Hot Chili gets a whole lotta love after visual copper intercepts at Valentina

STOCKHEAD | Special Report | 14 June 2022

Copper-gold love for Valentina. Pic: via Getty Images

The Cortadera porphyry deposit continues to deliver the high-grade goods for copper developer Hot Copper-gold prospectivity at Hot Chili’s Costa Fuego hub is not limited to its Cortadera and Productora projects as highlighted by strong visual copper from drilling at the Valentina deposit.

Diamond hole VALMET-002 recorded a 17m intersection of “interesting” copper mineralisation from a depth of 22m including 8m of “very interesting” mineralisation such as chalcocite, cuprite and covellite, which are all high-grade copper ore minerals by molecular weight.

Importantly for Hot Chili (ASX:HCH), the intersected zone is located about 120m south of existing underground mine workings at Valentina, which effectively extends the high-grade copper zone at the project by the same amount.

While visual observations are purely indicative and in no way a replacement for laboratory assays, they do provide a good idea of whether mineralisation has been intersected.

More to come

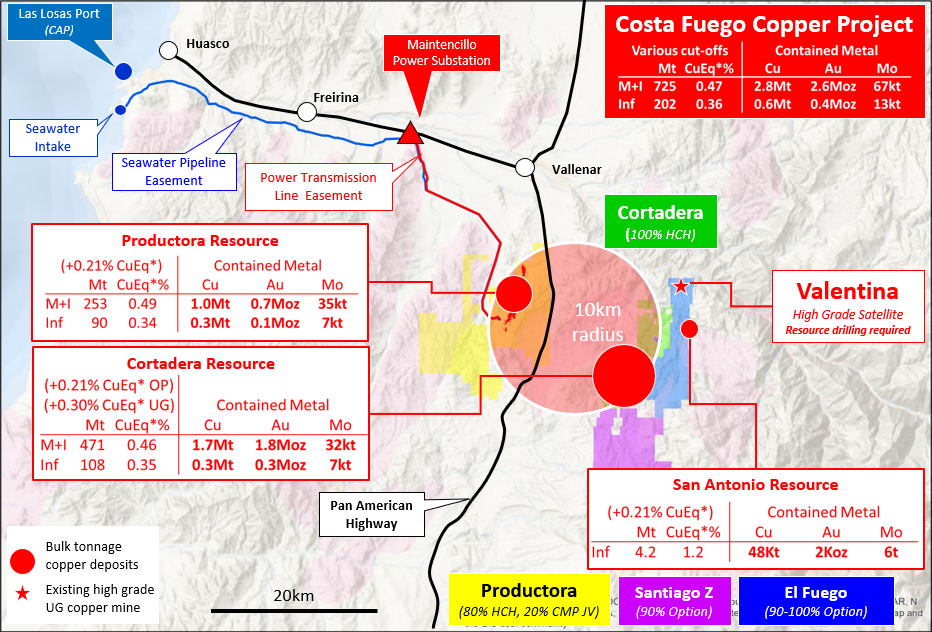

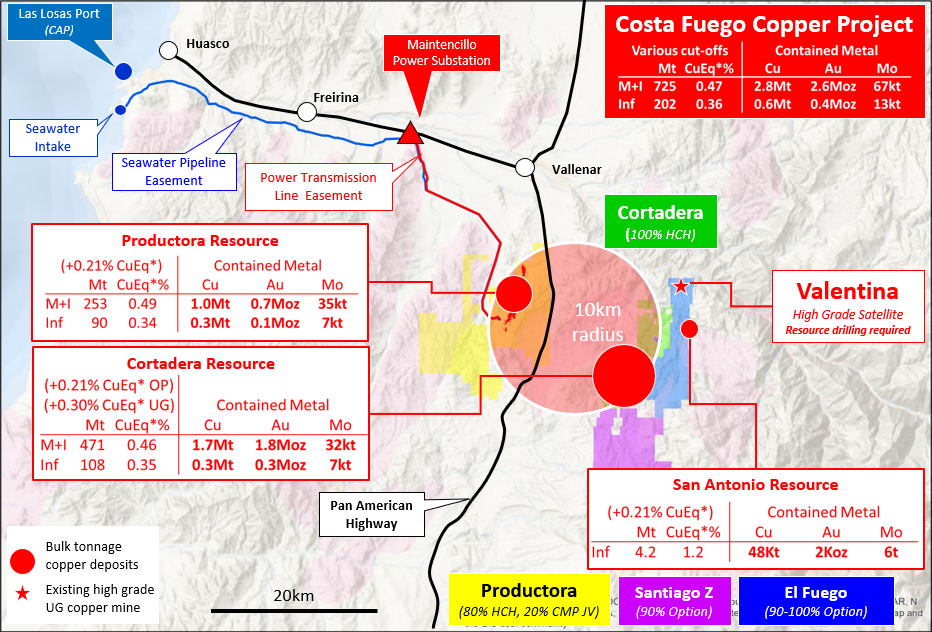

Two rigs are currently operating at the Valentina and San Antonio copper deposits about 5km east of the company’s outstanding Cortadera copper porphyry discovery.

