Hot Chili adds second major Cortadera porphyry, double exploration strike

STOCKHEAD | Nov 28, 2022

Hot Chili is set to grow its Cortadera copper-gold project over a large mineralised porphyry outcropping. Pic via Getty Images.

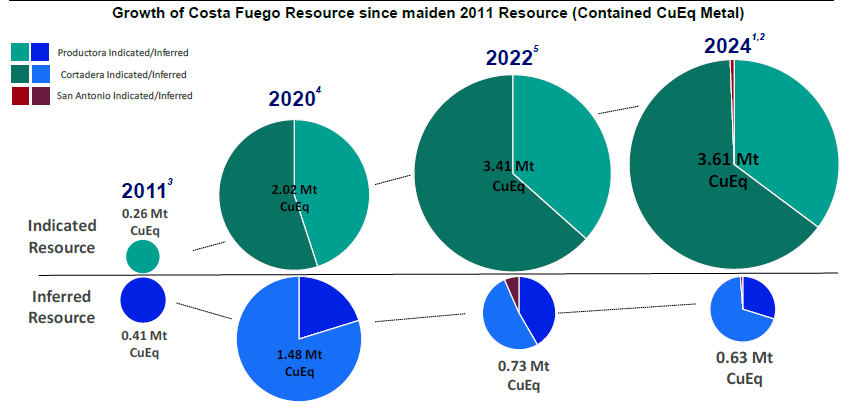

Hot Chili has executed an option agreement to extend its Cortadera copper-gold project over a large outcropping of mineralised porphyry similar in size to the main Cuerpo 3 porphyry.

The consolidation of Cortadera not only presents the opportunity to add significant mineralisation, it also about doubles the prospective strike length from 2.3km to 4.1km.

Given that Cuerpo 3 makes up a significant portion of the Cortadera mineralisation, which currently consists of a high confidence Indicated Resource of 471Mt grading 0.46% copper equivalent (CuEq) and an Inferred Resource of 108Mt at 0.35% CuEq, this could be hugely beneficial for the company.

Drilling of the new Cuerpo 4 porphyry by the vendor, Antofagasta Minerals (AMSA), has already confirmed several significant shallow drilling intersections including a thick 128m interval at 0.5% CuEq from a down-hole depth of 28m with a higher grade zone of 16m at 1.3% CuEq (1% copper and 0.5 grams per tonne gold) from 28m.

Hot Chili (ASX:HCH) intends to start a 6,000m drill program over the 700m by 300m Cuerpo 4 porphyry as soon as possible to assess a potential material resource addition to the broader Costa Fuego development.

New ground

The five mining rights acquired from AMSA cover 517 hectares and contain other identified porphyry targets besides Cuerpo 4.

Four of the five holes drilled by AMSA in 2005 returned wide intersections of mineralisation with their shallow nature highlighting open pit resource growth potential.

Hot Chili’s planned first pass program of both diamond and reverse circulation drilling will test Cuerpo 4 and two other targets within the new mining rights.

Drilling is also planned across the existing Cortadera North target, where earlier exploration drilling targeting a large surface molybdenum anomaly in 2020 intersected wide zones of silver mineralisation.

While this work vectored towards Cuerpo 4, the company had then ceased all exploration there until an agreement could be entered into with AMSA.

These rights are expected to provide relatively low cost and highly accretive resource growth potential.

Worth the wait

The acquisition has led the company to revise the release date for its next resource update to the second half of 2023 rather than late 2022 to include results from the proposed drilling.

Additionally, the combined Costa Fuego Pre-Feasibility Study – targeting annual production rates of up to 100,000t copper and up to 70,000oz of gold over a mine life of more than 20 years – will be paused until the company can assess the impact of resource growth potential at Cortadera.

This ensures that future expenditure relating to the PFS can be optimised for infrastructure location and a potentially larger scale copper operation.

Hot Chili keeps bringin’ the heat at its Costa Fuego copper development

STOCKHEAD | Oct 31, 2022

Pic: Hot Chili has gone back to basics to win a huge uptick in the value of its Costa Fuego copper development. Pic via Getty Images.

Here’s how to make an already attractive project even more lucrative: take some previously unsampled intervals and get high-grade results out of them.

Not exactly easy in real life but that’s exactly what Hot Chili (ASX:HCH) has managed at its Costa Fuego copper development in Chile with previously unsampled diamond core at the Productora and Alice pits yielding higher than expected copper grades.

And the results are encouraging to say the least – especially coming from a development that is no stranger to multi hundred metre copper-gold intersections.

Over at the Productora central pit area, the core returned an intersection of 244m at 0.8% copper equivalent (0.7% copper and 0.2g/t gold) from a down-hole depth of just 23m and includes a higher-grade zone of 71m at 1% CuEQ (0.8% copper and 0.2g/t gold).

The Alice satellite pit area yield a 152m zone at 0.6% CuEqu (0.6% copper and 0.1g/t gold) from 42m including 39m at 1.1% CuEq (1% copper and 0.1g/t gold) and a separate 23m interval at 0.9% CuEq from 226m to the end of hole.

This is on top of final drill results from the Valentina deposit returning a 6m interval at 1.3% copper from 10m down-hole while first ever drilling at Santiago Z did not intersect significant widths of copper but returned wide zones of silver which may indicate a potential distal response to copper porphyry mineralisation.

Drill results

The results from the first holes at the Productora and Alice pits provide further high grade growth ahead of a planned resource upgrade for Costa Fuego.

