potential source of value for Hot Chili. Easterday draws a parallel to a recent transaction in the sector, “Antofagasta took their water rights, they sold them for 600 million to a consortium and is now also building their water expansion of 380 million – Antofagasta has supplied them a 20-year offtake agreement to supply water.”

While the situations are not directly comparable, this example illustrates the potential value that could be unlocked from Hot Chili’s water assets. The company is considering various options for monetizing this asset, including potentially selling a majority stake to a strategic investor in the water industry.

Infrastructure Cost Savings

The development of Huasco Water also provides direct benefits to the Costa Fuego project. As Easterday explains:

“Our water infrastructure is around $140 million of capital, and that is what we can now outsource out of our build cost.”

By potentially selling the water business while retaining the necessary supply for Costa Fuego, Hot Chili could significantly reduce its capital requirements for the copper project while also generating funds to contribute to overall project development.

Financial Position & Funding Strategy

Hot Chili is well-funded for its current phase of development. Easterday notes:

“Hot Chili’s been able to fund itself very well this year in a really well-timed capital raising, which means we’re sitting here with $30 million and doing what we need to do to get the project pushed forward.”

This funding allows the company to advance its prefeasibility studies for both the copper project and the water business, as well as prepare for the environmental impact assessment submission.

Looking ahead to project construction, Hot Chili is developing a multi-faceted strategy to fund the estimated $1 billion capital cost. This strategy could potentially include:

- Monetization of the Huasco Water business

- Streaming agreements on precious metals production

- Additional offtake agreements

- Strategic partnerships or investments, particularly from Asian investors

- Traditional project finance from banking syndicates

Easterday is confident in the company’s ability to attract funding.

“We have a copper asset that’s going to have a prefeasibility at the end of the year, a water asset that’s going to have a prefeasibility not far after, and you know, both of those project values are significantly large.”

Market Outlook & Timing

Hot Chili’s development timeline aligns well with projected supply-demand dynamics in the copper market. Many analysts anticipate a significant supply deficit in the coming years, driven by growing demand from electrification and renewable energy sectors, coupled with a lack of new large-scale projects coming online.

Easterday notes the industry’s chronic underestimation of challenges in bringing new supply to market:

“Since 2014, so the last 10 years, they’ve overestimated the progression of supply forecast. There is a huge gap between what has been forecast every year to come and what has actually come.”

This dynamic could create a favorable pricing environment for new producers like Hot Chili as they enter the market.

Hot Chili’s goal is to be “first in line to finance a 100,000 ton per annum project,” as Easterday puts it. By advancing its studies and permitting processes now, the company aims to be ready for a final investment decision and financing in late 2026 or early 2027, potentially ahead of many competing projects.

This timing could allow Hot Chili to secure favorable terms for project financing and offtake agreements, as well as potentially benefit from strong copper prices as it enters production.

The Investment Thesis for Hot Chili

- Large-scale copper project with significant production potential (95,000 tons copper, 50,000 oz gold annually)

- Low capital intensity due to favorable coastal location ($1 billion vs. $2 billion for comparable high-altitude projects)

- Advanced permitting status with environmental impact assessment submission planned for mid-2024

- Strategic partnership with Glencore, with potential for additional offtake agreements

- Unique water business (Huasco Water) that could be monetized to fund a significant portion of project development

- Well-funded for current development phase with $30 million on hand

- Aligns with projected copper supply deficit, potentially benefiting from favorable pricing environment

- Management team with clear strategy and timeline for project development and financing

Hot Chili presents a compelling investment opportunity in the copper development sector. With its large-scale Costa Fuego project, strategic coastal location, cost advantages, and innovative approach to water infrastructure, the company is well-positioned to become a significant player in the copper market.

The company’s progress on permitting, strategic partnerships, and funding strategies demonstrate a clear path towards project development. Moreover, the potential monetization of the Huasco Water business could provide a unique source of funding, setting Hot Chili apart from many of its peers.

As the global demand for copper continues to grow, driven by the green energy transition and infrastructure development, well-positioned projects like Costa Fuego are likely to attract significant interest from investors, offtakers, and strategic partners. For investors seeking exposure to the copper market, Hot Chili offers a combination of scale, advanced development status, and potential for value creation that merits serious consideration.

Macro Thematic Analysis

The global transition to clean energy and electric vehicles is driving unprecedented demand for copper, creating a compelling macro environment for copper developers like Hot Chili. As countries worldwide commit to decarbonization targets, the need for copper in renewable energy infrastructure, electric vehicles, and energy storage systems is set to surge.

Concurrently, the supply side of the copper market is facing significant challenges. Years of underinvestment in exploration and development, coupled with declining ore grades at existing mines, have created a looming supply deficit. Many analysts predict this supply-demand imbalance will persist and potentially worsen in the coming years.

