Market Movers with Barry Fitzgerald – Hot Chili’s Two Key Announcements

Christian Easterday of Hot Chili talks to Joe Mazumdar at the March 2023 Metals Investor Forum

Interview with Rick Rule and Hot Chili CEO Christian Easterday – Rule Investment Symposium – Boca Raton, Florida

Proactive Interview – Hot Chili Ltd says it has ‘quadrupled’ the company’s copper resource base over the past 13 months

Hot Chili gets power boost for Chilean copper project

The West Australian | Matt Birney | 18 August 2022

Hot Chili says its pre-feasibility study will establish Costa Fuego as one of a few new material copper mines in the world set for near-term production. Credit: File

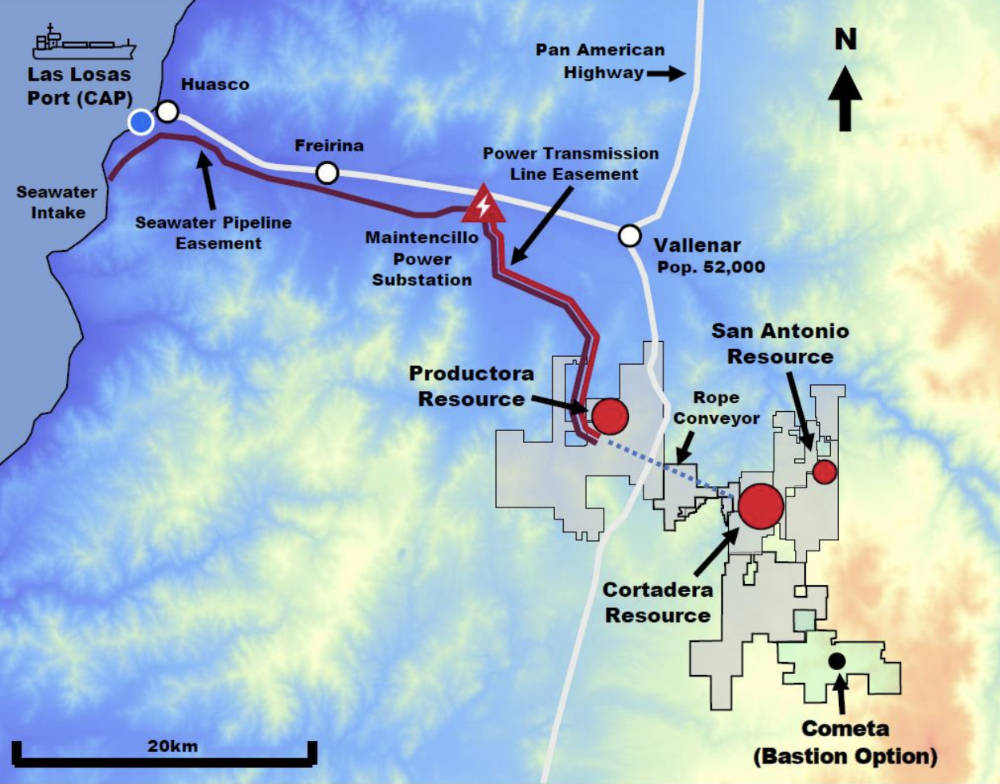

WA-based copper developer Hot Chili has dropped another piece of its Costa Fuego jigsaw into place after Chile’s Central Authority Electrical Regulator approved the company’s application for connection to the Maitencillo sub-electrical power station, 17km from the promising copper project.

Hot Chili says the approval is as a key step forward for the development of Costa Fuego because it will provide access not only to Chile’s national energy grid but also to multiple renewable energy providers.

Discussions have begun with electrical market advisers and providers and several non-binding quotations have been received for long-term power supply.

The selection process for a power provider or providers is expected to begin in the last quarter of this year.

Hot Chili controls 100 per cent of Sociedad Minera La Frontera, the operating company that owns Costa Fuego.

It regards Costa Fuego as one of the few global copper projects with low economic hurdles to clear and without infrastructure or permitting hurdles that might prevent its timely production.