Both have continued to demonstrate grade upside with infill drilling, providing positive reconciliation ahead of any future mining activities.

Entire hole results from the remaining two diamond holes at Productora are expected to be received in the coming weeks.

Valentina and its neighbouring San Antonio satellite copper deposit are immediately to the east of the company-making Cortadera deposit.

Of the four holes drilled in the expanded program at Valentina, two recorded significant intersections while one hit historical underground workings.

A regulatory clearing application has been submitted to facilitate follow-up drilling at Valentina, which will expand resource drill definition across this potential high-impact future addition to Costa Fuego that could provide early, high-grade copper feed.

The company is also updating its Santiago Z geological model using RC chip logging and downhole multi-element geochemistry for use in any additional phases of exploration.

Further exploration is expected to focus on the southern extent of the Santiago Z porphyry footprint in advance of any planned second-pass clearing and drilling activities.

This article was developed in collaboration with Hot Chili, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Hot Chili’s satellite drilling to spice up Costa Fuego development

STOCKHEAD | Sep 08, 2022

Pic: Via Getty Images

Hot Chili is all but certain to be upgrading resources at its Costa Fuego copper development after reporting new copper-silver intersections at the high-grade San Antonio deposit.

Resource upgrade drilling results such as 21m grading 1.6% copper equivalent (CuEq) from 74m down-hole, 13m at 1.3% CuEq from 133m and 7m at 1.6% CuEq from 11m are likely to see most if not all of the current Inferred resource of 4.2Mt grading 1.2% CuEq upgraded to the higher confidence Indicated category.

This will also allow Hot Chili (ASX:HCH) to include San Antonio – one of the satellite deposits at the Costa Fuego copper hub in Chile – in its mine plan.

Final drill results are also pending from the Valentina satellite deposit, which has proven to be an even spicier meal with initial assays returning results such as 3m at 12.1% CuEq.

A regulatory application for follow-up drilling at Valentina is being prepared while drilling is currently underway at the Santiago Z porphyry exploration target where five holes have been completed.

San Antonio drilling

The company completed 13 reverse circulation drill holes across the San Antonio resource window to test extensional potential as well as infill areas of lower geological confidence.

Several of these holes returned higher grades than estimated in the current resource estimate while a further three diamond holes were drilled for metallurgical test work purposes.

San Antonio’s shallow, high-grade nature makes it amenable for open pit mining with relatively low strip ratios.

Along with Valentina, it is expected to provide high grade, front-end ore which could have a positive material impact on the payback period and overall economics for the broader Costa Fuego development.

Costa Fuego boasts more than 3Mt of copper metal across the major Productora and Cortedera deposits, with measured indicated resources of 725Mt grading 0.47% CuEq, containing 2.75Mt Cu, 2.56Moz Au, 10.49Moz Ag, and 67.4kt Mo and an inferred resource of 202Mt grading 0.36% CuEq containing 731kt Cu, 605koz Au, 2.03Moz Ag and 13.4kt Mo.

Hot Chili’s Valentina deposit could provide early, high-grade copper feed

STOCKHEAD | Aug 18, 2022

Pic: Getty Images

Hot Chili has uncovered further evidence that it has shallow, high-grade material that can provide early feed to a development at its Costa Fuego copper hub in Chile.

Drilling at the Valentina satellite deposit returned a very rich 3m intersection grading 12.1% copper equivalent (11.8% copper and 52.6g/t silver) from a down-hole depth of just 29m within a broader 12m zone at 4.6% copper equivalent from 25m.

Adding further interest for Hot Chili (ASX:HCH), the mineralisation in VALMET0002 is dominantly sulphide and amenable to sulphide flotation, which contributes further to the deposit’s potential to contribute to early sulphide cash flow generation.

With the hole also confirming a 120m extension of high-grade, copper-silver mineralisation to the south of the historical Valentina underground mine, mineralisation at the deposit is now defined over about 300m in strike while remaining open at depth and along strike.

Along with the San Antonio deposit, Valentina is looking increasingly likely to provide high-grade ore which could have a positive material impact on the payback period and overall project economics.

Assays are pending for a further six drill holes at Valentina and 16 holes at San Antonio.

Drill results

Hot Chili has received assays for 11 of the 17 Phase 2 drill holes. Of these, four holes returned significant drill intersections while three intersected the mineralised structure (at 0.2% to 0.5% copper).

This drilling was focused on proving the continuity of the mineralised trend along strike and at depth below the historical shallow underground mine.

High-grade hits received to date – including VALMET0002 – are located on the southern extent of an area previously masked at-surface by a shallow horizon of Atacama gravels.

