Proposed Share Consolidation Ahead of TSXV Dual Listing in Canada

Preparations to dual-list the Company in Canada are advancing through final stages and are on-track for Q4 this year.

ASX Announcement

Thursday 14th October 2021

Hot Chili Limited (ASX: HCH) (OTCQB: HHLKF) (“Hot Chili” or the “Company”) is pleased to announce that preparations to dual-list the Company in Canada are advancing through final stages and are on-track for Q4 this year.

A General Meeting is scheduled for Monday 15th of November to seek shareholder approval to undertake a consolidation of the number of Shares on issue on the basis that every fifty (50) Shares held be consolidated into one (1) Share (Consolidation), with a corresponding Consolidation of all other securities on issue and fractional entitlements to be rounded to the nearest whole number.

The Consolidation is being undertaken to reduce the number of Shares currently on issue from 4,370,972,524 Shares to approximately 87,419,450 Shares and effectively increase the value of the Company’s assets per Share by a factor of fifty. The Consolidation will have no effect on the percentage shareholding interest of each individual shareholder.

This is anticipated to provide a more effective capital structure of the Company and a more appropriate share price for a wider range of investors, particularly institutional investors, as the Company progresses its application for listing on the TSX Venture Exchange (TSXV) (as announced to ASX on 9th July 2021 “Hot Chili Commences TSXV Dual Listing Process”).

The proposed Consolidation will align Hot Chili’s share price within a range of its Canadian peers including Filo Mining (TSX: FIL, Share Price: CAN$9.00, Mkt Cap: CAN$1.019B), Josemaria Resources (TSX: JOSMF, Share Price: CAN$0.911, Mkt Cap: CAN$346M), Oroco Resources (TSXV: OCO, Share Price: CAN$2.40, Mkt Cap: CAN$460.3M) and Solaris Resources (TSX: SLS, Share Price: CAN$13.13, Mkt Cap: CAN$1.42B) as of 12th October 2021.

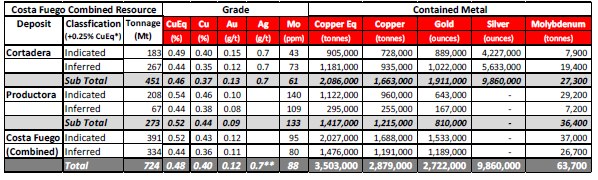

Hot Chili’s Cost Fuego resource (724Mt grading 0.48%CuEq) compares favourably to these leading copper-gold developers who are advancing copper-gold resources in the America’s ranging in scale between 571Mt and 1.0Bt at grades of between 0.32% CuEq to 0.64% CuEq (as announced to ASX on 12th October 2020 “Costa Fuego Becomes a Leading Global Copper Project”).

A Notice of General Meeting has been released concurrently with this announcement which outlines the background and details of the proposed Consolidation.

The Directors consider the Consolidation will strengthen the Company’s ability to drive a significant re-rate in the Company’s valuation, and support future funding of the Company’s Costa Fuego copper-gold development in Chile.

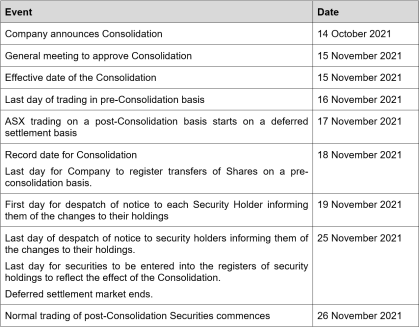

The indicative timetable if the Consolidation is approved by shareholders is as follows:

The proposed Consolidation will apply to all unlisted options at the time of the consolidation. In accordance with the option terms and ASX Listing Rule 7.22, these options will be consolidated on the same basis as the Shares with the existing exercise price amended in inverse proportion to the consolidation ratio. The expiry dates of the options will not change. The proposed Consolidation will also apply to all convertible notes and performance rights on issue in accordance with ASX Listing Rule 7.21.

This announcement is authorised by the Board of Directors for release to ASX.

For more information please contact:

| Christian Easterday | Tel: +61 8 9315 9009 |

| Managing Director | Email: christian@hotchili.net.au |

or visit Hot Chili’s website at www.hotchili.net.au

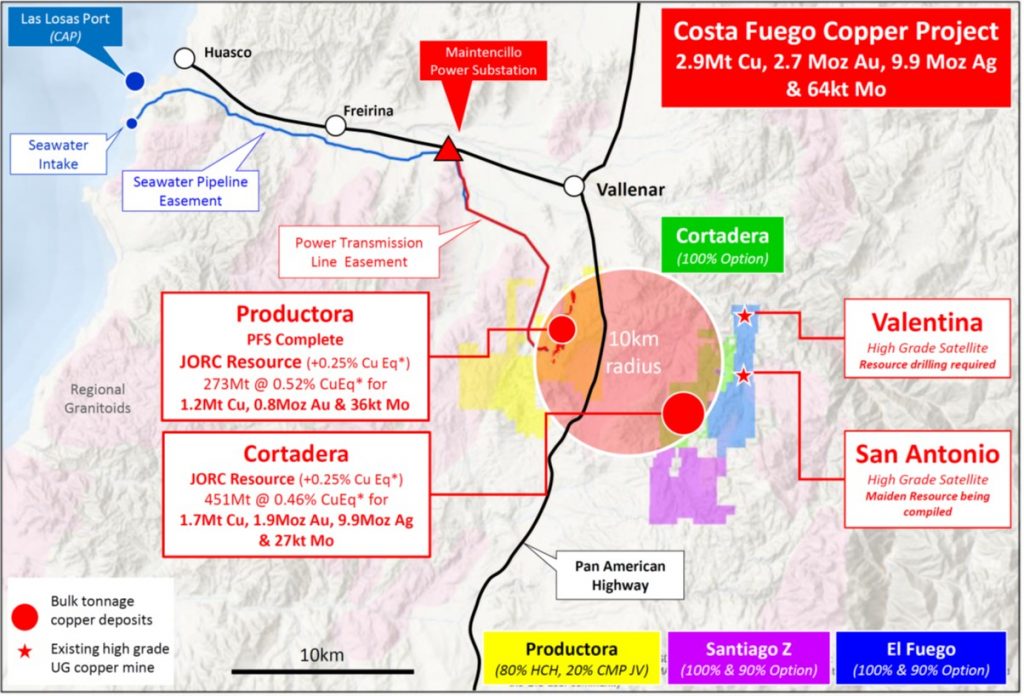

Figure 1 Location of Productora and the Cortadera discovery in relation to the coastal range infrastructure of Hot Chili’s combined Costa Fuego copper project, located 600km north of Santiago in Chile

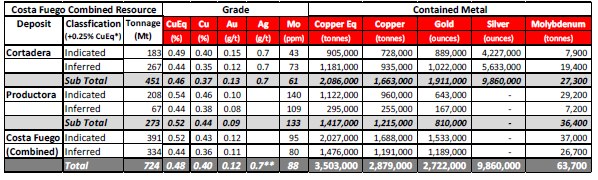

Refer to ASX Announcement “Costa Fuego Becomes a Leading Global Copper Project” (12th October 2020) for JORC Table 1 information related to the Cortadera JORC compliant Mineral Resource estimate by Wood and the Productora re-stated JORC compliant Mineral Resource estimate by AMC Consultants

* Copper Equivalent (CuEq) reported for the resource were calculated using the following formula: CuEq% = ((Cu% × Cu price 1% per tonne × Cu_recovery)+(Mo ppm × Mo price per g/t × Mo_recovery)+(Au ppm × Au price per g/t × Au_recovery)+ (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price 1% per tonne). The Metal Prices applied in the calculation were: Cu=3.00 USD/lb, Au=1,550 USD/oz, Mo=12 USD/lb, and Ag=18 USD/oz. For Cortadera (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=56%, Mo=82%, and Ag=37%. For Productora (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=43% and Mo=42%. For Costa Fuego (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=51%, Mo=67% and Ag=23%.

