Hot Chili chases US$447M free cash flow from Chilean water business

In partnership with BULLS N’ BEARS

Hot Chili says it can solve Chile’s water problem for large industrial projects in the Huasco Valley region and bank US$447m over 20 years in free cash by getting into the water supply business using its giant Costa Fuego copper play as a foundation off-taker.

The company recently tabled a pre-feasibility study on its 80 per cent owned Huasco Water project in Chile that makes use of its hard won permit to supply sea water to Chile’s Huasco Valley region. According to management, the Huasco joint venture holds the only active maritime license in the Huasco region – a feat that it says took 10 years of regulatory burden to achieve.

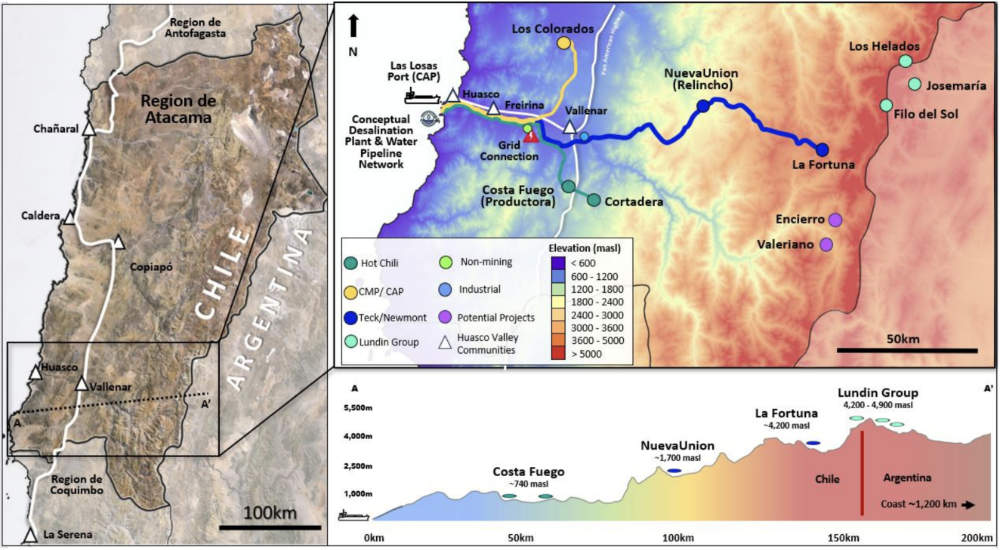

The JV is aiming to develop a long-term, regional multi-user seawater and desalination water supply network for the Huasco valley area of the Southern Atacama region of Chile, which sits about 600km north of the Santiago capital.

Hot Chili says the project will initially cost US$151m in start up capital which it says can be paid back in 4.5 years from the operation.

Total expected revenues have been modelled over 20 years and come in at US$880M and the project shows a pre-tax net present value using an 8 per cent discount rate of US$179m and a 22 per cent internal rate of return.

‘The company views the potential to outsourcing of its seawater supply infrastructure as a key value enabler…’Hot Chili managing director Christian Easterday

Stage 1 for the business will target the potential supply of seawater at 500 litres per second (L/s) to Hot Chili’s Costa Feugo copper-gold project which will be the foundation off-taker for the project via a 62km over-land pipeline.

A memorandum of understanding (MOU) has been executed with its own Costa Feugo project that will see the supply of seawater for the duration of the 20-year project life.

In addition to its sought after concessions to extract sea water, Huasco Water has permits for coastal land access, stage 1 pipeline easements and has secured connection to the electricity grid. The company plans to supply seawater by the end of the decade.

Stage 2 will see a desalination plant, estimated to cost US$1.4 billion, supply water at a rate of 1300L/s to a range of potential businesses within the Huasco Valley region.

The numbers really begin to ramp up during the second stage, with post-tax-free cash flows jumping to an estimated $4 billion from revenue of US$9.35B modelled over 22 years.

The post-tax NPV for stage 2 comes in at $977M with a 4 year payback.

The company’s staged approach enables scaling up for long term supply to mining, community and agricultural firms in the Huasco Valley region, with the potential to stretch beyond initial project estimates.

Hot Chili managing director Christian Easterday said: “The outcomes of the water supply preliminary feasibility study provide an opportunity for Hot Chili to fully consider the strategic value of its 80 per cent owned subsidiary company Huasco Water, which controls all our critical water assets. The company views the potential to outsourcing of its seawater supply infrastructure as a key value enabler and has anchored Huasco Water by executing a memorandum of understanding to negotiate a foundational seawater offtake agreement for Costa Fuego.”

Huasco Water has identified possible demand of at least up to 4000L/s across six undeveloped mining projects, all requiring access to a desalinated water supply.

Desalination water supply is projected to occur shortly after the seawater supply, due to begin at the end of the decade, is piped to Costa Feugo.

The permitting process to upgrade its maritime concessions to enable desalinated water to be provided is advancing.