10 holes have been completed to date at Valentina with a further eight holes planned, and assays from VALMET-002 are expected to be released in the coming weeks.

Once drilling at the two deposits is completed, further drilling is planned to test several large growth targets including Santiago Z and extensional porphyry targets along strike from Cortadera.

Hot Chili has also extended pre-feasibility studies to capture additional metallurgical test work opportunities across all deposits at Costa Fuego and preliminary mine planning is being extended to allow the incorporation of new resource growth from drilling in 2022.

Costa Fuego currently has a massive Indicated resource of 725 million tonnes grading 0.47% copper equivalent, or contained resources totalling 2.8Mt of copper, 2.6 million ounces of gold, 10.5Moz of silver and 67,000t of molybdenum.

Other updates include imminent results on ongoing port negotiations and final development study drill results from Cortadera and Productora once all results have been received.

This article was developed in collaboration with Hot Chili, a Stockhead advertiser at the time of publishing.

Hot Chili’s best copper intercept highlights value of satellite drilling

STOCKHEAD | Special Report | 12 Aug 2022

Image courtesy Getty Images

Hot Chili has intersected its highest grade intersection at its Costa Fuego copper hub in Chile with the hole at the Valentina deposit returning 8m grading 5.9% copper equivalent.

The intercept of 8m at 5.7% copper and 24 grams per tonne (g/t) silver from a depth of 27m (VAP0009) also outlines the potential of Valentina to be the second high-grade satellite for Costa Fuego.

VAP0009 also extends high-grade mineralisation at the deposit by 120m to the south of the shallow historical mine development.

Hot Chili (ASX:HCH) is now looking forward to assays from diamond hole VALMET0002, a twin of VAP0009 which recorded a stunning 17m visual intersection.

Assay results are pending for a further 17 drill holes at Valentina as well as 16 drill holes from the neighbouring San Antonio high grade copper resource.

Drilling at Valentina is aimed at defining a maiden resource estimate while San Antonio drilling is designed to upgrade resources from Inferred to the higher confidence Indicated category while testing for down-plunge mineralisation extensions.

Both high-grade satellites will be included in the next resource upgrade and subsequent Pre-Feasibility Study open pit mine scheduling which is expected in the first quarter of 2023.

They are expected to provide valuable front-end ore which could make a positive material impact on the payback period and overall project economics of the Costa Fuego copper-gold development.

First drilling is underway at the large-scale Santiago Z target, part of a potential regional porphyry cluster south of the company’s Cortadera porphyry copper-gold discovery.

Valentina and San Antonio satellite deposits

First phase drilling at Valentina is focused primarily on proving continuity of the mineralised trend along strike of the successful 2018 drill campaign.

Mineralisation is interpreted to be fault-hosted, dipping steeply towards the east within a sequence of volcanic sedimentary units, similar to the deposit setting of the neighbouring San Antonio resource.

At San Antonio, the 13 reverse circulation holes have infilled and extended the mineralised trend along interpreted high-grade plunging shoots, with most of the drill holes supporting the current interpretation of structure and mineralisation at San Antonio.

Three diamond holes were also drilled to provide material for metallurgical testwork, which is essential for including the resource in the Costa Fuego PFS.

Scorching drill results for Hot Chili at Cortadera ahead of resource upgrade and PFS

STOCKHEAD | Special Report | 20 May 2022

Pic: Frantic00/iStock via Getty Images

The Cortadera porphyry deposit continues to deliver the high-grade goods for copper developer Hot Chili, with the latest drilling program from the development striking a massive hit of 658m at 0.6% copper equivalent.

That’s a good grade over a very wide width for a porphyry, where copper resources far lower in grade can be cash cows thanks to their incredible scale.

Cortadera is part of Hot Chili’s (ASX:HCH) Costa Fuego, one of the only low altitude copper developments globally with a near term development timeline.

The strike of 658m at 0.4% copper, 0.2g/t gold and 122ppm molybdenum came from just 232m downhole, with narrower intersections of 134m at 0.8% CuEq, and 130m at 0.9% CuEq from 470m and 662m depth at the main Cuerpo 3 porphyry.