** Reported on a 100% Basis – combining Cortadera and Productora Mineral Resources using a +0.25% CuEq reporting cut-off grade

Qualifying Statements

Independent JORC Code Costa Fuego Combined Mineral Resource (Reported 12th October 2020)

Reported at or above 0.25% CuEq*. Figures in the above table are rounded, reported to appropriate significant figures, and reported in accordance with the JORC Code – Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves. Metal rounded to nearest thousand, or if less, to the nearest hundred. * * Copper Equivalent (CuEq) reported for the resource were calculated using the following formula:: CuEq% = ((Cu% × Cu price 1% per tonne × Cu_recovery)+(Mo ppm × Mo price per g/t × Mo_recovery)+(Au ppm × Au price per g/t × Au_recovery)+ (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price 1 % per tonne). The Metal Prices applied in the calculation were: Cu=3.00 USD/lb, Au=1,550 USD/oz, Mo=12 USD/lb, and Ag=18 USD/oz. For Cortadera (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=56%, Mo=82%, and Ag=37%. For Productora (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=43% and Mo=42%. For Costa Fuego (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=51%, Mo=67% and Ag=23%.

** Note: Silver (Ag) is only present within the Cortadera Mineral Resource estimate

Competent Person’s Statement- Exploration Results

Exploration information in this Announcement is based upon work compiled by Mr Christian Easterday, the Managing Director and a full-time employee of Hot Chili Limited whom is a Member of the Australasian Institute of Geoscientists (AIG). Mr Easterday has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a ‘Competent Person’ as defined in the 2012 Edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’ (JORC Code). Mr Easterday consents to the inclusion in the report of the matters based on their information in the form and context in which it appears.

Competent Person’s Statement- Productora Mineral Resources

The information in this Announcement that relates to the Productora Project Mineral Resources, is based on information compiled by Mr N Ingvar Kirchner. Mr Kirchner is employed by AMC Consultants (AMC). AMC has been engaged on a fee for service basis to provide independent technical advice and final audit for the Productora Project Mineral Resource estimates. Mr Kirchner is a Fellow of the Australasian Institute of Mining and Metallurgy (AusIMM) and is a Member of the Australian Institute of Geoscientists (AIG). Mr Kirchner has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’ (the JORC Code 2012). Mr Kirchner consents to the inclusion in this report of the matters based on the source information in the form and context in which it appears.

Competent Person’s Statement- Cortadera and Costa Fuego Mineral Resources

The information in this report that relates to Mineral Resources for the Cortadera and combined Costa Fuego Project is based on information compiled by Elizabeth Haren, a Competent Person who is a Member and Chartered Professional of the Australasian Institute of Mining and Metallurgy and a Member of the Australian Institute of Geoscientists. Elizabeth Haren is employed as an associate Principal Geologist of Wood, who was engaged by Hot Chili Limited. Elizabeth Haren has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the “Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves”. Elizabeth Haren consents to the inclusion in the report of the matters based on her information in the form and context in which it appears.

Reporting of Copper Equivalent

Copper Equivalent (CuEq) reported for the resource were calculated using the following formula: CuEq% = ((Cu% × Cu price 1% per tonne × Cu_recovery)+(Mo ppm × Mo price per g/t × Mo_recovery)+(Au ppm × Au price per g/t × Au_recovery)+ (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price 1 % per tonne). The Metal Prices applied in the calculation were: Cu=3.00 USD/lb, Au=1,550 USD/oz, Mo=12 USD/lb, and Ag=18 USD/oz. For Cortadera (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=56%, Mo=82%, and Ag=37%. For Productora (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=43% and Mo=42%. For Costa Fuego (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=51%, Mo=67% and Ag=23%.

Forward Looking Statements

This Announcement is provided on the basis that neither the Company nor its representatives make any warranty (express or implied) as to the accuracy, reliability, relevance or completeness of the material contained in the Announcement and nothing contained in the Announcement is, or may be relied upon as a promise, representation or warranty, whether as to the past or the future. The Company hereby excludes all warranties that can be excluded by law. The Announcement contains material which is predictive in nature and may be affected by inaccurate assumptions or by known and unknown risks and uncertainties and may differ materially from results ultimately achieved.

The Announcement contains “forward-looking statements”. All statements other than those of historical facts included in the Announcement are forward-looking statements including estimates of Mineral Resources. However, forward-looking statements are subject to risks, uncertainties and other factors, which could cause actual results to differ materially from future results expressed, projected or implied by such forward-looking statements. Such risks include, but are not limited to, copper, gold and other metals price volatility, currency fluctuations, increased production costs and variances in ore grade recovery rates from those assumed in mining plans, as well as political and operational risks and governmental regulation and judicial outcomes. The Company does not undertake any obligation to release publicly any revisions to any “forward-looking statement” to reflect events or circumstances after the date of the Announcement, or to reflect the occurrence of unanticipated events, except as may be required under applicable securities laws. All persons should consider seeking appropriate professional advice in reviewing the Announcement and all other information with respect to the Company and evaluating the business, financial performance and operations of the Company. Neither the provision of the Announcement nor any information contained in the Announcement or subsequently communicated to any person in connection with the Announcement is, or should be taken as, constituting the giving of investment advice to any person.

To read the full announcement click on the below link

Proposed Share Consolidation Ahead of TSXV Listing

Costa Fuego Hub to Leverage Low-Cost Transport & Central Processing

Materials handling scoping study results have significantly reduced the cost of ore transport

ASX Announcement

Tuesday 28th September 2021

Highlights

- Materials handling scoping study results have significantly reduced the cost of ore transport for Hot Chili’s Costa Fuego copper-gold development in Chile

- Central processing at Productora allows the use of RopeCon® and significantly reduces development timeframes and additional capital related to locating central processing at Cortadera

- RopeCon® ore transport determined to be most cost-effective materials handling system for transport of Cortadera ore approximately 14 km down-hill to Productora

- RopeCon® determined to be less than 10% of the operating cost associated with truck haulage and 25% less than conventional conveyor

- PFS making good progress across preliminary mine design, geotechnical studies and metallurgical workstreams, further updates expected

Hot Chili Limited (ASX: HCH) (OTCQB: HHLKF) (“Hot Chili” or “Company”) is pleased to announce that its Pre-feasibility study (PFS) into the combined Costa Fuego copper-gold development in Chile is gaining momentum.

A recently completed materials handling scoping study has highlighted the potential for a low-cost rope conveyor (RopeCon®) option to transport ore down-hill from Cortadera to Productora.

The introduction of low-cost transport into the current PFS has cemented the Company’s decision to locate central processing infrastructure at Productora and take advantage of the existing project definition and permitting (water and power easements, and surface rights) already secured in the 2016 Productora PFS.