The Huasco Valley region contains one of the largest groupings of major undeveloped copper projects in the world, all of which are in need of a reliable water supply. If an improving copper price warrants a move towards production for Hot Chili’s Costa Fuego, Huasco Water will be dragged along with it.

Management says just three potential clients in the region who may tap into their water business are Teck Resources, Atex Resources and Agrosuper.

Agrosuper is a food production company and also produces animal feed. An MOU for desalinated water has been executed with the group.

The HW Aguas para El Huasco SpA (Huasco Water) is a joint venture between Hot Chili (80 per cent interest) and Compañia Minera Del Pacifico – CMP (20 per cent interest).

Huasco Water is the only company with permitted access to supply seawater in the Huasco Valley region following a ten-year regulatory approval process.

The permitting process for desalination water has advanced over the past year with regulatory applications made to enable the supply from the existing maritime concession. A second maritime concession application by Huasco Water has been lodged. The second application includes brine discharge for the potential seawater desalination operations.

Hot Chili’s first mover advantage in the water sector in Chile cannot be overstated. The demand in the area appears to be real and the barriers to entry for others that have not suffered the ten year ordeal to get permitted just might give Huasco and Hot Chili a potentially decades long free run at supplying water to both its own project and the other mega projects that are littered around the area with no current water options.

With copper prices recently on the move, Hot Chili stands to derive a double benefit. Not only will the economics at its Costa Feugo project improve, but the company stands to reap the rewards from other copper groups in the region who may develop a thirst for some Huasco water.

Milestone registrations to expedite Hot Chili copper-gold project

Doug Bright BULLS N’ BEARS

Hot Chili has secured the milestone government registrations necessary to help fast-track its Costa Fuego copper-gold and Huasco Water projects in Chile.

The registrations, before Chile’s Office for Sustainable Project Management, confirm the two projects meet the government’s key criteria for consideration for a list of strategic investment projects that could be prioritised through a streamlined administrative approvals process.

Part of the office’s objectives is to optimise and accelerate approvals for projects that promote sustainability.

Hot Chili’s maiden combined probable open pit and underground ore reserves for its Costa Fuego project stands at 502 million tonnes at 0.37 per cent copper, 0.10 grams per tonne (g/t) gold, 0.49g/t silver and 97 parts per million molybdenum across multiple processing streams. The streams include the sulphide concentrator, oxide leach and low-grade sulphide leach processes.

The total combined metal in the reserves is a heady 1.86Mt copper, 1.58M ounces of gold, 7.95M ounces silver and 49,000t molybdenum.

Significant additional opportunity exists to extend the overall resource numbers with the company’s recent discovery of copper-gold porphyry mineralisation at its non-contiguous but nearby La Verde project.

La Verde is the latest addition to Hot Chili’s Costa Fuego production hub. It is only 50 kilometres south by road from the company’s central processing facility at Productora, within the company’s Costa Fuego group of projects.

The Costa Fuego complex is on Chile’s coastal range and comprises the company’s principal reserves zones at Productora, Alice, San Antonio and Cortadera, which all lie within a radius of about 10km.

The centre of the company’s contiguous tenure and its current resources is about 63km southeast of the port city of Huasco, in the Huasco province of the nation’s highly prospective Atacama region.

Huasco plays an important role in Hot Chili’s plans, as it is the proposed location for the seawater intake for the company’s Huasco Water project.

Huasco Water is an joint venture between Hot Chili and Chilean mining company Compañia Minera Del Pacifico. With its first-mover advantage, Huasco Water is the only company permitted to supply seawater in the Huasco Valley region, following a 10-year regulatory approval process.

The combined projects possess a valuable, unique and strategic mix for Hot Chili over the next decade and have what the company describes as a “top quartile copper production capacity with lowest quartile capital intensity”.

Hot Chili undertook March pre-feasibility studies for the water and the Costa Fuego gold-copper projects. A positive study outcome provides Hot Chili with an opportunity to consider the strategic value of its 80%-owned subsidiary company Huasco Water, which controls all its critical water assets.

The company sees significant value potential in outsourcing its vital seawater supply infrastructure and has secured Huasco Water’s position by executing a memorandum of understanding for a ground-breaking seawater offtake agreement for a proposed large-scale, multi-customer water business.

Its stage one water supply pre-feasibility study examined the delivery of 500 litres per second (L/s) of seawater, followed by a stage two 1300L/s of desalinated seawater supply.

A conceptual stage three study looked at future expansion to supply up to 2300L/s of desalinated water.

The staged approach considers the initial establishment of seawater supply infrastructure, including pumps and pipelines, towards the end of the decade, to be followed by an initial desalinated water supply and then subsequent phases of expansion.

It would enable long-term water supply to be scaled to regional demand growth to support mining, communities and agriculture in the Huasco Valley, with the potential to extend well beyond the project’s initial horizons.

The concept is further supported by significant interest in Huasco Water displayed by other Chilean and international water infrastructure investment groups, along with nearby mine developers, agricultural and community groups and government bodies.