This situation is further complicated by the increasing difficulty in developing new large-scale copper projects. Environmental concerns, water scarcity, and geopolitical tensions in key mining jurisdictions are making it harder to bring new supply online. Projects like Hot Chili’s Costa Fuego, with its favorable location and lower environmental impact, are therefore particularly valuable.

Moreover, the growing focus on responsible sourcing and ESG (Environmental, Social, and Governance) factors in the mining industry adds another layer of complexity. Copper projects that can demonstrate strong ESG credentials, including efficient water use and community support, are likely to be preferred by both investors and offtakers. Christian Easterday succinctly captures the opportunity this creates:

“We’re starting to approach this inflection point where a lot of the greenfield projects are starting to become lower capital intensity options for new supply.”

This dynamic positions well-advanced, economically robust projects like Costa Fuego to potentially command premium valuations as the copper supply crunch intensifies.

Hot Chili serves up Chilean copper PFS

Updated Costa Fuego study outlines 20 years of copper-gold production

27 March 2025

After a decade in the Chilean copper space, Hot Chili is closer than ever to delivering a developable Costa Fuego project it now believes can deliver some 3.3 billion pounds of the red metal over two decades.

Two years after delivering a preliminary economic assessment, today’s prefeasibility study has outlined a more expensive, but larger and more robust development option that could generate US$3.9 billion in free cash over 20 years.

The PFS outlines a project that could produce around 116,000 tonnes per annum of copper equivalent over the mine life at all-in sustaining costs of $1.85/lb after credits for the gold, silver, and molybdenum.

The first 14 years should support the production of 95,000tpa copper and 48,000 ounces per annum gold from reserves now re-stated as 502Mt grading 0.37% copper, 0.10 grams per tonne gold, 0.49gpt silver, and 97 parts per million molybdenum.

YOU MIGHT ALSO LIKE

- Traders eye $12k copper at Swiss conference

- Belararox bounces on thick copper shows

- Holy moly! Copper’s ‘ugly stepsister’ getting some love

Total resources are 798 Mt grading 0.45% CuEq, making it one of the largest undeveloped copper projects globally.

Early mining is concentrated at the Productora and Alice open pits before the focus shifts to the Cortadera underground.

Processing comes from a circa 21Mtpa sulphide concentrator and leaching facilities.

Initial capex is now $1.27 billion, almost $220 million more than originally outlined, while an expansion will cost almost double the prior estimate at $1.3 billion.

Assuming a copper price of $4.30/lb, post-tax net present value is put at $1.2 billion with an internal rate of return of 19%.

Payback should be around 4.5 years.

At the prevailing near-record spot price of $5.30/lb, NPV jumps to $2.2 billion with an IRR of 30%.

Credits: Hot Chili

Hot Chili says its work has reduced development risks, and it estimates it will offer some of the lowest capital intensities of any project along Chile’s coastal belt at $14,079/t CuEq.

The company expects to have a better leverage to the copper price than its peers, such as Capstone Copper’s Mantoverde mine or Santo Domingo development, BHP’s new Filo del Sol investment, or Solgold’s Cascabel.

Further, its location on the coastal belt offers easier access to water and power than its peers at higher elevations.

Hot Chili also claims to have a head start in permitting on its rivals. Its stage one environmental impact assessment is due to be submitted soon.

Growth targets

Work on a second EIA that supports the integration of the La Verde porphyry, which was excluded from the PFS, could enhance project economics in the planned definitive feasibility study.

Managing director Christian Easterday said Hot Chili was now “within an elite grouping of copper developments globally” that could offer a meaningful source of near-term copper into a market set to struggle to meet demand.

The company will advance its DFS and drill out La Verde over the next year.

It aims to deliver its first red metal by the end of the decade.

Glencore looming in background

The question remains: how will it pay for it? Hot Chili has around A$19 million in cash to fund its DFS and studies for a complementary Huasco water supply and desalination business.

With Glencore still on the register as a 7.5% shareholder, it is an obvious development partner. As long as the Swiss-based trader maintains that equity level, it can purchase up to 60% of concentrate for the first eight years of its life.

A PFS for the Huasco Water project is also imminent.

Hot Chili shares were up 2% in early trade to 72c, capitalising the company at $108 million.

The stock has traded between 60c and $1.31 over the past year, having peaked at $2.60 in 2020.

Hot Chili unveils blockbuster PFS in booming copper-gold market

Andrew ToddSponsored

Thu, 27 March 2025 2:47PM

Hot Chili has dropped a bombshell prefeasibility study for its Costa Fuego copper-gold project in Chile, cementing its place among the world’s top copper developments with a 20-year mine life, top-tier production scale and economics that scream upside in today’s red-hot metals market.

