Laura Tyler at World Mining Congress 2023

Think and Act Differently: transforming our oldest industry with our newest technology

We hear the term ‘transformation’ a lot lately – because it is a time of great change in the world. The pace of change, driven and enabled by technology, is increasing. And so it’s appropriate that we’re here talking about transformations in mining. But what is it that we’re transforming to? What are we seeking to become?

The world is starting to wake up to the role of the resources sector to support the global trends that are changing the world.

These trends will feed demand for metals and minerals for decades to come.

But new deposits are harder to come by.

What remains is deeper, harder to find, more difficult to access, or in more challenging locations.

And we have to produce those commodities in those locations with less – less energy, less water, less waste, less disruption – a fraction of the impacts traditionally caused by intensive mining activity.

I would ask us all to stand in the future for a moment – what do we see?

I see people removed from the line of fire, reducing both the risk of both safety and health impacts as we automate the work we do.

I see value chains with automated decision processes that lead to reduced power and water use and improve our productivity, contributing to responsible mining, and enhancing our ability to increase return on capital every day.

I see the democratisation of data with citizen developers throughout the value chain making processes run more efficiently, and digital twins enabling accurate prediction of problems to allow better maintenance and operational upgrades.

Under this vision, the processes we will be working on will be fundamentally different – we will have solved for in situ recovery, we will have eliminated energy hungry mill and float to use new and different ways to liberate the minerals we seek.

In doing so, we will have the ability to produce the commodities we need with a fraction of the waste, and whatever waste we do produce, can be repurposed into useful products.

Our power will have zero greenhouse gas emissions – and I believe nuclear energy will be a part of the baseload mix in the global elimination of carbon emissions rich energy.

As more of our systems and decisions are automated, we will become the orchestrators of improvement and innovation – the skills we need for the future must embrace highly digital operational and project management as the way we deliver value and efficiency.

We will fundamentally change what we consider to be an attractive resource.

The sub 0.5% copper resources of tomorrow will be just as attractive as the 2% copper resources of yesterday, delivering the critical minerals the world needs to decarbonise at low cost.

This means the mine waste of the past, will become some of the new resources of the future.

As we stand in the future I see an exciting, safe and automated sector, valued by society for the types of work it provides.

How do we set ourselves up to do this? At BHP we want to Think and Act Differently. But we also need to do it with urgency.

So how do we build a solution? What are we doing in BHP?

The solution

It’s been said before that data is the new gold – but we have to know how to use it.

Every mining operator generates reams of data. But it is how this information is captured, distilled, analysed, stored and used that makes the difference. You get out what you put in – quality outputs from quality inputs – or the alternative, garbage in, garbage out.

The opportunity – the prize – is clearly massive.

But there is no change without innovation.

Building the ecosystem

Firstly, we need to expand the ecosystem of ideas that we are exposed to – we are not in every pool of expertise, but we must be more open to conversations and ideas than ever before.

We know that not every good idea is our own idea.

I’m sure all the companies, universities, research groups represented here today have some very smart people working for them. We certainly do at BHP. But we know that the world of ideas is broader than our own company or our own industry.

And so we’re looking outwards to build an ecosystem of ideas, with a partnership mindset. So what have we done…

We are changing the way we work…

BHP Innovation has adopted an open innovation model, we are transparent about the ambitious opportunities and challenges we are working on and invite collaborators from universities, industry peers, adjacent industries and start-ups to join us.

We work with expert scanning and scouting partners, as well as ecosystem collaborators, like Deloitte’s new GreenSpace Tech ecosystem or MIT’s Industrial Liaison Program including their Startup Exchange.

We want to accelerate the technology development roadmaps of our partners and share in their success, not lock up their IP or restrict their growth potential.

We intend to Think and Act Differently in all our interactions.

We are also willing to invest.

BHP Ventures, our own Venture Capital arm, has been in action now for about 3 years. It is focused on emerging technologies that can help grow and improve our existing operations, our resource base, and our value chain.

It has screened more than 1,200 opportunities and built a high-quality global portfolio of over 20 holdings and continues to go from strength to strength.

We are thinking and acting differently about exploration.

Our exploration accelerator, BHP Xplor, merges concepts from venture capital and early-stage accelerators. We announced BHP Xplor in August 2022 and had many applications from all around the world, focused on the discovery of copper, nickel and other critical minerals. We’ve worked with seven companies, to provide funding and support to accelerate their growth. Wave 2 is coming soon…and I hope that all those from our first cohort can speak to this as a positive experience.

Operationally we also seek to be different, we have evolved our relationships with many of our vendors – we seek to partner to solve some of our biggest opportunities… this maybe quite tactical such as the partnership between Minerals America Technology, Escondida Operations and Microsoft to improve Escondida Concentrator recoveries…

A program that uses artificial intelligence and machine learning, to combine real-time plant data from the concentrators and AI-based recommendations from Microsoft’s Azure platform to feed our operations team information so they can adjust variables that affect ore processing and grade recovery.

This is the building of an eco-system, the setting of a foundation of partnerships and ways of working that is different – so what is that making possible.

What it’s delivering

Using these ecosystems, we must use data to drive solutions to make systems run better.

Partnering on tech and innovation is making our sites safer and more sustainable as we think and act differently to deliver real results.

One of the best ways we can reduce safety risks is through removing people from the frontline.

Where we have implemented truck automation at Jimblebar and Newman in Western Australia, there has been a 90% reduction in near miss events involving vehicles with a fatality potential.

We have extended automation to our fleets in Western Australia and here in Queensland and we are in implementation at Spence and Escondida in Chile.

Decision automation using real time data feeds from on the board fleet management systems provides a more efficient and productive result, shift in and shift out, delivering more safe tonnes per truck per year.

The advance of autonomous haulage by OEMs like Komatsu, Caterpillar – delivered in partnership with companies such as BHP are the first stage for decarbonisation…

The next stage is zero emission trucks…and at BHP we are investing in electric – even as we watch the hydrogen journey like hawks. We have a great partnership with Caterpillar and have a prototype truck running about in Arizona. We have advanced plans that consider trolley assists, recharging station distribution and dynamic charging as a part of the mine design of the future. Anna Wiley has presented BHPs vision of the electrified future here this week.

We can only create future value by through strong partnerships with our OEMs.

The other side of the equation is the need for sensible, innovative solutions to be shared for the collective benefit of the sector.

Our Operation and Technology teams at our Newman operation recently won their category at the Safety Excellence Awards run by the Western Australian government, for a remotely operated thermal lance for removing debris jams in crushers. It connects to a boom, meaning no more handheld thermal lances, removing people from potential harm from uncontrolled energy release.