Significant time and capital cost savings were expected if the location of central processing remained at Productora, now significant operating savings from transport can also be captured with RopeCon determined to be less than 10% of the operating cost associated with truck haulage.

Costa Fuego combined resource base (Cortadera and Productora) currently stands of 724 Mt grading 0.48% CuEq for 2.9 Mt copper, 2.7 Moz gold, 9.9 Moz silver and 64 kt molybdenum, and the Company has a maritime concession secured to extract sea water for the processing requirements of the entire combined development.

The Company is pursuing a similar development approach to the Nueva Union (Teck 50%, Newmont Goldcorp 50%) copper project in Chile, where the Relincho and El Morro copper-gold deposits are being combined into one development via haulage using a 40 km conveyor belt.

Nueva Union is located between 2,000 m and 4,000 m elevation, approximately 100 km east-northeast of Costa Fuego, with similar average copper grades and co-credit metals. By comparison, Costa Fuego’s Cortadera and Productora copper-gold deposits are located 14 km apart, at low attitude (800 -1,000 m elevation), along the Pan American Highway and within 50 km of port facilities.

Materials Handling a Key Focus

The Costa Fuego hub mining operations will consist of the open pits at Productora, plus three open pits coupled with an underground block cave operation at Cortadera. The objective of the current study is to determine the optimal output of each area coupled with the analyses and recommendation for a suitable and cost-effective materials handling system to transport the Cortadera ore approximately 14 km to the processing plant at Productora.

The key decision governing this study strategy will be to keep the processing plant located at Productora therefore avoiding lengthy and costly permitting processes to potentially re-locate the processing facility. The proposed location of the processing plant and associated infrastructure, such as the tailings storage facility, are within the Productora project footprint, are permitted and currently supported by the 2016 Productora Pre-Feasibility Study.

Four primary materials handling options for ore transport between Productora and Cortadera were considered:

- Trucking

- Conveyors

- Aerial Ropeway

- RopeCon

Of these options, the RopeCon offers the lowest total cost option for transport of the open pit and block cave ore from Cortadera to Productora. The system design criteria, coupled with the Capital and Operating Expenditure estimates, were calculated from the various OEM options and costs provided for the study.

The RopeCon system can provide handling capacities of up to 25,000 t/hr across difficult terrain whilst occupying a minimum structural footprint. Simple maintenance of the conveying line and low space requirements are the key features of this product. The unit cost for running a RopeCon installation is estimated to be approximately a quarter of the cost when compared to a conventional conveyor for this project.

The mined ore transport route spans 15 km and threads along a relatively straight route from the Cortadera Project directly across the hilly terrain toward the proposed Productora processing plant, progressing through the southern section of the Productora footprint, making use of the natural topographic low point directly South – Southeast of the main Productora open pit area termed the “saddle”

Hot Chili is pursuing a strategy of low-cost ore transport to a central concentrator for high-grade ore in conjunction with low-grade sulphide leaching adjacent to mining operations.

Executive Study Manager John Hearne described the option value by saying:

“The beauty of this strategy is that it allows the selection of ore grade for the concentrator to be highly dynamic.

“Not only can it be optimised to deliver value in our study models, it will be flexible enough to adapt with the evolving resource base being assembled regionally.

“A region that appears to be getting larger when we consider a low-operating cost option like a RopeCon.”

This announcement is authorised by the Board of Directors for release to ASX.

For more information please contact:

| Christian Easterday | Tel: +61 8 9315 9009 |

| Managing Director | Email: christian@hotchili.net.au |

or visit Hot Chili’s website at www.hotchili.net.au

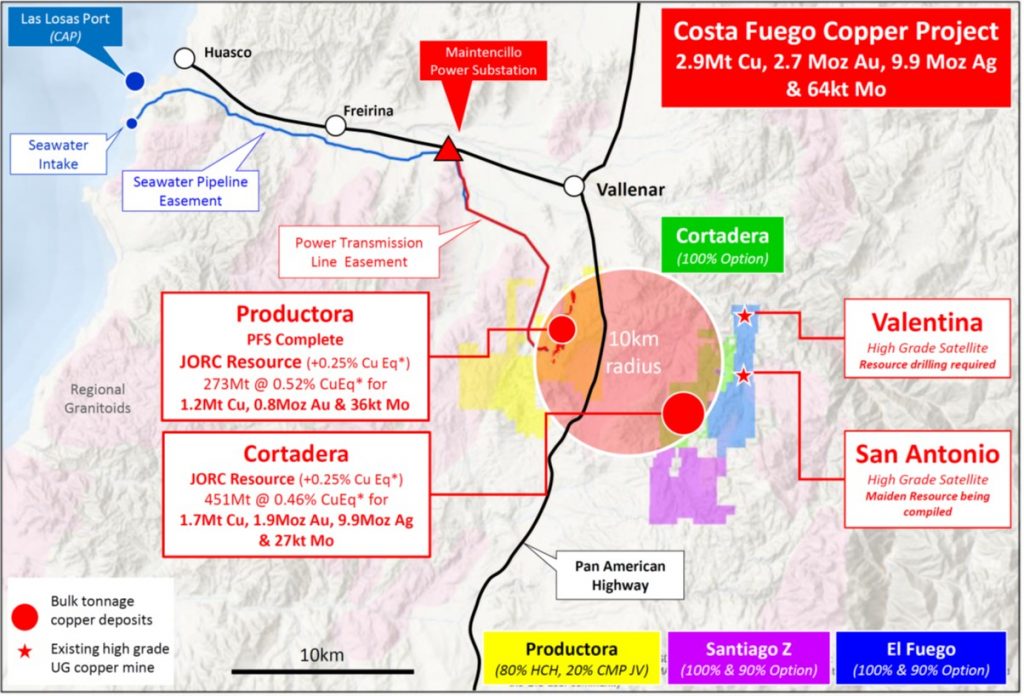

Figure 3 Location of Productora and the Cortadera discovery in relation to the coastal range infrastructure of Hot Chili’s combined Costa Fuego copper project, located 600km north of Santiago in Chile

Refer to ASX Announcement “Costa Fuego Becomes a Leading Global Copper Project” (12th October 2020) for JORC Table 1 information related to the Cortadera JORC compliant Mineral Resource estimate by Wood and the Productora re-stated JORC compliant Mineral Resource estimate by AMC Consultants

* Copper Equivalent (CuEq) reported for the resource were calculated using the following formula: CuEq% = ((Cu% × Cu price 1% per tonne × Cu_recovery)+(Mo ppm × Mo price per g/t × Mo_recovery)+(Au ppm × Au price per g/t × Au_recovery)+ (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price 1% per tonne). The Metal Prices applied in the calculation were: Cu=3.00 USD/lb, Au=1,550 USD/oz, Mo=12 USD/lb, and Ag=18 USD/oz. For Cortadera (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=56%, Mo=82%, and Ag=37%. For Productora (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=43% and Mo=42%. For Costa Fuego (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=51%, Mo=67% and Ag=23%.

