Hot Chili -Major Copper-Gold Discovery, Large Scale Appeal

Crux Investor

Hot Chili doubles copper-gold discovery footprint in Chile

STOCKHEAD

- HCH doubles footprint of La Verde copper-gold discovery

- Prospect sits within Costa Fuego project in Chile’s Atacama region

- Company planning deeper drilling to expand discovery further

Special Report: Hot Chili has doubled its porphyry discovery footprint at its Chilean project, with a third round of strong assay results at the La Verde copper-gold discovery at its Costa Fuego project.

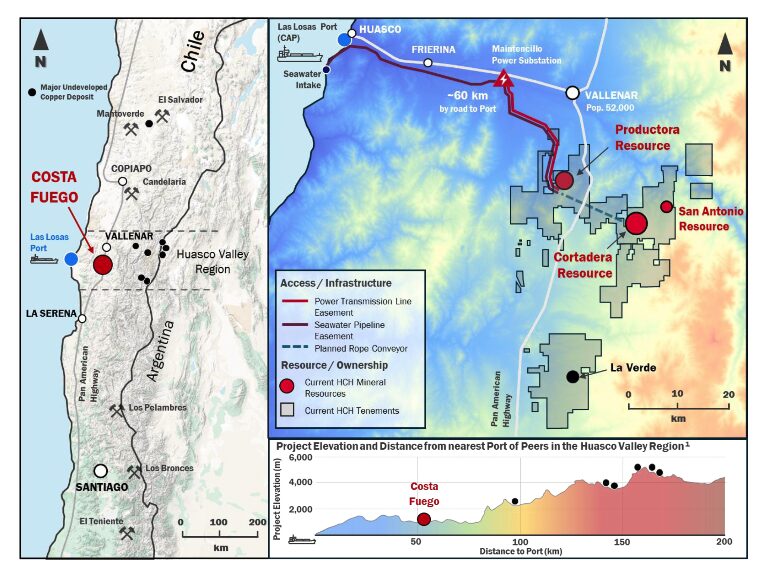

La Verde is around 30km south of the Costa Fuego planned central processing hub at low elevation in the coastal range of the Atacama region.

The phase one reverse circulation (RC) drilling has now doubled the initial discovery footprint, confirming copper-gold mineralisation extends over 1km in length and up to 750m in width, from near surface.

Notable results include:

- 389m grading 0.4% copper and 0.1g/t gold from 4 m depth to end-of-hole (DKP030), including 46m at 0.6% copper and 0.2g/t gold from 238m, including 34m at 0.6% copper and 0.2g/t gold from 322m;

- 120m grading 0.4% copper and 0.1 /t gold from 6m depth (DKP028), including 48m at 0.5% copper and 0.1g/t gold from 26m and, 114m at 0.3% copper, 0.1g/t gold from 318m depth to end-of-hole, including 34m at 0.4% copper, 0.2g/t gold from 380m to end-of-hole;

- 114m grading 0.4% copper from 86m depth (DKP024), including 52m at 0.5% copper and 0.1 g/t gold from 96m;

- 286m grading 0.3% copper and 0.1g/t gold from 4m depth (DKP027), including 154m at 0.4% copper, 0.1g/t gold from 44m; and

- 228m grading 0.3% copper and 0.2g/t gold from 42m depth (DKP013), including 104m at 0.4% copper and 0.3g/t gold from 42m.

Hot Chili (ASX:HCH) has also confirmed higher-grade centres across the extent of the shallow oxide and sulphide discovery, indicating:

Importantly, multiple distinct higher-grade centres have been confirmed from near surface. Assessment of each of these higher-grade centres indicates:

- A North-East (NE) higher-grade centre, 180m strike by 280m width by 320m in vertical extent

- South-east (SE) higher-grade centre, 320m strike by 340m width by 400m in vertical extent

- South-west (SW) higher-grade centre, 90m strike by 120m width by 260m in vertical extent

Deeper diamond drilling planned

Since over half of the drill holes ending in significant mineralisation at the limit of RC drilling depth capability, HCH is on the hunt for a potentially larger porphyry cluster at La Verde.

The extent of the mineralisation beneath the open pit remains untested.

The company is now planning deeper diamond drilling for phase two to extend these higher-grade centres at depth.

This could potentially add to the open-pit mine life for the Costa Fuego hub, with further development study updates expected in the near-term.

Watch: Hot Chili adds mine-making credentials for Costa Fuego copper-gold

Regulatory application for phase-two drilling access is progressing, with drilling to commence once approved.

