Hot Chili is raising $29.9m as studies ramp up on massive Costa Fuego copper project

STOCKHEAD

- Hot Chili has secured $24.9m through a private placement and is raising up to $5m under a share purchase plan

- Funds will support a Costa Fuego PFS, drilling, exploration and land consolidation

- Proceeds will also be used to set up a new water company

Special Report: Hot Chili is raising up to $29.9m through a private placement and share purchase plan to accelerate development of its meaty 798Mt Costa Fuego copper-gold project in Chile.

Australian, Canadian and overseas institutional investors along with existing shareholders demonstrated their confidence in the company’s assets by quickly snapping up the $24.9 million shares priced at $1 each under the private placement.

The company has good reason to be confident.

In the past two years, Hot Chili (ASX:HCH) has built Costa Fuego into a low-risk, low-cost and long-life copper-gold project with a current indicated resource of 798Mt at 0.45% copper equivalent, or contained resources of 2.9Mt copper, 2.6Moz gold, 12.9Moz silver and 68,000t molybdenum.

Indicated resources grant enough certainty for the company to start mine planning and also serve as a platform for a maiden reserve estimate for the upcoming pre-feasibility study.

HCH has already executed a five-year MoU deal with the nearby port to evaluate bulk tonnage loading alternatives for copper concentrate from Costa Fuego that would include a ‘take or pay volume’ clause based on at least 80% of the project’s future annual concentrate production.

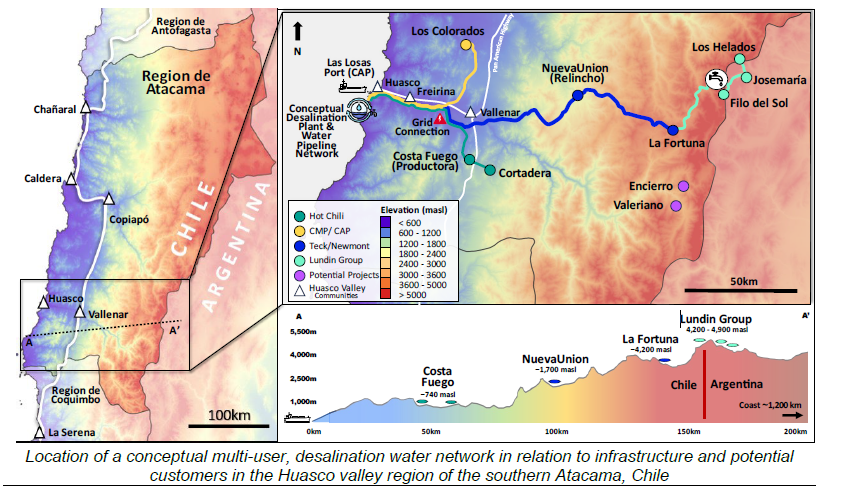

The company is also exploring the potential to develop a water supply network in the Huasco valley region – one of the driest places in the world.

Fully funded to deliver key milestones

The placement is part of a broader capital raising that includes a share purchase plan offering existing shareholders the opportunity to subscribe for up to $30,000 worth of shares to raise up to $5m.

Taken together, the $29.9m capital raising ensures that HCH is fully funded to deliver the following key milestones in the growth and development of Costa Fuego:

- Completion the Costa Fuego PFS, expected in H2 2024

- Advance the water supply study and create a new water company, expected in H2 2024

- Up to 25,000m of drilling, exploration and further land consolidation over next 18 months, and,

- Commencement of a bankable feasibility study over the next 18 months

It will also increase the company’s s trading liquidity on the TSX Venture exchange.

“We control large-scale assets in two of the most critical commodities of our time – copper and water – with two of the most desirable attributes – low-risk and near-term,” Hot Chili managing director Christian Easterday said.

“The company has been receiving increasing interest from potential strategic funding parties in its advanced Costa Fuego copper-gold development and its recently announced water supply studies.

“This interest, in combination with a rising copper price environment, provides confidence to accelerate the Company’s growth and development plans while preserving control of these assets for our shareholders.”

Easterday is bullish the world is currently witnessing the early stages of a new copper price cycle, with a valuation of US$9,910/t on the LME at the time of writing.

Three-month contract prices rose around 18% in April alone, with a $60bn bid by BHP for Anglo American demonstrating the dearth of significant new copper developments in the global pipeline.