** Reported on a 100% Basis – combining Cortadera and Productora Mineral Resources using a +0.25% CuEq reporting cut-off grade

Qualifying Statements

Independent JORC Code Costa Fuego Combined Mineral Resource (Reported 12th October 2020)

Reported at or above 0.25% CuEq*. Figures in the above table are rounded, reported to appropriate significant figures, and reported in accordance with the JORC Code – Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves. Metal rounded to nearest thousand, or if less, to the nearest hundred. * * Copper Equivalent (CuEq) reported for the resource were calculated using the following formula:: CuEq% = ((Cu% × Cu price 1% per tonne × Cu_recovery)+(Mo ppm × Mo price per g/t × Mo_recovery)+(Au ppm × Au price per g/t × Au_recovery)+ (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price 1 % per tonne). The Metal Prices applied in the calculation were: Cu=3.00 USD/lb, Au=1,550 USD/oz, Mo=12 USD/lb, and Ag=18 USD/oz. For Cortadera (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=56%, Mo=82%, and Ag=37%. For Productora (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=43% and Mo=42%. For Costa Fuego (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=51%, Mo=67% and Ag=23%.

** Note: Silver (Ag) is only present within the Cortadera Mineral Resource estimate

Competent Person’s Statement- Exploration Results

Exploration information in this Announcement is based upon work compiled by Mr Christian Easterday, the Managing Director and a full-time employee of Hot Chili Limited whom is a Member of the Australasian Institute of Geoscientists (AIG). Mr Easterday has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a ‘Competent Person’ as defined in the 2012 Edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’ (JORC Code). Mr Easterday consents to the inclusion in the report of the matters based on their information in the form and context in which it appears.

Competent Person’s Statement- Productora Mineral Resources

The information in this Announcement that relates to the Productora Project Mineral Resources, is based on information compiled by Mr N Ingvar Kirchner. Mr Kirchner is employed by AMC Consultants (AMC). AMC has been engaged on a fee for service basis to provide independent technical advice and final audit for the Productora Project Mineral Resource estimates. Mr Kirchner is a Fellow of the Australasian Institute of Mining and Metallurgy (AusIMM) and is a Member of the Australian Institute of Geoscientists (AIG). Mr Kirchner has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’ (the JORC Code 2012). Mr Kirchner consents to the inclusion in this report of the matters based on the source information in the form and context in which it appears.

Competent Person’s Statement- Cortadera and Costa Fuego Mineral Resources

The information in this report that relates to Mineral Resources for the Cortadera and combined Costa Fuego Project is based on information compiled by Elizabeth Haren, a Competent Person who is a Member and Chartered Professional of the Australasian Institute of Mining and Metallurgy and a Member of the Australian Institute of Geoscientists. Elizabeth Haren is employed as an associate Principal Geologist of Wood, who was engaged by Hot Chili Limited. Elizabeth Haren has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the “Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves”. Elizabeth Haren consents to the inclusion in the report of the matters based on her information in the form and context in which it appears.

Reporting of Copper Equivalent

Copper Equivalent (CuEq) reported for the resource were calculated using the following formula: CuEq% = ((Cu% × Cu price 1% per tonne × Cu_recovery)+(Mo ppm × Mo price per g/t × Mo_recovery)+(Au ppm × Au price per g/t × Au_recovery)+ (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price 1 % per tonne). The Metal Prices applied in the calculation were: Cu=3.00 USD/lb, Au=1,550 USD/oz, Mo=12 USD/lb, and Ag=18 USD/oz. For Cortadera (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=56%, Mo=82%, and Ag=37%. For Productora (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=43% and Mo=42%. For Costa Fuego (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=51%, Mo=67% and Ag=23%.

Forward Looking Statements

This Announcement is provided on the basis that neither the Company nor its representatives make any warranty (express or implied) as to the accuracy, reliability, relevance or completeness of the material contained in the Announcement and nothing contained in the Announcement is, or may be relied upon as a promise, representation or warranty, whether as to the past or the future. The Company hereby excludes all warranties that can be excluded by law. The Announcement contains material which is predictive in nature and may be affected by inaccurate assumptions or by known and unknown risks and uncertainties and may differ materially from results ultimately achieved.

The Announcement contains “forward-looking statements”. All statements other than those of historical facts included in the Announcement are forward-looking statements including estimates of Mineral Resources. However, forward-looking statements are subject to risks, uncertainties and other factors, which could cause actual results to differ materially from future results expressed, projected or implied by such forward-looking statements. Such risks include, but are not limited to, copper, gold and other metals price volatility, currency fluctuations, increased production costs and variances in ore grade recovery rates from those assumed in mining plans, as well as political and operational risks and governmental regulation and judicial outcomes. The Company does not undertake any obligation to release publicly any revisions to any “forward-looking statement” to reflect events or circumstances after the date of the Announcement, or to reflect the occurrence of unanticipated events, except as may be required under applicable securities laws. All persons should consider seeking appropriate professional advice in reviewing the Announcement and all other information with respect to the Company and evaluating the business, financial performance and operations of the Company. Neither the provision of the Announcement nor any information contained in the Announcement or subsequently communicated to any person in connection with the Announcement is, or should be taken as, constituting the giving of investment advice to any person.

To read the full announcement click on the below link

Costa Fuego Hub to Leverage Low-Cost Transport & Central Processing

Liberty and Finance Video Interview – Rick Rule & Christian Easterday – World Class Copper Co About to Jump to Majors

Small Caps Interview with Rick Rule: inflation, markets, politics…where are we headed? (HCH at 40 min)

Hot Chili and Christian Easterday anecdote at 40 minutes.

Hot Chili Pioneers Low-Cost Copper Development in Chile’s Costa Fuego Copper-Gold Project

October 8, 2024 | Crux Investor

- Hot Chili is developing the Costa Fuego copper project in Chile, aiming to be one of the top five large-scale copper developers outside of major mining companies.

- The project has an estimated annual production of 95,000 tons of copper and 50,000 ounces of gold, with a 16-year mine life based on current estimates.

- Hot Chili has a strategic partnership with Glencore for 60% of offtake for the first 8 years, leaving 40% uncommitted for potential future deals.

- The company is developing a water supply business, Huasco Water, which could potentially be monetized to help fund the main copper project.

- Hot Chili is targeting completion of prefeasibility studies for both the copper project and water business by late 2023/early 2024, with the goal of securing project financing by late 2026/early 2027.

In an era where the global demand for copper is steadily rising, driven by the green energy transition and infrastructure development, Hot Chili Limited stands out as a compelling investment opportunity in the copper mining sector. As one of the preeminent large-scale copper developers outside of major mining companies, Hot Chili is advancing its flagship Costa Fuego project on the Chilean coastline. With a combination of strategic advantages, including a favorable location, significant resource base, and innovative approaches to infrastructure development, Hot Chili is positioning itself to become a major player in the copper market.

Project Overview: Costa Fuego

Hot Chili’s Costa Fuego copper project is located on the Chilean coastline. The project benefits from several natural advantages that set it apart from many of its peers in the copper development space.

Costa Fuego is projected to produce approximately 95,000 tons of copper and 50,000 ounces of gold annually. This substantial output places Hot Chili among the top five large-scale copper developers globally, outside of major mining companies. The current mine life is estimated at 16 years, based on a resource base of one billion tons, with potential for extension as further studies are completed.

Christian Easterday, CEO and Managing Director of Hot Chili, emphasizes the project’s significance:

“There are only five projects that are scaled at 100,000 tons per annum of fine copper production globally outside of the control of majors. For the independent projects, there are not many of those that are near term.”