Hot Chili says while long permitting timelines continue, its desalination permitting is progressing and no regulatory changes have been made to Chile’s maritime permitting process since Huasco Water was granted its concession.

Additionally, the company’s environmental impact assessment (EIA) is advancing, with its stage one seawater supply baseline studies completed for inclusion in its Costa Fuego EIA.

The latest registration is a significant milestone that confirms Hot Chili’s projects meet the Chilean government’s objective criteria to acquire priority status.

With the paperwork in hand for both Costa Fuego and Huasco Water, the company is now able to centralise and monitor all of its active permitting processes through a single platform and supervisory entity.

The current permitting needs include the company’s second maritime concession application for Huasco Water and its upcoming EIA submission for Costa Fuego and Huasco Water.

Hot Chili strengthens team to push Chile projects into development

Andrew Todd BULLS N’ BEARS

Hot Chili has secured the services of two seasoned mining executives to bolster leadership as the company progresses its Costa Fuego copper-gold project and Huasco Water venture in Chile’s Atacama region.

Ex-Gold Fields Australia executive Stuart Mathews joins as non-executive chairman, while Chilean copper expert Alberto Cerda assumes the role of project director. Cerda brings a particular set of skills… namely in mine development and operations to support the company’s upcoming definitive feasibility studies for both projects.

The appointments align with Hot Chili’s strategic focus on advancing its low-altitude, copper and water projects amid a looming copper market, which has international majors clamouring for quality.

Hot Chili says Mathews’ and Cerda’s proven expertise in delivering large-scale mining operations – particularly in Chile in Cerda’s case – positions the company to navigate the complexities of project development, resource optimisation and strategic partnerships in the world’s top copper producing country.

Costa Fuego is a large copper-gold porphyry set to churn out 116,000 tonnes per annum of copper-equivalent metal, which includes 95,000t of copper and 48,000 ounces of gold in its first 14 years. Importantly for Hot Chili’s metals mix, chairman Mathews comes from a gold mining background as the recent executive vice president for Gold Fields in Australasia, where he oversaw operations producing more than 1 million ounces of gold annually.

Cerda takes care of the copper background as a Chilean mining engineer with more than 40 years of experience in major copper projects in Chile for companies such as Newmont, Barrick and BHP Billiton.

Hot Chili’s projects are strategically positioned to benefit from rising copper demand and regional infrastructure needs. Costa Fuego’s robust economics and Huasco Water’s exclusive water supply permit make it strategically significant to the region.

With environmental permitting and exploration ongoing, the company is well-placed to deliver and further extend its overall resource numbers, thanks to a recent discovery of copper-gold porphyry mineralisation at its non-contiguous but nearby La Verde project.

Located 60 kilometres from Las Losas port on Chile’s coastal range, Costa Fuego is Hot Chili’s flagship project. A recent prefeasibility study outlined a 20-year mine life with a maiden ore reserve of 502Mt grading 0.37 per cent copper, 0.10 grams per tonne (g/t) gold, 0.49g/t silver, and 97 parts per million (ppm) molybdenum, with a contained 1.86Mt copper, 1.58M ounces gold, 7.95M ounces silver and 49,000t molybdenum.

The project is expected to generate a post-tax net present value (NPV) of US$1.2 billion at a US$4.30 a pound copper price and US$2280 per ounce gold price. At current market prices, the NPV increases to US$2.2B, with a 19 per cent internal rate of return and a five-year payback on US$1.27B capital expenditure.

Hot Chili’s 80 per cent-owned Huasco Water project, in partnership with Compañia Minera del Pacifico, addresses critical water scarcity in the Huasco Valley.

Secured after a decade-long regulatory process, Huasco Water holds the region’s only maritime licence for seawater supply, providing the project with a significant competitive advantage. Its recent pre-feasibility study detailed a two-stage development plan to supply water to local major copper producers, to earn an estimated revenue of US$9.35B and a US$977M NPV over 22 years of supply.

The company has completed its baseline environmental studies and a second maritime concession application is under review, positioning Huasco Water, like Costa Fuego copper, to commence supply by the end of the decade.

With copper prices soaring and gold continuing at all-time highs, the appointments come at pivotal time in the company’s development. Hot Chili says it remains on a tidy $7.5M cash pile to rapidly expand its resources, while simultaneously courting strategic partners for production at its huge copper and water undertakings.

Hot Chili rocks out as drilling reveals potential scale of “major” La Verde copper-gold discovery

February 11, 2025 | Stockhead

- Hot Chili drilling intersects more broad zones of copper-gold mineralisation at La Verde

- Results highlight potential to be the company’s next major copper-gold discovery

- Assays pending for a further seven holes while step-out drilling is underway

Special Report: Hot Chili now has multiple new significant drill intersections from a further 10 holes to prove that its La Verde project in low elevation coastal Chile is a major copper-gold porphyry discovery.

The company first received a taste of the project’s potential back in mid-December 2024 after announcing very thick copper-gold intersections from its first two drill holes.