Costa Fuego is at low altitude, about 600km north of the country’s capital, Santiago and only about 55km from the coast and the Las Losas port.

The company is aiming to tick as many “green” boxes as possible for the project and is taking a low-energy intensity development approach.

Water licences have already been granted to use sea water, without the need for desalination, for processing and existing infrastructure.

The company aims to operate the project on a 100 per cent renewable power mix of nearby solar generators, wind turbines and hydroelectric power to add to the project’s environmental credentials.

Hot Chili has been drilling the project’s Cortadera, Productora and Sant Antonio ore bodies to build its planned prefeasibility study, or “PFS” — expected in the first quarter of 2023.

The company says the PFS will establish the project as one of few new material copper mines in the world set for production in the near-term.

Earlier this year, good assay results helped boost Costa Fuego’s mineral resource estimate by more than two-thirds.

The total now stands at 725 million tonnes grading at 0.47 per cent copper equivalent for 2.8 million tonnes of contained copper and 2.6 million ounces of gold.

However, with exploration and resource growth drilling continuing, the company plans on a resource upgrade later this year.

With Hot Chili flagging more announcements across multiple work streams at the project, the rest of this year looks like being an especially busy period for the copper player.

Hot Chili bolsters South American copper ground

The West Australian | Matt Birney | 28 November 2022

Hot Chili has added scale to its South American copper hunt after completing a deal to pick five proximal mining rights. Credit: File

Hot Chili has added scale to its South American copper hunt after completing a deal to pick five proximal mining rights. Credit: File

South American copper explorer Hot Chili has executed an option agreement with Antofagasta Minerals S.A. to procure a 100 per cent stake in five mining tenements that straddle the western extension of its Cortadera copper-gold discovery in Chile. The company is now gearing up to launch an initial 6000m drilling program to test its new ground and bolster its current resource.

Cortadera forms part of Hot Chili’s larger Costa Fuego project that boasts a mammoth 725 million tonne resource base going 0.47 per cent copper equivalent. The figure is derived from inventories embedded across two key deposits which sit 14 kilometres apart: Cortadera and Productura.

Productora offers a 253 million tonnes measured and inferred resource at 0.49 per cent copper equivalent.

At Cortadera Hot Chili has carved out a 471 million tonne resource grading 0.46 per cent copper equivalent in the indicated and inferred categories. The deposit houses more than 1.7 million tonnes of copper, about 1.8 million ounces of gold and 32,000 tonnes of molybdenum.

Importantly, the company says its latest acquisition virtually doubles the prospective strike length of Cortadera’s existing discovery from 2.3km to 4.1km.

Management believes its new ground is vastly prospective and houses a large-scale outcropping mineralised porphyry. At 700m in strike length and 300m in width the company argues the ore body is of similar stature to Cortadera’s main porphyry – Cuerpo 3.

A 2005 drilling campaign across a porphyry coined “Cuerpo 4” inside one of Hot Chili’s new mining rights returned several near surface intercepts including 16m grading 1.3 per cent copper equivalent from 28m inside a broader 128m parcel at 0.5 per cent copper equivalent from 28m.

The company says the nature of the strikes at Cuerpo 4 suggests it could establish an open pit resource at the site – a play that could allow it to vector in on the ground’s shallow copper, gold and molybdenum mineralisation.

Hot Chili now plans to drill test a pair of targets within Cuerpo 4 using a cocktail of RC and diamond-lead programs.

To claim a 100 per cent stake in the mining rights Hot Chili is obliged to complete 6000m of drilling and finalise the payment of a US$1.5 million option exercise price.

After the option has been exercised, Antofagasta Minerals S.A. has the opportunity to re-establish a 55 per cent interest in the mining rights by paying 55 per cent of the option’s exercise price and five times the option period’s exploration costs.

Management says the deal represents a strategic consolidation of the Cortadera porphyry deposit region and has the potential to provide the Costa Fuego copper hub with an economic and organic pathway to resource expansion.