Hot Chili seals access to Chilean national grid, ensuring Costa Fuego copper project will run on 100% renewables

STOCKHEAD | Aug 18, 2022

Pic: Michael Duva/Stone via Getty Images

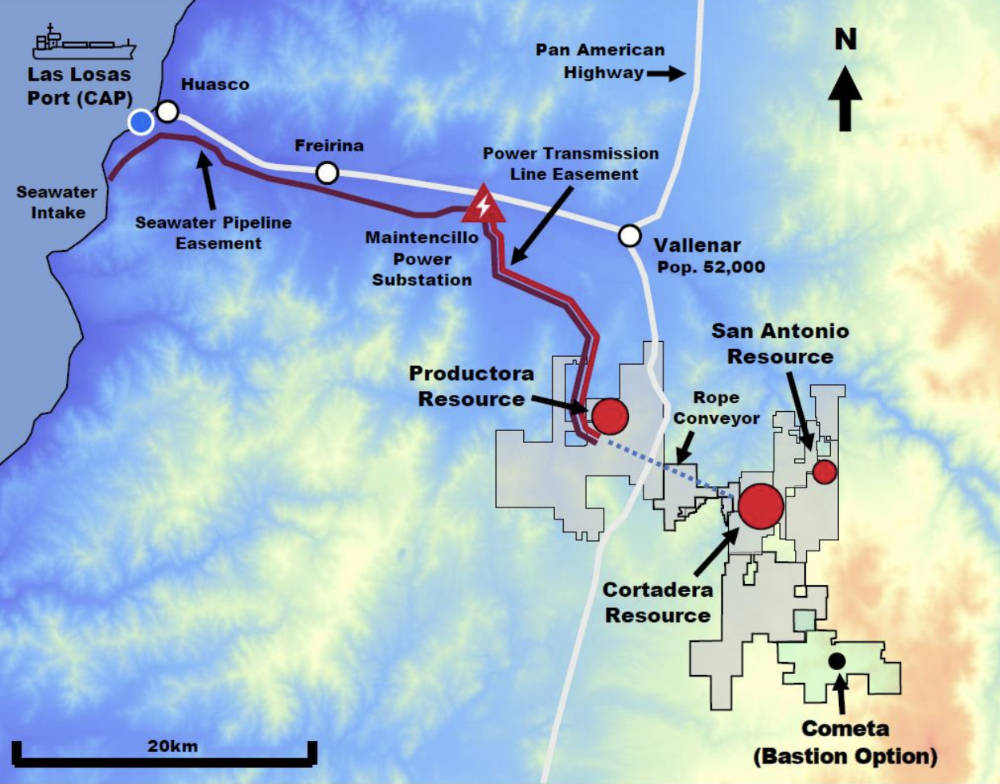

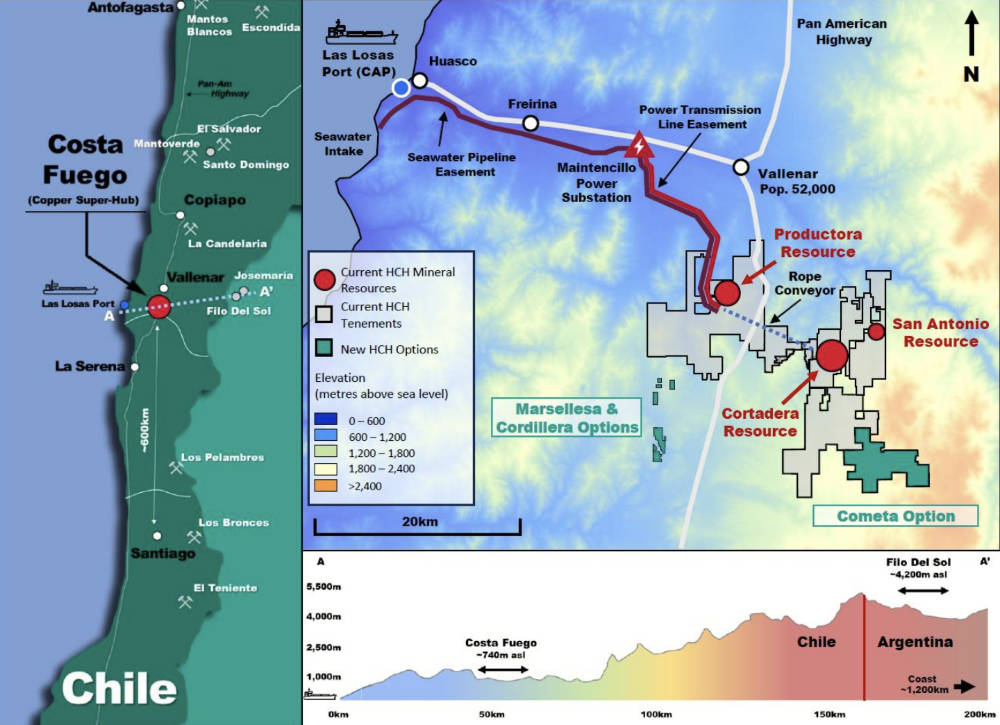