BHP is licensing the design on a royalty-free basis so it can be used across the industry, worldwide – so please do get in touch with us if you want more information.

Tech and innovation supports better exploration.

Over the last couple of years BHP has re-organised our exploration team to seek out new deposits located across four global regions. We recognise that the old ways in which we approached exploration will not serve us as well in a new deeper, under-cover type of world.

We have leveraged the systems thinking of the petroleum industry and seek to understand the dynamic system required to emplace a new ore deposit – we aim to look at the earth in a different way.

I have to acknowledge the many BHP Petroleum colleagues who worked with the mineral geologists to develop and mature a minerals systems model using the extensive BHP datasets.

They have built a new way of thinking of the accumulations and concentrations of metals in given regions to inform our exploration search spaces. Those interested in more deeply understanding this can refer to the paper presented yesterday in this conference by Dr Cam McCuaig.

We also partner with those who bring new eyes, a different way of thinking and challenge to our process – the AI/ML partnerships such as those with DeepIQ/SRK, and Kobold are such examples.

And as we home in on our new targets we recognise the importance of new ways of using and collecting data. BHP Innovation, the Resource Centre of Excellence and Olympic Dam geologists and geometallurgists, have applied the first sparse 3D Hardrock Seismic Survey across the Olympic Dam deposit with very interesting results.

This work is an adaption of modern-day hard-rock seismic methodologies (again borrowed from the petroleum industry) and successfully applied across an ore deposit. This will accelerate resource characterisation and the targeting of drillholes – ultimately reducing cost and time to production.

If you are interested, check out a series of three papers presented at this year’s Australasian Exploration Geoscience Conference, led by Kathy Ehrig, Heather Schijns, and Jared Townsend, that explore these concepts more deeply.

And so what is old, or known in one industry, is being refashioned, accelerated and innovated to deliver new and exciting results today.

Collaborating on tech and innovation changes production and reduces waste.

At BHP, we have organised to have Digital Factories at all our operated assets, seeking to resolve problems through application of digital solutions using agile methodologies and strong asset sponsorship.

Let me give you an example. We all know product variability is a challenge across the industry. When we over or underestimate the quality of ore shipped to customers, it impacts the value we create.

So our digital factories got to work and came up with the Product Variability program, which we’ve been using at West Australian Iron Ore.

The technology used a Grade Adjustment Model that uses data sources to capture movements of ore across the supply chain in real time to map the grade coming from the mine.

We then use an application called StacksOn to maintain a 3D model of material in the stockyard, so we know what to load when.

The program addresses a fundamental issue in an innovative way. It is materially adding value to our operations, and we’re rolling it out across other commodities.

We have a Value Engineering team who work with operations to build dynamic models to answer questions about value chain performance and anticipated improvement options – able to define where capital spend, operational or improvement effort should be applied to maximise value, the team is in high demand across our business.

From modelling capital spend at NiWest, to defining the improvement activities to maximise throughput in the Escondida Concentrators, to predicting maintenance in train loadout stations in the WAIO, we are using data to define, measure and solve for the production impacts of tomorrow through dynamic modelling and digital twins.

At all stages of production, whether in exploration, in trucking, or extraction, we seek ways to innovate or disrupt… but we can only do this by thinking and acting differently.

How to support it

The evolution of the new mine site – safer, smarter, more automated and less manual – means the capabilities we need to run these operations are changing

We’re moving to a world where we are less hands on.

We increasingly need more people with digital skills right through our sector from the innovators to the front lines of production and maintenance. We need to bring workers with us on that journey. We simply don’t have enough of them.

The good news is that today’s generations of primary and secondary students are picking up digital skills as they learn coding etc at school; the base language of digital analysis is being engrained early.

The concept of a ‘citizen developer’ is built on this growing familiarity and comfort with code – and it’s important that the industry recognises the opportunity in these new generations of future resource sector workers.

At BHP, we enable people to register as a citizen developer to work on BHP problems. They are formally onboarded, supported with access to resources like security groups and environment access, and provided with education and training. There are more than 300 registered citizen developers at BHP, working individually and in collaborative communities.

The outcomes are exciting – for example, an app that improves on a complex escalation process for safety and environment events within our integrated remote operating centre has been a game changer for that team. The app was built by a processing specialist with no coding experience – he just saw a process that could be improved and set about doing it.

The industry needs more citizen developers. We need to train them now, and we need to make sure they see the mining industry as stable, attractive – dare I say exciting and future facing.

Conclusion

In conclusion, to deliver what the world needs, means identifying, developing and implementing digital and technical innovations – some of it novel and maybe a little scary(!)… and investing now in the people we need to find, build and work the mines of the future.

We all need to be thinking about setting ourselves up to do this now; Build our ecosystems, be open to new partnerships and ways of working, and be organised to move faster – driving ourselves forward with data, with people close to the opportunity finding the solution and then sharing the outcome for us all to use.

The data this industry can capture is increasing apace with the speed and quality of our capability to analyse it the only limiter. The opportunities to improve will be driven by our use of this data as much as by any other factor.

These mines of the future are vital to help to deliver the world of the future and a surer pathway to net zero. A transformation of mining, to deliver a global transformation by mining.

Hot Chili to upscale Costa Fuego

The Mining Journal | Paul Harris | 27 July 2023

Australian copper developer Hot Chili is looking to increase the scale of its Costa Fuego project in Chile as it advances towards a prefeasibility study (PFS), MD Christian Easterday told Mining Journal at the Rule Symposium in Boca Raton, Florida, US.

With the PFS 80% complete and due early in 2024, the company is looking to add to the mine life and production scale, with a 30,000m drilling programme to commence soon.

“Hopefully, we can take advantage of an upscale opportunity to scale this project up from around 100,000tpa of copper production for a 16-year life with 50,000oz of gold production towards a 22 or 23-year mine life and upscaling this towards 150,000tpa.

“This would make it not only one of the largest projects in the development pipeline outside of a major but would allow the cash costs to be reduced and sit within the first quartile for the industry,” Easterday said.

Easterday said the project has a lower-than-average capital intensity of $10,000/t of annual copper production capacity, compared with a $17,000-18,000/t average.

“The last cycle for copper was unfortunately littered with a number of projects which saw significant overruns on capital. It is about being able to build these with the correct economics that produces quick paybacks and, ultimately strong returns. [The project in Chile’s Coastal Belt] is about half the cost it would be if it were in the high Andes alongside our global peers,” said Easterday.

Last man standing

Hot Chili is listed on the ASX and uniquely positioned as the last copper developer standing following M&A transactions. Barrick Gold acquired Equinox Minerals for C$7.3 billion in 2011 at a 30% premium, Oz Minerals was acquired by BHP for US$6.4 billion in March and Newcrest is being taken over by Newmont.