Those results in hole CORMET005 are the latest example of Cortadera’s capacity to outperform expectations.

“The PFS in-fill drill programme across Cortadera has collected important geotechnical and hydrogeological information and has also continued to define and expand high grade resources,” HCH managing director Christian Easterday said.

“Upgrading our resources with wide drill intersections grading 0.8% to 1.0% copper equivalent is a great outcome, which demonstrates the quality and growth potential of Costa Fuego as one of the only low-altitude, material, copper developments in the world capable of near-term development.”

High grade continues to expand

Hot Chili, which has an offtake partnership with one of the world’s largest metals traders in Glencore to back its plans to enter production at the proposed Chilean mine, has an indicated and inferred resource at Cortadera of 451Mt at 0.46% CuEq including 2.086Mt of copper equivalent metal and 1.663Mt of copper and 1.9Moz gold in the ground.

That’s on top of a 273Mt resource at the nearby Productora at 0.52% CuEq for 1.215Mt Cu and 810,000oz Au.

But development study drilling at Cortadera ahead of a planned PFS continues to highlight opportunities to grow its high grade resource, with multiple wide and high grade strikes outside the existing resource.

That includes 30m at 1.4% CuEq (1.1% copper, 0.5g/t gold and 165ppm molybdenum) from 690m in hole CORMET005, which is outside the current high grade resource (anything above 0.6% CuEq).

It builds on recently reported drill results from Cuerpo 3 including 552m at 0.6% CuEq from 276m deep, including 248m at 0.8% CuEq, and 876m at 0.5% CuEq from 246m, including 206m at 0.9% CuEq.

Diamond drill hole CORMET002 has also returned 370m at 0.4% CuEq (0.3% Cu and 0.1g/t Au) from surface at the Cuerpo 2 porphyry, including 20m at 0.8% CuEq from 24m and 22m at 1% CuEq from 136m depth. The high grade intersections are both outside the current high grade resource at Cuerpo 2.

A final development study drill hole is still being completed at Cortadera, with four metallurgical diamond drill holes completed at the Productora orebody.

Productora also contains a probable ore reserve of 166.9Mt at 0.43% copper, 0.09g/t gold and 138ppm molybdenum for 716,800t of contained copper metal, 470,700oz of contained gold and 23,100t of molybdenum with payable metal of 562,900t Cu, 191,900oz Au and 11,200t Mo.

Satellite drilling under way

The scale of Costa Fuego is such that there are multiple deposits likely to be developed once the mining operation is under way.

Just 5km northeast of Cortadera, Hot Chili boasts the San Antonio and Valentina deposits, two high grade satellite orebodies where HCH plans to grow its resources through drilling.

Ten drill holes are planned at Valentina, where drilling is already under way, with another 13 to be sunk into San Antonio. Both are expected to be part of Costa Fuego’s next resource upgrade and its combined PFS open pit mine schedule this year.

San Antonio already boasts a maiden inferred resource reported in March of 4.2Mt at 1.2% CuEq (1.1% copper and 2.1g/t silver) for 48,000t of copper and 287,000oz of silver.

Meanwhile platform and access clearing is expected to be complete in the coming week at the Santiago Z exploration target, another high quality copper prospect at Costa Fuego.

Drilling will commence at Santiago Z after Hot Chili wraps up at Valentina and San Antonio.

Located immediately south of Cortadera, soil results and mapping have confirmed a large potential copper porphyry footprint at the Santiago Z measuring over 4km in length and 2km in width.

Hot Chili delivers fiery results as focus turns to satellite deposits

STOCKHEAD | July 19, 2022

Pic: Via Getty Images

Hot Chili’s drill focus may have switched to other targets but the final development study drill hole at Cortadera has not disappointed, delivering a better than expected result.

Diamond hole CORMET004 returned a 484m intersection grading 0.5% copper equivalent (0.4% copper and 0.1 grams per tonne gold) from a down-hole depth of 548m that includes higher grade zones of 56m at 1% copper equivalent from 644m and 206m at 0.l7% copper equivalent from 800m.

The last of six development study holes drilled as part of a hydrological and geotechnical testwork program also confirmed further down-plunge extensions of the high grade core at the main Cuerpo-3 porphyry, with the intersection of a 44m zone grading 1% copper equivalent from 878m outside of the current high-grade resource domain.

Results from the program will be included in the next resource upgrade, expected in late 2022.

Metallurgical testwork yields rewards

And if this stellar result isn’t enough to whet your appetite, Hot Chili (ASX:HCH) has more up its sleeves.