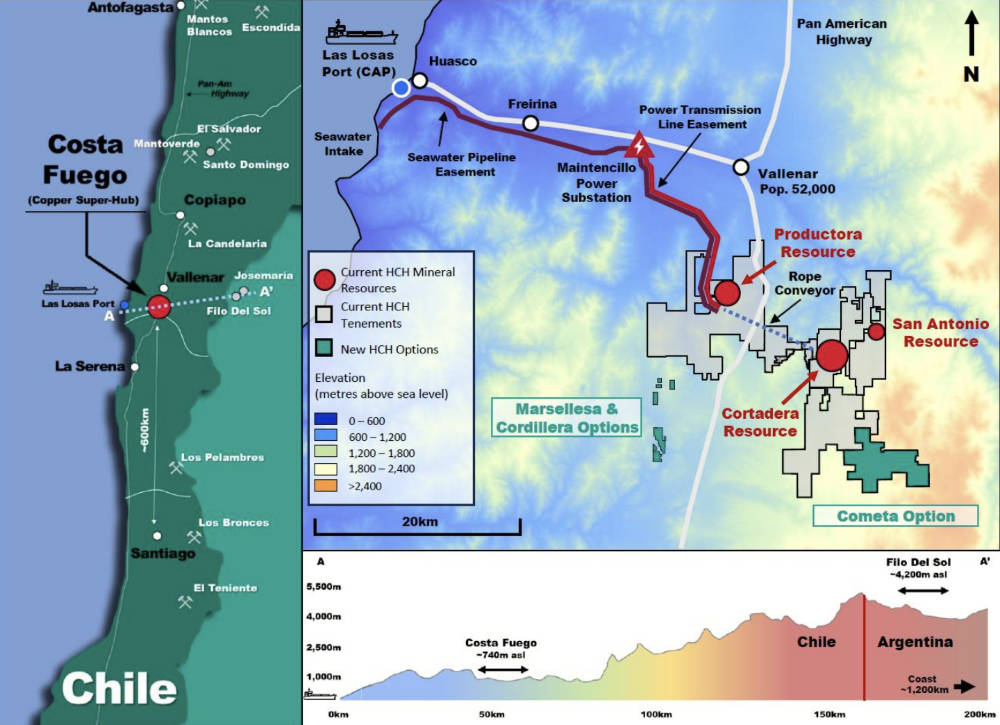

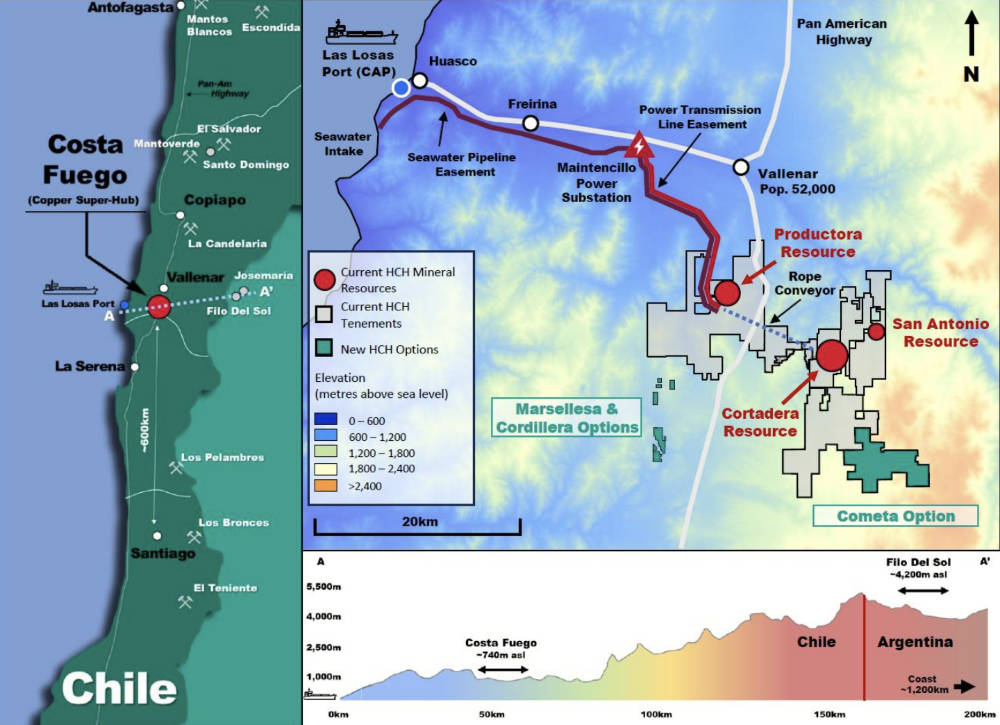

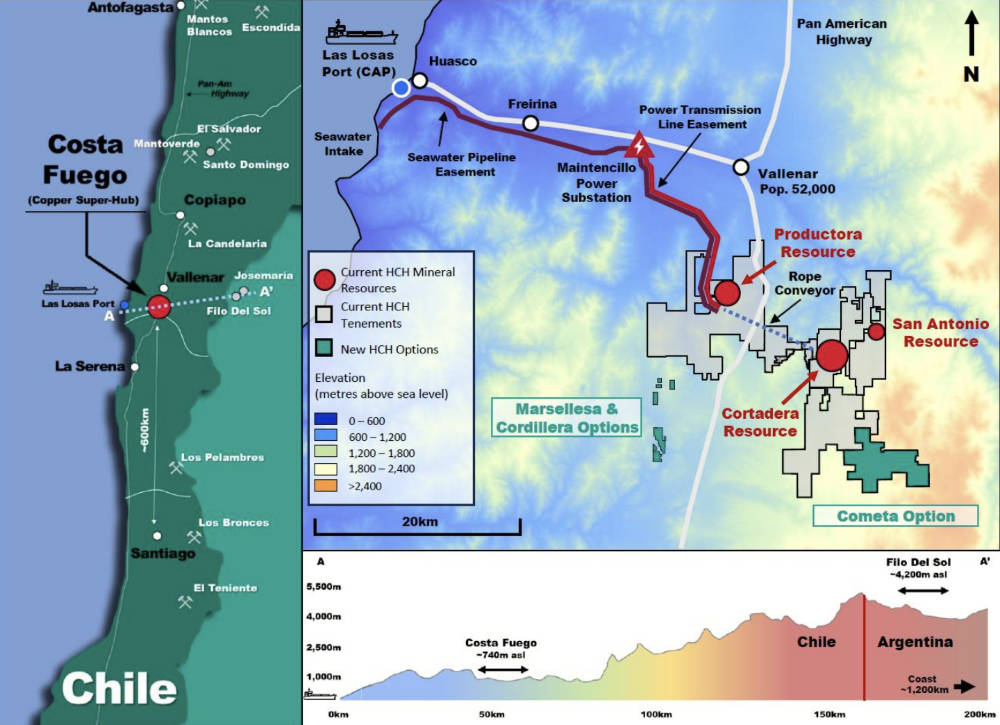

Hot Chili’s Costa Fuego copper project in Chile is already a monster, representing the lowest altitude development of a major copper deposit in the Americas.