“The placement and share purchase plan maintain the company’s strategic funding optionality, while ensuring Costa Fuego remains one of a limited number of globally significant copper developments, not owned by a major mining company, that could deliver meaningful new copper supply this decade,” Easterday said.

“Market conditions are indicative of the initial stages of a new copper price cycle being driven by a lack of new supply. The company is now well funded to take advantage of controlling the right assets at the right time in the right place.”

Hot Chili moves to seal port access for giant copper project

STOCKHEAD

Hot Chili wants to provide desalinated water to the mining-intensive Huasco Valley. Pic via Getty Image

- Hot Chili is the only company in the Atacama region holding most necessary permits/licences to provide desalinated water supply to Huasco valley

- HCH has now submitted second maritime concession application to support a potential multi-user, water network for the Huasco valley area

- Both raw seawater and desalinated water could be provided by a potential water network

- HCH’s water assets to be transferred to a new, wholly owned water company

Special Report: Tier 1 copper-gold mine developer Hot Chili is expanding its horizons beyond traditional mining ventures with a focus on water infrastructure in Chile’s Atacama region – where water scarcity is a major challenge.

Hot Chili (ASX:HCH) is developing its flagship Costa Fuego copper-gold project, where 24 months of extensive drilling has confirmed the endowment of a 798Mt at 0.45% copper equivalent for 2.9Mt copper, 2.6Moz gold and 12.9Moz silver – with 68,000t of molybdenum to boot.

While the Costa Fuego project plans to utilise raw seawater, HCH sees an opportunity to build a water company focused on desalination operations along the Huasco coastline where major iron ore and copper mining projects exist and water scarcity is the current reality.

Beyond Costa Fuego: HCH is establishing a water company

Aligning with the Chilean Government’s push for multi-user desalination networks in the Atacama, HCH’s proactive approach positions it to address the critical challenge of water scarcity for new mining projects.

A water supply concept study released in February confirmed the potential for a large-scale, multi-user desalinated water network serving the entire Huasco Valley.

It’s now submitted a second maritime concession application to establish a multi-user network there and is preparing to transfer its water assets, including permits and land access, to a new water company under its control.

HCH says the application is crucial for developing this large-scale water supply, which aims to deliver up to 3,700L/s in the long term in the region and is the culmination of over a decade of permitting efforts for HCH’s Costa Fuego project.

Hot Chili executive VP José Ignacio Silva says water scarcity is a critical issue for projects in the Atacama, where Costa Fuego is surrounded by existing and potential mine developments.

“Hot Chili is the only company holding most of the necessary permits required to provide desalinated water to the Huasco valley – a prolific region for potential new global copper supply needed to support global electrification and decarbonisation,” Silva says.

“Securing these assets has involved over a decade of commitment. Socially and environmentally, multiclient and multipurpose water infrastructure is the new reality.”

A water supply business case study is underway and engagement with potential customers, infrastructure partners, and government regulators is ongoing.

Hot Chili moves to seal port access for giant copper project

The West Australian

The Las Losas Port facility to be tasked with handling Hot Chili’s copper concentrate. Credit: File.

Hot Chili has made a key step towards securing port access – one of the final in-country advantages for its Costa Fuego copper-gold project in Chile – by securing a crucial memorandum of understanding (MOU) with local port managers.

The Los Losas port at the centre of the negotiations is just 50km west of the company’s project that boasts 3.62 million tonnes of contained copper-equivalent.

As part of the MOU, management says it will fund 20 per cent of a two-year, US$4.6 million (AUD$6.95 million) feasibility study into developing a bulk-tonnage copper concentrate facility at the port. The study will include bulk loading alternatives for copper concentrates from existing facilities, potentially without modifying the existing infrastructure at the port.

The company believes the developed port would be a stimulant for many other projects in the area.

Following the study, Hot Chili says it will have a right of first refusal to ship copper concentrates through Puerto Las Losas facilities for three years. The company says it now has up to five years to negotiate a binding port services agreement, which may include a “Take or Pay Volume” clause, based on at least 80 per cent of Costa Fuego’s projected future annual concentrate production.

Management has confirmed the first item to be addressed will be the formation of a technical committee to progress the feasibility study. The committee will take aim at defining key deliverables and a timetable for management of the completion of the study’s workstreams within the first month.