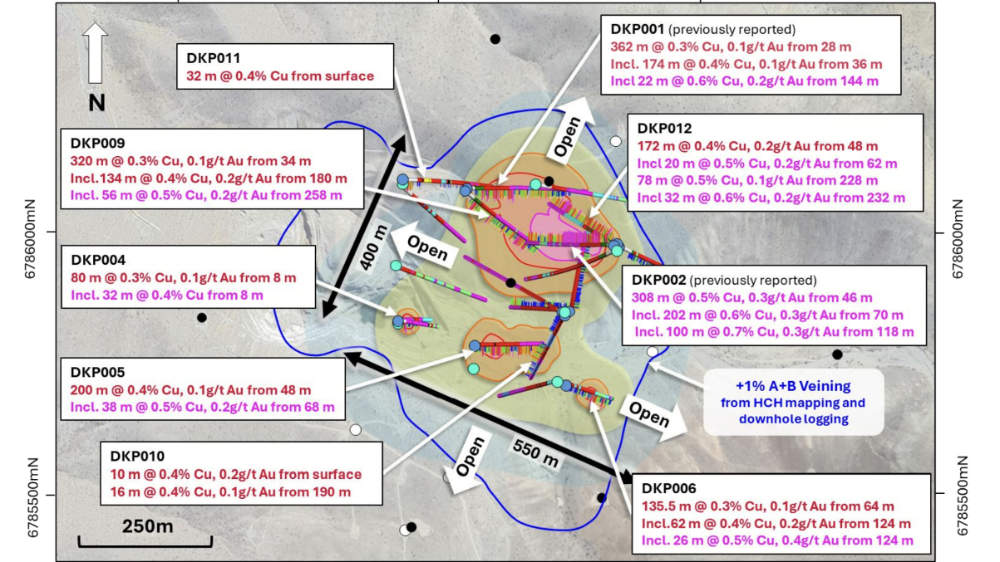

Hole DKP001 got the show on the road with a 174m intersection grading 0.4% copper and 0.1g/t gold from a down-hole depth of just 36m before DKP002 quickly blew Hot Chili’s (ASX:HCH) expectations out of the water with a stunning 308m interval at 0.5% copper and 0.3g/t gold from 46m to end of hole.

DPK002 also hosts a higher grade zone of 202m at 0.6% copper and 0.3g/t gold from 70m, which is encouraging from a development standpoint as its places the richest resources closer to surface.

A fantastic start no matter how you look at it and one that just got a whole lot better.

Assays from another 10 holes have now returned broad, consistently mineralised intersections extending over 300m vertically that start from shallow depths.

Notable intersections from the rapidly growing oxide and sulphide find are:

- 320m at 0.3% copper and 0.1g/t gold from 34m to EOH including 134m at 0.4% copper and 0.2g/t gold from 180m and 56m at 0.5% copper and 0.2g/t gold from 258m (DKP009)

- 200m at 0.4% copper and 0.1g/t gold from 48m to EOH including 38m at 0.5% copper and 0.2g/t gold from 68m (DKP005); and

- 172m at 0.4% copper and 0.2g/t gold from 48m including 20m at 0.5% copper and 0.2g/t gold from 62m with a separate intersection of 78m at 0.5% copper and 0.1g/t gold from 228m to EOH including 32m at 0.6% copper and 0.2g/t gold from 232m (DKP012).

Major discovery

The new drill results outline La Verde’s potential scale with managing director Christian Easterday saying the project is shaping up to be the company’s next major copper-gold discovery that could lift the scale of its Costa Fuego project.

“With primary copper supply declining, copper and gold prices rallying, and a PFS on each of our planned businesses (copper-gold and water) nearing completion – momentum is building fast,” Easterday said.

“Following in the footsteps of our successes at Cortadera and Productora, we’ve secured full control of La Verde after years of strategic consolidation, finally allowing us unrestricted access to test this historically overlooked porphyry system.

“Drill results have exceeded expectations, revealing a much larger porphyry system than first recognised, with broad, consistent copper-gold mineralisation extending from shallow depths and largely hidden below shallow gravel cover.

“This discovery has all the signs of becoming our third bulk-tonnage, copper-gold deposit, and is open in all directions and growing fast. We’re also preparing to deploy AI-powered exploration to fast-track our nearby exploration growth pipeline, leveraging 16 years of expertise in Chile.

“With La Verde’s scale potential and the Costa Fuego copper-gold hub expanding, we’re at a major inflection point in Hot Chili’s growth story.”

The project, which hosts the historical La Verde copper mine, is at the core of the historical Domeyko mining district and in the centre of the company’s recently consolidated and larger Domeyko landholding.

La Verde drilling

To date, HCH has drilled 19 holes totalling 5700m at La Verde and received assays from 12 holes.

This has defined a discovery footprint measuring 550m by 400m that remains open in all directions.

Mineralisation starts from shallow depths and extends to more than 300m below surface with indications that its deeper potential remains untapped as eight of the holes reported to date ended in mineralisation.

Adding further interest, the gravel cover at La Verde could mask a much larger porphyry system with the company noting that step-out drilling is now underway.