Now it has been confirmed the mine will be able to operate on 100% renewable energy from day 1, with Hot Chili (ASX:HCH) receiving approval to connect to the Maitencillo sub-station 17km from the centre of the Costa Fuego development.

Chile’s Central Authority Electrical Regulator has approved the connection application, the company said today.

It opens access for Hot Chili to the national electricity grid, with the company able to negotiate with the multiple renewable energy providers in the South American nation.

A process to select one of more electrical providers is expected to begin in the fourth quarter of 2022.

The news adds another layer to the project’s environmental credentials to the Costa Fuego project, with Hot Chili able to operate off a mix of nearby solar, wind and hydroelectric generators.

The company is taking a low energy intensity development approach to Costa Fuego, including raw seawater processing without the need for a desalination plant. Hot Chili is fast approaching ‘infrastructure readiness’ with port access and services discussions advancing.

A PFS is due in the first quarter of 2023, making it one of the few copper mines ready to answer the call for material new sources of production as demand for the metal surges from the energy transition.

Resource growth drilling is still ongoing, with a resource upgrade expected in late 2022.

Costa Fuego boasts more than 3Mt of copper metal across the major Productora and Cortedera deposits, with measured indicated resources of 725Mt grading 0.47% CuEq, containing 2.75Mt Cu, 2.56Moz Au, 10.49Moz Ag, and 67.4kt Mo and an inferred resource of 202Mt grading 0.36% CuEq containing 731kt Cu, 605koz Au, 2.03Moz Ag and 13.4kt Mo.

Acquisition all part of Hot Chili’s plan to upscale Costa Fuego, ‘one of the world’s lowest capital intensity major copper developments’

StockHead | August 2023

- Company moves to acquire Cometa project near flagship 725Mt Costa Fuego asset

- New project provides opportunity to discover more resources, upgrade production to 150,000tpa CuEq

- 30km expansion drilling campaign is continuing

Hot Chili is progressing its strategy of upscaling its already significant 2.8Mt copper, 2.6Moz gold Costa Fuego flagship project in Chile with a move to acquire the nearby Cometa asset.

Hot Chili says Costa Fuego is already “one of the world’s lowest capital intensity major copper developments” and one of only a handful of projects outside of the control of major miners capable of delivering meaningful new copper supply this decade.

Its indicated resource of 725Mt grading 0.47% copper equivalent powers a punchy Preliminary Economic Assessment (PEA) – essentially a Scoping Study – which showcases attractive returns.

The PEA envisages a US$1.05bn project capable of producing 112,000t of copper equivalent (95,000t of copper and 49,000oz of gold) per annum over 14-years of a 16-year mine life.

Ove this time it would deliver revenue and free cash flow of US$13.52bn and US$3.28bn, respectively.

Post-tax net present value and internal rate of return – both measures of a project’s profitability – are estimated at US$1.1bn and 24% respectively.

Exploration, acquisitions to support production boost to 150,000tpa

Hot Chili (ASX:HCH) is now focused on upscaling Costa Fuego’s resource base to support an increase in the copper production profile to 150,000tpa ahead of its Pre-Feasibility Study, which is expected to be delivered in the first half of 2024.

Its planned acquisition of Bastion Minerals’ (ASX:BMO) Cometa project, 15km from Costa Fuego’s planned operating centre, is aimed at furthering this strategy via the discovery of further mineral deposits which could add supplemental feed or extend mine life.

Acquisition terms

Under the letter of intent, the company has secured a 60-day exclusivity period to carry out due diligence with the intention to enter into a definitive option agreement for the acquisition of Cometa.

Hot Chili will pay Bastion US$100,000 in cash on the grant of the option and will pay a further US$200,000 within 12 months of its grant to keep the option in good standing.

Should the company exercise the option within 18 months of it being granted, it will have to pay Bastion US$2.4m in cash or an equal mix of cash and HCH shares.

This increases to US$3m if the decision is made after the initial 18 months and before the option expires 30 months from its grant.

An emerging copper monster

Hot Chili’s acquisition of the Cortadera project in early 2019 delivered multiple, very thick copper-gold porphyry hits that drastically changed the scale of what became the Costa Fuego project.

Not only does Cortadera account for the majority of resources at Costa Fuego – at 451Mt at 0.46% copper equivalent – but drilling also outside of the resource envelope continues to deliver more thick, copper-gold porphyry hits that strongly indicate there’s plenty of growth to come.

Expansion drilling continuing

The company is continuing a 30,000m expansion drilling campaign at Cortadera with nine reverse circulation holes totalling 2,010m completed so far.

Four of these drillholes have been completed across the western extension of the Cortadera porphyry resource, including one pre-collar in preparation for a deep diamond hole beneath Cuerpo 4.