Hot Chili doubles down on South American copper play

The West Australian | Matt Birney | 30 Nov 2022

Core logging at a Hot Chili copper project in South America. Credit: File

Hot Chili has completed another land grab in South America, picking up seven new tenements for 757 hectares that have extended the boundaries of its Cortadera copper-gold discovery in Chile.

The purchase is hot on the heels of an adjacent acquisition yesterday that landed it a five-piece package of prospective copper ground that flanks the western rim of Cortadera.

The newly acquired tenements were obtained at a total cost of just US$110,000 through a government-run open auction.

The company says three of the tenements coined “Falla Maipo 2”, “Falla Maipo 3” and “Falla Maipo 4” bore the entirety of the financial burden whilst the remaining four were granted following forfeiture of overlapping third-party mining rights.

The Falla Maipo tenements adjoin the company’s existing copper ground at Cortadera and extend its potential strike length to 5.2 km.

Hot Chili says the acquisition of the seven new tenements are significant as they house four substantial copper porphyries that could expand the scope of its overall Costa Fuego copper-gold development.

Additionally, the acquisition consolidates Cortadera’s western extension and permits the company to get boots on the ground to explore a potentially much larger porphyry cluster.

Porphyry copper deposits are ore bodies formed when hydrothermal fluids deposit minerals from magma chambers and are major sources of the metal. The deposits are commonly found in regions of volcanic activity and a suite of them are currently being worked across Canada, Peru, Chile and Mexico.

Notably, the four new porphyries located within Hot Chili’s new tenements add a significant prospective strike length to a pair of mineralised trends.

The company’s Las Canas trend which hosts 4 porphyry targets has been extended by 1.8km whilst the Cortadera trend has been stretched by an additional 1.1km.

The Cortadera trend hosts a large porphyry target along strike from the Cortadera deposit and also takes in a mineralised fault corridor that connects the company’s Cortadera and Productora copper-gold deposits.

Cortadera is a fragment of Hot Chili’s larger Costa Fuego project that houses a gargantuan 725 million tonne resource base going 0.47 per cent copper equivalent. The number is drawn from two key assets located about 14 kilometres apart: Cortadera and Productora.

The Cortadera deposit hosts a 471 million tonne indicated and inferred resource going 0.46 per cent copper equivalent. The deposit takes in more than 1.7 million tonnes of copper, 1.8 million ounces of gold and 32,000 tonnes of molybdenum.

Productora hosts a 253 million tonnes measured and inferred resource grading 0.49 per cent copper equivalent.

In what could serve as a shot in the arm for Hot Chili a recent report by the Mineral Council of Australia suggests global demand for copper is tipped to rise from about 23.5 million tonnes in 2019 to 31.1 million tonnes in 2030.

Next Phase of Copper-Gold Growth Begins

Investing News Network | 13 Jan 2022

Hot Chili Limited (ASX: HCH) (TSXV:HCH) (OTCQX: HHLKF) (“Hot Chili” or the “Company”) is pleased to announce that drilling has commenced across the recently secured western extension to the Cortadera copper-gold discovery, the centrepiece of the Company’s low-altitude, Costa Fuego senior copper development in Chile.

One diamond drill rig (operating on a double-shift basis) and one reverse circulation drill rig (operating on a single-shift basis) are in operation, testing the potential for Cortadera to host a much larger copper porphyry cluster than currently defined.

The initial programme, comprising approximately 10,000m of drilling, will test four porphyry targets (including three targets on the recently optioned AMSA landholding) added to Cortadera through successful consolidation efforts announced in late November 2022.

Importantly, Hot Chili has more than doubled the prospective strike length of the discovery from 2.3km to 5.2km (as outlined in figure 3), increasing the near term, material resource growth potential for Hot Chili.

Cortadera’s current Indicated resource of 471Mt grading 0.46% CuEq for 1.7Mt copper and 1.8Moz gold and Inferred resource of 108Mt grading 0.35% CuEq for an additional 0.3Mt copper and 0.3Moz gold (ASX announcement dated 31st March 2022) is contained within three porphyry centres.