Four diamond holes completed for metallurgical testwork across the Productora resource – three in the Productora central pit area and one into the Alice satellite pit area) – have also returned some impressive results.

While only the intervals to be used in the metallurgical testwork program were assayed, every hole returned good intersections such as 45m grading 1.2% copper equivalent from 280nm including 8m at 3.6% copper equivalent in MET027, and 39m at 1.1% copper equivalent from 46m including 12m at 1.5% copper equivalent in MET028 (Alice).

The company noted that the intersection in MET028 is particularly interesting as it is located near-surface in the higher-grade Alice porphyry satellite pit.

Not bad for drill holes designed to confirm the processing flowsheet with a focus on material that will be extracted in the first three years of production at Productora.

Development drilling wrapped up

These results come as the company slows down its tempo with just one drill rig operating on a single shift each day from the previous three rigs following the completion of development drilling and a focus on the upcoming resource upgrade and pre-feasibility study for the broader Costa Fuego project.

Results are currently pending for drilling undertaken across the high-grade San Antonio and Valentina satellite deposits.

Hot Chili has drilled 22 holes to date at Valentina with another eight holes still to be drilled while 12 holes have been completed with another four holes to be drilled at San Antonio.

San Antonio already hosts a resource of 4.2Mt grading 1.2% copper equivalent (1.1% copper and 2.1g/t silver), though this is a (admittedly higher quality) drop in the ocean that’s the broader Costa Fuego resource of 725Mt at 0.47% copper equivalent.

The new holes at San Antonio are designed to upgrade the categorisation of the resource from Inferred to Indicated, as well as testing for down-plunge mineralisation extensions.

Both deposits will be included in the next resource upgrade and subsequent PFS open pit mine schedule, which is expected in the first quarter of 2023.

Maiden drilling is also poised to begin on the large-scale Santiago Z prospect target in early August.

This article was developed in collaboration with Hot Chili, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Hot Chili’s Cortadera copper discovery delivers strong copper results ahead of resource upgrade

STOCKHEAD | April 29, 2022

Pic: Chris Ryan, OJO Images via Getty Images

Hot Chili’s Cortadera porphyry discovery has returned a whopping intersection of 552m grading 0.6% copper equivalent in hole CORMET003 at the Costa Fuego Copper-Gold hub in Chile.

Importantly, this development study drilling at Cortadera continues to demonstrate growth potential following the recent Costa Fuego resource upgrade.

Other high-grade hits were also returned in CORMET003 recorded 552m grading 0.6% copper equivalent (0.4% copper, 0.2g/t gold and 89ppm molybdenum) from 276m, including 248m grading 0.8% copper equivalent (0.6% copper, 0.2g/t gold and 179ppm molybdenum) from 574m.

Hot Chili (ASX:HCH) says high-grade indicated resources, which currently stand at 156Mt grading 0.79% copper equivalent for 1Mt copper, 0.85Moz gold, 2.9Moz silver and 24,000t molybdenum will be expanded in the next resource upgrade planned for 2023.

Productora Central RC assay results

Assay results returned for the first 11 deep reverse circulation (RC) drill holes completed at the Productora Central target have provided HCH with encouragement and further drilling is planned.

Productora Central is a 1.2km by 1km geochemical target, located along the western flank of the planned Productora open pit.

The most encouraging result was returned from drill hole PRF003, close to the Serrano fault where clay zones mask the target along strike to the northwest.

PRF003 recorded an end of hole intersection of 36m grading 0.2% copper, 0.1g/t gold, 0.5g/t silver from 290m, including 12m grading 0.4% copper 0.1g/t gold and 0.4g/t silver.

Interestingly, the hole ended in copper mineralisation and a diamond tail is planned to extend the drill hole this quarter.

The next phase of drilling will aim to penetrate the clay zone which is masking an area of elevated molybdenum along the Serrano fault.

This article was developed in collaboration with Hot Chili, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Hannam and Partners: Hot Chili is deeply discounted despite quality project

STOCKHEAD | April 26, 2022

Hot Chili’s Costa Fuego project is a high-quality, sizeable project. Pic: Sebastian Leesch / EyeEm via Getty Images

Hot Chili is not restiHot Chili and its exciting Costa Fuego hub with multiple coppery porphyries are Hot Chili and its exciting Costa Fuego hub with multiple coppery porphyries are undervalued by the market, according to Hannam and Partners.

The independent investment bank has initiated coverage of the company with a price target of $8 per share, which is almost 400% higher than the current price of $1.61.