Once the RC pre-collars are drilling, the RC rig is expected to begin a hydrogeological program at Cortadera from mid-September.

Hot Chili also plans to have one diamond drilling rig starting double shift drilling in September with preparations underway to bring a second rig online as it ramps up drilling across multiple exploration targets.

Acquisitions deliver ‘pipeline of opportunities’ to increase Hot Chili’s copper resources at Costa Fuego

By STOCKHEAD

Surfs up as Hot Chili signs options to acquire two previously producing copper mine areas near Costa Fuego. Pic: via Getty Images.

- Hot Chili is acquiring two previously producing copper mine areas that have never been drill tested

- The acquisition is in line with strategy to increase resources at Costa Fuego to underpin a copper production profile of 150,000tpa

- First pass RC drilling at the newly acquired Marsellesa and Cordillera tenements to begin in the coming week

Special Report: Flush with the ongoing success of its Costa Fuego development in Chile, Hot Chili is now moving to acquire two nearby copper mine areas that have never been drill tested before, despite previously reaching production.

With an indicated resource of 725Mt grading 0.47% copper equivalent underpinned by an attractive preliminary economic assessment (PEA) (a rough equivalent to a scoping study), Costa Fuego is rapidly emerging as one of the few projects in the world capable of delivering meaningful new copper supply that isn’t controlled by a major.

Under the PEA, Hot Chili (ASX:HCH) estimated the US$1.05bn project would be capable of producing 112,000t of copper equivalent (95,000t of copper and 49,000oz of gold) per annum over 14-years of a 16-year mine life.

Over this time, it would deliver revenue and free cash flow of US$13.52bn and US$3.28bn, respectively.

Post-tax net present value and internal rate of return – both measures of a project’s profitability – are estimated at US$1.1bn and 24% respectively.

While certainly attractive, the company is looking to increase its resource base to support an increase in Costa Fuego’s copper production profile to 150,000tpa ahead of its pre-feasibility study, which is expected to be delivered in the first half of 2024.

One of the first steps to achieve this objective was signing a binding letter of intent to acquire Bastion Minerals’ (ASX:BMO) ~56km2 Cometa project about 15km from Costa Fuego’s planned operating centre.

Historical producers offer “pipeline of opportunities”

The new project options near Costa Fuego. Pic via Hot Chili

HCH’s latest option agreements to acquire the Marsellesa and Cordillera copper mine areas about 10km from the planned central processing hub at Costa Fuego are part of the company’s strategy to increase resources.

Both mine areas have been privately held and historically exploited for shallow copper oxide and copper sulphide material, but have never previously been drill tested.

Marsellesa measures 400x200m with mine workings exposing multiple zones of shallow-dipping, strata-bound (manto-style) copper mineralisation.

The smaller Cordillera mine workings expose outcropping porphyry copper mineralisation with well-developed stockwork and sheeted A and B style porphyry veining.

Along with Cometa, the new project additions provide the company with a pipeline of opportunities and additional optionality for the discovery of new mineral resources.

HCH will pay Marsellesa vendor Hermanos Pefaur up to US$1.35m and a 1% net smelter royalty (NSR) to acquire the project while Mr Arnaldo Del Campo – the holder of the concessions comprising Cordillera – could receive up to US$4m and a 1% NSR from underground operations and 1.5% NSR from open pit work if the option is exercised.

That’s hot: Costa Fuego’s indicated resource increases to 798Mt as Hot Chili prepares for PFS completion

By STOCKHEAD

The expansion of Costa Fuego’s indicated resource is timely for Hot Chili ahead of the upcoming PFS. Pic via Getty Images

- Resources for the Costa Fuego project now total 798Mt @ 0.45% copper equivalent