Drill testing of the historical oxide copper open pit at the project is also pending.

HCH is now awaiting assays from seven additional reverse circulation holes.

It is also planning to carry out diamond drilling to test potential for deeper, higher-grade zones at depth and to test potential for +1km vertical depth extent, typical of other recent major porphyry discoveries, such as the company’s Cortadera discovery and BHP/Lundin Mining’s Filo del Sol find.

Hot Chili’s standout drill intersections raise the mercury at La Verde

December 18, 2024 | Stockhead

- Hot Chili’s thick copper-gold intersections validate historical drilling at its La Verde project

- Second hole’s 308m intersection at 0.5% copper and 0.3g/t gold exceeds expectations

- It also highlights La Verde’s potential to host a higher-grade copper-gold zone

Special Report: Hot Chili’s initial drilling at La Verde has validated its decision to acquire the historical copper mine in Chile after returning thick copper-gold intersections.

While the first hole – DKP001 – provided a good show with a 174m intersection grading 0.4% copper and 0.1g/t gold from 36m, the second hole about 120m to the southeast really upped the ante after recording a 308m interval at 0.5% copper and 0.3g/t gold from a down-hole depth of 46m to the end of hole.

Not only did DKP002 exceed the company’s expectations and end in mineralisation, it also intersected a higher grade zone of 202m at 0.6% copper and 0.3g/t gold from 70m.

The results are hugely encouraging for Hot Chili (ASX:HCH) as the La Verde porphyry footprint measures about 850m by 700m, which is roughly comparable to its higher-grade Cortadera Cuerpo 3 copper-gold porphyry about 30km to the north.

Cuerpo 3 is also the largest porphyry at Cortadera with a higher confidence indicated resource of 798Mt grading 0.45% copper equivalent, or contained metal of 3.6Mt copper and 3Moz gold, and inferred resources of 203Mt at 0.31% CuEq.

What this means is that further drilling successes could unlock another resource of similar size, which will in turn provide a substantial boost to the company’s Costa Fuego copper hub.

La Verde mine

The historical La Verde open pit mine in the Domeyko mining district, which the company acquired in November 2024, was previously exploited by private interests for shallow porphyry copper-style oxide mineralisation with limited drill testing outside the central lease or at depth.

Importantly, it sits in the centre of the company’s recently consolidated and larger Domeyko landholding, secured in an option agreement back in April 2024.

This marks the first time the area has been consolidated, and provides the company with access to a much larger potential porphyry copper deposit footprint measuring around 1.4km by 1.2km.

HCH promptly launched and completed a 12-hole reverse circulation drill program totalling ~3150m with the first two holes designed to validate historical drill intercepts and test the interpreted northern extension of the porphyry from the open pit.

While DKP001 was successful in validating the most notable copper intercept from historical drilling, the assays from DPK002 really demonstrated the value of La Verde by highlighting its potential to host a higher-grade copper-gold zone.

The consistent higher-grade results confirm the extension of the porphyry system almost 400m to the northeast of the open pit, a significant step out considering the existing pit measures about 200m by 400m.

It is also located immediately beneath a gravel cover sequence which obscures the ultimate extent of the porphyry system.

Assays are pending for the remaining 10 holes though the success of the first holes has prompted HCH to expand the RC program by another 2000m of drilling, expected to be completed in late January 2025.

Kristie Batten: BHP’s Filo takeover shortens list of large copper developers

September 23, 2024 | Kristie Batten

One of Australia’s top mining journalists, Kristie Batten writes for Stockhead every week in her regular column placing a watchful eye on the movers and shakers of the small cap resources scene.

When BHP (ASX:BHP) and Lundin Mining Corporation announced a joint bid for Toronto-listed copper explorer Filo Corp in late July, it set pulses racing.

The C$4.1 billion cash and scrip bid represents a premium of 32.2% and will give the pair ownership of the Filo del Sol copper project.

BHP will also buy 50% of Lundin’s Josemaria project for US$690 million.

Both projects sit on the border of Chile and Argentina.

Goldman Sachs forecasts the two projects have the potential to produce a combined 400,000t of copper per annum, but could cost US$12-16 billion due to the infrastructure, which would include a desalination plant and concentrate pipeline.

Hot Chili (ASX:HCH) managing director Christian Easterday was quick to highlight the lack of large-scale copper projects outside the majors in his presentation to the Precious Metals Summit in Colorado this month.

“There’s not many of us out there and there’s not many that are meaningful and near-term,” he said.

“With Filo being taken over by BHP, the list just got shorter.”

In fact, according to Hot Chili, there are only a handful of projects with the potential to produce around 100,000tpa of copper sitting in companies outside the majors.

Hot Chili’s Costa Fuego in Chile is one. The others are SolGold’s Cascabel project in Ecuador, Los Andes Copper’s Vizcachitas project in Chile and McEwen Mining’s Loz Azules project in Argentina.

All are in South America, reaffirming the region’s position as a global hot spot for copper.

“The region hosts almost 20% of new copper supply,” Easterday said.

