Hot Chili rocks out as drilling reveals potential scale of “major” La Verde copper-gold discovery

February 11, 2025 | Stockhead

- Hot Chili drilling intersects more broad zones of copper-gold mineralisation at La Verde

- Results highlight potential to be the company’s next major copper-gold discovery

- Assays pending for a further seven holes while step-out drilling is underway

Special Report: Hot Chili now has multiple new significant drill intersections from a further 10 holes to prove that its La Verde project in low elevation coastal Chile is a major copper-gold porphyry discovery.

The company first received a taste of the project’s potential back in mid-December 2024 after announcing very thick copper-gold intersections from its first two drill holes.

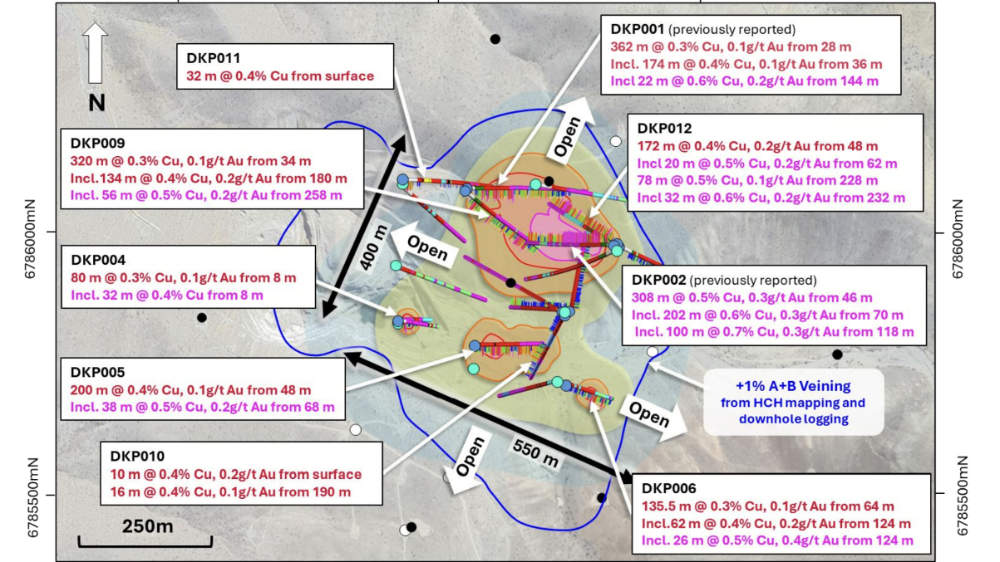

Hole DKP001 got the show on the road with a 174m intersection grading 0.4% copper and 0.1g/t gold from a down-hole depth of just 36m before DKP002 quickly blew Hot Chili’s (ASX:HCH) expectations out of the water with a stunning 308m interval at 0.5% copper and 0.3g/t gold from 46m to end of hole.

DPK002 also hosts a higher grade zone of 202m at 0.6% copper and 0.3g/t gold from 70m, which is encouraging from a development standpoint as its places the richest resources closer to surface.

A fantastic start no matter how you look at it and one that just got a whole lot better.

Assays from another 10 holes have now returned broad, consistently mineralised intersections extending over 300m vertically that start from shallow depths.

Notable intersections from the rapidly growing oxide and sulphide find are:

- 320m at 0.3% copper and 0.1g/t gold from 34m to EOH including 134m at 0.4% copper and 0.2g/t gold from 180m and 56m at 0.5% copper and 0.2g/t gold from 258m (DKP009)

- 200m at 0.4% copper and 0.1g/t gold from 48m to EOH including 38m at 0.5% copper and 0.2g/t gold from 68m (DKP005); and

- 172m at 0.4% copper and 0.2g/t gold from 48m including 20m at 0.5% copper and 0.2g/t gold from 62m with a separate intersection of 78m at 0.5% copper and 0.1g/t gold from 228m to EOH including 32m at 0.6% copper and 0.2g/t gold from 232m (DKP012).

Major discovery

The new drill results outline La Verde’s potential scale with managing director Christian Easterday saying the project is shaping up to be the company’s next major copper-gold discovery that could lift the scale of its Costa Fuego project.

“With primary copper supply declining, copper and gold prices rallying, and a PFS on each of our planned businesses (copper-gold and water) nearing completion – momentum is building fast,” Easterday said.

“Following in the footsteps of our successes at Cortadera and Productora, we’ve secured full control of La Verde after years of strategic consolidation, finally allowing us unrestricted access to test this historically overlooked porphyry system.

“Drill results have exceeded expectations, revealing a much larger porphyry system than first recognised, with broad, consistent copper-gold mineralisation extending from shallow depths and largely hidden below shallow gravel cover.

“This discovery has all the signs of becoming our third bulk-tonnage, copper-gold deposit, and is open in all directions and growing fast. We’re also preparing to deploy AI-powered exploration to fast-track our nearby exploration growth pipeline, leveraging 16 years of expertise in Chile.

“With La Verde’s scale potential and the Costa Fuego copper-gold hub expanding, we’re at a major inflection point in Hot Chili’s growth story.”

The project, which hosts the historical La Verde copper mine, is at the core of the historical Domeyko mining district and in the centre of the company’s recently consolidated and larger Domeyko landholding.

La Verde drilling

To date, HCH has drilled 19 holes totalling 5700m at La Verde and received assays from 12 holes.

This has defined a discovery footprint measuring 550m by 400m that remains open in all directions.

Mineralisation starts from shallow depths and extends to more than 300m below surface with indications that its deeper potential remains untapped as eight of the holes reported to date ended in mineralisation.

Adding further interest, the gravel cover at La Verde could mask a much larger porphyry system with the company noting that step-out drilling is now underway.

Drill testing of the historical oxide copper open pit at the project is also pending.

HCH is now awaiting assays from seven additional reverse circulation holes.

It is also planning to carry out diamond drilling to test potential for deeper, higher-grade zones at depth and to test potential for +1km vertical depth extent, typical of other recent major porphyry discoveries, such as the company’s Cortadera discovery and BHP/Lundin Mining’s Filo del Sol find.