“We are the largest resource on the ASX in copper outside of BHP, and now we are the largest project in the entire market for Australia by producer, developer or explorer class that is holding a project capable of 100,000tpa of copper production. We find ourselves in the very weird situation that one of the world’s leading venture capital markets for mining does not have a mid-tier copper space and Hot Chili being the only player in that space,” said Easterday.

Easterday is keen to emulate the success of some of those takeovers. With a market capitalisation of about US$130 million, he sees the development of Costa Fuego as the path the company needs to tread to derisk the project and potentially elicit a bid fully.

“From here to a financing decision in 2026 and potential production, to be one of the first of the 100,000 tonners to come to market this decade is not a long period of time to wait after building this company for 15 years. There is tremendous upside if by the end of the decade copper is around $8/lb, and that’s a pretty exciting equation on our share price,” said Easterday.

A US$15 million investment from Osisko Gold Royalties in early July appears to have added more than funding to the company, as its share price increased more than 50% to about C$1.30.

“The Osisko transaction has allowed us to put the asset value to work rather than the market capitalisation of Hot Chili. The addition of NPV (net present value) we add with these funds is extraordinary. It leverages the value equation but removes any overhang of a fundraising anytime in the future.”

“The significant endorsement from Osisko, one of the leading North American streaming-royalty groups, has an amplification effect, particularly following our dual listing into the North American market through the TSXV and the OTCQX,” said Easterday.

Rename rejected

The North American listings saw the company work on a rebrand and a new name, Costa Copper, but while the new brand image is being used, the name change was rejected at the company’s May shareholder meeting.

“We were getting negative feedback on the name, and we thought that was something the shareholders should vote on. I didn’t have an opinion either way as I believe that a company makes the name; the name doesn’t make the company,” said Easterday.

Copper Explorers coasting in Chile

The Mining Journal | Paul Harris | 23 January 2023

The drive north along Ruta 5 from La Serena towards Vallenar is to drive through more than a century of mining history. From the silver mines of the 1800s, to the iron ore mines of the late twentieth century, and the almost continual small-scale production of high-grade copper oxide. The four-lane highway passes through a wide valley with desert scrub and cacti, in parts reminiscent of Nevada or Arizona in the US, particularly with the cobalt blue sky and beating sun.

The drive passes a wind farm funded by Barrick Gold and various solar generation facilities but tucked away to the east of the Coastal Range and the Pacific Ocean, it also runs along part of the 2,000km-long north-south Atacama Fault in central Chile, which hosts iron, copper-iron and copper-gold deposits including IOCG, porphyry and vein deposits.

It also holds promise for Chile’s future copper developments, such as with companies like Hot Chili and Tribeca Resources, and further north, Capstone Copper’s Santo Domingo project, looking at bringing forward affordable projects which benefit from the rich regional infrastructure endowment, which includes access, high-tension power lines, local mining culture and port facilities. This should be music to the ears of mining investors who are still beating the capital discipline drum and nervous about development cost blowouts, which has made the greenlighting of new mine developments noticeable by their absence despite the copper price being notionally above the US$4 per pound incentive price. No wonder diversified miner Glencore and royalty company Osisko Royalties are interested.

Within this context, the long-overlooked coastal range in Chile is drawing increasing attention from copper explorers and developers who believe viable and economic deposits can be found, which, while smaller than the mega porphyries in the high cordillera which have powered the country’s copper production, can potentially be brought to market with less permitting, development and financing risk.

Costa Fuego

Hot Chili and its Costa Fuego project is growing into a strong development candidate south of Vallenar, with exploration bringing the project ever closer to the magical threshold of 1 billion tonnes of resources. While its Productora deposit has been around for a number of years, the more recent definition and integration of the Cortadera deposit 14km away into Costa Fuego via a 2022 resource update has increased the scale and attractiveness of the project. The continual fall in the average production grade in Chile adds shine to the project, which with each passing year, sees it get closer to and equalling production grade.

Diversified miner Glencore certainly sees the possibilities, having invested in the company and provided an offtake agreement in 2022. Glencore invested as Hot Chili debuted on the TSXV in 2022, participating in the C$30 million capital raise to take a 9.99% stake. “The Glencore investment gives us a solid endorsement and provides a good rubber stamp on what we’re doing and the asset we have,” Hot Chili chief executive Christian Easterday told Mining Journal at the time.

Glencore’s influence can be seen in the current drill programme at the Las Cañas target (body #1, Cortadera), to rapidly add further tonnes to its overall resource, with a prefeasibility study postponed until this drilling and the next resource update has been completed.

The consolidated March 2022 Costa Fuego resource featured an indicated resource of 725Mt grading 0.47% copper equivalent for 2.8Mt of copper, 2.6Moz of gold, 10.5Moz of silver and 67,000t of molybdenum, and inferred resources of 202Mt grading 0.36% copper equivalent. It also featured a high-grade indicated component of 156Mt grading 0.79% copper equivalent for 1Mt of copper, 850,000oz of gold, 2.9Moz of silver and 24,000 of molybdenum.

Hot Chili and Productora were widely dismissed by the market as being too small and too low-grade. That is no longer the case with the company looking at 100,000tpa of copper production for 20 years, and possibly more, although the market view perhaps still languishes in its past perception judging by the slow uptick of its share price. However, Costa Fuego is rapidly taking its position on the relatively short list of development stage projects that can be developed.

While Hot Chili’s star is starting to rise, the years spent in the investor doldrums saw the company use the time to advance low-cost but equally important work to derisk the project and make it a more robust and viable development proposition. “During the downturn in the market, we held onto Productora but stopped drilling and instead focused on the infrastructure we would need, such as obtaining the surface rights and easements we will need for access, power, a water pipeline and the maritime concession,” country manager Jose Ignacio Silver told Mining Journal during a site visit.

Cortadera has been a game-changer for the company, bringing high-grade outcropping material into the picture and almost quadrupling the resource base. The area has seen small-scale mining from local miners targeting high-grade copper oxide exposures on the mountain tops, with material containing 3% copper or more sent to the processing plants of state mineral company Enami. Their workings with the outcropping bluish-green chrysocolla mineral provide an obvious visual clue for explorers like Hot Chili to start their exploration efforts.

At Cortadera, which the company obtained in 2019, it has defined three ore bodies and an indicated resource of 471Mt grading 0.46% copper equivalent and an inferred resource of 108Mt grading 0.36% CuEq. The mineralisation outcrops at body #1, with mineralisation getting deeper and larger volumes moving to the southeast for body #2 and then again for body #3. Body #3 is the biggest and deepest, and where the company completed an 1185m hole which showed high-grade at depth in hole 13D (750m grading 0.6% Cu and 0.2g/t Au from 204m depth down-hole, including 188m grading 0.9% copper and 0.4g/t gold).