At a conservative copper price of US$4.30 (A$6.79) per pound and gold at US$2280 per ounce, Costa Fuego has a post-tax net present value (NPV) of US$1.2 billion (A$1.9b) assuming an 8 per cent discount rate. The figure quickly blows out to a massive US$2.2b (A$3.5b) at current spot prices, allowing for a much quicker return on investment in the process.

The company’s latest milestone reveals Costa Fuego is poised to pump out an average of 116,000 tonnes per annum of copper-equivalent metal, which includes 95,000t of copper and 48,000 ounces of gold in its first 14 years.

Across its full 20-year life span the project is set to deliver a staggering 1.5 million tonnes of copper and 780,000 ounces of gold before any by-products are factored in. Hot Chili says the haul will put it firmly in the top quartile of global producing copper projects.

The project is set for a five-year payback period on capital expenditure clocking in an internal rate of return of 19 per cent on an upfront US$1.27b (A$2b) to get the mine running.

Hot Chili reports a total life-of-mine free cash flow of some US$3.86b after tax, with revenue pegged at a whopping US$17.3b.

The eye-popping numbers still have plenty of room for improvement, thanks to a surging gold and copper price. Copper is flying thanks to United States President Donald Trump’s tariff war. The gold price is too, as it continues to push new all-time highs above US$3000 per ounce. At current prices, Hot Chili’s forecast NPV rockets up to US$2.2b (A$3.5b) and the internal rate of return jumps to 30 per cent.

In fact, every US$0.10 per pound bump in the copper price adds another US$100 million to the NPV, making Costa Fuego a highly leveraged play in a market screaming for more copper amid electrification and renewable energy booms.

The company will now kick off its definitive feasibility study (DFS) and submission for stage one environmental approvals to keep the project on-track for first production before the end of the decade.

With cash of approximately A$19 million as at the end of last year and both of our key assets (Costa Fuego and Huasco Water) at PFS level study, we are well positioned to pursue potential strategic partnership and sponsorship funding discussions.Hot Chili managing director Christian Easterday

Costa Fuego is widely regarded as one of the better undeveloped copper resources globally. It has a mammoth combined resource of 798mt grading 0.45 per cent copper equivalent for 2.9mt of copper, 2.6m ounces of gold, 12.9m ounces of silver and 68,000t of molybdenum.

The company has tabled a maiden ore reserve of 502 million tonnes grading 0.37 per cent copper, 0.10 grams per tonne (g/t) gold from blending an open pit and underground mining strategy across its Cortadera, Productora, Alice and San Antonio deposits.

Nestled at a low 740 metres above sea level on Chile’s coastal range, Costa Fuego leverages a strategic edge few jurisdictions can match. It is just 60 kilometres from the Las Losas port and a stone’s throw from Vallenar’s skilled workforce.

The projected mining costs are calculated to be below the benchmark of undeveloped competitors, with the project’s C1 cash cost sits at a lean US$1.38 per pound of copper, including by-product credits, with an all-in sustaining cost of US$1.85 per pound – placing it among the lowest-cost producers globally.

Hot Chili has outlined a hybrid mining approach for its considerable undertaking. Open pits will cornerstone the low-cost operation, accompanied by a massive block cave mining operation down to 1000m at its flagship Cortadera deposit. The operation will kick off in year three and add 146mt of higher-grade feed.

The company’s processing will be undertaken by a massive 20.7mt-21.7mt per annum sulphide concentrator, a 4mtpa oxide heap leach and a 3.6mtpa low-grade sulphide leach that will churn out concentrate and cathode copper.

Hot Chili isn’t quite done yet with exploration at its Chile operation, saying its recent La Verde copper-gold porphyry discovery, 35km south of Costa Fuego, is shaping up as a game-changing second porphyry project.

La Verde’s wide, shallow intercepts, including 320m at 0.3 per cent copper and 0.1g/t gold, hint at a massive system still open in all directions. Step-out drilling is underway, and the company believes it can one day fold La Verde into Costa Fuego’s production hub, potentially juicing front-end mine life and economics ahead of a DFS.

With copper prices soaring and gold continuously at all-time highs, Costa Fuego’s timing is impeccable. The company’s $19m cash pile positions it well to rapidly expand La Verde while simultaneously courting strategic partners for production, as it charges toward the all-important DFS milestone.

Hot Chili chases US$447M free cash flow from Chilean water business

In partnership with BULLS N’ BEARS

Hot Chili says it can solve Chile’s water problem for large industrial projects in the Huasco Valley region and bank US$447m over 20 years in free cash by getting into the water supply business using its giant Costa Fuego copper play as a foundation off-taker.