Hot Chili’s standout drill intersections raise the mercury at La Verde

December 18, 2024 | Stockhead

- Hot Chili’s thick copper-gold intersections validate historical drilling at its La Verde project

- Second hole’s 308m intersection at 0.5% copper and 0.3g/t gold exceeds expectations

- It also highlights La Verde’s potential to host a higher-grade copper-gold zone

Special Report: Hot Chili’s initial drilling at La Verde has validated its decision to acquire the historical copper mine in Chile after returning thick copper-gold intersections.

While the first hole – DKP001 – provided a good show with a 174m intersection grading 0.4% copper and 0.1g/t gold from 36m, the second hole about 120m to the southeast really upped the ante after recording a 308m interval at 0.5% copper and 0.3g/t gold from a down-hole depth of 46m to the end of hole.

Not only did DKP002 exceed the company’s expectations and end in mineralisation, it also intersected a higher grade zone of 202m at 0.6% copper and 0.3g/t gold from 70m.

The results are hugely encouraging for Hot Chili (ASX:HCH) as the La Verde porphyry footprint measures about 850m by 700m, which is roughly comparable to its higher-grade Cortadera Cuerpo 3 copper-gold porphyry about 30km to the north.

Cuerpo 3 is also the largest porphyry at Cortadera with a higher confidence indicated resource of 798Mt grading 0.45% copper equivalent, or contained metal of 3.6Mt copper and 3Moz gold, and inferred resources of 203Mt at 0.31% CuEq.

What this means is that further drilling successes could unlock another resource of similar size, which will in turn provide a substantial boost to the company’s Costa Fuego copper hub.

La Verde mine

The historical La Verde open pit mine in the Domeyko mining district, which the company acquired in November 2024, was previously exploited by private interests for shallow porphyry copper-style oxide mineralisation with limited drill testing outside the central lease or at depth.

Importantly, it sits in the centre of the company’s recently consolidated and larger Domeyko landholding, secured in an option agreement back in April 2024.

This marks the first time the area has been consolidated, and provides the company with access to a much larger potential porphyry copper deposit footprint measuring around 1.4km by 1.2km.

HCH promptly launched and completed a 12-hole reverse circulation drill program totalling ~3150m with the first two holes designed to validate historical drill intercepts and test the interpreted northern extension of the porphyry from the open pit.

While DKP001 was successful in validating the most notable copper intercept from historical drilling, the assays from DPK002 really demonstrated the value of La Verde by highlighting its potential to host a higher-grade copper-gold zone.

The consistent higher-grade results confirm the extension of the porphyry system almost 400m to the northeast of the open pit, a significant step out considering the existing pit measures about 200m by 400m.

It is also located immediately beneath a gravel cover sequence which obscures the ultimate extent of the porphyry system.

Assays are pending for the remaining 10 holes though the success of the first holes has prompted HCH to expand the RC program by another 2000m of drilling, expected to be completed in late January 2025.

Kristie Batten: BHP’s Filo takeover shortens list of large copper developers

September 23, 2024 | Kristie Batten

One of Australia’s top mining journalists, Kristie Batten writes for Stockhead every week in her regular column placing a watchful eye on the movers and shakers of the small cap resources scene.

When BHP (ASX:BHP) and Lundin Mining Corporation announced a joint bid for Toronto-listed copper explorer Filo Corp in late July, it set pulses racing.

The C$4.1 billion cash and scrip bid represents a premium of 32.2% and will give the pair ownership of the Filo del Sol copper project.

BHP will also buy 50% of Lundin’s Josemaria project for US$690 million.

Both projects sit on the border of Chile and Argentina.

Goldman Sachs forecasts the two projects have the potential to produce a combined 400,000t of copper per annum, but could cost US$12-16 billion due to the infrastructure, which would include a desalination plant and concentrate pipeline.

Hot Chili (ASX:HCH) managing director Christian Easterday was quick to highlight the lack of large-scale copper projects outside the majors in his presentation to the Precious Metals Summit in Colorado this month.

“There’s not many of us out there and there’s not many that are meaningful and near-term,” he said.

“With Filo being taken over by BHP, the list just got shorter.”

In fact, according to Hot Chili, there are only a handful of projects with the potential to produce around 100,000tpa of copper sitting in companies outside the majors.

Hot Chili’s Costa Fuego in Chile is one. The others are SolGold’s Cascabel project in Ecuador, Los Andes Copper’s Vizcachitas project in Chile and McEwen Mining’s Loz Azules project in Argentina.

All are in South America, reaffirming the region’s position as a global hot spot for copper.

“The region hosts almost 20% of new copper supply,” Easterday said.

Capstone Copper is ramping up its Mantoverde copper project in Chile to the north of Costa Fuego, which Easterday says is similar to what Hot Chili is aiming to build.

Costa Fuego

Hot Chili, which has spent $220 million at Costa Fuego, completed a preliminary economic assessment for the project in 2023, outlining capital costs of US$1.05 billion.

Costs are low compared to the company’s copper peers due to Costa Fuego’s low elevation and proximity to the coast.

“It’s half the cost to build because we’re not up in the Andes,” Easterday said.

The project is projected to produce 112,000t of copper equivalent in the first 14 years at a C1 cash cost of US$1.33 per pound, net of by-product credits.

Using a US$3.85/lb copper price and US$1750 an ounce gold price, the project has a post-tax net present value of US$1.1 billion and internal rate of return of 21%.

“We are not special by grade, but we’re special by the location and that has directly led to these financial outcomes,” Easterday said.

A pre-feasibility study is underway and due for completion by the end of the year.

Copper is now trading at around US$4.26/lb, while gold is at a record of above US$2600/oz.

“Every US10c above US$3.85 (copper), we add about another US$100 million NPV after tax to the bottom line,” Easterday said.

