COMMODITY 1X1 – The Significant Value of Water Rights

Grizzle

Hot Chili – Road to 2025

Stockhead

Hot Chili VRIC 2025

Hot Chili and the future of the project with Glencore on board

Making Money Matter

Break it Down: Hot Chili primed to supply water

Break It Down | Stockhead TV

Major copper discovery for Hot Chili

Making Money Matter

Hot Chili -Major Copper-Gold Discovery, Large Scale Appeal

Crux Investor

The Copper Play the Market Is Missing

Streetwise

Disconnects between price and value in the resource sector occur regularly but are usually accompanied by issues. Issues such as a low metal price, local social pressures, political interference, or an environmental problem.

In situations like these, the disconnect between price and value makes sense. There is something that has to be overcome to get price recognition from the market. Investors looking to take positions in these sorts of situations must be cautious of their approach and understand how these risks will be overcome. In essence, this is what a contrarian investor is all about: taking a calculated risk on a solution to issues such as these.

That said, there are times when there is a disconnect and no major reason for it. These aren’t as common, but I have learned that when I personally come across them, I need to pursue them as strongly as I can. These are the true asymmetrical bets that can really propel a portfolio’s return forward.

Over the last two years, I have personally benefited by identifying a few of these situations, taking a big position, and waiting.

In my experience, the biggest factor to overcome in situations is time.

As they say, patience is a virtue. In situations like this, it becomes glaringly obvious.

Today, I have for you an opportunity that I think has no obvious reason for the major disconnect between price and value. The company is focused on developing two copper-gold porphyry projects in Chile. One is at the feasibility study stage, while the other is a brand new discovery story.

The company is

Hot Chili Ltd. (HCH:ASX; HCH:TSXV; HHLKF:OTCQX).

Let me explain to you why I think this is arguably the most undervalued junior mining company in the sector right now.

Costa Fuego

Costa Fuego is Hot Chili’s flagship project, which just recently had a PFS completed.

Costa Fuego will be both an open pit and an underground mining operation in the future.

On average, it will produce 116kt CuEq (copper equivalent) for 14 of the 20 years of its mine life, making it one of the largest undeveloped copper operations owned by a junior.

In terms of economics, Costa Fuego has great leverage to the copper price, with an NPV above US$2B and an IRR of 27% at US$5.30/lb copper.

- Post-tax NPV8% of US$1.2 B and IRR of 19% (at US$4.30/lb copper)

- Post-tax NPV8% of US$2.2 B and IRR of 27% (at US$5.30/lb copper)

As I mentioned, Costa Fuego will start as an open pit mining operation and then transition to an underground block caving operation later in the mine life.

Upfront CAPEX is, therefore, estimated to be US$1.27B with an expansionary capital around US$1.35B — big mines cost big money.

If I were to pick a reason for Hot Chili’s low valuation, this might be it. That said, if you look at all of the large, advanced (at least PFS level) projects out there and owned by a junior, billions in CAPEX is the commonality.

Not only this, but I view Hot Chili’s recent discovery of copper-gold mineralization at their La Verde project as reason to believe that the impact of the CAPEX will be lessened.

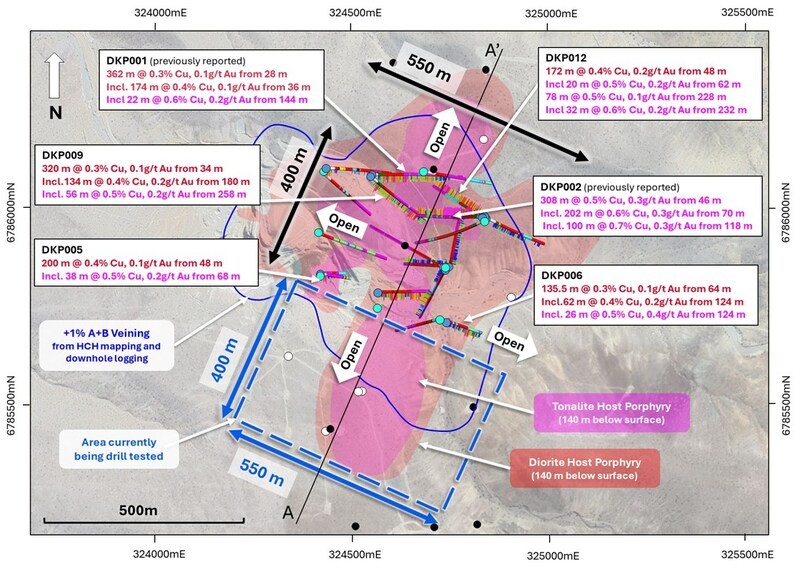

Discovery hole: DKP002 308m of 0.5% copper + 0.3g/t gold, including 202m of 0.6% copper + 0.3g/t gold, and including 100m of 0.7% copper + 0.3g/t gold.

As I see it, La Verde has the potential to add significant amounts of ore early on into a future combined mining operation. This additional open pit tonnage from La Verde could be trucked to nearby Costa Fuego and push out the expansionary capital needed to build the underground — this is very meaningful.