Leveraging an existing port, located 50km away, into a bulk concentrate export facility has the potential to unlock significant capital and operating savings for Costa Fuego and other potential mine developers in the Huasco region of Chile. Hot Chili plans to jointly develop a significant copper infrastructure corridor, enabling our own production, and unlocking multiple projects within the region, which would benefit significantly from desalinated water supply and proximal bulk copper concentrate port facilities.

Hot Chili managing director and chief executive officer Christian Easterday.

Last month, Hot Chili unveiled a six per cent boost to the indicated copper-gold resource at its Costa Fuego project and management says 85 per cent of its mineral resource estimate now sits in the indicated category. The company’s proposed open pit mine development will dig away at 93 per cent of the resource and the remaining 7 per cent will be accessed via underground mining.

The total Costa Fuego resource in the indicated category is now 798 million tonnes grading 0.45 per cent copper-equivalent for 2.9 million tonnes of copper, 2.6 million ounces of gold, 12.9 million ounces of silver and 68,000 tonnes of molybdenum. The total inferred resource is 203 million tonnes at 0.31 per cent copper-equivalent for 500,000 tonnes of copper, 400,000 ounces of gold, 2.4 million ounces of silver and 12,000 tonnes of molybdenum.

The project sits at low altitude, between 800m and 100m above sea level, about 600km north of Chile’s capital of Santiago and is comprised of four deposits – Cortadera, Productora, Alice and San Antonio – which are all in close proximity. The majority of the resource contained within the Cortadera deposit contains about 64 per cent of total indicated resources and 69 per cent of total inferred estimates.

The company says it is engaging with several potential infrastructure partners and reviewing the potential for direct government support to assist with driving the project forward. Management says that drive includes a concept study for a 100 per cent renewable energy-driven desalination water project for the southern Atacama region.

The proposition has the potential to supply agricultural, community and new mining demand in the Huasco valley region, near the Costa Fuego project, of up to a massive 3700 litres per second.

With port talks well and truly underway, Hot Chili is busily converting data from 24.5km of drilling across Costa Fuego into a maiden mineral reserve for its upcoming prefeasibility study (PFS) that is expected to be completed in the second half of this year.

The company’s share price was up on today’s news to hit an intraday high of $1.07 on good volume, up almost 14 per cent from yesterday’s close of 94c.

Hot Chili Announced as Winners of The Parker Challenge Competition

At the inaugural AusIMM Mineral Resource Estimation Conference in Perth last week the results of the Parker Challenge Competition were presented, with the Hot Chili Resource Development team awarded first place for their outstanding application and demonstration of professional best practice.

The innovative Parker Challenge was designed and judged by the mining industry’s most experienced Resource Geologists, to quantify the “between person variance” seen in resource estimation. Hundreds of participants from around the world were given the same deposit to estimate, with Rio Tinto suppling the dataset from their Oyu Tolgoi deposit in Mongolia, as well as sponsoring a $55,000 prize.

Hot Chili Resource Development Manager Kirsty Sheerin thanked her team for their afterhours dedication to completing the Challenge, while also advancing the company’s Costa Fuego Project in Chile, currently on track to deliver a Preliminary Economic Assessment this financial year. The experience and talent of Senior Resource Geologist Chris McKie, Senior Project Geologist Madeline Wallace and Senior Database Administrator Katie Collins resulted in a winning submission, which the judges unanimously deemed to have no fatal flaws, standing out from other entries for its robustness of process and execution.

Ms Sheerin added, “Hot Chili has assembled one of the best resource development teams going around, highly motivated – and clearly competitive! – the collaborative culture fostered by Managing Director Christian Easterday has enabled this result. Hot Chili developed this approach with the guidance and mentoring of industry doyens such as Dr Steve Garwin as Chief Technical Advisor, Elizabeth Haren as Resource Geology Qualified Person, and Dr John Beeson as Lead Structural Geologist. This technical mentoring resulted in a first-class porphyry estimate, with the team utilising knowledge gained during completion of the Cortadera Mineral Resource Estimate in 2022”.