Capstone Copper is ramping up its Mantoverde copper project in Chile to the north of Costa Fuego, which Easterday says is similar to what Hot Chili is aiming to build.

Costa Fuego

Hot Chili, which has spent $220 million at Costa Fuego, completed a preliminary economic assessment for the project in 2023, outlining capital costs of US$1.05 billion.

Costs are low compared to the company’s copper peers due to Costa Fuego’s low elevation and proximity to the coast.

“It’s half the cost to build because we’re not up in the Andes,” Easterday said.

The project is projected to produce 112,000t of copper equivalent in the first 14 years at a C1 cash cost of US$1.33 per pound, net of by-product credits.

Using a US$3.85/lb copper price and US$1750 an ounce gold price, the project has a post-tax net present value of US$1.1 billion and internal rate of return of 21%.

“We are not special by grade, but we’re special by the location and that has directly led to these financial outcomes,” Easterday said.

A pre-feasibility study is underway and due for completion by the end of the year.

Copper is now trading at around US$4.26/lb, while gold is at a record of above US$2600/oz.

“Every US10c above US$3.85 (copper), we add about another US$100 million NPV after tax to the bottom line,” Easterday said.

Hot Chili’s “secret weapon” for funding the project is its new 80%-owned subsidiary, Huasco Water, a joint venture with Compañía Minera del Pacífico.

Huasco holds a maritime water permit and will aim to develop a multi-user seawater and desalinated water supply network for communities, agriculture and new mining developments in the Huasco Valley region of Chile.

The company will release a study on the water business in the coming months.

“The project is positioned for major catalysts at the end of this year,” Easterday said.

ASX unmoved

Despite owning the largest copper development project on the ASX outside the majors in the world’s hot spot for copper development and M&A, Hot Chili shares have fallen by 37% over the past year.

The company listed on the TSX in 2021, but it still underperforms against its Toronto-listed peers.

Of the four firms that issue research coverage on Hot Chili, three are based in Canada, further highlighting the disinterest in the Australian market.

That’s despite counting Glencore as its major shareholder.

“We’re in the early stages of a copper cycle,” Easterday said.

“It’s a very, very different cycle we’re moving into. It’s about lack of supply.”

Earlier this year, S&P Global Commodity Insights found that the average time from discovery to production was now 16.3 years.

“The timeframes of 17-20 years to develop these assets are very real,” Easterday said.

“We’re sitting at probably the precipice of an electrification future, where copper is the key ingredient, and we simply don’t have an answer about where the supply is going to come from.”

Easterday said the incentive price still needed to be higher for new large-scale copper mines.

“We’re like a large-scale iron ore producer when iron ore is sitting at US$20/t,” he said.

Hot Chili pours new water company into Chilean valley

July 8, 2024 | The West Australian

Hot Chili has entered into a new joint venture (JV) aimed at supplying seawater and desalinated water to mining projects throughout Chile’s Huasco Valley where it is pursuing its own mammoth Costa Fuego copper-gold project.

The company today confirmed it will hold an 80 per cent interest in Huasco Water and its critical water assets in the JV with Chilean iron ore company Compania Minera del Pacifico (CMP). The new company is expected to supply desalinated water to operations including Costa Fuego and CMP’s Los Colorados iron ore mine.

The JV says further offtake negotiations are already underway.

The Huasco Valley region in Chile’s Atacama Desert is one of the driest regions on Earth, inducing significant water demands from mining operations and local communities. The new water initiative reflects an increasing trend in the Atacama region towards collaborative water infrastructure development, highlighted by a recent US$600 million (AU$890 million) deal for Antofagasta Minerals’ Atacama water rights and assets.

The Company has been receiving increasing interest from potential strategic funding parties in its advanced Costa Fuego copper-gold development and its recently announced Water Supply Studies. This interest, in combination with a rising copper price environment, provides confidence to accelerate the Company’s growth and development plans whilst preserving control of these assets.

Hot Chili managing director Christian Easterday

The company holds the only granted maritime water concession and necessary permits to provide critical water access to the Huasco Valley. It has outlined about 3700 litres per second of potential future desalinated water demand from new mine developments around the valley alone.

The JV partners are likely to underpin Huasco Water as potential foundation offtakers with the Costa Fuego copper project requiring some 700 litres per second of future seawater demand, while Los Colorados needs a further 200 litres per second. Hot Chili says significant economic, environmental and social synergies exist for all potential customers in the Huasco Valley, especially given growing community and regulatory opposition to continental water extraction in the Atacama.

Initial offtake discussions are already underway with nearby mine developers, with additional non-mining desalinated water customers expected to come from the area immediately adjacent to the Costa Fuego copper hub.

The Costa Fuego copper-gold project, which lies some 740m up the hill from the proposed Huasco desalination plant, features a measured and indicated resource that sits at 798 million tonnes at 0.45 per cent copper equivalent for 3.62 million tonnes of copper equivalent, containing 2.91 million tonnes of copper, 2.64 million ounces of gold, 12.8 million ounces of silver and 68,100 tonnes of molybdenum. It makes it one of a limited number of “globally-significant” copper developments that are not in the hands of a major mining company.