In a discounted cash flow model, cash flows in the future are discounted.

Meaning, the earlier in a mine life you can produce higher cash flow, the better the net present value (NPV).

Hot Chili still has much to prove at La Verde, but I think they are well on their way to doing it.

In closing, additional tonnage from La Verde doesn’t negate the size of the CAPEX; what it does is push it further out in the mine life, which will increase the overall NPV of the project.

Huasco Water

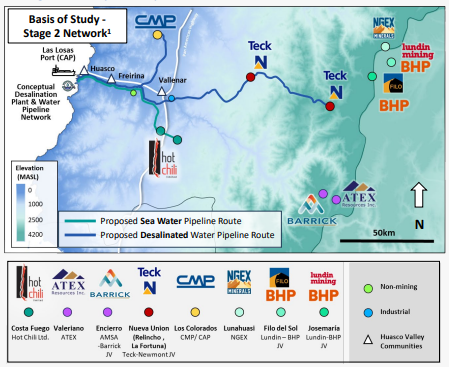

One of the biggest factors affecting copper project development in both Chile and Argentina right now is access to water. On the Chilean side, it’s both an altitude and a permit issue.

Firstly, the Chilean government is no longer allowing water extraction via underground sources. They are exclusively forcing development projects to apply for a maritime concession or do a deal with a company that already has one. A maritime concession allows for the extraction and treatment of seawater.

The reality of the situation is that there have only been two maritime concessions granted in the last 13 years. One of those was granted to Hot Chili, which has since placed that permit into Huasco Water — of which they own 80%.

Hot Chili is now very much in the driver’s seat for water supply of a region which is on the cusp of a major development cycle.

Now, I don’t believe that this situation allows Hot Chili to unreasonably leverage their position; that isn’t what the Chilean government would promote or accept.

What it means, though, is that HCH has a major source of value that the market isn’t giving them credit for.

So the question begs: What are the water rights worth?

It’s a great question, one that I can’t fully answer.

What I will draw your attention to is Antofastga’s deal with Transelec and Almar Water Solutions for $600M. That situation is a little different because it includes some existing infrastructure, but essentially gives us a rough idea of what these types of assets are worth.

Further, Hot Chili completed an economic study on the Huasco Water business, which proves its potential — 2 Stage / 1300L/s Desalinated Water Supply: Post-tax NPV(8%) of US$977M and IRR of 19%.

Not only do I think that this supply is meaningful for Chilean development projects, but it is an obvious source of water for the Argentinian side, too.

I think one of the biggest misnomers right now is the water situation for a few of the largest copper development projects in the world — BHP & Lundin’s Jose Maria and Filo projects.

Personally, I don’t think they have an alternative to doing an off-take agreement with Hot Chili’s Huasco Water. . .

Concluding Remarks

Nothing is for sure in life, especially in the junior mining sector. However, once in a while there are asymmetric bets that you can make that are mostly a function of time, rather than the solving of some other specific issue.

In my view, the opportunity in Hot Chili is one of those high-potential asymmetric bets whose value recognition is just a matter of time.

Currently, Hot Chili’s MCAP is around $70M, which I think is extremely cheap.

Its flagship project, Costa Fuego, has a PFS completed on it with an after-tax value well over US$1B at today’s copper price. Not only is the project undervalued to the current state of development, but I think it has a clear path towards optimization with the combination of the discovery at La Verde.

The real X-Factor lies with Huasco Water, which holds the water rights to a region of Chile and Argentina which is on the cusp of major development.

Mine construction and operation don’t happen without water, and, therefore, this is a catalyst that is very much a when question, not if.

With over AU$10M in cash, continued drilling at La Verde and the potential for water offtake agreements to be signed with Huasco, I believe it is only a matter of time before Hot Chili’s value is recognized by the market.

Hot Chili’s standout drill intersections raise the mercury at La Verde

December 18, 2024 | Stockhead

- Hot Chili’s thick copper-gold intersections validate historical drilling at its La Verde project

- Second hole’s 308m intersection at 0.5% copper and 0.3g/t gold exceeds expectations

- It also highlights La Verde’s potential to host a higher-grade copper-gold zone

Special Report: Hot Chili’s initial drilling at La Verde has validated its decision to acquire the historical copper mine in Chile after returning thick copper-gold intersections.

While the first hole – DKP001 – provided a good show with a 174m intersection grading 0.4% copper and 0.1g/t gold from 36m, the second hole about 120m to the southeast really upped the ante after recording a 308m interval at 0.5% copper and 0.3g/t gold from a down-hole depth of 46m to the end of hole.

Not only did DKP002 exceed the company’s expectations and end in mineralisation, it also intersected a higher grade zone of 202m at 0.6% copper and 0.3g/t gold from 70m.

The results are hugely encouraging for Hot Chili (ASX:HCH) as the La Verde porphyry footprint measures about 850m by 700m, which is roughly comparable to its higher-grade Cortadera Cuerpo 3 copper-gold porphyry about 30km to the north.