- Over 59% of Costa Fuego’s resource is now classified as indicated

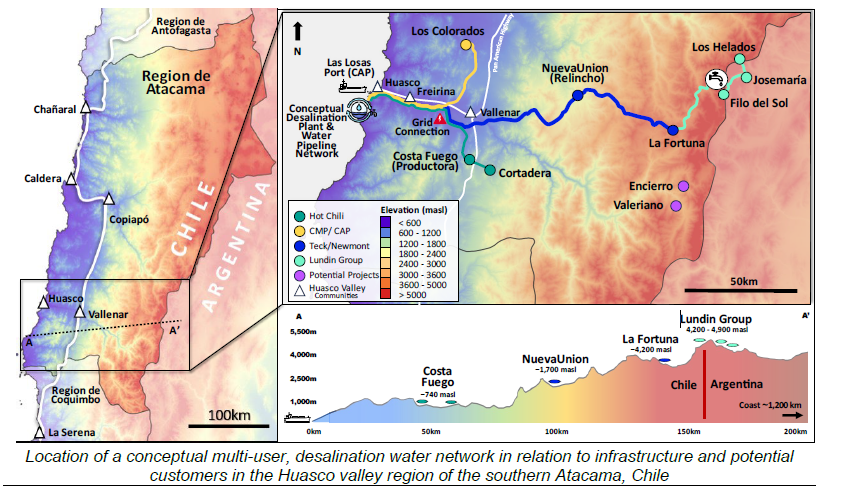

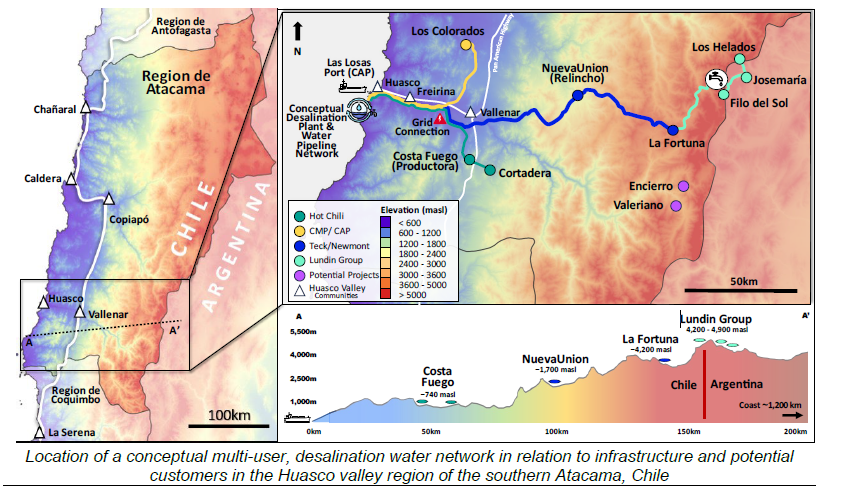

- Hot Chili has also completed a water supply concept study for the Huasco valley region of Chile, allowing it to develop a regional water business for the southern Atacama

Special Report: Hot Chili’s Costa Fuego copper-gold project in Chile has seen a 6% increase in copper equivalent contained metal and a 9% increase for the higher-grade component of the indicated resource.

Hot Chili’s (ASX:HCH) Costa Fuego project comprises the Cortadera, Productora (including Alice) and San Antonio deposits, all of which have updated resource estimates and lie proximal to one another, around 600km north of Santiago.

Over 85% of Costa Fuego’s resource estimate is now classified as indicated following 24 months of material investment and 24.5km of drilling across the project tenure.

This included a mix of development activities such as metallurgical, geotechnical, resource expansion and exploration drilling – all designed to progress the PFS on Costa Fuego towards completion in H2 2024.

Total indicated resources now sit at 798Mt @ 0.45% copper equivalent for 2.9Mt copper, 2.6Moz gold and 12.9Moz silver as well as 68,000t molybdenum, while inferred resources have now topped 203Mt @ 0.31% copper equivalent for 0.5Mt copper, 0.4Moz gold, 2.4Moz silver and 12,000t molybdenum.

Cortadera resource grows another 13%

At Cortadera, which has again delivered the majority of resource growth for Costa Fuego, Hot Chili completed 43 reverse circulation (RC) and diamond drillhole (DD) tails for 17,000m of additional exploration and resource extension drilling.

Cortadera’s indicated resource tonnage has grown by a further 13%, supporting the June 2023 preliminary economic assessment which outlined Costa Fuego as having the potential to be one of the world’s lowest capital intensity major copper developments.

It now contains an indicated resource of 531Mt @ 0.44% copper equivalent and an inferred resource of 149Mt @ 0.29% copper equivalent.

Meanwhile, the Productora resource has been re-estimated following an additional 16 RC and DD exploration drillholes for 5,000m with an additional 2.8Moz of silver metal at 0.35g/t, which has now been incorporated into the copper equivalent contained metal.

Indicated resources at San Antonio now total 3Mt @ 0.71% copper equivalent, while the inferred resource sits at 2Mt @ 0.41% copper equivalent.

Regional water supply opportunity

In other news, Hot Chili has completed a water supply concept study for the Huasco valley region of Chile, confirming the potential for a large, multi-user desalination water supply network.

While Costa Fuego’s mine development plan considers the use of raw seawater for future processing, the water supply concept study confirms potential to also develop a large, multi-user, desalination water supply business.

It outlines an opportunity to develop a potentially 100% renewable energy driven desalination water business to supply community, agricultural and new mining demand of up to 3,700 litres per second (L/s) over the long-term.

Staged development scenarios were assessed considering the initial development of a 300L/s desalination plant being supported by potential foundation off-take partners.

The company holds the only active granted maritime water concession and most of the necessary permits to provide critical water access to the Huasco valley region following over a decade of permitting for the Costa Fuego project.

‘The perfect marriage’

“One, single, desalination water supplier, with the potential to unlock several significant mining investments, is a blueprint for the future of responsible water supply in the Atacama,” HCH managing director Christian Easterday says.

“This is an exciting opportunity to surface value for Hot Chili, following over 10 years of investment to obtain the necessary water concession and permits.

“It brings together the perfect marriage of economic, environment and social benefits for a wide range of stakeholders.”

Hot Chili bites into US$1bn Costa Fuego copper-gold project with another 10,000m of drilling under way

By STOCKHEAD

Pic: via Getty Images.

- A 10,000m drilling campaign across 10 holes has kicked off at Costa Fuego

- Assays are back from four RC holes at the Marsellesa pit showing grades of up to 1% copper and six holes from Cordillera showing up to 0.4% copper

- Final stages of an upgrade to the mineral resource are being finalised

Special Report: The next phase of Hot Chili’s 30,000m resource growing expedition at its Costa Fuego copper-gold project in Chile has kicked off at seven large-scale targets adjacent to the Cortadera and Productora deposits.

Hot Chili’s return to drilling comes off the back of a landholding expansion of the project and a recent scoping study which estimated the >US$1 billion project can produce ~112,000tpa of copper equivalent (95,000t CU and 49,000oz Au) for an initial 14-year mine life.