The area has been picked over by larger companies in the past, but seemingly in a half-hearted manner and never consolidated, perhaps using exploration results as a reason to move on rather than as a reason to stay and grow a resource. “Explorers didn’t want the Coastal Range as they were looking for the mega porphyries in the high Andes. There was also the issue of consolidating the concessions and the surface rights, which not everyone wants to take on,” geology manager Andrea Aravena told Mining Journal.

Piecing the project together is a task that the relatively young and ambitious Hot Chili team relished, particularly Silva, a lawyer who studied international trade law in the UK and spent some time working with the UK Serious Fraud Squad. There is a palpable enthusiasm for the exploration opportunities this now provides, with various new drill targets being worked up and permitted around both deposits. Silva has a similar enthusiasm for obtaining the infrastructure easements and entering the permitting process in the future. “I love this because we are building a long-term company and something that will have real value,” he said.

The next piece of the puzzle, and the one which may push the company over the 1Bt of resources threshold (already 927Mt), is an earn-in agreement with Antofagasta Minerals (AMSA) on the ground between Productora and Cortadera called Las Cañas for $1.5 million and 6,000m of drilling in two phases. The first phase is underway and will see 3,000m drilled as part of Hot Chili’s 10,000m initial exploration drill plan for 2023. Following a joint review of the results with AMSA, the second 3,000m will be drilled. AMSA previously drilled five holes at Las Cañas, and so the first Hot Chili holes are twinning some of those holes seeking to confirm the high-grade results previously obtained.

The evolution of Productora and Cortadera into Costa Fuego, with a central processing plant planned to be located at Productora, has energised the exploration team to find more ore bodies nearby in the Huasco Valley which could potentially feed into this. This is a task helped by growing confidence in the geological model they have developed and refined. Zones carrying mineralisation are characterized by the presence of tightly packed parallel quartz veinlets, which carry the copper sulphide mineral chalcopyrite, gold, silver and molybdenum credits.

Consulting geologist Dr Steve Garwin, a key member of the SolGold team which discovered the Alpala deposit in Ecuador, is also the lead technical advisor to Hot Chili and has trained the exploration team on the key things to record in core logging, such as the alteration, the number of veinlets and the presence of a molybdenum halo. With accurate core logging of crucial importance, one or both of the principal project geologists Miguel Tapia and Cristian Vasquez, are always on-site to ensure this is done correctly and consistently. “What we see at the #1 ore body at Cortadera we see at Las Cañas, which means we can advance quicker because we have a good idea of what is happening,” Tapia told Mining Journal.

“We always start by looking at the regional context as we think about the potential of having a cluster of deposits. Most deposits are structurally controlled by the north-south Atacama Fault structure and NW trending faults. The intersection of these can be zones of interest,” said Aravena.

Productora is a different beast as it is a structurally-controlled tourmaline breccia hosted in volcanic rocks, although exploration has also been guided by where small miners previously worked.

While undertaking a PFS on Costa Fuego has been postponed pending the Las Cañas drilling, the company has a general idea of how it wants to develop the project, having previously completed a PFS on Productora, as well as the majority of a PFS for the combined project. Mining would start with open pits at Productora and high-grade material from body #1 at Cortadera, with the company targeting a multi-decade project to produce approximately 100,000tpa of copper and up to 70,000ozpa of gold.

Material from Cortadera is planned to be transported to Productora via a rope conveyor, one of three key elements to reduce the environmental footprint and lower operating costs for future operation. The tailings storage facility has been relocated down the valley to a site that will have greater storage capacity and be cheaper to build and operate. “This is not upstream of any river, so there should be no opposition from the Huasco Valley Agricultural Association. The rope conveyor towers have minimal surface disturbance, and the Project is being designed with all stakeholders in mind,” said Silva.

The company reported a key development in December about the award of a maritime concession from the government where it will build its seawater capture infrastructure, the culmination of eight years of work. Processing will use seawater, and not needing to build a desalination plant will save considerable capital and operating cost. “It also improves the copper recovery,” said Silva. Marimaca Copper, which is advancing its Marimaca project in the coastal range near Antofagasta, is also looking to use seawater for processing and also says this will improve recoveries.

With the wind in its sails, the coming milestones for Hot Chili are to complete a preliminary economic assessment during the first semester, a resource upgrade in the second semester, and then the PFS in the first half of 2024.

“Growth from the drill bit is very much Hot Chili’s focus in 2023, with the company confident of continued resource growth. This is underpinning the company and our shareholder Glencore’s view that Costa Fuego and our regional consolidation may support a long-life mine producing 150,000tpa of copper. This would put Costa Fuego toward the top-end of scale for new copper developments being advanced in the world,” said Easterday.

Silva also noticed a clear change in the government’s attitude towards mining following the rejection of a new draft constitution on September 4 last year. While the country will continue creating a new constitution, it will likely be a less radical and more centrist document than the rejected draft.

“After 4 September, everything felt more stable in Chile. The rejection of the new draft constitution was a defeat for the extreme Left and moved politics in Chile back into the centre. The new constitution will have limits as there are 12 basic aspects of the political structure which have been agreed upon and will not be changed,” said Silva. These include that Chile is one united nation with a separation of powers and the existence of an independent Central Bank, as well as an independent Prosecutor and Electoral Office.

Hot Chili is not alone in this new development thrust. Some 500km north near Antofagasta, Marrimaca Copper plans a feasibility study this year for its Marimaca coastal range deposit for a 50,000-60,000tpa operation from a measured and indicated resource of 140Mt grading 0.48% copper for 665,500t of contained copper. Capstone Copper’s permitted and shovel-ready Santo Domingo copper-iron-gold project near regional mining hub Copiapo is due to see a feasibility study update later this year, which will include additional processing circuits for cobalt and iron ore, and may see a lower capex than the $1.5 billion in the current feasibility through integration with its nearby Manto Verde mine.

Tribeca

Exploration spending in Chile has been increasing in recent years, amounting to US$713.2 million in 2022, according to state copper agency Cochilco, a 24.6% rebound from the low of $450 million in 2020, the lowest amount since before 2010. The majority of spending at $345 million is by miners around their mines, with large mining companies spending most on exploration at 74.6% of the total. Early-stage exploration accounted for $197.3 million in 2022, with the amount spent by junior explorers almost doubling from 2021 to 2022, increasing its share from 9% to 18%. Copper is the most sought mineral, accounting for 74% of spend, followed by gold at 21%.