Cuerpo 3 is also the largest porphyry at Cortadera with a higher confidence indicated resource of 798Mt grading 0.45% copper equivalent, or contained metal of 3.6Mt copper and 3Moz gold, and inferred resources of 203Mt at 0.31% CuEq.

What this means is that further drilling successes could unlock another resource of similar size, which will in turn provide a substantial boost to the company’s Costa Fuego copper hub.

La Verde mine

The historical La Verde open pit mine in the Domeyko mining district, which the company acquired in November 2024, was previously exploited by private interests for shallow porphyry copper-style oxide mineralisation with limited drill testing outside the central lease or at depth.

Importantly, it sits in the centre of the company’s recently consolidated and larger Domeyko landholding, secured in an option agreement back in April 2024.

This marks the first time the area has been consolidated, and provides the company with access to a much larger potential porphyry copper deposit footprint measuring around 1.4km by 1.2km.

HCH promptly launched and completed a 12-hole reverse circulation drill program totalling ~3150m with the first two holes designed to validate historical drill intercepts and test the interpreted northern extension of the porphyry from the open pit.

While DKP001 was successful in validating the most notable copper intercept from historical drilling, the assays from DPK002 really demonstrated the value of La Verde by highlighting its potential to host a higher-grade copper-gold zone.

The consistent higher-grade results confirm the extension of the porphyry system almost 400m to the northeast of the open pit, a significant step out considering the existing pit measures about 200m by 400m.

It is also located immediately beneath a gravel cover sequence which obscures the ultimate extent of the porphyry system.

Assays are pending for the remaining 10 holes though the success of the first holes has prompted HCH to expand the RC program by another 2000m of drilling, expected to be completed in late January 2025.

Hot Chili pours new water company into Chilean valley

July 8, 2024 | The West Australian

Hot Chili has entered into a new joint venture (JV) aimed at supplying seawater and desalinated water to mining projects throughout Chile’s Huasco Valley where it is pursuing its own mammoth Costa Fuego copper-gold project.

The company today confirmed it will hold an 80 per cent interest in Huasco Water and its critical water assets in the JV with Chilean iron ore company Compania Minera del Pacifico (CMP). The new company is expected to supply desalinated water to operations including Costa Fuego and CMP’s Los Colorados iron ore mine.

The JV says further offtake negotiations are already underway.

The Huasco Valley region in Chile’s Atacama Desert is one of the driest regions on Earth, inducing significant water demands from mining operations and local communities. The new water initiative reflects an increasing trend in the Atacama region towards collaborative water infrastructure development, highlighted by a recent US$600 million (AU$890 million) deal for Antofagasta Minerals’ Atacama water rights and assets.

The Company has been receiving increasing interest from potential strategic funding parties in its advanced Costa Fuego copper-gold development and its recently announced Water Supply Studies. This interest, in combination with a rising copper price environment, provides confidence to accelerate the Company’s growth and development plans whilst preserving control of these assets.

Hot Chili managing director Christian Easterday

The company holds the only granted maritime water concession and necessary permits to provide critical water access to the Huasco Valley. It has outlined about 3700 litres per second of potential future desalinated water demand from new mine developments around the valley alone.

The JV partners are likely to underpin Huasco Water as potential foundation offtakers with the Costa Fuego copper project requiring some 700 litres per second of future seawater demand, while Los Colorados needs a further 200 litres per second. Hot Chili says significant economic, environmental and social synergies exist for all potential customers in the Huasco Valley, especially given growing community and regulatory opposition to continental water extraction in the Atacama.

Initial offtake discussions are already underway with nearby mine developers, with additional non-mining desalinated water customers expected to come from the area immediately adjacent to the Costa Fuego copper hub.

The Costa Fuego copper-gold project, which lies some 740m up the hill from the proposed Huasco desalination plant, features a measured and indicated resource that sits at 798 million tonnes at 0.45 per cent copper equivalent for 3.62 million tonnes of copper equivalent, containing 2.91 million tonnes of copper, 2.64 million ounces of gold, 12.8 million ounces of silver and 68,100 tonnes of molybdenum. It makes it one of a limited number of “globally-significant” copper developments that are not in the hands of a major mining company.

Hot Chili recently executed a $29.9 million fundraising campaign on the back of a US$15 million (A$22.23 million) net smelter royalty (NSR) deal with Osisko Gold Royalties, aimed at driving its Costa Fuego copper hub in Chile into production. It comes as the red metal’s price recently launched to 60-year highs, prompting majors across the world to look to acquire copper-producing assets of scale.

The Costa Fuego prefeasibility study (PFS) is expected in the second half of this year.

By further securing its water supply and also creating a new company capable of luring significant offtake partnerships, Hot Chili now feels confident enough to sink another 25,000m of drilling into the project. It will also pursue more regional exploration and land consolidation in a show of confidence at the copper project, taking final steps forward before a bankable feasibility study and final investment decision.

Copper, water and deep pockets of cash have Hot Chili set up for an eventful second half of the year. And with copper prices remaining solid, the company appears well-positioned now to give its giant Costa Fuego project a good crack at development.