Chile is renowned for its high-value copper deposits and is the largest producer of the red metal in the world, with heavy hitters such as BHP, Rio Tinto and JECO running the operations of world-class deposits.

Phased drilling

47 RC drill holes for 11,500m have been completed since Hot Chili (ASX:HCH) kicked off the extensive drill program in late July last year, and this round comprises 10 diamond holes to test four large-scale targets near Cortadera and three large-scale targets near Productora for a total of 10,000m.

Assays have come back from the late-2023 targets of Marsellesa, Cordillera and Correteo – all within 15km of Costa Fuego’s planned central processing hub showing grades of up to 1% copper across 500m of prospective strike length.

Four RC holes for 1,244m were completed and include:

- 25m @ 0.4% copper from surface, including 10m grading 0.8% copper from 7m depth

- 8m @ 0.8% copper from 1m depth downhole, including 4m grading 1.0% copper from 4m depth

HCH says the higher grade copper intersections are associated with both copper oxide and sulphide mineralisation and further work is being planned to assess mineralisation continuity.

The Marsellesa mine area is laterally extensive, measuring 400x200m, with historical open pit and underground mine workings exposing multiple zones of shallow-dipping, strata-bound (manto-style), copper mineralisation.

Six holes for 1,450m at Cordillera, 1km to the west of Marsellesa, showed up to 0.4% copper below and surrounding the historical small surface mine workings, including:

- 93m @ 0.3% copper from surface, including 14m grading 0.4% copper from surface

- 53m @ 0.3% copper from 19m depth, including 10m grading 0.4% copper from 44m depth

Eight RC holes for 2,324m were completed at the greenfield Corroteo exploration target, however, no significant intersections were recorded.

HCH is in the final stages of the resource upgrade for Costa Fuego, which is expected to be released this quarter.

Hot Chili’s new option deal reduces payments from US$11m at the Costa Fuego copper hub for 2024

By STOCKHEAD

The new El Fuego Option will also increase the company’s ownership from 90% to 100% at the San Antonio, Valentina and Santiago Z privately-owned landholdings. Pic via Getty Images

- Three options due for exercise in 2024 have now been terminated and replaced with one new option agreement

- Hot Chili’s new deal, named the ‘El Fuego Option’ covers the San Antonio, Valentina and Santiago Z privately-owned landholdings

- Updates on growth drilling, resource upgrades and water conceptual studies are expected in the near term

Special Report: Hot Chili has materially improved the terms of the El Fuego option agreement to acquire landholdings as part of the company’s Costa Fuego copper-gold project in Chile.

Hot Chili’s (ASX:HCH) 725Mt Costa Fuego project is rapidly emerging as one of the few projects in the world capable of delivering meaningful new copper supply that isn’t controlled by a major.

A recent PEA – the equivalent of a scoping study – estimated the US$1.05bn project would be capable of producing 112,000t of copper equivalent (95,000t of copper and 49,000oz of gold) per annum over 14-years of a 16-year mine life.

Over this time, it would deliver revenue and free cash flow of US$13.52bn and US$3.28bn, respectively.

HCH is now looking to increase its resource base to support an increase in Costa Fuego’s copper production profile to 150,000tpa ahead of its pre-feasibility study, which is expected to be delivered in the first half of 2024.

A new deal

HCH has now renegotiated terms over the El Fuego option which covers the San Antonio, Valentina, and Santiago Z privately owned landholdings along the eastern extent of the Costa Fuego project.

The new deal – originally due to exercise next year – will now be exercised in September 2026 with a revitalised agreement which comes with better terms for HCH.

Improvements to the deal include:

- A material reduction to HCH’s option payments due in 2024 from US$11m to US$1m;

- An increase to HCH’s ownership from 90% to 100%, subject to the exercise of the option;

- Extends the option expiry from 2024 to 2026 in exchange for payments of US$4.3m over the next three years

Strength of local partnerships in Chile

HCH managing director Christian Easterday says the option re-negotiation is further confirmation of the strength of the company’s local partnerships in Chile.

“Alignment of local partners has been a key element of our consolidation strategy for Costa Fuego,” he says.

“The El Fuego Option allows the company to focus its balance sheet on exploration and growth of our mineral resource as opposed to property payments.

“Our near-term focus on increasing value per share and leverage to future copper price for our shareholders centres around enhancing Costa Fuego’s mineral resource and potential economics in advance of a planned pre-feasibility study.”

Easterday says the company is “actively” evaluating the region for consolidation opportunities and expects to see further success on this front as it looks to up-scale Costa Fuego’s potential study scale towards a 150kt per annum copper development from its current 95kt per annum copper metal production scale.

Updates on growth drilling, resource upgrades and water conceptual studies are also expected shortly.

Acquisition delivers pipeline of opportunities

HCH announced the move to acquire two nearby copper mine areas that have never been drill tested before – despite previously reaching production – around 10km from the planned central processing hub at Costa Fuego.

The latest option agreements to acquire the Marsellesa and Cordillera copper mine areas are part of the company’s strategy to increase resources.

The new project options near Costa Fuego. Pic via Hot Chili

Both mine areas have been privately held and historically exploited for shallow copper oxide and copper sulphide material but have never previously been drill tested.

Marsellesa measures 400x200m with mine workings exposing multiple zones of shallow-dipping, strata-bound (manto-style) copper mineralisation.

The smaller Cordillera mine workings expose new, outcropping porphyry copper mineralisation with well-developed stockwork and sheeted A and B style porphyry veining.