Both drill rigs are currently drilling Cortadera’s potential fourth porphyry (Cuerpo 4), where previous historical drilling had intersected encouraging shallow copper-gold porphyry mineralisation, including COR-03 which recorded 128m grading 0.5% CuEq (0.4% Cu & 0.1g/t Au) from 28m downhole depth, including 16m grading 1.3% CuEq (1% Cu & 0.5g/t Au) from 28m (as announced to ASX and TSXV on 28th November 2022).

The Company is well funded to complete its planned drilling and deliver its next set of key growth and development milestones for Costa Fuego this year, including: a Preliminary Economic Assessment (PEA) in H1; and a resource upgrade in H2.

This next growth phase provides an opportunity to optimise and potentially up-scale Costa Fuego’s future annual metal production rates, currently being studied at up to 100kt Cu and up to 70koz Au for a +20-year life of mine.

The Company plans to deliver Costa Fuego’s Pre-feasibility Study (PFS) in H1 2024 and remains on-track as one of only a few near-term production projects in the world capable of producing +100 ktpa Cu in the next five years, while also boasting low capital intensity and strong ESG credentials.

The Directors look forward to an exciting period of news flow and results from drilling activities at Cortadera this year.

Click here for the full News Release

BHP crystal ball gazer upgrades warning of impending copper deficit

Barry Fitzgerald | August 2023

Increasing supply challenges and soaring demand means copper price take-off must be close. And RareX eyes DSO fertiliser to help it grow.

BHP’s erudite vice president of market analysis and economics, Huw McKay, lobbed his commodity outlook report during the week alongside the company’s FY2023 profit report.

His report was interesting reading as always. The main findings from a short-term perspective were that there could be a balanced copper market emerging and that iron ore remains broadly balanced.

No surprise in the latter (price support is expected in a $US80-$US100t range) but the call on copper represents an upgrade from the call in February that the market was facing a short-term surplus with its price pressure implications.

The suggestion that the surplus which most were forecasting in the next couple of years could in fact be replaced by a balanced market does not carry the same importance for BHP in isolation as it does for the broader copper and equity markets, where negative sentiment reigns on all things copper and economic.

So it is a nice tonic for ASX-listed copper equities.

McKay made the point that better Chinese end-use demand, particularly for its green energy build-out, electric vehicles and housing completions (as distinct from housing starts where there is some real drama), and likely higher operational shortfalls at the world’s fleet of copper mines than most are forecasting, indicated the potential for a balanced copper market, or maybe just a small surplus.

As it is, the copper price is doing okay anyway at $US3.80/lb, even if it is below the June half year average of US$3.95/lb. But where things get really interesting for the metal is the medium term (FY2025-FY2026) to the long-term, (FY2027 and beyond).

McKay’s call on copper for the long-term remains super bullish, which is just as well as his bosses set out to spend as much $US20 billion expanding copper production in South Australia and Chile in coming years.

In short, McKay is forecasting “pronounced” (supply) deficits in the copper industry’s medium-term future. He did not say so, but that means a take-off in copper prices can’t be that far off, remembering that it is almost Christmas.

Actually, Mckay did reference a take-off from a demand perspective.

“These expected deficits are a joint function of historical under–investment in new primary supply and geological headwinds at existing operations intersecting with the ‘take–off’ of demand from copper–intensive energy transition spending that we expect will be a key feature of global industry dynamics as the final third of the 2020s arrives, if not earlier,” McKay said.

“Our confidence in medium term deficits is underpinned by both the demand and supply side, but if forced to elevate one over the other, supply headwinds would be the #1 motive force.

“Simply put, the supply response to supportive demand and price signals in the 2020s to date has been underwhelming, despite copper’s future-facing halo effect. And time is running very, very short to turn that story around.

“It is quite apparent that there is a very substantial disconnect between what needs to be done at the macro level to support both rising traditional demand and the exponential lift in metal needs implied by the energy transition and what is occurring at a micro level.”

McKay has previously estimated that in a “plausible upside” case for demand, the cumulative industry-wide growth capex bill out to 2030 (which will be here before we know it) could reach one–quarter of a trillion dollars.

Now he is saying that an updated analysis suggests that could be an under–estimate.