Cost Advantages

One of the most compelling aspects of Costa Fuego is its relatively low capital intensity. Easterday notes:

“It’s a billion dollars to build. If we were in the high Andes and we required fresh water or desalinated water to process with, which we don’t, then we would be talking about a $2 billion project to put out that kind of metal production.”

This cost advantage is primarily due to the project’s coastal location, which eliminates the need for expensive water infrastructure and reduces overall development costs. The lower elevation also simplifies operations and reduces associated risks compared to high-altitude projects in the Andes.

Development Timeline & Permitting Progress

Hot Chili is making steady progress towards project development. The company is preparing to submit its environmental impact assessment in mid-2024, which will be the last major permit required before obtaining the mining permit for Costa Fuego. This puts Hot Chili ahead of many of its peers in terms of permitting progress. Easterday outlines the timeline:

“Conceivably, with our best timelines at the moment, early production no earlier than late 2028 is what we foresee in the schedule.”

This timeline includes a two-year construction phase and a six-month ramp-up period to reach nameplate capacity.

Glencore Partnership

Hot Chili has secured a strategic partnership with Glencore, one of the world’s largest commodity traders. This partnership includes an offtake agreement for 60% of Costa Fuego’s production for the first eight years. This arrangement provides Hot Chili with a guaranteed market for a significant portion of its future production while leaving room for additional partnerships or spot market sales.

Importantly, Hot Chili has retained 40% of its offtake uncommitted, providing flexibility and potential upside. Easterday explains the strategy:

“We very prudently kept 40% of our offtake uncommitted outside of the Glencore arrangement, and that’s getting a significant amount of interest.”

This uncommitted portion could be particularly valuable given the tight copper concentrate market and growing interest from Asian investors in securing supply from new copper projects.

Interview with Managing Director & CEO, Christian Easterday

Huasco Water: A Strategic Asset

In addition to its core copper project, Hot Chili has developed a potentially valuable water supply business, Huasco Water. This subsidiary holds rights to supply both saltwater and desalinated water to the region, including to Hot Chili’s own project and potentially to other mining and industrial operations in the area.

The water business represents a significant potential source of value for Hot Chili. Easterday draws a parallel to a recent transaction in the sector, “Antofagasta took their water rights, they sold them for 600 million to a consortium and is now also building their water expansion of 380 million – Antofagasta has supplied them a 20-year offtake agreement to supply water.”

While the situations are not directly comparable, this example illustrates the potential value that could be unlocked from Hot Chili’s water assets. The company is considering various options for monetizing this asset, including potentially selling a majority stake to a strategic investor in the water industry.

Infrastructure Cost Savings

The development of Huasco Water also provides direct benefits to the Costa Fuego project. As Easterday explains:

“Our water infrastructure is around $140 million of capital, and that is what we can now outsource out of our build cost.”

By potentially selling the water business while retaining the necessary supply for Costa Fuego, Hot Chili could significantly reduce its capital requirements for the copper project while also generating funds to contribute to overall project development.

Financial Position & Funding Strategy

Hot Chili is well-funded for its current phase of development. Easterday notes:

“Hot Chili’s been able to fund itself very well this year in a really well-timed capital raising, which means we’re sitting here with $30 million and doing what we need to do to get the project pushed forward.”

This funding allows the company to advance its prefeasibility studies for both the copper project and the water business, as well as prepare for the environmental impact assessment submission.

Looking ahead to project construction, Hot Chili is developing a multi-faceted strategy to fund the estimated $1 billion capital cost. This strategy could potentially include:

- Monetization of the Huasco Water business

- Streaming agreements on precious metals production

- Additional offtake agreements

- Strategic partnerships or investments, particularly from Asian investors

- Traditional project finance from banking syndicates

Easterday is confident in the company’s ability to attract funding.

“We have a copper asset that’s going to have a prefeasibility at the end of the year, a water asset that’s going to have a prefeasibility not far after, and you know, both of those project values are significantly large.”

Market Outlook & Timing

Hot Chili’s development timeline aligns well with projected supply-demand dynamics in the copper market. Many analysts anticipate a significant supply deficit in the coming years, driven by growing demand from electrification and renewable energy sectors, coupled with a lack of new large-scale projects coming online.

Easterday notes the industry’s chronic underestimation of challenges in bringing new supply to market:

“Since 2014, so the last 10 years, they’ve overestimated the progression of supply forecast. There is a huge gap between what has been forecast every year to come and what has actually come.”

This dynamic could create a favorable pricing environment for new producers like Hot Chili as they enter the market.

Hot Chili’s goal is to be “first in line to finance a 100,000 ton per annum project,” as Easterday puts it. By advancing its studies and permitting processes now, the company aims to be ready for a final investment decision and financing in late 2026 or early 2027, potentially ahead of many competing projects.

This timing could allow Hot Chili to secure favorable terms for project financing and offtake agreements, as well as potentially benefit from strong copper prices as it enters production.

The Investment Thesis for Hot Chili

- Large-scale copper project with significant production potential (95,000 tons copper, 50,000 oz gold annually)

- Low capital intensity due to favorable coastal location ($1 billion vs. $2 billion for comparable high-altitude projects)

- Advanced permitting status with environmental impact assessment submission planned for mid-2024

- Strategic partnership with Glencore, with potential for additional offtake agreements

- Unique water business (Huasco Water) that could be monetized to fund a significant portion of project development

- Well-funded for current development phase with $30 million on hand

- Aligns with projected copper supply deficit, potentially benefiting from favorable pricing environment

- Management team with clear strategy and timeline for project development and financing

Hot Chili presents a compelling investment opportunity in the copper development sector. With its large-scale Costa Fuego project, strategic coastal location, cost advantages, and innovative approach to water infrastructure, the company is well-positioned to become a significant player in the copper market.

The company’s progress on permitting, strategic partnerships, and funding strategies demonstrate a clear path towards project development. Moreover, the potential monetization of the Huasco Water business could provide a unique source of funding, setting Hot Chili apart from many of its peers.

As the global demand for copper continues to grow, driven by the green energy transition and infrastructure development, well-positioned projects like Costa Fuego are likely to attract significant interest from investors, offtakers, and strategic partners. For investors seeking exposure to the copper market, Hot Chili offers a combination of scale, advanced development status, and potential for value creation that merits serious consideration.

Macro Thematic Analysis

The global transition to clean energy and electric vehicles is driving unprecedented demand for copper, creating a compelling macro environment for copper developers like Hot Chili. As countries worldwide commit to decarbonization targets, the need for copper in renewable energy infrastructure, electric vehicles, and energy storage systems is set to surge.

Concurrently, the supply side of the copper market is facing significant challenges. Years of underinvestment in exploration and development, coupled with declining ore grades at existing mines, have created a looming supply deficit. Many analysts predict this supply-demand imbalance will persist and potentially worsen in the coming years.

This situation is further complicated by the increasing difficulty in developing new large-scale copper projects. Environmental concerns, water scarcity, and geopolitical tensions in key mining jurisdictions are making it harder to bring new supply online. Projects like Hot Chili’s Costa Fuego, with its favorable location and lower environmental impact, are therefore particularly valuable.