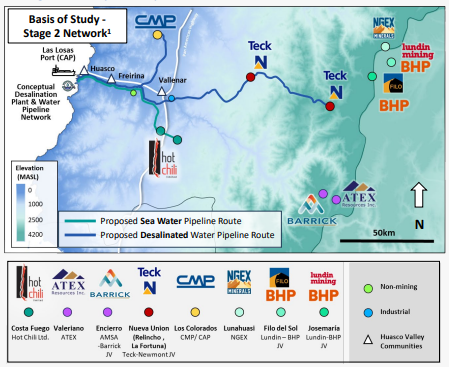

The company recently tabled a pre-feasibility study on its 80 per cent owned Huasco Water project in Chile that makes use of its hard won permit to supply sea water to Chile’s Huasco Valley region. According to management, the Huasco joint venture holds the only active maritime license in the Huasco region – a feat that it says took 10 years of regulatory burden to achieve.

The JV is aiming to develop a long-term, regional multi-user seawater and desalination water supply network for the Huasco valley area of the Southern Atacama region of Chile, which sits about 600km north of the Santiago capital.

Hot Chili says the project will initially cost US$151m in start up capital which it says can be paid back in 4.5 years from the operation.

Total expected revenues have been modelled over 20 years and come in at US$880M and the project shows a pre-tax net present value using an 8 per cent discount rate of US$179m and a 22 per cent internal rate of return.

‘The company views the potential to outsourcing of its seawater supply infrastructure as a key value enabler…’Hot Chili managing director Christian Easterday

Stage 1 for the business will target the potential supply of seawater at 500 litres per second (L/s) to Hot Chili’s Costa Feugo copper-gold project which will be the foundation off-taker for the project via a 62km over-land pipeline.

A memorandum of understanding (MOU) has been executed with its own Costa Feugo project that will see the supply of seawater for the duration of the 20-year project life.

In addition to its sought after concessions to extract sea water, Huasco Water has permits for coastal land access, stage 1 pipeline easements and has secured connection to the electricity grid. The company plans to supply seawater by the end of the decade.

Stage 2 will see a desalination plant, estimated to cost US$1.4 billion, supply water at a rate of 1300L/s to a range of potential businesses within the Huasco Valley region.

The numbers really begin to ramp up during the second stage, with post-tax-free cash flows jumping to an estimated $4 billion from revenue of US$9.35B modelled over 22 years.

The post-tax NPV for stage 2 comes in at $977M with a 4 year payback.

The company’s staged approach enables scaling up for long term supply to mining, community and agricultural firms in the Huasco Valley region, with the potential to stretch beyond initial project estimates.

Hot Chili managing director Christian Easterday said: “The outcomes of the water supply preliminary feasibility study provide an opportunity for Hot Chili to fully consider the strategic value of its 80 per cent owned subsidiary company Huasco Water, which controls all our critical water assets. The company views the potential to outsourcing of its seawater supply infrastructure as a key value enabler and has anchored Huasco Water by executing a memorandum of understanding to negotiate a foundational seawater offtake agreement for Costa Fuego.”

Huasco Water has identified possible demand of at least up to 4000L/s across six undeveloped mining projects, all requiring access to a desalinated water supply.

Desalination water supply is projected to occur shortly after the seawater supply, due to begin at the end of the decade, is piped to Costa Feugo.

The permitting process to upgrade its maritime concessions to enable desalinated water to be provided is advancing.

The Huasco Valley region contains one of the largest groupings of major undeveloped copper projects in the world, all of which are in need of a reliable water supply. If an improving copper price warrants a move towards production for Hot Chili’s Costa Fuego, Huasco Water will be dragged along with it.

Management says just three potential clients in the region who may tap into their water business are Teck Resources, Atex Resources and Agrosuper.

Agrosuper is a food production company and also produces animal feed. An MOU for desalinated water has been executed with the group.

The HW Aguas para El Huasco SpA (Huasco Water) is a joint venture between Hot Chili (80 per cent interest) and Compañia Minera Del Pacifico – CMP (20 per cent interest).

Huasco Water is the only company with permitted access to supply seawater in the Huasco Valley region following a ten-year regulatory approval process.

The permitting process for desalination water has advanced over the past year with regulatory applications made to enable the supply from the existing maritime concession. A second maritime concession application by Huasco Water has been lodged. The second application includes brine discharge for the potential seawater desalination operations.

Hot Chili’s first mover advantage in the water sector in Chile cannot be overstated. The demand in the area appears to be real and the barriers to entry for others that have not suffered the ten year ordeal to get permitted just might give Huasco and Hot Chili a potentially decades long free run at supplying water to both its own project and the other mega projects that are littered around the area with no current water options.

With copper prices recently on the move, Hot Chili stands to derive a double benefit. Not only will the economics at its Costa Feugo project improve, but the company stands to reap the rewards from other copper groups in the region who may develop a thirst for some Huasco water.