Hot Chili recently executed a $29.9 million fundraising campaign on the back of a US$15 million (A$22.23 million) net smelter royalty (NSR) deal with Osisko Gold Royalties, aimed at driving its Costa Fuego copper hub in Chile into production. It comes as the red metal’s price recently launched to 60-year highs, prompting majors across the world to look to acquire copper-producing assets of scale.

The Costa Fuego prefeasibility study (PFS) is expected in the second half of this year.

By further securing its water supply and also creating a new company capable of luring significant offtake partnerships, Hot Chili now feels confident enough to sink another 25,000m of drilling into the project. It will also pursue more regional exploration and land consolidation in a show of confidence at the copper project, taking final steps forward before a bankable feasibility study and final investment decision.

Copper, water and deep pockets of cash have Hot Chili set up for an eventful second half of the year. And with copper prices remaining solid, the company appears well-positioned now to give its giant Costa Fuego project a good crack at development.

Hot Chili’s new JV to ensure water supply security for Costa Fuego

July 8, 2024 | STOCKHEAD

- Hot Chili forms water joint venture with Chilean iron ore company Compania Minera del Pacifico

- Huasco Water will develop a multi-user seawater and desalinated water supply network

- This will supply future water demand for communities, agriculture and new mining developments for the Huasco Valley region

Special Report: Water is a valued resource that is scarce in areas like the Atacama, which is why copper-gold developer Hot Chili is pairing up with Chile’s Compania Minera del Pacifico to form a water joint venture.

The Atacama region includes the Atacama Desert – the world’s driest nonpolar desert in the world – and is unsurprisingly one of the most water stressed regions of the world.

It is also where Hot Chili’s (ASX:HCH) Tier-1 Costa Fuego copper-gold project is located – specifically within the Huasco Valley that has a long history of mining.

Costa Fuego includes the outstanding Cortadera deposit with an indicated resource of 798Mt grading 0.45% copper equivalent for contained resources of 2.9Mt copper, 2.6Moz gold, 12.9Moz silver and 68,000t of molybdenum.

Costa Fuego also holds a further inferred resource of 203Mt @ 0.31% copper equivalent for 0.5Mt copper, 0.4Moz gold, 2.4Moz silver and 12,000t molybdenum.

Mines typically need considerable amounts of water to operate, a point highlighted by Hot Chili’s estimate the Huasco Valley may need up to 3,700 litres per second of desalinated water in the future for its new mine developments.

A water supply concept study released in February this year confirmed the potential for a large-scale, multi-user desalinated water network serving the entire Huasco Valley, which rather neatly aligns with the Chilean Government’s push for such networks in the Atacama.

Water supply security

Given how important a secure water supply is to mining developments – including Costa Fuego – agriculture and communities in the Huasco Valley, HCH and Chilean iron ore company Compania Minera del Pacifico have established a new water company HW Aguas para El Huasco SpA (Huasco Water).

The 80-20 joint venture will hold the maritime water extraction licence, water easements, costal land accesses and second maritime application previously held by Sociedad Minera El Águila SpA (SMEA), which is also jointly owned by the two companies.

Huasco Water aims to develop a multi-user seawater and desalinated water supply network to supply future water demand for communities, agriculture and new mining developments for the Huasco Valley region of Chile.

HCH and CMP will be foundation offtakers for Huasco Water with the former’s Costa Fuego project expected to consume some 700l/s of sea water while CMP’s Los Colorados iron ore mine will require about 200l/s of desalinated water.

Water offtake discussions are also underway with nearby mine developers and additional non-mining, desalinated water customers situated close to Costa Fuego.

Water infrastructure trends

The company noted that its approach towards potential outsourcing and development of shared infrastructure, in addition to preserving scarce continental water sources, is fast becoming the accepted and responsible approach for unlocking future mining developments in the world’s most prolific copper producing region.

It highlighted Antofagasta’s recent sale of their water assets and water rights to the Centinela copper mine for US$600 million to a consortium of Transelec and Almar Water, which will finance, build, own and operate an expansion project that will sell seawater to the Centinela mine expansion.

The consortium will build a 144km long seawater pipeline using Centinela’s water rights that will parallel the existing pipeline from port to mine, allowing Antofagasta to save US$380M in capital expenditure for the construction of its stage 2 water infrastructure expansion.

HCH said this highlights the strategic nature and implicit value of critical water access rights within the Atacama, and an increasing trend in Chile towards outsourcing in the industrial infrastructure sector.

Hot Chili to pump in $29.9m to develop Chilean copper play

Hot Chili has loaded its financial base with a $29.9 million fundraising campaign aimed at supercharging its Costa Fuego copper hub in Chile – at a time when the reddish metal’s price is at a 60-year high.

The $119.45 million market-capped company’s significant raise, which it said drew strong demand from Australian and overseas institutional investors, coincides with a rising copper price sitting at about US$4.57 (A$6.91) per pound.