Moreover, the growing focus on responsible sourcing and ESG (Environmental, Social, and Governance) factors in the mining industry adds another layer of complexity. Copper projects that can demonstrate strong ESG credentials, including efficient water use and community support, are likely to be preferred by both investors and offtakers. Christian Easterday succinctly captures the opportunity this creates:

“We’re starting to approach this inflection point where a lot of the greenfield projects are starting to become lower capital intensity options for new supply.”

This dynamic positions well-advanced, economically robust projects like Costa Fuego to potentially command premium valuations as the copper supply crunch intensifies.

Kristie Batten: BHP’s Filo takeover shortens list of large copper developers

September 23, 2024 | Kristie Batten

One of Australia’s top mining journalists, Kristie Batten writes for Stockhead every week in her regular column placing a watchful eye on the movers and shakers of the small cap resources scene.

When BHP (ASX:BHP) and Lundin Mining Corporation announced a joint bid for Toronto-listed copper explorer Filo Corp in late July, it set pulses racing.

The C$4.1 billion cash and scrip bid represents a premium of 32.2% and will give the pair ownership of the Filo del Sol copper project.

BHP will also buy 50% of Lundin’s Josemaria project for US$690 million.

Both projects sit on the border of Chile and Argentina.

Goldman Sachs forecasts the two projects have the potential to produce a combined 400,000t of copper per annum, but could cost US$12-16 billion due to the infrastructure, which would include a desalination plant and concentrate pipeline.

Hot Chili (ASX:HCH) managing director Christian Easterday was quick to highlight the lack of large-scale copper projects outside the majors in his presentation to the Precious Metals Summit in Colorado this month.

“There’s not many of us out there and there’s not many that are meaningful and near-term,” he said.

“With Filo being taken over by BHP, the list just got shorter.”

In fact, according to Hot Chili, there are only a handful of projects with the potential to produce around 100,000tpa of copper sitting in companies outside the majors.

Hot Chili’s Costa Fuego in Chile is one. The others are SolGold’s Cascabel project in Ecuador, Los Andes Copper’s Vizcachitas project in Chile and McEwen Mining’s Loz Azules project in Argentina.

All are in South America, reaffirming the region’s position as a global hot spot for copper.

“The region hosts almost 20% of new copper supply,” Easterday said.

Capstone Copper is ramping up its Mantoverde copper project in Chile to the north of Costa Fuego, which Easterday says is similar to what Hot Chili is aiming to build.

Costa Fuego

Hot Chili, which has spent $220 million at Costa Fuego, completed a preliminary economic assessment for the project in 2023, outlining capital costs of US$1.05 billion.

Costs are low compared to the company’s copper peers due to Costa Fuego’s low elevation and proximity to the coast.

“It’s half the cost to build because we’re not up in the Andes,” Easterday said.

The project is projected to produce 112,000t of copper equivalent in the first 14 years at a C1 cash cost of US$1.33 per pound, net of by-product credits.

Using a US$3.85/lb copper price and US$1750 an ounce gold price, the project has a post-tax net present value of US$1.1 billion and internal rate of return of 21%.

“We are not special by grade, but we’re special by the location and that has directly led to these financial outcomes,” Easterday said.

A pre-feasibility study is underway and due for completion by the end of the year.

Copper is now trading at around US$4.26/lb, while gold is at a record of above US$2600/oz.

“Every US10c above US$3.85 (copper), we add about another US$100 million NPV after tax to the bottom line,” Easterday said.

Hot Chili’s “secret weapon” for funding the project is its new 80%-owned subsidiary, Huasco Water, a joint venture with Compañía Minera del Pacífico.

Huasco holds a maritime water permit and will aim to develop a multi-user seawater and desalinated water supply network for communities, agriculture and new mining developments in the Huasco Valley region of Chile.

The company will release a study on the water business in the coming months.

“The project is positioned for major catalysts at the end of this year,” Easterday said.

ASX unmoved

Despite owning the largest copper development project on the ASX outside the majors in the world’s hot spot for copper development and M&A, Hot Chili shares have fallen by 37% over the past year.

The company listed on the TSX in 2021, but it still underperforms against its Toronto-listed peers.

Of the four firms that issue research coverage on Hot Chili, three are based in Canada, further highlighting the disinterest in the Australian market.

That’s despite counting Glencore as its major shareholder.

“We’re in the early stages of a copper cycle,” Easterday said.

“It’s a very, very different cycle we’re moving into. It’s about lack of supply.”

Earlier this year, S&P Global Commodity Insights found that the average time from discovery to production was now 16.3 years.

“The timeframes of 17-20 years to develop these assets are very real,” Easterday said.

“We’re sitting at probably the precipice of an electrification future, where copper is the key ingredient, and we simply don’t have an answer about where the supply is going to come from.”

Easterday said the incentive price still needed to be higher for new large-scale copper mines.

“We’re like a large-scale iron ore producer when iron ore is sitting at US$20/t,” he said.

Copper Explorers coasting in Chile

The Mining Journal | Paul Harris | 23 January 2023

The drive north along Ruta 5 from La Serena towards Vallenar is to drive through more than a century of mining history. From the silver mines of the 1800s, to the iron ore mines of the late twentieth century, and the almost continual small-scale production of high-grade copper oxide. The four-lane highway passes through a wide valley with desert scrub and cacti, in parts reminiscent of Nevada or Arizona in the US, particularly with the cobalt blue sky and beating sun.

The drive passes a wind farm funded by Barrick Gold and various solar generation facilities but tucked away to the east of the Coastal Range and the Pacific Ocean, it also runs along part of the 2,000km-long north-south Atacama Fault in central Chile, which hosts iron, copper-iron and copper-gold deposits including IOCG, porphyry and vein deposits.

It also holds promise for Chile’s future copper developments, such as with companies like Hot Chili and Tribeca Resources, and further north, Capstone Copper’s Santo Domingo project, looking at bringing forward affordable projects which benefit from the rich regional infrastructure endowment, which includes access, high-tension power lines, local mining culture and port facilities. This should be music to the ears of mining investors who are still beating the capital discipline drum and nervous about development cost blowouts, which has made the greenlighting of new mine developments noticeable by their absence despite the copper price being notionally above the US$4 per pound incentive price. No wonder diversified miner Glencore and royalty company Osisko Royalties are interested.

Within this context, the long-overlooked coastal range in Chile is drawing increasing attention from copper explorers and developers who believe viable and economic deposits can be found, which, while smaller than the mega porphyries in the high cordillera which have powered the country’s copper production, can potentially be brought to market with less permitting, development and financing risk.

Costa Fuego

Hot Chili and its Costa Fuego project is growing into a strong development candidate south of Vallenar, with exploration bringing the project ever closer to the magical threshold of 1 billion tonnes of resources. While its Productora deposit has been around for a number of years, the more recent definition and integration of the Cortadera deposit 14km away into Costa Fuego via a 2022 resource update has increased the scale and attractiveness of the project. The continual fall in the average production grade in Chile adds shine to the project, which with each passing year, sees it get closer to and equalling production grade.

Diversified miner Glencore certainly sees the possibilities, having invested in the company and provided an offtake agreement in 2022. Glencore invested as Hot Chili debuted on the TSXV in 2022, participating in the C$30 million capital raise to take a 9.99% stake. “The Glencore investment gives us a solid endorsement and provides a good rubber stamp on what we’re doing and the asset we have,” Hot Chili chief executive Christian Easterday told Mining Journal at the time.