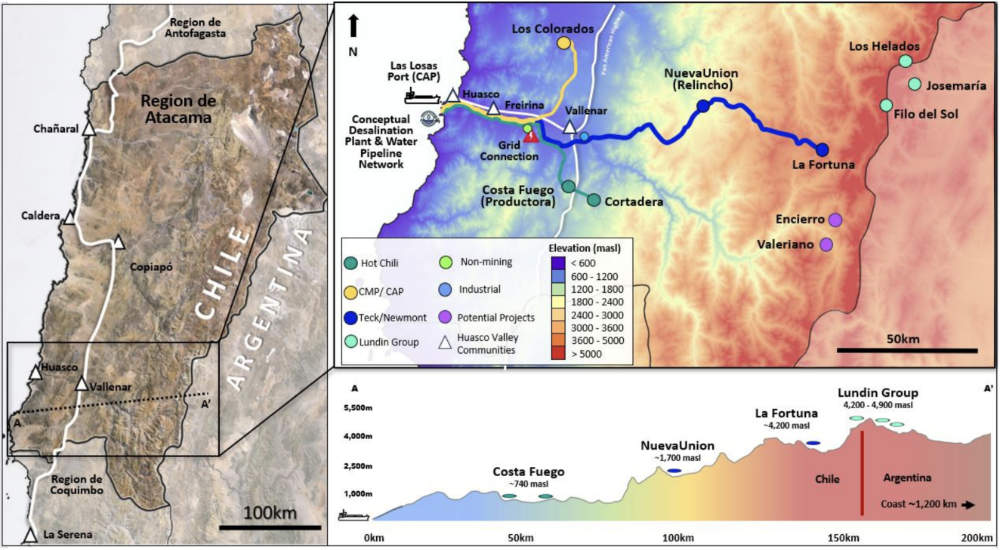

Hot Chili’s “secret weapon” for funding the project is its new 80%-owned subsidiary, Huasco Water, a joint venture with Compañía Minera del Pacífico.

Huasco holds a maritime water permit and will aim to develop a multi-user seawater and desalinated water supply network for communities, agriculture and new mining developments in the Huasco Valley region of Chile.

The company will release a study on the water business in the coming months.

“The project is positioned for major catalysts at the end of this year,” Easterday said.

ASX unmoved

Despite owning the largest copper development project on the ASX outside the majors in the world’s hot spot for copper development and M&A, Hot Chili shares have fallen by 37% over the past year.

The company listed on the TSX in 2021, but it still underperforms against its Toronto-listed peers.

Of the four firms that issue research coverage on Hot Chili, three are based in Canada, further highlighting the disinterest in the Australian market.

That’s despite counting Glencore as its major shareholder.

“We’re in the early stages of a copper cycle,” Easterday said.

“It’s a very, very different cycle we’re moving into. It’s about lack of supply.”

Earlier this year, S&P Global Commodity Insights found that the average time from discovery to production was now 16.3 years.

“The timeframes of 17-20 years to develop these assets are very real,” Easterday said.

“We’re sitting at probably the precipice of an electrification future, where copper is the key ingredient, and we simply don’t have an answer about where the supply is going to come from.”

Easterday said the incentive price still needed to be higher for new large-scale copper mines.

“We’re like a large-scale iron ore producer when iron ore is sitting at US$20/t,” he said.

Hot Chili pours new water company into Chilean valley

July 8, 2024 | The West Australian

Hot Chili has entered into a new joint venture (JV) aimed at supplying seawater and desalinated water to mining projects throughout Chile’s Huasco Valley where it is pursuing its own mammoth Costa Fuego copper-gold project.

The company today confirmed it will hold an 80 per cent interest in Huasco Water and its critical water assets in the JV with Chilean iron ore company Compania Minera del Pacifico (CMP). The new company is expected to supply desalinated water to operations including Costa Fuego and CMP’s Los Colorados iron ore mine.

The JV says further offtake negotiations are already underway.

The Huasco Valley region in Chile’s Atacama Desert is one of the driest regions on Earth, inducing significant water demands from mining operations and local communities. The new water initiative reflects an increasing trend in the Atacama region towards collaborative water infrastructure development, highlighted by a recent US$600 million (AU$890 million) deal for Antofagasta Minerals’ Atacama water rights and assets.

The Company has been receiving increasing interest from potential strategic funding parties in its advanced Costa Fuego copper-gold development and its recently announced Water Supply Studies. This interest, in combination with a rising copper price environment, provides confidence to accelerate the Company’s growth and development plans whilst preserving control of these assets.

Hot Chili managing director Christian Easterday

The company holds the only granted maritime water concession and necessary permits to provide critical water access to the Huasco Valley. It has outlined about 3700 litres per second of potential future desalinated water demand from new mine developments around the valley alone.

The JV partners are likely to underpin Huasco Water as potential foundation offtakers with the Costa Fuego copper project requiring some 700 litres per second of future seawater demand, while Los Colorados needs a further 200 litres per second. Hot Chili says significant economic, environmental and social synergies exist for all potential customers in the Huasco Valley, especially given growing community and regulatory opposition to continental water extraction in the Atacama.

Initial offtake discussions are already underway with nearby mine developers, with additional non-mining desalinated water customers expected to come from the area immediately adjacent to the Costa Fuego copper hub.

The Costa Fuego copper-gold project, which lies some 740m up the hill from the proposed Huasco desalination plant, features a measured and indicated resource that sits at 798 million tonnes at 0.45 per cent copper equivalent for 3.62 million tonnes of copper equivalent, containing 2.91 million tonnes of copper, 2.64 million ounces of gold, 12.8 million ounces of silver and 68,100 tonnes of molybdenum. It makes it one of a limited number of “globally-significant” copper developments that are not in the hands of a major mining company.

Hot Chili recently executed a $29.9 million fundraising campaign on the back of a US$15 million (A$22.23 million) net smelter royalty (NSR) deal with Osisko Gold Royalties, aimed at driving its Costa Fuego copper hub in Chile into production. It comes as the red metal’s price recently launched to 60-year highs, prompting majors across the world to look to acquire copper-producing assets of scale.

The Costa Fuego prefeasibility study (PFS) is expected in the second half of this year.

By further securing its water supply and also creating a new company capable of luring significant offtake partnerships, Hot Chili now feels confident enough to sink another 25,000m of drilling into the project. It will also pursue more regional exploration and land consolidation in a show of confidence at the copper project, taking final steps forward before a bankable feasibility study and final investment decision.

Copper, water and deep pockets of cash have Hot Chili set up for an eventful second half of the year. And with copper prices remaining solid, the company appears well-positioned now to give its giant Costa Fuego project a good crack at development.