McKay added that the capex mountain presumes that there projects ready and waiting.

“The reality is that the industry’s collective set of development options is modest by comparison with prior decades, with the well–known lack of discoveries, the depth and complexity of what has been found, and the lengthening catalogue of above-ground risks and regulatory hurdles that confront project developers all adding to the challenges of bringing additional copper to end–users in a timely fashion,” he said.

“We reiterate our view that the price setting marginal tonne a decade hence will come from either a lower grade brownfield expansion in a mature jurisdiction, or a higher grade greenfield in a higher risk and/or emerging jurisdiction. None of these sources of metal are likely to come cheaply, easily – or, unfortunately, promptly.”

COPPER JUNIORS:

There is a message in all that for the junior copper explorers and would-developers out there – stick to your knitting and resist the temptation to go off on the lithium hunt, a sector BHP does not rate because of a lack of “rent” in coming years as supply grows hand over fist.

It is warming stuff for the copper juniors. They have being doing in tough in recent months as investors fret about the China slowdown.

But by BHP’s road map, their day in the sun will arrive around 2025 when the world wakes up to the profound supply deficits coming in the back third of the decade, something the market will front run by a couple of years by supporting both the copper producers and juniors.

Most of the likely candidates to benefit from that scenario have been mentioned here before and include names like Hot Chili (HCH), Coda (COD), Caravel (CVV) and Hammer (HMX). All have established copper resources with exploration upside.

CHINA:

A final message from McKay which is really a maths lesson. It has particular relevance to the current hysteria about China’s economy falling into a hole in the longer-term because of its ageing population, among other things.

While China has set a GDP growth target of 4.7% for this year, McKay reckons that come the 2030s, it will be a considerable stretch for anything in the 4s because of existing scale of the Chinese economy.

“Our mid case point estimates for growth in 2025, 2030, 2035 and 2050 are (rounded) 5%, 4¾%, 3½% and 1¾% respectively. But such is the underlying scale of the economy – in 2035 China will be roughly the same size as the US, India, Europe, and Japan put together today – 3½% growth in that year would be equivalent to $1¾ trillion of incremental new activity (PPP terms),” McKay said.

“That is roughly double the annual incremental change that China produced in the high–speed growth era of the mid–to–late 2000s.”

He said that it would also big enough to produce the equivalent of a new G20 member annually, being larger than the entire economies (in 2019) of Canada, Saudi Arabia, Australia, Thailand, Egypt, and Spain, just to name a few.

“Knowledge of that arithmetic is part of the reason why we are not perturbed that percentage rates of growth are bound to slow down. China is expected to remain the largest incremental volume contributor to global industrial value–added and fixed investment activity through the 2020s and many decades beyond: not just GDP,” McKay said.

That should mean something to long-term investors in the resources space. A confidence builder perhaps.

RareX:

Talking about the big thematics out there, RareX (REE) has set out to ride two of the biggest – fertiliser to meet the need to feed the world and rare earths for global decarbonisation through electrification.

It has the underpinning phosphate-rare earths project to proceed down the dual carriageway – its large scale Cummins Range deposit some 135km from Halls Creek in Western Australia’s Kimberley region.

Phosphate – one of the three primary macronutrients for plant growth – is a relative late-comer to the Cummins Range story but is now emerging as a low capex/high returning “starter” project, with combined phosphate/rare earths to follow in later years.

Prices for rare earths (RE) have taken a beating in 2023, making it difficult for RE explorers/developers to gain traction in the market. Even so, broad agreement that demand/pricing for the magnet REs will take off in the second half of the decade remains.

RareX was a 3.8c stock on Thursday for a market cap of $26 million. So it is not as if it has the scale to stare down both the RE market and the equities market and get cracking on the RE component of the Cummins Range orebody in the here and now.

Think of a simple direct shipping (DSO) phosphate rock project as a bridge to becoming a RE producer of scale. As the company likes to put it, it is all about phosphate production enabling RE production. It is a neat bit of de-risking not available to most of the RE players on the ASX.