Glencore’s influence can be seen in the current drill programme at the Las Cañas target (body #1, Cortadera), to rapidly add further tonnes to its overall resource, with a prefeasibility study postponed until this drilling and the next resource update has been completed.

The consolidated March 2022 Costa Fuego resource featured an indicated resource of 725Mt grading 0.47% copper equivalent for 2.8Mt of copper, 2.6Moz of gold, 10.5Moz of silver and 67,000t of molybdenum, and inferred resources of 202Mt grading 0.36% copper equivalent. It also featured a high-grade indicated component of 156Mt grading 0.79% copper equivalent for 1Mt of copper, 850,000oz of gold, 2.9Moz of silver and 24,000 of molybdenum.

Hot Chili and Productora were widely dismissed by the market as being too small and too low-grade. That is no longer the case with the company looking at 100,000tpa of copper production for 20 years, and possibly more, although the market view perhaps still languishes in its past perception judging by the slow uptick of its share price. However, Costa Fuego is rapidly taking its position on the relatively short list of development stage projects that can be developed.

While Hot Chili’s star is starting to rise, the years spent in the investor doldrums saw the company use the time to advance low-cost but equally important work to derisk the project and make it a more robust and viable development proposition. “During the downturn in the market, we held onto Productora but stopped drilling and instead focused on the infrastructure we would need, such as obtaining the surface rights and easements we will need for access, power, a water pipeline and the maritime concession,” country manager Jose Ignacio Silver told Mining Journal during a site visit.

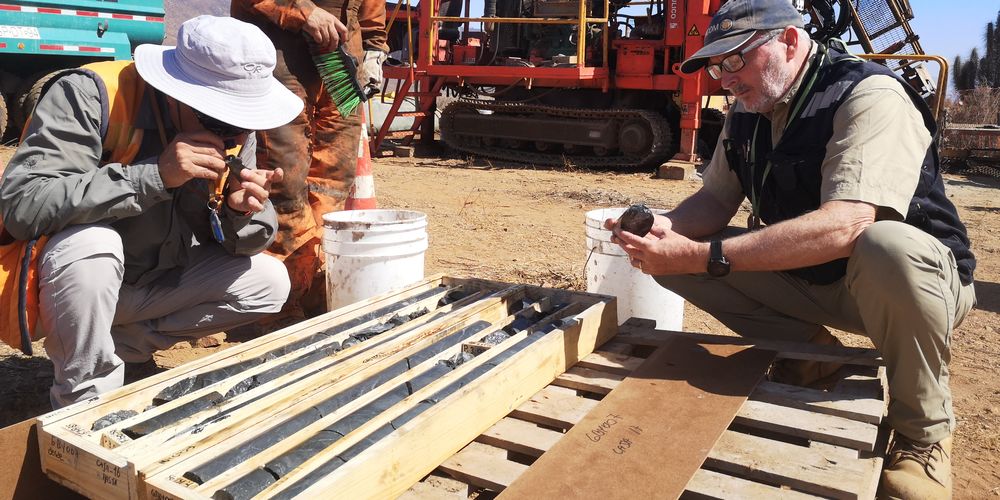

Cortadera has been a game-changer for the company, bringing high-grade outcropping material into the picture and almost quadrupling the resource base. The area has seen small-scale mining from local miners targeting high-grade copper oxide exposures on the mountain tops, with material containing 3% copper or more sent to the processing plants of state mineral company Enami. Their workings with the outcropping bluish-green chrysocolla mineral provide an obvious visual clue for explorers like Hot Chili to start their exploration efforts.

At Cortadera, which the company obtained in 2019, it has defined three ore bodies and an indicated resource of 471Mt grading 0.46% copper equivalent and an inferred resource of 108Mt grading 0.36% CuEq. The mineralisation outcrops at body #1, with mineralisation getting deeper and larger volumes moving to the southeast for body #2 and then again for body #3. Body #3 is the biggest and deepest, and where the company completed an 1185m hole which showed high-grade at depth in hole 13D (750m grading 0.6% Cu and 0.2g/t Au from 204m depth down-hole, including 188m grading 0.9% copper and 0.4g/t gold).

The area has been picked over by larger companies in the past, but seemingly in a half-hearted manner and never consolidated, perhaps using exploration results as a reason to move on rather than as a reason to stay and grow a resource. “Explorers didn’t want the Coastal Range as they were looking for the mega porphyries in the high Andes. There was also the issue of consolidating the concessions and the surface rights, which not everyone wants to take on,” geology manager Andrea Aravena told Mining Journal.

Piecing the project together is a task that the relatively young and ambitious Hot Chili team relished, particularly Silva, a lawyer who studied international trade law in the UK and spent some time working with the UK Serious Fraud Squad. There is a palpable enthusiasm for the exploration opportunities this now provides, with various new drill targets being worked up and permitted around both deposits. Silva has a similar enthusiasm for obtaining the infrastructure easements and entering the permitting process in the future. “I love this because we are building a long-term company and something that will have real value,” he said.

The next piece of the puzzle, and the one which may push the company over the 1Bt of resources threshold (already 927Mt), is an earn-in agreement with Antofagasta Minerals (AMSA) on the ground between Productora and Cortadera called Las Cañas for $1.5 million and 6,000m of drilling in two phases. The first phase is underway and will see 3,000m drilled as part of Hot Chili’s 10,000m initial exploration drill plan for 2023. Following a joint review of the results with AMSA, the second 3,000m will be drilled. AMSA previously drilled five holes at Las Cañas, and so the first Hot Chili holes are twinning some of those holes seeking to confirm the high-grade results previously obtained.

The evolution of Productora and Cortadera into Costa Fuego, with a central processing plant planned to be located at Productora, has energised the exploration team to find more ore bodies nearby in the Huasco Valley which could potentially feed into this. This is a task helped by growing confidence in the geological model they have developed and refined. Zones carrying mineralisation are characterized by the presence of tightly packed parallel quartz veinlets, which carry the copper sulphide mineral chalcopyrite, gold, silver and molybdenum credits.

Consulting geologist Dr Steve Garwin, a key member of the SolGold team which discovered the Alpala deposit in Ecuador, is also the lead technical advisor to Hot Chili and has trained the exploration team on the key things to record in core logging, such as the alteration, the number of veinlets and the presence of a molybdenum halo. With accurate core logging of crucial importance, one or both of the principal project geologists Miguel Tapia and Cristian Vasquez, are always on-site to ensure this is done correctly and consistently. “What we see at the #1 ore body at Cortadera we see at Las Cañas, which means we can advance quicker because we have a good idea of what is happening,” Tapia told Mining Journal.

“We always start by looking at the regional context as we think about the potential of having a cluster of deposits. Most deposits are structurally controlled by the north-south Atacama Fault structure and NW trending faults. The intersection of these can be zones of interest,” said Aravena.

Productora is a different beast as it is a structurally-controlled tourmaline breccia hosted in volcanic rocks, although exploration has also been guided by where small miners previously worked.

While undertaking a PFS on Costa Fuego has been postponed pending the Las Cañas drilling, the company has a general idea of how it wants to develop the project, having previously completed a PFS on Productora, as well as the majority of a PFS for the combined project. Mining would start with open pits at Productora and high-grade material from body #1 at Cortadera, with the company targeting a multi-decade project to produce approximately 100,000tpa of copper and up to 70,000ozpa of gold.