H&P noted that the addition of the Cortadera project several years ago to the existing Productora project, which already had a pre-feasibility study, significantly transformed Hot Chili’s (ASX:HCH) Chilean portfolio.

Cortadera has proven to be a true winner with many thick copper-gold porphyry drill intersections leading to the definition of a 725 million tonne Indicated resource grading 0.47% copper equivalent that has plenty of room to grow.

Small wonder then that H&P believes the company is deeply discounted despite its exposure to what it considers to be a high-quality, sizeable project that could play a crucial role in filling the looming global copper supply deficit over the coming decade.

“With a new blockbuster resource and TSX-V cross-listing, an updated PFS due in Q3 2022 will merge several deposits for the first time and leverage HCH’s significant permitting and site design work already completed,” H&P explained.

“Combined with its relative low altitude and existing infrastructure advantages, we expect this to offer a fast-track to production and act as a significant catalyst for the stock.”

1 billion tonnes makes for attractive comparisons

The combined Costa Fuego development has a current resource of 927Mt at 0.45% copper equivalent, three times higher than the Productora resource back in 2016.

Much of this is due to the addition of Cortadera and over 52km of drilling carried out since then.

It also makes for an attractive enterprise value to measured and indicated resource (EV/M&I) of US$0.01 per pound of copper equivalent, which H&P said is the lowest of its direct peers and significantly discounted to the US$0.03/lb copper equivalent median of late-stage copper porphyry projects.

The upcoming Costa Fuego PFS is also expected to really highlight the project’s scale and attractiveness.

H&P modelled a 25-year mine life at 23.3Mt throughput to generate net present value of US$1.7 billion and internal rate of return of 27%.

Capital intensity and cash costs are also expected to be low at US$11,490 per tonne and US$1.47/lb respectively.

“We believe Hot Chili is well poised to deliver significant catalysts this year and remains funded for the next 18 months following a strategic investment from Glencore as well as a TSX-V cross-listing in January this year,” H&P added.

This article was developed in collaboration with Hot Chili, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Hot Chili’s latest copper-gold drill hit adds certainty to Cortadera high-grade core

STOCKHEAD | April 14, 2022

Hot Chili newest drill intersection has added more weight to the Cortadera high-grade core.

Hot Chili is not resting on its laurels despite a recent, sizeable resource upgrade with drilling returning yet another outstanding intersection of mineralisation at Cortadera.

Drill hole CORMET006 demonstrated the strong continuity of high-grade resources with +0.6% copper equivalent at Cortadera with the intersection of a 206m zone grading 0.9% copper equivalent (0.7% copper and 0.3 grams per tonne gold) within a much broader 876m intercept at 0.5% copper equivalent from a downhole depth of 246m.

Such results are pretty much par for the course at Cortadera – as can be seen here, here and here – and provide greater confidence in the Indicated Resource of 725 million tonnes grading 0.47% copper equivalent.

CORMET006 is the first of five development study diamond holes that Hot Chili (ASX:HCH) has already completed to aid with hydrological and geotechnical modelling with a sixth hole being planned.

While assays are pending for the four other completed holes, visual observations have recorded wide, strongly mineralised, intersections.

Productora drilling

Hot Chili is also giving some love to the Productora project, the other major part of its Costa Fuego copper-gold hub, with two diamond rigs drilling development holes and a reverse circulation rig undertaking exploration drilling.

Assays from both the Productora drilling and remaining Cortadera development study holes are expected shortly.

Costa Fuego has already drawn considerable attention from the likes of Glencore, which inked an offtake agreement with the company in early March.

Glencore – also Hot Chili’s largest shareholder – agreed to take 60% of copper concentrate from Costa Fuego for eight years from start of commercial production at “arm’s-length commercially-competitive” benchmark terms.

This article was developed in collaboration with Hot Chili, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Hot Chili Ltd hits the ground running

RESOURCE WORLD | March 31, 2022

Copper explorer ticks all the boxes key for successful large-scale-mine development

After battling to get market recognition on the Australia Stock Exchange, Hot Chili Ltd. has just completed a $34 million TSX.V initial public offering (TSXV: HCH, OTC: HHLKF) that will garner North American eyes on this evolving copper story.

There’s lots to like about Hot Chili. The company, which once traded at a high of A$37.00 on the ASX (2011), has plenty of good reasons for its stock to begin migrating back up toward historical highs. They’ve just announced a resource estimate that renders the flagship Costa Fuego project one of the world’s top 10 largest copper inventories not controlled by a major mining company and will have a pre-feasibility study in hand by the end of 2022, a definitive feasibility in 2024 and be producing copper by 2026.