Hot Chili’s new JV to ensure water supply security for Costa Fuego

July 8, 2024 | STOCKHEAD

- Hot Chili forms water joint venture with Chilean iron ore company Compania Minera del Pacifico

- Huasco Water will develop a multi-user seawater and desalinated water supply network

- This will supply future water demand for communities, agriculture and new mining developments for the Huasco Valley region

Special Report: Water is a valued resource that is scarce in areas like the Atacama, which is why copper-gold developer Hot Chili is pairing up with Chile’s Compania Minera del Pacifico to form a water joint venture.

The Atacama region includes the Atacama Desert – the world’s driest nonpolar desert in the world – and is unsurprisingly one of the most water stressed regions of the world.

It is also where Hot Chili’s (ASX:HCH) Tier-1 Costa Fuego copper-gold project is located – specifically within the Huasco Valley that has a long history of mining.

Costa Fuego includes the outstanding Cortadera deposit with an indicated resource of 798Mt grading 0.45% copper equivalent for contained resources of 2.9Mt copper, 2.6Moz gold, 12.9Moz silver and 68,000t of molybdenum.

Costa Fuego also holds a further inferred resource of 203Mt @ 0.31% copper equivalent for 0.5Mt copper, 0.4Moz gold, 2.4Moz silver and 12,000t molybdenum.

Mines typically need considerable amounts of water to operate, a point highlighted by Hot Chili’s estimate the Huasco Valley may need up to 3,700 litres per second of desalinated water in the future for its new mine developments.

A water supply concept study released in February this year confirmed the potential for a large-scale, multi-user desalinated water network serving the entire Huasco Valley, which rather neatly aligns with the Chilean Government’s push for such networks in the Atacama.

Water supply security

Given how important a secure water supply is to mining developments – including Costa Fuego – agriculture and communities in the Huasco Valley, HCH and Chilean iron ore company Compania Minera del Pacifico have established a new water company HW Aguas para El Huasco SpA (Huasco Water).

The 80-20 joint venture will hold the maritime water extraction licence, water easements, costal land accesses and second maritime application previously held by Sociedad Minera El Águila SpA (SMEA), which is also jointly owned by the two companies.

Huasco Water aims to develop a multi-user seawater and desalinated water supply network to supply future water demand for communities, agriculture and new mining developments for the Huasco Valley region of Chile.

HCH and CMP will be foundation offtakers for Huasco Water with the former’s Costa Fuego project expected to consume some 700l/s of sea water while CMP’s Los Colorados iron ore mine will require about 200l/s of desalinated water.

Water offtake discussions are also underway with nearby mine developers and additional non-mining, desalinated water customers situated close to Costa Fuego.

Water infrastructure trends

The company noted that its approach towards potential outsourcing and development of shared infrastructure, in addition to preserving scarce continental water sources, is fast becoming the accepted and responsible approach for unlocking future mining developments in the world’s most prolific copper producing region.

It highlighted Antofagasta’s recent sale of their water assets and water rights to the Centinela copper mine for US$600 million to a consortium of Transelec and Almar Water, which will finance, build, own and operate an expansion project that will sell seawater to the Centinela mine expansion.

The consortium will build a 144km long seawater pipeline using Centinela’s water rights that will parallel the existing pipeline from port to mine, allowing Antofagasta to save US$380M in capital expenditure for the construction of its stage 2 water infrastructure expansion.

HCH said this highlights the strategic nature and implicit value of critical water access rights within the Atacama, and an increasing trend in Chile towards outsourcing in the industrial infrastructure sector.

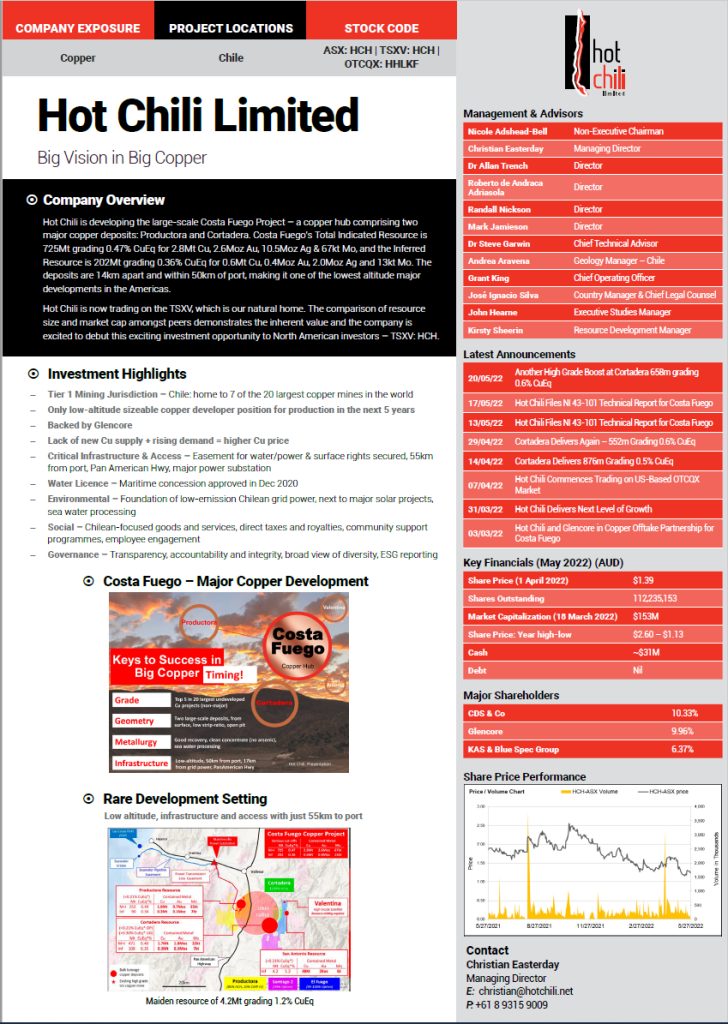

Big Vision in Big Copper

By The Assay – TSX Edition 2022 | June 2022

Full news click on the link below:

Hot Chili Limited Big Cision in Big Copper – The Assay – TSX Edition 2022

Hot Chili Ltd hits the ground running

RESOURCE WORLD | March 31, 2022

Copper explorer ticks all the boxes key for successful large-scale-mine development

After battling to get market recognition on the Australia Stock Exchange, Hot Chili Ltd. has just completed a $34 million TSX.V initial public offering (TSXV: HCH, OTC: HHLKF) that will garner North American eyes on this evolving copper story.