In the meantime, development study activities to optimise the recent Costa Fuego Pre-Feasibility Study (PFS) are underway, building on the recently released PFS, which highlighted impressive post-tax numbers for the asset including an NPV of US$1.2b and IRR of 19%.

All-in sustaining costs totalled US$1.85/lb from the production of 1.5Mt of copper and 780,000oz of gold over a 20-year mine life.

The Copper Play the Market Is Missing

Streetwise

Disconnects between price and value in the resource sector occur regularly but are usually accompanied by issues. Issues such as a low metal price, local social pressures, political interference, or an environmental problem.

In situations like these, the disconnect between price and value makes sense. There is something that has to be overcome to get price recognition from the market. Investors looking to take positions in these sorts of situations must be cautious of their approach and understand how these risks will be overcome. In essence, this is what a contrarian investor is all about: taking a calculated risk on a solution to issues such as these.

That said, there are times when there is a disconnect and no major reason for it. These aren’t as common, but I have learned that when I personally come across them, I need to pursue them as strongly as I can. These are the true asymmetrical bets that can really propel a portfolio’s return forward.

Over the last two years, I have personally benefited by identifying a few of these situations, taking a big position, and waiting.

In my experience, the biggest factor to overcome in situations is time.

As they say, patience is a virtue. In situations like this, it becomes glaringly obvious.

Today, I have for you an opportunity that I think has no obvious reason for the major disconnect between price and value. The company is focused on developing two copper-gold porphyry projects in Chile. One is at the feasibility study stage, while the other is a brand new discovery story.

The company is

Hot Chili Ltd. (HCH:ASX; HCH:TSXV; HHLKF:OTCQX).

Let me explain to you why I think this is arguably the most undervalued junior mining company in the sector right now.

Costa Fuego

Costa Fuego is Hot Chili’s flagship project, which just recently had a PFS completed.

Costa Fuego will be both an open pit and an underground mining operation in the future.

On average, it will produce 116kt CuEq (copper equivalent) for 14 of the 20 years of its mine life, making it one of the largest undeveloped copper operations owned by a junior.

In terms of economics, Costa Fuego has great leverage to the copper price, with an NPV above US$2B and an IRR of 27% at US$5.30/lb copper.

- Post-tax NPV8% of US$1.2 B and IRR of 19% (at US$4.30/lb copper)

- Post-tax NPV8% of US$2.2 B and IRR of 27% (at US$5.30/lb copper)

As I mentioned, Costa Fuego will start as an open pit mining operation and then transition to an underground block caving operation later in the mine life.

Upfront CAPEX is, therefore, estimated to be US$1.27B with an expansionary capital around US$1.35B — big mines cost big money.

If I were to pick a reason for Hot Chili’s low valuation, this might be it. That said, if you look at all of the large, advanced (at least PFS level) projects out there and owned by a junior, billions in CAPEX is the commonality.

Not only this, but I view Hot Chili’s recent discovery of copper-gold mineralization at their La Verde project as reason to believe that the impact of the CAPEX will be lessened.