The good news starts with the new resource estimate upgrade just announced that makes Hot Chili a standout copper resource holder on the TSX.V. 927Mt grading 0.45% CuEq for 4.1Mt of copper equivalent metal (3.3Mt copper, 2.9Moz gold, 12Moz silver and 81kt molybdenum). Importantly, over 80% of Costa Fuego’s resource is classified as Indicated and over one third of the metal grades approximately 0.8%CuEq, and can be accessed by shallow open pit mining.

“The past year has been transformational in terms of reshaping the company. We’ve consolidated our capital structure and completed the exhaustive process of listing on the TSX.V and put ourselves amongst the senior copper developers in the world that have enjoyed significant appreciation with the copper prices going up,” says Christian Ervin Easterday, managing director and CEO of Hot Chili Ltd.

Hot Chili is developing the Costa Fuego project, a copper hub comprising two major deposits—the 100%-owned Cortadera porphyry deposit and neighbouring 80%-owned Productora porphyry-related breccia deposit. The most recent resource upgrade has also included the addition of the close-by, high grade, San Antonio deposit (4.2Mt grading 1.2% CuEq). While the company has been advancing Productora over the better part of the last decade (including a 2016 PFS), the resource potential took a step-change with the addition of the previously privately-owned Cortadera porphyry discovery in 2019.

“We have consolidated our copper deposits to form the Costa Fuego Copper Project – a major copper mining hub located on the Chilean coastal range. The centerpiece of our Chilean copper mining portfolio is the Cortadera porphyry deposit, regarded as one of the most significant copper-gold discoveries of the past decade in Chile,” says Christian Ervin Easterday, managing director of Hot Chili Ltd.

The Company’s profile is further bolstered by the location of the Costa Fuego project at low elevations (less than 1,000m elevation) in Chile’s coastal range, unique amongst senior copper developers in the America’s which are more used to high altitude locations – typically above 3,000m elevation in the high Andes. Costa Fuego is situated almost 600 kilometres north of Santiago, next to the Pan American highway, with access to the power grid and 50 kilometres from the port of Las Losas. Additionally, Hot Chili has surface rights and easements to establish a sea water pipeline and power transmission lines. Also unique is that Hot Chili has a maritime concession, water license, which was approved in December 2020 – a critical element of any project development in the world, not least of all in Chile’s Atacama region.

Global copper demand on the rise

Without new capital investments, Commodities Research Unit (CRU) predicts global copper mined production will drop from 20 million tonnes to below 12 million tonnes by 2034, leading to a supply shortfall of more than 15 million tonnes. Over 200 copper mines are expected to run out of ore before 2035, with not enough new mines in the pipeline to take their place.

Some of the largest copper mines are seeing their reserves dwindle; have to dramatically slow production due to major capital-intensive projects to move operations from open pit to underground. Examples include the world’s two largest copper mines, Escondida in Chile and Grasberg in Indonesia, along with Chuquicamata, the biggest open pit mine on Earth.

These cuts are significant to the global copper market because Chile is the world’s biggest copper-producing nation — supplying 30% of the world’s red metal. Adding insult to injury, copper grades have declined about 25% in Chile over the last decade, bringing less ore to market.

By 2020, the international industry’s head grade was 30% lower than in 2001, and the capital cost per tonne of annual production had surged four-fold during that time — both classic signs of depletion. According to the Goehring & Rozencwajg model, the industry is “approaching the lower limits of cut-off grades,” and brownfield expansions for many of the major copper miners are no longer a viable solution.

“Projects of the scale of Costa Fuego are hard to find. But they’re even harder to find at low altitude, sitting in the middle of infrastructure in one of the top three mining countries of the world. I think what most people don’t know is that over the past two decades head grades for copper have dropped to about half a percent from 1.6 percent copper and now it’s all about economy of scale and that’s the space we are in,” says Ervin Easterday.

Lower grades and increased demand shine a light on the importance of making new discoveries in establishing a sustainable copper supply chain. Over the past 10 years, greenfield additions to copper reserves have slowed dramatically, with tonnage from new discoveries falling by 80% since 2010—something that can’t be changed overnight.

Some of the world’s largest copper companies are doing everything they can to expand existing mines and acquire prospective new deposits, as they seek to replace their rapidly depleting copper reserves and resources.

But it takes many years to bring a copper deposit into production, even for the majors moving from open pit to underground. According to Bloomberg Intelligence, the average lead time from first discovery to first metal has increased by four years from previous cycles, to almost 14 years. In places like the United States and Canada, where miners face strict permitting regulations that can cause significant delays, it’s not unusual for a copper mine to take 20 years to develop.