The plan began to take shape this week with the release of a scoping study into a rock phosphate direct shipping project with a 3-year life as the first stage of a three-stage development plan that moves into phosphate-RE concentrate in the second stage, and an upgraded third stage.

The second stage involves big bucks (an estimated $304m) but the strategic nature of RE and the north Australian location suggests grant funding is likely to be available. The forecast surge in RE demand/prices would also no doubt help.

But before then, a rock phosphate costing a doable $45m and producing 63,000t annually of contained phosphorus pentoxide annually could be chugging away earning a solid cashflow and establishing an operational base for the main event of large scale phosphate and RE production.

Acquisition all part of Hot Chili’s plan to upscale Costa Fuego, ‘one of the world’s lowest capital intensity major copper developments’

StockHead | August 2023

- Company moves to acquire Cometa project near flagship 725Mt Costa Fuego asset

- New project provides opportunity to discover more resources, upgrade production to 150,000tpa CuEq

- 30km expansion drilling campaign is continuing

Hot Chili is progressing its strategy of upscaling its already significant 2.8Mt copper, 2.6Moz gold Costa Fuego flagship project in Chile with a move to acquire the nearby Cometa asset.

Hot Chili says Costa Fuego is already “one of the world’s lowest capital intensity major copper developments” and one of only a handful of projects outside of the control of major miners capable of delivering meaningful new copper supply this decade.

Its indicated resource of 725Mt grading 0.47% copper equivalent powers a punchy Preliminary Economic Assessment (PEA) – essentially a Scoping Study – which showcases attractive returns.

The PEA envisages a US$1.05bn project capable of producing 112,000t of copper equivalent (95,000t of copper and 49,000oz of gold) per annum over 14-years of a 16-year mine life.

Ove this time it would deliver revenue and free cash flow of US$13.52bn and US$3.28bn, respectively.

Post-tax net present value and internal rate of return – both measures of a project’s profitability – are estimated at US$1.1bn and 24% respectively.

Exploration, acquisitions to support production boost to 150,000tpa

Hot Chili (ASX:HCH) is now focused on upscaling Costa Fuego’s resource base to support an increase in the copper production profile to 150,000tpa ahead of its Pre-Feasibility Study, which is expected to be delivered in the first half of 2024.

Its planned acquisition of Bastion Minerals’ (ASX:BMO) Cometa project, 15km from Costa Fuego’s planned operating centre, is aimed at furthering this strategy via the discovery of further mineral deposits which could add supplemental feed or extend mine life.

Acquisition terms

Under the letter of intent, the company has secured a 60-day exclusivity period to carry out due diligence with the intention to enter into a definitive option agreement for the acquisition of Cometa.

Hot Chili will pay Bastion US$100,000 in cash on the grant of the option and will pay a further US$200,000 within 12 months of its grant to keep the option in good standing.

Should the company exercise the option within 18 months of it being granted, it will have to pay Bastion US$2.4m in cash or an equal mix of cash and HCH shares.

This increases to US$3m if the decision is made after the initial 18 months and before the option expires 30 months from its grant.

An emerging copper monster

Hot Chili’s acquisition of the Cortadera project in early 2019 delivered multiple, very thick copper-gold porphyry hits that drastically changed the scale of what became the Costa Fuego project.

Not only does Cortadera account for the majority of resources at Costa Fuego – at 451Mt at 0.46% copper equivalent – but drilling also outside of the resource envelope continues to deliver more thick, copper-gold porphyry hits that strongly indicate there’s plenty of growth to come.

Expansion drilling continuing

The company is continuing a 30,000m expansion drilling campaign at Cortadera with nine reverse circulation holes totalling 2,010m completed so far.

Four of these drillholes have been completed across the western extension of the Cortadera porphyry resource, including one pre-collar in preparation for a deep diamond hole beneath Cuerpo 4.

Once the RC pre-collars are drilling, the RC rig is expected to begin a hydrogeological program at Cortadera from mid-September.

Hot Chili also plans to have one diamond drilling rig starting double shift drilling in September with preparations underway to bring a second rig online as it ramps up drilling across multiple exploration targets.