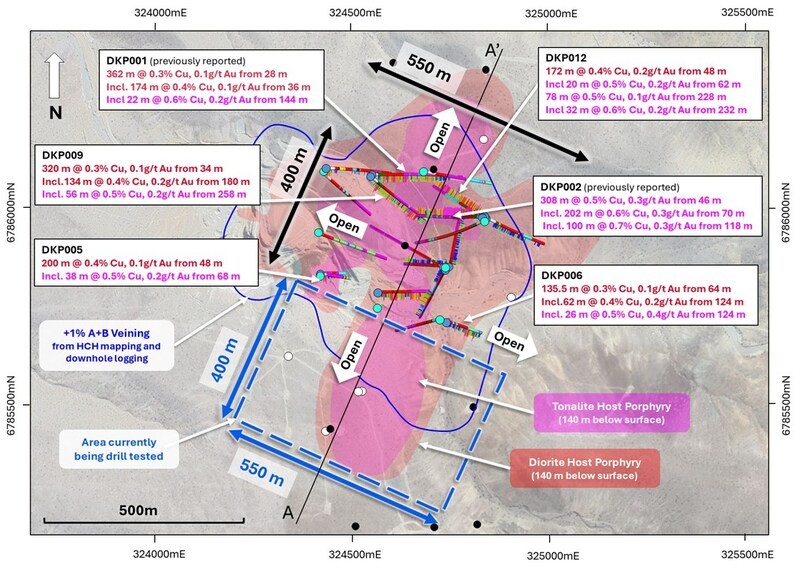

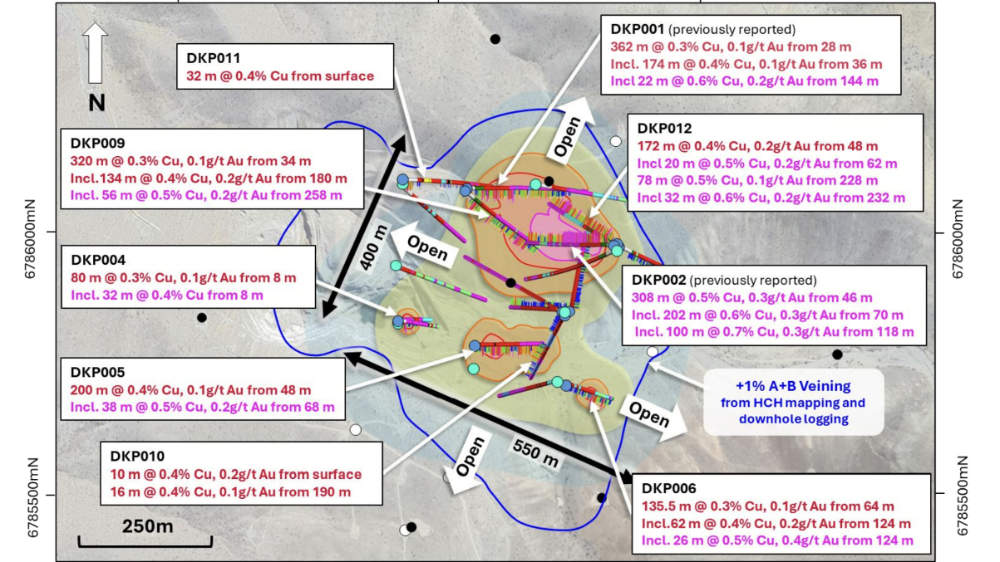

Discovery hole: DKP002 308m of 0.5% copper + 0.3g/t gold, including 202m of 0.6% copper + 0.3g/t gold, and including 100m of 0.7% copper + 0.3g/t gold.

As I see it, La Verde has the potential to add significant amounts of ore early on into a future combined mining operation. This additional open pit tonnage from La Verde could be trucked to nearby Costa Fuego and push out the expansionary capital needed to build the underground — this is very meaningful.

In a discounted cash flow model, cash flows in the future are discounted.

Meaning, the earlier in a mine life you can produce higher cash flow, the better the net present value (NPV).

Hot Chili still has much to prove at La Verde, but I think they are well on their way to doing it.

In closing, additional tonnage from La Verde doesn’t negate the size of the CAPEX; what it does is push it further out in the mine life, which will increase the overall NPV of the project.

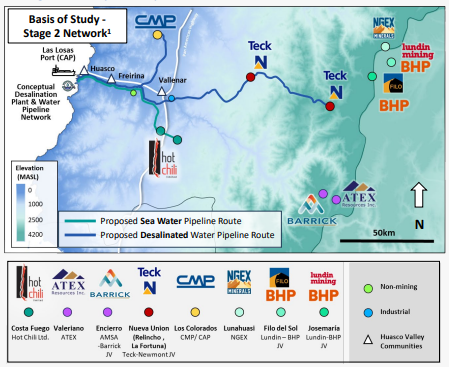

Huasco Water

One of the biggest factors affecting copper project development in both Chile and Argentina right now is access to water. On the Chilean side, it’s both an altitude and a permit issue.

Firstly, the Chilean government is no longer allowing water extraction via underground sources. They are exclusively forcing development projects to apply for a maritime concession or do a deal with a company that already has one. A maritime concession allows for the extraction and treatment of seawater.

The reality of the situation is that there have only been two maritime concessions granted in the last 13 years. One of those was granted to Hot Chili, which has since placed that permit into Huasco Water — of which they own 80%.

Hot Chili is now very much in the driver’s seat for water supply of a region which is on the cusp of a major development cycle.

Now, I don’t believe that this situation allows Hot Chili to unreasonably leverage their position; that isn’t what the Chilean government would promote or accept.

What it means, though, is that HCH has a major source of value that the market isn’t giving them credit for.

So the question begs: What are the water rights worth?

It’s a great question, one that I can’t fully answer.