Hot Chili starts next phase of porphyry growth at Cortadera copper-gold discovery

STOCKHEAD | January 13, 2023

Two drill rigs are currently drilling Cortadera’s potential fourth porphyry. Pic: Getty Images

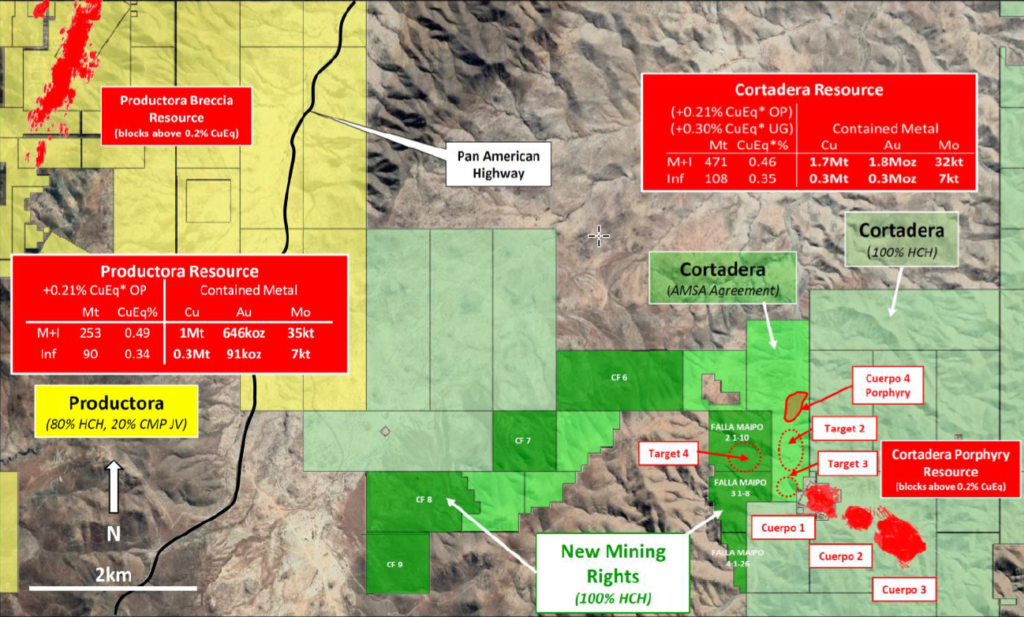

An initial 10,000m drilling program will test four porphyry targets as well as three other targets on the recently optioned AMSA landholding.

The company has started the new year with a bang as one diamond drill rig – operating on a double shift basis – and one reverse circulation rig are back in operation, testing Cortadera’s potential to host a much larger copper porphyry cluster than originally defined.

Hot Chili (ASX:HCH) has more than doubled the strike length of the discovery from 2.3km to 5.2km, increasing the near term material resource growth potential.

Both drill rigs are busy drilling Cortadera’s fourth porphyry, where previous historical drilling intersected shallow copper-gold porphyry mineralisation at 128m grading 0.5% copper equivalent (0.4% copper and 0.1g/t gold) from 28m.

Key growth activities on track for delivery this year

HCH says it is well funded to complete its planned drilling and deliver the next set of key growth and development milestones for Costa Fuego this year, which include a Preliminary Economic Assessment (PEA) in the first half of this year and a resource upgrade in the second half.

It hopes to potentially up-scale Costa Fuego’s future annual metal production rates, currently being studied at up to 100,000t copper and up to 70,000oz gold for a +20-year life of mine.

Hot Chili intends to deliver Costa Fuego’s Pre-feasibility Study (PFS) by 2024 and remains on-track as one of only a few near-term production projects in the world capable of producing +10,000tpa copper in the next five years.

Hot Chili Files NI 43-101 Technical Report For Costa Fuego

The Assay | May 17, 2022

Hot Chili Ltd (TSXV:HCH, OTCQX:HHLKF, ASX:HCH) has filed a National Instrument 43-101 Technical Report for its Costa Fuego copper-gold project in Chile with the Canadian Securities Administrators.

The filing of the report is further to its mineral resources upgrade announcement released to ASX on March 31, 2022 “Hot Chili Delivers Next Level of Growth” (Mineral Resources Upgrade Announcement).

The Report titled “Resource Report For the Costa Fuego Copper Project Located in Atacama, Chile Technical Report NI43-101” and dated May 13, 2022, with an effective date of March 31 2022, was prepared pursuant to Canadian National Instrument 43-101.

It is available for review on both SEDAR (www.sedar.com) and the company’s website (www.hotchili.net.au). The Report supports the news release dated March31, 2022 announcing a significant increase in the company’s mineral resource estimates at Costa Fuego.

Click here to view the Full News

The Assay | May 20, 2022

Hot Chili Limited (ASX: HCH) (TSXV: HCH) has obtained another outstanding drill result at the Cortadera porphyry deposit, part of the company’s Costa Fuego, coastal range, copper-gold hub in Chile.