Milestone registrations to expedite Hot Chili copper-gold project

Doug Bright BULLS N’ BEARS

Hot Chili has secured the milestone government registrations necessary to help fast-track its Costa Fuego copper-gold and Huasco Water projects in Chile.

The registrations, before Chile’s Office for Sustainable Project Management, confirm the two projects meet the government’s key criteria for consideration for a list of strategic investment projects that could be prioritised through a streamlined administrative approvals process.

Part of the office’s objectives is to optimise and accelerate approvals for projects that promote sustainability.

Hot Chili’s maiden combined probable open pit and underground ore reserves for its Costa Fuego project stands at 502 million tonnes at 0.37 per cent copper, 0.10 grams per tonne (g/t) gold, 0.49g/t silver and 97 parts per million molybdenum across multiple processing streams. The streams include the sulphide concentrator, oxide leach and low-grade sulphide leach processes.

The total combined metal in the reserves is a heady 1.86Mt copper, 1.58M ounces of gold, 7.95M ounces silver and 49,000t molybdenum.

Significant additional opportunity exists to extend the overall resource numbers with the company’s recent discovery of copper-gold porphyry mineralisation at its non-contiguous but nearby La Verde project.

La Verde is the latest addition to Hot Chili’s Costa Fuego production hub. It is only 50 kilometres south by road from the company’s central processing facility at Productora, within the company’s Costa Fuego group of projects.

The Costa Fuego complex is on Chile’s coastal range and comprises the company’s principal reserves zones at Productora, Alice, San Antonio and Cortadera, which all lie within a radius of about 10km.

The centre of the company’s contiguous tenure and its current resources is about 63km southeast of the port city of Huasco, in the Huasco province of the nation’s highly prospective Atacama region.

Huasco plays an important role in Hot Chili’s plans, as it is the proposed location for the seawater intake for the company’s Huasco Water project.

Huasco Water is an joint venture between Hot Chili and Chilean mining company Compañia Minera Del Pacifico. With its first-mover advantage, Huasco Water is the only company permitted to supply seawater in the Huasco Valley region, following a 10-year regulatory approval process.

The combined projects possess a valuable, unique and strategic mix for Hot Chili over the next decade and have what the company describes as a “top quartile copper production capacity with lowest quartile capital intensity”.

Hot Chili undertook March pre-feasibility studies for the water and the Costa Fuego gold-copper projects. A positive study outcome provides Hot Chili with an opportunity to consider the strategic value of its 80%-owned subsidiary company Huasco Water, which controls all its critical water assets.

The company sees significant value potential in outsourcing its vital seawater supply infrastructure and has secured Huasco Water’s position by executing a memorandum of understanding for a ground-breaking seawater offtake agreement for a proposed large-scale, multi-customer water business.

Its stage one water supply pre-feasibility study examined the delivery of 500 litres per second (L/s) of seawater, followed by a stage two 1300L/s of desalinated seawater supply.

A conceptual stage three study looked at future expansion to supply up to 2300L/s of desalinated water.

The staged approach considers the initial establishment of seawater supply infrastructure, including pumps and pipelines, towards the end of the decade, to be followed by an initial desalinated water supply and then subsequent phases of expansion.

It would enable long-term water supply to be scaled to regional demand growth to support mining, communities and agriculture in the Huasco Valley, with the potential to extend well beyond the project’s initial horizons.

The concept is further supported by significant interest in Huasco Water displayed by other Chilean and international water infrastructure investment groups, along with nearby mine developers, agricultural and community groups and government bodies.

Hot Chili says while long permitting timelines continue, its desalination permitting is progressing and no regulatory changes have been made to Chile’s maritime permitting process since Huasco Water was granted its concession.

Additionally, the company’s environmental impact assessment (EIA) is advancing, with its stage one seawater supply baseline studies completed for inclusion in its Costa Fuego EIA.

The latest registration is a significant milestone that confirms Hot Chili’s projects meet the Chilean government’s objective criteria to acquire priority status.

With the paperwork in hand for both Costa Fuego and Huasco Water, the company is now able to centralise and monitor all of its active permitting processes through a single platform and supervisory entity.

The current permitting needs include the company’s second maritime concession application for Huasco Water and its upcoming EIA submission for Costa Fuego and Huasco Water.