What I will draw your attention to is Antofastga’s deal with Transelec and Almar Water Solutions for $600M. That situation is a little different because it includes some existing infrastructure, but essentially gives us a rough idea of what these types of assets are worth.

Further, Hot Chili completed an economic study on the Huasco Water business, which proves its potential — 2 Stage / 1300L/s Desalinated Water Supply: Post-tax NPV(8%) of US$977M and IRR of 19%.

Not only do I think that this supply is meaningful for Chilean development projects, but it is an obvious source of water for the Argentinian side, too.

I think one of the biggest misnomers right now is the water situation for a few of the largest copper development projects in the world — BHP & Lundin’s Jose Maria and Filo projects.

Personally, I don’t think they have an alternative to doing an off-take agreement with Hot Chili’s Huasco Water. . .

Concluding Remarks

Nothing is for sure in life, especially in the junior mining sector. However, once in a while there are asymmetric bets that you can make that are mostly a function of time, rather than the solving of some other specific issue.

In my view, the opportunity in Hot Chili is one of those high-potential asymmetric bets whose value recognition is just a matter of time.

Currently, Hot Chili’s MCAP is around $70M, which I think is extremely cheap.

Its flagship project, Costa Fuego, has a PFS completed on it with an after-tax value well over US$1B at today’s copper price. Not only is the project undervalued to the current state of development, but I think it has a clear path towards optimization with the combination of the discovery at La Verde.

The real X-Factor lies with Huasco Water, which holds the water rights to a region of Chile and Argentina which is on the cusp of major development.

Mine construction and operation don’t happen without water, and, therefore, this is a catalyst that is very much a when question, not if.

With over AU$10M in cash, continued drilling at La Verde and the potential for water offtake agreements to be signed with Huasco, I believe it is only a matter of time before Hot Chili’s value is recognized by the market.

Hot Chili rocks out as drilling reveals potential scale of “major” La Verde copper-gold discovery

February 11, 2025 | Stockhead

- Hot Chili drilling intersects more broad zones of copper-gold mineralisation at La Verde

- Results highlight potential to be the company’s next major copper-gold discovery

- Assays pending for a further seven holes while step-out drilling is underway

Special Report: Hot Chili now has multiple new significant drill intersections from a further 10 holes to prove that its La Verde project in low elevation coastal Chile is a major copper-gold porphyry discovery.

The company first received a taste of the project’s potential back in mid-December 2024 after announcing very thick copper-gold intersections from its first two drill holes.

Hole DKP001 got the show on the road with a 174m intersection grading 0.4% copper and 0.1g/t gold from a down-hole depth of just 36m before DKP002 quickly blew Hot Chili’s (ASX:HCH) expectations out of the water with a stunning 308m interval at 0.5% copper and 0.3g/t gold from 46m to end of hole.

DPK002 also hosts a higher grade zone of 202m at 0.6% copper and 0.3g/t gold from 70m, which is encouraging from a development standpoint as its places the richest resources closer to surface.

A fantastic start no matter how you look at it and one that just got a whole lot better.

Assays from another 10 holes have now returned broad, consistently mineralised intersections extending over 300m vertically that start from shallow depths.

Notable intersections from the rapidly growing oxide and sulphide find are:

- 320m at 0.3% copper and 0.1g/t gold from 34m to EOH including 134m at 0.4% copper and 0.2g/t gold from 180m and 56m at 0.5% copper and 0.2g/t gold from 258m (DKP009)

- 200m at 0.4% copper and 0.1g/t gold from 48m to EOH including 38m at 0.5% copper and 0.2g/t gold from 68m (DKP005); and

- 172m at 0.4% copper and 0.2g/t gold from 48m including 20m at 0.5% copper and 0.2g/t gold from 62m with a separate intersection of 78m at 0.5% copper and 0.1g/t gold from 228m to EOH including 32m at 0.6% copper and 0.2g/t gold from 232m (DKP012).

Major discovery

The new drill results outline La Verde’s potential scale with managing director Christian Easterday saying the project is shaping up to be the company’s next major copper-gold discovery that could lift the scale of its Costa Fuego project.

“With primary copper supply declining, copper and gold prices rallying, and a PFS on each of our planned businesses (copper-gold and water) nearing completion – momentum is building fast,” Easterday said.

“Following in the footsteps of our successes at Cortadera and Productora, we’ve secured full control of La Verde after years of strategic consolidation, finally allowing us unrestricted access to test this historically overlooked porphyry system.