“I guess you could say we are ahead of the crowd being 12 years into our journey already. There are few copper developers of our scale that have the near-term timelines to production we do,” says ErvinEasterday, who credits the recent Glencore investment on the Company’s advanced exploration and development, project scale and clean concentrate potential (no arsenic).

Vote of confidence from Glencore

Glencore became Hot Chili’s largest shareholder after a series of investments in 2021 where Glencore took a 9.96 percent stake. It also won a seat at the board in the form of Mark Jamieson and further management in the form of participation on the technical steering committee, positions it can hold onto as long as Glencore keeps a minimum 7.5 per cent stake in the company. The investment was backed up recently when Glencore agreed to an eight year off-take agreement to purchase 60 percent of the copper concentrate from Hot Chili’s Costa Fuego copper-gold project in Chile.

“We ensured project financing flexibility with 40 percent of our first eight years of concentrate production remaining uncommitted ahead of initiating project financing discussions in 2022, following completion of the Costa Fuego Pre-Feasibility Study. Glencore’s expertise and support is welcomed and is an important part of our strategy to transform the company into a material copper-gold producer. It is unique to have one of the world’s largest miners as a major shareholder and off-take partner in advance of a PFS” says Ervin Easterday.

Boosting its international capability even further, Hot Chili recently appointed Dr Nicole Adshead-Bell as the company’s independent, non-executive chairman, after she joined the board in January. Residing in Canada, Dr Adshead-Bell has 25 years of technical and investment banking experience across the capital markets and resource sectors and sits on the boards of Toronto-listed Altius Minerals and ASX-listed Matador Mining.

Lots of exploration upside

Fresh with a world-class resource estimate, which is fast approaching 1 billion tonnes, and pre-feasibility in the works, there are no signs of Hot Chili resting on their laurels.

“Now that we have a strong treasury of $30 to $40 million, this year is also about growing our resources from within. We are moving with a series of drill holes on some of the larger scale un-drilled targets on the property,” says Ervin Easterday.

The last word

“I know there is some frustration with retail investors wondering just like myself, how a company holding an asset of the size, quality, location, infrastructure advantage and attracting the attention of one of the top three miners in the world would have a market capitalization at about a fifth of what it probably should be. That frustration is well understood, but we have not shied away from making important decisions. What we are doing her is putting together a 20-to-30-year mine plan on something that has the potential to produce upwards of $US1 billion in revenue annually on long-term copper prices. In addition, we are de-risking our project, and as we hit our catalysts and milestones over the next year, I’m sure the market will look after itself – value will always eventually rise to the top” says Ervin Easterday.

Hot Chili is determined to commission the Cortadera copper gold project by 2026, a time frame that would be the envy of most mining majors. Now with a locked in offtake agreement with Glencore and the further upside to its resource base, it appears Hot Chili will hit the ground running this year.

Full news click on the link below:

Hot Chili Ltd hits the ground running

Hot Chili Heating Up With Surge To Next Level Of Growth

THE ASSAY | Coline Sandell-Hay | March 31, 2022

Hot Chili Limited (ASX: HCH) (TSXV:HCH) (OTCQB: HHLKF) has released a major resource upgrade for its coastal range, Costa Fuego copper-gold project in Chile.

Costa Fuego comprises the Cortadera, Productora and San Antonio deposits, all of which have updated Mineral Resource Estimates (MRE) and lie proximal to one another at low-altitude elevations (800m to 1,000m), 600km north of Santiago.

The resource upgrade follows 18 months of material investment, including completion of 52,000 metres of additional resource drilling at Cortadera, purchase of 100% of the Cortadera copper-gold porphyry discovery and execution of an offtake agreement with Glencore for future concentrate production (60% for the first eight years). The Cortadera MRE has delivered the majority of resource growth for Costa Fuego.

Cortadera is defined by over 92,000m of drilling and contains an Indicated resource of 471Mt grading 0.46% CuEq (previously 183Mt grading 0.49% CuEq) and an Inferred resource of 108Mt grading 0.35% CuEq (previously 267Mt grading 0.44% CuEq).

Cortadera’s Indicated resource has grown by 134% and is now able to be studied for conversion into ore reserves in the Company’s Pre-Feasibility Study (PFS), forecast for Q3, 2022.

The Productora MRE has been re-estimated following review of the 2016 MRE, completion of underground mine development and exploration drilling in 2021.

The review and subsequent resource re-estimation has resulted in a material increase in high grade Indicated resources reported above 0.6% CuEq.