Hot Chili doubles copper-gold discovery footprint in Chile

STOCKHEAD

- HCH doubles footprint of La Verde copper-gold discovery

- Prospect sits within Costa Fuego project in Chile’s Atacama region

- Company planning deeper drilling to expand discovery further

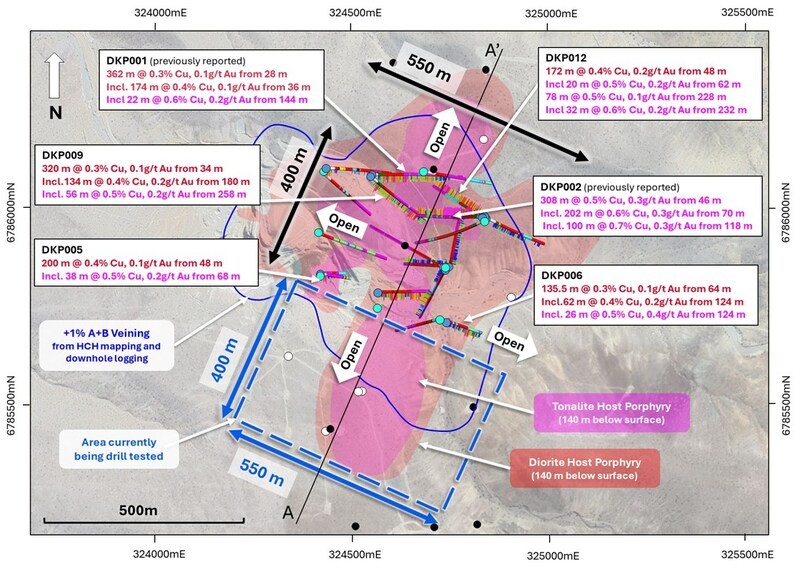

Special Report: Hot Chili has doubled its porphyry discovery footprint at its Chilean project, with a third round of strong assay results at the La Verde copper-gold discovery at its Costa Fuego project.

La Verde is around 30km south of the Costa Fuego planned central processing hub at low elevation in the coastal range of the Atacama region.

The phase one reverse circulation (RC) drilling has now doubled the initial discovery footprint, confirming copper-gold mineralisation extends over 1km in length and up to 750m in width, from near surface.

Notable results include:

- 389m grading 0.4% copper and 0.1g/t gold from 4 m depth to end-of-hole (DKP030), including 46m at 0.6% copper and 0.2g/t gold from 238m, including 34m at 0.6% copper and 0.2g/t gold from 322m;

- 120m grading 0.4% copper and 0.1 /t gold from 6m depth (DKP028), including 48m at 0.5% copper and 0.1g/t gold from 26m and, 114m at 0.3% copper, 0.1g/t gold from 318m depth to end-of-hole, including 34m at 0.4% copper, 0.2g/t gold from 380m to end-of-hole;

- 114m grading 0.4% copper from 86m depth (DKP024), including 52m at 0.5% copper and 0.1 g/t gold from 96m;

- 286m grading 0.3% copper and 0.1g/t gold from 4m depth (DKP027), including 154m at 0.4% copper, 0.1g/t gold from 44m; and

- 228m grading 0.3% copper and 0.2g/t gold from 42m depth (DKP013), including 104m at 0.4% copper and 0.3g/t gold from 42m.

Hot Chili (ASX:HCH) has also confirmed higher-grade centres across the extent of the shallow oxide and sulphide discovery, indicating:

Importantly, multiple distinct higher-grade centres have been confirmed from near surface. Assessment of each of these higher-grade centres indicates:

- A North-East (NE) higher-grade centre, 180m strike by 280m width by 320m in vertical extent

- South-east (SE) higher-grade centre, 320m strike by 340m width by 400m in vertical extent

- South-west (SW) higher-grade centre, 90m strike by 120m width by 260m in vertical extent

Deeper diamond drilling planned

Since over half of the drill holes ending in significant mineralisation at the limit of RC drilling depth capability, HCH is on the hunt for a potentially larger porphyry cluster at La Verde.

The extent of the mineralisation beneath the open pit remains untested.

The company is now planning deeper diamond drilling for phase two to extend these higher-grade centres at depth.

This could potentially add to the open-pit mine life for the Costa Fuego hub, with further development study updates expected in the near-term.

Watch: Hot Chili adds mine-making credentials for Costa Fuego copper-gold

Regulatory application for phase-two drilling access is progressing, with drilling to commence once approved.

In the meantime, development study activities to optimise the recent Costa Fuego Pre-Feasibility Study (PFS) are underway, building on the recently released PFS, which highlighted impressive post-tax numbers for the asset including an NPV of US$1.2b and IRR of 19%.

All-in sustaining costs totalled US$1.85/lb from the production of 1.5Mt of copper and 780,000oz of gold over a 20-year mine life.

The Copper Play the Market Is Missing

Streetwise

Disconnects between price and value in the resource sector occur regularly but are usually accompanied by issues. Issues such as a low metal price, local social pressures, political interference, or an environmental problem.