A new crop of junior copper explorers in Chile includes Culpeo Minerals, Torq Resources, Atacama Copper, Pampa Metals, ATEX Resources, Solis Minerals, Rugby Resources, Alto Verde Copper, Great Southern Copper and Nobel Resources. The newest of all is Tribeca Resources, one of a new generation of copper exploration juniors in Chile’s IOCG belt whose La Higuera project, some 100km south of Costa Fuego echoes many of the attractions Hot Chili sees in the region.

Tribeca is also drawn by the fact the coastal region has been overlooked and under-appreciated in the past, even though it is possible to find a sizeable deposit. Lundin Mining’s Candelaria near Copiapo is the exemplar in this context. With infrastructure development being a key factor in development time and cost blowouts, the coastal zone and its proximity to existing infrastructure are very attractive.

I drove to the site, a few hundred metres off the Pan-American highway, with chief executive Paul Gow in a VW Gol. Having a four-wheel drive truck was unnecessary, which also attests to Gow’s frugal and parsimonious financial management, a habit carried over from when he and partner Thomas Schmidt funded the early days of the company from their own pockets. Both Gow and Schmidt worked for Xstrata Copper in their previous lives. The company doesn’t have a corporate office and has a monthly burn rate of just $40,000, excluding drilling, while its drilling costs are just $130/m before assays and geological team.

Tribeca was also attracted by the presence of high-grade small-scale operations in the district and is leveraging the experience of Gow exploring for IOCG deposits around the Olympic Dam mine in Australia. Olympic Dam has several hundred metres of barren sedimentary cover above its mineralisation. “We are looking for a sulphide copper-gold system containing hundreds of millions of tonnes of resources. We see opportunity under the gravel cover in areas where there have been high-grade oxides exploited from the mountain tops. Copper is present in outcrops, and we follow them under the gravel,” Gow told Mining Journal during the visit.

Like Hot Chili, the Atacama Fault is the main regional controlling structure, and the northwest cross faulting is also relevant. With up to 60m of gravel cover, soil geochemistry is not such a useful exploration tool, but the presence of magnetite and hematite in IOCG deposits means geophysical methods like magnetics and gravity are.

Gow says good targets are near high magnetic anomalies, although the highest copper grade is not necessarily where the highest magnetic anomaly is. “My experience in the Olympic Dam province, particularly with the Prominent Hill discovery by Minotaur Resources, is that the mineralisation is related to hematite and is commonly offset from the magnetic anomaly. The magnetic anomaly tells you there is a hydrothermal system present, but then you have to identify where the mineralisation is located within that system.”

The company is also picking up where a previous explorer called Peregrine Metals left off. Peregrine drilled some 4000m in 12 holes at Gaby, which is Tribeca’s main target and where drilling began in November 2022. “We are drilling step-out holes to the north of the Peregrine drilling and have drilled up to 600m to the north,” Gow said.

Tribeca expects to release its first drill results in the coming weeks and show whether or not it has been successful in its initial aim of expanding the mineralisation footprint. “What got me into exploration was the excitement of waiting by the fax machine for the drilling results to come in,” said Gow. With the company’s concessions extending for another kilometre to the north, there is potential to continue expanding the footprint further.

For its first programme, Tribeca uses reverse circulation drilling to pre-collar the holes and penetrate the gravels and weathered zone before switching to diamond drilling for the tail to a total depth of about 400m. It plans some 2200m at Gaby and will then look to drill 600m at its Chirsposo target, 3km to the south.

Luck plays a role in exploration, and Tribeca appears to have had some already. It is perhaps the youngest copper explorer in Chile, having completed a reverse takeover transaction in October 2022 to list on the Toronto Stock Exchange Junior board when at least two other Chile copper exploration hopefuls delayed their listing efforts. “We raised US$2.1 million in January 2022 from mainly experienced mining people, so we didn’t look to raise any money when we listed, so we didn’t encounter any adverse market reaction,” said Gow.

Shares in Hot Chili are trading at C95c, valuing the company at C$114 million.

Shares in Tribeca Resources are trading at C36c, valuing the company at C$19 million.

Hot Chili to spice up copper play with new probe

The West Australian | Matt Birney | 13 Jan 2022

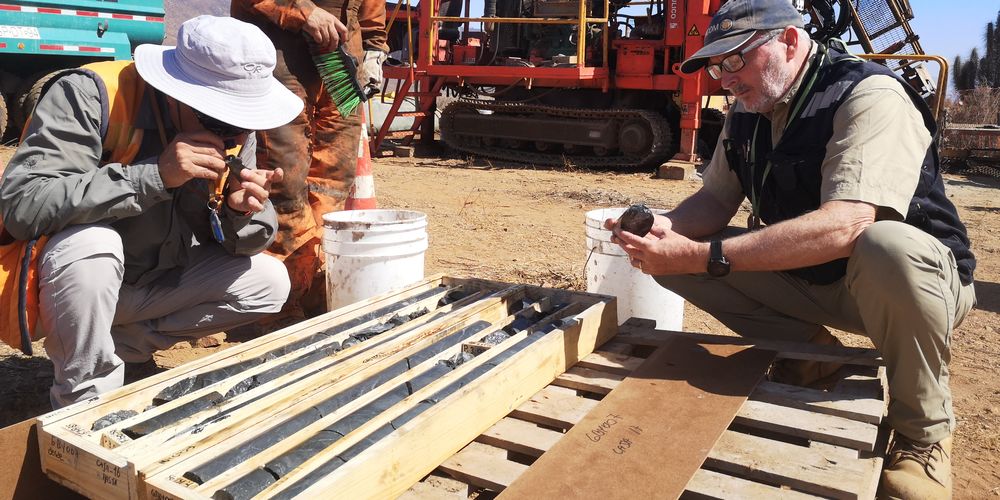

Drilling at the Cortadera copper-gold discovery in Chile. Credit: File

ASX-listed Hot Chili has launched a 10,000m probe of a recently secured land package which straddles the western extension of its massive 417 million tonne indicated Cortadera copper-gold discovery in Chile, South America. The company plans to evaluate four porphyry targets in the drill campaign and has unleashed both a diamond and RC rig to complete its two-pronged plan of attack.

Both drill rigs are currently plugging away at Cortadera’s fourth porphyry target known as “Cuerpo 4” where earlier programs struck a host of shallow copper-gold porphyry mineralisation. The best of the previously scored strikes was a 128m intercept at 0.5 per cent copper equivalent from 28m downhole. The 128m hit was comprised of 0.4 per cent copper and 0.1 gram per tonne gold and also included a 16m parcel at 1.3 per cent copper equivalent.