“Drill results have exceeded expectations, revealing a much larger porphyry system than first recognised, with broad, consistent copper-gold mineralisation extending from shallow depths and largely hidden below shallow gravel cover.

“This discovery has all the signs of becoming our third bulk-tonnage, copper-gold deposit, and is open in all directions and growing fast. We’re also preparing to deploy AI-powered exploration to fast-track our nearby exploration growth pipeline, leveraging 16 years of expertise in Chile.

“With La Verde’s scale potential and the Costa Fuego copper-gold hub expanding, we’re at a major inflection point in Hot Chili’s growth story.”

The project, which hosts the historical La Verde copper mine, is at the core of the historical Domeyko mining district and in the centre of the company’s recently consolidated and larger Domeyko landholding.

La Verde drilling

To date, HCH has drilled 19 holes totalling 5700m at La Verde and received assays from 12 holes.

This has defined a discovery footprint measuring 550m by 400m that remains open in all directions.

Mineralisation starts from shallow depths and extends to more than 300m below surface with indications that its deeper potential remains untapped as eight of the holes reported to date ended in mineralisation.

Adding further interest, the gravel cover at La Verde could mask a much larger porphyry system with the company noting that step-out drilling is now underway.

Drill testing of the historical oxide copper open pit at the project is also pending.

HCH is now awaiting assays from seven additional reverse circulation holes.

It is also planning to carry out diamond drilling to test potential for deeper, higher-grade zones at depth and to test potential for +1km vertical depth extent, typical of other recent major porphyry discoveries, such as the company’s Cortadera discovery and BHP/Lundin Mining’s Filo del Sol find.

Hot Chili’s standout drill intersections raise the mercury at La Verde

December 18, 2024 | Stockhead

- Hot Chili’s thick copper-gold intersections validate historical drilling at its La Verde project

- Second hole’s 308m intersection at 0.5% copper and 0.3g/t gold exceeds expectations

- It also highlights La Verde’s potential to host a higher-grade copper-gold zone

Special Report: Hot Chili’s initial drilling at La Verde has validated its decision to acquire the historical copper mine in Chile after returning thick copper-gold intersections.

While the first hole – DKP001 – provided a good show with a 174m intersection grading 0.4% copper and 0.1g/t gold from 36m, the second hole about 120m to the southeast really upped the ante after recording a 308m interval at 0.5% copper and 0.3g/t gold from a down-hole depth of 46m to the end of hole.

Not only did DKP002 exceed the company’s expectations and end in mineralisation, it also intersected a higher grade zone of 202m at 0.6% copper and 0.3g/t gold from 70m.

The results are hugely encouraging for Hot Chili (ASX:HCH) as the La Verde porphyry footprint measures about 850m by 700m, which is roughly comparable to its higher-grade Cortadera Cuerpo 3 copper-gold porphyry about 30km to the north.

Cuerpo 3 is also the largest porphyry at Cortadera with a higher confidence indicated resource of 798Mt grading 0.45% copper equivalent, or contained metal of 3.6Mt copper and 3Moz gold, and inferred resources of 203Mt at 0.31% CuEq.

What this means is that further drilling successes could unlock another resource of similar size, which will in turn provide a substantial boost to the company’s Costa Fuego copper hub.

La Verde mine

The historical La Verde open pit mine in the Domeyko mining district, which the company acquired in November 2024, was previously exploited by private interests for shallow porphyry copper-style oxide mineralisation with limited drill testing outside the central lease or at depth.

Importantly, it sits in the centre of the company’s recently consolidated and larger Domeyko landholding, secured in an option agreement back in April 2024.

This marks the first time the area has been consolidated, and provides the company with access to a much larger potential porphyry copper deposit footprint measuring around 1.4km by 1.2km.

HCH promptly launched and completed a 12-hole reverse circulation drill program totalling ~3150m with the first two holes designed to validate historical drill intercepts and test the interpreted northern extension of the porphyry from the open pit.

While DKP001 was successful in validating the most notable copper intercept from historical drilling, the assays from DPK002 really demonstrated the value of La Verde by highlighting its potential to host a higher-grade copper-gold zone.

The consistent higher-grade results confirm the extension of the porphyry system almost 400m to the northeast of the open pit, a significant step out considering the existing pit measures about 200m by 400m.

It is also located immediately beneath a gravel cover sequence which obscures the ultimate extent of the porphyry system.

Assays are pending for the remaining 10 holes though the success of the first holes has prompted HCH to expand the RC program by another 2000m of drilling, expected to be completed in late January 2025.