In situations like these, the disconnect between price and value makes sense. There is something that has to be overcome to get price recognition from the market. Investors looking to take positions in these sorts of situations must be cautious of their approach and understand how these risks will be overcome. In essence, this is what a contrarian investor is all about: taking a calculated risk on a solution to issues such as these.

That said, there are times when there is a disconnect and no major reason for it. These aren’t as common, but I have learned that when I personally come across them, I need to pursue them as strongly as I can. These are the true asymmetrical bets that can really propel a portfolio’s return forward.

Over the last two years, I have personally benefited by identifying a few of these situations, taking a big position, and waiting.

In my experience, the biggest factor to overcome in situations is time.

As they say, patience is a virtue. In situations like this, it becomes glaringly obvious.

Today, I have for you an opportunity that I think has no obvious reason for the major disconnect between price and value. The company is focused on developing two copper-gold porphyry projects in Chile. One is at the feasibility study stage, while the other is a brand new discovery story.

The company is

Hot Chili Ltd. (HCH:ASX; HCH:TSXV; HHLKF:OTCQX).

Let me explain to you why I think this is arguably the most undervalued junior mining company in the sector right now.

Costa Fuego

Costa Fuego is Hot Chili’s flagship project, which just recently had a PFS completed.

Costa Fuego will be both an open pit and an underground mining operation in the future.

On average, it will produce 116kt CuEq (copper equivalent) for 14 of the 20 years of its mine life, making it one of the largest undeveloped copper operations owned by a junior.

In terms of economics, Costa Fuego has great leverage to the copper price, with an NPV above US$2B and an IRR of 27% at US$5.30/lb copper.

- Post-tax NPV8% of US$1.2 B and IRR of 19% (at US$4.30/lb copper)

- Post-tax NPV8% of US$2.2 B and IRR of 27% (at US$5.30/lb copper)

As I mentioned, Costa Fuego will start as an open pit mining operation and then transition to an underground block caving operation later in the mine life.

Upfront CAPEX is, therefore, estimated to be US$1.27B with an expansionary capital around US$1.35B — big mines cost big money.

If I were to pick a reason for Hot Chili’s low valuation, this might be it. That said, if you look at all of the large, advanced (at least PFS level) projects out there and owned by a junior, billions in CAPEX is the commonality.

Not only this, but I view Hot Chili’s recent discovery of copper-gold mineralization at their La Verde project as reason to believe that the impact of the CAPEX will be lessened.

Discovery hole: DKP002 308m of 0.5% copper + 0.3g/t gold, including 202m of 0.6% copper + 0.3g/t gold, and including 100m of 0.7% copper + 0.3g/t gold.

As I see it, La Verde has the potential to add significant amounts of ore early on into a future combined mining operation. This additional open pit tonnage from La Verde could be trucked to nearby Costa Fuego and push out the expansionary capital needed to build the underground — this is very meaningful.

In a discounted cash flow model, cash flows in the future are discounted.

Meaning, the earlier in a mine life you can produce higher cash flow, the better the net present value (NPV).

Hot Chili still has much to prove at La Verde, but I think they are well on their way to doing it.

In closing, additional tonnage from La Verde doesn’t negate the size of the CAPEX; what it does is push it further out in the mine life, which will increase the overall NPV of the project.

Huasco Water

One of the biggest factors affecting copper project development in both Chile and Argentina right now is access to water. On the Chilean side, it’s both an altitude and a permit issue.

Firstly, the Chilean government is no longer allowing water extraction via underground sources. They are exclusively forcing development projects to apply for a maritime concession or do a deal with a company that already has one. A maritime concession allows for the extraction and treatment of seawater.

The reality of the situation is that there have only been two maritime concessions granted in the last 13 years. One of those was granted to Hot Chili, which has since placed that permit into Huasco Water — of which they own 80%.

Hot Chili is now very much in the driver’s seat for water supply of a region which is on the cusp of a major development cycle.

Now, I don’t believe that this situation allows Hot Chili to unreasonably leverage their position; that isn’t what the Chilean government would promote or accept.

What it means, though, is that HCH has a major source of value that the market isn’t giving them credit for.

So the question begs: What are the water rights worth?

It’s a great question, one that I can’t fully answer.

What I will draw your attention to is Antofastga’s deal with Transelec and Almar Water Solutions for $600M. That situation is a little different because it includes some existing infrastructure, but essentially gives us a rough idea of what these types of assets are worth.

Further, Hot Chili completed an economic study on the Huasco Water business, which proves its potential — 2 Stage / 1300L/s Desalinated Water Supply: Post-tax NPV(8%) of US$977M and IRR of 19%.

Not only do I think that this supply is meaningful for Chilean development projects, but it is an obvious source of water for the Argentinian side, too.

I think one of the biggest misnomers right now is the water situation for a few of the largest copper development projects in the world — BHP & Lundin’s Jose Maria and Filo projects.