There’s lots to like about Hot Chili. The company, which once traded at a high of A$37.00 on the ASX (2011), has plenty of good reasons for its stock to begin migrating back up toward historical highs. They’ve just announced a resource estimate that renders the flagship Costa Fuego project one of the world’s top 10 largest copper inventories not controlled by a major mining company and will have a pre-feasibility study in hand by the end of 2022, a definitive feasibility in 2024 and be producing copper by 2026.

The good news starts with the new resource estimate upgrade just announced that makes Hot Chili a standout copper resource holder on the TSX.V. 927Mt grading 0.45% CuEq for 4.1Mt of copper equivalent metal (3.3Mt copper, 2.9Moz gold, 12Moz silver and 81kt molybdenum). Importantly, over 80% of Costa Fuego’s resource is classified as Indicated and over one third of the metal grades approximately 0.8%CuEq, and can be accessed by shallow open pit mining.

“The past year has been transformational in terms of reshaping the company. We’ve consolidated our capital structure and completed the exhaustive process of listing on the TSX.V and put ourselves amongst the senior copper developers in the world that have enjoyed significant appreciation with the copper prices going up,” says Christian Ervin Easterday, managing director and CEO of Hot Chili Ltd.

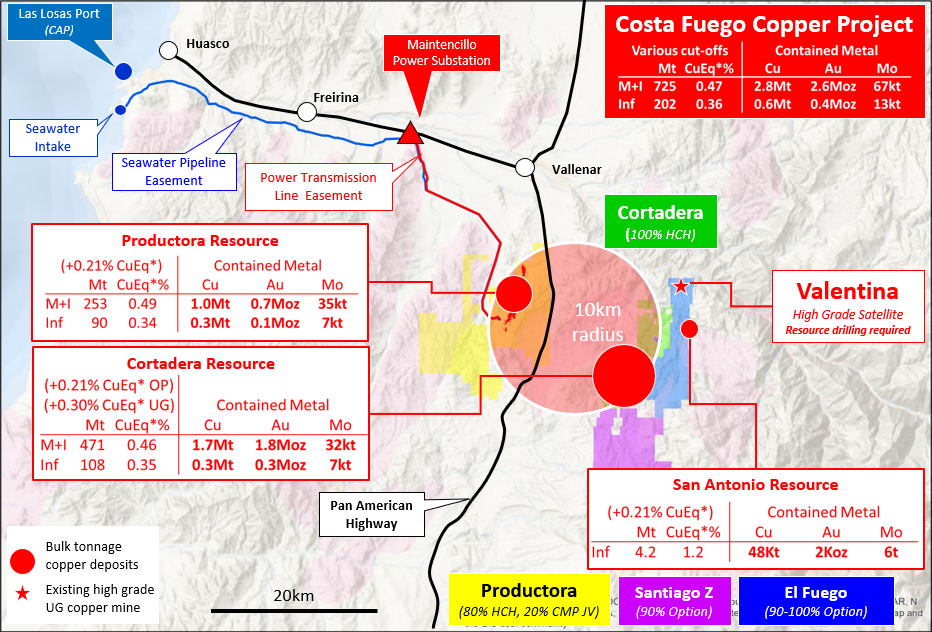

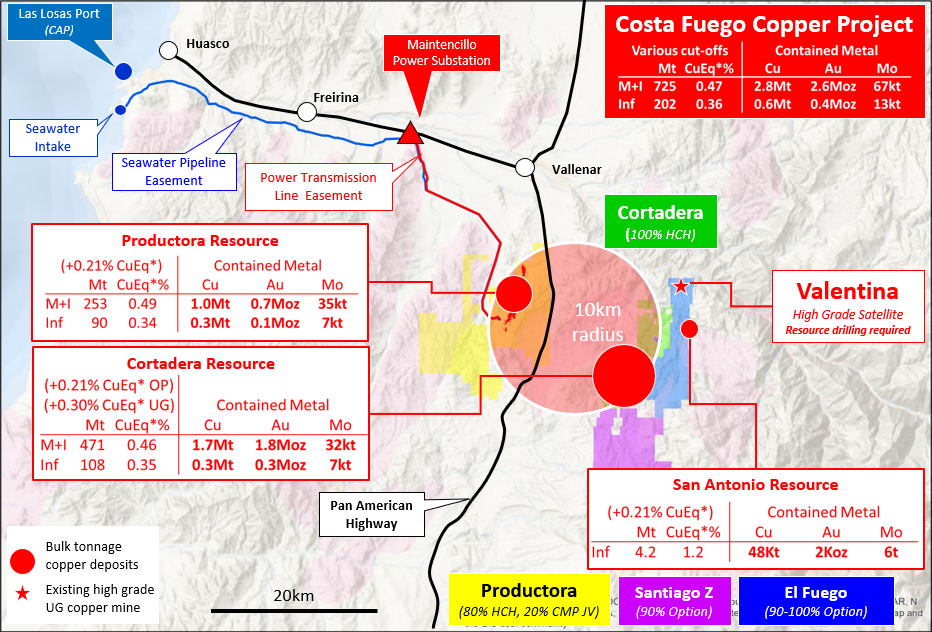

Hot Chili is developing the Costa Fuego project, a copper hub comprising two major deposits—the 100%-owned Cortadera porphyry deposit and neighbouring 80%-owned Productora porphyry-related breccia deposit. The most recent resource upgrade has also included the addition of the close-by, high grade, San Antonio deposit (4.2Mt grading 1.2% CuEq). While the company has been advancing Productora over the better part of the last decade (including a 2016 PFS), the resource potential took a step-change with the addition of the previously privately-owned Cortadera porphyry discovery in 2019.