Hot Chili has flagged Cortadera as the jewel in the crown of its low-altitude, Costa Fuego copper development and has cited the asset’s bumper indicated resource of 471Mt grading 0.46 per cent copper equivalent for 1.7Mt of copper and 1.8 million ounces of gold as key merits in its designation. Notably, Cortadera also hosts a 108Mt inferred resource base at 0.35per cent copper equivalent for an additional 0.3Mt of copper and 0.3Moz gold.

The inventory is hosted in three porphyry centres coined Cuerpo 1, Cuerpo 2 and Cuerpo 3 which sit within a 2.3km strike length of the company’s Cortadera trend. Importantly, Hot Chili’s recent land grab which extended the western tenements of Cortadera also more than doubled the prospective strike length of the discovery from 2.3km to 5.2km and swelled the site’s near-term hopes for potential resource growth

According to the company, it is well placed to bankroll a suite of drilling this year and has a number of milestones in its crosshairs including a preliminary economic assessment and a resource upgrade.

Management states the play could permit an upgrade to its future annual metal production rates and an extension to its current mine life. If all goes to plan, Hot Chili envisions an extra production output of 100,000 tonnes of copper and 70,000 ounces of gold each year along with 20 years of additional mine life.

The company also plans to deliver a pre-feasibility study associated to Costa Fuego next year and says the project is amongst only a handful of near-term production projects in the world able to deliver more than 100,000 tonnes of copper in the next five years.

Copper is tipped to play an integral role in the world’s low-carbon future and is employed across a host of clean energy applications including wind turbines, solar panels, electric vehicle or “EV” batteries and wide-scale energy storage facilities. In addition, copper is prevalent in the construction of EVs with about 38kg of the material finding its way into hybrid and roughly 60kg going into every plug-in hybrid.

A recent study by the International Copper Association predicts by 2027 demand for EVs will rise by 900 per cent, a tantalising proposition for companies with massive copper plays such as Hot Chili.

Hot Chili closes US$15m investment by Osisko Gold Royalties for Chilean copper-gold project

StockHead | 26 July 2023

The company is now fully funded for its 30,000m drilling program in the coming weeks. Pic via Getty Images.

Hot Chili has closed its transaction with Osisko Gold Royalties, receiving proceeds of US$15 million in exchange for the sale of a 1% Net Smelter Return (NSR) royalty on copper and a 3% NSR royalty on gold across its Costa Fuego copper-gold project in Chile.

Not only is the transaction a significant endorsement of the project from one of North America’s leading royalty-streaming groups, it’s also a nice boost to the company’s cash position to around A$26m – which means the upcoming 30,000m drill program is fully funded.

The deal also clearly highlights the value Osisko attributes to the project.

Hot Chili (ASX:HCH) MD Christian Easterday says that Osisko’s involvement, alongside Glencore’s strategic shareholding, demonstrates “Costa Fuego is globally relevant, being one of only a handful of projects with potential to deliver near-term, meaningful, new copper supply into a looming global copper supply shortage.”

“We are very pleased to have closed the Investment with Osisko Gold Royalties enabling the Company to advance the project without the dilution of a share issuance,” he said.

Near-term drilling and PFS in H2

The Costa Fuego project has a massive measured and indicated resource of 725Mt grading 0.47% copper equivalent.

And the recent scoping study flagged an estimated copper equivalent production rate of 112,000t per annum – consisting of 95,000t of copper and 49,000oz of gold over a 14-year period of a 16-year mine life – to the estimated revenue and free cash flow of US$13.52bn and US$3.28bn down to the post-tax net present value (a measure of profitability) of US$1.1bn.

For context, that’s the equivalent of bringing another Oz Minerals (ASX:OZL) into production.

The project also has an inferred resource of 202Mt grading 0.36% copper equivalent, meaning there’s still plenty of room to grow with Hot Chili targeting a potential increase in study scale towards 150,000tpa copper for a +20-year mine life.

Now the Osisko deal is wrapped up, Hot Chili is well-funded to kick off its 30,000m drilling program in the coming weeks which is targeting a resource expansion, and exploration targets ahead of an upcoming resource upgrade by late 2023.

Hot Chili is also aiming to deliver the Pre-Feasibility Study (PFS) – which is currently around 80% complete – in H2 2024.

Hot Chili closes $22 million deal to boost copper play

The West Australian | 26 July 2023

Hot Chili’s Costa Fuego copper project has got a timely cash boost. Credit: Claudia Aliste/File.

A cashed-up Hot Chili will ramp up a new exploration campaign at its Costa Fuego project in Chile after banking $22 million in a strategic deal with leading United States royalty streaming group, Osisko Gold Royalties.

Management says money from the deal – from which Osisko will get a 1 per cent net smelter return royalty on copper and a 3 per cent royalty on gold – will be used to fund the next steps in its project’s development, including a 30,000m drilling program.

It will also help fund the completion of the project’s resource upgrade and the delivery of its much-anticipated prefeasibility study (PFS). The company has pencilled in late this year for its resource upgrade and the second half of 2024 for unveiling its PFS.

We are very pleased to have closed the Investment with Osisko Gold Royalties enabling the Company to advance the project without the dilution of a share issuance. Costa Fuego is globally relevant, being one of only a handful of projects with potential to deliver near term, meaningful, new copper supply into a looming global copper supply shortage.

Hot Chili managing director Christian Easterday

Management sees Osisko’s involvement as a heavy-hitting endorsement for the operation. It argues that the group’s presence, alongside mining giant Glencore’s strategic lead shareholding in the company, demonstrates Costa Fuego’s global relevance and the project’s potential to deliver a near-term, meaningful, new copper supply.

The company recently revealed a preliminary economic assessment (PEA) showing the project will spit out a whopping $309 million a year on average in free cash across a 16-year mine life.

With the impressive set of numbers outlined, the project is emerging as one of the world’s biggest and lowest-cost copper plays, with an estimated post-tax net present value (NPV) of US$1.1 billion (AU$1.66 billion).

Despite the eye-watering US$1.05 billion (AU$1.57 billion) Hot Chili says it will cost to build its project, it says its payback period will be just three and a half years. Average annual operating costs clocked in at US$1.33 (AU$2) per pound of copper in the study, positioning the company at the low end of the cost curve among its industry peers.

Keys to the lower-cost estimates include the fact that at its relatively low altitude, it does not face the extraordinary costs of having to pump water up into the mountains, in addition to the fact it has proven better recoveries using salt water and does not need an expensive desalination plant. It is believed those factors alone save the company about US$1 billion (AU$1.51 billion).

The economic evaluation pegged a long-term average selling price at US$3.85 (AU$5.76) per pound of copper and US$1750 (AU$2620) per ounce of gold. But the company says that for every extra 10 cents added to that copper selling estimate – and at a time when global predictions of a significant price hike are growing by the day – it will add another US$100 million (AU$150.1 million) to its post-tax NPV.