Personally, I don’t think they have an alternative to doing an off-take agreement with Hot Chili’s Huasco Water. . .

Concluding Remarks

Nothing is for sure in life, especially in the junior mining sector. However, once in a while there are asymmetric bets that you can make that are mostly a function of time, rather than the solving of some other specific issue.

In my view, the opportunity in Hot Chili is one of those high-potential asymmetric bets whose value recognition is just a matter of time.

Currently, Hot Chili’s MCAP is around $70M, which I think is extremely cheap.

Its flagship project, Costa Fuego, has a PFS completed on it with an after-tax value well over US$1B at today’s copper price. Not only is the project undervalued to the current state of development, but I think it has a clear path towards optimization with the combination of the discovery at La Verde.

The real X-Factor lies with Huasco Water, which holds the water rights to a region of Chile and Argentina which is on the cusp of major development.

Mine construction and operation don’t happen without water, and, therefore, this is a catalyst that is very much a when question, not if.

With over AU$10M in cash, continued drilling at La Verde and the potential for water offtake agreements to be signed with Huasco, I believe it is only a matter of time before Hot Chili’s value is recognized by the market.

Hot Chili strengthens team to push Chile projects into development

Andrew Todd BULLS N’ BEARS

Hot Chili has secured the services of two seasoned mining executives to bolster leadership as the company progresses its Costa Fuego copper-gold project and Huasco Water venture in Chile’s Atacama region.

Ex-Gold Fields Australia executive Stuart Mathews joins as non-executive chairman, while Chilean copper expert Alberto Cerda assumes the role of project director. Cerda brings a particular set of skills… namely in mine development and operations to support the company’s upcoming definitive feasibility studies for both projects.

The appointments align with Hot Chili’s strategic focus on advancing its low-altitude, copper and water projects amid a looming copper market, which has international majors clamouring for quality.

Hot Chili says Mathews’ and Cerda’s proven expertise in delivering large-scale mining operations – particularly in Chile in Cerda’s case – positions the company to navigate the complexities of project development, resource optimisation and strategic partnerships in the world’s top copper producing country.

Costa Fuego is a large copper-gold porphyry set to churn out 116,000 tonnes per annum of copper-equivalent metal, which includes 95,000t of copper and 48,000 ounces of gold in its first 14 years. Importantly for Hot Chili’s metals mix, chairman Mathews comes from a gold mining background as the recent executive vice president for Gold Fields in Australasia, where he oversaw operations producing more than 1 million ounces of gold annually.

Cerda takes care of the copper background as a Chilean mining engineer with more than 40 years of experience in major copper projects in Chile for companies such as Newmont, Barrick and BHP Billiton.

Hot Chili’s projects are strategically positioned to benefit from rising copper demand and regional infrastructure needs. Costa Fuego’s robust economics and Huasco Water’s exclusive water supply permit make it strategically significant to the region.

With environmental permitting and exploration ongoing, the company is well-placed to deliver and further extend its overall resource numbers, thanks to a recent discovery of copper-gold porphyry mineralisation at its non-contiguous but nearby La Verde project.

Located 60 kilometres from Las Losas port on Chile’s coastal range, Costa Fuego is Hot Chili’s flagship project. A recent prefeasibility study outlined a 20-year mine life with a maiden ore reserve of 502Mt grading 0.37 per cent copper, 0.10 grams per tonne (g/t) gold, 0.49g/t silver, and 97 parts per million (ppm) molybdenum, with a contained 1.86Mt copper, 1.58M ounces gold, 7.95M ounces silver and 49,000t molybdenum.

The project is expected to generate a post-tax net present value (NPV) of US$1.2 billion at a US$4.30 a pound copper price and US$2280 per ounce gold price. At current market prices, the NPV increases to US$2.2B, with a 19 per cent internal rate of return and a five-year payback on US$1.27B capital expenditure.

Hot Chili’s 80 per cent-owned Huasco Water project, in partnership with Compañia Minera del Pacifico, addresses critical water scarcity in the Huasco Valley.

Secured after a decade-long regulatory process, Huasco Water holds the region’s only maritime licence for seawater supply, providing the project with a significant competitive advantage. Its recent pre-feasibility study detailed a two-stage development plan to supply water to local major copper producers, to earn an estimated revenue of US$9.35B and a US$977M NPV over 22 years of supply.

The company has completed its baseline environmental studies and a second maritime concession application is under review, positioning Huasco Water, like Costa Fuego copper, to commence supply by the end of the decade.

With copper prices soaring and gold continuing at all-time highs, the appointments come at pivotal time in the company’s development. Hot Chili says it remains on a tidy $7.5M cash pile to rapidly expand its resources, while simultaneously courting strategic partners for production at its huge copper and water undertakings.