“We have consolidated our copper deposits to form the Costa Fuego Copper Project – a major copper mining hub located on the Chilean coastal range. The centerpiece of our Chilean copper mining portfolio is the Cortadera porphyry deposit, regarded as one of the most significant copper-gold discoveries of the past decade in Chile,” says Christian Ervin Easterday, managing director of Hot Chili Ltd.

The Company’s profile is further bolstered by the location of the Costa Fuego project at low elevations (less than 1,000m elevation) in Chile’s coastal range, unique amongst senior copper developers in the America’s which are more used to high altitude locations – typically above 3,000m elevation in the high Andes. Costa Fuego is situated almost 600 kilometres north of Santiago, next to the Pan American highway, with access to the power grid and 50 kilometres from the port of Las Losas. Additionally, Hot Chili has surface rights and easements to establish a sea water pipeline and power transmission lines. Also unique is that Hot Chili has a maritime concession, water license, which was approved in December 2020 – a critical element of any project development in the world, not least of all in Chile’s Atacama region.

Global copper demand on the rise

Without new capital investments, Commodities Research Unit (CRU) predicts global copper mined production will drop from 20 million tonnes to below 12 million tonnes by 2034, leading to a supply shortfall of more than 15 million tonnes. Over 200 copper mines are expected to run out of ore before 2035, with not enough new mines in the pipeline to take their place.

Some of the largest copper mines are seeing their reserves dwindle; have to dramatically slow production due to major capital-intensive projects to move operations from open pit to underground. Examples include the world’s two largest copper mines, Escondida in Chile and Grasberg in Indonesia, along with Chuquicamata, the biggest open pit mine on Earth.

These cuts are significant to the global copper market because Chile is the world’s biggest copper-producing nation — supplying 30% of the world’s red metal. Adding insult to injury, copper grades have declined about 25% in Chile over the last decade, bringing less ore to market.

By 2020, the international industry’s head grade was 30% lower than in 2001, and the capital cost per tonne of annual production had surged four-fold during that time — both classic signs of depletion. According to the Goehring & Rozencwajg model, the industry is “approaching the lower limits of cut-off grades,” and brownfield expansions for many of the major copper miners are no longer a viable solution.

“Projects of the scale of Costa Fuego are hard to find. But they’re even harder to find at low altitude, sitting in the middle of infrastructure in one of the top three mining countries of the world. I think what most people don’t know is that over the past two decades head grades for copper have dropped to about half a percent from 1.6 percent copper and now it’s all about economy of scale and that’s the space we are in,” says Ervin Easterday.

Lower grades and increased demand shine a light on the importance of making new discoveries in establishing a sustainable copper supply chain. Over the past 10 years, greenfield additions to copper reserves have slowed dramatically, with tonnage from new discoveries falling by 80% since 2010—something that can’t be changed overnight.

Some of the world’s largest copper companies are doing everything they can to expand existing mines and acquire prospective new deposits, as they seek to replace their rapidly depleting copper reserves and resources.

But it takes many years to bring a copper deposit into production, even for the majors moving from open pit to underground. According to Bloomberg Intelligence, the average lead time from first discovery to first metal has increased by four years from previous cycles, to almost 14 years. In places like the United States and Canada, where miners face strict permitting regulations that can cause significant delays, it’s not unusual for a copper mine to take 20 years to develop.

“I guess you could say we are ahead of the crowd being 12 years into our journey already. There are few copper developers of our scale that have the near-term timelines to production we do,” says ErvinEasterday, who credits the recent Glencore investment on the Company’s advanced exploration and development, project scale and clean concentrate potential (no arsenic).

Vote of confidence from Glencore

Glencore became Hot Chili’s largest shareholder after a series of investments in 2021 where Glencore took a 9.96 percent stake. It also won a seat at the board in the form of Mark Jamieson and further management in the form of participation on the technical steering committee, positions it can hold onto as long as Glencore keeps a minimum 7.5 per cent stake in the company. The investment was backed up recently when Glencore agreed to an eight year off-take agreement to purchase 60 percent of the copper concentrate from Hot Chili’s Costa Fuego copper-gold project in Chile.

“We ensured project financing flexibility with 40 percent of our first eight years of concentrate production remaining uncommitted ahead of initiating project financing discussions in 2022, following completion of the Costa Fuego Pre-Feasibility Study. Glencore’s expertise and support is welcomed and is an important part of our strategy to transform the company into a material copper-gold producer. It is unique to have one of the world’s largest miners as a major shareholder and off-take partner in advance of a PFS” says Ervin Easterday.

Boosting its international capability even further, Hot Chili recently appointed Dr Nicole Adshead-Bell as the company’s independent, non-executive chairman, after she joined the board in January. Residing in Canada, Dr Adshead-Bell has 25 years of technical and investment banking experience across the capital markets and resource sectors and sits on the boards of Toronto-listed Altius Minerals and ASX-listed Matador Mining.

Lots of exploration upside

Fresh with a world-class resource estimate, which is fast approaching 1 billion tonnes, and pre-feasibility in the works, there are no signs of Hot Chili resting on their laurels.

“Now that we have a strong treasury of $30 to $40 million, this year is also about growing our resources from within. We are moving with a series of drill holes on some of the larger scale un-drilled targets on the property,” says Ervin Easterday.

The last word

“I know there is some frustration with retail investors wondering just like myself, how a company holding an asset of the size, quality, location, infrastructure advantage and attracting the attention of one of the top three miners in the world would have a market capitalization at about a fifth of what it probably should be. That frustration is well understood, but we have not shied away from making important decisions. What we are doing her is putting together a 20-to-30-year mine plan on something that has the potential to produce upwards of $US1 billion in revenue annually on long-term copper prices. In addition, we are de-risking our project, and as we hit our catalysts and milestones over the next year, I’m sure the market will look after itself – value will always eventually rise to the top” says Ervin Easterday.

Hot Chili is determined to commission the Cortadera copper gold project by 2026, a time frame that would be the envy of most mining majors. Now with a locked in offtake agreement with Glencore and the further upside to its resource base, it appears Hot Chili will hit the ground running this year.