An pre-tax internal rate of return of 24 per cent and a pre-tax NPV of US$1.54 billion (A$2.30 billion) were also predicted in the study.

Costa Fuego holds 725 million tonnes of measured and indicated resources grading 0.47 per cent copper equivalent for 2.8 million tonnes of copper and 2.6 million ounces of gold with molybdenum credits.

A PEA study is similar in nature to an Australian JORC scoping study. Hot Chili believes its cursory assessment at its Costa Fuego project suggests it could churn out about 112,000 tonnes of copper equivalent each year for the first 14 years of an initial 16-year mine life.

American investment bank Morgan Stanley has already predicted copper to have a strong quarter, largely on its central role in anything to do with electrification and decarbonisation. Key to its success in the next few months could be a meeting of the Chinese politburo next week, where a much-anticipated package of economic stimulus could be announced, especially if it boosts spending on electric vehicles and electronics.

A shortage in copper has been widely predicted as demand heats up. According to global consultancy firm McKinsey, the want for the red metal is expected to increase to 36.6 million tonnes by 2031, compared to the current demand of about 25 million tonnes.

However, the copper supply is forecast to be around 30.1 million tonnes, leaving a gap of 6.5 million tonnes by the start of next decade.

So with a hungry market baying for more copper, Hot Chili will be keen to get some to the table in double quick time and its latest cash boost should make that pursuit a little easier.

Hot Chili copper play to spit out $309 million a year

The West Australian | Helen Barling | 28 June 2023

Hot Chili’s drill rig at its picturesque Cortadera project on Chile’s copper coastline. Credit: File

Hot Chili says its Costa Fuego project in Chile will spit out a whopping AU$309 million a year on average in free cash across a 16-year mine life.

With an impressive set of numbers outlined in a freshly-minted preliminary economic assessment (PEA), the project is emerging as one of the world’s biggest and lowest-cost copper plays, with an estimated post-tax net present value (NPV) of US$1.1 billion (AU$1.66 billion).

And in a heavy-hitting endorsement for the operation, leading US royalty streaming group Osisko Gold Royalties has tipped US$15 million (AU$22.4 million) into Hot Chili’s till.That up-front investment for down-the-track royalty payments is destined to fast-track the company’s ongoing prefeasibility study and will also be used to fund resource growth drilling.

Hot Chili managing director Christian Easterday says Osiko’s involvement, alongside mining giant Glencore’s strategic lead shareholding in the company, demonstrates Costa Fuego’s global relevance and the project’s potential to deliver a near-term, meaningful, new copper supply.

Osisko’s funding comes in exchange for a 1 per cent net smelter return (NSR) royalty on copper and a 3 per cent NSR on gold from across the Costa Fuego copper-gold project, which sits in the low coastal range of the Atacama Region, 600km north of the Chilean capital of Santiago.

Despite the eye-opening US$1.05 billion (AU$1.57 billion) Hot Chili says it will cost to build its project, it says its payback period will be just three and a half years. Average annual operating costs have clocked in at US$1.33 (AU$2) per pound of copper in the study, positioning the company at the low end of the cost curve among its industry peers.

Keys to the lower-cost estimates include the fact that at its relatively low altitude, it does not face the extraordinary costs of having to pump water up into the mountains, in addition to the fact it has proven better recoveries using salt water and does not need an expensive desalination plant. It is believed those factors alone save the company about US$1 billion (AU$1.51 billion).

The economic evaluation pegged a long-term average selling price at US$3.85 (AU$5.76) per pound of copper and US$1750 (AU$2620) per ounce of gold. But the company says that for every extra 10 cents added to that copper selling estimate – and at a time when global predictions of a significant price hike are growing by the day – it will add another US$100 million (AU$150.1 million) to its post-tax NPV.

An pre-tax internal rate of return of 24 per cent and a pre-tax NPV of US$1.54 billion (A$2.30 billion) are also predicted in the study.

Costa Fuego holds 725 million tonnes of measured and indicated resources grading 0.47 per cent copper equivalent for 2.8 million tonnes of copper and 2.6 million ounces of gold with molybdenum credits.

A PEA study is similar in nature to an Australian JORC scoping study. Hot Chili believes its cursory assessment at its Costa Fuego project suggests it could churn out about 112,000 tonnes of copper equivalent each year for the first 14 years of an initial 16-year mine life.

Hot Chili is now one of a select group of companies with a copper development project of this scale of production that is not controlled by a major. The Company is also advantaged by its coastal, low elevation location and abundant existing infrastructure, reducing its economic hurdle and resulting in one of the lowest capital intensity of its global peer projects.

Hot Chili chairman Nicole Adshead-Bell

While copper prices have softened in recent months from this year’s high of US$4.27 (AU$6.39) per pound, demand for the red metal is set to skyrocket.

Billionaire copper juggernaut Robert Friedland, of Ivanhoe Electric, recently weighed in on the looming copper “train wreck”, predicting prices could increase tenfold amid expected global shortages.

Mr Friedland, who has been instrumental behind major copper discoveries in Mongolia and the Congo, believes the metal’s longer-term prospects will be supported by decarbonisation, ongoing Chinese demand, the emergence of India as a significant industry player and re-militarisation in the wake of Russia’s invasion of Ukraine.

Copper is yet to find a place on the critical metals lists of most developing nations. However, the metal is crucial in the global push towards net-zero carbon emissions due to its thermo-conductivity properties. The European Union recently proposed that both copper and battery-grade nickel be classified as critical raw materials key to the energy transition in a move designed to bolster its supplies.

Meanwhile, Hot Chili is warming up the drill rigs to start a 30,000m drilling blitz to target resource extensions, in addition to exploring additional priority prospects designed to feed into a resource upgrade later this year. The company has also completed the lion’s share of a prefeasibility study, which is due to be released next year.

Importantly, it still has only 119 million shares on issue, giving it a genuine opportunity to raise equity without blowing up its capital structure.

Timing, as the saying goes, is everything. With copper prices yet to reflect the dangerously low shortages of the critical metal, Hot Chili looks poised to develop its low-cost Costa Fuego project at precisely the right time.

It has been some ride for the company since it listed in 2010. It survived when the copper industry was largely decimated by a price downturn to build up to a billion-tonne resource after adding the Cortadera project to its original Productora play.

And while its project on an established Chilean copper coastline might sit in the shadows of the towering Andes mountain range, it appears to now be well on the way to putting other ASX-listed copper hunters in the shade.