High grade open pit resources from Productora are a key focus for the combined PFS and are expected to feature prominently in the early mine schedule for Costa Fuego.

A maiden San Antonio MRE has also been added to the Costa Fuego Hub. San Antonio was historically exploited by small-scale underground mining of high-grade copper. The maiden resource estimate utilised an underground drone survey (increasing the spatial confidence of historic mining activities) and 4,922 metres of drilling undertaken by Hot Chili in 2018.

Managing Director Christian Easterday said the company is encouraged by the initial Inferred resource of 4.2Mt grading 1.2% CuEq.

The high-grade, shallow nature of San Antonio provides an additional open pittable deposit for Costa Fuego’s potential early mine schedule. Further resource upgrade drilling is planned at San Antonio and the nearby Valentina high-grade deposit in the coming months.

“I would like to thank our entire team who have delivered this very strong result on-time and within guidance – elevating Costa Fuego’s position amongst the largest undeveloped copper projects in the world,” Mr Easterday said:

“The world is hungry for advanced, low-risk, senior copper developments with near-term production potential.

“Copper prices are driving higher and new meaningful copper supply is fast becoming a mirage.

“Hot Chili is well positioned to deliver into this forecast supply gap and contribute to the decarbonisation super cycle, particularly due to Costa Fuego’s lower economic hurdle resulting from its low elevation location and proximity to existing infrastructure; including abundant grid power with high renewables contributions.

“We are fully funded for 18 months and on-track to deliver our next resource upgrade and PFS later this year as we transform Costa Fuego into one of the world’s next material copper mines.”

Full news click on the link below:

Hot Chili Heating Up With Surge To Next Level Of Growth

Breathtaking Hot Chili resource upgrade launches Costa Fuego copper-gold to new heights

STOCKHEAD | March 31, 2022

Hot Chili has reinforced its Costa Fuego copper-gold hub’s position as a top tier development project after upgrading its higher confidence Indicated Resource by a massive 67%.

The upgraded Costa Fuego now features an Indicated Resource of 725 million tonnes grading 0.47% copper equivalent, or contained resources totalling 2.8Mt of copper, 2.6 million ounces of gold, 10.5Moz of silver and 67,000t of molybdenum.

This is more than 80% of its total resource and includes a higher grade Indicated Resource of 156Mt at 0.79% copper equivalent with contained resources of 1Mt of copper, 850,000oz of gold, 2.9Moz of silver and 24,000t of molybdenum – more than a third of the total contained resource.

The resource upgrade is another sign that Hot Chili’s (ASX:HCH) plans are coming together in a spectacular fashion, as it follows on the back of a key offtake agreement that will see Glencore buy 60% of the project’s copper concentrate production for an eight-year period at “arm’s-length commercially-competitive” terms.

Managing director Christian Easterday said the resource upgrade elevates Costa Fuego’s position amongst the largest undeveloped copper projects in the world.

“The world is hungry for advanced, low-risk, senior copper developments with near-term production potential. Copper prices are driving higher and new meaningful copper supply is fast becoming a mirage,” he noted.

“Hot Chili is well positioned to deliver into this forecast supply gap and contribute to the decarbonisation super cycle, particularly due to Costa Fuego’s lower economic hurdle resulting from its low elevation location and proximity to existing infrastructure; including abundant grid power with high renewables contributions.

“We are fully funded for 18 months and on-track to deliver our next resource upgrade and PFS later this year as we transform Costa Fuego into one of the world’s next material copper mines.”

Resource upgrade

The Costa Fuego upgrade is the culmination of 18 months of material investment, which included the completion of 52,000m of additional resource drilling at the Cortadera project – the main engine of growth for Costa Fuego.

Cortadera now has an Indicated resource of 471Mt grading 0.46% copper equivalent, a 134% increase over its previous estimate of 183Mt at 0.49% copper equivalent.

And there’s room for further growth with Costa Fuego hosting an Inferred Resource of 202Mt at 0.36% copper equivalent, or contained metals totalling 600,000t of copper, 400,000oz of gold, 2Moz of silver and 13,000t of molybdenum.

This includes a high-grade maiden resource of 4.2Mt at 1.2% copper equivalent at the San Antonio deposit, which represents an additional open pittable deposit for Costa Fuego’s potential early mine schedule.

Hot Chili is also planning to carry out further resource upgrade drilling at San Antonio and the nearby Valentina high grade deposit in the coming months.

Full news click on the link below:

Hot Chili resource upgrade launches Costa Fuego copper-gold to new heights