Full news click on the link below:

Hot Chili Ltd hits the ground running

Hot Chili Heating Up With Surge To Next Level Of Growth

THE ASSAY | Coline Sandell-Hay | March 31, 2022

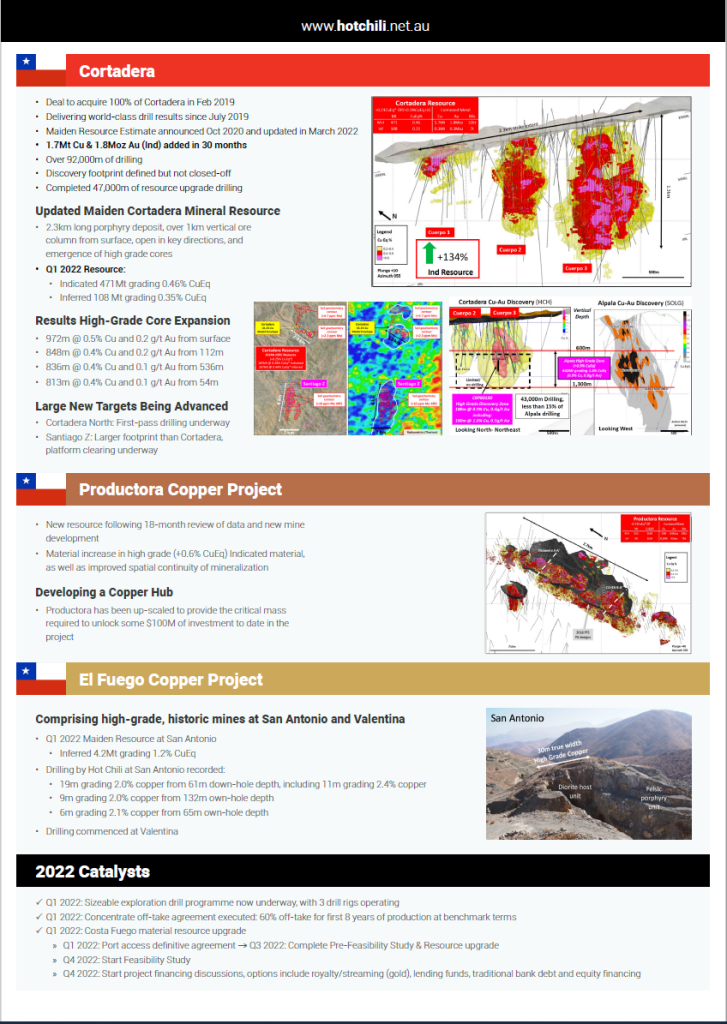

Hot Chili Limited (ASX: HCH) (TSXV:HCH) (OTCQB: HHLKF) has released a major resource upgrade for its coastal range, Costa Fuego copper-gold project in Chile.

Costa Fuego comprises the Cortadera, Productora and San Antonio deposits, all of which have updated Mineral Resource Estimates (MRE) and lie proximal to one another at low-altitude elevations (800m to 1,000m), 600km north of Santiago.

The resource upgrade follows 18 months of material investment, including completion of 52,000 metres of additional resource drilling at Cortadera, purchase of 100% of the Cortadera copper-gold porphyry discovery and execution of an offtake agreement with Glencore for future concentrate production (60% for the first eight years). The Cortadera MRE has delivered the majority of resource growth for Costa Fuego.

Cortadera is defined by over 92,000m of drilling and contains an Indicated resource of 471Mt grading 0.46% CuEq (previously 183Mt grading 0.49% CuEq) and an Inferred resource of 108Mt grading 0.35% CuEq (previously 267Mt grading 0.44% CuEq).

Cortadera’s Indicated resource has grown by 134% and is now able to be studied for conversion into ore reserves in the Company’s Pre-Feasibility Study (PFS), forecast for Q3, 2022.

The Productora MRE has been re-estimated following review of the 2016 MRE, completion of underground mine development and exploration drilling in 2021.

The review and subsequent resource re-estimation has resulted in a material increase in high grade Indicated resources reported above 0.6% CuEq.

High grade open pit resources from Productora are a key focus for the combined PFS and are expected to feature prominently in the early mine schedule for Costa Fuego.

A maiden San Antonio MRE has also been added to the Costa Fuego Hub. San Antonio was historically exploited by small-scale underground mining of high-grade copper. The maiden resource estimate utilised an underground drone survey (increasing the spatial confidence of historic mining activities) and 4,922 metres of drilling undertaken by Hot Chili in 2018.

Managing Director Christian Easterday said the company is encouraged by the initial Inferred resource of 4.2Mt grading 1.2% CuEq.

The high-grade, shallow nature of San Antonio provides an additional open pittable deposit for Costa Fuego’s potential early mine schedule. Further resource upgrade drilling is planned at San Antonio and the nearby Valentina high-grade deposit in the coming months.

“I would like to thank our entire team who have delivered this very strong result on-time and within guidance – elevating Costa Fuego’s position amongst the largest undeveloped copper projects in the world,” Mr Easterday said:

“The world is hungry for advanced, low-risk, senior copper developments with near-term production potential.

“Copper prices are driving higher and new meaningful copper supply is fast becoming a mirage.

“Hot Chili is well positioned to deliver into this forecast supply gap and contribute to the decarbonisation super cycle, particularly due to Costa Fuego’s lower economic hurdle resulting from its low elevation location and proximity to existing infrastructure; including abundant grid power with high renewables contributions.

“We are fully funded for 18 months and on-track to deliver our next resource upgrade and PFS later this year as we transform Costa Fuego into one of the world’s next material copper mines.”

Full news click on the link below:

Hot Chili Heating Up With Surge To Next Level Of Growth

Breathtaking Hot Chili resource upgrade launches Costa Fuego copper-gold to new heights

STOCKHEAD | March 31, 2022

Hot Chili has reinforced its Costa Fuego copper-gold hub’s position as a top tier development project after upgrading its higher confidence Indicated Resource by a massive 67%.

The upgraded Costa Fuego now features an Indicated Resource of 725 million tonnes grading 0.47% copper equivalent, or contained resources totalling 2.8Mt of copper, 2.6 million ounces of gold, 10.5Moz of silver and 67,000t of molybdenum.