Chilean Navy inks land deal for Hot Chili copper play

The West Australian | Matt Birney | 7 Dec 2022

The Chilean Navy and Hot Chili have come to a land use agreement Credit: File

Chile-focused copper player Hot Chili has put pen to paper on a land access deal with the South American country’s navy to extract sea water for its proposed Costa Fuego project processing plant.

The navy access deal grants Hot Chili access to the defence authority’s maritime concession 60km northwest of the Costa Fuego project in order to pump water from the ocean.

Hot Chili’s use of sea water will boost the project’s green credentials through negating the need to tap groundwater.

The Perth-based copper hopeful has spruiked the eco-cred of its project due to the fact it will be built on an existing infrastructure footprint, is close to some of Chile’s largest solar farms and will produce an arsenic-free concentrate.

Costa Fuego’s ore reserve currently sits at 166.9 million tonnes going 0.43 percent copper for 716,800t and grading 0.9 g/t gold for 470,000 ounces.

The company in September reported a total project mineral resource of 725Mt containing 0.38 per cent copper for 2.755Mt and grading 0.11 g/t for 2,564,000 ounces of gold.

That figure was nearly double the 2021 estimate achieved largely on the back of a 128Mt mineral resource expansion of the centrepiece Cordatera deposit.

Cordatera was acquired in 2021 from Chile’s SCM Carola and sits near two historic copper mines encompassed by Hot Chili’s third deposit, El Fuego.

The duo churned out high grade copper whilst active but have been shown little love by explorers in modern times.

Acquisition of what the company describes as a world-class resource was heralded as key to developing a long-life, large-scale copper mine by Hot Chili.

The deposit was expanded in November with the purchasing of adjacent tenements via a government auction.

As a result Cordatera now boasts a 5.2km prospective strike length and drilling on the new sites is expected by the company to begin imminently.

Chile produces some 28 per cent of the world’s copper, more than any other nation and like many others has set a bold climate change agenda to achieve net-zero emissions by 2050.

Targets set by Chilean government on industry include a 70 per cent reduction of greenhouse gas emissions on 2018 levels.

Hot Chili’s eagerness to become a clean green Chilean copper machine appears to sit well with the South American nation’s newfound environmental focus.

Hot Chili looks at fourth Chilean copper discovery

The West Australian | Matt Birney | 14 June 2022

Early drilling results from Hot Chili’s Valentina prospect has revealed a significant extension to the orebody with strong visual copper cores. Credit: File

Follow-up drilling on Hot Chili’s Valentina prospect, only a few kilometres from its three existing copper orebodies, has revealed a significant extension to the discovery with strong visual copper intersections. The discovery could beef up the numbers in the company’s pre-feasibility study on the low altitude, coastal Costa Fuego copper gold project.

Hot Chili has been driving the Costa Fuego deposits towards commercialisation for several years. The company says its low-cost overheads and proximity to local port export facilities make the project one of the most significant copper-gold discoveries of the past decade.

The explorer has been drilling out the Cortadera, Productora and San Antonio orebodies and the early indications from the Valentina drilling looks to be adding to the numbers associated with Costa Fuego.

The latest buzz has been generated from a 17m visual core of interesting copper mineralisation from 22m depth including malachite, copper clays, chalcopyrite, chalcocite and covellite.

An additional 8m visual estimate of interesting copper mineralisation from 28m depth shows chalcocite, cuprite, chalcopyrite, covellite, malachite, copper clays with cuprite, covellite and chalcocite all being all high-grade copper ore minerals.

The company says the visual estimates of sulphide and oxide minerals are not an accurate representation of final assay values and are provided for indicative purposes only.

It is expecting the lab results for the 10 drill holes Hot Chili has punched into Valentina in the coming weeks with another eight drill holes planned into the step-out target.

Hot Chili has two drill rigs currently spinning the bit at the Valentina and San Antonio deposits, 5km east of its Cortadera copper porphyry discovery.

Once the current round of drilling at Valentina and San Antonio is completed, Hot Chili is shifting to test several large growth targets including Santiago Z and porphyry extensions along strike from Cortadera.

A wider look at Costa Fuego so far has delivered an indicated resource of 391 million tonnes grading 0.52 per cent copper equivalent, containing 1.7 Mt of copper, 1.5 million ounces of gold, 4.2 Moz silver, and 37kt molybdenum as well as an inferred resource of 334Mt grading 0.44 per cent containing 1.2 Mt copper, 1.2 Moz gold, 5.6 Moz silver and 27 Kt molybdenum, at a cut-off grade of 0.25 per cent copper equivalent.

Hot Chili controls 80 per cent of the Costa Fuego operating company, Sociedad Minera La Frontera that wholly owns the project.

It says port access and associated services negotiations are progressing well with initial proposals under discussion.

Hot Chili gets a whole lotta love after visual copper intercepts at Valentina

STOCKHEAD | Special Report | 14 June 2022

Copper-gold love for Valentina. Pic: via Getty Images

The Cortadera porphyry deposit continues to deliver the high-grade goods for copper developer Hot Copper-gold prospectivity at Hot Chili’s Costa Fuego hub is not limited to its Cortadera and Productora projects as highlighted by strong visual copper from drilling at the Valentina deposit.

Diamond hole VALMET-002 recorded a 17m intersection of “interesting” copper mineralisation from a depth of 22m including 8m of “very interesting” mineralisation such as chalcocite, cuprite and covellite, which are all high-grade copper ore minerals by molecular weight.

Importantly for Hot Chili (ASX:HCH), the intersected zone is located about 120m south of existing underground mine workings at Valentina, which effectively extends the high-grade copper zone at the project by the same amount.

While visual observations are purely indicative and in no way a replacement for laboratory assays, they do provide a good idea of whether mineralisation has been intersected.

More to come

Two rigs are currently operating at the Valentina and San Antonio copper deposits about 5km east of the company’s outstanding Cortadera copper porphyry discovery.

10 holes have been completed to date at Valentina with a further eight holes planned, and assays from VALMET-002 are expected to be released in the coming weeks.

Once drilling at the two deposits is completed, further drilling is planned to test several large growth targets including Santiago Z and extensional porphyry targets along strike from Cortadera.

Hot Chili has also extended pre-feasibility studies to capture additional metallurgical test work opportunities across all deposits at Costa Fuego and preliminary mine planning is being extended to allow the incorporation of new resource growth from drilling in 2022.

Costa Fuego currently has a massive Indicated resource of 725 million tonnes grading 0.47% copper equivalent, or contained resources totalling 2.8Mt of copper, 2.6 million ounces of gold, 10.5Moz of silver and 67,000t of molybdenum.

Other updates include imminent results on ongoing port negotiations and final development study drill results from Cortadera and Productora once all results have been received.

This article was developed in collaboration with Hot Chili, a Stockhead advertiser at the time of publishing.