Management says it expects its private $24.9 million placement to be complemented by a further $5 million share purchase plan (SPP) to reach the $29.9 million in new funding. Shares were offered at $1 for both the placement and the SPP.

Following the completion of the raise, Hot Chili says it will move to finish its Costa Fuego prefeasibility study (PFS) in the second half of the year, further secure its water supply and also create a new water company, plug in 25,000m of drilling, pursue more exploration and land consolidation in the next 18 months and kick off a “bankable” feasibility study.

The boost to its finances follows hot on the heels of its recent half-yearly figures that showed it already had A$13.3 million in cash at the bank after reducing its 2024 commitments by US$10 million (A$15.12 million) through consolidating its option agreements, securing its water supplies and filing its technical report for the Costa Fuego copper-gold project.

We control large-scale assets in two of the most critical commodities of our time – copper and water – with two of the most desirable attributes – low-risk and near-term. In combination with a rising copper price which indicates the initial stages of a new copper price cycle driven by lack of supply, this gives the Company confidence to accelerate its growth and development plans while preserving control of these assets for our shareholders.Hot Chili managing director Christian Easterday

Easterday said the company had received increasing interest from potential strategic funding parties to help Costa Fuego’s copper-gold development and its recently-announced water supply studies. He said the project remains one of a limited number of “globally-significant” copper developments that was not in the hands of a major mining company.

Costa Fuego’s measured and indicated resource sits at 798 million tonnes at 0.45 per cent copper equivalent for 3.62 million tonnes of copper equivalent, containing 2.91 million tonnes of copper, 2.64 million ounces of gold, 12.8 million ounces of silver and 68,100 tonnes of molybdenum.

Hot Chili also recently inked a deal with Osisko Gold Royalties, pocketing US$15 million (A$22.68 million) in exchange for a 1 per cent net smelter return (NSR) royalty on copper and a 3 per cent NSR on gold across the Costa Fuego project. Management says the Osisko investment provided an endorsement of its project and its economics from one of North America’s leading royalty-streaming groups.

In addition, the company consolidated its tenure while expanding its ground footprint and kicked off its exploration and resource expansion drilling programs. It updated its resource numbers and obtained results from its initial drilling of its latest satellite targets at Marsellesa, Cordillera and Corroteo, with some good copper hits including 25m grading 0.4 per cent copper from surface with 10m at 0.8 per cent from just 7m depth at Marsellesa.

Hot Chili’s Costa Fuego is a boomer of a resource that is seems to be emerging at just the right time and the latest funding moves look set to put a solid set of wheels under the venture to get it fully on track.

Hot Chili grows Costa Fuego with Domeyko acquisition, where historical copper-gold mines are unexplored at depth

STOCKHEAD

The nearby Domeyko mountains of the Andes in copper-rich Chile. Pic via Getty Images

- Landholding increased by 25% at flagship Costa Fuego project, which has a current resource of 798Mt at 0.45% copper equivalent

- Domeyko concessions bought as exercisable options to purchase for $4m

- Domeyko mining centre hosts several significant historical copper-gold mines, unexplored at depth

Special Report: Porphyry developer Hot Chili has acquired the ‘Domeyko cluster’ tenements to boost the size of its flagship 798Mt Costa Fuego copper-gold project in Chile by 25%.

Costa Fuego has a current resource of 798Mt at 0.45% copper equivalent for 2.9Mt copper, 2.6Moz gold, 12.9Moz silver and 68,000t molybdenum.

Two years of drilling and studies have the project now pegged as a low-risk, low-cost and long-life copper project in the world’s largest producer of the red metal.

Lately, Hot Chili (ASX:HCH) has been busy building out a network around its project with water supply and transport deals in the region.

It’s executed a five-year MoU deal with the nearby port to evaluate bulk tonnage loading alternatives for copper concentrate from Costa Fuego that would include a ‘take or pay volume’ clause based on at least 80% of the project’s future annual concentrate production.

The explorer has also announced a focus on water infrastructure and desalination in Chile’s Atacama region – one of the driest regions on earth.

A new addition to the south

Domeyko is the largest land consolidation undertaken by Hot Chili since Cortadera was added to Costa Fuego in 2019, adding 141km2 and representing a 25% lift in the company’s total tenure in the region.

The move contains several new tenement applications in addition to an option agreement to acquire 100% interest in several key tenements covering a highly prospective, 10km-long copper-gold mineralisation corridor.

The Domeyko mining centre hosts several significant historical copper-gold mines which were principally exploited for oxide mineralisation yet have had very limited exploration for copper sulphide mineralisation.

Both porphyry and structurally hosted styles of mineralisation are present in the area and historic datasets are currently being looked over across several highly prospective targets that have never been drilled.

The total exercisable option to purchase Domeyko comes to $4m, payable within two years to a private Chilean syndicate.

More drilling, exploration and development study workstreams across Costa Fuego are ongoing and further updates on progress of the company’s regional water supply business case study are expected soon.