This is more than 80% of its total resource and includes a higher grade Indicated Resource of 156Mt at 0.79% copper equivalent with contained resources of 1Mt of copper, 850,000oz of gold, 2.9Moz of silver and 24,000t of molybdenum – more than a third of the total contained resource.

The resource upgrade is another sign that Hot Chili’s (ASX:HCH) plans are coming together in a spectacular fashion, as it follows on the back of a key offtake agreement that will see Glencore buy 60% of the project’s copper concentrate production for an eight-year period at “arm’s-length commercially-competitive” terms.

Managing director Christian Easterday said the resource upgrade elevates Costa Fuego’s position amongst the largest undeveloped copper projects in the world.

“The world is hungry for advanced, low-risk, senior copper developments with near-term production potential. Copper prices are driving higher and new meaningful copper supply is fast becoming a mirage,” he noted.

“Hot Chili is well positioned to deliver into this forecast supply gap and contribute to the decarbonisation super cycle, particularly due to Costa Fuego’s lower economic hurdle resulting from its low elevation location and proximity to existing infrastructure; including abundant grid power with high renewables contributions.

“We are fully funded for 18 months and on-track to deliver our next resource upgrade and PFS later this year as we transform Costa Fuego into one of the world’s next material copper mines.”

Resource upgrade

The Costa Fuego upgrade is the culmination of 18 months of material investment, which included the completion of 52,000m of additional resource drilling at the Cortadera project – the main engine of growth for Costa Fuego.

Cortadera now has an Indicated resource of 471Mt grading 0.46% copper equivalent, a 134% increase over its previous estimate of 183Mt at 0.49% copper equivalent.

And there’s room for further growth with Costa Fuego hosting an Inferred Resource of 202Mt at 0.36% copper equivalent, or contained metals totalling 600,000t of copper, 400,000oz of gold, 2Moz of silver and 13,000t of molybdenum.

This includes a high-grade maiden resource of 4.2Mt at 1.2% copper equivalent at the San Antonio deposit, which represents an additional open pittable deposit for Costa Fuego’s potential early mine schedule.

Hot Chili is also planning to carry out further resource upgrade drilling at San Antonio and the nearby Valentina high grade deposit in the coming months.

Full news click on the link below:

Hot Chili resource upgrade launches Costa Fuego copper-gold to new heights

Hot Chili Warming Up In Chile

The Assay | Colin Sandell-Hay | 2 October 2021

Cortadera’s North Flank Delivers Wide Copper Hits

Hot Chili Limited (ASX: HCH) (OTCQB: HHLKF) has unveiled that recent drill results from its Cortadera copper-gold discovery in Chile continue to demonstrate strong resource growth.

Hot Chili’s Resource Development Manager Kirsty Sheerin said the expansion of the main porphyry was very pleasing ahead of the company’s plans to up-grade the maiden 451Mt Cortadera resource. “The North Flank of the high-grade core to the main porphyry has continued to be a significant resource addition,” Sheerin said.

“We have added approximately 170m of width to Cuerpo 3 and hope to extend several other open flanks to the high-grade core by year-end. “We are also continuing to see positive shallow intersections in the current RC drilling program at Cuerpo 2.

“The next resource upgrade at Cortadera will provide a strong basis for the first combined open pit and block cave mining reserve estimate at our growing Costa Fuego copper-gold development.” Cuerpo 3 North Flank Confirmed as Extensive High-Grade Addition

Continued strong results have been reported from extensional resource drilling across the North Flank to the high-grade core of the main porphyry (Cuerpo 3) at Cortadera.

CRP0134D returned an extensive intersection of 610m grading 0.5% CuEq (0.4% copper (Cu), 0.1g/t gold (Au)) from 216m depth down-hole, including 138m grading 0.8% CuEq (0.6% Cu, 0.1g/t Au) from 634m depth.

Importantly, the high-grade results in CRP0134D were recorded at approximately the same vertical depth and lateral to CRP0124D, which recorded 82m grading 1.0% CuEq (0.7% Cu and 0.3g/t Au) within a broader intersection of 362m grading 0.6% CuEq (0.5% Cu, 0.2g/t Au) from 634m depth.

This recent drilling has demonstrated strong continuity of high grade (+0.7% CuEq) mineralisation and extended the North Flank by approximately 170m. A follow-up hole (CRP0155D) is currently underway to extend the North Flank by a further 80m. CRP0155D is currently at 490m depth and is in mineralisation.

Expansion of Shallow Resources at Cortadera

Initial results have been returned for 5 shallow Reverse Circulation (RC) drill holes at Cuerpo 2. The results have extended the boundary of the resource across the southern, eastern and north eastern flanks of Cuerpo 2.

In addition, CRP0139 was drilled in an up-dip position over the Cuerpo 2 resource and has recorded a 42m intersection grading 0.5% CuEq (0.4% Cu, 0.3g/t Au) from 180m depth to end-of-hole, within a broader 222m zone grading 0.3% CuEq (0.2% Cu, 0.1g/t Au) from surface.

The result of CRP0139 has shown an upgrade in both copper and gold from the maiden resource model in this area. Assay results are pending for a further five drill holes which have recorded wide zones of oxide and sulphide mineralisation from surface.

Additional RC drilling is continuing in this area to determine the potential for this shallow mineralisation to extend further.

Momentum Building Ahead of Canadian TSXV Dual-Listing

Hot Chili is currently the only major copper-gold developer in the America’s that is not listed in Canada. The Company’s low-altitude Costa Fuego copper-gold development in Chile is expected to compare favourably to leading copper-gold developers in Canada, which currently trade at many multiples of Hot Chili’s market capitalisation.

The Company plans to continue building momentum with its activities and news flow ahead of its dual listing on the TSXV in Q4 this year, with several updates expected from ongoing drilling, exploration and development workstreams. Hot Chili is operating five shifts of drilling per day with three drill rigs at Cortadera.

In addition, a fourth drill rig is being sourced to commence drill testing several large-scale growth targets.

Following its dual listing in Canada, Hot Chili aims to release a major resource upgrade from Cortadera followed by the completion of a combined Pre-feasibility study.

These two major milestones will lay the foundation for the company’s transformation into a major copper-gold producer in the coming years.