Managing Director Christian Easterday said that Cortadera has a track record of outperforming expectation.

“The PFS in-fill drill programme across Cortadera has collected important geotechnical and hydrogeological information and has also continued to define and expand high grade resources,” Mr Easterday said.

“Upgrading our resources with wide drill intersections grading 0.8% to 1.0% copper equivalent is a great outcome, which demonstrates the quality and growth potential of Costa Fuego as one of the only low-altitude, material, copper developments in the world capable of near-term development.”

Latest Significant Drill Results from Cortadera

Latest results from development study drilling at Cortadera have returned further significant intersections.

Diamond drill hole CORMET005 returned 658m grading 0.6% CuEq (0.4% Cu, 0.2g/t Au, 122ppm Mo) from 232m depth, including 134m grading 0.8% CuEq (0.6% Cu, 0.2g/t Au, 181ppm Mo) from 470m depth, and including 130m grading 0.9% CuEq (0.6% Cu, 0.2g/t Au, 253ppm Mo) from 662m depth.

CORMET005 was drilled across the northern flank to the high-grade core within the main porphyry (Cuerpo 3) at Cortadera.

Mr Easterday said that pleasingly, the wide significant intersection again confirmed further extension to the high grade core and included an impressive 30m grading 1.4% CuEq (1.1% Cu, 0.5g/t Au, 165ppm Mo) from 690m depth outside of the current high grade (+0.6% CuEq) resource model.

The latest result follows the previous two outstanding drill results in April 2022 from Cuerpo 3, which also confirmed further growth of the high grade core, notably:

• 552m at 0.6% CuEq from 276m depth, including 248m at 0.8% CuEq (CORMET003), and

• 876m grading 0.5% CuEq from 246m depth, including 206m grading 0.9% CuEq (CORMET006)

In addition, diamond drill hole CORMET002 has returned 370m grading 0.4% CuEq (0.3% Cu, 0.1g/t Au) from surface, including 20m grading 0.8% CuEq (0.6% Cu, 0.4g/t Au) from 24m depth, and including 22m grading 1.0% CuEq (0.8% Cu, 0.5g/t Au) from 136m depth at Cuerpo 2.

These high-grade intersections were also outside the current high grade resource at Cuerpo 2.

A final development study diamond drill hole (CORMET004) is being completed at Cortadera and results are also pending for four metallurgical diamond drill holes completed at Productora.

High-Grade Satellite Resource Drilling Underway

Resource growth drilling has commenced targeting the San Antonio and Valentina high grade copper deposits, located 5 kms northeast of Cortadera.

High-grade, copper-gold mineralisation at both deposits remains open at depth and along strike. Drilling is already underway at Valentina where ten drill holes are planned. A further thirteen drill holes are planned at San Antonio.

San Antonio’s maiden Inferred resource, reported in March, extends from surface and already stands at 4.2Mt @ 1.2% CuEq (1.1% Cu, 2.1g/t Ag) for 48kt Cu and 287kt Ag. Both high grade satellite deposits are intended to form part of Costa Fuego’s next resource upgrade and combined PFS open pit mine schedule later this year.

Santiago Z Target Prepared for First-Ever Drilling Platform and access clearing across the Santiago Z exploration target is expected to be complete in the coming week and first-pass drilling is expected to commence following conclusion of drilling at Valentina and San Antonio.

Hot Chili’s soil results and mapping have confirmed a potentially large copper porphyry footprint measuring.

Click here to view the Full News

Hot Chili nabs maritime concession for sea water for its green Costa Fuego copper project

STOCKHEAD | Dec 07, 2022

Hot Chili has taken another bite of the cherry, expanding the footprint of its Cortadera copper-gold play. Pic via Getty Images.

The Chilean Naval Authority has granted copper developer Hot Chili access to the physical land of its Maritime Concession for extraction of sea water just 60km from the proposed location of Costa Fuego’s central processing facilities in Chile.

It’s another feather in the cap for the company, whose Costa Fuego project is slated to be a green copper development using sea water – with no ground water or desalination plant required.

Hot Chili (ASX:HCH) says the approval of its maritime application (water extraction right and associated land access rights) shows the Government’s support for the development of a new large-scale copper hub for the Vallenar region of Chile.

100% run on renewables too

This news adds another layer to the project’s environmental credentials at the Costa Fuego project, with Hot Chili able to operate off a mix of nearby solar, wind and hydroelectric generators, and having a clean (arsenic-free) concentrate.