Material from Cortadera is planned to be transported to Productora via a rope conveyor, one of three key elements to reduce the environmental footprint and lower operating costs for future operation. The tailings storage facility has been relocated down the valley to a site that will have greater storage capacity and be cheaper to build and operate. “This is not upstream of any river, so there should be no opposition from the Huasco Valley Agricultural Association. The rope conveyor towers have minimal surface disturbance, and the Project is being designed with all stakeholders in mind,” said Silva.

The company reported a key development in December about the award of a maritime concession from the government where it will build its seawater capture infrastructure, the culmination of eight years of work. Processing will use seawater, and not needing to build a desalination plant will save considerable capital and operating cost. “It also improves the copper recovery,” said Silva. Marimaca Copper, which is advancing its Marimaca project in the coastal range near Antofagasta, is also looking to use seawater for processing and also says this will improve recoveries.

With the wind in its sails, the coming milestones for Hot Chili are to complete a preliminary economic assessment during the first semester, a resource upgrade in the second semester, and then the PFS in the first half of 2024.

“Growth from the drill bit is very much Hot Chili’s focus in 2023, with the company confident of continued resource growth. This is underpinning the company and our shareholder Glencore’s view that Costa Fuego and our regional consolidation may support a long-life mine producing 150,000tpa of copper. This would put Costa Fuego toward the top-end of scale for new copper developments being advanced in the world,” said Easterday.

Silva also noticed a clear change in the government’s attitude towards mining following the rejection of a new draft constitution on September 4 last year. While the country will continue creating a new constitution, it will likely be a less radical and more centrist document than the rejected draft.

“After 4 September, everything felt more stable in Chile. The rejection of the new draft constitution was a defeat for the extreme Left and moved politics in Chile back into the centre. The new constitution will have limits as there are 12 basic aspects of the political structure which have been agreed upon and will not be changed,” said Silva. These include that Chile is one united nation with a separation of powers and the existence of an independent Central Bank, as well as an independent Prosecutor and Electoral Office.

Hot Chili is not alone in this new development thrust. Some 500km north near Antofagasta, Marrimaca Copper plans a feasibility study this year for its Marimaca coastal range deposit for a 50,000-60,000tpa operation from a measured and indicated resource of 140Mt grading 0.48% copper for 665,500t of contained copper. Capstone Copper’s permitted and shovel-ready Santo Domingo copper-iron-gold project near regional mining hub Copiapo is due to see a feasibility study update later this year, which will include additional processing circuits for cobalt and iron ore, and may see a lower capex than the $1.5 billion in the current feasibility through integration with its nearby Manto Verde mine.

Tribeca

Exploration spending in Chile has been increasing in recent years, amounting to US$713.2 million in 2022, according to state copper agency Cochilco, a 24.6% rebound from the low of $450 million in 2020, the lowest amount since before 2010. The majority of spending at $345 million is by miners around their mines, with large mining companies spending most on exploration at 74.6% of the total. Early-stage exploration accounted for $197.3 million in 2022, with the amount spent by junior explorers almost doubling from 2021 to 2022, increasing its share from 9% to 18%. Copper is the most sought mineral, accounting for 74% of spend, followed by gold at 21%.

A new crop of junior copper explorers in Chile includes Culpeo Minerals, Torq Resources, Atacama Copper, Pampa Metals, ATEX Resources, Solis Minerals, Rugby Resources, Alto Verde Copper, Great Southern Copper and Nobel Resources. The newest of all is Tribeca Resources, one of a new generation of copper exploration juniors in Chile’s IOCG belt whose La Higuera project, some 100km south of Costa Fuego echoes many of the attractions Hot Chili sees in the region.

Tribeca is also drawn by the fact the coastal region has been overlooked and under-appreciated in the past, even though it is possible to find a sizeable deposit. Lundin Mining’s Candelaria near Copiapo is the exemplar in this context. With infrastructure development being a key factor in development time and cost blowouts, the coastal zone and its proximity to existing infrastructure are very attractive.

I drove to the site, a few hundred metres off the Pan-American highway, with chief executive Paul Gow in a VW Gol. Having a four-wheel drive truck was unnecessary, which also attests to Gow’s frugal and parsimonious financial management, a habit carried over from when he and partner Thomas Schmidt funded the early days of the company from their own pockets. Both Gow and Schmidt worked for Xstrata Copper in their previous lives. The company doesn’t have a corporate office and has a monthly burn rate of just $40,000, excluding drilling, while its drilling costs are just $130/m before assays and geological team.

Tribeca was also attracted by the presence of high-grade small-scale operations in the district and is leveraging the experience of Gow exploring for IOCG deposits around the Olympic Dam mine in Australia. Olympic Dam has several hundred metres of barren sedimentary cover above its mineralisation. “We are looking for a sulphide copper-gold system containing hundreds of millions of tonnes of resources. We see opportunity under the gravel cover in areas where there have been high-grade oxides exploited from the mountain tops. Copper is present in outcrops, and we follow them under the gravel,” Gow told Mining Journal during the visit.

Like Hot Chili, the Atacama Fault is the main regional controlling structure, and the northwest cross faulting is also relevant. With up to 60m of gravel cover, soil geochemistry is not such a useful exploration tool, but the presence of magnetite and hematite in IOCG deposits means geophysical methods like magnetics and gravity are.

Gow says good targets are near high magnetic anomalies, although the highest copper grade is not necessarily where the highest magnetic anomaly is. “My experience in the Olympic Dam province, particularly with the Prominent Hill discovery by Minotaur Resources, is that the mineralisation is related to hematite and is commonly offset from the magnetic anomaly. The magnetic anomaly tells you there is a hydrothermal system present, but then you have to identify where the mineralisation is located within that system.”

The company is also picking up where a previous explorer called Peregrine Metals left off. Peregrine drilled some 4000m in 12 holes at Gaby, which is Tribeca’s main target and where drilling began in November 2022. “We are drilling step-out holes to the north of the Peregrine drilling and have drilled up to 600m to the north,” Gow said.

Tribeca expects to release its first drill results in the coming weeks and show whether or not it has been successful in its initial aim of expanding the mineralisation footprint. “What got me into exploration was the excitement of waiting by the fax machine for the drilling results to come in,” said Gow. With the company’s concessions extending for another kilometre to the north, there is potential to continue expanding the footprint further.

For its first programme, Tribeca uses reverse circulation drilling to pre-collar the holes and penetrate the gravels and weathered zone before switching to diamond drilling for the tail to a total depth of about 400m. It plans some 2200m at Gaby and will then look to drill 600m at its Chirsposo target, 3km to the south.

Luck plays a role in exploration, and Tribeca appears to have had some already. It is perhaps the youngest copper explorer in Chile, having completed a reverse takeover transaction in October 2022 to list on the Toronto Stock Exchange Junior board when at least two other Chile copper exploration hopefuls delayed their listing efforts. “We raised US$2.1 million in January 2022 from mainly experienced mining people, so we didn’t look to raise any money when we listed, so we didn’t encounter any adverse market reaction,” said Gow.

Shares in Hot Chili are trading at C95c, valuing the company at C$114 million.

Shares in Tribeca Resources are trading at C36c, valuing the company at C$19 million.