Plus, the company recently received approval from Chile’s Central Authority Electrical Regulator to connect to the Maitencillo substation 17km from the centre of the Costa Fuego development.

It opens access for Hot Chili to the national electricity grid, with the company able to negotiate with the multiple renewable energy providers in the South American nation.

A process to select one or more electrical providers is expected to begin in the fourth quarter of 2022.

Hot Chili bulks up Cortadera land position – again.

STOCKHEAD | Nov 30, 2022

Hot Chili has taken another bite of the cherry, expanding the footprint of its Cortadera copper-gold play. Pic via Getty Images.

Mere days after securing a second major porphyry, Hot Chili has further expanded the footprint of its Cortadera copper-gold play by acquiring new mining rights.

The new rights – secured at low-cost through a government-run public auction – cover the western extension of the discovery and increases its prospective strike length to 5.2km, an increase from the 4.1km following the Cuerpo 4 acquisition.

Importantly for Hot Chili (ASX:HCH), the seven new mining rights covering 757 hectares host four large porphyry targets that have the potential to materially increase the scale of the broader Costa Fuego copper-gold development.

It also consolidates the western extension of Cortadera, allowing the company to test a potentially much larger porphyry cluster.

Extending two major trends

Hot Chili’s new ground extends the prospective strike lengths of two mineralised trends.

The Las Canas trend, which includes three of the new porphyry targets and the Cuerpo 4 porphyry, has been extended by more than 1.8km.

Meanwhile, the key Cortadera trend has been extended by 1.1km with the addition of a new porphyry target that is directly along strike from Cortadera on the Serrano fault, an important mineralising fault corridor connecting the Cortadera and Productora copper-gold deposits.

Hot Chili adds second major Cortadera porphyry, double exploration strike

STOCKHEAD | Nov 28, 2022

Hot Chili is set to grow its Cortadera copper-gold project over a large mineralised porphyry outcropping. Pic via Getty Images.

Hot Chili has executed an option agreement to extend its Cortadera copper-gold project over a large outcropping of mineralised porphyry similar in size to the main Cuerpo 3 porphyry.

The consolidation of Cortadera not only presents the opportunity to add significant mineralisation, it also about doubles the prospective strike length from 2.3km to 4.1km.

Given that Cuerpo 3 makes up a significant portion of the Cortadera mineralisation, which currently consists of a high confidence Indicated Resource of 471Mt grading 0.46% copper equivalent (CuEq) and an Inferred Resource of 108Mt at 0.35% CuEq, this could be hugely beneficial for the company.

Drilling of the new Cuerpo 4 porphyry by the vendor, Antofagasta Minerals (AMSA), has already confirmed several significant shallow drilling intersections including a thick 128m interval at 0.5% CuEq from a down-hole depth of 28m with a higher grade zone of 16m at 1.3% CuEq (1% copper and 0.5 grams per tonne gold) from 28m.

Hot Chili (ASX:HCH) intends to start a 6,000m drill program over the 700m by 300m Cuerpo 4 porphyry as soon as possible to assess a potential material resource addition to the broader Costa Fuego development.

New ground

The five mining rights acquired from AMSA cover 517 hectares and contain other identified porphyry targets besides Cuerpo 4.

Four of the five holes drilled by AMSA in 2005 returned wide intersections of mineralisation with their shallow nature highlighting open pit resource growth potential.

Hot Chili’s planned first pass program of both diamond and reverse circulation drilling will test Cuerpo 4 and two other targets within the new mining rights.

Drilling is also planned across the existing Cortadera North target, where earlier exploration drilling targeting a large surface molybdenum anomaly in 2020 intersected wide zones of silver mineralisation.

While this work vectored towards Cuerpo 4, the company had then ceased all exploration there until an agreement could be entered into with AMSA.

These rights are expected to provide relatively low cost and highly accretive resource growth potential.

Worth the wait

The acquisition has led the company to revise the release date for its next resource update to the second half of 2023 rather than late 2022 to include results from the proposed drilling.

Additionally, the combined Costa Fuego Pre-Feasibility Study – targeting annual production rates of up to 100,000t copper and up to 70,000oz of gold over a mine life of more than 20 years – will be paused until the company can assess the impact of resource growth potential at Cortadera.

This ensures that future expenditure relating to the PFS can be optimised for infrastructure location and a potentially larger scale copper operation.